High Performance Films Market

High Performance Films Market Analysis- Size, Share and Forecast Outlook 2025 to 2035

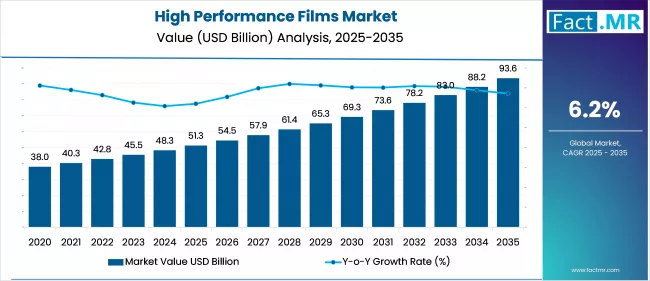

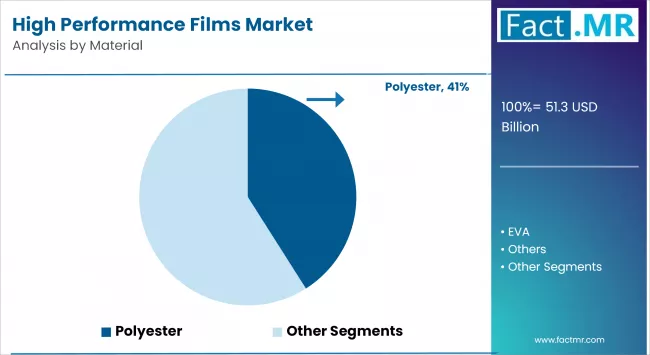

The high performance films market is likely to reach USD 51.3 billion in 2025 and is projected to reach USD 93.6 billion by 2035, rising at a CAGR of 6.2%. Polyester remains the preferred material, while barrier films comprise the dominant type.

High Performance Films Market Size, Share and Forecast Outlook 2025 to 2035

The global high performance films market is forecast to reach USD 93.6 billion by 2035, up from USD 51.3 billion in 2025. During the forecast period, the industry is projected to register at a CAGR of 6.2%. The development of films with superior properties, such as enhanced durability, improved optical clarity, and outstanding resistance to environmental factors, has been facilitated by innovation in film manufacturing techniques and materials science.

These developments facilitate the development of films that satisfy the changing requirements of numerous sectors, such as aerospace, automotive, and electronics, thereby increasing the demand for high-performance films.

Quick Stats of High Performance Films Market

- High Performance Films Market Size (2025): USD 51.3 billion

- Projected High Performance Films Market Size (2035): USD 93.6 billion

- Forecast CAGR of High Performance Films Market (2025 to 2035): 6.2%

- Leading Material Segment of High Performance Films Market: Polyester

- Key Growth Regions of High Performance films Market: United States, China, Japan

- Key Players of the High Performance Films Market: Dow Chemical Company, The 3M Company, Solvay S.A., Covestro, Evonik, Honeywell International Inc., others.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 51.3 billion |

| Industry Size (2035F) | USD 93.6 billion |

| CAGR (2025-2035) | 6.2% |

The market is projected to increase from USD 51.3 billion in 2025 to approximately USD 69.3 billion by 2030, indicating a consistent growth trajectory that facilitates capacity planning and long-term agreements.Packaging and labeling films are expected to comply with the EU’s Packaging and Packaging Waste Regulation, which took effect on February 11, 2025, and will be applicable from August 12, 2026.

The regulations establish recyclability standards and Design for Recycling criteria, encouraging converters to adopt mono-material or recyclable film structures and increase recycled content. This will benefit suppliers possessing advanced technologies in PE, PP, PET, and coatings, as well as those demonstrating traceable EPR performance.

New U.S. tariffs on plastics imports from China, effective in 2025, along with ongoing tariff discussions, are leading to a re-evaluation of supply chains. Plastics processors in the United States may experience increased reshoring demand in the automotive and consumer goods sectors, potentially leading to a constriction in the supply of specific resins and specialty films within North America. Buyers must anticipate pricing variability across regions and evaluate the option of dual sourcing.

The market is projected to grow from approximately USD 69.3 billion in 2030 to USD 93.6 billion by 2035. Growth will be concentrated in high-specification films for energy, mobility, and electronics. In solar photovoltaic technology, manufacturers are increasingly adopting coated polyethylene terephthalate backsheets and polyvinylidene fluoride-layer solutions.

This shift in demand favors durable barrier and UV-resistant coatings over certain multilayer legacy stacks, thereby creating opportunities for coating chemistries and PET substrate suppliers.

Electronics continues to serve as a catalyst. Recent developments in flexible and stretchable displays have positioned colorless polyimide and other high-heat, optically clear films favorably, thereby sustaining premium pricing in thin, low-haze grades for applications in foldables, wearables, and in-vehicle displays.

The demand for high-barrier films, such as PCTFE, in pharmaceutical packaging is increasing, leading to niche capacity expansions and innovations in laminates. Solar PV backsheets demonstrate significant growth, underscoring the energy sector's demand for specialty films.

In conjunction with the EU circularity regulations and shifts in U.S. trade policy, these elements indicate a combination of compliance-driven reformulation, targeted regional capacity expansion, and enhancements in product mix, rather than expansion driven by price increases.

Top High Performance Films Market Dynamics

The high-performance films market is experiencing consistent development as a result of their growing presence in a variety of applications, including electronics, automotive, aerospace, medical, and packaging. In industries that necessitate precision, efficiency, and durability, their exceptional mechanical, thermal, and barrier properties render them indispensable.

Technological advancements and sustainability trends are generating new opportunities; however, environmental concerns, capital-intensive manufacturing, and high production costs continue to be significant obstacles that affect market dynamics.

Increasing Demand from the Electronics Industry

The increasing adoption of electronic devices and appliances is fueling the need for films that provide electrical insulation, thermal management, and protection against electromagnetic interference.

In applications like protective covers, touchscreens, and flexible displays, high-performance specialty films are highly regarded for their distinctive properties that improve both the durability and functionality of products. As the landscape of consumer electronics advances, the demand for these sophisticated films is anticipated to increase significantly.

Transition to Sustainable and Eco-Conscious Materials

The growing focus on environmental responsibility, along with strict regulatory standards, is driving sectors to embrace sustainable, biodegradable, and recyclable film options.

Organizations are diligently developing specialty films that ensure superior performance while minimizing environmental impact. This transition to sustainable options is expected to greatly increase the need for high-performance green films in the near future.

Innovations in Film Production Processes

Continuous advancements in material science and manufacturing technologies are facilitating the creation of films that offer improved strength, flexibility, and durability under extreme conditions.

Innovations like nanocoatings, multi-layer structures, and enhanced polymer blends are broadening the scope of applications for high-performance films in sectors such as automotive, aerospace, and medical devices. These technological advancements are enhancing the versatility, cost-effectiveness, and commercial viability of high-performance films.

High Manufacturing Costs and Non-Biodegradability to Restrict Adoption

The production of high-performance films involves advanced polymers and chemicals, making manufacturing costly. Fluctuating prices of petroleum-based raw materials like naphtha also add instability to production costs, impacting profitability and access especially for small and medium enterprises (SMEs).

Many high-performance films are non-biodegradable and pose environmental disposal problems. Stricter environmental regulations globally, such as the EU’s Circular Economy Action Plan and bans on single-use plastics, require manufacturers to invest in sustainable and recyclable alternatives. Compliance with these regulations adds to operational complexity and cost.

Capital Intensive Nature of High-Performance Films Manufacturing Discourages New Players’ Entry

Manufacturing high-performance films demands technical expertise and capital-intensive processes. This restricts growth and entry of new players, especially smaller companies with limited R&D budgets. Extended product development lead times due to complexity also slow market responsiveness.

The market is highly competitive with ongoing demands for product innovation to meet diverse industrial standards, requiring continuous investment in research and development. Crude oil price fluctuations directly affect feedstock costs for films, adding uncertainty and potential cost increases.

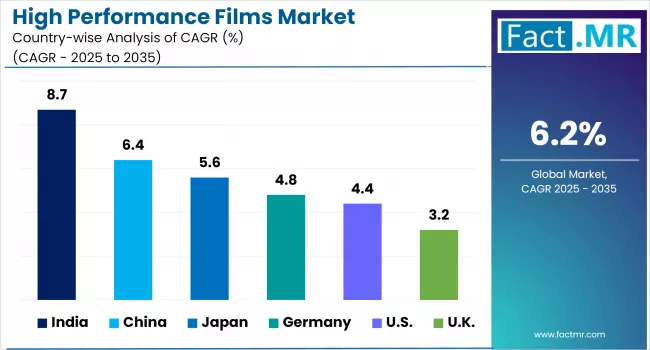

Top Regions in the High Performance Films Market

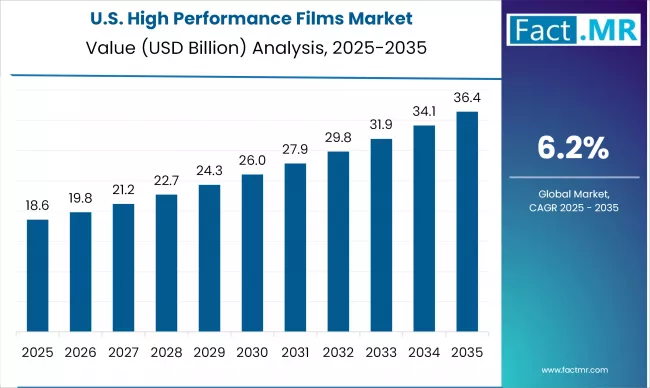

North America accounts for a significant portion of the high-performance films market, influenced by robust manufacturing and technological industries. Industries including aerospace, automotive, and electronics continuously pursue innovative films that provide durability, flexibility, and resistance to environmental factors, while adhering to regulatory standards. The increasing demand for advanced materials is driving market growth in the region.

Europe has developed into a lucrative market, driven by the increasing prevalence of online shopping and the demand for efficient, aesthetically pleasing packaging. High-performance films are essential in protective packaging due to their lightweight characteristics and excellent barrier properties against moisture, oxygen, and various contaminants.

The UK is experiencing significant growth attributed to its expanding electronics sector, where these films are utilized in displays, insulation layers, protective coatings, and flexible printed circuits.

Asia Pacific is an important investment hub, attributed to swift urbanization and infrastructure advancement. The demand for advanced building materials, such as energy-efficient glazing and protective coatings, is increasing in residential and commercial projects.

There is a significant demand for specialty films that provide thermal insulation, UV protection, and increased durability, especially in large-scale construction and modernization projects.

Country-Wise Outlook

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

| China | 6.4% |

| Japan | 5.6% |

Strong Packaging Demand and Cross-Sector Adoption Fuel Market Expansion in the United States

The U.S. high performance films market is expanding rapidly, driven by rising demand in the food and beverage packaging sector. These films deliver enhanced hygiene, extended shelf life, and tamper-proof features, making them integral to packaged and frozen food applications. Innovations in durability, barrier performance, and aesthetics further strengthen adoption.

In automotive, lightweight and durable films are increasingly deployed in interiors, windows, and electrical insulation to improve fuel efficiency and reduce emissions, supported by stringent fuel economy regulations.

In electronics, superior heat resistance and mechanical strength position these films as essential in flexible displays, touchscreens, printed circuit boards, and photovoltaic cells, benefiting from the rapid growth of solar PV and flexible electronics.

Healthcare adoption is rising due to their biocompatibility, barrier protection, and sterilization properties, ensuring product integrity and patient safety. Increased healthcare spending and ongoing medical device innovation sustain this trajectory.

- Packaging sector demand underpinned by hygiene, shelf life, and safety requirements.

- Automotive and electronics leveraging lightweight, durable, heat-resistant properties.

- Healthcare demand supported by biocompatibility and sterilization capabilities.

Automotive Sector Growth and Technological Advancements Drive Market Performance in China

China’s high performance films market is advancing on the back of robust automotive production, rising vehicle sales, and heightened preventive maintenance demand.

Expanding vehicle ownership has accelerated the need for modern, high-precision service equipment in repair and maintenance facilities. Adoption of advanced technologies such as automation, virtual reality, and optical imaging are improving service accuracy and efficiency.

The automotive aftermarket is undergoing transformation as stricter regulations, advanced vehicle designs, and evolving consumer expectations drive investments in next-generation equipment. Rising used vehicle sales and the need for pre-resale repairs are boosting demand for wheel and tire servicing solutions.

Strategic R&D investments and initiatives such as Smithers’ expansion of its Suzhou testing facilities position China as a global hub for automotive testing, innovation, and partnerships.

- Market growth fueled by automotive expansion and preventive maintenance demand.

- Technology adoption enhancing precision and efficiency in automotive servicing.

- R&D and facility investments reinforcing China’s position in global automotive testing.

Premium Tire Demand and Service Automation Support Steady Market Growth in Japan

Japan’s high performance films market benefits from sustained automotive output, strong demand for fuel-efficient and eco-friendly tires, and continuous advances in tire technology.

Growing vehicle ownership and preference for premium tires with enhanced safety and low rolling resistance drive robust replacement demand, especially for aging vehicles under strict safety compliance. Urban investments in advanced tire service infrastructure such as touchless and run-flat changers are elevating efficiency and service quality.

While high-profile partnerships have been limited in 2025, ongoing domestic innovation and long-standing international collaborations, such as Yokohama’s partnership with SCI Pneus in Brazil, continue to integrate Japan into global technical and supply chain ecosystems.

- Premium tire demand and safety compliance boosting replacement market growth.

- Urban facility upgrades driving adoption of automated tire service solutions.

- International partnerships reinforcing global integration and technical exchange.

Analyzing High Performance Films Market by Leading Segments

The high-performance films market is characterized by materials and types that integrate advanced functionality with sustainability, addressing the changing requirements of sectors including electronics, packaging, automotive, and healthcare. Ongoing advancements in material science and manufacturing techniques are leading to improvements in product durability, thermal stability, and barrier efficiency.

Polyester films represent the largest material share among the leading segments, attributed to their versatility and performance in electronic devices. In contrast, barrier films dominate by type, owing to their essential function in maintaining product integrity. Both segments are experiencing significant investment in recyclability, multi-functionality, and innovations tailored to specific applications to meet regulatory and consumer demands.

Polyester Films Dominant Material Choice Driven by Electronics and Wearable Tech

In 2025, polyester accounted for the largest share of the high performance films market. Its exceptional thermal stability and electrical insulation make it ideal for substrates in touchscreens, displays, and flexible circuits. Demand is accelerating with the rapid evolution of electronics, particularly the trend toward compact, high-functionality devices.

Wearable technology and consumer electronics are expanding the application scope of polyester films, ensuring sustained growth. Industry players are also diversifying offerings to address sustainability, recyclability, and enhanced properties like chemical resistance, biocompatibility, and thermal stability.

Recent developments include Cosmo Films’ launch of seven new specialty films in the U.S. in 2024, spanning PVC-free signage films, PETG shrink label films, CPP lamination films, heat-resistant laminates, and advanced labeling films, and Essen Speciality Films’ 2025 expansion into high-performance stocks for packaging, automotive, electronics, and medical markets.

- Polyester retains largest material share due to superior thermal and insulation properties.

- Growth driven by consumer electronics, wearable tech, and evolving display technologies.

- Product innovation focuses on sustainability, recyclability, and multifunctional properties.

Barrier Films Demand Underpinned by Packaging Shelf-Life Demands

Barrier films held the largest market share in 2025, valued for their ability to protect products from moisture, oxygen, and UV light—key to extending shelf life in food and beverage applications.

Innovations include metallic polyester ultra-high barrier films designed to replace aluminum foil in flexible packaging, offering superior oxygen/moisture protection (0.1 cc/m²-day & 0.1 g/m²-day), recyclability, reduced pinholes, and enhanced puncture resistance. These films streamline laminate structures, lowering complexity and cost while improving sustainability.

Advancements such as thermoformable barrier films with up to 18 layers and rigid high-barrier films for pharmaceuticals highlight their growing relevance in healthcare packaging, aligning with strict safety and product integrity standards.

- Barrier films are preferred due to superior protection and extended shelf life capabilities

- Next-gen designs replacing aluminum foil improve recyclability and reduce packaging complexity

- Increasing adoption in healthcare and pharmaceutical packaging for product safety

Competitive Analysis

BASF SE provides a wide selection of high-performance and specialty films that are specifically engineered to address the diverse requirements of a variety of industries, such as automotive, electronics, construction, and packaging.

These films are designed to exhibit exceptional qualities, including resistance to environmental factors, flexibility, and durability. The company's portfolio comprises polyamide (PA) films, polyethylene (PE) films, and other advanced polymer-based solutions that are tailored to specific applications that necessitate high barrier performance against gases and moisture.

Advanced technologies that enable features such as anti-fogging, UV protection, and anti-static properties are incorporated into specialty films offered by Clariant AG. These advancements render them appropriate for a diverse range of applications, including electronic devices that necessitate durable protective coatings and food packaging that extends its shelf life.

Key players in the market are Dow Chemical Company, The 3M Company, Solvay S.A., Covestro, Evonik, Honeywell International Inc., Amcor, Berry Global Group, American Durafilm Co., Eastman Chemical Company, DuPont and other players.

Recent Developments

- In May 2024, Clariant AG unveiled a range of innovative solutions at NPE 2024 to significantly reduce the environmental impact of plastics, particularly in specialty and high-performance films. These new offerings are designed to enhance the sustainability profile of plastic products while maintaining their performance characteristics.

- In January 2024, LANXESS launched a sustainability film highlighting its commitment to sustainable practices within the specialty and high-performance films sector. This film showcases how the company integrates sustainability into its production processes, emphasizing the development of innovative materials that meet high-performance standards and adhere to environmental regulations and sustainability goals.

Segmentation of High Performance Films Market

-

By Material :

- Polyester

- EVA

- Polyolefin

- Polyamide

- Fluoropolymer

- Other Materials

-

By Type :

- Barrier Films

- Safety & Security Films

- Decorative Films

- Microporous Films

- Other Types

-

By Application :

- Automotive

- Aerospace

- Electrical & Electronics

- Packaging

- Construction

- Other Applications

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Sq. M.) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Material

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Analysis By Material, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Sq. M.) Analysis and Forecast By Material, 2025-2035

- Polyester

- EVA

- Polyolefin

- Polyamide

- Fluoropolymer

- Other Materials

- Y-o-Y Growth Trend Analysis By Material, 2020-2024

- Absolute $ Opportunity Analysis By Material, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Analysis By Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Sq. M.) Analysis and Forecast By Type, 2025-2035

- Barrier Films

- Safety & Security Films

- Decorative Films

- Microporous Films

- Other Types

- Y-o-Y Growth Trend Analysis By Type, 2020-2024

- Absolute $ Opportunity Analysis By Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Sq. M.) Analysis and Forecast By Application, 2025-2035

- Automotive

- Aerospace

- Electrical & Electronics

- Packaging

- Construction

- Other Applications

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Sq. M.) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Sq. M.) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Sq. M.) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Material

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Material

- By Type

- By Application

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Bn) & Volume (Sq. M.)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- Value (USD Bn) & Volume (Sq. M.)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Material

- By Type

- By Application

- Value (USD Bn) & Volume (Sq. M.)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Material

- By Type

- By Application

- Competition Analysis

- Competition Deep Dive

- Rogers Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Saint-Gobain Performance Plastic

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- BASF SE

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Evonik Industries AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- SRF Limited, Polyplex Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Innovia Films

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Formosa Plastics Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- POLIFILM Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Rogers Corporation

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Sq. M.) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 4: Global Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 6: Global Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 8: Global Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 12: North America Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 14: North America Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 16: North America Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 20: Latin America Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 22: Latin America Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 24: Latin America Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 28: Western Europe Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 30: Western Europe Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 32: Western Europe Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: East Asia Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 36: East Asia Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 37: East Asia Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 38: East Asia Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 39: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 40: East Asia Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 41: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: South Asia Pacific Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 43: South Asia Pacific Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 44: South Asia Pacific Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 45: South Asia Pacific Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 46: South Asia Pacific Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 47: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 48: South Asia Pacific Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 52: Eastern Europe Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 54: Eastern Europe Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 56: Eastern Europe Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Volume (Sq. M.) Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 60: Middle East & Africa Market Volume (Sq. M.) Forecast by Material, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 62: Middle East & Africa Market Volume (Sq. M.) Forecast by Type, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 64: Middle East & Africa Market Volume (Sq. M.) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Sq. M.) Forecast 2020–2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020–2035

- Figure 4: Global Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 6: Global Market Attractiveness Analysis by Material

- Figure 7: Global Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 9: Global Market Attractiveness Analysis by Type

- Figure 10: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 12: Global Market Attractiveness Analysis by Application

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2025–2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2025–2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2025–2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2025–2035

- Figure 19: East Asia Market Incremental $ Opportunity, 2025–2035

- Figure 20: South Asia Pacific Market Incremental $ Opportunity, 2025–2035

- Figure 21: Eastern Europe Market Incremental $ Opportunity, 2025–2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2025–2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 26: North America Market Attractiveness Analysis by Material

- Figure 27: North America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 29: North America Market Attractiveness Analysis by Type

- Figure 30: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 32: North America Market Attractiveness Analysis by Application

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 36: Latin America Market Attractiveness Analysis by Material

- Figure 37: Latin America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 39: Latin America Market Attractiveness Analysis by Type

- Figure 40: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 42: Latin America Market Attractiveness Analysis by Application

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 46: Western Europe Market Attractiveness Analysis by Material

- Figure 47: Western Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 49: Western Europe Market Attractiveness Analysis by Type

- Figure 50: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 52: Western Europe Market Attractiveness Analysis by Application

- Figure 53: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: East Asia Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 55: East Asia Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 56: East Asia Market Attractiveness Analysis by Material

- Figure 57: East Asia Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 58: East Asia Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 59: East Asia Market Attractiveness Analysis by Type

- Figure 60: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 61: East Asia Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 62: East Asia Market Attractiveness Analysis by Application

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: South Asia Pacific Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 65: South Asia Pacific Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 66: South Asia Pacific Market Attractiveness Analysis by Material

- Figure 67: South Asia Pacific Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 68: South Asia Pacific Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 69: South Asia Pacific Market Attractiveness Analysis by Type

- Figure 70: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 71: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 72: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: Eastern Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 75: Eastern Europe Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 76: Eastern Europe Market Attractiveness Analysis by Material

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 78: Eastern Europe Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 79: Eastern Europe Market Attractiveness Analysis by Type

- Figure 80: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 81: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 82: Eastern Europe Market Attractiveness Analysis by Application

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Material, 2025–2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Material

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by Type, 2025–2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025–2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 93: Global Market – Tier Structure Analysis

- Figure 94: Global Market – Company Share Analysis

- FAQs -

What is the global high performance films market size in 2025?

The high-performance films market is valued at USD 51.3 billion in 2025

Who are the major players operating in the high performance films market?

Prominent players in the market include 3M Company, Solvay S.A., Covestro, Evonik, and Honeywell International Inc.

What is the estimated valuation of the high performance films market by 2035?

The market is expected to reach a valuation of USD 93.6 billion by 2035.

At what CAGR is the high performance films market slated to grow during the study period?

The growth rate of the high performance films market is 6.2% from 2025-2035.