Winding Machines Market

Winding Machines Market Analysis, By Machine Type, By Winding Type, By Number of Spindles, By Spindle Speed, By Operation, By End-use Industry, and Region - Market Insights 2025 to 2035

Analysis of Winding Machines Market Covering 30+ Countries, Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Winding Machines Market Outlook (2025 to 2035)

The winding machines market is valued at USD 4,330 million in 2025. As per Fact.MR analysis, the industry will grow at a CAGR of 7.4% and reach USD 8,840 million by 2035.

The winding machines industry closed in 2024 at an estimated value of USD 4,030 million, reflecting a year of sector-specific shifts rather than uniform growth. In the textile industry, demand rebounded strongly in Q2, following a weak Q1 caused by delayed capital expenditures in South Asia and Central Europe, impacting production.

Meanwhile, manufacturers in the electrical and electronics sector-particularly in East Asia-ramped up orders for wire and coil equipment to support the escalating production of transformers and motors, driven by ongoing electrification trends and infrastructure upgrades.

In contrast, paper and foil winding segments underperformed due to limited investments in packaging upgrades and delayed infrastructure projects in Western Europe and Latin America. Large OEMs across sectors undertook inventory rationalization to cope with macroeconomic uncertainty, exerting mild downward pressure on prices of manual winding models.

However, automated machine pricing remained firm, underpinned by persistent supply bottlenecks in spindle assembly components and high demand for consistent throughput and quality.

Entering 2025, Fact.MR analysis found the industry poised for significant growth driven by automation. Rising global labor costs and stringent quality standards in defense, healthcare, and EV battery manufacturing are pushing demand toward semi-automatic and fully automatic winding systems.

With the worldwide value expected to reach USD 4,330 million by the end of 2025, firms are prioritizing spindle speed enhancements, integrating predictive maintenance technologies, and securing upstream component supply chains. Growth will increasingly favor intelligent, high-precision winding solutions over standard legacy systems.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 4,330 Million |

| Projected Size in 2035 | USD 8,840 Million |

| CAGR (2025 to 035) | 7.4% |

Fact.MR Survey Results: Industry Dynamics Based on Stakeholder Perspectives

Key Priorities of Stakeholders

- Automation and Efficiency: 74% of stakeholders globally identified automation and efficiency as a 'critical' priority for future investments in winding technology. The demand for fully automated solutions is particularly strong in the electrical and electronics sectors.

- Durability and Cost-effectiveness: 68% of respondents emphasized the importance of durable materials, especially steel and aluminum, to ensure long-term performance and minimize operational downtime.

Regional Variance:

- USA: 60% prioritized automation features to offset labor shortages, particularly in industries like automotive and consumer electronics, which require higher throughput.

- Western Europe: 82% highlighted sustainability and energy-efficient machines, driven by stringent EU regulations regarding carbon emissions.

- Japan/South Korea: 54% highlighted the need for compact, space-efficient systems due to land constraints in urban manufacturing facilities.

Embracing Advanced Technologies

- High Adoption of IoT: 59% of USA manufacturers are adopting IoT-enabled systems for real-time monitoring and predictive maintenance. This technology is proving essential in reducing downtime and improving efficiency in high-demand sectors such as automotive and aerospace.

- Europe’s Leading Role in Automation: 53% of Western European manufacturers are embracing robotic systems to improve consistency in production. Germany, in particular, leads with 67% adoption, driven by high regulatory standards and industry demand for precision.

- Asia’s Pragmatic Approach: In Japan and South Korea, only 30% are using high-tech, automated solutions. This is primarily due to cost concerns and the need for simpler, more cost-effective models for small-scale operations.

Convergent Perspectives on ROI:

- USA: 72% of stakeholders consider automation investments highly lucrative, citing significant operational cost savings and increased production speed.

- Japan: Only 44% of respondents see the ROI from automation as beneficial, as manual models still dominate in smaller facilities.

Material Preferences

- Steel vs. Aluminum: 63% of stakeholders globally prefer steel for its durability in high-stress environments, especially for heavy-duty applications.

- Sustainability Concerns: 47% of stakeholders in Western Europe favor aluminum due to sustainability demands, as the region seeks to reduce its carbon footprint and adhere to environmental regulations.

Regional Variance:

- USA: 71% of stakeholders selected steel due to its strength, while 19% of manufacturers in the Pacific Northwest are moving toward aluminum due to its lightweight and ease of handling.

- Japan/South Korea: 38% chose hybrid steel-aluminum models, primarily for corrosion resistance in humid manufacturing conditions.

Price Sensitivity

- Global Consensus on Rising Material Costs: 85% of respondents noted that rising material costs, particularly steel (up by 27%) and aluminum (up by 15%), pose a major challenge.

- Premiumization vs. Cost Sensitivity: 64% of USA manufacturers are willing to pay a 15-20% premium for advanced automation features, reflecting the growing demand for high-performance solutions. In contrast, 74% of respondents in Japan and South Korea prioritize lower-cost models, particularly those priced below USD 10,000.

Pain Points in the Value Chain

Manufacturers:

- USA: 58% struggle with labor shortages, particularly in skilled trades such as welding and assembly, which impacts production timelines.

- Western Europe: 50% cite regulatory complexities and certification requirements (e.g., CE marking) as barriers to quicker industry entry.

Distributors:

- USA: 65% mention inventory delays from overseas suppliers, mainly from East Asia, as a significant challenge.

- Japan/South Korea: 63% report logistical issues in rural areas that hinder distribution speed, particularly for smaller, less-centralized manufacturing hubs.

End-Users:

- USA: 42% of end-users report high maintenance costs for older, less-efficient equipment as a pain point.

- Western Europe: 37% of customer’s experience difficulties retrofitting older barns and facilities with modern, automated systems, increasing upfront investment costs.

Future Investment Priorities

- Automation & Robotics R&D: 70% of manufacturers globally plan to invest heavily in R&D for automation and robotic systems, driven by demand for precision and reduced operational costs.

- Sustainability: 53% of Western European stakeholders are focusing on developing more energy-efficient systems with reduced environmental impact, particularly in light of stricter EU policies on emissions.

Regional Divergence:

- USA: 61% of manufacturers plan to invest in modular designs that can serve multiple functions, such as winding and sorting.

- Japan/South Korea: 48% are prioritizing compact, space-saving technologies, including foldable or easily portable equipment, due to space constraints in urban production facilities.

Regulatory Impact

- USA: 72% of stakeholders expressed concerns over the increasing regulatory burden in compliance with environmental and safety standards, particularly as the USA introduces stricter regulations on energy usage and carbon emissions.

- Western Europe: 80% of respondents view the EU’s environmental regulations as a key driver for innovation, particularly in the production of sustainable equipment.

- Japan/South Korea: Regulatory changes have a minimal impact on purchasing decisions, with only 36% of stakeholders citing regulations as a significant influence on equipment choices.

Conclusion: Variance vs. Consensus

- High Consensus: Automation, material durability, and cost-effectiveness are universally critical priorities, with all regions highlighting the need for improved efficiency and sustainable solutions.

Key Regional Variances:

- USA: High growth in automation adoption, driven by labor shortages and demand for high-speed production.

- Western Europe: Leading focus on sustainability, with heavy investment in carbon-neutral production methods and materials.

- Asia: Pragmatic approach, with hybrid steel-aluminum materials and a preference for more cost-effective, space-saving models.

Strategic Insight:

Tailoring strategies to specific regional needs-automation in the USA, sustainability in Europe, and compact solutions in Asia-will be key to capturing industry share.

Impact of Government Regulation

| Country | Impact of Policies & Government Regulations |

|---|---|

| United States |

|

| Western Europe |

|

| Japan |

|

| South Korea |

|

Market Analysis

The industry is entering a high-growth phase, driven by rising automation demand across precision-intensive sectors like EVs, defense, and healthcare. Advancements in spindle technology and predictive maintenance are reshaping competitive dynamics in favor of manufacturers offering intelligent, high-speed systems. Traditional manual equipment providers risk obsolescence unless they pivot toward semi- or fully automated-solutions.

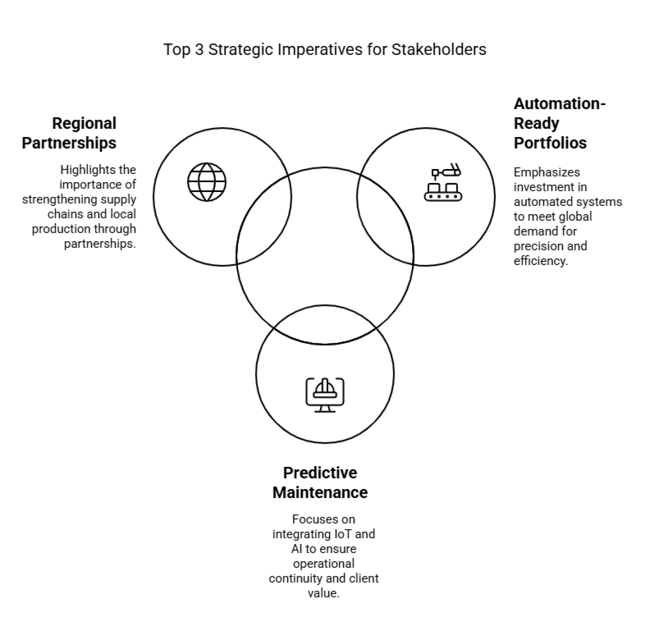

Top 3 Strategic Imperatives for Stakeholders

Prioritize Automation-Ready Product Portfolios

Executives should accelerate investments in semi-automatic and fully automatic systems to align with rising global demand for high-precision, labor-efficient solutions across EV, medical, and aerospace sectors.

Integrate Predictive Maintenance & Smart Controls

To stay ahead of technology shifts, firms must embed IoT-based monitoring, real-time diagnostics, and AI-driven control systems into new machine designs, ensuring operational continuity and long-term client value.

Strengthen Regional Partnerships & Component Supply Chains

Focus on expanding partnerships with spindle and control unit suppliers in East Asia and Europe to secure component availability while exploring M&A or joint ventures to boost localized production and service capabilities.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruption- Limited availability of high-precision spindle components, especially from East Asia and Europe, may delay automated machine production and increase lead times for OEMs. | Medium Probability, High Impact |

| Slow Automation Uptake- Cost-sensitive regions like South Asia and Africa may continue relying on manual machines, limiting demand for high-end automation and capping potential returns on advanced R&D investments. | High Probability, Medium Impact |

| Regulatory Delays- Extended approval cycles for safety and industrial compliance standards, particularly in defense and medical applications, could hinder the rollout of next-gen intelligent winding systems. | Low Probability, High Impact |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Automation Integration | Initiate R&D projects focused on integrating predictive maintenance and AI-driven controls into winding systems. |

| Supply Chain Resilience | Run a feasibility study on sourcing high-precision spindle components from alternative suppliers in East Asia. |

| Regional Industry Penetration | Initiate partnerships with local distributors and OEMs in cost-sensitive regions to explore semi-automatic adoption. |

For the Boardroom

To stay ahead of competition, companies must accelerate the development of semi-automatic and fully automated solutions to meet the increasing demand for precision and efficiency across high-growth industries like EVs and healthcare. This insight necessitates a strategic pivot towards integrating predictive maintenance and AI-driven technologies into product offerings while concurrently fortifying supply chain resilience for critical components like spindles.

The roadmap should prioritize regional penetration in cost-sensitive industries to expand the adoption of advanced automation while also forging strategic partnerships to mitigate supply risks and enhance local manufacturing capabilities. By doing so, the client can position itself as a leader in automation-driven growth while safeguarding against supply and regulatory delays.

Segment-wise Analysis

By Winding Type

The horizontal segment is anticipated to be most profitable, growing with a CAGR of 6.5% from 2025 to 2035. These machines are particularly useful in applications where stability and ease of access are key. They are commonly used for winding large coils or heavier materials, such as those found in the power generation, aerospace, and transformer industries.

The demand for the horizontal segment is driven by the need for robust, high-performance equipment capable of handling demanding workloads. These machines are integral to industries focusing on high-efficiency production with minimal downtime. As global production capacities expand, the horizontal segment will maintain its steady demand in various heavy-duty applications.

By Number of Spindles

Machines with fewer than 2 spindles will be most profitable for stakeholders as they are projected to grow at a CAGR of 5.8% during the forecast period. These machines are ideal for small-scale applications and industries with limited space or lower production demands. While they may not be as prevalent in large-scale manufacturing, they are crucial in niche industries such as artisanal production, prototype development, and small-batch manufacturing.

The growth in sectors like small electronics and personalized textile manufacturing is contributing to the demand for machines with lower spindle counts. Despite their smaller capacity, these machines are cost-effective and essential for industries focused on customization and precision.

By Spindle Speed

The increasing demand for high-volume production, coupled with the need for precision, is driving the adoption of these machines. As manufacturing operations evolve and industries continue to integrate more automation, the demand for mid-range spindle speeds is expected to grow, especially in sectors requiring higher efficiency and lower cycle times.

Machines with spindle speeds between 2500 and 5000 RPM are expected to provide most opportunities, growing at a CAGR of 6.0% over the next decade. These machines are ideal for industries requiring a balance between speed and precision. This range is commonly used in applications like wire and cable manufacturing, textiles, and small parts assembly.

By Operation

Automatic winding machines will be lucrative during the assessment period, growing at a CAGR of 7.9%. This will make them the fastest-expanding segment in the industry. This growth is fueled by increasing demand for fully automated solutions across smart factories and high-speed production lines.

These machines reduce human error, cut labor costs, and ensure high-precision winding across diverse sectors such as textiles, electronics, and printing. Their integration with AI, IoT, and advanced feedback systems enhances real-time monitoring and boosts operational efficiency. As industries modernize and prioritize predictive maintenance and lean production, automatic machines are becoming a core enabler of sustainable, scalable, and competitive manufacturing ecosystems.

By End-use Industry

Automated systems are helping textile producers scale up production while minimizing defects and ensuring consistent yarn tension. Additionally, the integration of wearables and textile-based sensors in healthcare and sportswear is fostering innovation in fabric processing.

As textile firms push for energy efficiency, digital control, and better ergonomics, machines optimized for performance, speed, and reduced maintenance are witnessing heightened adoption across both developed and emerging textile hubs.

The textile industry is expected to be profitable, growing at a CAGR of 8.1% between 2025 and 2035, making it the leading end-use sector for machines. Demand is rising as manufacturers seek faster, more efficient yarn processing and package quality improvements in response to the growing global appetite for apparel, technical textiles, and smart fabrics.

Country-wise Insights

USA

The industry in the USA is set to expand steadily with a CAGR of 7.5% through 2035, driven by EV growth and industrial automation. Rising demand from the automotive, renewable energy, and defense sectors is accelerating the shift toward digital and AI-enabled systems.

Labor shortages and reshoring trends are accelerating the adoption of fully automated, low-maintenance solutions across manufacturing hubs. Precision processing for EV motors and transformers is becoming a strategic priority, especially in the Midwest and West Coast.

UK

The UK's industry will expand at a CAGR of 6.8% between 2025 and 2035, supported by clean energy targets and digital transition in manufacturing. Demand is rising for compact, high-efficiency systems in the automotive and aerospace sectors.

Post-Brexit regulatory clarity has encouraged investment in CE-certified units, especially in customized production lines for EV and wind components. Legacy systems are steadily being phased out in mid-sized manufacturing facilities.

France

France’s sales is expected to grow at a CAGR of 6.5% as EV infrastructure, wind energy, and sustainability initiatives boost demand for high-efficiency systems. Industry upgrades are centered around smart automation and eco-friendly production.

EV motor production and the modernization of transformers are driving purchases of precision equipment. France’s energy mix transition toward solar and wind has further supported uptake in closed-loop systems and digital solutions.

National regulations emphasizing low-emission manufacturing are pushing vendors to offer sustainable, AI-compatible solutions.

Germany

Germany’s winding machine industry will maintain a strong CAGR of 7.2%, powered by advanced manufacturing, EV scaling, and Industry 4.0 strategies. Precision automation is gaining traction in automotive, electrical, and export-driven equipment production.

Stringent carbon regulations are accelerating the replacement of legacy units. Local machine builders are focusing on high-precision, export-compliant winding equipment with robotic and vision-integrated systems.

Italy

Italy’s sales is projected to grow at a CAGR of 6.0% through 2035, supported by demand in HVAC, industrial equipment, and custom EV motor winding. SMEs are central to the shift toward semi-automated winding platforms. Incentives under Transition 4.0 are helping local firms digitize their production. Precision control and material traceability are gaining priority as exports to the EU and North Africa grow.

South Korea

In South Korea, the industry will expand at a CAGR of 7.0%, propelled by EV battery, electronics, and high-precision automation industries. Smart winding systems are being rapidly adopted in cleanroom and semiconductor environments.

The government push for "smart factories" is accelerating the phasing out of manual and semi-automatic machines. High-speed, compact winding units are in demand for industrial zones around Seoul and Busan. Clean energy transitions and export competitiveness are further boosting investment in low-noise, energy-efficient machines.

Japan

Manufacturers are prioritizing compact, high-precision machines for use in limited-space urban facilities in Japan. Emphasis is on durability, energy efficiency, and minimal human intervention. Government support through manufacturing subsidies is enabling automation transitions among Tokyo and Osaka-based SMEs.

The industry in Japan is projected to grow at a CAGR of 6.2%, supported by demand for medical device winding and robotic automation. However, infrastructure limitations and conservative spending are slowing growth compared to peers.

China

Local production of systems in China is surging to meet high-speed, high-volume demands. Domestic firms are integrating AI, sensors, and predictive maintenance in coil and wire processing solutions. Export competitiveness is strengthening due to low cost and rapid innovation.

Environmental mandates are pushing machine builders toward energy-efficient, software-driven systems in line with green manufacturing targets. China will lead global growth with a CAGR of 8.3%, fueled by EV, electronics, and grid infrastructure expansion.

Australia-New Zealand

The industry in Australia and New Zealand are expected to grow at a combined CAGR of 6.6%, with increasing demand across wind power, mining electrification, and food-grade processing sectors. Compact and mobile solutions are favored in geographically dispersed or off-grid locations.

High labor costs are accelerating automation adoption. Plug-and-play systems with minimal maintenance requirements are gaining traction among small- and mid-scale manufacturers. Green manufacturing policies and digital transformation incentives are helping SMEs upgrade winding systems.

Competitive analysis

The winding machines industry remains fragmented, characterized by the presence of multiple regional and global players competing across diverse end-use sectors. However, a trend toward strategic consolidation is emerging, as key players seek to scale operations and expand portfolios through targeted acquisitions and partnerships.

Leading companies are competing primarily through technological innovation, pricing flexibility, and strategic partnerships. Many are investing in automation, AI-integrated controls, and energy-efficient winding systems to differentiate their offerings. Expansion into high-growth regions-especially Southeast Asia and Eastern Europe-is another key focus. Top players are also prioritizing aftermarket services and digital monitoring solutions to enhance customer lifetime value.

In 2024, Roth Industries announced the acquisition of Mertes Winding Systems, a Germany-based player specializing in high-speed textile winding equipment, to strengthen its automation portfolio and European footprint.

Similarly, BTSR International entered a strategic technology partnership with Saurer Group in March 2024 to co-develop intelligent yarn tension control systems for automated winding applications. Meanwhile, Suzhou Super Machinery Co., Ltd. launched its AI-powered dual-spindle winding machine series in April 2024, targeting demand in the EV motor and electronics sector.

Market Share Analysis

Siemens AG: 18-22%

Siemens will dominate with AI-driven automation and high-precision winding systems for EV motors. In 2025, it plans to launch a modular winding platform for gigafactories, backed by partnerships with Tesla and European battery manufacturers.

ABB Ltd.: 15-19%

ABB’s growth will hinge on EV battery winding technology, including a 2025 partnership with CATL for ultra-fast winding systems. Its "Winding 4.0" IoT platform will integrate predictive maintenance, targeting 30% efficiency gains by 2030.

Fuji Electric Co., Ltd.: 12-16%

Fuji will leverage its high-efficiency industrial motors and niche in semiconductor winding systems. A 2025 joint venture with TSMC for chip-grade winding solutions will boost its position. By 2030, its hydrogen fuel cell winding technology will disrupt the green energy sector.

Rockwell Automation: 10-14%

Rockwell’s integrated smart manufacturing ecosystem-combining FactoryTalk with winding automation modules-is expected to witness robust adoption across North America. Strategic alliances with Amazon's Kuiper (satellite cable winding) and DoD contracts will fuel post-2030 growth.

Yaskawa Electric Corp.: 9-13%

Yaskawa’s robotics-powered precision winding will dominate in micro-motor applications (e.g., medical devices). A 2026 IPO of its winding division and AI-guided tension control systems will elevate its position.

Other Key Players

- Schlumberger Limited

- Sauer-Danfoss

- Usha Martin Ltd.

- Toray Engineering Co., Ltd.

- Jainson Winding Pvt. Ltd.

- Baldor Electric Company

- MTS Systems Corporation

- Lapp Group

- Heidenhain Corporation

- Shenzhen Sanyuan Intelligent Technology Co., Ltd.

- Nordson Corporation

- KUKA Robotics

- Omron Corporation

- Cognex Corporation

- Festo AG

- Ametek Inc.

- AIKI RIOTECH

- Armature Coil Equipment

- Bianco

- Broomfield

- CONSTRUMA

- CORGHI TEXTILE

- DEMAS MAKINE

- Eternal Automation

- FADIS

- FORMERTRON Engineering (I) Pvt. Ltd

- LAE LUGHESE ATTREZZATURE PER

- LOIMEX

- Marsilli

- Rieter

- RIUS

- Schleich

- Starlinger

- TRAINING MACHINE INDUSTRIAL CO., LTD

- TALLERES RATERA S.A.

- Tuboly-Astronic AG

- Whitelegg Machines Ltd

Winding Machines Market Segmentation

By Machine Type:

- Paper Winding Machines

- Film Winding Machines

- Thread Winding Machines

- Foil Winding Machines

- Wire & Coil Winding Machines

- Others (Spool Winding Machines)

By Winding Type:

- Vertical

- Horizontal

By Number of Spindles:

- Less than 2

- 2-4

- 4-6

- Above 6

By Spindle Speed:

- Less than 2500 RPM

- 2500-5000 RPM

- 5000-7500 RPM

- Above 7500 RPM

By Operation:

- Manual Winding Machine

- Semi-Automatic Winding Machine

- Automatic Winding Machine

By End-use Industry:

- Aerospace & Defense

- Automotive

- Construction & Mining

- Consumer Electronics

- Electrical & Electronics

- Healthcare & Medical Devices

- Industrial Machineries

- Paper & Printing

- Textile Industry

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

Table of Content

- Market - Executive Summary

- Market Overview

- Market Background and Foundation Data

- Global Winding Machine Demand (Units) Analysis and Forecast: 2020 to 2035

- Global Market - Pricing Analysis: 2020 to 2035

- Global Market Value (USD Million) Analysis and Forecast: 2020 to 2035

- Global Market Analysis and Forecast, by Machine Type

- Paper Winding Machines

- Film Winding Machines

- Thread Winding Machines

- Foil Winding Machines

- Wire & Coil Winding Machines

- Others (Spool Winding Machines)

- Global Market Analysis and Forecast, by Winding Type

- Vertical

- Horizontal

- Global Market Analysis and Forecast, by Number of Spindles

- Less than 2

- 2 to 4

- 4 to 6

- Above 6

- Global Market Analysis and Forecast, by Spindle Speed

- Less than 2500 RPM

- 2500 to 5000 RPM

- 5000 to 7500 RPM

- Above 7500 RPM

- Global Market Analysis and Forecast, by Operation

- Manual Winding Machine

- Semi-Automatic Winding Machine

- Automatic Winding Machine

- Global Market Analysis and Forecast, by End-use Industry

- Aerospace & Defense

- Automotive

- Construction & Mining

- Consumer Electronics

- Electrical & Electronics

- Healthcare & Medical Devices

- Industrial Machineries

- Paper & Printing

- Textile Industry

- Others

- Global Market Analysis and Forecast, by Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

- North America Market Analysis and Forecast: 2020 to 2035

- Latin America Market Analysis and Forecast: 2020 to 2035

- Europe Market Analysis and Forecast: 2020 to 2035

- East Asia Market Analysis and Forecast: 2020 to 2035

- South Asia & Oceania Market Analysis and Forecast: 2020 to 2035

- Middle East & Africa Market Analysis and Forecast: 2020 to 2035

- Country-level Market Analysis and Forecast: 2020 to 2035

- Market Structure Analysis

- Winding Machine Competition Analysis

- Schlumberger Limited

- Sauer-Danfoss

- Usha Martin Ltd.

- Toray Engineering Co., Ltd.

- Jainson Winding Pvt. Ltd.

- Baldor Electric Company

- MTS Systems Corporation

- Lapp Group

- Heidenhain Corporation

- Shenzhen Sanyuan Intelligent Technology Co., Ltd.

- ABB Ltd.

- Siemens AG

- Yaskawa Electric Corporation

- Nordson Corporation

- Fuji Electric Co., Ltd.

- KUKA Robotics

- Omron Corporation

- Cognex Corporation

- Festo AG

- Rockwell Automation

- Ametek Inc.

- AIKI RIOTECH

- Armature Coil Equipment

- Bianco

- Broomfield

- CONSTRUMA

- CORGHI TEXTILE

- DEMAS MAKINE

- Eternal Automation

- FADIS

- FORMERTRON Engineering (I) Pvt. Ltd

- LAE LUGHESE ATTREZZATURE PER

- LOIMEX

- Marsilli

- Rieter

- RIUS

- Schleich

- Starlinger

- TAINING MACHINE INDUSTRIAL CO., LTD

- TALLERES RATERA S.A.

- Tuboly-Astronic AG

- Whitelegg Machines Ltd

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

List Of Figures

- FAQs -

What are the key factors driving the growth of winding machines in various industries

Automation, efficiency demands, labor shortages, and industry-specific needs like electronics and textiles are driving growth.

How do automatic winding machines improve efficiency compared to manual models?

They reduce manual labor, improve consistency, and increase production speed with less downtime.

What are the primary applications of winding machines across different sectors?

They are used in textiles, electronics, renewable energy, and automotive industries for winding yarn, wires, and coils.

How is the demand for winding machines influenced by technological advancements?

Advancements in IoT and AI enhance productivity, precision, and energy efficiency, boosting demand.

What are the main challenges faced by manufacturers in the winding machine industry?

Challenges include adapting to technology, supply chain issues, and upgrading to automated systems.