Pyridine Market

Pyridine Market Analysis, By Product Type, By End-use Application, and Region - Market Insights 2025 to 2035

Analysis of Pyridine Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Pyridine Market Outlook (2025 to 2035)

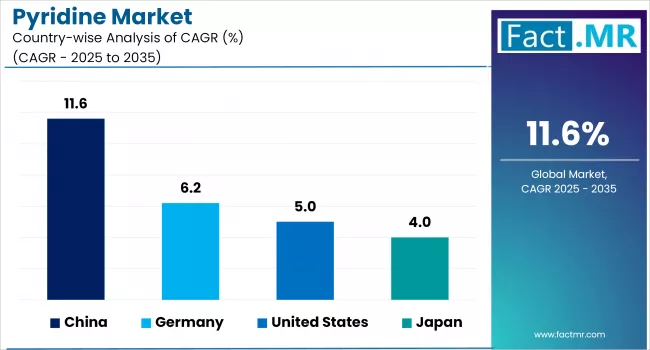

The global pyridine market is projected to increase from USD 1 billion in 2025 to USD 3 billion by 2035, with a CAGR of 11.6% during the forecast period. Growth is driven by rising demand across pharmaceuticals, agrochemicals, and specialty chemical industries.

Pyridine, a versatile heterocyclic compound, continues to play a vital role in synthesizing active pharmaceutical ingredients (APIs), herbicides, and solvents, ensuring its significance in global supply chains.

-2025-to-2035.webp)

Quick Stats for Pyridine Market

- Industry Value (2025): USD 1 Billion

- Projected Value (2035): USD 3 Billion

- Forecast CAGR (2025 to 2035): 11.6%

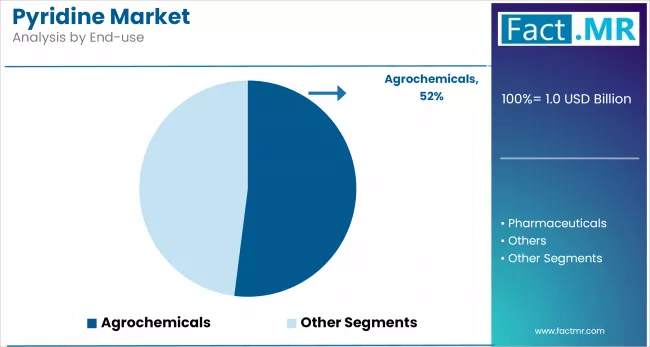

- Leading Segment (2025): Agrochemical (52% Market Share)

- Fastest Growing Country (2025-35): U.S. (5% CAGR)

- Top Key Players: Vertellus Specialties Inc., Jubilant Life Sciences Limited, Lonza Group Ltd., and Red Sun Group

What are the Drivers of Pyridine Market?

Demand for pyridine continues to grow steadily due to its wide-ranging applications in pharmaceuticals, agrochemicals, food additives, and industrial chemicals. Pyridine and its derivatives are used broadly as solvents, reagents and building blocks in a variety of chemical syntheses, making it highly relevant industrially and commercially important.

There are several growth drivers in the pyridine market, especially the booming pharmaceutical sector, as pyridine is a critical intermediate in the synthesis of antihistamines, anti-tuberculosis drugs, and vitamins, such as B3, niacin and niacinamide.

The expectation is that as healthcare spending increases and drug innovation globally matures and accelerates, especially in developing countries, there will be a commensurate increase in demand for pyridine-based compounds. Moreover, the generic drug business continues to grow as pharmaceutical patents expire, increasing demand for pyridine as a raw material.

Likely the other major end-use sector impacting demand for pyridine is in agrochemicals. Pyridine is an important component used in the formulation of herbicides, insecticides, and fungicides, including chlorpyrifos, paraquat, and diquat.

With the increase in global population and the growing demand for food security, there is an increasing need for crop protection chemicals. Demand for crop protection chemicals is especially apparent in developing markets - for example, India, China and Latin America, where agriculture is being modernized.

Furthermore, expanding requirements for pyridine derivatives, such as picolines, lutidines, and piperidine, which are utilized in rubber chemicals, dyes, adhesives, and solvents, will support market expansion in the future. The derivatives, such as picolines and lutidines, improve attributes of products in downstream applications in many industrial applications that reinforce the pyridine position in contractual relationships within the value chain.

Another key growth driver is the rise of R&D and green chemistry, with innovative bio-based pyridine production methods increasingly entering the market. Sustainable synthesis methods to develop and interconnect the carbon leftovers during the production of pyridine are creating ongoing innovation.

Manufacturers in Europe and North America must adapt their existing processes to comply with the environmental laws and regulations that require cleaner technologies (i.e., "green"), and source the new solvents from greener/renewable sources. The use of pyridine derivatives is becoming a viable option for these manufacturers.

Lastly, as a solvent and catalyst, pyridine will create long-term potential as new/previous uses in specialty chemistry, electronics, and polymers continue to expand. Industrialization within Asia-Pacific and Africa will expand the use of multipurpose intermediates, and pyridine fits the profile of an industrial chemistry intermediate, as a cornerstone chemical in the European and North American market.

What are the Regional Trends of Pyridine Market?

The Asia-Pacific region accounts for the majority of the global market for pyridine, both in production and consumption. Countries such as China and India are at the forefront of growth, based on the extensive base of agrochemical and pharmaceutical manufacturing the countries have developed. China is clearly influential as a major supplier of pyridine and its derivatives, leveraging its large-scale chemical infrastructure and relatively cheaper production advantages.

India, with its increasing investment in specialty chemicals and active pharmaceutical ingredients (APIs) is also boosting the domestic demand for pyridine derivatives.

The sustained focus on agricultural yield improvement in the region and high consumption rates of pesticides continue to drive demand. Many countries, including Vietnam and Indonesia, implement supportive government policies to encourage the growth of the chemicals sector in the region.

In North America, pyridine demand is primarily driven by pharmaceutical production fueled by ongoing research, along with technological advancements leading to new agrochemical formulations. In particular, the U.S. is the most important country in the North America region, due to significant market size, la arge pharmaceutical sector and R&D activities in life sciences and crop protection.

Environmental regulation related to pesticides; the use of pesticides and emissions of solvents will encourage the adoption of pyridine derivatives with improved performance and reduced toxicity. Nutritional supplement manufacturers have also contributed to demand as pyridine is employed as a precursor to Vitamin B3 production.

Steady demand exists in Europe; however, supply is heavily influenced by stringent environmental and safety regulations. Countries such as Germany, France, and the U.K. are emphasizing clean manufacturing and more sustainable chemical utilization.

Use of pyridine in Europe is mainly found in pharmaceuticals, specialty chemicals, and selected agrochemical use that is in compliance with EU REACH regulations. While the movement towards bio-based and low-emission solvents will continue to promote innovation in the sourcing and production of pyridine, the market will be constrained.

In Latin America, there is increasing demand for pyridine formulation in agrochemicals within its massive agricultural base, especially in Brazil and Argentina.

Development is modest but continuing in the Middle East & Africa, where industrial development and pharmaceutical investment (and subsequent pyridine demand) is growing. In these regions, local production is limited, so there is strong pressure to import the material.

What are the Challenges and Restraining Factors of Pyridine Market?

A major obstacle to the growth of the market is the increasing number of environmental and safety regulations associated with pyridine. As a volatile, toxic, and hazardous chemical, the environmental and health risks related to its production, handling, and disposal must be understood. Agencies within North America and Europe have established limitations on the amount of pyridine, for possible health effects, in formulations and emissions.

This has placed companies in a position where expensive compliance costs must be accounted for. These slow down the approval process to use pyridine-containing products and increase the costs of production.

The pyridine market is closely linked to petroleum-derived feedstocks, such as ammonia and acetaldehyde. Variability in crude oil pricing and geopolitical instability, or global disruptions of the supply chain (i.e., pandemics), directly impact the availability and price of raw materials needed to form pyridine.

Market volatility challenges manufacturers by making it difficult to stay competitive while also maintaining profitability and honoring long-term supply contracts.

Past submissions of pyridine have introduced new solvent systems and products that have been developed to replace pyridine in particular applications requiring lower toxicity or better environmental considerations. The trend of environmentally benign chemistries is visible in lab work across pharmaceutical and agrochemical-related R&D, as the use of alternative reagents and catalysts is being introduced to comply with environmental regulations and improve process efficiency.

Jen considers pyridine a hazardous chemical when assessing occupational safety. When inhaled, acute exposure to vapors of pyridine can result in irritative respiratory effects, irritative dermal effects, and neurological effects. The necessity for improved containment equipment and PPE will further complicate business requirements and increase costs in use of pyridine for pure English or as an ingredient in formulations, particularly for small businesses.

In developing economies, a lack of knowledge about the advantages and safe handling of the chemical pyridine frequently results in underuse or reliance upon imported long, short, or iso-pyridine derivatives. Insufficient regulatory framework both regionally and locally, as well as a shortage of local expertise in pyridine reformulation, hinders growth prospects, particularly in the pharmaceutical and agriculture market development.

Country-Wise Outlook

China Shows Strong Growth Driven by Pharmaceutical and Agrochemical Demand

The country’s extensive chemical production infrastructure, cost-efficient raw materials, and skilled labor force have established it as a dominant manufacturer of pyridine and its derivatives. Rising healthcare expenditure and a booming pharmaceutical sector drive the demand for pyridine as a key intermediate in active pharmaceutical ingredient (API) synthesis.

China’s agriculture industry continues to rely heavily on pyridine-based herbicides and insecticides to meet the food needs of its large population. While environmental concerns have led to stricter regulations around chemical manufacturing, Chinese producers are rapidly adopting advanced purification and waste management systems.

Government initiatives promoting self-reliance in specialty chemicals and increased R&D spending further strengthen the market. Exports to Asia-Pacific, Europe, and North America also contribute significantly to China’s position as the largest producer and consumer globally.

U.S. Focuses on High-Purity Production and Sustainable Applications

Growth is underpinned by robust demand in the pharmaceutical and specialty chemical sectors, where pyridine serves as a critical solvent and intermediate. The agrochemical industry also continues to consume significant volumes of pyridine for pesticide and herbicide production, though a shift towards greener alternatives is moderating growth in this segment.

-2025-to-2035.webp)

Stringent environmental standards imposed by agencies such as the EPA have pushed manufacturers to adopt sustainable production processes, including cleaner technologies and bio-based pyridine derivatives. Investments in R&D, coupled with a focus on high-value applications such as electronics and advanced materials, position the U.S. as a leading consumer of high-purity pyridine products. These factors collectively support steady market growth across the country.

Japan’s Precision Industry Drives Demand for Pyridine

The country’s emphasis on high-quality, precision chemical manufacturing ensures consistent demand for pyridine in the synthesis of APIs and agrochemical formulations.

Environmental sustainability remains a key focus area, with manufacturers investing in energy-efficient production technologies and waste minimization practices. Despite limited domestic raw material availability, Japan maintains its position as a major importer and processor of pyridine for use in specialty chemicals and electronic components. The steady push for technological innovation and clean energy solutions further sustains market momentum in the region.

Category-wise Analysis

N-oxide to Exhibit Leading by Product Type

Pyridine N-oxide holds a dominant position in the pyridine market and remains the preferred product type due to its extensive utility across key industries. It serves as an essential intermediate in the synthesis of agrochemicals, pharmaceuticals, and specialty chemicals. In agrochemicals, pyridine N-oxide is a crucial building block for herbicides and pesticides, enabling efficient crop protection solutions. Its ability to act as an oxidizing agent and its high solubility in various organic solvents make it highly desirable in chemical synthesis.

The pharmaceutical industry is the fastest-growing segment in the pyridine market. This industry utilizes pyridine N-oxide in the production of antibiotics, anti-inflammatory drugs, and other therapeutic agents, supporting its strong demand globally. Emerging applications in fine chemicals and catalysts are further expanding their market footprint. Rising investments in agricultural productivity and healthcare infrastructure worldwide continue to strengthen its market position. Future demand is expected to be supported by ongoing R&D efforts aimed at improving production efficiency and exploring new applications of Pyridine N-oxide in advanced chemical processes.

Agrochemical to Exhibit Leading by End-Use

The agrochemicals segment dominates the pyridine market due to the extensive use of chemical intermediates in the production of fertilizers, pesticides, and herbicides. The global push for higher agricultural productivity to meet rising food demand has fueled the consumption of agrochemical products. Additionally, advancements in crop protection solutions and government initiatives supporting modern farming practices have reinforced demand. This has positioned agrochemicals as the most dominant end-use segment in terms of both volume and revenue.

The pharmaceutical industry is the fastest-growing segment in the pyridine market. Pyridine and its derivatives play an integral role in the synthesis of active pharmaceutical ingredients (APIs), making them indispensable for drug manufacturing processes. Common therapeutic categories where pyridine-based intermediates are utilized include antihistamines, antiviral medications, anticancer drugs, and cardiovascular treatments.

Competitive Analysis

The pyridine market is becoming increasingly competitive, with a mix of global and regional players focusing on innovation, capacity expansion, and sustainable production. Major manufacturers are investing in advanced technologies to achieve higher purity levels and reduce environmental impacts, aligning with stringent regulatory standards in North America and Europe.

Strategic partnerships and collaborations with pharmaceutical and agrochemical companies are common, as players aim to secure long-term supply agreements and expand their customer base. In Asia-Pacific, particularly China and India, local producers benefit from cost-effective manufacturing and growing domestic demand, allowing them to compete in international markets.

Sustainability trends are pushing producers toward bio-based pyridine derivatives and cleaner production methods, giving companies a competitive edge in markets with strict environmental regulations. Additionally, R&D efforts targeting new applications in specialty chemicals and electronic materials are helping diversify product portfolios. This competitive landscape encourages continuous innovation and positions the market for steady growth.

Key players in the pyridine industry include Vertellus Specialties Inc., Jubilant Life Sciences Limited, Lonza Group Ltd., Red Sun Group, Resonance Specialties Limited, Shandong Luba Chemical Co., Ltd., Koei Chemical Co., Ltd., Weifang Sunwin Chemicals Co., Ltd., Bayer AG, LOBA Feinchemie AG, Merck KGaA, The Dow Chemical Company, Nippon Steel & Sumikin Chemical Co., Ltd., Labex Corporation, and other players.

Recent Development

- In October 2024, Lonza finalized its acquisition of the Genentech large-scale biologics manufacturing site in Vacaville, California, from Roche for USD 1.2 billion. This strategic move significantly strengthens Lonza's position in the global biomanufacturing market and expands its presence on the US West Coast.

- In March 2023, Aurorium, formerly known as Vertellus, announced the acquisition of CENTAURI Technologies (CENTAURI), a technology-driven manufacturer of specialty materials based in Pasadena, Texas.

Segmentation of Pyridine Market

-

By Product Type :

- Pyridine N-oxide

- Alpha Picoline

- Beta Picoline

- Gamma Picoline

- 2-Methyl-5-Ethylpyridine (MEP)

-

By End-use :

- Agrochemicals

- Pharmaceuticals

- Chemicals

- Building & Construction

- Food & Beverages

- Others (Dyestuffs, Alcohol)

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Materials Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Product Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Product Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Product Type, 2025-2035

- N-oxide

- Alpha Picoline

- Beta Picoline

- Gamma Picoline

- 2-Methyl-5-Ethyl(MEP)

- Y-o-Y Growth Trend Analysis By Product Type, 2020-2024

- Absolute $ Opportunity Analysis By Product Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End-Use

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By End-Use, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By End-Use, 2025-2035

- Agrochemicals

- Pharmaceuticals

- Chemicals

- Building & Construction

- Food & Beverages

- Others (Dyestuffs, Alcohol)

- Y-o-Y Growth Trend Analysis By End-Use, 2020-2024

- Absolute $ Opportunity Analysis By End-Use, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Product Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End-Use

- Key Takeaways

- Key Countries Market Analysis

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By End-Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By End-Use

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By End-Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By End-Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By End-Use

- China

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product Type

- By End-Use

- Competition Analysis

- Competition Deep Dive

- Vertellus Specialties Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Jubilant Life Sciences Limited

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Lonza Group Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Red Sun Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Resonance Specialties Limited

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Shandong Luba Chemical Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Koei Chemical Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Weifang Sunwin Chemicals Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Bayer AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- LOBA Feinchemie AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Merck KGaA

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- The Dow Chemical Company

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Nippon Steel & Sumikin Chemical Co. Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Labex Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Vertellus Specialties Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Tons) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 4: Global Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 6: Global Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 7: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 8: North America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 10: North America Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 12: North America Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 13: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 15: Latin America Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 18: Latin America Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 19: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 21: Western Europe Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 23: Western Europe Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 24: Western Europe Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 25: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: East Asia Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 27: East Asia Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 28: East Asia Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 29: East Asia Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 30: East Asia Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 31: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: South Asia Pacific Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 33: South Asia Pacific Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 34: South Asia Pacific Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 35: South Asia Pacific Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 36: South Asia Pacific Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 37: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 38: Eastern Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 39: Eastern Europe Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 40: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 41: Eastern Europe Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 42: Eastern Europe Market Volume (Tons) Forecast by End-Use, 2020 to 2035

- Table 43: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 45: Middle East & Africa Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 46: Middle East & Africa Market Volume (Tons) Forecast by Product Type, 2020 to 2035

- Table 47: Middle East & Africa Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 48: Middle East & Africa Market Volume (Tons) Forecast by End-Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Tons) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Product Type

- Figure 7: Global Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by End-Use

- Figure 10: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Region

- Figure 13: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 21: North America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 22: North America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 23: North America Market Attractiveness Analysis by Product Type

- Figure 24: North America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by End-Use

- Figure 27: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Latin America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 29: Latin America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 30: Latin America Market Attractiveness Analysis by Product Type

- Figure 31: Latin America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 32: Latin America Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 33: Latin America Market Attractiveness Analysis by End-Use

- Figure 34: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 35: Western Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 36: Western Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 37: Western Europe Market Attractiveness Analysis by Product Type

- Figure 38: Western Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 39: Western Europe Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 40: Western Europe Market Attractiveness Analysis by End-Use

- Figure 41: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 42: East Asia Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 43: East Asia Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 44: East Asia Market Attractiveness Analysis by Product Type

- Figure 45: East Asia Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 46: East Asia Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 47: East Asia Market Attractiveness Analysis by End-Use

- Figure 48: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 49: South Asia Pacific Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 50: South Asia Pacific Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 51: South Asia Pacific Market Attractiveness Analysis by Product Type

- Figure 52: South Asia Pacific Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 53: South Asia Pacific Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 54: South Asia Pacific Market Attractiveness Analysis by End-Use

- Figure 55: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 57: Eastern Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Product Type

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 60: Eastern Europe Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End-Use

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: Middle East & Africa Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 64: Middle East & Africa Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 65: Middle East & Africa Market Attractiveness Analysis by Product Type

- Figure 66: Middle East & Africa Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 67: Middle East & Africa Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 68: Middle East & Africa Market Attractiveness Analysis by End-Use

- Figure 69: Global Market - Tier Structure Analysis

- Figure 70: Global Market - Company Share Analysis

- FAQs -

What was the size of the global pyridine market in 2022?

The global pyridine market was valued at US$ 1.3 billion in 2022.

At what rate did the demand for pyridine increase from 2018 to 2022?

Worldwide demand for pyridine increased at a CAGR of 8.2% from 2018 to 2022.

How big is the pyridine market at present?

The market for pyridine is estimated at US$ 1.43 billion in 2023.

What is the market share held by the pharmaceutical industry?

The pharmaceutical industry accounts for a market share of 37.9% in 2023.

What is the estimated sales valuation of pyridine for 2033?

Sales of pyridine are predicted to reach US$ 2.88 billion by the end of 2033.

What is the expected growth rate for the market in China?

The market in China is forecasted to expand at 7.7% CAGR through 2033.