Gallium Market

Gallium Market Size and Share Forecast Outlook 2025 to 2035

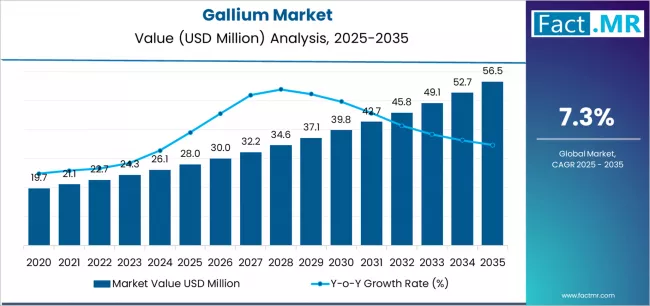

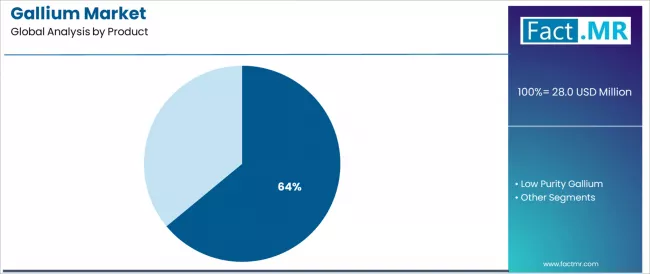

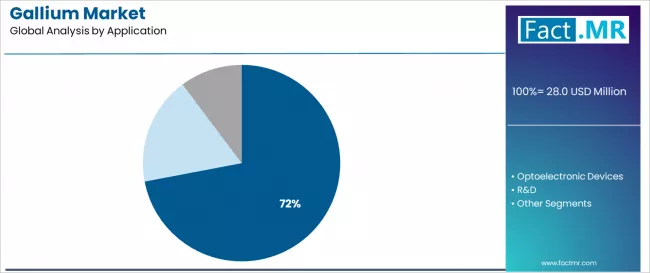

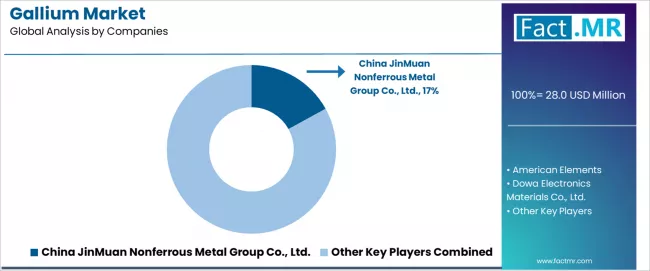

Gallium market is projected to grow from USD 28.0 million in 2025 to USD 56.5 million by 2035, at a CAGR of 7.3%. High Purity Gallium will dominate with a 64.0% market share, while ics will lead the application segment with a 72.0% share.

Gallium Market Forecast and Outlook 2025 to 2035

The global gallium market is set to grow from USD 28.0 million in 2025 to USD 56.5 million by 2035, adding USD 28.5 million in new revenue and advancing at a CAGR of 7.3%. Growth is driven by escalating demand for semiconductor manufacturing validation, expanding integrated circuit production infrastructure across regulated markets, and accelerating electronic device requirements among technology manufacturers and telecommunications organizations seeking high-performance material solutions.

Gallium materials are increasingly recognized as essential compounds for semiconductor fabrication practitioners, offering superior electronic properties capabilities, thermal conductivity assurance, and comprehensive performance characteristics compared to traditional semiconductor material approaches.

Quick Stats for Gallium Market

- Gallium Market Value (2025): USD 28.0 million

- Gallium Market Forecast Value (2035): USD 56.5 million

- Gallium Market Forecast CAGR: 7.3%

- Leading Product in Gallium Market: High Purity Gallium (64.0%)

- Key Growth Regions in Gallium Market: Asia Pacific, North America, and Europe

- Top Players in Gallium Market: China JinMuan Nonferrous Metal Group Co. Ltd., American Elements, Dowa Electronics Materials Co. Ltd., NEO Performance Materials, NICHIA Corporation

High purity gallium dominates, favored in semiconductor and optoelectronics environments for their established quality properties, providing precise electronic characteristics mechanisms, reliable compound semiconductor capabilities, and manufacturing consistency across diverse integrated circuit applications and technology demographics.

ICs remain fundamental in semiconductor manufacturing protocols where routine gallium arsenide production and gallium nitride device fabrication match operational requirements and performance confidence standards. Optoelectronic Devices are advancing among application categories as specialized LED manufacturing facility networks expand and telecommunications infrastructure increases accessibility in technology-convenient locations with stringent quality structures.

Geographic concentration demonstrates dynamic growth patterns with China and India leading expansion, supported by rising semiconductor manufacturing capacity, electronics production consciousness expansion among technology populations, and gallium refining establishment programs in industrial centers.

USA, Japan, South Korea, Germany, and Brazil demonstrate robust development through established semiconductor quality ecosystems, regulatory framework maturity for electronic materials, and standardized acceptance of compound semiconductor procedures. Competitive advantage is consolidating around purity profiles, supply chain security documentation, refining technology compatibility, and integrated semiconductor material portfolios rather than standalone gallium formulations alone.

The first half of the decade will witness the market climbing from USD 28.0 million to approximately USD 39.8 million, adding USD 11.8 million in value, which constitutes 41% of the total forecast growth period. This phase will be characterized by the continued dominance of high purity methodologies in integrated circuit manufacturing settings, combined with accelerating adoption of gallium nitride technologies in power electronics applications where performance validation and efficiency enhancement create favorable semiconductor outcomes.

The latter half will witness sustained expansion from USD 39.8 million to USD 56.5 million, representing an addition of USD 16.7 million or 59% of the decade's growth, defined by broadening acceptance of wide bandgap semiconductor protocols and integration of advanced optoelectronic platforms across mainstream electronics manufacturing facilities.

Where revenue comes from - Now Vs Next (industry-level view)

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | High Purity Gallium | 64.0% | Product dominance |

| ICs | 72.0% | Primary application | |

| Gallium Arsenide | 45-50% | Established compound | |

| LED Manufacturing | 15-20% | Optoelectronics | |

| Low Purity Gallium | 36.0% | Secondary grade | |

| Future (3-5 yrs) | Gallium Nitride Devices | 38-44% | Power electronics |

| 5G Infrastructure | 32-38% | Telecommunications | |

| Electric Vehicle Components | 28-34% | Automotive integration | |

| Photovoltaic Applications | 22-28% | Solar technology | |

| Defense Electronics | 26-32% | Specialized systems | |

| Emerging Markets | 35-41% | Geographic expansion | |

| Recycling Programs | 18-24% | Circular economy |

Gallium Market Key Takeaways

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 28.0 million |

| Market Forecast (2035) ↑ | USD 56.5 million |

| Growth Rate ★ | 7.3% CAGR |

| Leading Product → | High Purity Gallium |

| Primary Application → | ICs |

The market demonstrates exceptional fundamentals with High Purity Gallium capturing a commanding 64.0% share through superior quality characteristics, established semiconductor grade advantages, and proven performance profiles across integrated circuit and optoelectronics applications. ICs drive primary application demand at 72.0% share, supported by established semiconductor manufacturing infrastructure and electronic device requirements that maintain technology compliance across diverse electronics segments.

Geographic concentration remains anchored in Asia Pacific and North America with emerging market leadership through semiconductor production expansion and gallium refining infrastructure development, while developed markets show accelerated adoption rates driven by advanced electronics demographics and compound semiconductor technology procedure preferences.

Imperatives for Stakeholders in Gallium Market

Design for purity and reliability, not just material supply

- Offer complete semiconductor material solutions: ultra-high purity gallium + supply chain security support + quality documentation systems + technical specification validation + application engineering platforms.

- Preconfigured material packages: semiconductor grade specifications, optoelectronics quality configurations, compound semiconductor programs, and research-grade protocols for diverse manufacturing requirements.

Supply chain readiness for critical material applications

- Comprehensive traceability documentation, supply security systems, and sourcing infrastructure (primary production verification, recycling integration, strategic reserve protocols).

Affordability-by-design approach

- Cost-optimized sourcing portfolios, flexible contract models, long-term supply programs, and transparent pricing documentation.

Technical support-focused market penetration

- Established material characterization workshops + comprehensive certification programs (purity analysis, compound semiconductor processing, quality assurance management); direct manufacturer engagement for relationship development and material confidence building.

Segmental Analysis

Primary Classification: The market segments by product into High Purity Gallium and Low Purity Gallium, representing the evolution from general industrial applications toward sophisticated semiconductor manufacturing with ultra-pure material capabilities, comprehensive quality control, and integrated electronics-grade characteristics.

Secondary Classification: The application segmentation divides the market into ICs (72.0%), Optoelectronic Devices, and R&D, reflecting distinct utilization objectives for semiconductor device fabrication and electronic component manufacturing versus optical communications implementation and research application validation.

The segmentation structure reveals gallium evolution from basic metal extraction toward comprehensive semiconductor material platforms with enhanced purity characteristics and multi-dimensional performance compliance capabilities, while application diversity spans from integrated circuits to optoelectronic systems requiring specialized compound semiconductor techniques.

What Makes High Purity Gallium Command the Largest Share in the Gallium Market?

Market Position: High purity gallium commands the leading position in the gallium market with a dominant 64.0% market share through superior quality characteristics, including established semiconductor-grade specifications, extensive purity documentation, and standardized processing pathways that enable manufacturers to achieve predictable device performance outcomes across varied integrated circuit categories and diverse electronics demographics.

Value Drivers: The segment benefits from exceptional purity advantages through advanced refining technology, 99.9999% (6N) and higher purity levels without metallic impurity concerns, and proven semiconductor compatibility documentation without requiring extensive qualification procedures. Advanced purification technology enables zone refining optimization, distillation process variation, and contamination control customization, where purity precision and consistency represent critical semiconductor manufacturing requirements. Ultra-high purity (7N and above) formulations hold significant share within the product segment, appealing to advanced semiconductor manufacturers seeking superior material capabilities for next-generation device fabrication.

Competitive Advantages: High purity gallium products differentiate through proven semiconductor performance profiles, manufacturer qualification advantages, and integration with established compound semiconductor protocols that enhance device reliability while maintaining compliant quality outcomes for diverse electronics manufacturing applications.

Key market characteristics:

- Advanced purity properties with trace impurity control and consistent specifications for semiconductor-grade applications

- Superior performance reliability, enabling predictable device characteristics and manufacturing yield optimization for production operations

- Comprehensive quality documentation, including certificate of analysis and traceability records for semiconductor industry compliance

Which is the Dominant Application Area for Gallium?

Market Context: ICs demonstrate application leadership in the gallium market with a 72.0% share due to widespread semiconductor device requirements and established focus on gallium arsenide compound semiconductors, gallium nitride power devices, and RF component manufacturing that maximizes electronic performance while maintaining appropriate material quality characteristics.

Appeal Factors: Semiconductor manufacturers and device designers prioritize IC applications for high-frequency performance needs, power efficiency requirements, and integration with established compound semiconductor workflows that enables coordinated fabrication experiences across multiple device categories. The segment benefits from substantial technology advancement documentation and industry adoption campaigns that emphasize gallium-based semiconductor delivery for critical electronics applications across diverse technology demographics. Gallium arsenide RF devices capture significant share within the IC segment, demonstrating semiconductor industry preference for high-frequency performance formats.

Growth Drivers: 5G infrastructure expansion incorporates gallium-based semiconductors as essential device components for telecommunications equipment, while electric vehicle development increases power electronics demand with efficiency requirements for comprehensive performance enhancement outcomes.

What are the Drivers, Restraints, and Key Trends of the Gallium Market?

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Rising semiconductor demand & electronics manufacturing (5G deployment, IoT expansion) | ★★★★★ | Technology requirements enable gallium adoption for compound semiconductor manufacturing; increasing electronics production drives material consumption across global markets and diverse technology segments. |

| Driver | Growth in power electronics and energy efficiency applications (EVs, renewable energy) | ★★★★★ | Drives demand for high-performance semiconductor materials and efficient power conversion systems; manufacturers providing superior gallium nitride devices gain competitive advantage in energy-focused electronics segments. |

| Driver | Telecommunications infrastructure expansion and RF device requirements (5G networks, satellite communications) | ★★★★☆ | Device manufacturers demand high-frequency materials and validated performance systems; technology advancement visibility expanding addressable segments beyond traditional semiconductor demographics and consumer electronics clientele. |

| Restraint | Limited primary production & supply chain concentration (China dominance, geopolitical risks) | ★★★★☆ | Supply-dependent manufacturers face sourcing limitations and security concerns, restricting material availability and affecting technology penetration in Western semiconductor facilities and strategic electronics manufacturing operations. |

| Restraint | High material costs & price volatility (refining complexity, supply constraints) | ★★★☆☆ | Cost-conscious manufacturers face budget pressures and pricing uncertainty; increases procurement barriers and affects adoption penetration in price-sensitive applications and emerging market electronics operations. |

| Trend | Recycling program development & circular economy initiatives (e-waste recovery, sustainability focus) | ★★★★★ | Growing supply security preference for secondary sourcing approaches and environmental responsibility beyond traditional primary production extraction; recycling technologies become core supply diversification strategy for strategic material positioning. |

| Trend | Gallium nitride technology advancement & wide bandgap semiconductor adoption (power devices, RF applications) | ★★★★☆ | Semiconductor technology evolving beyond silicon limitations toward advanced compound materials; GaN positioning drives enhanced device performance and energy efficiency in sophisticated electronics manufacturing environments. |

Analysis of the Gallium Market by Key Countries

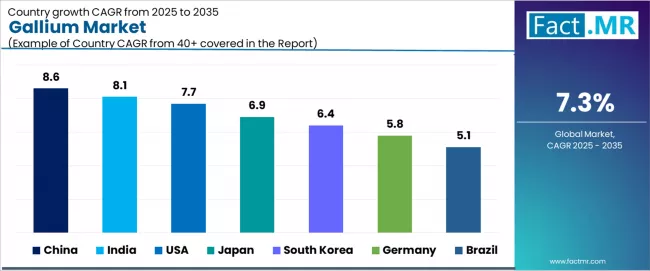

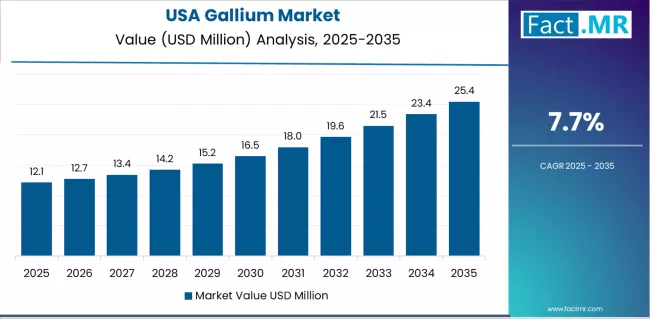

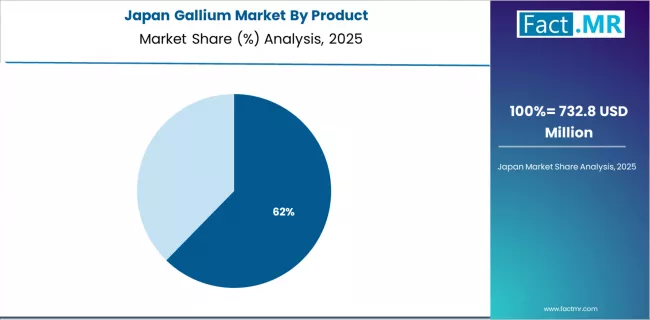

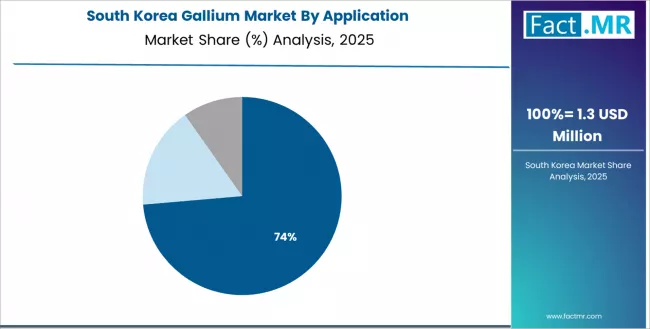

The gallium market demonstrates robust regional growth dynamics with emerging leaders including China (8.6% CAGR) and India (8.1% CAGR) driving expansion through semiconductor manufacturing programs and refining infrastructure development. Strong Performers encompass USA (7.7% CAGR), Japan (6.9% CAGR), and South Korea (6.4% CAGR), benefiting from established electronics manufacturing infrastructure and compound semiconductor demographics. Developed Markets feature Germany (5.8% CAGR) and Brazil (5.1% CAGR), where technology adoption normalization and manufacturing expertise support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through comprehensive semiconductor production positioning and primary gallium refining expansion, while Western countries demonstrate measured growth potential supported by compound semiconductor preferences and supply chain security influence. North American markets show solid development driven by strategic material acquisition integration and advanced electronics infrastructure.

| Region/Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 8.6% | Focus on production capacity portfolios | Export restrictions; geopolitical tensions |

| India | 8.1% | Lead with electronics manufacturing positioning | Infrastructure gaps; technical capability |

| USA | 7.7% | Provide supply chain security strategies | Import dependence; production limitations |

| Japan | 6.9% | Offer advanced material quality | Market maturity; production costs |

| South Korea | 6.4% | Maintain semiconductor integration | Supply vulnerability; China dependence |

| Germany | 5.8% | Deliver high-purity solutions | Supply security; refining capacity |

| Brazil | 5.1% | Push industrial application programs | Limited infrastructure; market development |

China Drives Fastest Market Growth

China establishes fastest market growth through progressive primary gallium production expansion and comprehensive refining infrastructure development, positioning gallium materials as essential strategic resources in semiconductor manufacturing centers and emerging electronics production facilities. The country's 8.6% growth rate reflects substantial industrial investment levels supporting materials production spending and growing electronics manufacturing segments that encourage the deployment of domestically-refined gallium products in diverse semiconductor settings.

Growth concentrates in major industrial regions, including Inner Mongolia, Guangxi, and Yunnan provinces, where aluminum smelting operations showcase increasing capacity for gallium recovery adoption that appeals to semiconductor manufacturers demanding secured material supply and competitive pricing outcomes.

Chinese producers are developing integrated supply chain protocols that combine primary aluminum smelting with gallium recovery technologies, including high-purity refining expansion and semiconductor-grade production growth. Distribution channels through domestic semiconductor manufacturers and electronics assembly operations expand market access, while strategic material reserve initiatives support availability across diverse technology types and manufacturing specialization levels.

India Emerges as Electronics Manufacturing Leader

In Karnataka, Tamil Nadu, and Maharashtra regions, semiconductor fabrication facilities and electronics manufacturing plants are adopting gallium-based materials as essential components for device production operations, driven by increasing government semiconductor initiatives and elevation of domestic electronics manufacturing expectations that emphasize the importance of strategic material sourcing.

The market holds an 8.1% growth rate, supported by semiconductor park development and electronics infrastructure investment that promote gallium adoption for technology-focused applications. Indian manufacturers are favoring high-purity material platforms that provide comprehensive quality documentation and supply reliability evidence, particularly appealing in semiconductor clusters where material consistency and device performance represent critical operational factors.

Market expansion benefits from substantial government semiconductor incentive programs and electronics manufacturing policy establishment that enable widespread adoption of compound semiconductor methodologies for diverse technology applications. Industry adoption follows patterns established in global semiconductor excellence, where material quality advantages and supply chain integration drive manufacturer confidence and facility certification achievement.

USA Shows Supply Chain Security Leadership

USA establishes supply chain security leadership through comprehensive critical materials strategy and established semiconductor manufacturing ecosystem, integrating gallium materials across domestic semiconductor fabs, defense electronics facilities, and telecommunications equipment manufacturers.

The country's 7.7% growth rate reflects strategic material acquisition focus and sophisticated technology development levels that support deployment of secured gallium supplies in critical and commercial applications. Growth concentrates in established semiconductor regions, including Arizona, Texas, and Oregon, where manufacturers showcase advanced supply diversification adoption that appeals to defense-focused organizations seeking predictable material availability and domestic sourcing outcomes.

American technology providers leverage strategic partnerships and comprehensive supply security frameworks, including recycling program development and alternative sourcing initiatives that create material confidence and national security assurance. The market benefits from substantial CHIPS Act investment and defense electronics requirements that encourage domestic production development while supporting continuous supply chain resilience investments and critical material stockpiling.

Japan Shows Advanced Technology Integration

Japan's sophisticated electronics market demonstrates established gallium integration with documented quality emphasis in material specification and device fabrication precision through specialized semiconductor manufacturers and compound semiconductor facilities. The country leverages rigorous material standards and technology leadership approaches to maintain a 6.9% growth rate. Premium technology markets, including advanced power electronics and RF devices, showcase quality-driven material approaches where gallium products integrate with established semiconductor cultures and thorough characterization practices to optimize device performance and ensure appropriate material quality assessment.

Japanese manufacturers prioritize comprehensive material characterization requirements and systematic quality documentation in gallium procurement, creating demand for ultra-high purity products with extensive specification characteristics, including impurity analysis, crystal structure verification, and batch consistency data. The market benefits from established compound semiconductor expertise and advanced electronics specialization that provide premium positioning opportunities and compliance with strict Japanese semiconductor material standards.

South Korea Shows Semiconductor Manufacturing Integration

South Korea's advanced semiconductor market demonstrates progressive gallium adoption with documented manufacturing emphasis in compound semiconductor production and device fabrication protocols through leading memory chip manufacturers and electronics conglomerates. The country maintains a 6.4% growth rate, leveraging established semiconductor industry leadership and comprehensive manufacturing infrastructure in chip production.

Major semiconductor hubs, including Seoul metropolitan area and regional fabrication facilities, showcase technology-driven material priorities where gallium products integrate with established semiconductor manufacturing cultures and advanced process technologies to optimize device characteristics and maintain competitive manufacturing under evolving technology requirements.

Korean manufacturers prioritize supply chain stability strategies and comprehensive quality system integration in material procurement, creating demand for reliable products with consistent supply characteristics, including long-term contract availability, quality assurance programs, and technical support services. The market benefits from established semiconductor manufacturing dominance and technology innovation culture that provide strategic positioning opportunities and maintain alignment with Korean semiconductor industry requirements.

Germany Demonstrates High-Tech Manufacturing Preferences

Germany's advanced industrial market demonstrates established gallium integration with documented quality compliance focus in material specification and compound semiconductor protocols through comprehensive specialty semiconductor manufacturers and automotive electronics suppliers. The country maintains a 5.8% growth rate, leveraging strict material standards alignment with European quality frameworks and established precision manufacturing expertise in power electronics.

Key industrial regions, including Bavaria and Baden-Württemberg, showcase quality-driven material approaches where gallium products integrate with established automotive supply chain cultures and comprehensive testing systems to optimize power device performance and maintain technology leadership compliance under stringent automotive qualification requirements.

German manufacturers prioritize comprehensive analytical documentation and supply chain transparency assurance in material program development, creating demand for certified products with extensive traceability characteristics, including origin verification, purity certification, and sustainability documentation. The market benefits from established automotive electronics sectors and power device manufacturing expertise that provide quality positioning opportunities and maintain alignment with German industrial material standards.

Brazil Shows Industrial Application Integration

Brazil's developing industrial market demonstrates progressive gallium adoption with documented accessibility emphasis in material availability and industrial application execution through emerging electronics manufacturing operations and research institutions. The country maintains a 5.1% growth rate, leveraging growing technology sector development and improving industrial infrastructure in urban centers.

Major industrial regions, including São Paulo and Rio de Janeiro areas, showcase industrial-driven material priorities where gallium products integrate with expanding electronics assembly cultures and developing semiconductor research to optimize technology development outcomes and maintain accessible strategic material availability under evolving industrial policy requirements.

Brazilian manufacturers prioritize affordability strategies and comprehensive industrial integration in material sourcing, creating demand for cost-effective products with adequate quality characteristics, including industrial-grade purity, basic documentation, and technical support availability. The market benefits from established aerospace and defense sectors and growing electronics assembly presence that provide market positioning opportunities and maintain alignment with Brazilian industrial development policies.

Competitive Landscape of the Gallium Market

The gallium market exhibits a moderately consolidated competitive structure with approximately 15-25 active players operating across global primary production networks and regional refining distribution portfolios. China JinMuan Nonferrous Metal Group Co. Ltd. maintains market leadership at a 17.0% share, reflecting strong production capacity positioning across primary gallium recovery with sophisticated aluminum smelting integration strategies.

This competitive landscape demonstrates the maturation of gallium extraction technology, where established players leverage geographic concentration advantages, extensive aluminum industry integration documentation, and strategic material control programs to maintain dominant positions, while Western refiners and specialty material companies create niche opportunities through high-purity production offerings and supply diversification strategies.

Market leadership is maintained through several critical competitive advantages extending beyond extraction capabilities and product portfolios. Integrated aluminum smelting operations enable leading players to control primary gallium production economics and access byproduct recovery advantages unavailable to standalone refiners. Refining technology infrastructure and purification capability availability represent crucial differentiators in strategic material categories, where decades of metallurgical expertise, zone refining protocols, and quality control frameworks create supply preference among semiconductor manufacturers. Production efficiency in aluminum smelting facilities, byproduct recovery optimization, and high-purity refining systems separate integrated producers from smaller competitors, while comprehensive quality documentation addressing semiconductor-grade specifications, analytical testing data, and consistency evidence strengthen market position and manufacturer confidence.

The market demonstrates emerging differentiation opportunities in recycling technology categories and supply diversification initiatives, where traditional primary production methodologies face competition from circular economy-focused entrants offering supply security advantages.

Significant competitive advantages persist in Chinese primary production through comprehensive cost structure benefits and integrated aluminum industry depth. Strategic positioning through supply chain security and domestic production capabilities commands attention in Western markets through reduced import dependence and critical material sovereignty integration.

Specialized material portfolios combining ultra-high purity capabilities with technical support services create comprehensive positioning that justifies premium pricing beyond commodity gallium competition. Integrated supply solution offerings emphasizing recycling program compatibility, unified quality assurance, and long-term contract availability generate customer loyalty and supply preferences beyond spot market purchases.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Chinese primary producers | Aluminum smelting integration; production capacity; supply dominance | Cost advantages; production scale; market control; supply leverage | Western market access; geopolitical risks; quality perception; customer relationships |

| Specialized refining companies | Purification technology; quality optimization; semiconductor-grade production | Product differentiation; purity excellence; technical expertise; customer service | Production scale; cost competitiveness; primary supply access; geographic reach |

| Western material suppliers | Regional distribution; technical support; quality assurance | Supply reliability; quality consistency; customer proximity; technical service | Production capacity; cost structure; primary production; China competition |

| Recycling technology companies | Secondary recovery; e-waste processing; circular economy | Sustainability positioning; supply diversification; innovation; environmental compliance | Scale economics; purity achievement; cost competitiveness; technology maturity |

| Semiconductor manufacturers | Captive consumption; specification requirements; quality standards | Application knowledge; volume leverage; vertical integration; quality requirements | Supply security; production expertise; refining capability; market influence |

Key Players in the Gallium Market

- China JinMuan Nonferrous Metal Group Co., Ltd.

- American Elements

- Dowa Electronics Materials Co., Ltd.

- NEO Performance Materials

- NICHIA Corporation

- Noah Chemicals Corporation

- Reade Advanced Materials

- Umicore

- Vital Materials Co., Ltd.

- Zhuzhou Smelter Group Co., Ltd. (ZSG)

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 28.0 million |

| Product | High Purity Gallium, Low Purity Gallium |

| Application | ICs, Optoelectronic Devices, R&D |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, USA, Japan, South Korea, Germany, Brazil, and 15+ additional countries |

| Key Companies Profiled | China JinMuan Nonferrous Metal Group Co. Ltd., American Elements, Dowa Electronics Materials Co. Ltd., NEO Performance Materials, NICHIA Corporation |

| Additional Attributes | Dollar sales by product and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with established primary production corporations and specialized refining companies, manufacturer preferences for high purity gallium and integrated circuit applications, integration with semiconductor fabrication facilities and compound semiconductor manufacturing organizations, innovations in recycling technologies and purification platforms, and development of sophisticated supply security systems with enhanced purity profiles and comprehensive quality documentation frameworks. |

Gallium Market by Segments

-

Product :

- High Purity Gallium

- Low Purity Gallium

-

Application :

- ICs

- Optoelectronic Devices

- R&D

-

Region :

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

- North America

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Product, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Product, 2025 to 2035

- High Purity Gallium

- Low Purity Gallium

- Y to o to Y Growth Trend Analysis By Product, 2020 to 2024

- Absolute $ Opportunity Analysis By Product, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- ICs

- Optoelectronic Devices

- R&D

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Product

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Application

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Application

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product

- By Application

- Competition Analysis

- Competition Deep Dive

- China JinMuan Nonferrous Metal Group Co., Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- American Elements

- Dowa Electronics Materials Co., Ltd.

- NEO Performance Materials

- NICHIA Corporation

- Noah Chemicals Corporation

- Reade Advanced Materials

- Umicore

- Vital Materials Co., Ltd.

- Zhuzhou Smelter Group Co., Ltd. (ZSG)

- China JinMuan Nonferrous Metal Group Co., Ltd.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 7: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 8: Latin America Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 11: Western Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 12: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Eastern Europe Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 15: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 17: East Asia Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 18: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 19: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 20: South Asia and Pacific Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 21: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 22: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 23: Middle East & Africa Market Value (USD Million) Forecast by Product, 2020 to 2035

- Table 24: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020 to 2035

- Figure 3: Global Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 5: Global Market Attractiveness Analysis by Product

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Region, 2025 to 2035

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 13: Latin America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 14: Western Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 15: Eastern Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 16: East Asia Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 17: South Asia and Pacific Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 18: Middle East & Africa Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 20: North America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 21: North America Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 22: North America Market Attractiveness Analysis by Product

- Figure 23: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 25: North America Market Attractiveness Analysis by Application

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Latin America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 28: Latin America Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 29: Latin America Market Attractiveness Analysis by Product

- Figure 30: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 31: Latin America Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 32: Latin America Market Attractiveness Analysis by Application

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Western Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 35: Western Europe Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 36: Western Europe Market Attractiveness Analysis by Product

- Figure 37: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 38: Western Europe Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 39: Western Europe Market Attractiveness Analysis by Application

- Figure 40: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 42: Eastern Europe Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 43: Eastern Europe Market Attractiveness Analysis by Product

- Figure 44: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 45: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 46: Eastern Europe Market Attractiveness Analysis by Application

- Figure 47: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 48: East Asia Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 49: East Asia Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 50: East Asia Market Attractiveness Analysis by Product

- Figure 51: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 52: East Asia Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 53: East Asia Market Attractiveness Analysis by Application

- Figure 54: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 55: South Asia and Pacific Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 56: South Asia and Pacific Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 57: South Asia and Pacific Market Attractiveness Analysis by Product

- Figure 58: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 59: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 60: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 63: Middle East & Africa Market Y to o to Y Growth Comparison by Product, 2025 to 2035

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Product

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 66: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 67: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

How big is the gallium market in 2025?

The global gallium market is estimated to be valued at USD 28.0 million in 2025.

What will be the size of gallium market in 2035?

The market size for the gallium market is projected to reach USD 56.5 million by 2035.

How much will be the gallium market growth between 2025 and 2035?

The gallium market is expected to grow at a 7.3% CAGR between 2025 and 2035.

What are the key product types in the gallium market?

The key product types in gallium market are high purity gallium and low purity gallium.

Which application segment to contribute significant share in the gallium market in 2025?

In terms of application, ics segment to command 72.0% share in the gallium market in 2025.