Construction Lubricants Market

Construction Lubricants Market Analysis, By Application, By Base Oil, By Sales Channel, Formulation Type, By Equipment Type and Region - Market Insights 2025 to 2035

Analysis of Construction Lubricants Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more.

Construction Lubricants Market Outlook (2025 to 2035)

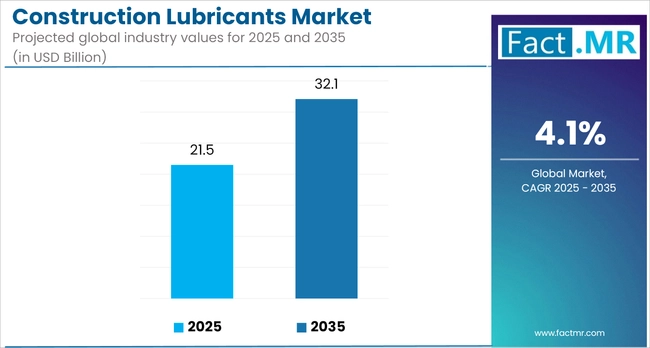

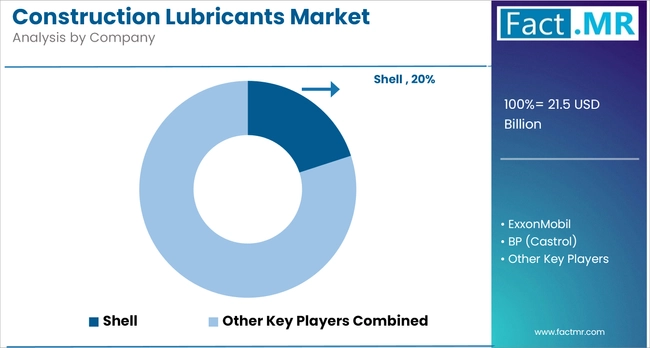

The global construction lubricants market is projected to increase from USD 21.5 billion in 2025 to USD 32.1 billion by 2035, with an annual growth rate of 4.1%, driven by rising infrastructure development, increased use of heavy machinery, and the shift toward synthetic lubricants for better performance and durability.

The Asia-Pacific region leads the market due to urbanization, while North America and Europe experience a rising demand for eco-friendly, bio-based lubricants driven by regulatory pressures. Evolving equipment needs and a focus on maintenance efficiency underpin the market's expansion.

What are the Drivers of the Construction Lubricants Market?

The construction lubricants market is being propelled by multiple factors tied to infrastructure expansion, equipment modernization, and sustainability mandates.

One of the primary drivers is the increase in global infrastructure spending. Governments and private developers are investing heavily in transportation networks, commercial complexes, smart cities, and energy projects. For instance, India’s National Infrastructure Pipeline, valued at over USD 1.4 trillion, and China’s Belt and Road Initiative are boosting the use of heavy-duty construction equipment, which in turn increases demand for high-performance lubricants.

The growing complexity of construction equipment and harsher operating conditions are driving demand for synthetic and semi-synthetic lubricants, which offer longer service life, better heat resistance, and lower friction. This shift enhances efficiency and reduces maintenance costs. At the same time, rising focus on equipment reliability and preventive maintenance is leading contractors to favor high-quality lubricants to minimize downtime. Stricter environmental regulations, particularly in Europe and North America, are also driving the market toward bio-based, low-toxicity formulations that strike a balance between performance and sustainability.

Lastly, urbanization in emerging markets is creating sustained demand for residential and commercial construction, which in turn is further accelerating lubricant usage. Southeast Asia, Africa, and parts of Latin America are witnessing increased deployment of machinery in roadbuilding, housing, and energy sectors, all of which rely on specialized lubricants for engines, hydraulics, and gear systems.

What are the Regional Trends of the Construction Lubricants Market?

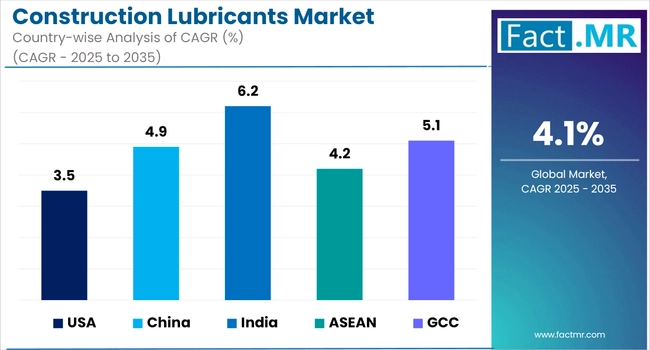

The construction lubricants market shows distinct regional dynamics shaped by infrastructure priorities, industrial maturity, and environmental regulations.

Asia-Pacific leads global consumption, driven by urbanization, expanding infrastructure, and a growing fleet of construction machinery. Countries such as China and India are investing heavily in large-scale projects, including smart cities, highways, and industrial corridors.

China’s Belt and Road Initiative and India’s National Infrastructure Pipeline are prime examples, both generating sustained demand for lubricants across a range of construction equipment. Southeast Asian nations, including Indonesia, Vietnam, and the Philippines, are also emerging as high-growth markets due to rising real estate development and public works investments.

North America remains a mature yet expanding market, supported by government funding in infrastructure renewal, such as the USA Infrastructure Investment and Jobs Act, which allocates over USD 1.2 trillion toward transportation, energy, and public utilities. This has triggered increased demand for lubricants in sectors such as road construction, energy infrastructure, and commercial construction. Additionally, the region is witnessing a noticeable shift toward synthetic and bio-based lubricants, which aligns with stricter environmental standards and decarbonization targets.

Europe presents moderate but steady growth, shaped by sustainability regulations and a strong preference for high-performance, environmentally friendly lubricants. Germany, France, and the Nordic countries are advancing green construction practices, which are encouraging the use of biodegradable and low-emission lubricants. Investments in smart infrastructure and energy-efficient buildings are further supporting market expansion.

In Latin America, growth is tied to mining, energy infrastructure, and urban expansion in countries such as Brazil, Mexico, and Chile. While economic volatility has influenced investment cycles, the region continues to present a demand for heavy machinery lubricants, particularly in oil exploration and industrial development.

The Middle East and Africa are experiencing an increase in mega infrastructure projects, including smart cities, transport corridors, and industrial zones, in the UAE, Saudi Arabia (under Vision 2030), and Egypt. These developments are driving the adoption of advanced lubricants, particularly those designed for extreme temperatures and heavy-duty machinery.

What are the Challenges and Restraining Factors of the Construction Lubricants Market?

Despite stable growth prospects, the construction lubricants market faces challenges that could impact its pace of expansion across regions.

One of the primary restraints is the fluctuation in crude oil prices, which directly affects the cost of base oils, the key raw material for lubricant formulations. Price volatility, driven by geopolitical tensions, OPEC+ production shifts, and global supply chain disruptions, can erode profit margins for manufacturers and increase procurement uncertainty for end users.

The shift toward electric construction equipment is reducing the demand for traditional engine oils and hydraulic fluids, as battery-powered machines typically require fewer lubricants. However, the need for lubrication of gear and cooling systems remains. In developing regions, counterfeit and low-quality lubricants pose a risk of damaging equipment and discouraging the use of premium products. Additionally, limited awareness and inconsistent maintenance practices, particularly in informal construction sectors, often result in the use of substandard lubricants, which negatively impact equipment performance and reliability.

Finally, supply chain constraints, including availability of high-performance additives and packaging materials, have been exacerbated by global logistics disruptions and raw material shortages. These issues affect timely delivery, pricing stability, and the ability of suppliers to meet rising demand across multiple construction sectors.

Country-Wise Outlook

United States Sees Robust Growth in Construction Lubricants Driven by Infrastructure Investment and Sustainability Needs

The US construction lubricants market is gaining momentum, backed by substantial federal investment in infrastructure, including initiatives under the Infrastructure Investment and Jobs Act worth over USD 1.2 trillion. This funding has boosted the use of heavy machinery in road construction, energy projects, and commercial facilities, thereby increasing demand for high-performance lubricants.

Domestic manufacturers are increasingly producing synthetic and bio-based lubricants that meet stricter environmental standards and extend equipment service life, thereby supporting fuel efficiency and enhancing equipment uptime. As electric and hybrid construction machinery becomes common, the demand is shifting toward specialized fluids for thermal management and gear protection. Meanwhile, fleet operators and contractors are adopting predictive maintenance strategies, using digital monitoring systems and supplier partnerships to optimize lubrication and reduce downtime.

China Sees Strong Growth in Construction Lubricants Market Amid Infrastructure Push and Equipment Modernization

China's construction lubricants market is witnessing robust growth, driven by sustained infrastructure expansion and a shift toward higher-performance machinery. Flagship initiatives, such as the Belt and Road Initiative and the New Urbanization Plan, have triggered a large-scale demand for lubricants used in heavy equipment operating under high stress and variable climatic conditions.

As construction firms adopt advanced machinery, there is a clear shift from conventional mineral oils to synthetic and semi-synthetic lubricants, which offer improved thermal stability, reduced wear, and longer service intervals. The push for greener construction practices and stricter emission norms is also encouraging the use of low-toxicity, biodegradable formulations.

Additionally, China’s domestic lubricant manufacturers are upgrading product quality to compete with international brands, with increased focus on Group II/III base oils and compliance with evolving industry standards. Overall, the rising sophistication of machinery, large public investments, and tightening regulations are reshaping China’s lubricant market toward more efficient and sustainable solutions.

Japan Sees Gradual Shift Toward Advanced and Sustainable Lubricants in Construction and Industry

Japan’s construction and industrial lubricants sector is steadily evolving, shaped by machinery modernization, environmental policies, and a maturing equipment base. Large-scale infrastructure efforts, including airport expansions and urban redevelopment, are increasing the demand for high-performance lubricants used in hydraulic systems, gears, and heavy-duty engines. There is a clear trend toward synthetic and biobased formulations, which are favored for their thermal stability and reduced environmental impact.

Domestic manufacturers are increasingly producing synthetic and bio-based lubricants that meet stricter environmental standards and extend equipment service life, thereby supporting fuel efficiency and enhancing equipment uptime. As electric and hybrid construction machinery becomes common, the demand is shifting toward specialized fluids for thermal management and gear protection. Meanwhile, fleet operators and contractors are adopting predictive maintenance strategies, using digital monitoring systems and supplier partnerships to optimize lubrication and reduce downtime.

Category-wise Analysis

Synthetic oil construction lubricants are expected to Maintain Leading Market Share by product Type.

Synthetic oil-based construction lubricants are expected to maintain a dominant market position, driven by their superior performance characteristics and increasing adoption in high-demand applications. These lubricants offer better thermal stability, longer service intervals, and enhanced protection under extreme operating conditions, key advantages in heavy-duty construction environments where equipment is exposed to high loads, pressure, and temperature fluctuations.

The rise of advanced machinery with tighter tolerances is driving demand for synthetic lubricants, which offer improved friction control, reduced wear, and cleaner engine operation, resulting in lower maintenance costs and increased reliability. At the same time, stricter environmental regulations are driving a shift toward synthetic oils due to their lower emissions, extended drain intervals, and improved biodegradability, particularly in North America, Europe, and advanced Asia-Pacific markets.

As contractors and equipment operators seek to minimize downtime and extend equipment lifespan, synthetic lubricants are increasingly becoming the preferred choice, positioning this segment to lead the construction lubricants market across both developed and emerging regions.

Backhoe Construction Lubricants by Equipment Type Segment to Dominate Construction Lubricants Market

Backhoe loaders are expected to hold the leading share in the construction lubricants market by equipment type, owing to their widespread use in urban infrastructure, road maintenance, utility installation, and light to medium construction tasks. Their versatility, functioning both as excavators and loaders, makes them indispensable across a range of job sites, especially in densely populated regions and smaller construction zones where larger machinery is impractical.

As governments and private developers invest in expanding urban infrastructure and smart city projects in Asia-Pacific and Latin America, the demand for backhoe loaders continues to rise. This directly fuels lubricant consumption, especially for engine oils, hydraulic fluids, greases, and transmission fluids, which are crucial for maintaining performance under continuous operation and varying load conditions.

Furthermore, the growing adoption of advanced and compact construction equipment with stringent emission and efficiency standards is driving the shift toward higher-grade synthetic and semi-synthetic lubricants within this segment. With their critical role in both public works and private construction, backhoes are expected to remain a primary contributor to lubricant demand across global markets.

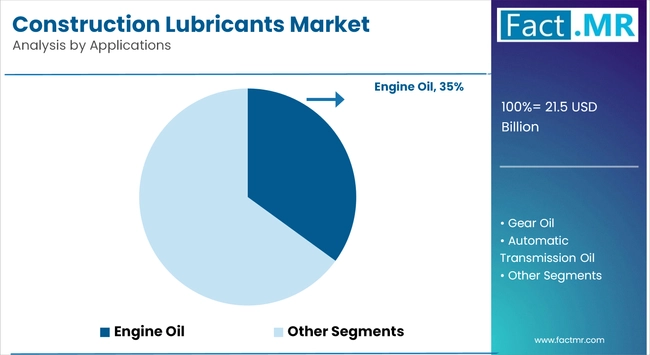

Engine Oil by Application Segment to Dominate Construction Lubricants Market

Engine oil is projected to lead the construction lubricants market by application, driven by its essential role in maintaining engine performance, reducing wear, and supporting fuel efficiency across a wide range of construction machinery. As equipment such as excavators, backhoe loaders, bulldozers, and haul trucks operate in harsh conditions, often under continuous load and extreme temperatures, the demand for high-quality engine oils remains consistently strong.

Engine oil not only ensures smooth internal engine function but also helps manage heat, reduce friction, and prevent deposit formation, all of which are critical in extending engine life and minimizing unplanned downtime. With the rise in global infrastructure development, particularly in fast-growing economies such as India, China, and Southeast Asia, the number of active construction machines has surged, underscoring the need for reliable lubrication solutions.

Additionally, the growing shift toward synthetic engine oils, valued for their longer drain intervals, improved oxidation resistance, and better cold-start protection, is amplifying market value within this segment. As machinery becomes technologically advanced and emission standards tighten, engine oil will remain central to preventive maintenance strategies, cementing its position as the dominant application in the construction lubricants market.

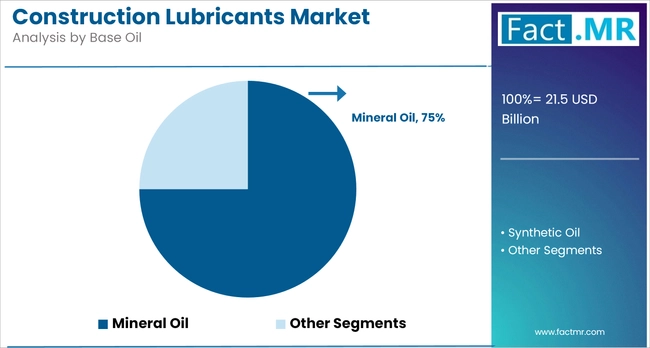

Mineral Oil-based Construction Lubricants by Base Oil Segment to Dominate Construction Lubricants Market

Mineral oil-based lubricants are expected to continue holding the largest share of the construction lubricants market by base oil type, primarily due to their cost-effectiveness and widespread use in standard construction equipment. These lubricants are favored in price-sensitive and developing markets where infrastructure activity is high, but operating budgets remain tight.

Mineral oil-based lubricants remain widely used due to their compatibility with various equipment, such as excavators, loaders, and cranes, as well as their suitability for moderate-duty applications. Their affordability and ease of production support continued dominance in cost-sensitive regions such as Southeast Asia, Africa, and Latin America, despite the growing shift toward synthetic alternatives.

However, to meet evolving regulatory requirements and performance expectations, manufacturers are increasingly offering enhanced formulations of mineral oils with additive packages that improve wear protection, oxidation resistance, and equipment cleanliness, helping extend the product's relevance in a changing market landscape.

Asia Pacific Holds Leading Share in Construction Lubricants Market

The Asia-Pacific region remains the dominant market for construction lubricants, driven by large-scale infrastructure development, urbanization, and growing industrial activity. Countries such as China, India, and Indonesia continue to invest heavily in roads, railways, residential complexes, and industrial corridors, driving strong demand for heavy machinery and, in turn, lubricants for engines, hydraulics, and gear systems.

China’s Belt and Road Initiative and India’s nationwide infrastructure programs are notable contributors to this growth, while Southeast Asian countries are witnessing a surge in real estate and commercial construction. The region also benefits from a growing base of domestic and international manufacturers producing construction equipment, which further amplifies lubricant requirements.

Additionally, rising awareness of equipment maintenance and performance, along with gradual shifts toward synthetic and semi-synthetic formulations, is improving lubricant quality standards in the region. With strong support from both the public and private sectors, the Asia-Pacific region is expected to retain its leading role in shaping global construction lubricant consumption in the coming years.

Competitive Analysis

The construction lubricants industry is characterized by the presence of global and regional players competing on the basis of pricing, innovation, and distribution efficiency. Leading companies such as BP Plc, Indian Oil Corporation, TotalEnergies SE, Balmer Lawrie & Co. Ltd., PetroChina Company Limited, Berg Chilling Systems Inc., Chevron Corporation, and Eni S.p.A. actively shape market dynamics through their extensive product portfolios, technological capabilities, and strategic market positioning.

Key players are expanding through regional networks and partnerships with OEMs and contractors, while investing in synthetic and eco-friendly formulations to meet regulatory and performance standards. In developing markets, firms such as Indian Oil and PetroChina benefit from public infrastructure projects, while Chevron and Total Energies strengthen their presence through branded services and advanced lubricant offerings.

Additionally, sustainability goals are influencing competitive strategies, as players work to reduce carbon intensity, improve energy efficiency, and introduce biodegradable alternatives in response to global climate targets. The ongoing modernization of construction fleets, rising maintenance standards, and preference for long-drain interval products continue to shape market share dynamics across both established and emerging markets.

Recent Development

- In 2025, BP Plc (Castrol) initiated a strategic review and began the sale of its Castrol lubricants division, aiming to raise USD 8-10 billion as part of a broader divestment strategy targeting USD 20 billion by 2027. This sale marks a major repositioning for BP’s lubricants brand.

- In 2023, USA ExxonMobil committed USD 110 million to build a lubricant manufacturing facility in Raigad, Maharashtra (India), with a production capacity of 159,000 kL/year, scheduled to come online by late 2025

Segmentation of the Construction Lubricants Market

-

By Application :

- Engine Oil

- Gear Oil

- Automatic Transmission Oil

- Greases

- Brake Fluid

- Hydraulic Fluid

-

By Base Oil :

- Mineral Oil-based Construction Lubricants

- Synthetic Oil-based Construction Lubricants

-

By Sales Channel :

- Automotive Dealers

- Independent Garages & Service Stations

- Retailers/Automotive Part Stores

-

By Formulation Type :

- Conventional Construction Lubricants

- Bio-based Construction Lubricants

-

By Equipment Type :

- Excavators

- Backhoe

- Bulldozers

- Loaders

- Graders

- Articulated Hauler

- Soil Compactor

- Cranes

- Rigid Dump Trucks

- Others

-

By Region :

- North America

- Latin America

- Europe

- Asia Pacific

- The Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Trends and Success Factors, including Macro-economic Factors, Market Dynamics, and Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035, including Historical Analysis and Future Projections

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Application

- Base Oil

- Sales Channel

- Formulation Type

- Equipment Type

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Engine Oil

- Greases

- Brake Fluid

- Hydraulic Fluid

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Base Oil

- Mineral Oil-based Construction Lubricants

- Synthetic Oil-based Construction Lubricants

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Automotive Dealers

- Independent Garages & Service Stations

- Retailers/Automotive Part Stores

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Formulation Type

- Conventional Construction Lubricants

- Bio-based Construction Lubricants

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Equipment Type

- Excavators

- Backhoe

- Bulldozers

- Loaders

- Graders

- Articulated Hauler

- Soil Compactor

- Cranes

- Rigid Dump Trucks

- Others

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- South Asia & Pacific

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia & Pacific Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast to 2035 by Application, Base Oil, Sales Channel, Formulation Type, and Equipment Type for 30 Countries

- Competitive Assessment, Company Share Analysis by Key Players, and Competition Dashboard

- Company Profile

- BP Plc.

- Indian Oil Corporation

- TOTAL S.A.

- Balmer Lawrie & Co. Ltd.

List Of Table

- Table 1: Global Market Units Forecast by Region, 2020 to 2035

- Table 2: Global Market Units Forecast by Application, 2020 to 2035

- Table 3: Global Market Units Forecast by Base Oil, 2020 to 2035

- Table 4: Global Market Units Forecast by Sales Channel, 2020 to 2035

- Table 5: Global Market Units Forecast by Formulation Type, 2020 to 2035

- Table 6: Global Market Units Forecast by Equipment Type, 2020 to 2035

- Table 7: North America Market Units Forecast by Country, 2020 to 2035

- Table 8: North America Market Units Forecast by Application, 2020 to 2035

- Table 9: North America Market Units Forecast by Base Oil, 2020 to 2035

- Table 10: North America Market Units Forecast by Sales Channel, 2020 to 2035

- Table 11: North America Market Units Forecast by Formulation Type, 2020 to 2035

- Table 12: North America Market Units Forecast by Equipment Type, 2020 to 2035

- Table 13: Latin America Market Units Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Units Forecast by Application, 2020 to 2035

- Table 15: Latin America Market Units Forecast by Base Oil, 2020 to 2035

- Table 16: Latin America Market Units Forecast by Sales Channel, 2020 to 2035

- Table 17: Latin America Market Units Forecast by Formulation Type, 2020 to 2035

- Table 18: Latin America Market Units Forecast by Equipment Type, 2020 to 2035

- Table 19: Western Europe Market Units Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Units Forecast by Application, 2020 to 2035

- Table 21: Western Europe Market Units Forecast by Base Oil, 2020 to 2035

- Table 22: Western Europe Market Units Forecast by Sales Channel, 2020 to 2035

- Table 23: Western Europe Market Units Forecast by Formulation Type, 2020 to 2035

- Table 24: Western Europe Market Units Forecast by Equipment Type, 2020 to 2035

- Table 25: South Asia & Pacific Market Units Forecast by Country, 2020 to 2035

- Table 26: South Asia & Pacific Market Units Forecast by Application, 2020 to 2035

- Table 27: South Asia & Pacific Market Units Forecast by Base Oil, 2020 to 2035

- Table 28: South Asia & Pacific Market Units Forecast by Sales Channel, 2020 to 2035

- Table 29: South Asia & Pacific Market Units Forecast by Formulation Type, 2020 to 2035

- Table 30: South Asia & Pacific Market Units Forecast by Equipment Type, 2020 to 2035

- Table 31: East Asia Market Units Forecast by Country, 2020 to 2035

- Table 32: East Asia Market Units Forecast by Application, 2020 to 2035

- Table 33: East Asia Market Units Forecast by Base Oil, 2020 to 2035

- Table 34: East Asia Market Units Forecast by Sales Channel, 2020 to 2035

- Table 35: East Asia Market Units Forecast by Formulation Type, 2020 to 2035

- Table 36: East Asia Market Units Forecast by Equipment Type, 2020 to 2035

- Table 37: Eastern Europe Market Units Forecast by Country, 2020 to 2035

- Table 38: Eastern Europe Market Units Forecast by Application, 2020 to 2035

- Table 39: Eastern Europe Market Units Forecast by Base Oil, 2020 to 2035

- Table 40: Eastern Europe Market Units Forecast by Sales Channel, 2020 to 2035

- Table 41: Eastern Europe Market Units Forecast by Formulation Type, 2020 to 2035

- Table 42: Eastern Europe Market Units Forecast by Equipment Type, 2020 to 2035

- Table 43: Middle East & Africa Market Units Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Units Forecast by Application, 2020 to 2035

- Table 45: Middle East & Africa Market Units Forecast by Base Oil, 2020 to 2035

- Table 46: Middle East & Africa Market Units Forecast by Sales Channel, 2020 to 2035

- Table 47: Middle East & Africa Market Units Forecast by Formulation Type, 2020 to 2035

- Table 48: Middle East & Africa Market Units Forecast by Equipment Type, 2020 to 2035

List Of Figures

- Figure 1: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 2: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 3: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 4: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 5: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 6: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Region, 2020 to 2035

- Figure 7: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 8: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 9: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 10: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 11: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 12: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 13: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 14: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 15: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 16: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 17: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 18: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 19: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 20: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 21: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 22: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 23: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 24: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 25: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 26: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 27: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 28: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 29: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 30: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 31: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 32: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 33: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 34: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 35: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 36: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 37: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 38: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 39: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 40: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 41: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 42: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 43: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Application, 2020 to 2035

- Figure 44: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Base Oil, 2020 to 2035

- Figure 45: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Sales Channel, 2020 to 2035

- Figure 46: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Formulation Type, 2020 to 2035

- Figure 47: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Equipment Type, 2020 to 2035

- Figure 48: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- FAQs -

What is the Global Construction Lubricants Market Size in 2025?

The construction lubricants market is valued at USD 21.5 billion in 2025.

Who are the Major Players Operating in the Construction Lubricants Market?

Prominent players in the construction lubricants market include BP Plc., Indian Oil Corporation, TOTAL S.A., Balmer Lawrie & Co. Ltd., and others.

What is the Estimated Valuation of the Construction Lubricants Market by 2035?

The construction lubricants market is expected to reach a valuation of USD 32.1 billion by 2035.

What Value CAGR Did the Construction Lubricants Market Exhibit over the Last Five Years?

The historic growth rate of the construction lubricants market was 3.8% from 2020 to 2024.