Ceiling Tiles Market

Ceiling Tiles Market Analysis, By Material, By Form, By Application, By Installation, and Region - Market Insights 2025 to 2035

Analysis of Ceiling Tiles Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more.

Ceiling Tiles Market Outlook (2025 to 2035)

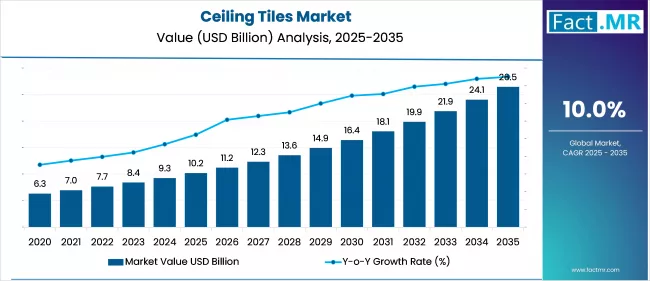

The global ceiling tiles market is projected to increase from USD 10.2 billion in 2025 to USD 26.5 billion by 2035, with a CAGR of 10.0%, driven by the global rise in commercial construction activities, particularly in office, institutional, and healthcare sectors. Their use makes them ideal for enhancing acoustics, aesthetics, and fire resistance in modern interior spaces.

What are the Drivers of Ceiling Tiles Market?

The market is poised to experience significant growth due to shifting consumer preferences toward aesthetically appealing office and residential spaces, rising demand for thermal and acoustic insulation, and increasing disposable incomes in emerging economies.

Additionally, the market dynamics are expected to be positively influenced by the implementation of sustainable and innovative construction solutions that incorporate eco-friendly materials for floors, ceilings, and walls during the forecast period.

Ceiling tiles are manufactured from a variety of basic materials, including metals, mineral fiber, fiberglass, gypsum, wood, and plastic. Several of them have detrimental environmental consequences, which hinder the expansion of the ceiling tile industry.

Fiberglass is primarily manufactured using formaldehyde binders. When using these formaldehyde compounds to remove fiberglass ceiling tile installations, microfibers may fall, posing a health risk. The increasing number of commercial construction initiatives in the U.S. has a positive impact on product demand, as the construction industry is in the process of recovering.

Furthermore, the mineral wool segment is expected to experience growth in the country due to evolving consumer behavior and the increasing availability of alternatives for soundproofing and decorative interiors in commercial complexes.

Various raw material suppliers, including those that provide metals, mineral fiber, fiberglass, gypsum, wood, and plastics, are prominently represented in the market. Additionally, there is a substantial degree of backwards integration, in which manufacturers are the primary producers of basic materials, which diminishes the bargaining power of suppliers.

Over the forecast period, the utilization of conventional products is expected to be influenced by the increasing prevalence of environmentally friendly tiles that are certified in accordance with green building standards for emitting minimal VOCs. Leading manufacturers of the product are expanding their product lines by introducing asbestos-free and low-VOC-emitting lines to the market.

What are the Regional Trends of Ceiling Tiles Market?

The ceiling tiles market in North America dominated the revenue share in 2025 as a result of the growing popularity of products in various application industries. The region's increased adoption of ceiling tiles has been significantly influenced by technological advancements in this field and the necessity for acoustic insulation.

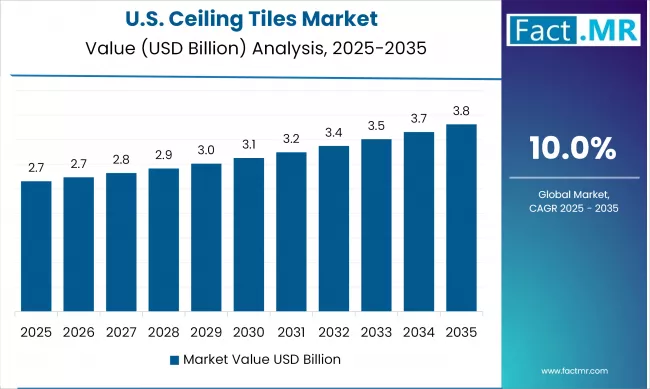

The U.S. held the majority of the global market's revenue share in 2025, which was attributed to the rising demand for soundproof and decorative interiors in commercial complexes, as well as the changing behavior of consumers and a high level of consumer disposable income. The industry's development over the forecast period is significantly influenced by residential growth, specifically single-family housing.

In 2025, Europe represented a substantial portion of the global market in terms of revenue. The region's market growth is driven by the availability of innovative and sustainable construction solutions, simple installation techniques, a well-established construction industry, and stringent regulations on particulate emissions, which have resulted in increased product demand.

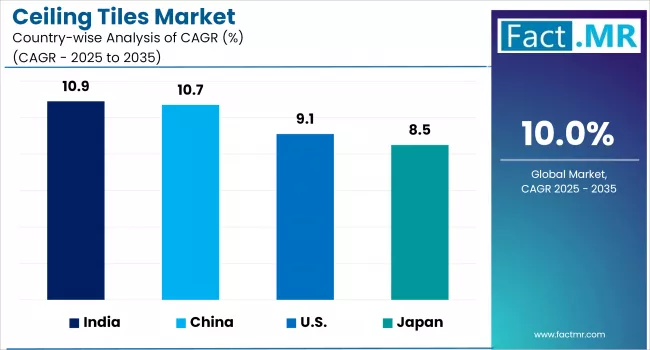

The Asia Pacific region is expected to become the market leader, with the fastest compound annual growth rate (CAGR), due to rapid industrialization and an increase in consumer disposable income.

Additionally, between 2025 and 2035, it is anticipated that demand for the product from various application segments will increase due to population growth, urbanization, and a rise in renovation activities in Southeast Asia.

What are the Challenges And Restraining Factors of Ceiling Tiles Market?

The market faces several key challenges and restraining factors. One of the most significant is raw material price volatility, as the costs of mineral fiber, gypsum, metal, and wood fluctuate due to factors like supply chain disruptions, global trade policies, and energy prices.

This unpredictability impacts production costs, profit margins, and market stability, forcing manufacturers to either absorb increased costs or pass them to consumers, which can reduce demand, especially in price-sensitive markets. Another major challenge is the high cost of manufacturing and installation for ceiling tiles.

These costs restrict their use mainly to commercial spaces, with limited penetration in residential applications, particularly in developing economies where adding ceiling tiles significantly increases building costs. The installation process itself is expensive, requiring additional components and skilled labor, which further hampers market growth.

Intense competition and market fragmentation also restrain the market growth. Numerous regional and global players offer similar products, leading to price wars, reduced profit margins, and the need for continuous innovation to differentiate offerings. This competition is intensified by the entry of new players, who leverage advanced manufacturing technologies to offer lower-cost alternatives.

Health and environmental concerns present additional challenges. Some ceiling tiles, such as those made from vinyl, can emit hazardous chemicals, raising health concerns among consumers. Acoustic tiles can harbor bacteria, fungi, and mildew, which can potentially cause respiratory issues.

As a result, there is a growing preference for environmentally friendly materials, which often come at a higher cost and require innovation in product development. Additionally, changing consumer preferences, economic slowdowns, and regulatory pressures further restrict the market.

Economic downturns can reduce construction activity and consumer spending, directly impacting demand for ceiling tiles. Stricter regulations on sustainability and emissions require manufacturers to invest in eco-friendly materials and processes, adding to operational costs and complexity.

Country-Wise Outlook

U.S. ceiling tiles market sees growth driven by aesthetic and functional benefits

The market is experiencing significant growth, driven primarily by large-scale commercial and institutional construction, particularly in sectors such as healthcare, education, and corporate offices. Key factors driving this growth include the demand for ceiling tiles that offer both functional and aesthetic benefits, such as concealing structural components, enhancing indoor air quality, and complying with fire safety regulations.

Sustainability is a major market driver, with a rising demand for ceiling products made from recycled, low-emission, and bio-based materials, supported by green building standards such as LEED. Technological innovation has also expanded the market, enabling customizable textures, integrated lighting, and enhanced acoustic control.

Several new ceiling tiles and innovations have been launched in the U.S., reflecting a strong focus on technology integration, sustainability, and design versatility. For example, Turf Partners and USAI Lighting introduced ceiling tiles that integrate acoustic control and LED lighting, offering both noise management and energy-efficient illumination for commercial space.

ClearOne Communications launched the BMA 360D, a ceiling tile with built-in beamforming microphone array technology, providing high-quality audio and seamless integration with smart building systems (notably for conference rooms and tech-enabled spaces).

China Witnesses Rapid Market Growth Backed by Domestic Manufacturing Strength

The China market is witnessing significant expansion, primarily driven by rapid urbanization, infrastructure development, and a surge in commercial construction. As the largest market in the Asia-Pacific region, China benefits from a robust construction pipeline and government-led urban redevelopment initiatives, which are fueling demand for modern ceiling solutions.

Mineral fiber and PVC ceiling tiles are especially popular in China due to their affordability, ease of installation, and superior acoustic and fire-resistant properties, making them ideal for offices, hospitals, and transit infrastructure.

The commercial sector, including offices, retail spaces, and healthcare facilities, remains the dominant consumer, as these environments require both functional and aesthetic ceiling solutions. Sustainability is becoming increasingly important, with manufacturers focusing on environmentally friendly materials and innovative designs that offer fire and moisture resistance.

Modular and easily replaceable ceiling systems are gaining traction, particularly in renovation projects. The market is also benefiting from the rise of smart cities and luxury housing, which demand advanced, energy-efficient, and visually appealing ceiling systems.

Major Chinese manufacturers, such as Taishan Gypsum, continue to expand their portfolios, introducing new PVC laminated gypsum ceiling tiles and vinyl-faced options for new building projects in 2025. These launches underscore the market’s focus on durability, visual appeal, and compliance with evolving green building standards.

Japan is Experiencing Steady Growth, Driven by Ongoing Construction Activities in Both Residential and Commercial Sectors

Growth is fueled by urbanization, economic development, and rising demand in both commercial and residential sectors. Mineral fiber ceiling tiles, known for their sound insulation and fire resistance, hold the largest market share, especially in non-residential applications such as offices, hospitals, and retail spaces.

The market outlook remains positive, with Japan focusing on energy-efficient and aesthetically appealing ceiling solutions to meet the evolving needs of construction and design trends. Additionally, modular ceiling systems that allow for easy replacement and low maintenance are gaining popularity, particularly for renovation and retrofit projects in Japan’s aging building stock.

Innovations also include ceiling tiles designed for seismic safety and lightweight installation, addressing Japan’s unique construction requirements. Manufacturers are investing in R&D to introduce high-quality, visually appealing tiles that meet both aesthetic and functional needs, such as enhanced soundproofing and thermal insulation.

Category-wise Analysis

Aluminium to Exhibit Leading by Material

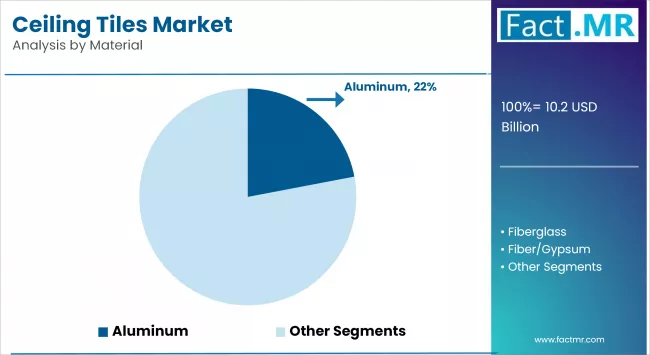

Aluminum dominates the ceiling tiles market, holding the largest share in 2025 due to its lightweight nature, durability, and resistance to corrosion. Its sleek appearance and ease of maintenance make it a preferred choice for modern commercial and institutional settings. Aluminum tiles are also fire-resistant and recyclable, aligning with the growing trend of sustainability. Their widespread use in airports, hospitals, and offices reflects their long-term cost efficiency and functional appeal, driving consistent demand across new construction and renovation projects.

Fiberglass is a steadily growing segment, driven by the increasing adoption of fiberglass ceiling tiles in educational institutions, healthcare facilities, and industrial settings. Their ability to improve sound absorption and indoor air quality makes them ideal for high-traffic, noise-sensitive environments. As indoor environmental standards become more stringent, fiberglass is gaining traction as a high-performance alternative to traditional materials in both commercial and institutional applications.

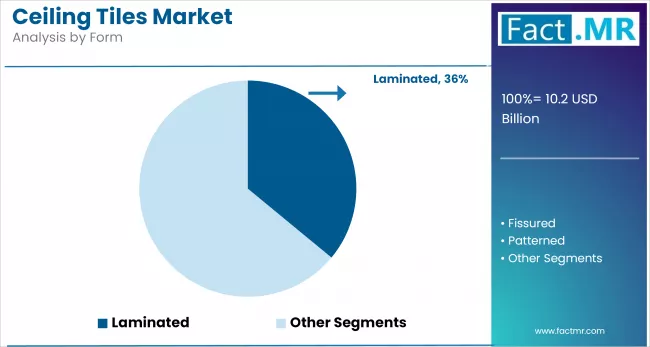

Laminated Ceiling to Exhibit Leading by Form

Laminated ceiling tiles dominate the market due to their aesthetic appeal, durability, and resistance to stains and moisture. These tiles offer a clean, modern finish, making them highly suitable for corporate offices, retail spaces, and healthcare settings. Their ease of installation and low maintenance needs further add to their appeal in fast-paced construction and renovation environments, particularly where visual consistency and functionality are equally important.

Textured ceiling tiles are a steadily growing segment, expected to witness strong demand through 2035. Their decorative patterns and surface designs enhance the visual dimension of ceilings, making them ideal for hospitality, residential, and boutique commercial spaces. Textured tiles offer both acoustic benefits and design versatility, appealing to interior designers and architects who seek to create engaging, comfortable environments. The increasing demand for customized, visually striking interiors is driving the growing adoption of textured ceiling solutions.

Commercial Construction to Exhibit leading by Application

Commercial construction dominates the ceiling tiles market, due to ongoing expansion in office buildings, retail outlets, and hospitality venues. Ceiling tiles in commercial spaces enhance aesthetics, provide sound insulation, and comply with fire safety codes. Their modularity and maintenance efficiency make them a go-to choice for developers and facility managers aiming for fast installation and easy access to overhead systems like lighting and HVAC.

The residential application segment is steadily growing, driven by increasing demand for soundproofing and thermal insulation in modern homes and apartments. As homebuyers and renovators seek stylish and functional interiors, decorative ceiling tiles are being used to add texture and character to living spaces. Rising urbanization and disposable incomes are fueling interest in enhanced interior design, particularly in multi-unit housing developments, supporting long-term growth in the residential ceiling tile market.

Drop/Suspend to Exhibit Leading by Installation

Drop/suspended ceiling tiles dominate the market, holding the largest share in 2025 due to their flexibility, ease of maintenance, and ability to conceal wires, ducts, and piping. These systems are widely used in commercial buildings, schools, and hospitals, where quick access to infrastructure is essential. Drop ceilings also offer enhanced acoustic performance and fire resistance, making them a practical and compliant choice in regulated environments.

Surface-mounted ceiling tiles are a steadily growing segment, particularly in residential and hospitality sectors where aesthetics and space-saving are priorities. These tiles attach directly to the ceiling substrate, providing a cleaner and more minimalistic look. Ideal for renovations and spaces with limited height clearance, surface-mounted tiles are gaining popularity due to their sleek designs, ease of installation, and increasing availability in various textures and materials.

Competitive Analysis

The global ceiling tiles market is becoming increasingly competitive, with a mix of established building material manufacturers, interior solution providers, and emerging eco-friendly brands catering to sectors such as commercial, residential, hospitality, and institutional construction.

This competitive environment is largely driven by advancements in product design, acoustic performance, sustainability, and ease of installation. Companies that focus on innovation, offer a wide range of aesthetic and functional ceiling solutions, and emphasize energy efficiency and environmental compliance are gaining a distinct competitive advantage in the evolving architectural and construction landscape.

To sustain their competitive edge, companies consistently invest in research and development to launch innovative designs, enhance product performance, and align with changing consumer preferences and market trends. Strategic partnerships, mergers, and acquisitions are frequently implemented by organizations to broaden their market presence.

Major players maintain a strong foothold in developed regions such as Europe, North America, and parts of Asia Pacific, including Australia. Their extensive forward and backward integration across the value chain has heightened market competition and created significant entry barriers, making it challenging for new entrants to gain a foothold in the global ceiling tiles market.

Key players in the ceiling tiles industry include Armstrong World Industries, Inc., Saint-Gobain S.A., USG Corporation, Knauf, Techno Ceiling Products, KET Ceilings, Hunter Douglas, HIL Limited, SAS International, Rockwool International A/S, and other notable companies.

Recent Development

- In December 2024, Armstrong World Industries acquired A. Zahner Company, for USD 30 million. This acquisition significantly expands Armstrong's presence in the architectural metal sector, especially within the exterior segment.

- In April 2024, Armstrong World Industries acquired 3form, LLC, for USD 95 million. This acquisition expands Armstrong’s portfolio with innovative, design-forward solutions that feature unique combinations of form, texture, light, and colour, allowing architects and designers greater creative flexibility.

Segmentation of Ceiling Tiles Market

-

By Material :

- Aluminum

- Fiberglass

- Fiber/Gypsum

- PVC

- Steel

- Wood

- Other Materials (Polystyrene, Urethane, MDF, and Copper)

-

By Form :

- Laminated

- Fissured

- Patterned

- Plain

- Textured

- Coffered

- Other Forms (Open Cells and Fine Ceiling Tiles)

-

By Application :

- Residential

- Hospitality

- Commercial

- Institutional

- Industrial

-

By Installation :

- Drop/Suspended

- Surface-mounted

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025 to 2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Material

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Material, 2020 to 2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Material, 2025 to 2035

- Aluminum

- Fiberglass

- Fiber/Gypsum

- PVC

- Steel

- Wood

- Other Materials

- Y-o-Y Growth Trend Analysis By Material, 2020 to 2024

- Absolute $ Opportunity Analysis By Material, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Form, 2020 to 2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Form, 2025 to 2035

- Laminated

- Fissured

- Patterned

- Plain

- Textured

- Coffered

- Other Forms

- Y-o-Y Growth Trend Analysis By Form, 2020 to 2024

- Absolute $ Opportunity Analysis By Form, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Application, 2025 to 2035

- Residential

- Hospitality

- Commercial

- Institutional

- Industrial

- Industrial

- Y-o-Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Installation

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Installation, 2020 to 2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Installation, 2025 to 2035

- Drop/Suspended

- Surface-mounted

- Y-o-Y Growth Trend Analysis By Installation, 2020 to 2024

- Absolute $ Opportunity Analysis By Installation, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- U.S.

- Canada

- Mexico

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- South Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Material

- By Form

- By Application

- By Installation

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Form

- By Application

- By Installation

- Key Takeaways

- Key Countries Market Analysis

- United States

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Form

- By Application

- By Installation

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Form

- By Application

- By Installation

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Form

- By Application

- By Installation

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Form

- By Application

- By Installation

- United Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Form

- By Application

- By Installation

- United States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Material

- By Form

- By Application

- By Installation

- Competition Analysis

- Competition Deep Dive

- Armstrong World Industries, Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Saint-Gobain S.A.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- USG Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Knauf

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Techno Ceiling Products

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- KET Ceilings

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hunter Douglas

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Armstrong World Industries, Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 9: Global Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 10: Global Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 17: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 18: North America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 19: North America Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 20: North America Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 22: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 24: Latin America Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 25: Latin America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 26: Latin America Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 27: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 28: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 29: Latin America Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 30: Latin America Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: Western Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 34: Western Europe Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 35: Western Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 36: Western Europe Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 37: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 38: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 39: Western Europe Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 40: Western Europe Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 41: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: East Asia Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 44: East Asia Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 45: East Asia Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 46: East Asia Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 47: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 48: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 49: East Asia Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 50: East Asia Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 51: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 52: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 53: South Asia Pacific Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 54: South Asia Pacific Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 55: South Asia Pacific Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 56: South Asia Pacific Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 57: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 58: South Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 59: South Asia Pacific Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 60: South Asia Pacific Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 61: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 62: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: Eastern Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 64: Eastern Europe Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 65: Eastern Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 66: Eastern Europe Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 67: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 68: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 69: Eastern Europe Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 70: Eastern Europe Market Volume (Units) Forecast by Installation, 2020 to 2035

- Table 71: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 72: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Middle East & Africa Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 74: Middle East & Africa Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 75: Middle East & Africa Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 76: Middle East & Africa Market Volume (Units) Forecast by Form, 2020 to 2035

- Table 77: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 78: Middle East & Africa Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 79: Middle East & Africa Market Value (USD Bn) Forecast by Installation, 2020 to 2035

- Table 80: Middle East & Africa Market Volume (Units) Forecast by Installation, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Material

- Figure 7: Global Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Form

- Figure 10: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Application

- Figure 13: Global Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Installation

- Figure 16: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 17: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 18: Global Market Attractiveness Analysis by Region

- Figure 19: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: North America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Material

- Figure 30: North America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by Form

- Figure 33: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 34: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 35: North America Market Attractiveness Analysis by Application

- Figure 36: North America Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 37: North America Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 38: North America Market Attractiveness Analysis by Installation

- Figure 39: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 40: Latin America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by Material

- Figure 43: Latin America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 44: Latin America Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 45: Latin America Market Attractiveness Analysis by Form

- Figure 46: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 47: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 48: Latin America Market Attractiveness Analysis by Application

- Figure 49: Latin America Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 50: Latin America Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 51: Latin America Market Attractiveness Analysis by Installation

- Figure 52: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Western Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 54: Western Europe Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 55: Western Europe Market Attractiveness Analysis by Material

- Figure 56: Western Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 57: Western Europe Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 58: Western Europe Market Attractiveness Analysis by Form

- Figure 59: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 60: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 61: Western Europe Market Attractiveness Analysis by Application

- Figure 62: Western Europe Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 63: Western Europe Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 64: Western Europe Market Attractiveness Analysis by Installation

- Figure 65: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 66: East Asia Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 67: East Asia Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 68: East Asia Market Attractiveness Analysis by Material

- Figure 69: East Asia Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 70: East Asia Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 71: East Asia Market Attractiveness Analysis by Form

- Figure 72: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 73: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 74: East Asia Market Attractiveness Analysis by Application

- Figure 75: East Asia Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 76: East Asia Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 77: East Asia Market Attractiveness Analysis by Installation

- Figure 78: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 79: South Asia Pacific Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 80: South Asia Pacific Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 81: South Asia Pacific Market Attractiveness Analysis by Material

- Figure 82: South Asia Pacific Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 83: South Asia Pacific Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 84: South Asia Pacific Market Attractiveness Analysis by Form

- Figure 85: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 86: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 87: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 88: South Asia Pacific Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 89: South Asia Pacific Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 90: South Asia Pacific Market Attractiveness Analysis by Installation

- Figure 91: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: Eastern Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 93: Eastern Europe Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 94: Eastern Europe Market Attractiveness Analysis by Material

- Figure 95: Eastern Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 96: Eastern Europe Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 97: Eastern Europe Market Attractiveness Analysis by Form

- Figure 98: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 99: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 100: Eastern Europe Market Attractiveness Analysis by Application

- Figure 101: Eastern Europe Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 102: Eastern Europe Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 103: Eastern Europe Market Attractiveness Analysis by Installation

- Figure 104: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 105: Middle East & Africa Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 106: Middle East & Africa Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 107: Middle East & Africa Market Attractiveness Analysis by Material

- Figure 108: Middle East & Africa Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 109: Middle East & Africa Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 110: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 111: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 112: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 113: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 114: Middle East & Africa Market Value Share and BPS Analysis by Installation, 2025 and 2035

- Figure 115: Middle East & Africa Market Y-o-Y Growth Comparison by Installation, 2025 to 2035

- Figure 116: Middle East & Africa Market Attractiveness Analysis by Installation

- Figure 117: Global Market - Tier Structure Analysis

- Figure 118: Global Market - Company Share Analysis

- FAQs -

What is the Global Ceiling Tiles Market Size in 2025?

The ceiling tiles market is valued at USD 10.2 billion in 2025.

Who are the Major Players Operating in the Ceiling Tiles market?

Prominent players in the market include Armstrong World Industries, Inc., Saint-Gobain S.A., USG Corporation, Knauf, Techno Ceiling Products, KET Ceilings, and Hunter Douglas.

What is the Estimated Valuation of the Ceiling Tiles Market by 2035?

The market is expected to reach a valuation of USD 26.5 billion by 2035.

What Value CAGR Did the Ceiling Tiles Market Exhibit Over the Last Five Years?

The growth rate of the ceiling tiles market is 7.9% from 2020 to 2024.