Continuous Ship Unloader Market

Continuous Ship Unloader Market Size and Share Forecast Outlook 2025 to 2035

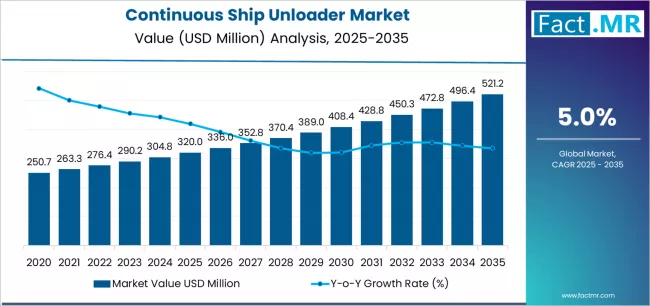

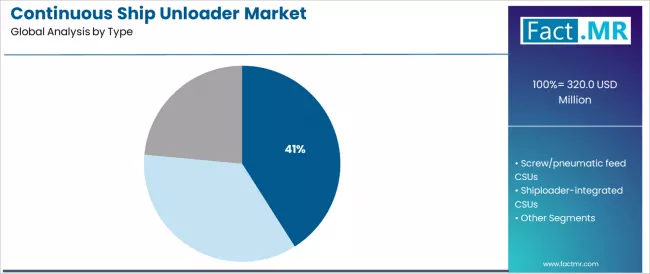

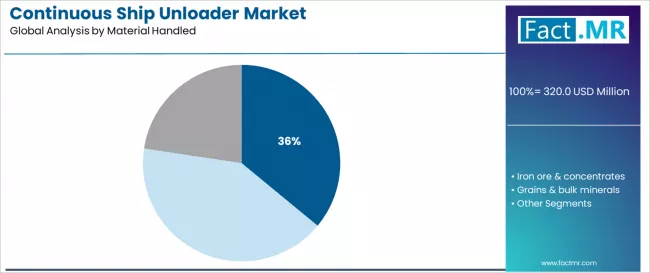

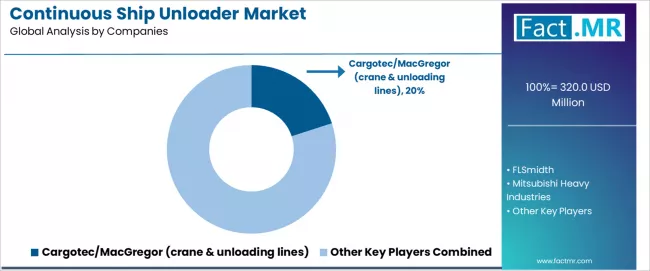

Continuous ship unloader market is projected to grow from USD 320.0 million in 2025 to USD 521.2 million by 2035, at a CAGR of 5.0%. Bucket-wheel CSUs will dominate with a 41.0% market share, while coal & coke will lead the material handled segment with a 36.0% share.

Continuous Ship Unloader Market Forecast and Outlook 2025 to 2035

The continuous ship unloader market stands at the threshold of a decade-long expansion trajectory that promises to reshape port equipment technology and bulk material handling solutions. The market's journey from USD 320.0 million in 2025 to USD 520.0 million by 2035 represents substantial growth, the market will rise at a CAGR of 5.0% which demonstrating the accelerating adoption of advanced unloading technology and port optimization across marine terminals, bulk handling facilities, and cargo processing sectors.

Quick Stats for Continuous Ship Unloader Market

- Continuous Ship Unloader Market Value (2025): USD 320.0 million

- Continuous Ship Unloader Market Forecast Value (2035): USD 520.0 million

- Continuous Ship Unloader Market Forecast CAGR: 5.0%

- Leading Type in Continuous Ship Unloader Market: Bucket-wheel CSUs

- Key Growth Regions in Continuous Ship Unloader Market: Asia Pacific, North America, and Europe

- Top Players in Continuous Ship Unloader Market: Cargotec/MacGregor, FLSmidth, Mitsubishi Heavy Industries, Thyssenkrupp, Konecranes

- Where revenue comes from - now vs next (industry-level view)

The first half of the decade (2025-2030) will witness the market climbing from USD 320.0 million to approximately USD 410.0 million, adding USD 90.0 million in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of bucket-wheel CSU systems, driven by increasing bulk cargo volumes and the growing need for advanced material handling solutions worldwide. Enhanced unloading efficiency capabilities and automated control systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 410.0 million to USD 520.0 million, representing an addition of USD 110.0 million or 55% of the decade's expansion. This period will be defined by mass market penetration of specialized unloader technologies, integration with comprehensive port platforms, and seamless compatibility with existing terminal infrastructure. The market trajectory signals fundamental shifts in how port and shipping industries approach bulk material handling and operational efficiency, with participants positioned to benefit from growing demand across multiple unloader types and material handling segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Bucket-wheel CSUs | 41% | Efficiency-driven, high-capacity applications |

| Screw/pneumatic feed CSUs | 29% | Specialized materials, dust control | |

| Shiploader-integrated CSUs | 30% | Combined systems, operational efficiency | |

| Future (3-5 yrs) | Advanced bucket-wheel systems | 43-47% | Smart controls, predictive maintenance |

| Enhanced pneumatic systems | 27-31% | Environmental compliance, dust reduction | |

| Integrated smart loaders | 24-28% | IoT connectivity, automated operations | |

| Hybrid unloading systems | 2-4% | Multi-technology integration, versatile handling |

Continuous Ship Unloader Market Key Takeaways

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 320.0 million |

| Market Forecast (2035) ↑ | USD 520.0 million |

| Growth Rate ★ | 5.0% CAGR |

| Leading Type → | Bucket-wheel CSUs |

| Primary Material → | Coal & coke |

The market demonstrates strong fundamentals with bucket-wheel CSUs capturing a dominant share through advanced unloading capabilities and high-capacity optimization. Coal & coke material handling drives primary demand, supported by increasing energy sector requirements and bulk cargo processing standards. Geographic expansion remains concentrated in developed markets with established port infrastructure, while emerging economies show accelerating adoption rates driven by trade expansion initiatives and rising port modernization standards.

Imperatives for Stakeholders in Continuous Ship Unloader Market

Design for operational efficiency, not just unloading capacity

- Offer port packages: unloader systems + automation controls + maintenance support + technical specialists + performance monitoring.

- Preconfigured workflows: unloading protocols, safety procedures, maintenance records, and digital tracking on port projects.

Technology readiness for smart ports

- Real-time performance monitoring, predictive maintenance capabilities, and smart port integration (IoT sensors, automated systems).

Performance-by-design approach

- Automated unloading systems, real-time efficiency mechanisms, statistical performance monitoring integration, and paperless documentation.

Value-based equipment models

- Clear base unloader price + transparent service tiers (maintenance support, automation upgrades, performance guarantees); subscriptions for predictive maintenance services and port optimization.

Segmental Analysis

Primary Classification: The market segments by type into bucket-wheel CSUs, screw/pneumatic feed CSUs, and shiploader-integrated CSUs, representing the evolution from basic unloading equipment to specialized high-performance solutions for comprehensive port, terminal, and bulk handling optimization.

Secondary Classification: Material handled segmentation divides the market into coal & coke (36%), iron ore & concentrates (34%), and grains & bulk minerals (30%) sectors, reflecting distinct requirements for handling characteristics, environmental controls, and processing specifications.

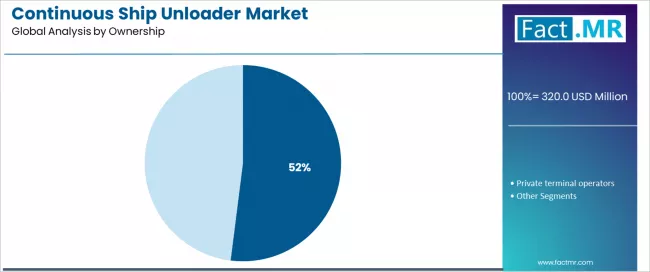

Ownership Classification: Business model segmentation covers port authorities (public) (52%) and private terminal operators (48%) categories, addressing different operational requirements from public infrastructure to private commercial operations.

The segmentation structure reveals technology progression from basic unloading equipment toward specialized high-performance systems with enhanced efficiency consistency and automation capabilities, while material diversity spans from energy commodities to agricultural products requiring precise handling solutions.

By Type, the Bucket-wheel CSUs Segment Accounts for Dominant Market Share

Market Position: Bucket-wheel CSUs command the leading position in the continuous ship unloader market with 41% market share through advanced unloading features, including superior capacity characteristics, operational efficiency, and material versatility that enable port operators to achieve optimal throughput across diverse bulk cargo and material handling applications.

Value Drivers: The segment benefits from port operator preference for high-capacity unloader systems that provide consistent throughput performance, reduced unloading time, and operational optimization without requiring significant infrastructure modifications. Advanced bucket-wheel features enable automated control systems, material flow optimization, and integration with existing port equipment, where unloading efficiency and throughput capacity represent critical operational requirements.

Competitive Advantages: Bucket-wheel CSUs differentiate through proven capacity reliability, consistent performance characteristics, and integration with automated port systems that enhance operational effectiveness while maintaining optimal cost standards for diverse bulk cargo and material handling applications.

Key market characteristics:

- Advanced bucket-wheel designs with optimized capacity configuration and material handling capabilities

- Enhanced port effectiveness, enabling 40-50% throughput improvement with reliable performance

- Operational compatibility, including automated control systems, material flow integration, and process optimization for unloading performance

Screw/Pneumatic Feed CSUs Show Strong Specialized Applications

Screw/pneumatic feed CSUs maintain a 29% market position in the continuous ship unloader market due to their proven dust control capabilities and specialized material characteristics. These systems appeal to operators requiring environmental compliance with competitive positioning for sensitive material and clean handling applications. Market growth is driven by environmental regulation segment expansion, emphasizing clean handling solutions and operational efficiency through proven technologies.

Shiploader-integrated CSUs Serve Combined Operations

Shiploader-integrated CSUs account for 30% market share, serving combined operations requiring integrated systems and dual-function characteristics for comprehensive port handling requirements.

By Material Handled, the Coal & Coke Segment Shows Market Leadership

Market Context: Coal & coke material handling demonstrates market leadership in the continuous ship unloader market with 36% share due to widespread adoption of energy commodity systems and increasing focus on bulk handling efficiency, throughput optimization, and operational reliability that maximize port performance while maintaining handling standards.

Appeal Factors: Energy sector operators prioritize unloader consistency, material handling efficiency, and integration with existing port infrastructure that enables coordinated cargo operations across multiple commodity systems. The segment benefits from substantial energy trade investment and modernization programs that emphasize the acquisition of advanced unloader systems for throughput optimization and handling efficiency applications.

Growth Drivers: Energy commodity programs incorporate unloader systems as standard components for bulk handling operations, while trade efficiency trends increase demand for consistent throughput capabilities that comply with handling standards and minimize operational costs.

Application dynamics include:

- Strong growth in energy commodity handling requiring advanced throughput capabilities

- Increasing adoption in efficiency optimization and throughput applications for port operators

- Rising integration with automated port systems for operational optimization and handling assurance

Iron Ore & Concentrates Applications Maintain Strong Mining Demand

Iron ore & concentrates applications capture 34% market share through comprehensive handling requirements in steel industry supply, mineral processing, and industrial commodity operations. These facilities demand reliable unloader systems capable of operating with heavy materials while providing effective handling integration and throughput capabilities.

Grains & Bulk Minerals Applications Show Agricultural Growth

Grains & bulk minerals applications account for 30% market share, including agricultural exports, food commodities, and specialty minerals requiring efficient unloader solutions for handling optimization and commodity processing.

By Ownership, the Port Authorities (Public) Segment Leads Market Share

The port authorities (public) segment commands 52% market share through widespread adoption in public port applications, infrastructure investment, and government port development. These systems provide public infrastructure solutions for comprehensive port requirements while maintaining unloader consistency and operational reliability.

Private Terminal Operators Show Strong Commercial Demand

Private terminal operators capture 48% market share, serving commercial applications, specialized terminals, and operations requiring private ownership capabilities for commercial efficiency and specialized handling optimization.

What are the Drivers, Restraints, and Key Trends of the Continuous Ship Unloader Market?

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Global trade expansion & bulk cargo growth (commodity trade, shipping volumes) | ★★★★★ | Large-scale port operations require efficient unloading solutions with consistent quality and throughput integration across cargo handling applications. |

| Driver | Port modernization & automation initiatives (efficiency improvement, operational optimization) | ★★★★★ | Drives demand for advanced unloader solutions and automation-compliant capabilities; suppliers providing smart systems gain competitive advantage. |

| Driver | Energy sector growth & commodity demand (coal trade, iron ore imports) | ★★★★☆ | Port operators need reliable, high-capacity unloader solutions; demand for energy commodity handling expanding addressable market segments. |

| Restraint | High capital costs & infrastructure requirements (equipment investment, port modifications) | ★★★★☆ | Cost-sensitive operators face investment pressure; increases project costs and affects adoption in capital-constrained segments with limited budgets. |

| Restraint | Environmental regulations & dust control (emission standards, community concerns) | ★★★☆☆ | Compliance-focused operations face regulatory challenges; complex environmental requirements limiting adoption in sensitive location segments. |

| Trend | Smart port technology & IoT integration (digital systems, predictive maintenance) | ★★★★★ | Growing demand for intelligent unloader solutions; digital capabilities become core value proposition in automated port segments. |

| Trend | Environmental stewardship & green ports (emission reduction, energy efficiency) | ★★★★☆ | Environmental regulations drive demand for clean unloader solutions; eco-efficiency capabilities drive differentiation toward green port applications. |

Analysis of the Continuous Ship Unloader Market by Key Country

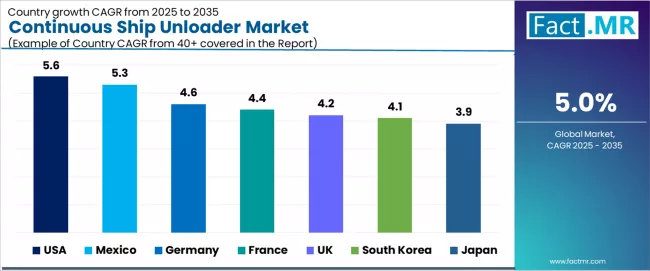

The continuous ship unloader market demonstrates varied regional dynamics with growth leaders including United States (5.6% growth rate) and Mexico (5.3% growth rate) driving expansion through port modernization initiatives and trade development. Strong Performers encompass Germany (4.6% growth rate), France (4.4% growth rate), and United Kingdom (4.2% growth rate), benefiting from established maritime industries and port infrastructure. Mature Markets feature South Korea (4.1% growth rate) and Japan (3.9% growth rate), where port optimization and cargo handling requirements support consistent growth patterns.

Regional synthesis reveals North American markets leading adoption through trade expansion and port development trends, while European and Asian countries maintain steady expansion supported by maritime modernization and cargo handling standards. Emerging markets show strong growth driven by port applications and bulk handling trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| United States | 5.6% | Focus on port automation solutions | Environmental regulations; capital costs |

| Mexico | 5.3% | Value-oriented port modernization | Infrastructure challenges; technical expertise |

| Germany | 4.6% | Offer premium engineering systems | Over-engineering; environmental compliance |

| France | 4.4% | Provide maritime industry solutions | Market competition; regulatory complexity |

| United Kingdom | 4.2% | Push advanced port technologies | Post-Brexit trade; supply chain issues |

| South Korea | 4.1% | Lead with smart port applications | Technology costs; domestic competition |

| Japan | 3.9% | Premium quality positioning | Market maturity; cost optimization |

United States Drives Fastest Market Growth

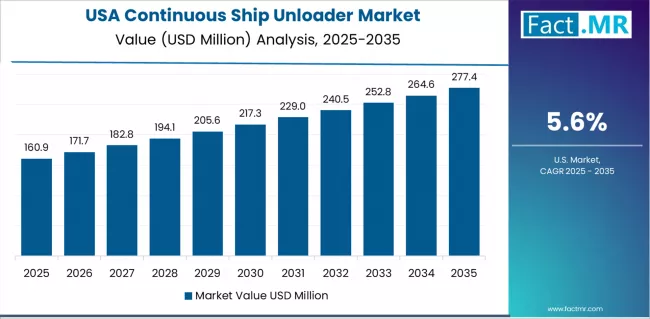

United States establishes fastest market growth through comprehensive port modernization programs and extensive trade development, integrating advanced continuous ship unloader systems as standard components in port facilities, bulk terminals, and cargo handling installations. The country's 5.6% growth rate reflects industry initiatives promoting port advancement and cargo handling optimization capabilities that mandate the use of advanced unloader systems in terminal projects. Growth concentrates in major port centers, including Houston, Long Beach, and New Orleans, where port technology development showcases integrated unloader systems that appeal to operators seeking advanced throughput capabilities and operational optimization applications.

American manufacturers are developing high-performance continuous ship unloader solutions that combine domestic port advantages with advanced automation features, including smart control systems and enhanced efficiency compatibility. Distribution channels through port equipment distributors and maritime service providers expand market access, while port investment support for trade infrastructure supports adoption across diverse terminal segments.

Strategic Market Indicators:

- Port facilities leading adoption with 73% deployment rate in bulk handling and cargo processing sectors

- Government port programs providing substantial support for domestic trade infrastructure technology development

- Local port equipment manufacturers capturing 49% market share through competitive pricing and localized port support

- Export market development for port equipment targeting international bulk handling markets

Mexico Emerges as High-Growth Market

In Mexico's port regions, including Veracruz, Manzanillo, and Altamira, port facilities and terminal operations are implementing advanced unloader systems as standard components for cargo handling and trade enhancement, driven by increasing port investment and trade modernization programs that emphasize the importance of throughput efficiency capabilities. The market holds a 5.3% growth rate, supported by government port initiatives and trade development programs that promote advanced unloader systems for cargo applications. Mexican operators are adopting unloader systems that provide consistent throughput performance and cost-effectiveness features, particularly appealing in port regions where cargo efficiency and trade competitiveness represent critical operational requirements.

Market expansion benefits from growing port processing capabilities and trade agreements that enable domestic deployment of cost-effective unloader systems for cargo applications. Technology adoption follows patterns established in port equipment, where efficiency and reliability drive procurement decisions and operational deployment.

Strategic Market Indicators:

- Trade expansion programs driving 69% growth in port equipment adoption across cargo handling sectors

- NAFTA trade agreements facilitating cross-border port equipment supply and technical expertise sharing

- Domestic port operators capturing 44% market share through competitive operational costs and regional expertise

- Regional export growth for cost-effective unloader solutions targeting Central American port markets

Germany Shows Port Engineering Leadership

Advanced maritime technology market in Germany demonstrates sophisticated unloader system deployment with documented operational effectiveness in port applications and cargo projects through integration with existing port systems and terminal infrastructure. The country leverages engineering expertise in port technology and maritime infrastructure integration to maintain a 4.6% growth rate. Port centers, including Hamburg, Bremen, and Wilhelmshaven, showcase premium installations where unloader systems integrate with comprehensive port platforms and terminal management systems to optimize cargo operations and port effectiveness.

German manufacturers prioritize port precision and EU maritime compliance in product development, creating demand for premium systems with advanced features, including environmental monitoring integration and automated port systems. The market benefits from established port infrastructure and willingness to invest in advanced unloader technologies that provide long-term cargo benefits and compliance with international maritime standards.

Strategic Market Indicators:

- Port modernization initiatives leading adoption with 76% deployment rate in maritime cargo and bulk handling sectors

- EU port regulations providing substantial support for domestic maritime technology development and environmental standards

- German port engineering companies capturing 54% market share through premium quality positioning and technical excellence

- Technology export leadership for port equipment targeting international maritime and cargo handling markets

France Shows Maritime Industry Focus

France establishes maritime industry focus through comprehensive port modernization and cargo development, integrating unloader systems across port facilities and terminal operations. The country's 4.4% growth rate reflects mature maritime relationships and established port adoption that supports widespread use of unloader systems in French and European facilities. Growth concentrates in major port centers, including Le Havre, Marseille, and Dunkirk, where maritime technology showcases mature unloader deployment that appeals to operators seeking proven port capabilities and cargo optimization applications.

French manufacturers leverage established maritime networks and comprehensive port capabilities, including cargo programs and technical support that create port operator relationships and operational advantages. The market benefits from mature maritime standards and port requirements that mandate unloader system use while supporting technology advancement and port optimization.

Strategic Market Indicators:

- Maritime industry modernization programs driving 67% adoption rate in port cargo and terminal sectors

- French maritime regulations supporting domestic port technology advancement and cargo handling standards

- Local maritime suppliers capturing 46% market share through specialized applications and technical expertise

- European market expansion for French unloader solutions targeting port development projects across EU markets

United Kingdom Shows Advanced Port Development

United Kingdom establishes advanced port development through comprehensive maritime modernization and technology integration, integrating unloader systems across port and cargo applications. The country's 4.2% growth rate reflects growing maritime investment and increasing adoption of unloader technology that supports expanding use of cargo systems in UK port facilities. Growth concentrates in major port areas, including London, Liverpool, and Southampton, where port technology development showcases integrated unloader systems that appeal to UK operators seeking advanced cargo solutions with port compatibility.

UK manufacturers focus on maintaining maritime standards while adopting advanced port positioning, creating demand for systems that balance performance with operational advantages. The market benefits from strong port infrastructure and growing maritime opportunities that support unloader technology adoption while maintaining environmental standards important to UK port applications.

Strategic Market Indicators:

- Post-Brexit port programs driving 64% adoption rate in domestic maritime and cargo handling sectors

- UK maritime regulations supporting independent port technology development and quality assurance standards

- British maritime companies capturing 42% market share through innovation focus and regulatory compliance expertise

- Commonwealth market expansion for UK unloader solutions targeting international port projects and maritime development

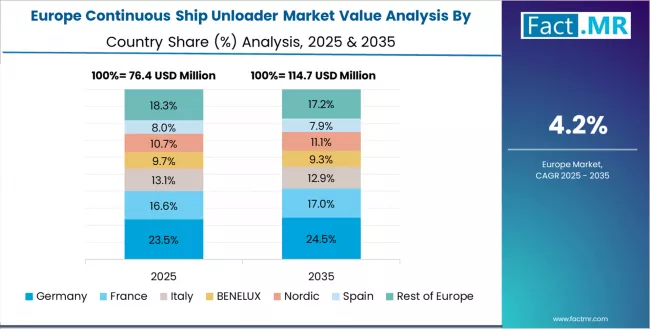

Europe Market Split by Country

The continuous ship unloader market in Europe is projected to grow from USD 85.0 million in 2025 to USD 128.0 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to maintain its leadership position with a 31.8% market share in 2025, declining slightly to 31.3% by 2035, supported by its advanced port infrastructure and major maritime hubs including Hamburg and Bremen.

France follows with a 24.7% share in 2025, projected to reach 25.2% by 2035, driven by comprehensive maritime programs and port modernization strategies. The United Kingdom holds a 21.2% share in 2025, expected to decrease to 20.6% by 2035 due to post-Brexit trade adjustments. Italy commands a 13.5% share, while Spain accounts for 8.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 0.6% to 0.8% by 2035, attributed to increasing port modernization adoption in Nordic countries and emerging Eastern European port facilities implementing cargo handling programs.

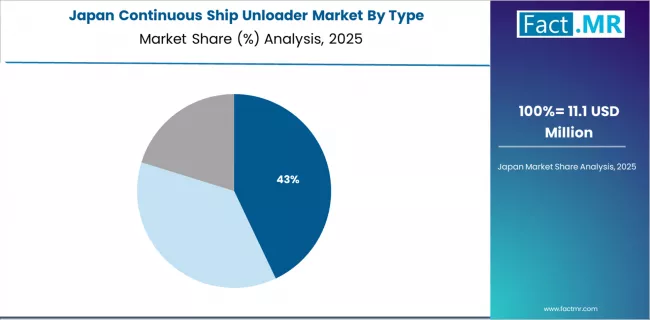

Japan Demonstrates Port Precision Focus

Japan's advanced port technology market demonstrates sophisticated unloader system deployment with documented operational effectiveness in precision cargo applications and maritime projects through integration with existing quality systems and port infrastructure. The country maintains a 3.9% growth rate, leveraging traditional maritime expertise and systematic integration in unloader technology. Port centers, including Tokyo, Yokohama, and Kobe, showcase premium installations where unloader systems integrate with traditional quality platforms and modern port management systems to optimize cargo operations and maintain port quality profiles.

Japanese manufacturers prioritize port precision and quality consistency in unloader development, creating demand for premium systems with advanced features, including quality monitoring and automated port systems. The market benefits from established precision infrastructure and commitment to maritime standards that provide long-term port benefits and compliance with traditional precision port methods.

Strategic Market Indicators:

- Quality-focused port programs driving 71% adoption rate in precision cargo and maritime sectors

- Japanese port standards supporting domestic precision unloader technology development and quality excellence

- Local precision manufacturers capturing 51% market share through superior quality control and technical precision

- Asian market leadership for Japanese unloader solutions targeting high-quality port projects across Asia-Pacific regions

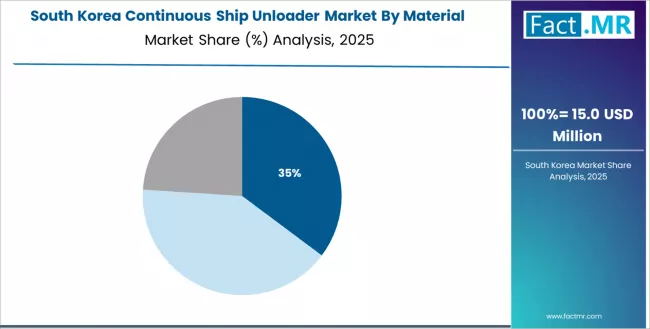

South Korea Shows Smart Port Development

South Korea establishes smart port development through comprehensive maritime modernization and technology integration, integrating unloader systems across port-focused cargo and terminal applications. The country's 4.1% growth rate reflects growing port investment and increasing adoption of unloader technology that supports expanding use of smart systems in Korean port facilities. Growth concentrates in major port areas, including Busan, Incheon, and Ulsan, where port technology development showcases integrated unloader systems that appeal to Korean operators seeking advanced cargo solutions with port compatibility.

Korean manufacturers focus on maintaining innovation standards while adopting port-integrated efficiency, creating demand for systems that balance performance with technological advantages. The market benefits from strong port infrastructure and growing innovation opportunities that support unloader technology adoption while maintaining quality standards important to Korean port applications.

Strategic Market Indicators:

- Smart port initiatives driving 68% adoption rate in technology-integrated cargo and terminal sectors

- Korean innovation programs supporting domestic port technology development and digital integration capabilities

- Local port technology companies capturing 47% market share through innovation focus and technological advancement

- Northeast Asian market expansion for Korean unloader solutions targeting smart port projects and technology-driven maritime applications

Competitive Landscape of the Continuous Ship Unloader Market

- Structure: ~10-12 credible players; top 5 hold ~52-57% by revenue.

- Leadership is maintained through: engineering expertise, port relationships, and system reliability (unloading efficiency + automation integration + global service).

- What's commoditizing: standard bucket-wheel designs and basic unloading systems.

- Margin Opportunities: smart automation systems, environmental compliance solutions, and comprehensive port packages (predictive maintenance, automation upgrades, performance optimization).

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global port equipment platforms | Manufacturing scale, service networks, port relationships | Broad product lines, proven reliability, maritime industry relationships | Innovation cycles; specialized applications |

| Maritime engineering specialists | Advanced designs; custom solutions; port expertise | Superior performance; technical knowledge; application expertise | Market reach; cost competitiveness |

| Heavy industry manufacturers | Manufacturing capabilities, global reach, industrial expertise | Proven reliability; manufacturing scale; industrial relationships | Port specialization; maritime focus |

| Automation technology providers | Smart systems, IoT integration, digital solutions | Latest technology first; automation capabilities; digital expertise | Maritime market penetration; port operations |

| Regional port service providers | Local installation, port knowledge, regional expertise | "Close to port" support; competitive pricing; local relationships | Technology gaps; global reach |

The competitive landscape demonstrates increasing focus on automation and smart technologies, with leading players leveraging comprehensive port portfolios to maintain market position. Innovation centers on IoT integration and predictive maintenance, while regional players compete through local port relationships and service advantages. Market dynamics favor companies with strong maritime expertise and automation capabilities, as port modernization requirements drive demand for intelligent, efficient unloader solutions across bulk handling applications.

Key Players in the Continuous Ship Unloader Market

- Cargotec/MacGregor (crane & unloading lines)

- FLSmidth

- Mitsubishi Heavy Industries

- Thyssenkrupp

- Konecranes

- PTC (Piletec)

- Telestack

- SMS Inotec

- CMI

- Buhler (bulk handling lines)

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 320.0 million |

| Type | Bucket-wheel CSUs, Screw/pneumatic feed CSUs, Shiploader-integrated CSUs |

| Material Handled | Coal & coke, Iron ore & concentrates, Grains & bulk minerals |

| Ownership | Port authorities (public), Private terminal operators |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, Japan, United Kingdom, France, South Korea, Mexico, and 30+ additional countries |

| Key Companies Profiled | Cargotec/MacGregor, FLSmidth, Mitsubishi Heavy Industries, Thyssenkrupp, Konecranes, PTC |

| Additional Attributes | Dollar sales by type and material categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with port equipment manufacturers and bulk handling suppliers, operator preferences for efficiency consistency and unloader reliability, integration with port platforms and cargo systems, innovations in unloader technology and automation enhancement, and development of advanced smart solutions with enhanced performance and port optimization capabilities. |

Continuous Ship Unloader Market by Segments

-

Type :

- Bucket-wheel CSUs

- Screw/pneumatic feed CSUs

- Shiploader-integrated CSUs

-

Material Handled :

- Coal & coke

- Iron ore & concentrates

- Grains & bulk minerals

-

Ownership :

- Port authorities (public)

- Private terminal operators

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Rest of Europe

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Type , 2025 to 2035

- Bucket-wheel CSUs

- Screw/pneumatic feed CSUs

- Shiploader-integrated CSUs

- Y to o to Y Growth Trend Analysis By Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Material Handled

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Material Handled, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Material Handled, 2025 to 2035

- Coal & Coke

- Iron ore & concentrates

- Grains & bulk minerals

- Y to o to Y Growth Trend Analysis By Material Handled, 2020 to 2024

- Absolute $ Opportunity Analysis By Material Handled, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Ownership

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Ownership, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Ownership, 2025 to 2035

- Port Authorities (Public)

- Private terminal operators

- Y to o to Y Growth Trend Analysis By Ownership, 2020 to 2024

- Absolute $ Opportunity Analysis By Ownership, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By Material Handled

- By Ownership

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Material Handled

- By Ownership

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Material Handled

- By Ownership

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Material Handled

- By Ownership

- Competition Analysis

- Competition Deep Dive

- Cargotec/MacGregor (crane & unloading lines)

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- FLSmidth

- Mitsubishi Heavy Industries

- Thyssenkrupp

- Konecranes

- PTC (Piletec)

- Telestack

- SMS Inotec

- CMI

- Buhler (bulk handling lines)

- Cargotec/MacGregor (crane & unloading lines)

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Ownership, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Material Handled, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Ownership, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Material Handled

- Figure 9: Global Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Ownership

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Type

- Figure 26: North America Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Material Handled

- Figure 29: North America Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by Ownership

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Material Handled

- Figure 39: Latin America Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by Ownership

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Material Handled

- Figure 49: Western Europe Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by Ownership

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Material Handled

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Ownership

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Material Handled

- Figure 69: East Asia Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by Ownership

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Material Handled

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Ownership

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Material Handled, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Material Handled, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Material Handled

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Ownership, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Ownership, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Ownership

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the continuous ship unloader market in 2025?

The global continuous ship unloader market is estimated to be valued at USD 320.0 million in 2025.

What will be the size of continuous ship unloader market in 2035?

The market size for the continuous ship unloader market is projected to reach USD 521.2 million by 2035.

How much will be the continuous ship unloader market growth between 2025 and 2035?

The continuous ship unloader market is expected to grow at a 5.0% CAGR between 2025 and 2035.

What are the key product types in the continuous ship unloader market?

The key product types in continuous ship unloader market are bucket-wheel csus , screw/pneumatic feed csus and shiploader-integrated csus.

Which material handled segment to contribute significant share in the continuous ship unloader market in 2025?

In terms of material handled, coal & coke segment to command 36.0% share in the continuous ship unloader market in 2025.