EPA and DHA Omega-3 Ingredient Market

EPA and DHA Omega-3 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

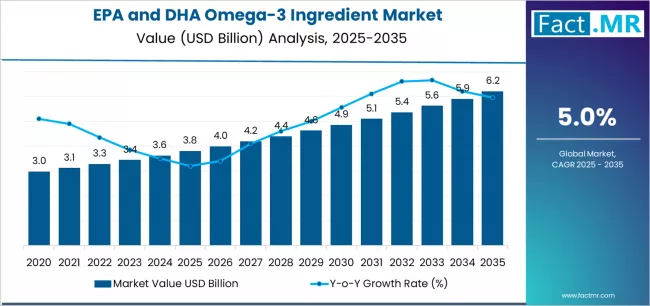

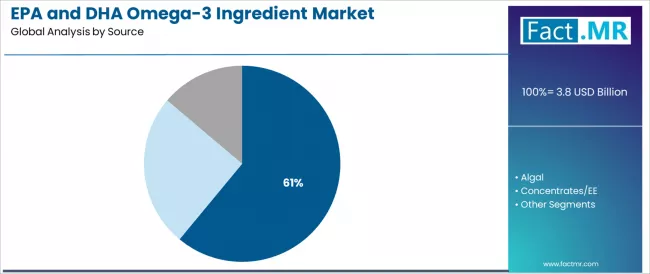

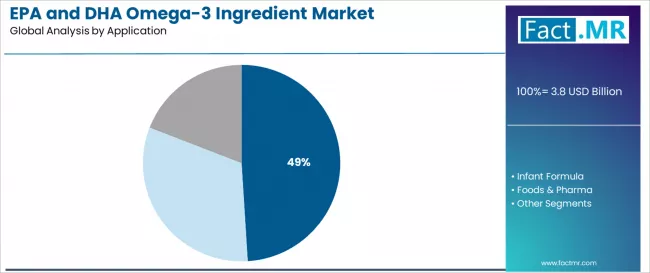

EPA and dha omega-3 ingredient market is projected to grow from USD 3.8 billion in 2025 to USD 6.2 billion by 2035, at a CAGR of 5.0%. Marine Oils will dominate with a 61.0% market share, while dietary supplements will lead the application segment with a 49.0% share.

EPA and DHA Omega-3 Ingredient Market Forecast and Outlook 2025 to 2035

The global EPA and DHA omega-3 ingredient market is valued at USD 3.8 billion in 2025. It is slated to reach USD 6.2 billion by 2035, recording an absolute increase of USD 2.4 billion over the forecast period. This translates into a total growth of 63.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.0% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.63X during the same period, supported by increasing consumer awareness of cardiovascular health benefits, growing demand for brain health supplements, expanding applications in infant nutrition, and rising adoption of sustainable omega-3 sources.

Quick Stats for EPA and DHA Omega-3 Ingredient Market

- EPA and DHA Omega-3 Ingredient Market Value (2025): USD 3.8 billion

- EPA and DHA Omega-3 Ingredient Market Forecast Value (2035): USD 6.2 billion

- EPA and DHA Omega-3 Ingredient Market Forecast CAGR: 5.0%

- Leading Source Type in EPA and DHA Omega-3 Ingredient Market: Marine Oils

- Key Growth Regions in EPA and DHA Omega-3 Ingredient Market: North America, Europe, and Asia-Pacific

- Key Players in EPA and DHA Omega-3 Ingredient Market: DSM Firmenich, BASF, Croda, Epax, GC Rieber, KD Pharma

The growth of the EPA and DHA omega-3 ingredient market is strongly underpinned by a global shift toward preventive healthcare and functional nutrition. Consumers are increasingly seeking dietary supplements and fortified foods that support heart, brain, and eye health, as well as overall well-being. Extensive scientific research linking omega-3 fatty acids to reduced risk of cardiovascular disease, improved cognitive function, and enhanced maternal and infant health is driving confidence in these ingredients, encouraging broader adoption across various age groups and demographic segments.

Infant and pediatric nutrition represents a particularly significant growth segment for EPA and DHA omega-3 ingredients. Formulas enriched with these essential fatty acids are widely recommended for supporting brain and visual development during the critical early years of life. Rising awareness among parents about the long-term cognitive and developmental benefits of DHA supplementation is fueling demand, particularly in regions with expanding middle-class populations and increasing disposable income. Moreover, regulatory approvals and health claims for fortified infant formulas further incentivize manufacturers to incorporate high-quality omega-3 oils into their product portfolios.

The functional food and beverage sector is also contributing to market expansion. Omega-3-enriched dairy products, bakery items, beverages, and nutrition bars are gaining traction among health-conscious consumers seeking convenient sources of these nutrients. Fortification of everyday foods provides an accessible alternative for individuals who may not consistently consume fish or seafood, thereby broadening the potential consumer base. Plant-based and algae-derived omega-3 sources are particularly appealing to vegetarian and vegan populations, as well as those concerned with sustainable and environmentally friendly sourcing practices.

Sustainability is emerging as a critical factor in market growth, with increasing emphasis on responsible sourcing of marine oils and the development of algal oil alternatives that minimize environmental impact. Companies are investing in traceability, eco-certifications, and transparent production practices to meet consumer expectations and regulatory requirements.

Geographically, North America and Europe currently lead the market due to high awareness levels, established supplement industries, and favorable regulatory frameworks. Meanwhile, the Asia-Pacific region is expected to experience rapid growth, fueled by rising health consciousness, urbanization, and expanding access to fortified foods and dietary supplements. Overall, the EPA and DHA omega-3 ingredient market is poised for sustained growth, driven by preventive health trends, functional food innovation, and the rising emphasis on sustainable nutrition solutions worldwide.

Between 2025 and 2030, the EPA and DHA omega-3 ingredient market is projected to expand from USD 3.8 billion to USD 4.9 billion, resulting in a value increase of USD 1.1 billion, which represents 45.8% of the total forecast growth for the decade.

This phase of development will be shaped by increasing health consciousness among aging populations, growing scientific evidence of omega-3 benefits, and expanding fortification applications in functional foods.

Ingredient manufacturers and supplement companies are expanding their omega-3 capabilities to address the growing demand for heart-healthy and brain-supporting nutritional solutions.

EPA and DHA Omega-3 Ingredient Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3.8 billion |

| Forecast Value in (2035F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

From 2030 to 2035, the market is forecast to grow from USD 4.9 billion to USD 6.2 billion, adding another USD 1.3 billion, which constitutes 54.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of algae-based omega-3 production, development of enhanced bioavailability formulations, and growth of personalized nutrition applications targeting specific health outcomes.

The growing adoption of sustainable sourcing practices and plant-based alternatives will drive demand for EPA and DHA omega-3 ingredients with enhanced purity and environmental performance characteristics.

Between 2020 and 2025, the EPA and DHA omega-3 ingredient market experienced steady growth, driven by increasing scientific research validating health benefits and growing recognition of omega-3 fatty acids as essential nutrients for cardiovascular health, cognitive function, and overall wellness.

The market developed as consumers and healthcare professionals recognized the potential for EPA and DHA supplementation to support various health objectives while addressing dietary gaps and lifestyle-related health concerns.

Why is the EPA and DHA Omega-3 Ingredient Market Growing?

Market expansion is being supported by the increasing consumer awareness of omega-3 health benefits driven by scientific research and healthcare recommendations, alongside the corresponding need for high-quality nutritional ingredients that can support cardiovascular health, cognitive function, and inflammatory response across various demographic groups and health applications. Modern ingredient manufacturers and supplement companies are increasingly focused on implementing EPA and DHA omega-3 solutions that can address specific health concerns, support preventive healthcare, and provide scientifically validated nutritional benefits for optimal health outcomes.

The growing emphasis on preventive healthcare and healthy aging is driving demand for EPA and DHA omega-3 ingredients that can support long-term health maintenance, enhance cognitive performance, and ensure comprehensive cardiovascular protection. Ingredient manufacturers' preference for ingredients that combine scientific validation with broad health benefits and consumer acceptance is creating opportunities for innovative omega-3 implementations. The rising influence of functional foods and personalized nutrition is also contributing to increased adoption of EPA and DHA ingredients that can provide superior health benefits without compromising taste or product characteristics.

Segmental Analysis

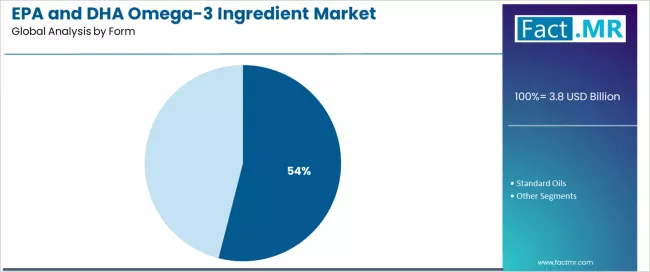

The market is segmented by source, application, and form. By source, the market is divided into marine oils, algal, and concentrates/EE. Based on application, the market is categorized into dietary supplements, infant formula, and foods & pharma. By form, the market is segmented into concentrates and standard oils.

By Source, the Marine Oils Segment Leads the Market

The marine oils segment is projected to maintain its leading position in the EPA and DHA omega-3 ingredient market in 2025 with a 61.0% market share, reaffirming its role as the preferred source for omega-3 fatty acid production due to established supply chains and proven efficacy. Ingredient manufacturers and supplement companies increasingly utilize marine-derived omega-3s for their superior EPA and DHA concentrations, extensive clinical research validation, and proven effectiveness in delivering cardiovascular and cognitive health benefits while maintaining regulatory acceptance and consumer familiarity. Marine oil's proven effectiveness and supply infrastructure directly address industry requirements for reliable omega-3 sourcing and consistent quality across diverse nutritional and pharmaceutical applications.

Marine oil forms the foundation of modern omega-3 production, as it represents the source with the greatest contribution to commercial omega-3 supply and established manufacturing processes across multiple ingredient producers and application segments. Nutritional industry investments in marine sourcing technologies continue to strengthen adoption among manufacturers and formulators. With health applications requiring proven and reliable omega-3 sources, marine oils align with both efficacy objectives and commercial viability requirements, making them the central component of comprehensive omega-3 ingredient strategies.

By Application, the Dietary Supplements Segment Dominates Market Demand

The dietary supplements application segment is projected to represent the largest share of EPA and DHA omega-3 ingredient demand in 2025 with a 49.0% market share, underscoring its critical role as the primary driver for omega-3 ingredient adoption across capsules, softgels, and liquid supplement formulations. Supplement manufacturers prefer EPA and DHA ingredients for their exceptional health benefits, consumer recognition, and ability to support various health claims while maintaining product stability and regulatory compliance. Positioned as essential ingredients for cardiovascular and cognitive health supplements, EPA and DHA offer both immediate health advantages and long-term wellness benefits.

The segment is supported by continuous research in nutritional science and the growing availability of specialized omega-3 formulations that enable superior bioavailability with enhanced absorption and therapeutic effectiveness. Additionally, supplement manufacturers are investing in comprehensive quality assurance programs to support increasingly sophisticated omega-3 supplement offerings and consumer health optimization requirements. As health consciousness increases and preventive care advances, the dietary supplements application will continue to dominate the market while supporting advanced formulation strategies and consumer health optimization.

By Form, the Concentrates Segment Leads Market Sophistication

The concentrates form segment is projected to maintain its leading position in the EPA and DHA omega-3 ingredient market in 2025 with a 54.0% market share, reflecting the growing demand for higher potency and purity in omega-3 products. Manufacturers increasingly prefer concentrated forms for their enhanced therapeutic potential, reduced dosage requirements, and premium positioning capabilities.

What are the Drivers, Restraints, and Key Trends of the EPA and DHA Omega-3 Ingredient Market?

The EPA and DHA omega-3 ingredient market is advancing steadily due to increasing consumer awareness of cardiovascular and cognitive health benefits driven by scientific research and healthcare recommendations, alongside growing demand for high-quality nutritional ingredients that provide anti-inflammatory effects, support brain function, and enhance overall wellness across various age groups and health applications.

However, the market faces challenges, including sustainability concerns about marine sourcing, price volatility of raw materials, and competition from plant-based omega-3 alternatives. Innovation in sustainable sourcing technologies and algae-based production methods continues to influence market dynamics and expansion patterns.

Expansion of Health-Conscious Consumer Demographics

The growing health consciousness across various demographic groups is driving demand for EPA and DHA omega-3 ingredients that can support healthy aging, cognitive performance, and cardiovascular wellness through scientifically validated nutritional interventions and preventive healthcare approaches. Health-conscious consumers require advanced omega-3 formulations that deliver superior health benefits across multiple physiological systems while maintaining safety and regulatory compliance.

Ingredient companies are increasingly recognizing the competitive advantages of EPA and DHA integration for health-focused product development and consumer wellness positioning, creating opportunities for specialized ingredients designed for specific demographic needs and health objectives.

Integration of Sustainable and Alternative Sourcing

Modern omega-3 ingredient manufacturers are incorporating sustainable sourcing practices and alternative production methods to enhance environmental performance, reduce pressure on marine ecosystems, and support comprehensive sustainability objectives through algae cultivation, improved extraction efficiency, and circular economy principles.

Leading companies are developing algae-based EPA and DHA production, implementing sustainable fishing practices, and advancing biotechnology methods that minimize environmental impact while maintaining ingredient quality and therapeutic effectiveness. These technologies improve sustainability credentials while enabling new market opportunities, including vegan supplements, environmentally conscious formulations, and sustainable nutrition products.

Development of Enhanced Bioavailability Technologies

The expansion of nutritional science and delivery technology is driving demand for EPA and DHA omega-3 ingredients with enhanced bioavailability, improved absorption characteristics, and optimized therapeutic effectiveness through advanced formulation techniques and delivery systems.

These ingredient forms require sophisticated processing capabilities and quality control systems that exceed traditional omega-3 production requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in bioavailability research and formulation technology to serve emerging therapeutic applications while supporting innovation in personalized nutrition and targeted health solutions.

Analysis of the EPA and DHA Omega-3 Ingredient Market by Key Countries

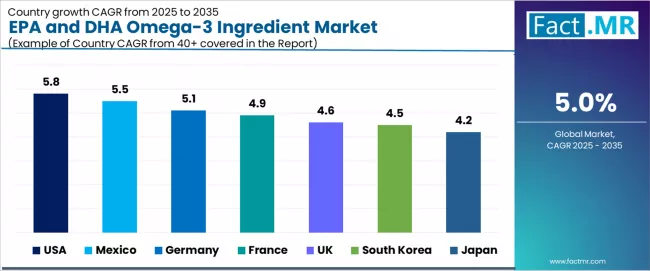

| Country | CAGR (2025-2035) |

|---|---|

| USA | 5.8% |

| Mexico | 5.5% |

| Germany | 5.1% |

| France | 4.9% |

| UK | 4.6% |

| South Korea | 4.5% |

| Japan | 4.2% |

The EPA and DHA omega-3 ingredient market is experiencing solid growth globally, with the USA leading at a 5.8% CAGR through 2035, driven by extensive supplement market development, strong health consciousness, and comprehensive scientific research supporting omega-3 benefits.

Mexico follows at 5.5%, supported by growing health awareness, expanding supplement industry, and increasing consumer education about cardiovascular health. Germany shows growth at 5.1%, emphasizing scientific validation, quality standards, and comprehensive health approaches to nutrition.

France demonstrates 4.9% growth, supported by health-conscious consumers, aging population needs, and preventive healthcare trends. The UK records 4.6%, focusing on heart health awareness, supplement market maturity, and quality-focused consumption.

South Korea exhibits 4.5% growth, emphasizing health optimization and premium nutrition trends. Japan shows 4.2% growth, supported by aging population health requirements and quality supplement preferences.

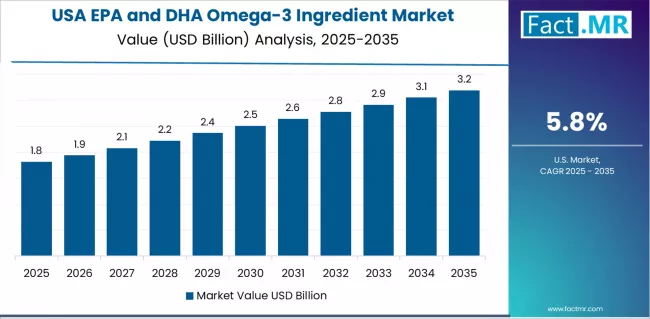

USA Leads Global Market Growth with Health Research Leadership

Revenue from EPA and DHA omega-3 ingredients in the USA is projected to exhibit strong growth with a CAGR of 5.8% through 2035, driven by extensive scientific research validation and rapidly growing consumer awareness of cardiovascular and cognitive health benefits supporting omega-3 adoption among health-conscious consumers, healthcare professionals, and supplement manufacturers.

The country's established supplement industry infrastructure and increasing focus on preventive healthcare are creating substantial demand for omega-3 ingredient solutions. Major ingredient manufacturers and supplement companies are establishing comprehensive research and development capabilities to serve both domestic markets and export opportunities.

- Strong health consciousness and cardiovascular disease prevention focus are driving demand for EPA and DHA omega-3 ingredients throughout supplement manufacturers, functional food producers, and healthcare channels across urban markets and health-focused consumer segments.

- Growing scientific research and healthcare professional recommendations are supporting the rapid adoption of omega-3 ingredients among consumers seeking evidence-based nutritional support and preventive health strategies for heart and brain wellness.

Mexico Demonstrates Strong Market Potential with Health Awareness Growth

Revenue from EPA and DHA omega-3 ingredients in Mexico is expanding at a CAGR of 5.5%, supported by the country's growing health awareness, expanding middle-class health consciousness, and increasing consumer education about cardiovascular health and nutritional supplementation.

The country's evolving healthcare perspectives and supplement market development are driving demand for omega-3 ingredients throughout urban centers and health-conscious consumer segments. Leading ingredient suppliers and supplement brands are establishing comprehensive distribution networks to address growing demand for health-enhancing nutritional products.

- Rising health awareness and expanding healthcare access are creating opportunities for EPA and DHA omega-3 ingredient adoption across supplement retailers, pharmacies, and health stores in major urban markets and health-conscious communities.

- Growing consumer education and disposable income increases are driving adoption of premium omega-3 products among consumers seeking cardiovascular health support and cognitive enhancement solutions for family wellness.

Germany Demonstrates Scientific Excellence with Quality Leadership

Revenue from EPA and DHA omega-3 ingredients in Germany is expanding at a CAGR of 5.1%, driven by the country's emphasis on scientific validation, stringent quality standards, and comprehensive approach to nutritional health supporting evidence-based omega-3 adoption.

Germany's regulatory rigor and consumer sophistication are driving demand for high-quality omega-3 ingredient solutions. Leading pharmaceutical and nutraceutical companies are establishing comprehensive quality development programs for scientifically validated nutritional products.

- Advanced quality standards and consumer preference for scientifically validated products are creating demand for premium EPA and DHA omega-3 ingredients among health-conscious consumers seeking evidence-based cardiovascular and cognitive support.

- Strong pharmaceutical expertise and research focus are supporting the adoption of clinically researched omega-3 formulations across pharmacies, health stores, and medical nutrition channels throughout major urban and healthcare regions.

France Focuses on Health Optimization and Aging Population Support

Revenue from EPA and DHA omega-3 ingredients in France is expanding at a CAGR of 4.9%, driven by the country's health-conscious consumer base, aging population health requirements, and comprehensive approach to wellness and preventive healthcare supporting omega-3 integration into healthy aging strategies.

France's health culture and longevity focus are supporting investment in cardiovascular and cognitive health technologies. Major health brands and pharmaceutical companies are establishing comprehensive innovation programs incorporating omega-3 ingredients with French health approaches.

- Advanced health consciousness and aging population focus are creating demand for EPA and DHA omega-3 ingredients throughout pharmacies, health stores, and wellness centers serving health-focused consumer segments and elderly care applications.

- Strong preventive healthcare trends and longevity emphasis are driving the adoption of omega-3 supplements across healthcare channels, wellness programs, and aging-in-place support systems throughout major metropolitan and healthcare regions.

UK Shows Market Leadership with Heart Health Focus

Revenue from EPA and DHA omega-3 ingredients in the UK is expanding at a CAGR of 4.6%, supported by the country's strong awareness of cardiovascular health, established supplement market, and growing interest in brain health and cognitive enhancement through nutritional supplementation.

The UK's health optimization trends and preventive care focus are driving demand for scientifically validated omega-3 solutions. Leading supplement brands and healthcare companies are investing in omega-3 research and product development for health-conscious consumers.

- Advanced cardiovascular health awareness and consumer interest in heart disease prevention are creating opportunities for EPA and DHA omega-3 ingredients throughout supplement retailers, pharmacies, and health stores serving cardiovascular health-focused consumer segments.

- Strong supplement market maturity and brain health focus are driving the adoption of omega-3 ingredients across premium supplement formulations, cognitive health products, and wellness-oriented retail channels targeting health optimization consumers.

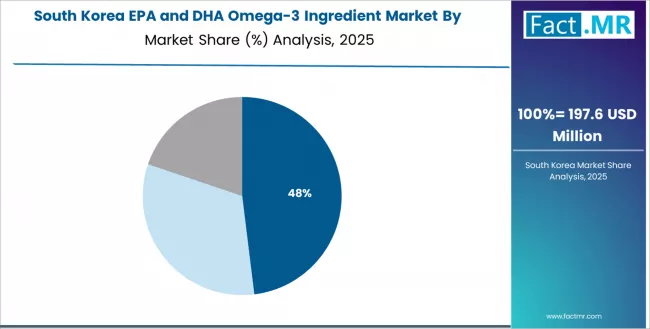

South Korea Demonstrates Wellness Leadership with Premium Health Focus

Revenue from EPA and DHA omega-3 ingredients in South Korea is expanding at a CAGR of 4.5%, supported by the country's health optimization culture, growing wellness lifestyle trends, and strong emphasis on premium nutrition and cognitive enhancement supporting advanced omega-3 adoption.

The nation's health consciousness and technology integration are driving demand for sophisticated omega-3 ingredient solutions. Leading health companies are investing extensively in premium nutrition product development and wellness market expansion.

- Advanced wellness culture and health optimization trends are creating demand for EPA and DHA omega-3 ingredients throughout premium health stores, wellness centers, and online platforms serving health-conscious consumer segments.

- Strong cognitive enhancement focus and premium nutrition trends are supporting the adoption of omega-3 ingredients designed for mental performance, brain health, and overall wellness optimization across diverse consumer demographics and health applications.

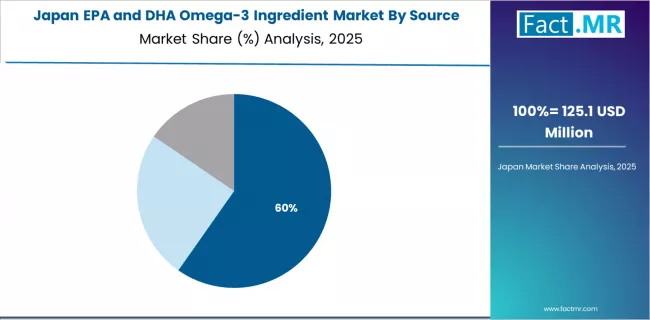

Japan Shows Premium Focus with Aging Population Applications

Revenue from EPA and DHA omega-3 ingredients in Japan is expanding at a CAGR of 4.2%, supported by the country's aging population health requirements, advanced nutritional science capabilities, and strong emphasis on longevity and cardiovascular health supporting omega-3 supplementation for healthy aging.

Japan's health consciousness and quality focus are driving demand for premium omega-3 ingredient products. Leading pharmaceutical and health companies are investing in specialized capabilities for aging population health and cardiovascular support applications.

- Advanced aging population needs and cardiovascular health focus are creating opportunities for EPA and DHA omega-3 ingredients throughout pharmacies, health stores, and medical channels serving health-conscious elderly consumers and cardiovascular health programs.

- Strong quality standards and longevity focus are driving adoption of premium omega-3 supplements meeting Japanese consumer expectations for purity, effectiveness, and comprehensive health support across diverse age groups and health objectives.

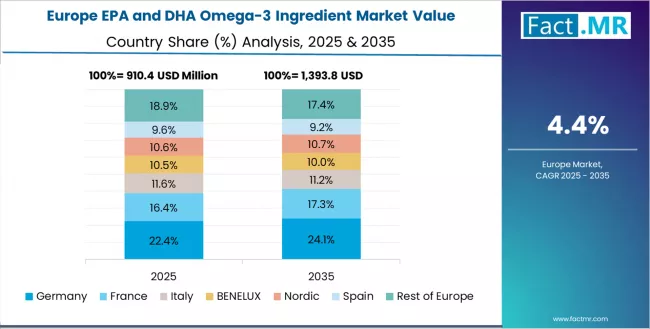

Europe Market Split by Country

The EPA and DHA omega-3 ingredient market in Europe is projected to grow from USD 1.2 billion in 2025 to USD 1.9 billion by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain leadership with a 28.3% market share in 2025, moderating to 28.0% by 2035, supported by scientific validation emphasis, stringent quality standards, and comprehensive health approaches to nutritional supplementation.

France follows with 22.5% in 2025, projected to reach 22.8% by 2035, driven by health-conscious consumer base, aging population health requirements, and preventive healthcare trends supporting omega-3 integration. The United Kingdom holds 21.7% in 2025, expected to reach 21.9% by 2035 due to strong cardiovascular health awareness and established supplement market.

Italy commands 15.0% in 2025, rising to 15.1% by 2035, while Spain accounts for 8.3% in 2025, reaching 8.4% by 2035. The Rest of Europe region is anticipated to hold 4.2% in 2025 and 3.8% by 2035, reflecting steady omega-3 market development in Nordic countries and emerging health markets in Eastern European countries.

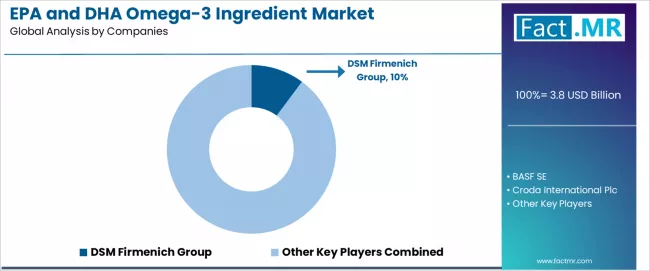

Competitive Landscape of the EPA and DHA Omega-3 Ingredient Market

The EPA and DHA omega-3 ingredient market is characterized by competition among established marine ingredient suppliers, biotechnology companies, and specialized nutritional ingredient manufacturers.

Companies are investing in sustainable sourcing technology development, advanced purification methods, bioavailability enhancement research, and alternative production technologies to deliver high-quality, effective, and environmentally responsible omega-3 ingredient solutions. Innovation in algae-based production, concentration techniques, and formulation optimization is central to strengthening market position and competitive advantage.

DSM Firmenich leads the market with a 10.2% share, offering comprehensive EPA and DHA omega-3 ingredient solutions with focus on sustainability, quality assurance, and innovative delivery systems across diverse nutritional and pharmaceutical applications. The company continues investing in algae-based production capabilities and sustainable sourcing while expanding global manufacturing capacity and technical service capabilities.

BASF provides advanced nutritional ingredient solutions with emphasis on quality and innovation. Croda specializes in high-purity omega-3 ingredients with sustainable sourcing focus. Epax offers premium marine-derived omega-3 concentrates. GC Rieber focuses on sustainable marine ingredient production. KD Pharma emphasizes pharmaceutical-grade omega-3 ingredients.

Key Players in the EPA and DHA Omega-3 Ingredient Market

- DSM Firmenich Group

- BASF SE

- Croda International Plc

- Epax AS

- GC Rieber AS

- KD Pharma Group GmbH

- Aker BioMarine ASA

- Corbion N.V.

- Polaris Ingredients

- Golden Omega, Inc.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.8 Billion |

| Source | Marine Oils, Algal, Concentrates/EE |

| Application | Dietary Supplements, Infant Formula, Foods & Pharma |

| Form | Concentrates, Standard Oils |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Mexico, Germany, France, UK, Japan, South Korea, and 40+ countries |

| Key Companies Profiled | DSM Firmenich, BASF, Croda, Epax, GC Rieber, KD Pharma |

| Additional Attributes | Dollar sales by source and application, regional demand trends, competitive landscape, technological advancements in omega-3 production, sustainability development, bioavailability enhancement, and health benefit optimization |

EPA and DHA Omega-3 Ingredient Market by Segments

-

Source :

- Marine Oils

- Algal

- Concentrates/EE

-

Application :

- Dietary Supplements

- Infant Formula

- Foods & Pharma

-

Form :

- Concentrates

- Standard Oils

-

Region :

-

North America

- United States

- Canada

- Mexico

-

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

-

Asia-Pacific

- Japan

- South Korea

- China

- India

- Australia

- Rest of Asia-Pacific

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

Middle East & Africa

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East & Africa

-

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Source , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Source , 2025 to 2035

- Marine Oils

- Algal

- Concentrates/EE

- Y to o to Y Growth Trend Analysis By Source , 2020 to 2024

- Absolute $ Opportunity Analysis By Source , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- Dietary Supplements

- Infant Formula

- Foods & Pharma

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Form, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Form, 2025 to 2035

- Concentrates

- Standard Oils

- Y to o to Y Growth Trend Analysis By Form, 2020 to 2024

- Absolute $ Opportunity Analysis By Form, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Source

- By Application

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Source

- By Application

- By Form

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Source

- By Application

- By Form

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Source

- By Application

- By Form

- Competition Analysis

- Competition Deep Dive

- DSM Firmenich Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- BASF SE

- Croda International Plc

- Epax AS

- GC Rieber AS

- KD Pharma Group GmbH

- Aker BioMarine ASA

- Corbion N.V.

- Polaris Ingredients

- Golden Omega, Inc.

- DSM Firmenich Group

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Form, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Source , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Form, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Source

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Form

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Source

- Figure 26: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Application

- Figure 29: North America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by Form

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Source

- Figure 36: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Application

- Figure 39: Latin America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by Form

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Source

- Figure 46: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Application

- Figure 49: Western Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by Form

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Source

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Application

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Form

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Source

- Figure 66: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Application

- Figure 69: East Asia Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by Form

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Source

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Form

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Source , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Source , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Source

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Form, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the epa and dha omega-3 ingredient market in 2025?

The global epa and dha omega-3 ingredient market is estimated to be valued at USD 3.8 billion in 2025.

What will be the size of epa and dha omega-3 ingredient market in 2035?

The market size for the epa and dha omega-3 ingredient market is projected to reach USD 6.2 billion by 2035.

How much will be the epa and dha omega-3 ingredient market growth between 2025 and 2035?

The epa and dha omega-3 ingredient market is expected to grow at a 5.0% CAGR between 2025 and 2035.

What are the key product types in the epa and dha omega-3 ingredient market?

The key product types in epa and dha omega-3 ingredient market are marine oils, algal and concentrates/ee.

Which application segment to contribute significant share in the epa and dha omega-3 ingredient market in 2025?

In terms of application, dietary supplements segment to command 49.0% share in the epa and dha omega-3 ingredient market in 2025.