High Purity Aluminium Market

High Purity Aluminium Market Analysis, By Grade, By End-Use, By Form, and Region - Market Insights 2025 to 2035

Analysis Of High Purity Aluminium Market Covering 30+ Countries Including Analysis Of US, Canada, UK, Germany, France, Nordics, GCC Countries, Japan, Korea And Many More

High Purity Aluminium Market Outlook (2025 to 2035)

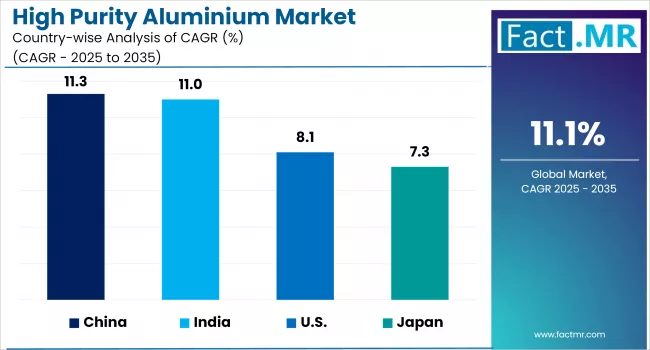

The global high-purity aluminium market is projected to increase from USD 5.3 billion in 2025 to USD 15.2 billion by 2035, with a CAGR of 11.1%, driven by the increasing use of high-purity alumina (HPA) in electric vehicle (EV) batteries and electronic manufacturing components. Their use makes them ideal for applications requiring superior conductivity, corrosion resistance, and high thermal stability in EV batteries and advanced electronics.

-2025-to-2035.webp)

What are the Drivers of High Purity Aluminium Market?

The lithium-ion battery's performance is enhanced by the nano-thickness of alumina-coated separators and the thin coating on the separator sheet. The battery's durability is improved by this HPA, which increases its capacity to withstand a high rate of discharge.

High Purity Alumina (HPA) is a refined form of aluminium oxide with a purity of 99.9% or higher. Its properties and applications are considerably influenced by its purity, which is categorized by the number of "nines" (4N, 5N, 6N). The U.S. Department of Energy anticipates that the majority of its lighting installation projects will be completed by 2035.

The residential sector is expected to incorporate LED lighting technology, facilitated by ENERGY STAR products. ENERGY STAR-qualified products consume approximately 75% less energy than LCDs. The HPA market is expected to expand during the forecast period due to its utilization in LED manufacturing for residential and commercial illumination.

The global HPA market is experiencing significant expansion due to the growing demand for LED manufacturing and electric vehicle batteries. In lithium-ion batteries, HPA is an essential component due to its stability and conductivity. Additionally, the market is observing trends such as the development of new technologies to reduce costs and strategic partnerships.

Additionally, the industry is significantly influenced by the increasing demand for LED lighting, electronics, and EV batteries, which are extensively utilized due to their superior hardness, thermal stability, and brightness.

HPA observes significant demand for plasma displays, as they are a cost-effective and energy-efficient alternative to traditional materials, such as incandescent light bulbs. It is also a fundamental base material for synthetic sapphire substrates, which are used in various microelectronics, particularly semiconductors.

What are the Regional Trends of High Purity Aluminium Market?

The North American market has tremendous growth potential due to improved technology and aggressive R&D. The U.S., Canada, and Mexico dominate the region's market with electric cars, semiconductors, and LED lighting innovations.

Additionally, investments in high purity alumina manufacturing capacities aim to improve domestic mineral supply chains and reduce imports, driving market growth. Due to its world-leading electronics industry and semiconductor production capabilities, the market is expected to dominate North America in 2025, with the largest revenue share.

Consumer demand also drives market growth, particularly in the semiconductor industry. Significant investments in new manufacturing and research facilities demonstrate the U.S.'s commitment to leadership in high-purity alumina production. European high-purity alumina consumption is expected to increase due to the growing demand for semiconductor technology and energy-efficient lighting solutions.

LEDs and electric vehicles benefit from the region's efforts to promote sustainability and reduce carbon emissions. Innovation in high-purity alumina technologies is encouraged by robust regulatory regimes. As Europe adopts greener technologies, demand for high-purity alumina is expected to rise.

In 2025, the APAC market had the largest revenue share. The strong manufacturing skills of China, Japan, South Korea, and India drove this expansion. This area dominates the LED market and is producing an increasing number of electric vehicles, particularly in China. The presence of major battery manufacturing facilities strengthens the region's market position.

Due to its large semiconductor production base and strong LED lighting sector, China's high-purity alumina market led the Asia-Pacific market in 2024. China is also a global leader in lighting products due to government initiatives and rising local demand. China's global dominance is reinforced by the growing demand for high-purity alumina in battery applications from the electric car sector.

The Latin America market is predicted to grow, driven by infrastructure and renewable energy initiatives. Brazil is also developing its industrial capabilities by using high-purity alumina for diverse purposes. LEDs and electric vehicles are gaining popularity due to concerns over energy efficiency and sustainability, which is expected to enhance the regional high-purity alumina market.

What are the Challenges and Restraining Factors of High Purity Aluminium Market?

The market faces challenges such as high production costs and limited availability of raw materials. The production of high-purity aluminum ingots is energy-intensive, and fluctuations in energy prices can have a substantial impact on manufacturing costs.

Furthermore, the market's expansion may be hindered by the cost and availability of raw materials, particularly bauxite. The financial burden on manufacturers is further compounded by the necessity for ongoing investment in research and development to enhance production efficiency and reduce costs.

While environmental regulations and the movement toward sustainable practices offer opportunities, they also introduce operational challenges and compliance costs that could potentially influence market dynamics.

The Bayer process is commonly used for the commercial production of high-purity aluminum; however, it generates significant industrial waste known as bauxite residue, also referred to as red mud, with approximately 1.4 to 1.5 tons of red mud produced per ton of aluminum.

Red mud is regarded as environmentally hazardous due to its substantial volume, alkalinity, and storage complications. Currently, over 200 aluminium smelters worldwide are involved in producing aluminium from bauxite.

The production of red soil is also increasing in tandem with the global demand for aluminium. Although red mud is classified as low- or non-hazardous waste in most countries, its storage and disposal require high capital investment, leading to significant additional costs that can erode profit margins for some companies.

Sophisticated apparatus and devices are necessary for the production of high-purity aluminium. Consequently, the production of these compounds is frequently accompanied by substantial operational expenses. To establish a standard plant with an annual capacity of 4,000 tons, a CAPEX of approximately USD 297.6 million and an OPEX of approximately USD 44.6 million are required.

The market trends will be influenced by a variety of factors, including weak global economic growth, rising inflation, and the emergence of wars that result in fluctuating trade conditions. In order to ensure their future in this business sector, HPA manufacturers will need to navigate these challenges.

Country-Wise Outlook

U.S. High Purity Aluminium Market Sees Growth Driven by Energy Storage And Electric Vehicles

The market is witnessing significant growth, primarily driven by its critical role in advanced technological applications. The expanding consumer electronics industry, along with extensive R&D activities, is a major factor fueling this demand. High purity alumina (HPA), also known as aluminum oxide, is a refined non-metallurgical form of alumina produced through processes such as hydrolysis of aluminum oxide, hydrochloric acid leaching, underwater spark discharge with aluminum, and vapor-phase oxidation.

-2025-to-2035.webp)

As industries like electronics, energy, and optoelectronics continue to advance, the demand for high-purity alumina is expected to grow, positioning the U.S. as a significant player in the regional market. The versatility and exceptional purity of high-purity alumina ensure its status as an essential material for cutting-edge technologies, which is expected to further propel market growth in the coming years.

China Witnesses Rapid Market Growth Backed by Government Policy and Industry Action Plans

The Chinese government’s 2025-2027 Aluminium Industry Action Plan emphasizes strengthening the aluminium supply chain, ensuring resource security, and promoting green transformation. Targets include increasing domestic bauxite reserves, boosting recycled aluminium output, and stricter energy and environmental standards for new projects.

These policies are designed to enhance resource self-sufficiency, circular economy practices, and green innovation, all of which support sustainable growth in the HPA sector. China is focusing on cleaner production methods and the integration of recycled aluminium to meet both environmental goals and rising product demand.

The push for energy efficiency and the use of clean energy in aluminium production aligns with global trends toward decarbonization, particularly as high-quality bauxite becomes increasingly scarce and environmental regulations tighten. Ongoing investments in research and development are improving production efficiency and enabling new applications for HPA in high-performance electronics and advanced manufacturing, further supporting high-purity aluminium market growth.

Japan is Experiencing Significant Growth, Primarily Driven by Aerospace And Defense

HPA is crucial for producing sapphire substrates used in LED devices. The increasing adoption of LED lighting in Japan, driven by both energy efficiency and regulatory compliance, is propelling market growth. The aerospace sector’s need for lightweight, high-strength, and ultra-pure materials is contributing to the rising demand for high-purity aluminum.

Japan is advancing several new initiatives in the high-purity aluminium sector, focusing on sustainability, advanced manufacturing, and technological innovation. Companies like Sumitomo Corporation are investing in the production of low-carbon aluminium using renewable energy sources such as hydro, solar, and wind power.

The launch of branded products like "GEM" aims to position low-carbon aluminium as a premium, environmentally friendly alternative, supporting Japan's broader carbon-neutral goals.

Category-wise Analysis

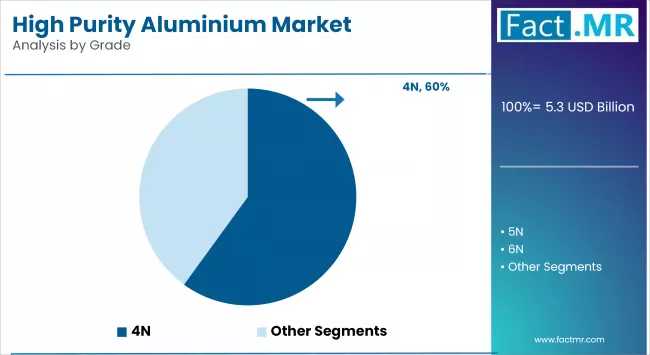

4N to Exhibit Leading by Grade

The 4N grade segment accounts for the largest revenue share in the high-purity aluminium market, owing to its extensive application in LED lighting, lithium-ion batteries, and other industrial uses. Its 99.99% purity level offers an effective balance between performance and cost, making it a popular choice across large-scale manufacturing sectors, particularly in the rapidly growing lighting and EV industries.

The 5N grade segment is projected to be the fastest-growing segment during the forecast period, driven by rising demand for ultra-high-purity materials in advanced electronics, aerospace, and semiconductor applications. As technological advancements continue to push for greater precision and reliability, the adoption of 5N aluminium is accelerating, supported by enhanced production capabilities and quality control by major manufacturers.

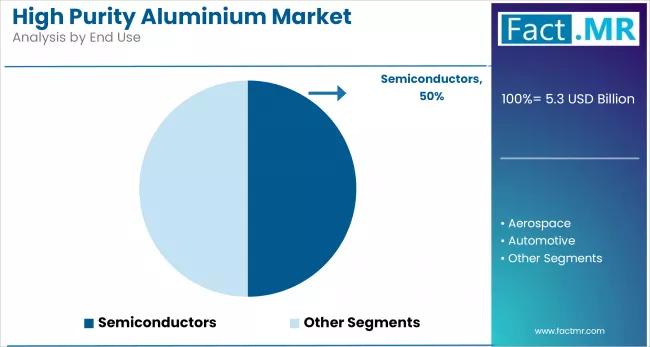

Semiconductor to Exhibit Leading by End-Use

The semiconductor industry dominates the high-purity aluminium market, driven by its essential role in wafer production and chemical vapor deposition processes. With the rapid growth in semiconductor device manufacturing and electronic components, demand for high-purity aluminum continues to surge.

In the broader electronics sector, high-purity aluminium is vital for producing capacitor foils, flat panel displays, thin films, and data storage systems. The ongoing trend of device miniaturization and increasing need for high-performance components are further fueling market growth across these applications.

Ingots to Exhibit Leading by Form

The ingots segment holds the largest revenue share in the high-purity aluminium market due to its widespread use across various end-use industries such as semiconductors, electronics, and aerospace. Ingots are favored for their ease of transport, storage, and further processing into different shapes and components, making them highly versatile and cost-effective for large-scale manufacturing.

The wires and coils segment is expected to be the fastest-growing during the forecast period, driven by increasing demand from the electronics and automotive sectors. These forms are essential for electrical conductivity applications, including high-precision wiring in semiconductors and EV components, where purity and performance are critical.

Competitive Analysis

The high purity aluminium (HPA) market is becoming increasingly competitive, with a mix of global corporations and emerging players competing on the basis of technological innovation, material purity, and application versatility.

Key companies such as Orbite Technologies Inc., Altech Chemicals Ltd., Almatis, Inc., and Nippon Light Metal Holdings Co., Ltd. have established strong footprints globally, particularly in Asia-Pacific and Europe, leveraging their advanced refining techniques and broad application portfolios. These players maintain a competitive edge through strong R&D capabilities, secure raw material sourcing, and diversified end-use partnerships in industries like semiconductors, LEDs, and lithium-ion batteries.

Strategic initiatives such as partnerships, capacity expansions, and vertical integration are also reshaping the competitive landscape. Companies are investing in proprietary refining processes to achieve higher purities (4N and above), enabling them to meet the stringent quality demands of high-tech applications.

In parallel, regional players in developing economies are offering cost-effective solutions to cater to price-sensitive markets, particularly in Latin America and Southeast Asia. These players focus on scalability and affordability to capture emerging demand across renewable energy, electronics, and EV infrastructure sectors.

Key players in the high-purity aluminium industry include Nature Alu, Chalco, Showa Denko KK, Norsk Hydro, Kyushu Mitsui Aluminium, Nippon Light Metal Holding Co., Join World, RuSAL, Sumitomo Chemicals Co., Ltd., and other notable players.

Recent Development

- In June 2025, Hindalco Industries Limited, the metals flagship of the Aditya Birla Group, acquired a 100% equity stake in AluChem Companies, Inc., a US-based manufacturer of specialty alumina. The acquisition was made for an enterprise value of USD 125 million through Aditya Holdings LLC, a step-down wholly owned subsidiary of Hindalco.

(Source: https://www.hindalco.com/media/press-releases/hindalco-to-acquire-us-based-aluchem-companies-inc)

- In May 2024, Alpha HPA finalized its investment decision to proceed with the full-scale production of High Purity Alumina (HPA) at its site in Gladstone, Queensland. The company aims to build the world's largest single-site HPA refinery, with construction anticipated to begin in mid-2024 at the existing HPA First project site in Yarwun, near Gladstone.

(Source: https://alphahpa.com.au/alpha-hpa-takes-final-investment-decision-to-enter-full-scale-production-in-gladstone)

Segmentation of High Purity Aluminium Market

-

By Grade :

- 4N

- 5N

- 6N

-

By End Use :

- Semiconductors

- Chip Production

- Flat Panel Display Production

- Thin Film Production

- Electrolytic Capacitor Foils

- Electronic Storage Systems

- Others

- Aerospace

- Automotive

- Others

-

By Form :

- Disks

- Pellets

- Ingots

- Wires & Coils

- Other Forms

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global High Purity Aluminium Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global High Purity Aluminium Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Grade

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Grade, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Grade, 2025-2035

- 4N

- 5N

- 6N

- Y-o-Y Growth Trend Analysis By Grade, 2020-2024

- Absolute $ Opportunity Analysis By Grade, 2025-2035

- Global High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By End Use

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By End Use, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By End Use, 2025-2035

- Semiconductors

- Chip Production

- Flat Panel Display

- Thin Film Production

- Electrolytic Capacitor Foils

- Electronic Storage Systems

- Others

- Aerospace

- Automotive

- Others

- Semiconductors

- Y-o-Y Growth Trend Analysis By End Use, 2020-2024

- Absolute $ Opportunity Analysis By End Use, 2025-2035

- Global High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Form, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Form, 2025-2035

- Disks

- Pellets

- Ingots

- Wires & Coils

- Other Forms

- Y-o-Y Growth Trend Analysis By Form, 2020-2024

- Absolute $ Opportunity Analysis By Form, 2025-2035

- Global High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- Latin America High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- Western Europe High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- East Asia High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- South Asia Pacific High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- Eastern Europe High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- Middle East & Africa High Purity Aluminium Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Grade

- By End Use

- By Form

- By Country

- Market Attractiveness Analysis

- By Country

- By Grade

- By End Use

- By Form

- Key Takeaways

- Key Countries High Purity Aluminium Market Analysis

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Grade

- By End Use

- By Form

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Grade

- By End Use

- By Form

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Grade

- By End Use

- By Form

- United States

- Pricing Analysis

- Market Share Analysis, 2024

- By Grade

- By End Use

- By Form

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Grade

- By End Use

- By Form

- China

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Grade

- By End Use

- By Form

- Competition Analysis

- Competition Deep Dive

- Nature Alu

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Chalco

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Showa Denko KK

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Norsk Hydro

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Kyushu Mitsui Aluminium

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Nippon Light Metal Holding Co.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Join World

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- RuSAL

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Sumitomo Chemicals Co. Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Nature Alu

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Tons) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 4: Global Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 6: Global Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 8: Global Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 12: North America Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 14: North America Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 16: North America Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 20: Latin America Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 22: Latin America Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 24: Latin America Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 28: Western Europe Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 30: Western Europe Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 32: Western Europe Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: East Asia Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 36: East Asia Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 37: East Asia Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 38: East Asia Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 39: East Asia Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 40: East Asia Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 41: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: South Asia Pacific Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 43: South Asia Pacific Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 44: South Asia Pacific Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 45: South Asia Pacific Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 46: South Asia Pacific Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 47: South Asia Pacific Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 48: South Asia Pacific Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 52: Eastern Europe Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 54: Eastern Europe Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 56: Eastern Europe Market Volume (Tons) Forecast by Form, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Grade, 2020 to 2035

- Table 60: Middle East & Africa Market Volume (Tons) Forecast by Grade, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by End Use, 2020 to 2035

- Table 62: Middle East & Africa Market Volume (Tons) Forecast by End Use, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by Form, 2020 to 2035

- Table 64: Middle East & Africa Market Volume (Tons) Forecast by Form, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Tons) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 6: Global Market Attractiveness Analysis by Grade

- Figure 7: Global Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 9: Global Market Attractiveness Analysis by End Use

- Figure 10: Global Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 12: Global Market Attractiveness Analysis by Form

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2020 to 2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2020 to 2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2020 to 2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2020 to 2035

- Figure 19: East Asia Market Incremental $ Opportunity, 2020 to 2035

- Figure 20: South Asia Pacific Market Incremental $ Opportunity, 2020 to 2035

- Figure 21: Eastern Europe Market Incremental $ Opportunity, 2020 to 2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2020 to 2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 26: North America Market Attractiveness Analysis by Grade

- Figure 27: North America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 29: North America Market Attractiveness Analysis by End Use

- Figure 30: North America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 32: North America Market Attractiveness Analysis by Form

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 36: Latin America Market Attractiveness Analysis by Grade

- Figure 37: Latin America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 39: Latin America Market Attractiveness Analysis by End Use

- Figure 40: Latin America Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by Form

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 46: Western Europe Market Attractiveness Analysis by Grade

- Figure 47: Western Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 49: Western Europe Market Attractiveness Analysis by End Use

- Figure 50: Western Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 52: Western Europe Market Attractiveness Analysis by Form

- Figure 53: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: East Asia Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 55: East Asia Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 56: East Asia Market Attractiveness Analysis by Grade

- Figure 57: East Asia Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 58: East Asia Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 59: East Asia Market Attractiveness Analysis by End Use

- Figure 60: East Asia Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 61: East Asia Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 62: East Asia Market Attractiveness Analysis by Form

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: South Asia Pacific Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 65: South Asia Pacific Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 66: South Asia Pacific Market Attractiveness Analysis by Grade

- Figure 67: South Asia Pacific Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 68: South Asia Pacific Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 69: South Asia Pacific Market Attractiveness Analysis by End Use

- Figure 70: South Asia Pacific Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 71: South Asia Pacific Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 72: South Asia Pacific Market Attractiveness Analysis by Form

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: Eastern Europe Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 75: Eastern Europe Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 76: Eastern Europe Market Attractiveness Analysis by Grade

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 78: Eastern Europe Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 79: Eastern Europe Market Attractiveness Analysis by End Use

- Figure 80: Eastern Europe Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 81: Eastern Europe Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 82: Eastern Europe Market Attractiveness Analysis by Form

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Grade, 2020 to 2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Grade

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by End Use, 2020 to 2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by End Use

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by Form, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by Form, 2020 to 2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 93: Global Market - Tier Structure Analysis

- Figure 94: Global Market - Company Share Analysis

- FAQs -

What is the Global High Purity Aluminium Market Size in 2025?

The high purity aluminium market is valued at USD 5.3 billion in 2025.

Who are the Major Players Operating in the High Purity Aluminium Market?

Prominent players in the market include Nature Alu, Chalco, Showa Denko KK, Norsk Hydro, and Kyushu Mitsui Aluminium.

What is the Estimated Valuation of the High Purity Aluminium Market by 2035?

The market is expected to reach a valuation of USD 15.2 billion by 2035.

What Value CAGR Did the High Purity Aluminium Market Exhibit Over the last Five Years?

The growth rate of the high purity aluminium market is 8.6% from 2020-2024.