Ruthenium Market

Ruthenium Market Size and Share Forecast Outlook 2025 to 2035

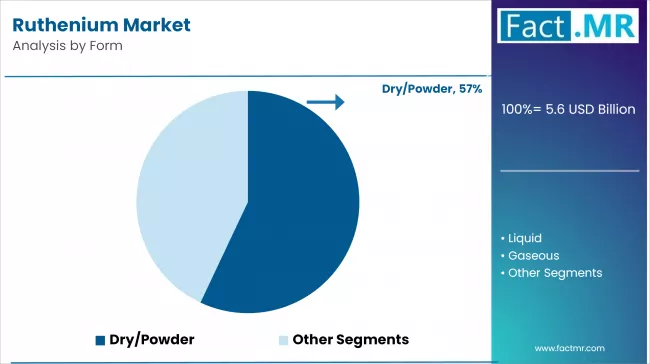

The Ruthenium Market Is Slated To Total USD 5.6 Billion In 2025, Expected To Reach USD 8.9 Billion By 2035, Expected To Advance At A 4.7% CAGR. Preference For Dry/Powdered Ruthenium Will Remain Preferred While Applications Abound In The Manufacturing Of Electrical And Electronics.

Ruthenium Market Outlook 2025 to 2035

The global ruthenium market is forecast to reach USD 8.9 billion by 2035, up from USD 5.6 billion in 2025. During the forecast period, the industry is projected to register at a CAGR of 4.7%. The increasing use of electronic components, including hard disk drives and computer chips drives the market’s expansion.

Another key driver is its use as a catalyst in chemical processes, including its applications in hydrogen fuel cells. Moreover, ruthenium’s use as an alloy to increase hardness and strengthen other metals used in wear-resistant components is another key driver.

Quick Stats on Ruthenium Market

- Ruthenium Market Size (2025): USD 5.6 billion

- Projected Ruthenium Market Size (2035): USD 8.9 billion

- Forecast CAGR of Ruthenium Market (2025 to 2035): 4.7%

- Leading From Segment of Ruthenium Market: Dry/Powder

- Leading End Use Segment of Ruthenium Market: Electrical and Electronics

- Key Growth Regions of Ruthenium Market: South Africa, China, United States

- Prominent Players in the Ruthenium Market: British Fluorspar Ltd., China Kings Resources Group Co. Ltd., Gupo Minersa, Jianyang Shanshui Chemicals Industry CORP. Ltd., Others

2025-to-2035.webp)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.6 billion |

| Industry Size (2035F) | USD 8.9 billion |

| CAGR (2025-2035) | 4.7% |

The ruthenium market is projected to expand from USD 5.6 billion in 2025 to USD 8.9 billion by 2035, registering a steady CAGR of 4.7%. The Y-o-Y growth trajectory demonstrates consistent year-on-year increases, reflecting gradual adoption across end-use applications rather than sudden spikes.

From 2025 to 2035, the market is expected to grow by approximately USD 3.3 billion cumulatively, translating to incremental annual gains of nearly USD 0.25-0.35 billion in early years and accelerating toward USD 0.5 billion by the latter part of the decade. This expansion is underpinned by rising demand for ruthenium in electronics, including memory chips, hard disk drives, and chip resistors, where it is valued for its high corrosion resistance and conductivity.

Catalytic applications in chemical synthesis and emerging hydrogen-based energy solutions further support demand growth. Industrial adoption is notably higher in regions investing in automotive emission control technologies and electrochemical devices, which leverage ruthenium as a key catalyst and electrode material.

The decade-long growth pattern remains moderate but resilient, with annual growth rates holding near 4.7%, ensuring predictability for suppliers and investors. Increasing utilization in renewable energy technologies, including electrolysis and fuel cell electrodes, is projected to sustain market momentum.

Additionally, regulatory emphasis on cleaner emissions and industrial processes is likely to encourage replacement of conventional catalysts with ruthenium-based solutions, reinforcing market stability. Price volatility of ruthenium may influence short-term fluctuations, but overall expansion is expected to remain consistent.

Key Insights

- Annual growth is projected consistently at approximately 4.7% from 2025 to 2035

- Incremental market value increases from USD 5.6 billion to USD 8.9 billion, driven by electronics, catalysis, and energy applications

- Regional adoption, particularly in Asia-Pacific and North America, will support steady growth, influenced by automotive and renewable energy industries

Analyzing the Ruthenium Market’s Key Dynamics

The ruthenium market is influenced by a combination of growth drivers and structural challenges that shape its trajectory from 2025 to 2035. Increasing applications in electronics, chemical catalysis, energy storage, and specialized industrial alloys are expanding adoption, while supply chain constraints, price volatility, and production concentration create obstacles that need to be addressed.

Understanding these key drivers and challenges provides insight into market dynamics, guiding stakeholders in strategic planning, investment, and risk mitigation. The following section outlines the primary factors accelerating growth and the constraints limiting expansion.

Expanding Electronics and Semiconductor Applications

Ruthenium is increasingly utilized in electronics due to its superior conductivity and corrosion resistance. Hard disk drives, chip resistors, and semiconductors leverage ruthenium to improve storage density, component efficiency, and device reliability. The proliferation of cloud computing, data centers, and high-performance computing equipment continues to stimulate demand, ensuring steady adoption across the electronics value chain.

The rising need for miniaturization and enhanced performance in electronic devices further supports growth. Manufacturers rely on ruthenium-based components to maintain long-term durability and precise operation, particularly in commercial and industrial computing environments. This positions ruthenium as a critical material for future electronics expansion.

Catalytic Efficiency in Chemical Production

Ruthenium serves as an effective catalyst in chemical synthesis, particularly in the production of acetic acid and ammonia. Its high reaction efficiency and selective activity allow manufacturers to optimize chemical processes, reduce waste, and improve overall productivity. These properties make it a preferred choice in chemical manufacturing operations where precision and yield are critical.

The market benefits from a shift toward energy-efficient production processes, where ruthenium reduces reaction time and energy consumption. Industries increasingly adopt ruthenium catalysts to enhance process reliability while maintaining compliance with regulatory standards for emissions and process safety.

Adoption in Energy Storage and Specialized Alloys

Ruthenium is widely used in dye-sensitized solar cells, modern batteries, and supercapacitors, supporting the development of renewable energy and advanced energy storage solutions. Its electrochemical stability and performance under high load conditions make it ideal for emerging energy technologies.

Additionally, ruthenium alloys with platinum or palladium are applied in aerospace, defense, and premium wear-resistant electrical contacts. High hardness and corrosion resistance enable components to withstand extreme operational conditions, reinforcing adoption in specialized industrial applications.

Supply Chain Limitations May Restrict Accessibility

Ruthenium is primarily obtained as a by-product of platinum and nickel mining, making its production dependent on the output of these metals. Fluctuations in platinum or nickel extraction directly affect ruthenium availability, creating uncertainty for manufacturers relying on consistent supply.

This supply dependency constrains market expansion and limits the ability to meet rising demand across electronics, catalysis, and energy storage applications. Companies must carefully manage procurement strategies to mitigate potential shortages.

Price Volatility May Lead to Fluctuations in Costing

Limited supply combined with strong demand from multiple sectors results in high price fluctuations. Ruthenium’s cost can hinder adoption in price-sensitive applications, forcing manufacturers to consider alternative materials or limit production volumes.

The high cost also impacts investment decisions for new technologies that rely on ruthenium. Organizations must balance material performance benefits with budget constraints, often slowing large-scale integration.

Geopolitical and Regional Concentration

South Africa and Russia dominate global ruthenium production, creating geopolitical risks for the supply chain. Political instability, economic challenges, or operational disruptions in these countries can trigger immediate global shortages.

Concentration in production regions also increases vulnerability to logistical and regulatory barriers. Companies face elevated risks in procurement, inventory planning, and long-term market strategies due to this dependence on a few producers.

Regional Trends of the Ruthenium Market

Asia Pacific leads in ruthenium consumption and demand, driven by its large and growing electronics and semiconductor industries. Countries such as China, Japan, and South Korea provide strong manufacturing support, which strengthens the adoption of ruthenium in hard disk drives, chip resistors, and other high-performance electronic components.

The presence of data centers, cloud computing infrastructure, and semiconductor manufacturing further reinforces regional demand, making Asia Pacific the dominant market for ruthenium globally.

In the U.S. and Europe, demand is shaped by technology, defense, chemical, and pharmaceutical applications. In the U.S., ruthenium is employed in aviation electronics, fuel cells, and renewable energy technologies, creating new opportunities in clean energy adoption.

Europe focuses on hydrogen and fuel cell technology, with significant investment in chemical and pharmaceutical processes where ruthenium acts as a critical catalyst.

While the Middle East and Africa are key producers, particularly South Africa, industrial consumption is limited, and the market is largely influenced by mining output and export performance.

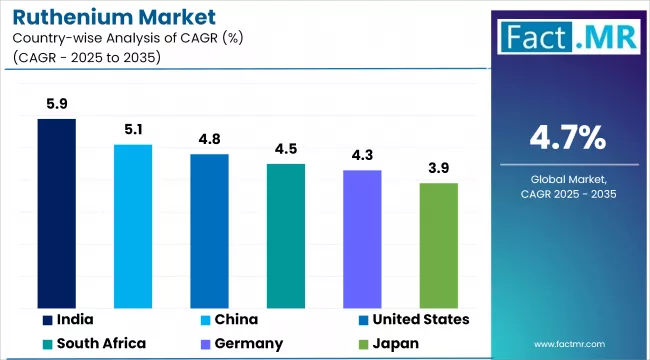

Country-Wise Outlook

| Countries | CAGR (2025-2035) |

|---|---|

| South Africa | 4.5% |

| China | 5.1% |

| United States | 4.8% |

South Africa is a Key Supplier in the Ruthenium Market

South Africa holds a remarkable reputation as a top producer of ruthenium and supplies the entire world with it. This iron-clad reputation stems from the country's large-scale gold and PGM (platinum group metal) mining operations. Ruthenium's mining as a byproduct ensures a correlation with the platinum and palladium market trends.

Having dominance in the market is a double-edged sword. Any power cuts or strikes in the country as a result of political boredom incur huge damages to the mining industry, which in the end can stall the entire global production of ruthenium. Because of this, South Africa is a critical manufacturer and a keystone to the world supply chain of ruthenium.

Thus far, South Africa can be painted as a predominant producer, but hands down, elbows deep into the industry, and exports the metal to China, Canada, and the UK for the value added. This lowers the trade value of South Africa and clearly states why South Africa remains just a producer and not a manufacturer.

- Major global supplier of ruthenium due to extensive platinum group metal mining

- Market dominance carries high geopolitical and operational risks, including strikes and power shortages

- Exports raw ruthenium to China, Canada, and the UK, limiting domestic value addition

China is Witnessing Driving Demand for Ruthenium Market through Electronics

China has a significant impact on the consumption of ruthenium due to the expanding electronics and semiconductor industries. The country's manufacturing sector relies on the metal for a variety of applications. This includes its use in hard disk drives and sophisticated chip resistors, which are vital for powering contemporary technology.

Technological self-sufficiency policies, as well as the deeply rooted manufacturing industries, are supported by the rise in consumer electronics. China’s substantial investments in data centers, 5G networks, and other digital infrastructure are set to escalate the demand for ruthenium. This positions China as a leading force for ruthenium in the international market.

Besides being a leading consumer, China is strategically positioning itself to advance in technology and research. The exploration of new ruthenium applications, such as in renewable energy and as chemical catalysts, may transform its market role from passive consumer to active innovator.

- Strong electronics and semiconductor manufacturing sector drives consistent ruthenium consumption

- Investments in data centers, 5G, and digital infrastructure further escalate demand

- Research and development in new ruthenium applications position China as an emerging innovator

United States Market is Growing Due to Technology and Clean Energy Driver

2025-to-2035.webp)

The market for ruthenium in the United States is primarily the focus of the high-tech, defense, and clean energy sectors. The industry’s need for ruthenium, in conjunction with demand for electrical contacts and semiconductors for high-performance devices, puts the US in a significant position in regard to ruthenium for the aerospace and defense sectors.

Aside from the ruthenium used in the aerospace and defense industries, the fuel cell and battery sectors will also be seeing a higher demand, contributing to the industry drivers. There is a growing need for green technologies and sustainable energy, with government incentives and corporate investments in renewables, helping expand the overall market.

Although the United States continues to be one of the leading technologies in R&D of ruthenium, with advancements in policies and technologies, it remains a net importer of ruthenium, alongside taking US production into account. There is also an advancement seen from the government regulations, which helps push the country further to detach from the net-importing support.

- High demand in aerospace, defense, and high-tech sectors drives growth

- Expansion of fuel cells and battery applications increases market adoption

- Government incentives and policy support promote domestic R&D and reduced reliance on imports

Category-wise Analysis

The ruthenium market is structured across multiple product forms, distribution channels, and end-use sectors, each contributing distinctly to overall growth. Understanding the dynamics within these categories provides insight into consumption patterns, emerging trends, and potential areas for expansion.

Product forms such as dry/powder and liquid are driven by specific industrial applications, while distribution channels reflect operational preferences and transaction security requirements. End-use sectors, including electrical and electronics and pharmaceuticals, highlight the industries that most significantly influence ruthenium demand. Analyzing these categories helps identify strategic focus areas and investment priorities for stakeholders, supporting informed decision-making and market positioning.

Dry/Powder Remains the Preferred Form

The dry/powder form still dominates the market for ruthenium. The reason for this is the electrical and electronics industry's prevailing applications. In the electrical and electronics industries, ruthenium is used as a powder. For thick-film chip resistors and hard disk drives, advanced components, dry ruthenium is a key material.

Even among catalysts for a variety of industries, ruthenium is the preferred dry powder. In industrial settings, dry ruthenium is easy to handle. Everything mentioned above confirms the position of dry ruthenium as the leading subsegment in the market. The increasing dry ruthenium powder is a consequence of the rising global demand for miniaturized electronic devices.

The liquid segment is also a vital area for future growth. There is an increasing need for liquid forms of ruthenium, especially in the chemical and pharmaceutical markets. For a variety of specialized chemicals and complex pharmaceuticals, liquid ruthenium compounds and solutions are utilized in many catalytic processes.

- Dry/powder form dominates due to widespread use in electronics and thick-film chip resistors

- Industrial handling and miniaturized device demand strengthen dry ruthenium’s market share

- Liquid ruthenium is emerging in chemicals, pharmaceuticals, and advanced energy applications

Offline Remains the Preferred Distribution Channel

The distribution of ruthenium in the market still largely depends on the offline segment. This channel has the greatest share, predominating the market due to the nature of the product. Ruthenium, for example, is an industrial material of high value that tends to trade in the context of outright contracts between suppliers and industrial customers.

Such dealings entail stringent quality assurance, precise and detailed requirements, and tight security logistics, which offline networks are best suited to manage. The offline channel facilitates inspection of the product prior to delivery, which is crucial as industries such as electronics and chemicals require metals of specific grades and particular forms.

Although offline channels continue to dominate, the online segment is exhibiting a notable growth trend. This is attributed to the digitalization of B2B dealings and the growing convenience of digital platforms. Online distribution is becoming more practical for smaller volumes as well as for some specific ruthenium compounds needed for research and development.

- Offline channels dominate due to high-value transactions, quality assurance, and secure logistics

- Bulk handling, inspection, and control requirements reinforce offline distribution preference

- Online channels grow due to digitalization, e-commerce convenience, and access to small-volume compounds

Electrical and Electronics Remain the Preferred End Use

The ruthenium metal market is most profoundly ruled by the consumption of the electrical and electronics sector. This is because of ruthenium’s remarkable features, like its extreme electrical conductivity and its hardness and corrosion resistance.

Ruthenium plays an essential role in the production of hard disk drives by increasing data storage and stability. It also contributes to the manufacturing of chip resistors used to control current in electronic devices.

The constant growth in technology and the increasing global market of consumer electronics, mobile devices, and data storage devices further ensures the dominance of this segment.

The pharmaceuticals segment is projected to grow significantly in the future. Although it currently has a small market share, the demand trends show a strong upward trajectory. This is driven by the increasing use of ruthenium as a catalyst in the synthesis of complex organic compounds, which are critical in the development of new medicines.

- Electrical and electronics sector dominates due to conductivity, hardness, and corrosion resistance

- Ruthenium is essential for hard disk drives, chip resistors, and consumer electronics applications

- Pharmaceuticals segment is emerging as a growth area due to catalysis in complex drug synthesis and medical research

Competitive Analysis

The ruthenium market stands out due to its limited competition and a small number of dominant industry participants that control the entire value chain. Demand for ruthenium is driven entirely by consumers of platinum and nickel. Such producers are the only suppliers of ruthenium. These suppliers exert considerable market power. These few suppliers shape the landscape, and competition is focused on securing contracts and relationship-building.

To differentiate themselves, businesses operating in this market utilize various approaches and innovations in ruthenium supply. This includes the development of high-purity ruthenium for electronics and novel ruthenium compounds for catalysts in the chemicals and pharmaceuticals industries. Specialized engineering and innovation are directed toward new applications. These businesses also recover ruthenium from old electronics and spent catalysts, thus supplementing the primary supply and reducing environmental impact.

Other competitive factors comprise pricing and market volatility. Ruthenium's price can be volatile because of its scarcity and the larger PGM markets. Thus, a firm’s capacity to provide stable pricing and a constant supply becomes a great asset. Also, technical support, quality assurance, and the ability to comprehend specific customer needs in different industries play a vital role in gaining a competitive edge. All these factors overshadow the sole existence of a lower price.

Key Players in the Market

- British Fluorspar Ltd.

- China Kings Resources Group Co. Ltd.

- Gupo Minersa

- Jianyang Shanshui Chemicals Industry CORP. Ltd.

- Prima Fluorspar Corp.

- Mongolrostsvetmet LLC.

- Seaforth Mineral & Ore Co.

- Sinochem Latina Co. Ltd.

Recent Developments

- In July 2025, Sibanye-Stillwater announced the acquisition of Metallix Refining, a US-based precious metals recycling company, for $82 million. This acquisition is part of their strategy to enhance their global recycling footprint by adding scale, technology, and expertise to their existing operations.

- In June 2025, Anglo American announced the successful demerger of its PGM business, now known as Valterra Platinum. This move was part of a larger portfolio simplification strategy to unlock value for its shareholders.

Segmentation of the Ruthenium Market

-

By Form :

- Dry/Powder

- Liquid

- Gaseous

-

By Distribution Channel :

- Online

- Offline

-

By End Use :

- Electrical & Electronics

- Pharmaceuticals

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Form, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Form, 2025-2035

- Dry/Powder

- Liquid

- Gaseous

- Y-o-Y Growth Trend Analysis By Form, 2020-2024

- Absolute $ Opportunity Analysis By Form, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Distribution Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Distribution Channel, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Distribution Channel, 2025-2035

- Online

- Offline

- Y-o-Y Growth Trend Analysis By Distribution Channel, 2020-2024

- Absolute $ Opportunity Analysis By Distribution Channel, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End Use

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By End Use, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By End Use, 2025-2035

- Electrical & Electronics

- Pharmaceuticals

- Y-o-Y Growth Trend Analysis By End Use, 2020-2024

- Absolute $ Opportunity Analysis By End Use, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Form

- By Distribution Channel

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Form

- By Distribution Channel

- By End Use

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Bn) & Volume (Tons)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- Value (USD Bn) & Volume (Tons)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Form

- By Distribution Channel

- By End Use

- Value (USD Bn) & Volume (Tons)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Form

- By Distribution Channel

- By End Use

- Competition Analysis

- Competition Deep Dive

- British Fluorspar Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- China Kings Resources Group Co. Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Gupo Minersa

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Jianyang Shanshui Chemicals Industry CORP. Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Prima Fluorspar Corp

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Mongolrostsvetmet LLC

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Seaforth Mineral & Ore Co

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Sinochem Latina Co. Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- British Fluorspar Ltd

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Tons) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 4: Global Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 6: Global Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 8: Global Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 12: North America Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 14: North America Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 16: North America Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 20: Latin America Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 22: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 28: Western Europe Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 30: Western Europe Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: East Asia Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 36: East Asia Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 37: East Asia Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 38: East Asia Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 39: East Asia Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 40: East Asia Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 41: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: South Asia Pacific Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 43: South Asia Pacific Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 44: South Asia Pacific Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 45: South Asia Pacific Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 46: South Asia Pacific Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 47: South Asia Pacific Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 48: South Asia Pacific Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 52: Eastern Europe Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 54: Eastern Europe Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 56: Eastern Europe Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 60: Middle East & Africa Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 62: Middle East & Africa Market Volume (Tons) Forecast by Distribution Channel, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 64: Middle East & Africa Market Volume (Tons) Forecast by End Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Tons) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Form

- Figure 7: Global Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Distribution Channel

- Figure 10: Global Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by End Use

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Form

- Figure 27: North America Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Distribution Channel

- Figure 30: North America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by End Use

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 36: Latin America Market Attractiveness Analysis by Form

- Figure 37: Latin America Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 39: Latin America Market Attractiveness Analysis by Distribution Channel

- Figure 40: Latin America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by End Use

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 46: Western Europe Market Attractiveness Analysis by Form

- Figure 47: Western Europe Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 49: Western Europe Market Attractiveness Analysis by Distribution Channel

- Figure 50: Western Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 52: Western Europe Market Attractiveness Analysis by End Use

- Figure 53: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: East Asia Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 55: East Asia Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 56: East Asia Market Attractiveness Analysis by Form

- Figure 57: East Asia Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 58: East Asia Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 59: East Asia Market Attractiveness Analysis by Distribution Channel

- Figure 60: East Asia Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 61: East Asia Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 62: East Asia Market Attractiveness Analysis by End Use

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: South Asia Pacific Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 65: South Asia Pacific Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 66: South Asia Pacific Market Attractiveness Analysis by Form

- Figure 67: South Asia Pacific Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 68: South Asia Pacific Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 69: South Asia Pacific Market Attractiveness Analysis by Distribution Channel

- Figure 70: South Asia Pacific Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 71: South Asia Pacific Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 72: South Asia Pacific Market Attractiveness Analysis by End Use

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: Eastern Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 75: Eastern Europe Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 76: Eastern Europe Market Attractiveness Analysis by Form

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 78: Eastern Europe Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 79: Eastern Europe Market Attractiveness Analysis by Distribution Channel

- Figure 80: Eastern Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 81: Eastern Europe Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 82: Eastern Europe Market Attractiveness Analysis by End Use

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Form, 2025 to 2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by Distribution Channel

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by End Use, 2025 to 2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by End Use

- Figure 93: Global Market - Tier Structure Analysis

- Figure 94: Global Market - Company Share Analysis

- FAQs -

What is the Global Ruthenium Market size in 2025?

The ruthenium market is valued at USD 5.6 billion in 2025.

Who are the Major Players Operating in the Ruthenium Market?

Prominent players in the market include Prima Fluorspar Corp., Mongolrostsvetmet LLC., Seaforth Mineral & Ore Co., Sinochem Latina Co. Ltd.

What is the Estimated Valuation of the Ruthenium Market by 2035?

The market is expected to reach a valuation of USD 8.9 billion by 2035.

At what CAGR is the Ruthenium Market slated to grow during the study period?

The growth rate of the ruthenium market is 4.7% from 2025 to 2035.The growth rate of the ruthenium market is 4.7% from 2025 to 2035.