Drug Eluting Balloon Catheter Market

Drug Eluting Balloon Catheter Market Analysis by Indication (Coronary Artery Disease Drug Eluting Balloon Catheters, Peripheral Vascular Disease Drug Eluting Balloon Catheters), by End User (Hospitals, Ambulatory Surgical Centers), by Raw Material & Regional Forecast, 2021-2031

Analysis of Drug Eluting Balloon Catheter market covering 30 + countries including analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Drug Eluting Balloon Catheter Market Outlook

The global market for drug eluting balloon catheters is anticipated to progress at an impressive CAGR of 18% over the next ten years. This analysis has been performed by skilled analysts at Fact.MR, a market research and competitive intelligence provider, also reveals that demand for drug eluting balloon catheters comprises 20% share in the overall balloon catheters market at present.

| Global Market Value in 2021 | US$ 1 Bn |

| CAGR (2021-2031) | 18% |

| Forecasted Market Value for 2031 | US$ 5.2 Bn |

| Dominant Market | Europe |

As per the study, the global drug eluting balloon catheter market is expected to be worth US$ 5.2 Bn by the end of 2031, with coronary artery disease drug eluting balloon catherization holding a mammoth 80% market share.

Know thy Competitors

Competitive landscape highlights only certain players

Complete list available upon request

Drug Eluting Balloon Catheter Demand Analysis (2016 to 2020) Vs Future Market Projections (2021 to 2031)

Healthcare infrastructure has seem some major changes over the past decade as technology proliferation increased and research on healthcare has also seen a substantial boom. Rising obesity, increasing geriatric population, and growing prevalence of coronary artery diseases are some of the factors propelling demand for drug eluting balloon catheters. When stents are used with a balloon catheter it is called a balloon expandable stent, which differs from self-expandable stents, and these are normally made from nitinol alloy.

Adoption of angioplasty balloons for patients who do not benefit from percutaneous coronary intervention (PCI) is also favouring growth of the drug eluting balloon (DEB) catheter market. Increased support from governments and other institutions backing research and granting funding to further develop drug eluting balloon catheters is being witnessed.

Overall demand is anticipated to rise at a stellar CAGR of around 18% over the decade.

What is the Outlook for the Peripheral Vascular Disease DEB Catheter Market?

Usage of drug eluting devices is majorly associated with cardiac conditions, and these are used to reduce the rate of restenosis. The peripheral drug-coated balloon catheter market is poised to rise at a steady CAGR over the next ten years. Use of drug-eluting balloon catheters for peripheral artery procedures is anticipated to increase as their benefits are realized and procedures become more affordable.

Under the indication segment, demand for coronary artery disease drug eluting balloon catheters is anticipated to account for nearly 80% market share in terms of value. Despite minimal market share, demand for peripheral vascular disease drug-eluting balloon catheters is anticipated to rise at a steady CAGR over the forecast period.

As more angioplasty balloons are being researched and developed, it is estimated that sales of peripheral drug-coated balloon catheters will also see an upward trend.

More Insights, Lesser Cost (-50% off)

Insights on import/export production,

pricing analysis, and more – Only @ Fact.MR

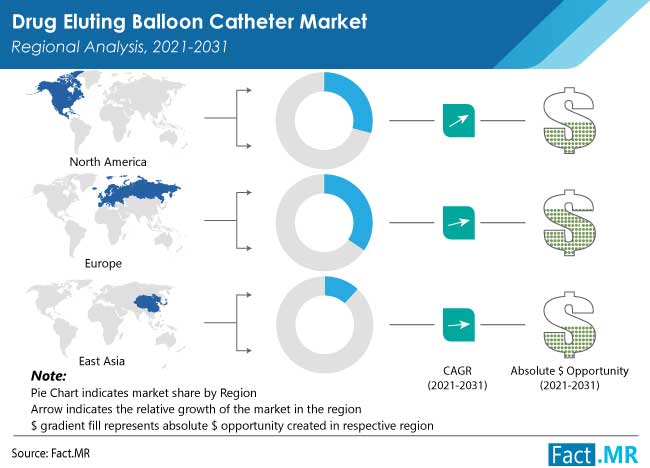

What is the Regional Outlook of the Drug Eluting Balloon Catheter Market?

This research details the global drug eluting balloon catheter industry landscape across the regions of North America, Latin America, Europe, APAC, and MEA.

Europe dominates the market and is anticipated to continue its domination throughout the forecast period. The U.K. is anticipated to lead the European market, surging at a stellar CAGR of around 20%.

North America is anticipated to be the second-largest market. The market in Asia is anticipated to rise at the fastest CAGR through the forecast period. India and China are anticipated to lead demand in the APAC region.

Adoption of drug eluting balloon catheters in MEA is expected to pick up pace as healthcare infrastructure develops across the region.

Country-wise Analysis

What Scope Does the U.S. Drug Eluting Balloon Catheter Market Provide?

The U.S. represents the largest market for drug eluting balloons in North America, followed by Canada. The nation has been seeing a surge in cardiac cases due to rising prevalence of obesity, poor lifestyle choices, rise in aging population, presence of key players, and high spending potential. This is propelling sales of drug-coated balloon (DCB) catheters in the U.S.

Will China Be a Profitable Market for Drug Eluting Balloon Catheter Suppliers?

China has a massive population and the geriatric population in the nation is on the rise, which, in turn, is increasing instances of cardiovascular diseases and disorders. Government-backed research initiatives are helping reshape and bolster the healthcare infrastructure in the nation. Rising medical tourism, high prevalence of cardiovascular diseases, and rapidly developing healthcare infrastructure are some of the factors driving demand in China.

Don't Need a Global Report?

save 40%! on Country & Region specific reports

Category-wise Analysis

How is Demand for Polyurethane Drug Eluting Balloon Catheters Expected to Play Out?

Sales of polyurethane drug eluting balloon catheters are expected to rise at the fastest CAGR as far as raw material is concerned. However, demand for nylon drug eluting balloon catheters is expected to account for a majority of share among all. Benefits such as soft nature, foldability, and easy withdrawal are propelling sales of nylon drug eluting balloon catheters.

COVID-19 Impact on Market

The COVID-19 pandemic massively affected healthcare infrastructure and how it was handled. Treatment for every disease became secondary as the focus was only on combating coronavirus. The COVID-19 pandemic affected research & development related to drug eluting balloon catheters and caused major disruptions in demand and supply chains.

However, in the post-pandemic era, demand for drug eluting balloon catheters is anticipated to see rapid rise. Even though the pandemic caused a major drop in sales, the market is expected to recover the losses over the coming years as research speeds up.

Competitive Landscape

Research in the drug eluting balloon catheter space by key players is anticipated bolster development and sales of more precise and efficient drug eluting balloon catheters.

- In February 2021, L2Mtech GmbH was awarded its first CE mark on six products. This marks a milestone in the company’s history and proves the efficacy and safety of its innovative cardiovascular and endovascular applications. The company is planning to commercially launch the products with the CE mark recognition.

- In June 2020, iVascular SLU, a medical device company, announced the global launch of its novel coronary artery drug-coated balloon. The product - Essential Pro - has several improvements from its predecessor.

- In March 2021, MedAlliance announced that it had received FDA approval for its drug-eluting coronary balloon. The product is called the Selution SLR sustained limus release drug-eluting balloon catheter. It received a go-ahead for its design, which improved luminal diameter in individuals affected with atherosclerotic lesions.

Drug Eluting Balloon Catheter Industry Report Scope

| Attribute | Details |

| Forecast Period | 2021-2031 |

| Historical Data Available for | 2016-2020 |

| Market Analysis | Units for Sales US$ Mn for Value |

| Key Regions Covered |

|

| Key Countries Covered |

|

| Key Market Segments Covered |

|

| Key Companies Profiled |

|

| Pricing | Available upon Request |

MaKey Segments of Drug Eluting Balloon Catheter Industry Surveyrket Taxonomy

-

By Indication:

- Coronary Artery Disease Drug Eluting Balloon Catheters

- Peripheral Vascular Disease Drug Eluting Balloon Catheters

-

By End User:

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Catheterization Laboratories

-

By Raw Material:

- Polyurethane Drug Eluting Balloon Catheters

- Nylon Drug Eluting Balloon Catheters

- Others

- FAQs -

Where does the market for drug eluting balloon catheters stand in terms of valuation?

In 2021, the global drug eluting balloon catheter market is expected to be worth US$ 1 Bn.

Which factors are expected to drive growth of the global drug eluting balloon catheter market?

Increasing geriatric population, rising healthcare expenditure, government initiatives backing research, and increasing proliferation of technology are some of the factors that are expected to influence demand growth.

Which indication product accounts majority market share?

Coronary artery disease drug eluting balloon catheters are expected to account for nearly 80% market share in terms of value.

What market estimates are predicted for the year 2031?

By 2031, the global market is predicted to surge to a valuation of US$ 5.2 Bn.

What is the outlook for drug eluting balloon catheter suppliers in Europe?

Europe dominates the global market in terms of share and is expected to continue its domination over the decade.

What CAGR is predicted for the market by this analysis?

Analysts have predicted the drug eluting balloon catheter industry to surge at a stellar CAGR of 18% over the decade.

Which drug eluting balloon catheter manufacturers are operating in the industry?

Top market players are Cardionovum GmbH Coo, Medical INC, Cordis Corporation, Abbott Laboratories, Meril Life Sciences Pvt Ltd, Jotech GmbH, MicroPort Scientific Corporation, Terumo Corporation, Boston Scientific Corporation, Tokai Medical Products Inc