Soil Compaction Machines Market

Soil Compaction Machines Market Analysis, By Product Type, By Application, and Region - Market Insights 2025 to 2035

Analysis of Soil Compaction Machines Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Soil Compaction Machines Market Outlook (2025 to 2035)

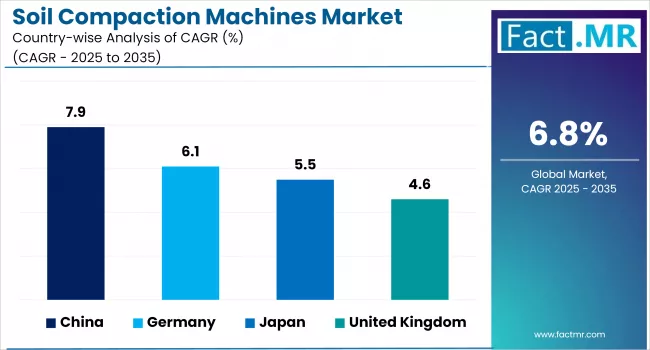

The global soil compaction machines market is projected to increase from USD 6.1 billion in 2025 to USD 11.8 billion by 2035, with a CAGR of 6.8% during the forecast period. Growth is driven by an increasing number of infrastructure and road construction projects that demand effective ground stabilization. Key trends include the adoption of intelligent compaction technologies for enhanced precision and monitoring.

-2025-to-2035.webp)

Quick Stats for Soil Compaction Machines Market

- Industry Value (2025): USD 6.1 Billion

- Projected Value (2035): USD 11.8 Billion

- Forecast CAGR (2025 to 2035): 6.8%

- Leading Segment (2025): Building & Construction (34% Market Share)

- Fastest Growing Country (2025-35): China (7.9% CAGR)

- Top Key Players: Volvo Construction Equipment, J.C. Bamford Excavators Limited, John Deere, and Zoomlion Heavy Industries

What are the Drivers of Soil Compaction Machines Market?

The rising demand for smart city development is expected to drive sales of soil compaction equipment, as stable construction foundations are essential for such projects. In smart cities, technology enhances public services and overall quality of life. At the same time, soil compaction ensures structural integrity by reducing air gaps between particles, making it a critical step in building durable and efficient urban infrastructure.

The Indian Ministry of Housing and Urban Affairs reported 3,997 smart city projects completed by June 2022, up from 1,290 in 2019. The Indian Union Budget allocated USD 7,504.14 million under NUHF for Pradhan Mantri Awas Yojana to build smart city homes. Soil compactor market.

Expansion in the construction sector is anticipated to significantly boost the growth of the soil compaction equipment market in the coming years. The construction industry builds, repairs, renovates, and maintains homes, roads, bridges, and other structures.

Soil compactors compact garbage and biomass. Building embankments, roads, subgrades, earth dams, and other structures requires compaction to improve soil density, water content, and gradation. The US Census Bureau, a key organization in the US Federal Data System that generates economic and population statistics, expects construction spending to reach $1,983.5 billion in August 2023, up 7.4% (1.8%) from $1,847.3 billion in August 2022.

The expansion of the mining sector and industrial zones also helps to drive market growth. Soil compaction is critical when preparing haul roads, storage areas, and facility sites, especially in large-scale industrial projects.

Advancements in machine performance, fuel efficiency, and intelligent compaction systems are rapidly accelerating the adoption of soil compaction equipment. Contractors and infrastructure firms are increasingly opting for machines equipped with features that enhance productivity, precision, and environmental compliance, prompting manufacturers to innovate and meet evolving project demands.

What are the Regional Trends of Soil Compaction Machines Market?

North America, particularly the U.S. and Canada, dominates the market, owing to its well-established construction industry and emphasis on cost-effective and sustainable construction practices. The region's emphasis on technological advancements, automation, and environmental compliance has aided the widespread adoption of advanced soil compaction equipment.

Europe is another prominent region in the soil compaction equipment market, with Germany, the U.K., and France leading the way. The region's commitment to sustainable infrastructure development, combined with stringent environmental regulations, has increased demand for efficient and environmentally friendly soil compaction solutions.

The Asia-Pacific region is expected to experience the fastest growth rate in the coming years, as countries such as China, India, and Indonesia continue to invest heavily in infrastructure expansion and urban development. Rapid urbanization, increased demand for transportation networks, and a greater emphasis on cost-effective construction methods have all created significant opportunities for the soil compaction equipment market.

Latin America and the Middle East & Africa offer opportunities for the soil compaction equipment market, albeit with lower market penetration than the other regions. As these regions work to improve their infrastructure and construction capabilities, the demand for dependable and efficient soil compaction solutions is expected to increase.

What are the Challenges and Restraining Factors of Soil Compaction Machines Market?

The soil compaction machines market faces significant challenges due to high initial and operating costs. Many small and medium-sized contractors, particularly in developing countries, struggle to afford sophisticated machines outfitted with intelligent compaction technologies. This financial barrier restricts market penetration and slows the adoption of newer, more effective models.

Fluctuating raw material prices, particularly steel, have an impact on the total production cost of these machines. Steel is a key component in the manufacturing of construction equipment, so any price volatility has a direct effect on equipment pricing, profit margins, and customer affordability. Manufacturers face difficulties in maintaining competitive pricing while ensuring quality and longevity.

Another barrier is a lack of skilled operators. Despite technological advancements, operating soil compaction machines requires expertise to achieve optimal compaction and fuel efficiency. In many regions, a shortage of trained personnel results in underutilization or inefficient use of machinery, which in turn affects project outcomes and slows market growth.

Environmental regulations governing noise and emissions also pose compliance issues. Stringent standards in regions such as the European Union and North America force manufacturers to invest in R&D for cleaner technologies, thereby increasing development costs. These regulations may also limit the use of older, more polluting machines, especially in urban construction areas.

Country-Wise Outlook

U.K. Soil Compaction Machines Market Boosted by Infrastructure Upgrades and Urban Development

In the U.K., the soil compaction machines market is supported by ongoing investments in infrastructure development and urban renewal projects. The ongoing upgrade of highways, rail networks such as HS2, and flood defense systems is driving the demand for efficient ground compaction equipment. These projects necessitate a wide range of machines, from light compactors for urban areas to heavy rollers for large-scale groundwork, which drives market growth.

In the U.K., the government's emphasis on sustainable infrastructure and green construction practices is a major driver. Contractors are increasingly required to use energy-efficient and low-emission equipment on job sites. This has resulted in a growing preference for newer models with Tier V-compliant engines, as well as hybrid or electric compactors, particularly in urban areas with strict emission and noise restrictions.

Digital monitoring systems and telematics are being used to improve accuracy and documentation on construction sites. This is especially useful for public projects, where quality assurance and regulatory compliance are essential. Contractors who use data-driven compaction solutions benefit from increased productivity and reduced fuel consumption.

Emission regulations and operator safety standards also play a crucial role in shaping the market landscape. Health and safety standards enforced by the Health and Safety Executive (HSE) require proper vibration control and noise reduction, pushing manufacturers to innovate in ergonomics and design. Equipment rental companies are also seeing an increase in demand for low-vibration and low-noise models to meet contractor expectations.

China Soil Compaction Machines Market Driven by Massive Infrastructure Growth

In China, the soil compaction machines market is primarily driven by extensive infrastructure development and government-led urbanization programs. Large-scale construction projects such as highways, high-speed railways, industrial zones, and smart cities continue to grow across the country, resulting in a steady demand for various types of compaction equipment. The "Belt and Road Initiative" has significantly increased the number of road and transportation projects that require heavy-duty soil compaction machinery.

Environmental regulations are gradually tightening, particularly in major cities such as Beijing, Shanghai, and Shenzhen. The Chinese government is advocating for greener construction practices, such as low-emission machinery and fuel-efficient vehicles. In response, manufacturers are looking into hybrid models and improved diesel technologies to meet new emissions standards.

Another important factor is the increasing use of rental services for compaction equipment. With small and medium-sized contractors frequently unable to afford full ownership, rental businesses are thriving. This trend also enables faster deployment of newer, regulatory-compliant equipment, thereby promoting market modernization.

Japan Soil Compaction Machines Market Driven by Disaster Resilience

In Japan, the soil compaction machines market is being driven by the country's ongoing efforts to maintain infrastructure and prepare for natural disasters. Given Japan's vulnerability to earthquakes, landslides, and typhoons, soil stabilization is essential for both new construction and disaster recovery projects. Soil compaction machines are essential for reinforcing embankments, roads, and levees, particularly in hazard-prone areas.

The aging infrastructure in Japan is a major driver. Many roads, bridges, and tunnels built during the postwar boom are being restored. These maintenance tasks necessitate compact and efficient machines, especially in urban or space-constrained settings. Light and medium-sized compaction equipment, such as walk-behind rollers and plate compactors, is in high demand because they are ideal for such conditions.

Strict environmental and safety regulations influence the market. Noise and vibration restrictions in residential areas have boosted demand for low-noise, low-emission machines. Equipment with Tier IV-compliant engines and enhanced vibration-damping features is preferred, particularly in densely populated areas.

There is also a strong emphasis on rental services in Japan. The market is heavily reliant on equipment leasing, with contractors preferring short-term access to high-performance machines to help manage project costs. Rental companies are under pressure to provide environmentally friendly and technologically advanced equipment in order to remain competitive.

Category-wise Analysis

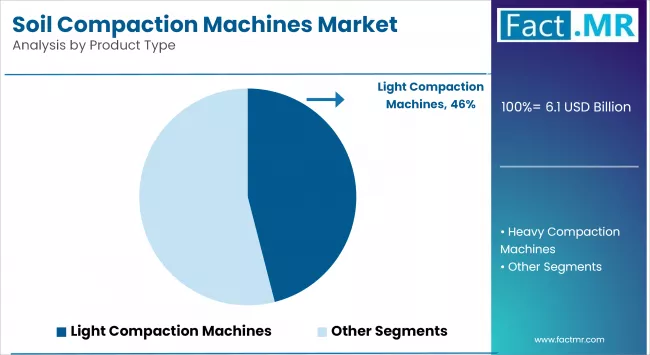

Light to Exhibit Leading by Product Type

Light compaction machines dominate the soil compaction machines market, as these machines are primarily used for small-scale compaction tasks in confined or urban environments. These machines are small, portable, and intended for tasks that require precision rather than high compaction force. This category includes equipment like rammers (jumping jacks), plate compactors (forward and reversible), and walk-behind rollers.

Light compaction machines are commonly used for pavement repairs, landscaping, utility trenching, footpaths, and small-scale foundation preparation. Their maneuverability and light operating weight make them ideal for tight or restricted spaces where larger machines cannot operate efficiently.

Heavy compaction equipment is the fastest-growing segment in the soil compaction machines market. Heavy compaction equipment, such as single drum rollers, tandem rollers, and pneumatic rollers, is used on large-scale infrastructure projects like highways, airports, and industrial sites. These machines provide high compaction force and efficiency, making them ideal for heavy-duty applications.

Large infrastructure projects drive demand for heavy compaction equipment, whereas light compaction equipment is preferred due to its versatility and lower operational costs.

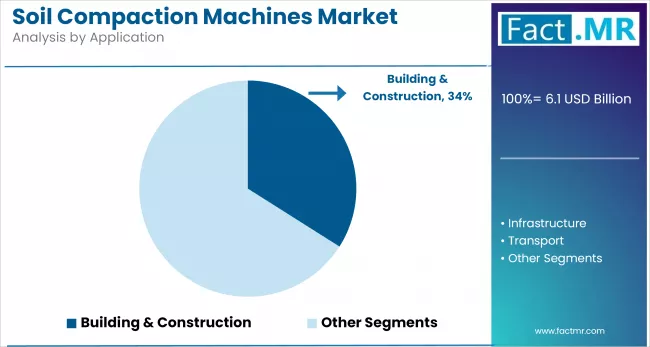

Building and Construction to Exhibit Leading by Application

The building and construction industry dominates the soil compaction machines market, as it is a major user of these machines. These machines are essential for site preparation, ensuring solid and stable ground before laying foundations for residential, commercial, and industrial buildings.

Plate compactors, rammers, and walk-behind rollers are common examples of light and medium compaction equipment used on construction sites. As urbanization and real estate development increase, particularly in the Asia-Pacific and the Middle East, demand for compact and efficient machines in this segment grows.

Soil compaction machines are the fastest-growing segment in the soil compaction machines market, as these are widely used in the infrastructure sector for large-scale projects, including highways, bridges, tunnels, and airports. Compaction ensures the long-term durability and load-bearing capacity of subgrade layers in roadbeds and other heavy structures.

This segment typically employs medium- to heavy-duty machines, such as single-drum and tandem rollers. With government investments in infrastructure modernization, such as the United States Infrastructure Investment and Jobs Act, demand for strong compaction solutions in this segment remains high.

Competitive Analysis

The soil compaction machine market is becoming increasingly competitive, with both global and regional players competing on technology, product variety, operational efficiency, and after-sales services. These machines are critical for maintaining soil stability during road construction, infrastructure projects, and industrial development. Demand is especially high in emerging economies, where large-scale development projects are underway.

Product differentiation is critical in competition. Manufacturers offer a variety of machines, including single drum rollers, tandem rollers, and pneumatic rollers, to meet a variety of project needs. The integration of features such as GPS tracking, real-time compaction monitoring, and automatic feedback systems has become critical in attracting buyers seeking precision and productivity.

The push for smarter and more sustainable construction practices is also influencing competition. Electric and hybrid vehicles, while still in their early stages of adoption, are emerging in response to environmental regulations and carbon reduction goals. Players who invest in R&D to develop quieter, cleaner machines with fuel-efficient engines gain a competitive advantage in urban construction.

Service capabilities such as equipment rental, maintenance packages, and operator training add to the level of competition. Customers in high-use industries such as road construction and mining frequently prefer companies that provide strong support services and rapid parts availability, particularly in remote locations.

Key players in the soil compaction machines industry include Caterpillar Inc., Volvo Construction Equipment, J.C. Bamford Excavators Limited, John Deere, Zoomlion Heavy Industries Science & Technology Co., Ltd., XCMG Co., Ltd., Sany Heavy Industries Co., Ltd., Fayat Group, Hitachi Construction Machinery, Wacker Neuson SE, and other notable players.

Recent Development

- In March 2023, Volvo Construction Equipment (Volvo CE) introduced two new entry-level Compact Assist packages, “Lite” and “Start,” for its soil compactors. These additions aim to provide a more tailored approach to intelligent compaction, catering to a wider range of customer needs and enabling them to optimize the performance of their Volvo soil compactors.

- In February 2023, Dynapac showcased its latest soil compactor, the CA30 Rhina, at the American Rental Association (ARA) Show 2023. This machine features an 84-inch drum and is designed to efficiently compact various types of soil, making it a versatile asset for a wide range of applications.

Segmentation of Soil Compaction Machines Market

By Product Type :

- Heavy Compaction Machines

- Heavy Tandem Rollers

- 5 to 8 Tons

- 8 to 11 Tons

- >11 Tons

- Single Drum Rollers

- 3 to 5 Tons

- 5 to 8 Tons

- 8 to 12 Tons

- 12 to 15 Tons

- >15 Tons

- Pneumatic Rollers

- Heavy Tandem Rollers

- Light Compaction Machines

- Hand Operated Machines

- Rammers

- Vibratory Plates (Forward)

- Vibratory Plates (Reverse)

- Walk Behind Rollers

- Light Tandem Rollers

- <1.8 Tons

- 1.8 to 3 Tons

- 3 to 5 Tons

- Trench Rollers

- Hand Operated Machines

By Application :

- Building & Construction

- Infrastructure

- Transport

- Others

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Components Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Product Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Product Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Product Type, 2025-2035

- Heavy Compaction Machines

- Light Compaction Machines

- Y-o-Y Growth Trend Analysis By Product Type, 2020-2024

- Absolute $ Opportunity Analysis By Product Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Application, 2025-2035

- Building & Construction

- Infrastructure

- Transport

- Others

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Product Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- Key Takeaways

- Key Countries Market Analysis

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- China

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product Type

- By Application

- Competition Analysis

- Competition Deep Dive

- Caterpillar Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Volvo Construction Equipment

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- J.C. Bamford Excavators Limited

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- John Deere

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Zoomlion Heavy Industries Science & Technology Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- XCMG Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Sany Heavy Industries Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Fayat Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hitachi Construction Machinery

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Wacker Neuson SE

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Caterpillar Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 7: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 8: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 10: North America Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 13: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 15: Latin America Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 18: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 19: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 21: Western Europe Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 23: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 24: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 25: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 27: East Asia Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 28: East Asia Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 29: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 30: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 31: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: South Asia Pacific Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 34: South Asia Pacific Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 35: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 36: South Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 37: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 38: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 39: Eastern Europe Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 40: Eastern Europe Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 41: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 42: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 43: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 45: Middle East & Africa Market Value (USD Bn) Forecast by Product Type, 2020 to 2035

- Table 46: Middle East & Africa Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 47: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 48: Middle East & Africa Market Volume (Units) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Product Type

- Figure 7: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Application

- Figure 10: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Region

- Figure 13: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 21: North America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 22: North America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 23: North America Market Attractiveness Analysis by Product Type

- Figure 24: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Application

- Figure 27: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Latin America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 29: Latin America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 30: Latin America Market Attractiveness Analysis by Product Type

- Figure 31: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 32: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 33: Latin America Market Attractiveness Analysis by Application

- Figure 34: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 35: Western Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 36: Western Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 37: Western Europe Market Attractiveness Analysis by Product Type

- Figure 38: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 39: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 40: Western Europe Market Attractiveness Analysis by Application

- Figure 41: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 42: East Asia Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 43: East Asia Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 44: East Asia Market Attractiveness Analysis by Product Type

- Figure 45: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 46: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 47: East Asia Market Attractiveness Analysis by Application

- Figure 48: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 49: South Asia Pacific Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 50: South Asia Pacific Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 51: South Asia Pacific Market Attractiveness Analysis by Product Type

- Figure 52: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 53: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 54: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 55: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 57: Eastern Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Product Type

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 60: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Application

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: Middle East & Africa Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 64: Middle East & Africa Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 65: Middle East & Africa Market Attractiveness Analysis by Product Type

- Figure 66: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 67: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 68: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 69: Global Market - Tier Structure Analysis

- Figure 70: Global Market - Company Share Analysis

- FAQs -

What is the Global Soil Compaction Machines Market size in 2025?

The soil compaction machines market is valued at USD 6.1 billion in 2025.

Who are the Major Players Operating in the Soil Compaction Machines Market?

Prominent players in the market include Volvo Construction Equipment, J.C. Bamford Excavators Limited, John Deere, Zoomlion Heavy Industries Science & Technology Co. Ltd.

What is the Estimated Valuation of the Soil Compaction Machines Market by 2035?

The market is expected to reach a valuation of USD 11.8 billion by 2035.

What Value CAGR Did the Soil Compaction Machines Market Exhibit over the Last Five Years?

The historic growth rate of the soil compaction machines market is 6.2% from 2020-2024.