Aircraft Pumps Market

Aircraft Pumps Market Analysis, By Type, By Technology, By Pressure, By Aircraft Type, By End User, and Region - Market Insights 2025 to 2035

Analysis of Aircraft Pumps Market Covering 30+ Countries, Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Aircraft Pumps Market Outlook (2025 to 2035)

The global aircraft pumps market is projected to be valued at USD 4,530 million by 2025. According to Fact.MR analysis, the industry is expected to grow at a CAGR of 5% and reach USD 7,379 million by 2035.

In 2024, the aircraft pumps industry experienced measured yet critical expansion, driven by increasing production of narrow-body aircraft and surging retrofit demand in mature aviation hubs. Fact.MR research found that OEM orders experienced a strong surge in Western Europe and North America, driven by the resumption of fleet modernization programs and the clearing of pandemic-era delivery backlogs.

Supply-side pressures, however, continued to dog manufacturers. Factories were confronted with delays in procurement for accurate parts, particularly in electro-mechanical units, which partially suppressed output. Simultaneously, pump technologies have improved for fuel pumps through increased attention to fuel economy and pollution controls, particularly in Europe, in response to the EU's Green Deal air transport requirements [Source: European Commission].

Demand in the aftermarket boomed in the Asia-Pacific region, as older regional jets and turboprops required performance enhancements. Fact.MR believes that 2024 was not an explosive growth year, but rather a year of recalibration and consolidation following the turbulent dynamics of the pandemic years.

By 2025, the industry is expected to reach USD 4,530 million and continue to grow steadily at a CAGR of 5% until 2035, when it is projected to reach USD 7,379 million. The convergence of technology, particularly electric motor-driven systems, and more electric aircraft architectures will characterize the next decade, with operators requiring efficiency without compromising power-to-weight ratios.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 4,530 Million |

| Projected Size in 2035 | USD 7,379 Million |

| CAGR (2025 to 2035) | 5% |

Fact.MR Survey Results: Market Dynamics Based on Stakeholder Perspectives

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, OEMs, and MROs in the USA, Western Europe, Japan, and South Korea)

Key Priorities of Stakeholders

- Compliance with Regulatory Standards: 85% of global stakeholders identified regulatory compliance, particularly regarding safety and environmental standards, as a key priority.

- Operational Efficiency: 78% of stakeholders emphasized improving operational efficiency, citing the rising demand for fuel-efficient and high-performance pumps as a central focus of their strategy.

Regional Variance:

- USA: 72% emphasized the importance of automation and digitalization, especially in next-generation fuel and hydraulic pump systems, driven by labor shortages and operational efficiency needs.

- Western Europe: 91% emphasized sustainability, including reductions in carbon emissions and the integration of recyclable materials into pump components.

- Japan/South Korea: 66% focused on reducing energy consumption and increasing the space efficiency of pumps for next-gen aircraft designs, responding to space constraints in new aircraft models.

Embracing Advanced Technologies

- USA: 64% of stakeholders are investing heavily in integrating IoT and AI technologies for real-time monitoring and predictive maintenance.

- Western Europe: 57% are embracing electric pump solutions for hybrid and electric aircraft, driven by stringent EU carbon reduction targets.

- Japan: 34% are hesitant to adopt new technologies due to the high cost and complexity of integration, preferring more conventional systems.

- South Korea: 45% of companies are investing in automation and robotic technologies, particularly for efficient aftermarket servicing and maintenance of aircraft pump systems.

Convergent & Divergent Perspectives on ROI:

- USA: 77% of stakeholders considered digital and automated systems a worthwhile investment for reducing downtime and increasing productivity.

- Japan and South Korea: 42% continue to prioritize traditional systems, showing reluctance to invest in cutting-edge technologies.

Material Preferences

- Consensus: Steel is preferred by 60% of global stakeholders due to its durability, especially in high-pressure and high-temperature conditions.

Regional Variance:

- Western Europe: 55% favor the use of aluminum, driven by sustainability demands and its lightweight properties, especially for pumps used in electric aircraft.

- Japan/South Korea: 48% select hybrid steel-aluminum combinations for corrosion resistance in maritime and coastal regions where aircraft are exposed to harsher environmental conditions.

- USA: 68% stick with steel due to its robust performance and longevity, although the trend in the Pacific Northwest is shifting towards aluminum for lightweight applications.

Price Sensitivity

Shared Challenges: 80% of respondents cited rising material and component costs, including those of steel and aluminum, as a major concern.

Regional Differences:

- USA/Western Europe: 62% are willing to accept a 15-20% premium for automated systems that improve operational efficiency.

- Japan and South Korea: 75% prefer more cost-effective solutions, with only 10% willing to pay a premium for advanced features.

- South Korea: 50% of stakeholders favor leasing models to better manage the costs associated with new technologies, particularly in an industry focused on cost control.

Pain Points in the Value Chain

Manufacturers:

- USA: 60% of manufacturers struggle with labor shortages, particularly in highly specialized pump assembly lines.

- Western Europe: 55% cited regulatory complexity, particularly in certification and safety requirements for new and innovative pump technologies.

- Japan: 65% highlighted the difficulty in meeting the growing demand for energy-efficient pump systems due to slow regulatory approval processes.

Distributors:

- USA: 70% face inventory delays due to dependence on international suppliers for high-tech pump components.

- Western Europe: 50% face increasing competition from lower-cost manufacturers in Eastern Europe.

- Japan/South Korea: 55% pointed to logistical issues in serving rural or isolated locations, where maintenance services are less accessible.

Future Investment Priorities

- Alignment: 72% of global manufacturers plan to invest in R&D for automation and digital technologies.

Regional Variance:

- USA: 65% focus on modular pump systems that can be used across various aircraft types and adapted for different operational environments.

- Western Europe: 58% are investing in technologies that support green aviation, including carbon-neutral pump systems and sustainable manufacturing processes.

- Japan/South Korea: 50% focus on space-saving pump systems that can be integrated into compact aircraft designs.

Regulatory Impact

- USA: 72% of stakeholders indicated that stringent state-level regulations, like those in California, have had a significant impact on the demand for sustainable, eco-friendly aircraft pump systems.

- Western Europe: 79% view EU regulations as a driving force for adopting advanced, eco-friendly pump technologies, which align with the European Green Deal.

- Japan/South Korea: Only 40% believe regulatory changes are influencing purchasing decisions, citing slower enforcement and less stringent regulations.

Conclusion: Variance vs. Consensus

High Consensus:

- Regulatory compliance, durability, and sustainability pressures are significant global challenges.

Key Variances:

- The USA is experiencing strong growth driven by automation and modular designs, whereas Japan and South Korea remain cautious and cost-conscious.

- Western Europe: Leading in sustainability efforts with a focus on eco-friendly solutions, while Asia focuses on hybrid solutions to balance cost and performance.

Strategic Insight:

- A region-specific approach is critical to industry penetration, stakeholders prioritize automation and efficiency, while European stakeholders are heavily.

Impact of Government Regulation

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States |

|

| Western Europe |

|

| Japan |

|

| South Korea |

|

Market Analysis

The industry is entering a stable growth phase, driven by rising commercial aircraft production and a shift toward more electric aircraft systems. The key driver is the aviation sector’s increasing demand for lightweight, energy-efficient pump technologies to improve fuel efficiency and reduce emissions. OEMs and advanced component manufacturers stand to benefit most, while legacy suppliers with outdated hydraulic systems may face competitive pressure.

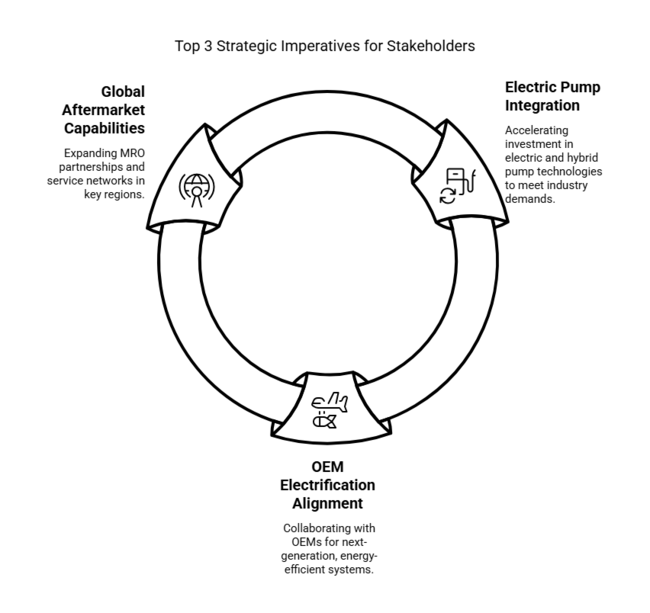

Top 3 Strategic Imperatives for Stakeholders

Prioritize Electric Pump Integration

Executives should accelerate investment in electric motor-driven and hybrid pump technologies to align with the aviation industry’s transition toward more electric aircraft (MEA) architectures and regulatory pressure for lower emissions.

Align with OEM Electrification Roadmaps

Collaborate closely with major aircraft OEMs to synchronize product development with next-generation aircraft platforms that demand lighter, energy-efficient, and digitally controlled pump systems.

Strengthen Global Aftermarket Capabilities

Expand MRO partnerships and invest in localized service networks in Asia-Pacific and the Middle East, where aging fleets and rising passenger traffic are driving long-term aftermarket demand.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Precision Component & Material Disruptions - Global bottlenecks in high-tolerance machining, electronic controllers, and aerospace-grade metals continue to impact lead times, especially for SMEs without diversified supplier bases. | Medium Probability, High Impact |

| Regulatory Delays for Electric Systems - National aviation regulators remain cautious in certifying newer electric pump systems for retrofitting, causing deployment delays and increased compliance costs in older fleets. | Low Probability, Medium Impact |

| OEM Order Volatility from Macroeconomic Shifts - Volatility in global interest rates and airline liquidity may lead to the postponement or cancellation of large aircraft orders, disrupting forward contracts and pump component deliveries. | Medium Probability, High Impact |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Supply Chain Resilience | Run feasibility on alternative sourcing for critical aerospace-grade materials to mitigate risks of raw material price volatility. |

| OEM and Aftermarket Alignment | Initiate feedback loop with key OEMs to assess demand for hybrid and electric pump systems in upcoming aircraft models. |

| Aftermarket Expansion | Launch aftermarket channel partner incentive pilot in Asia-Pacific and Middle East to boost service network coverage and demand for retrofit solutions. |

For the Boardroom

To gain a competitive edge, companies must prioritize strategic investments in electric and hybrid pump technologies, aligning product development with the next generation of aircraft platforms. Focusing on supply chain diversification will mitigate risks tied to material shortages and price volatility.

Strengthening collaboration with OEMs and aftermarket service networks will open growth avenues in retrofit and maintenance, particularly in emerging regions like Asia-Pacific. These actions should be integrated into the client’s roadmap to not only secure short-term wins in a highly competitive environment but also position them as a leader in the energy-efficient, next-generation industry.

Segment-wise Analysis

By Type

The hydraulic pumps segment is expected to remain dominant, growing at a CAGR of 3.5% during the assessment period. Hydraulic pumps have long been integral to aircraft systems, particularly in flight controls, landing gear, and brakes.

Despite the growing trend toward electrification in aircraft systems, hydraulic pumps remain essential due to their reliability, efficiency, and power density. However, their growth will be moderated by the shift toward more electric aircraft (MEA) designs, which aim to reduce reliance on hydraulic systems for cost and maintenance efficiency.

The demand for hydraulic pumps will continue to be driven primarily by legacy aircraft and specific systems that cannot yet be fully electrified. As the industry transitions, the focus on sustainability and energy efficiency may limit the expansion of hydraulic pump adoption. Still, it will remain a steady contributor to the industry.

By Technology

The engine-driven pump category is expected to be the most profitable, with a compound annual growth rate (CAGR) of 3.5% from 2025 to 2035. These pumps are powered directly by the aircraft engine and are primarily used in high-pressure applications such as lubrication and fuel systems. While the broader trend in the aerospace industry is shifting toward electric and hybrid technologies, engine-driven pumps remain integral to many traditional aircraft systems.

Their reliability, power, and efficiency make them indispensable for certain critical systems. The demand for engine-driven pumps is expected to remain strong, particularly in military and older commercial aircraft, although electric alternatives are anticipated to gain market share over time.

By Pressure

The 10 psi to 500 psi pressure range will provide the maximum opportunities for stakeholders, growing at a compound annual growth rate (CAGR) of 3.4% during the forecast period. This pressure range typically applies to low-pressure systems, such as lubrication and fuel transfer systems in smaller aircraft or specific aircraft components like air conditioning systems.

These pumps are widely used in regional jets, turboprops, and general aviation aircraft, where lower pressure is sufficient for operational requirements. As commercial aviation expands and regional connectivity improves, the demand for lower-pressure pumps in smaller aircraft is expected to remain stable. Additionally, maintenance cost considerations and the need for operational efficiency in legacy fleets will continue to sustain demand for pumps within this pressure range.

By Aircraft Type

The wide-body aircraft category is expected to be the most lucrative, growing at a CAGR of 4.5% from 2025 to 2035. These aircraft are in high demand for long-haul international flights, and as global air travel continues to recover and expand, wide-body aircraft are expected to see continued adoption.

The increasing number of wide-body aircraft in the commercial fleet will drive demand for various components, particularly fuel systems, hydraulic systems, and air conditioning systems, as these are crucial for efficient operation in large aircraft. Airlines are also seeking to enhance fuel efficiency and lower maintenance costs, thereby promoting the adoption of more efficient systems.

By End User

The OEM segment is expected to remain dominant, growing at a compound annual growth rate (CAGR) of 5.0% during the forecast period. Original equipment manufacturers (OEMs) play a vital role in developing and installing components for new aircraft. With the global aerospace sector expanding, driven by the rising production of both commercial and military aircraft, demand for OEM-installed systems is set to increase.

Aircraft designs are evolving toward more energy-efficient, sustainable, and reliable systems, boosting demand for advanced technologies. OEMs will also focus on integrating innovative materials to enhance fuel efficiency, reduce emissions, and comply with stricter regulations. The rise of electric and hybrid-electric aircraft will further stimulate this segment.

Country-wise Insights

USA

The US industry is expected to experience robust growth, with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2035. This is largely driven by the country’s significant aviation industry, comprising both commercial and defense aircraft production. The United States has a vast number of aircraft operators, with demand for reliable and high-performance systems soaring as new aircraft models are introduced.

The United States also hosts a strong base of original equipment manufacturers (OEMs) and key suppliers in the aerospace sector, driving rapid technological advancements and large-scale production. Additionally, the trend toward electrification and hybrid aircraft systems is expected to fuel the demand for advanced systems. Given its high adoption of cutting-edge technologies and continuous infrastructure upgrades, the USA is expected to remain a leading player in this industry.

UK

The UK’s sales are expected to grow at a CAGR of 4.7% in the industry during the 2025-2035 forecast period. As a major hub for aerospace manufacturing and research, the UK benefits from its strong industry ties with both civilian and military aviation sectors. The presence of prominent aerospace companies, including Rolls-Royce and BAE Systems, ensures high demand for systems as new, more fuel-efficient engines are introduced.

Additionally, the UK’s commitment to sustainability, including emissions reduction targets and innovations in electric aircraft systems, will drive the need for more efficient and specialized technologies. The UK government’s defense spending is expected to boost the industry, particularly with new military aircraft contracts anticipated in the coming years. These factors position the UK well for steady growth within the aircraft systems industry.

France

The need for cleaner technologies in France, including hybrid and electric aircraft, is expected to further accelerate demand for advanced systems. Additionally, the country’s investment in military aviation and air defense systems is likely to contribute to stable demand for high-performance systems. Moreover, its alignment with EU regulations on emissions and environmental standards will drive continued innovation and adoption of more efficient systems across the sector.

France’s revenue for the aircraft pumps industry is projected to grow at a CAGR of 5.2% between 2025 and 2035. The country's long-standing presence in aircraft manufacturing, particularly through major companies such as Airbus, significantly contributes to the demand for aircraft systems. France's aerospace industry is heavily involved in both commercial and military aircraft production, with a focus on innovation and environmental sustainability.

Germany

As Europe’s largest economy and a global leader in industrial technology, Germany plays a critical role in the aerospace industry. With the presence of key aerospace suppliers like Lufthansa Technik and MTU Aero Engines, the demand for aircraft systems is substantial. The focus on technological advancements, particularly in fuel-efficient and environmentally friendly aircraft, is driving innovation in the aviation industry.

This is creating the demand for next-generation systems that can support new propulsion technologies and hybrid electric aircraft. Additionally, Germany’s strong export capabilities and expanding aviation infrastructure will continue to support rising demand for aircraft systems. The industry in Germany is projected to grow at a CAGR of 5.4% during the forecast period.

Italy

Italy’s aircraft pumps market is projected to grow at a CAGR of 4.8% from 2025 to 2035. While Italy does not have the same large-scale commercial aircraft manufacturers as France or Germany, it plays a significant role in the global aerospace supply chain, particularly in the production of aircraft components and maintenance, repair, and overhaul (MRO) services. Companies like Leonardo and Avio Aero contribute to the growth of the aviation sector, driving demand for systems used in various aircraft systems.

The Italian aerospace sector is increasingly focusing on developing lightweight and energy-efficient components, which will likely motivate the demand for high-performance, lightweight systems. Additionally, Italy’s active participation in the EU's aerospace sustainability goals, combined with the growing trend of aviation decarbonization, will drive technological innovation in the industry.

South Korea

South Korea’s emphasis on advancing aerospace technologies, including next-generation aircraft, will be a key driver of demand for high-performance systems. Furthermore, South Korea’s growing military aircraft production and the modernization of its fleet are expected to significantly increase demand for advanced systems. The country’s sales are expected to grow at a CAGR of 4.5% during the forecast period.

The country boasts a growing aerospace industry, featuring prominent players such as Korean Aerospace Industries (KAI), alongside a rapidly expanding domestic commercial aviation sector. However, the South Korean industry is slightly constrained by high production costs and the need to rely on global supply chains for key components, which may limit the pace of growth to a certain extent. Despite this, ongoing technological developments and government investments in aerospace will continue to bolster the industry.

Japan

While Japan’s domestic aircraft manufacturing sector is smaller than that of other countries, its aerospace industry is renowned for its precision engineering and high-quality standards. Japanese manufacturers, such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries, contribute to the production of advanced components, thereby driving demand for specialized systems. The Japanese landscape is projected to experience a compound annual growth rate (CAGR) of 4.3% in the industry from 2025 to 2035.

Furthermore, Japan's emphasis on green aviation technologies and its commitment to reducing carbon emissions will foster the need for more energy-efficient systems, including those used in aircraft. However, Japan’s slower pace in adopting newer aircraft technologies, such as electrification and hybrid systems, compared to other countries may slightly limit the demand for certain types of systems. Nevertheless, Japan’s strong position in the MRO sector and its focus on technological innovation will support steady growth in the industry.

China

As the world's busiest aviation hub, China is heavily focused on expanding its commercial aircraft fleet and domestic manufacturing capabilities. Organizations such as COMAC (Commercial Aircraft Corporation of China) are driving the nation to become less dependent on international plane makers, thereby creating greater demand for high-quality national components, including systems and subsystems. The Chinese industry is expected to grow at the highest rate among all industries, with a CAGR of 6.1% between 2025 and 2035.

China's strong emphasis on technological innovation, including the manufacture of electric and hybrid planes, will continue to boost demand for specialized systems. The government's firm encouragement of the aviation industry, together with its ambitious expansion plans in commercial and military aviation, positions China as a vital stakeholder in advanced aircraft systems. Owing to the country's fast-paced urbanization and growth in passengers, the need for aviation-related parts will continue to expand steadily.

Competitive Landscape

The global aircraft pumps industry remains moderately consolidated, with a few dominant players holding significant market shares, while several regional and niche manufacturers continue to compete for specialized applications.

Top players in the aircraft pumps landscape are leveraging technological innovation, strategic partnerships, and geographic expansion to strengthen their positions. Competitive pricing remains a tactic mainly for aftermarket and regional suppliers, while OEM-focused companies emphasize advanced product development, fuel efficiency, and compliance with evolving aviation regulations. Key companies are also pursuing mergers and acquisitions to diversify portfolios and penetrate emerging markets.

In March 2024, Parker Hannifin Corporation announced its acquisition of RBC Bearings’ Aircraft Pump Division, aiming to bolster its capabilities in precision-engineered aerospace systems. This move expands Parker’s hydraulic pump offerings across both commercial and defense platforms. Similarly, Eaton Corporation unveiled its newly enhanced next-generation electric pump systems in April 2024, designed to support more electric aircraft (MEA) platforms and improve energy efficiency in narrow-body jets.

Safran, meanwhile, entered into a strategic agreement with MTU Aero Engines in February 2024 to jointly develop electric pump systems for hybrid-electric aircraft under Europe’s Clean Aviation program. This collaboration underlines the growing shift toward electrification and sustainability in aerospace fluid systems.

Market Share Analysis

Honeywell International Inc. (25-30%)

Honeywell will continue to pioneer the design of fuel and hydraulic pumps for both commercial and military planes. It will use improvements in smart, electric, and hybrid aircraft technology in 2025 to further its product portfolio. With good growth anticipated in the defense and aviation industries.

Eaton Corporation (20-25%)

Eaton is set to grow in the electric and intelligent pump systems segment. With the aerospace industry moving towards all-electric aircraft designs, Eaton's electric motor-based pump solutions will witness increased demand. From 2025, Eaton will see substantial momentum with its next-generation energy-efficient systems for both OEM and aftermarket industry with a strategy to expand its share in Asia-Pacific as well as North America.

Parker Hannifin Corporation (15-20%)

Parker Hannifin will strengthen its presence in next-generation aircraft fluid systems, driven by the increasing adoption of electric and hybrid technologies. In 2025, the company will focus on providing advanced fuel, hydraulic, and cooling pump systems for new aircraft designs. Its robust portfolio of high-performance fluid systems will benefit from the increasing demand from commercial and defense aerospace producers, propelling its growth in North America and Europe.

Woodward, Inc. (10-15%)

Woodward will continue to be a major driver in fuel pumps for defense as well as space. During 2025, the company is anticipated to consolidate its position by creating new fuel and power systems for military aviation and space exploration. As there will be an increasing focus on advanced, high-efficiency systems, Woodward will continue to grow in the USA as well as other major global defense industries, due to continued investments in defense technologies.

Crane Aerospace & Electronics (8-12%)

Crane Aerospace will further focus on high-pressure pumps, especially for advanced military aircraft as well as space applications. With a growing portfolio of high-performance fuel, lubrication, and air system pumps, Crane is well-placed to capture a larger percentage of the niche high-pressure pump industry. During 2025, the company will concentrate on further consolidating its position in commercial and defense aerospace industries, especially in North America and Europe.

Triumph Group, Inc. (5-10%)

Triumph Group will experience growth in MRO (Maintenance, Repair, and Overhaul) services. With aging aircraft fleets worldwide, replacement pumps as well as maintenance will become increasingly in demand. In 2025, Triumph will continue to expand its aftermarket services and develop its technological offerings to capitalize on the growing demand for more efficient, sustainable aircraft pump systems.

Other Key Players

- Zodiac Aerospace

- Cascon Inc.

- Weldon Pump LLC

- Crissair, Inc.

Aircraft Pumps Market Segmentation

-

By Type:

- Hydraulic Pumps

- Fuel Pumps

- Lubrication Pumps

- Water and Waste System Pumps

- Air Conditioning and Cooling Pumps

-

By Technology:

- Engine Driven

- Electric Motor Driven

- Ram Air Turbine Driven

- Air Driven

-

By Pressure:

- 10 psi to 500 psi

- 500 psi to 3000 psi

- 3000 psi to 5000 psi

- 5000 psi to 6500 psi

-

By Aircraft Type:

- Wide Body Aircraft

- Narrow Body Aircraft

- Regional Jet

- Turboprop

-

By End User:

- OEM

- Aftermarket

-

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

Table of Content

- Global Aircraft Pumps Market - Executive Summary

- Global Aircraft Pumps Market Overview

- Aircraft Pumps Market: Notable Developments

- Standards and Certifications

- List of Key Manufacturers

- Political-Economic-Social-Technological-Legal-Environmental (PESTLE) Analysis

- Porter’s Five Forces Analysis

- Global Aircraft Pumps Market Analysis and Forecast, 2025 to 2035

- Global Market Size and Forecast by Type, 2025 to 2035

- Hydraulic Pumps

- Fuel Pumps

- Lubrication Pumps

- Water and Waste System Pumps

- Air Conditioning and Cooling Pumps

- Global Market Size and Forecast by Technology, 2025 to 2035

- Engine Driven

- Electric Motor Driven

- Ram Air Turbine Driven

- Air Driven

- Global Market Size and Forecast by Pressure, 2025 to 2035

- 10 psi to 500 psi

- 500 psi to 3000 psi

- 3000 psi to 5000 psi

- 5000 psi to 6500 psi

- Global Market Size and Forecast by Aircraft Type, 2025 to 2035

- Wide Body Aircraft

- Narrow Body Aircraft

- Regional Jet

- Turboprop

- Global Market Size and Forecast by End User, 2025 to 2035

- OEM

- Aftermarket

- Global Market Size and Forecast by Region, 2025 to 2035

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

- Global Market Size and Forecast by Type, 2025 to 2035

- North America Aircraft Pumps Market Size and Forecast, 2025 to 2035

- Latin America Aircraft Pumps Market Size and Forecast, 2025 to 2035

- Europe Aircraft Pumps Market Size and Forecast, 2025 to 2035

- Japan Aircraft Pumps Market Size and Forecast, 2025 to 2035

- APEJ Aircraft Pumps Market Size and Forecast, 2025 to 2035

- MEA Aircraft Pumps Market Size and Forecast, 2025 to 2035

- Competitive Landscape - Global Aircraft Pumps Market

- Company Profiles

- Honeywell International Inc.

- Parker Hannifin Corporation

- Eaton Corporation plc

- Crane Aerospace & Electronics

- Triumph Group, Inc.

- Woodward, Inc.

- Zodiac Aerospace

- Cascon Inc.

- Weldon Pump LLC

- Crissair, Inc.

- Research Methodology

- Disclaimer

- FAQs -

What are the key factors driving the growth of aircraft pumps?

Technological advancements drive the growth of aircraft pumps, the increasing demand for fuel-efficient systems, and the rise of electric aircraft.

How are regulations impacting the adoption of aircraft pumps?

Government regulations, particularly in the aerospace and defense sectors, are driving the adoption of more efficient and sustainable pump technologies.

What types of pumps are commonly used in the aircraft industry?

Commonly used pumps in the aerospace industry include hydraulic, fuel, lubrication, water and waste systems, and air conditioning pumps.

Which countries are expected to see significant growth in the demand for aircraft pumps?

Countries with strong aerospace industries, such as the United States, China, and Germany, are expected to experience significant growth in demand.

How is the shift to electric aircraft influencing aircraft pump technologies?

The shift to electric aircraft is influencing the development of electric motor-driven pumps and energy-efficient solutions for next-generation aircraft designs.