Carob Seed Protein Concentrate Market

Carob Seed Protein Concentrate Market Size and Share Forecast Outlook 2026 to 2036

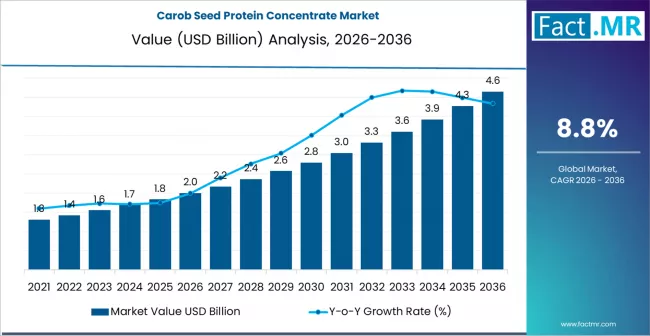

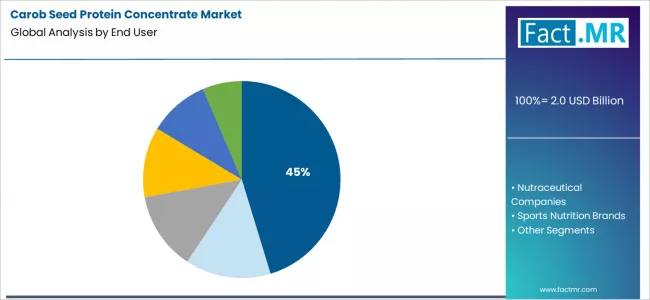

Carob Seed Protein Concentrate Market is projected to grow from USD 2.0 billion in 2026 to USD 4.6 billion by 2036, at a CAGR of 8.8%. Organic Carob Protein Isolate will dominate with a 49.8% market share, while plant-based food manufacturers will lead the end user segment with a 45.3% share.

Carob Seed Protein Concentrate Market Forecast and Outlook 2026 to 2036

Valuation of the global Carob Seed Protein Concentrate Market is projected to grow from USD 2.0 billion in 2026 to USD 4.6 billion by 2036, depicting a compound annual growth rate (CAGR) of 8.8% between 2026 and 2036. This translates into a total growth of 130.0%. The organic carob protein isolate segment is set to register 49.8% of the Carob Seed Protein Concentrate Market in 2026.

Key Takeaways from Carob Seed Protein Concentrate Market

- Carob Seed Protein Concentrate Market Value (2026): USD 2.0 billion

- Carob Seed Protein Concentrate Market Forecast Value (2036): USD 4.6 billion

- Carob Seed Protein Concentrate Market Forecast CAGR: 8.8%

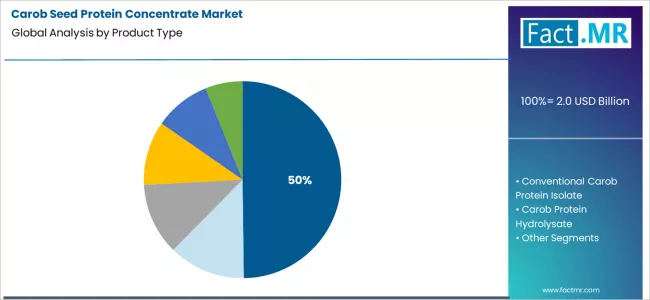

- Leading Product Category in Carob Seed Protein Concentrate Market: Organic Carob Protein Isolate (49.8%)

- Key Growth Regions in Carob Seed Protein Concentrate Market: North America, Europe, Asia Pacific

- Key Players in Carob Seed Protein Concentrate Market: Ingredion Inc., Cargill Inc., Barry Callebaut Group, Nexira, Carob House

Carob seed protein concentrate in food applications enables manufacturers to deliver enhanced protein functionality and comprehensive nutritional improvements with superior amino acid profiles and consistent performance across multiple food formulations, providing cost-effective protein solutions for health-conscious consumer requirements.

Plant-based food manufacturers are projected to register 45.3% of the Carob Seed Protein Concentrate Market in 2026. Plant-based food manufacturers in production enable advanced extraction protocols, standardized quality procedures, and operational optimization that are essential for product development, nutritional enhancement, and consumer satisfaction environments.

Carob Seed Protein Concentrate Market

| Metric | Value |

|---|---|

| Estimated Value in (2026E) | USD 2.0 billion |

| Forecast Value in (2036F) | USD 4.6 billion |

| Forecast CAGR 2026 to 2036 | 8.8% |

Category

| Category | Segments |

|---|---|

| Product Type | Organic Carob Protein Isolate; Conventional Carob Protein Isolate; Carob Protein Hydrolysate; Carob Germ Protein; Functional Carob Protein; Other |

| Application | Plant-Based Meat Alternatives; Protein Beverages; Nutritional Supplements; Bakery Products; Dairy Alternatives; Other |

| End User | Plant-Based Food Manufacturers; Nutraceutical Companies; Sports Nutrition Brands; Food Ingredient Suppliers; Beverage Manufacturers; Other |

| Distribution Channel | Direct Supplier Sales; Food Ingredient Distributors; Specialty Protein Suppliers; Health Food Distributors; Other |

| Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Segmental Analysis

By Product Type, Which Segment Holds the Dominant Share in the Carob Seed Protein Concentrate Market?

In terms of product type, the organic carob protein isolate segment leads the market with 49.8% share. Food manufacturers and protein producers increasingly utilize organic carob protein isolate systems for their superior functional properties and processing versatility characteristics.

- Manufacturing investments in advanced extraction technology and quality infrastructure continue to strengthen adoption among health-focused food production facilities.

- With food manufacturers prioritizing ingredient purity and nutritional validation, organic carob protein modules align with both consumer wellness objectives and product development requirements, making them the central component of comprehensive plant protein strategies.

By End User, Which Segment Registers the Highest Share in the Carob Seed Protein Concentrate Market?

By end user, plant-based food manufacturers dominates with 45.3% share, underscoring its critical role as the primary application category for companies seeking superior protein profiles and enhanced product differentiation credentials. Food technologists and production teams prefer carob-derived protein solutions for plant-based applications due to their established quality validation requirements.

- Food production facilities are optimizing protein selections to support application-specific requirements and comprehensive nutritional enhancement strategies.

- As extraction technology continues to advance and manufacturers seek efficient processing methods, plant-based food applications will continue to drive market growth while supporting nutritional optimization and consumer satisfaction strategies.

What are the Drivers, Restraints, and Key Trends of the Carob Seed Protein Concentrate Market?

- Drivers: Consumer demand for plant-based protein nutrition and improved digestibility in food products drives adoption of high-quality carob protein solutions across food manufacturing facilities.

- Restraint: Higher ingredient costs and processing complexity of integrating specialized carob protein protocols into existing food production procedures limit market penetration.

- Trend 1: Shift toward advanced extraction configurations that maximize protein yield and preserve natural amino acid structure for improved functionality.

- Trend 2: Development of specialized protein blends supporting various food applications and dietary requirement compatibility.

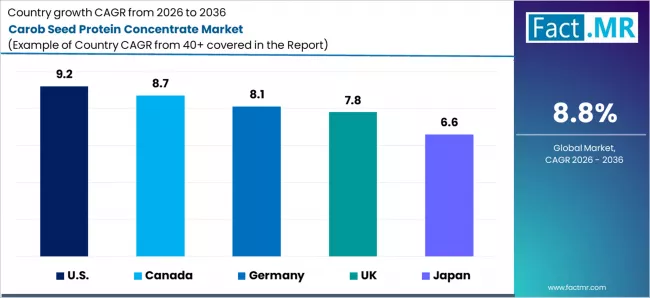

Analysis of the Carob Seed Protein Concentrate Market by Key Country

| Country | CAGR 2026 to 2036 |

|---|---|

| U.S. | 9.2% |

| Canada | 8.7% |

| Germany | 8.1% |

| UK | 7.8% |

| Japan | 6.6% |

The report covers an in-depth analysis of 30+ countries; top-performing countries are highlighted below.

What Opportunities Can Carob Seed Protein Concentrate Manufacturers Expect in U.S.?

Revenue from carob seed protein concentrate sales in U.S. is projected to exhibit strong growth with a CAGR of 9.2% through 2036, driven by the country's rapidly expanding plant protein sector, regulatory frameworks promoting alternative protein initiatives, and consumer awareness supporting sustainable protein technologies across major food production regions.

- Established food manufacturing infrastructure and expanding protein processing capabilities are driving demand for carob protein solutions across plant-based food facilities, nutrition developments, and comprehensive functional food systems throughout American food markets.

- Strong regulatory development and consumer health initiatives are supporting the rapid adoption of premium plant protein services among quality-focused manufacturers seeking to meet evolving nutritional standards and consumer requirements.

What is the Canadian Carob Seed Protein Concentrate Market Size?

Revenue from carob seed protein concentrate products in Canada is projected to expand at a CAGR of 8.7%, supported by rising food industry investment, growing health consciousness, and expanding plant protein capabilities. The country's advanced agricultural infrastructure and increasing investment in protein processing technologies are driving demand for carob protein solutions across both traditional and modern food applications.

- Rising agricultural development and expanding processing capabilities are creating opportunities for plant protein adoption across food manufacturing projects.

- Growing health awareness initiatives and protein processing advancement are driving the adoption of specialized nutritional ingredients and services among food manufacturers.

What Opportunities Can Carob Seed Protein Concentrate Manufacturers Expect in Germany?

Revenue from carob seed protein concentrate products in Germany is projected to grow at a CAGR of 8.1% through 2036, supported by the country's emphasis on food quality precision, nutritional excellence, and advanced manufacturing system integration requiring efficient processing solutions. German food manufacturers and quality-focused establishments prioritize ingredient precision and processing control, making specialized plant protein services essential components for both traditional and modern food applications.

- Advanced precision processing technology capabilities and growing functional food applications are driving demand for plant protein services across specialty manufacturing applications.

- Strong focus on food quality precision and nutritional excellence is encouraging manufacturers and suppliers to adopt carob protein solutions that support quality objectives.

What is the UK Carob Seed Protein Concentrate Market Size?

Revenue from carob seed protein concentrate products in the UK is projected to grow at a CAGR of 7.8% through 2036, supported by the country's emphasis on health food innovation, plant-based excellence, and advanced retail integration requiring efficient nutritional solutions. British food manufacturers and health-focused establishments prioritize ingredient quality and consumer health benefits, making specialized plant protein services essential components for both traditional and modern food applications.

- Advanced health food technology capabilities and growing plant-based applications are driving demand for carob protein services across specialty retail applications.

- Strong focus on health food innovation and plant-based excellence is encouraging manufacturers and retailers to adopt nutritional enhancement solutions.

What is the Japanese Carob Seed Protein Concentrate Market Size?

Revenue from carob seed protein concentrate products in Japan is projected to expand at a CAGR of 6.6%, supported by rising health food investment, growing functional food consciousness, and expanding wellness-focused food capabilities. The country's advanced food technology infrastructure and increasing investment in nutritional enhancement technologies are driving demand for carob protein solutions across both traditional and modern health food applications.

- Advanced food technology development and expanding wellness capabilities are creating opportunities for plant protein adoption across functional food projects.

- Growing health consciousness initiatives and nutritional technology advancement are driving the adoption of specialized functional ingredients among Japanese food manufacturers.

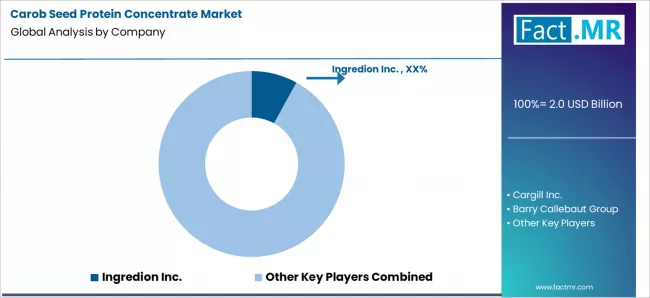

Competitive Landscape of the Carob Seed Protein Concentrate Market

The Carob Seed Protein Concentrate Market is characterized by competition among established plant protein manufacturers, specialized extraction service providers, and integrated protein companies. Companies are investing in advanced extraction technology, specialized processing platforms, innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable protein services.

Market players include Ingredion Inc., Cargill Inc., Barry Callebaut Group, Nexira, Carob House, and others, offering commercial and specialty services with emphasis on nutritional excellence and processing heritage. Ingredion Inc. provides integrated plant protein solutions with a focus on food ingredient market applications and premium quality networks.

Key Players in the Carob Seed Protein Concentrate Market

- Ingredion Inc.

- Cargill Inc.

- Barry Callebaut Group

- Nexira

- Carob House

- ADM Company

- Kerry Group

- Roquette Frères

- Tate & Lyle

- FrieslandCampina Ingredients

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2026) | USD 2.0 Billion |

| Product Type | Organic Carob Protein Isolate, Conventional Carob Protein Isolate, Carob Protein Hydrolysate, Carob Germ Protein, Functional Carob Protein, Other |

| Application | Plant-Based Meat Alternatives, Protein Beverages, Nutritional Supplements, Bakery Products, Dairy Alternatives, Other |

| End User | Plant-Based Food Manufacturers, Nutraceutical Companies, Sports Nutrition Brands, Food Ingredient Suppliers, Beverage Manufacturers, Other |

| Distribution Channel | Direct Supplier Sales, Food Ingredient Distributors, Specialty Protein Suppliers, Health Food Distributors, Other |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | U.S., Canada, Germany, Italy, UK, France, Japan, Australia, and other countries |

| Key Companies Profiled | Ingredion Inc., Cargill Inc., Barry Callebaut Group, Nexira, Carob House, and other leading protein companies |

| Additional Attributes | Dollar revenue by product type, application, end user, distribution channel, and region; regional demand trends, competitive landscape, technological advancements in extraction technology, nutritional enhancement optimization initiatives, functional protein development programs, and premium plant protein development strategies |

Carob Seed Protein Concentrate Market by Segments

-

Product Type :

- Organic Carob Protein Isolate

- Conventional Carob Protein Isolate

- Carob Protein Hydrolysate

- Carob Germ Protein

- Functional Carob Protein

- Other

-

Application :

- Plant-Based Meat Alternatives

- Protein Beverages

- Nutritional Supplements

- Bakery Products

- Dairy Alternatives

- Other

-

End User :

- Plant-Based Food Manufacturers

- Nutraceutical Companies

- Sports Nutrition Brands

- Food Ingredient Suppliers

- Beverage Manufacturers

- Other

-

Distribution Channel :

- Direct Supplier Sales

- Food Ingredient Distributors

- Specialty Protein Suppliers

- Health Food Distributors

- Other

-

Region :

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Italy

- UK

- France

- Spain

- Netherlands

- Switzerland

- Rest of Europe

- Asia Pacific

- Japan

- Australia

- South Korea

- China

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East and Africa

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

- North America

Bibliography

- International Food Technology Association Research Committee. (2023). Plant protein technologies and nutritional optimization in functional food systems. International Food Technology Association.

- International Organization for Standardization. (2023). Food quality management: Assessment of carob protein technology, processing efficiency, and quality control of plant protein systems (ISO Technical Report). ISO.

- European Committee for Standardization. (2022). Food quality management: Evaluation of plant protein processing, quality control, and nutritional compliance in food manufacturing facilities (EN Technical Report). CEN.

- Journal of Plant-Based Foods Editorial Board. (2024). Carob protein extraction, quality control, and nutritional optimization in modern food manufacturing. Journal of Plant-Based Foods, 152(3), 298-315.

- Food Processing Technology Agency, Technical Committee. (2023). Advances in carob protein processing and quality control technologies for food and beverage applications. Food Processing Technology Agency.

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2021 to 2025 and Forecast, 2026 to 2036

- Historical Market Size Value (USD Million) Analysis, 2021 to 2025

- Current and Future Market Size Value (USD Million) Projections, 2026 to 2036

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2021 to 2025 and Forecast 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Product Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Product Type, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Product Type, 2026 to 2036

- Organic Carob Protein Isolate

- Conventional Carob Protein Isolate

- Carob Protein Hydrolysate

- Carob Germ Protein

- Functional Carob Protein

- Other

- Organic Carob Protein Isolate

- Y to o to Y Growth Trend Analysis By Product Type, 2021 to 2025

- Absolute $ Opportunity Analysis By Product Type, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By End User

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End User, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End User, 2026 to 2036

- Plant-Based Food Manufacturers

- Nutraceutical Companies

- Sports Nutrition Brands

- Food Ingredient Suppliers

- Beverage Manufacturers

- Other

- Plant-Based Food Manufacturers

- Y to o to Y Growth Trend Analysis By End User, 2021 to 2025

- Absolute $ Opportunity Analysis By End User, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2021 to 2025

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2026 to 2036

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- USA

- Canada

- Mexico

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- Latin America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- Western Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- Eastern Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- East Asia Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- China

- Japan

- South Korea

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- South Asia and Pacific Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- Middle East & Africa Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Product Type

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By End User

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Canada

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Mexico

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Brazil

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Chile

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Germany

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- UK

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Italy

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Spain

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- France

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- India

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- China

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Japan

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- South Korea

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Russia

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Poland

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Hungary

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- South Africa

- Pricing Analysis

- Market Share Analysis, 2025

- By Product Type

- By End User

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product Type

- By End User

- Competition Analysis

- Competition Deep Dive

- Ingredion Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Cargill Inc.

- Barry Callebaut Group

- Nexira

- Carob House

- ADM Company

- Kerry Group

- Roquette Frères

- Tate & Lyle

- FrieslandCampina Ingredients

- Ingredion Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2021 to 2036

- Table 2: Global Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 3: Global Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 4: North America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 5: North America Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 6: North America Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 7: Latin America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 8: Latin America Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 9: Latin America Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 11: Western Europe Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 12: Western Europe Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 14: Eastern Europe Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 15: Eastern Europe Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 16: East Asia Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 17: East Asia Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 18: East Asia Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 19: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 20: South Asia and Pacific Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 21: South Asia and Pacific Market Value (USD Million) Forecast by End User, 2021 to 2036

- Table 22: Middle East & Africa Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 23: Middle East & Africa Market Value (USD Million) Forecast by Product Type, 2021 to 2036

- Table 24: Middle East & Africa Market Value (USD Million) Forecast by End User, 2021 to 2036

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2021 to 2036

- Figure 3: Global Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 4: Global Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 5: Global Market Attractiveness Analysis by Product Type

- Figure 6: Global Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 7: Global Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 8: Global Market Attractiveness Analysis by End User

- Figure 9: Global Market Value (USD Million) Share and BPS Analysis by Region, 2026 and 2036

- Figure 10: Global Market Y to o to Y Growth Comparison by Region, 2026 to 2036

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 13: Latin America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 14: Western Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 15: Eastern Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 16: East Asia Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 17: South Asia and Pacific Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 18: Middle East & Africa Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 20: North America Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 21: North America Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 22: North America Market Attractiveness Analysis by Product Type

- Figure 23: North America Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 24: North America Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 25: North America Market Attractiveness Analysis by End User

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 27: Latin America Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 28: Latin America Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 29: Latin America Market Attractiveness Analysis by Product Type

- Figure 30: Latin America Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 31: Latin America Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 32: Latin America Market Attractiveness Analysis by End User

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 34: Western Europe Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 35: Western Europe Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 36: Western Europe Market Attractiveness Analysis by Product Type

- Figure 37: Western Europe Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 38: Western Europe Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 39: Western Europe Market Attractiveness Analysis by End User

- Figure 40: Eastern Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 42: Eastern Europe Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 43: Eastern Europe Market Attractiveness Analysis by Product Type

- Figure 44: Eastern Europe Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 45: Eastern Europe Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 46: Eastern Europe Market Attractiveness Analysis by End User

- Figure 47: East Asia Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 48: East Asia Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 49: East Asia Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 50: East Asia Market Attractiveness Analysis by Product Type

- Figure 51: East Asia Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 52: East Asia Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 53: East Asia Market Attractiveness Analysis by End User

- Figure 54: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 55: South Asia and Pacific Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 56: South Asia and Pacific Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 57: South Asia and Pacific Market Attractiveness Analysis by Product Type

- Figure 58: South Asia and Pacific Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 59: South Asia and Pacific Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 60: South Asia and Pacific Market Attractiveness Analysis by End User

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Product Type, 2026 and 2036

- Figure 63: Middle East & Africa Market Y to o to Y Growth Comparison by Product Type, 2026 to 2036

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Product Type

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by End User, 2026 and 2036

- Figure 66: Middle East & Africa Market Y to o to Y Growth Comparison by End User, 2026 to 2036

- Figure 67: Middle East & Africa Market Attractiveness Analysis by End User

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

How big is the Carob Seed Protein Concentrate Market in 2026?

The global Carob Seed Protein Concentrate Market is estimated to be valued at USD 2.0 billion in 2026.

What will be the size of Carob Seed Protein Concentrate Market in 2036?

The market size for the Carob Seed Protein Concentrate Market is projected to reach USD 4.6 billion by 2036.

How much will be the Carob Seed Protein Concentrate Market growth between 2026 and 2036?

The Carob Seed Protein Concentrate Market is expected to grow at a 8.8% CAGR between 2026 and 2036.

What are the key product types in the Carob Seed Protein Concentrate Market?

The key product types in Carob Seed Protein Concentrate Market are organic carob protein isolate , conventional carob protein isolate , carob protein hydrolysate , carob germ protein , functional carob protein and other .

Which end user segment to contribute significant share in the Carob Seed Protein Concentrate Market in 2026?

In terms of end user, plant-based food manufacturers segment to command 45.3% share in the Carob Seed Protein Concentrate Market in 2026.