Bag-in-Box Containers Market

Bag-in-Box Containers Market Size and Share Forecast Outlook 2025 to 2035

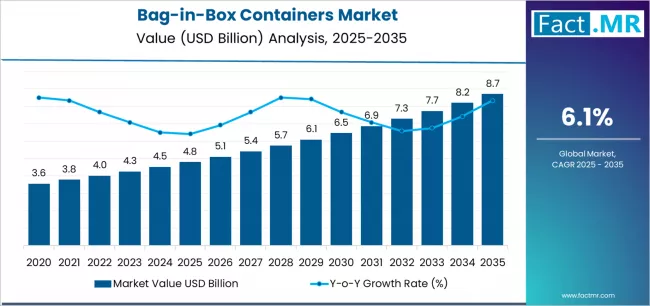

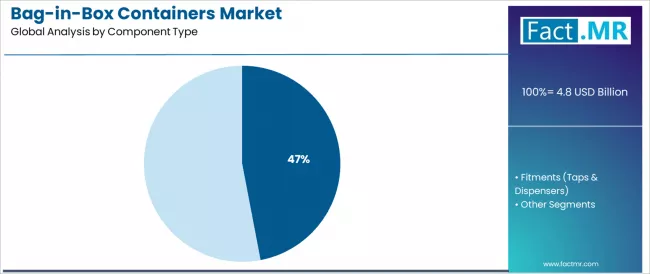

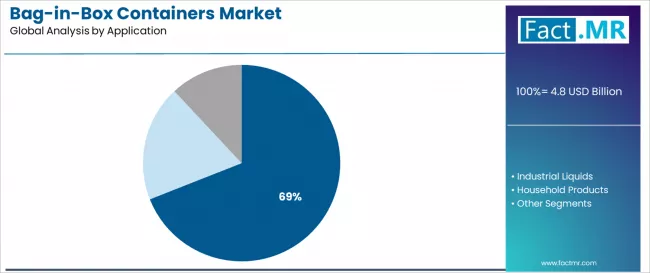

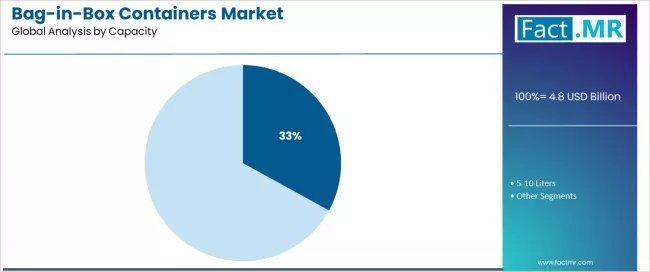

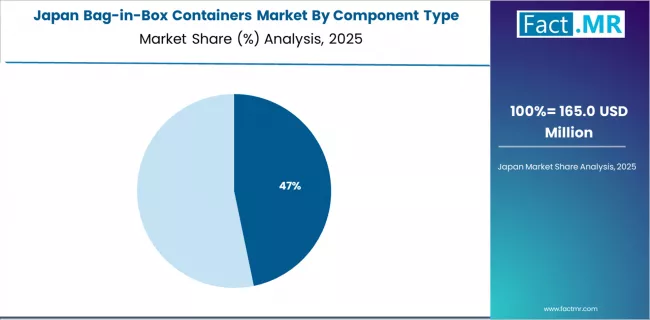

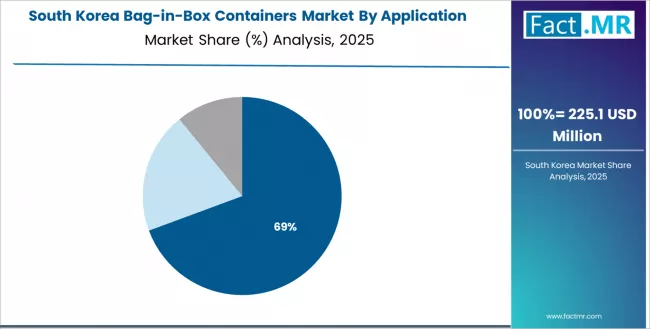

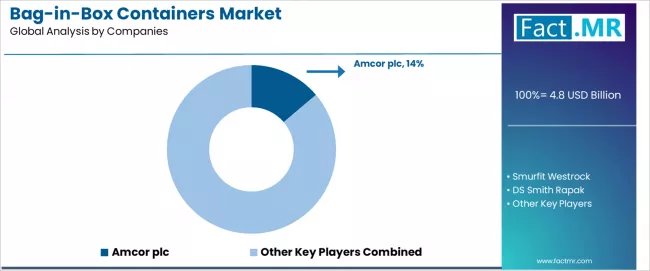

Bag-in-box containers market is projected to grow from USD 4.8 billion in 2025 to USD 8.7 billion by 2035, at a CAGR of 6.1%. Bags will dominate with a 47.0% market share, while food & beverages will lead the application segment with a 69.0% share.

Bag-in-Box Container Market Forecast and Outlook 2025 to 2035

The global bag-in-box container market is projected to reach USD 8.7 billion by 2035, recording an absolute increase of USD 3.9 billion over the forecast period. The market, valued at USD 4.8 billion in 2025, is expected to expand at a CAGR of 6.1% between 2025 and 2035.

Quick Stats for Bag-in-Box Containers Market

- Bag-in-Box Containers Market Value (2025): USD 4.8 billion

- Bag-in-Box Containers Market Forecast Value (2035): USD 8.7 billion

- Bag-in-Box Containers Market Forecast CAGR: 6.1%

- Leading Component in Bag-in-Box Containers Market: Bags

- Key Growth Regions in Bag-in-Box Containers Market: Asia Pacific, Europe, and North America

- Top Players in Bag-in-Box Containers Market: Amcor plc, Smurfit Westrock, DS Smith Rapak, SIG Combibloc, Sealed Air Corp., CDF Corporation, Aran Group, Optopack, Great Northern Corporation, BIBP sp. z o.o.

The market is anticipated to grow by nearly 1.8 times during the period, supported by rising consumer demand for sustainable packaging formats, longer product shelf-life, and cost-efficient liquid handling systems. Increasing emphasis on flexible packaging and eco-friendly materials continues to drive adoption across beverages, food ingredients, and industrial liquids, with multi-layer barrier films and advanced dispensing technologies gaining prominence in global supply chains.

Between 2025 and 2030, the bag-in-box container market is projected to expand from USD 4.8 billion to USD 6.5 billion, adding USD 1.7 billion in value and accounting for roughly 43.6% of the decade’s total growth. This phase will be defined by strong adoption within the wine, juice, and dairy sectors, where flexible liquid packaging solutions deliver measurable advantages in product preservation, reduced oxidation, and lower material costs.

The beverage industry’s shift toward space-efficient, recyclable, and lightweight packaging solutions will reinforce the growing preference for bag-in-box systems over rigid containers such as glass bottles or metal cans. Foodservice operators and hospitality businesses are also increasing their use of these containers due to lower spillage rates and simplified dispensing mechanisms. Improvements in multi-layer polyethylene film structures and fitment design will support better oxygen and light barriers, extending shelf stability across perishable beverages and sauces.

From 2030 to 2035, the market is forecast to grow from USD 6.5 billion to USD 8.7 billion, contributing USD 2.2 billion, or 56.4%, of the total ten-year expansion. This period will witness rapid advancements in film engineering, including the use of recyclable mono-material solutions, bio-based resins, and enhanced barrier coatings that reduce environmental impact without compromising performance. As circular economy policies gain traction in Europe and North America, manufacturers will increasingly align product design with recyclability and reusability standards.

Growth will also be driven by the premiumization of boxed beverages where improved design aesthetics and consumer convenience are helping to reposition bag-in-box formats as environmentally responsible alternatives to traditional packaging. Industrial applications such as liquid detergents, edible oils, and food concentrates will further diversify market opportunities, extending beyond consumer products into bulk transport and institutional supply chains.

Between 2020 and 2025, the bag-in-box container market experienced steady expansion, supported by sustainability initiatives, e-commerce growth, and the food and beverage sector’s pursuit of packaging cost reduction. The COVID-19 pandemic accelerated adoption in retail and at-home consumption channels as producers and distributors recognized the logistical advantages of lightweight, shelf-stable, and low-waste liquid packaging systems. Research and development during this period emphasized structural integrity, seal reliability, and tap precision, leading to improved consumer convenience and operational efficiency across the packaging process.

Bag-in-Box Containers Market Year-over-Year Forecast 2025 to 2035

Between 2025 and 2030, the bag-in-box containers market is projected to expand from USD 4.8 billion to USD 6.5 billion, resulting in a value increase of USD 1.7 billion, which represents 43.5% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for sustainable beverage packaging and foodservice dispensing solutions, product innovation in barrier film technologies and advanced fitment designs, as well as expanding integration with modern retail channels and e-commerce distribution platforms. Companies are establishing competitive positions through investment in multi-layer film development, aseptic filling capabilities, and strategic market expansion across wine applications, juice segments, and comprehensive liquid packaging programs.

From 2030 to 2035, the market is forecast to grow from USD 6.5 billion to USD 8.7 billion, adding another USD 2.2 billion, which constitutes 56.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized packaging innovations, including enhanced oxygen barrier systems and recyclable mono-material structures tailored for specific liquid products, strategic collaborations between film manufacturers and beverage brands, and an enhanced focus on circular economy practices and post-consumer recycling infrastructure. The growing emphasis on packaging sustainability and carbon footprint reduction will drive demand for validated bag-in-box solutions across diverse beverage categories.

Bag-in-Box Containers Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.8 billion |

| Market Forecast Value (2035) | USD 8.7 billion |

| Forecast CAGR (2025-2035) | 6.1% |

Why is the Bag-in-Box Containers Market Growing?

The bag-in-box containers market grows by enabling beverage producers, foodservice operators, and industrial liquid suppliers to access flexible packaging systems that support extended shelf-life while meeting sustainability requirements for reduced environmental impact.

Beverage manufacturers face mounting pressure to reduce packaging waste and transportation costs, with bag-in-box systems typically providing 80-90% less packaging material by weight compared to conventional rigid bottle alternatives, making these solutions essential for competitive positioning in sustainable packaging categories.

The liquid packaging industry's need for versatile applications and product protection compatibility creates demand for diverse bag-in-box configurations that can provide superior oxygen barrier properties, maintain consistent dispensing performance across different storage conditions, and ensure food safety standards without compromising product quality or brand presentation.

Government initiatives promoting circular economy principles and plastic waste reduction drive adoption in beverage packaging, industrial chemicals, and household products, where bag-in-box utilization has a direct impact on carbon footprint reduction and resource efficiency outcomes.

The foodservice industry's growing focus on bulk dispensing and portion control further expands market opportunities, with operational validation demonstrating measurable improvements in product waste reduction, storage space optimization, and handling efficiency following bag-in-box implementation.

Consumer perception challenges in premium segments and equipment investment requirements may limit accessibility among smaller beverage producers and developing regions with limited infrastructure for aseptic filling operations and specialized packaging equipment.

Segmental Analysis

The market is segmented by component type, application, capacity, and region. By component type, the market is divided into bags and fitments (taps & dispensers). Based on application, the market is categorized into food & beverages, industrial liquids, and household products. By capacity, the market includes 1-5 liters and 5-10 liters. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

By Component Type, why do Bags Command the Dominant Market Position?

The bags segment represents the dominant force in the bag-in-box containers market, capturing approximately 47.0% of total market share in 2025. This established component category encompasses solutions featuring multi-layer polyethylene and EVOH barrier films for liquid containment that enable effective product protection across all beverage and industrial applications. The bags segment's market leadership stems from its critical functional role, with products capable of meeting diverse barrier requirements while maintaining high flexibility and operational compatibility across all filling environments.

The bag components offer sophisticated multi-layer structures combining polyethylene, ethylene vinyl alcohol (EVOH), and metallized films that provide oxygen barrier protection, moisture resistance, and mechanical strength for various liquid products. These materials support applications ranging from ambient-stable wines to aseptic fruit juices, ensuring product integrity throughout distribution and storage cycles. The bags segment benefits from continuous innovation in sustainable materials, including recyclable mono-material structures and bio-based polymer alternatives that address environmental concerns.

The fitments (taps & dispensers) segment accounts for approximately 19.3% of the market, serving beverage and foodservice operations requiring controlled dispensing functionality with user-friendly operation for consumer and commercial applications. This segment demonstrates the fastest growth with a CAGR of 7.3% through 2035, driven by expanding adoption in beverage dispensing systems and foodservice bulk liquid handling requiring precise portion control and contamination prevention.

Key advantages driving the bags segment include:

- Advanced barrier technology with multi-layer film structures that prevent oxygen ingress and ensure extended shelf-life for sensitive liquid products

- Flexible packaging efficiency allowing significant volume reduction when empty, minimizing waste disposal costs and environmental impact

- Proven food safety compatibility, delivering reliable product protection while maintaining regulatory compliance across international markets

- Broad material availability enabling cost-effective production and customization for different liquid product requirements across multiple application jurisdictions

By Application, How Does Food & Beverages Dominate Market Utilization?

Food & beverages dominates the application segment with approximately 69.0% market share in 2025, reflecting the critical role of bag-in-box packaging in supporting global beverage distribution and foodservice operations worldwide. The food & beverages segment's market leadership is reinforced by sustainability advantages over rigid packaging, extended shelf-life capabilities maintaining product freshness, and rising consumer acceptance of boxed wine and juice formats across developed and emerging consumer markets.

Within the food & beverages segment, wine & juices represent 32.5% of total market share, driven by consumer appreciation for maintained freshness up to 6 weeks after opening and growing acceptance of premium boxed wine formats in Europe and Nordic countries. This subsegment benefits from expanding retail distribution, comprehensive sustainability messaging, and convenient dispensing features that meet consumer lifestyle requirements and reduce product waste in household consumption patterns.

The industrial liquids segment represents significant market presence, capturing 18.0% market share through lubricant packaging, chemical distribution, and bulk liquid handling applications. Within this segment, lubricants & oils account for 8.6% of total market share, serving automotive and industrial maintenance operations requiring contamination-free storage and dispensing. Household products maintain 13.0% market share through cleaner and detergent packaging, with cleaners & detergents representing 6.4% of total market share serving residential and commercial cleaning operations.

Key market dynamics supporting application growth include:

- Food & beverage expansion driven by sustainable packaging trends and premium boxed wine adoption, requiring certified food-grade materials in commercial operations

- Industrial liquid modernization trends require high-quality barrier films for contamination prevention consistency and product stability compliance

- Integration of dispensing technologies enabling portion control and comprehensive product protection solutions

- Growing emphasis on sustainability driving demand for comprehensive recyclable packaging systems

By Capacity, What Drives the 1-5 Liters Segment's Market Leadership?

The 1-5 liters capacity segment dominates with approximately 33.0% market share in 2025, reflecting strong consumer preference for household-sized portions and retail distribution requirements across wine, juice, and beverage categories. This capacity range serves the critical retail and household consumption segment, where convenient size formats enable manageable storage, reasonable consumption timeframes, and accessible pricing points for mass-market adoption.

The 1-5 liters formats offer optimal balance between product freshness duration and consumer usage patterns, typically supporting 4-6 week consumption periods for wine products while maintaining quality characteristics. These sizes benefit from established retail shelf positioning, standardized distribution logistics, and consumer familiarity that reduces adoption barriers in premium beverage categories.

The 5-10 liters segment accounts for approximately 21.0% market share, serving foodservice operations, hospitality establishments, and commercial dispensing applications requiring bulk liquid handling with controlled portion delivery. This segment demonstrates the fastest capacity growth with a CAGR of 6.6% through 2035, driven by expanding foodservice infrastructure, restaurant chain standardization, and institutional catering operations demanding cost-effective bulk beverage solutions.

Key market dynamics supporting capacity growth include:

- Household format expansion driven by retail wine and juice adoption, requiring convenient packaging in consumer-friendly sizes

- Foodservice bulk packaging trends require cost-effective large-format solutions for operational efficiency and waste reduction

- Integration of dispensing technologies enabling precise portion control across different capacity ranges

- Growing emphasis on format diversity driving demand for comprehensive size portfolios serving multiple distribution channels

What are the Drivers, Restraints, and Key Trends of the Bag-in-Box Containers Market?

The market is driven by three concrete demand factors tied to sustainability and operational efficiency. First, increasing environmental consciousness and plastic waste reduction initiatives create growing demand for bag-in-box packaging, with global beverage brands implementing sustainability commitments targeting 30-50% reduction in packaging materials by 2030, requiring comprehensive alternative packaging infrastructure. Second, foodservice industry expansion and bulk dispensing requirements drive increased adoption of bag-in-box systems, with many restaurant chains and hospitality operators implementing standardized beverage programs for cost optimization and waste reduction. Third, technological advancements in barrier film technologies and aseptic filling processes enable more effective and longer-lasting product protection that extends shelf-life capabilities while improving oxygen barrier performance and recyclability characteristics.

Market restraints include consumer perception challenges in premium wine segments that can limit brand adoption, particularly in regions where traditional glass bottle packaging maintains strong quality associations and heritage positioning. Initial capital investment requirements for filling equipment pose another significant barrier, as aseptic bag-in-box filling lines demand specialized machinery and validation protocols, potentially causing financial constraints for smaller beverage producers. Competition from alternative flexible packaging formats creates additional market challenges for universal adoption, demanding ongoing investment in consumer education programs and total cost-of-ownership demonstrations.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China and India, where expanding modern retail infrastructure and growing middle-class consumption drive comprehensive bag-in-box packaging adoption. Technology integration trends toward recyclable mono-material structures with maintained barrier performance, smart dispensing systems with digital tracking, and post-consumer recycling infrastructure enable sustainable packaging approaches that optimize environmental impact while maintaining product protection. However, the market thesis could face disruption if significant advances in alternative sustainable packaging technologies or major breakthroughs in biodegradable rigid containerss reduce reliance on flexible bag-in-box systems.

Analysis of the Bag-in-Box Containers Market by Key Country

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.7% |

| India | 6.5% |

| USA | 6.1% |

| Brazil | 6.2% |

| Germany | 6.0% |

| UK | 5.9% |

| Japan | 5.7% |

The bag-in-box containers market is expanding steadily, with China leading at a 6.7% CAGR through 2035, driven by growth in dairy and juice packaging applications, modern retail expansion, and urbanization supporting convenient liquid packaging formats. India follows at 6.5%, supported by adoption in edible oil and syrup segments, cost-efficient packaging advantages, and expanding organized retail infrastructure.

The USA posts 6.1%, anchored by expansion in boxed wine categories and cold-brew coffee products, ready-to-drink beverage innovation, and established foodservice distribution networks. Brazil records 6.2%, reflecting beverage industry growth, industrial lubricant packaging uptake, and increasing sustainability awareness among consumer brands.

Germany grows at 6.0%, with wine packaging tradition and foodservice demand, recycling infrastructure supporting circular economy initiatives, and premium beverage segment adoption. The UK advances at 5.9%, emphasizing sustainable wine packaging preferences and environmental regulations favoring reduced packaging waste, expanding premium boxed wine acceptance, while Japan grows steadily at 5.7%, focusing on premium non-alcoholic beverage packaging and space-saving urban packaging solutions, sophisticated consumer quality standards.

Why does China Lead in the Bag-in-Box Containers Market?

China demonstrates the strongest growth potential in the bag-in-box containers market with a CAGR of 6.7% through 2035. The country's leadership position stems from rapid growth in dairy and juice packaging applications serving expanding middle-class consumption, modern retail expansion creating distribution channels for innovative packaging formats, and urbanization supporting convenient liquid storage solutions.

Growth is concentrated in major metropolitan centers, including Shanghai, Beijing, Guangzhou, and Shenzhen, where modern retail chains and foodservice establishments are implementing bag-in-box systems for enhanced operational efficiency and sustainability positioning.

Distribution channels through supermarket chains, convenience store networks, and e-commerce platforms expand deployment across beverage brands and foodservice operators. The country's focus on food safety and quality control provides indirect support for advanced packaging adoption, including barrier film technologies.

Key market factors:

- Consumer demand concentrated in urban centers with modern retail infrastructure and quality-conscious purchasing behavior

- Manufacturing capacity expansion through domestic film producers and packaging converters providing local supply capabilities

- Comprehensive distribution ecosystem, including cold chain logistics with proven temperature-controlled capabilities

- Technology integration featuring advanced filling equipment, quality monitoring systems, and traceability technologies

Why does India emerge as a High Growth Market for Bag-in-Box Containers?

In Mumbai, Delhi, Bangalore, and Hyderabad, the adoption of bag-in-box packaging is accelerating across edible oil distribution and beverage segments, driven by cost efficiency advantages and expanding organized retail penetration. The market demonstrates strong growth momentum with a CAGR of 6.5% through 2035, linked to edible oil and syrup packaging adoption, cost-efficient packaging benefits supporting price-sensitive markets, and increasing modern retail infrastructure enabling premium packaging format distribution.

Indian manufacturers are implementing bag-in-box systems for cooking oil distribution and industrial liquid handling to enhance supply chain efficiency while meeting growing demand in expanding urban demographics and competitive food sectors. The country's focus on reducing packaging waste creates demand for sustainable alternatives, while increasing emphasis on food safety drives adoption of hygienic packaging systems.

Key development areas:

- Edible oil brands and beverage companies leading bag-in-box adoption with comprehensive distribution programs

- Cost advantages providing competitive positioning with locally produced film materials and packaging systems

- Technology partnerships between international packaging suppliers and Indian converters are expanding market capabilities

- Integration of retail distribution and comprehensive consumer education initiatives

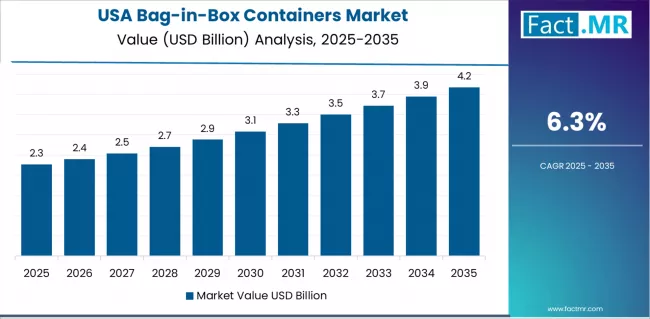

What are the Prospects for Bag-in-Box Container Sales in USA?

The USA’s market leads in bag-in-box innovation based on integration with premium beverage categories and established foodservice distribution systems. The country shows strong potential with a CAGR of 6.1% through 2035, driven by expansion in boxed wine segments and cold-brew coffee products, ready-to-drink beverage innovation, and the establishment of comprehensive foodservice supply networks in major commercial centers, including New York, Los Angeles, Chicago, and San Francisco.

American beverage brands are adopting bag-in-box systems for brand differentiation and sustainability messaging, particularly in regions with environmentally conscious consumers and specialized retail channels demanding comprehensive quality standards. Technology deployment channels through established packaging distributors and filling equipment manufacturers expand coverage across craft beverage producers and foodservice-focused operators.

Leading market segments:

- Wine producers and beverage brands implementing bag-in-box formats with integrated sustainability programs

- Foodservice distributors with packaging suppliers, achieving operational efficiency through standardized bulk systems

- Strategic collaborations between film manufacturers and beverage companies are expanding format innovation

- Focus on premium positioning and comprehensive consumer education requirements

How will the Bag-in-Box Containers Market Perform in Brazil?

Brazil's market expansion is driven by diverse application demand, including beverage packaging in São Paulo and Rio de Janeiro, and industrial liquid distribution across multiple regions. The country demonstrates promising growth potential with a CAGR of 6.2% through 2035, supported by beverage industry growth including juice and wine segments, industrial lubricant packaging adoption, and increasing sustainability awareness among consumer-facing brands.

Brazilian manufacturers face implementation challenges related to filling equipment availability and technical expertise requirements, requiring local converter development and support from international packaging suppliers. However, growing environmental consciousness and operational cost pressures create compelling business cases for bag-in-box adoption, particularly in beverage markets where packaging efficiency has a direct impact on total cost competitiveness.

Market characteristics:

- Beverage and industrial liquid sectors showing coordinated growth with expanding bag-in-box specifications

- Regional expansion trends focused on major metropolitan areas and industrial manufacturing zones

- Future projections indicate the need for filling infrastructure development and technical training programs

- Growing emphasis on sustainable packaging and cost-effective distribution methodologies

How will Wine Packaging Generate Bag-in-Box Containers Demand in Germany?

The German market leads in wine bag-in-box adoption based on integration with established wine consumption culture and comprehensive recycling infrastructure supporting circular economy principles. The country shows strong potential with a CAGR of 6.0% through 2035, driven by wine packaging tradition embracing sustainable formats, foodservice demand requiring bulk beverage solutions, and recycling infrastructure enabling post-consumer material recovery in major commercial centers, including Berlin, Munich, Hamburg, and Frankfurt.

German consumers are adopting premium boxed wines for everyday consumption and sustainability optimization, particularly in regions with strong environmental awareness and specialized retail channels demanding comprehensive quality certifications. Technology deployment channels through established wine distributors and foodservice suppliers expand coverage across retail wine brands and hospitality-focused operators.

Leading market segments:

- Wine producers and retailers implementing bag-in-box formats with integrated quality positioning

- Foodservice operations with packaging suppliers, achieving sustainability targets through reduced packaging waste

- Strategic collaborations between packaging manufacturers and beverage brands are expanding premium format development

- Focus on recyclability and comprehensive lifecycle assessment requirements

Will Adoption of Sustainable Packaging Solutions in the UK enhance Sales of Bag-in-Box Containers?

The UK's bag-in-box containers market demonstrates comprehensive sustainability focus aligned with environmental regulations and consumer preference shifts toward reduced packaging waste.

The country maintains steady growth momentum with a CAGR of 5.9% through 2035, driven by sustainable wine packaging preferences expanding beyond economy segments, environmental regulations favoring reduced packaging materials, and growing premium boxed wine acceptance challenging traditional quality perceptions.

Major retail markets, including London, Manchester, Birmingham, and Edinburgh, showcase advanced deployment of bag-in-box wines where brands integrate seamlessly with existing distribution channels and comprehensive sustainability messaging programs.

Key market characteristics:

- Retail wine brands and sustainability-focused producers driving bag-in-box adoption with emphasis on environmental benefits

- Regulatory frameworks enabling favorable positioning for reduced-waste packaging systems

- Technology collaboration between UK wine brands and international packaging manufacturers is expanding format capabilities

- Emphasis on consumer education and comprehensive quality assurance methodologies

What is the Bag-in-Box Containers Market Outlook in Japan?

Japan's bag-in-box containers market demonstrates sophisticated quality standards and space-efficiency focus, characterized by advanced adoption in premium non-alcoholic beverages and urban retail environments across Tokyo, Osaka, Yokohama, and Nagoya metropolitan regions.

The country shows steady growth momentum with a CAGR of 5.7% through 2035, driven by premium non-alcoholic beverage packaging including specialty teas and coffee products, space-saving urban packaging solutions addressing limited storage capacity, and sophisticated consumer quality expectations requiring validated barrier performance.

Japan's emphasis on product freshness and convenience creates requirements for high-performance bag-in-box systems that support comprehensive quality initiatives and food safety requirements in retail operations.

The market benefits from strong relationships between international packaging manufacturers and domestic beverage brands, creating comprehensive packaging ecosystems that prioritize barrier performance and dispensing reliability. Retail operations in major urban regions showcase advanced bag-in-box implementations where products achieve premium positioning through integrated quality programs.

Key market characteristics:

- Premium beverage brands and specialty retailers driving high-quality bag-in-box requirements with emphasis on barrier performance

- Quality validation systems enabling comprehensive shelf-life testing with documented freshness metrics

- Technology collaboration between Japanese beverage companies and international packaging manufacturers is expanding format capabilities

- Emphasis on space efficiency and continuous product innovation methodologies

How does Modern Retail Integration Open Avenues for Bag-in-Box Containers Market Expansion in South Korea?

South Korea's bag-in-box containers market reflects advanced retail infrastructure and sophisticated consumer preferences, with comprehensive convenience store networks in Seoul, Busan, and Incheon offering innovative beverage packaging formats. The market benefits from strong modern retail penetration, extensive cold chain logistics capabilities, and growing sustainability awareness among urban consumers.

South Korean retailers demonstrate advanced merchandising strategies with premium boxed beverage positioning, integrated cold storage systems, and comprehensive product rotation protocols that optimize freshness. The country serves as a regional innovation testing ground for new bag-in-box formats, with beverage brands collaborating closely with packaging suppliers to develop optimized barrier systems for specific product categories and consumption occasions.

Europe Market Split by Country

The bag-in-box containers market in Europe is projected to grow from USD 483.8 million in Germany in 2025, maintaining a 28.0% market share, supported by its extensive wine production infrastructure, advanced foodservice networks, and comprehensive recycling systems serving major European beverage markets.

The UK follows with USD 345.6 million and a 20.0% share in 2025, driven by comprehensive sustainable packaging initiatives in major retail regions implementing advanced boxed wine format adoption. France holds USD 259.2 million with a 15.0% share through the ongoing development of wine packaging innovation and foodservice distribution networks.

Italy commands USD 207.4 million with a 12.0% share, while Spain accounts for USD 155.5 million with a 9.0% share in 2025. The rest of Europe maintains USD 276.5 million with a 16.0% collective share, attributed to increasing bag-in-box adoption in Nordic countries and emerging Eastern European beverage markets implementing comprehensive sustainable packaging programs.

Competitive Landscape of the Bag-in-Box Containers Market

The bag-in-box containers market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 36-38% of global market share through established product portfolios and extensive beverage industry relationships. Competition centers on barrier technology innovation, filling system integration, and sustainability credentials rather than price competition alone.

Market leaders include Amcor plc, Smurfit Westrock, and DS Smith Rapak, which maintain competitive advantages through comprehensive bag-in-box solution portfolios, global manufacturing capabilities, and deep expertise in the flexible packaging and barrier film sectors, creating high switching costs for beverage producers.

These companies leverage established brand relationships and ongoing technical support services to defend market positions while expanding into adjacent sustainable packaging applications and advanced fitment technologies.

Amcor plc holds the highest global market share at approximately 13.8% in 2025, reinforced by its barrier film innovation leadership and multi-layer bag system development, demonstrating strong technical capabilities and comprehensive product portfolio breadth.

Challengers encompass SIG Combibloc and Sealed Air Corp., which compete through integrated dispensing system technologies and food safety packaging expertise in key beverage markets. Specialized packaging manufacturers, including CDF Corporation, Aran Group, and Optopack, focus on specific application segments or regional markets, offering differentiated capabilities in custom liquid packaging, industrial bulk systems, and specialized wine dispensing solutions for competitive positioning.

Regional players and emerging packaging converters create competitive pressure through innovative material approaches and rapid market deployment capabilities, particularly in high-growth markets including China and India, where local manufacturing capabilities provide advantages in cost positioning and supply chain responsiveness.

Market dynamics favor companies that combine advanced barrier film technology expertise with comprehensive filling equipment support programs that address the complete packaging lifecycle from material selection through filling optimization and end-of-life recyclability. Smurfit Westrock's PowerGrip BiB line and DS Smith Rapak's circular packaging design initiatives exemplify the industry trend toward sustainable innovation and integrated system solutions.

Key Players in the Bag-in-Box Containers Market

- Amcor plc

- Smurfit Westrock

- DS Smith Rapak

- SIG Combibloc

- Sealed Air Corp.

- CDF Corporation

- Aran Group

- Optopack

- Great Northern Corporation

- BIBP sp. z o.o.

- Scholle IPN

- Liqui-Box

- Vine Valley Ventures LLC

- TPS Rental Systems

- International Paper Company

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Value (USD Million)s | USD 4.8 Billion |

| Component Type | Bags, Fitments (Taps & Dispensers) |

| Application | Food & Beverages, Industrial Liquids, Household Products |

| Capacity | 1-5 Liters, 5-10 Liters |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, USA, Brazil, Germany, UK, Japan, South Korea, and 40+ countries |

| Key Companies Profiled | Amcor plc, Smurfit Westrock, DS Smith Rapak, SIG Combibloc, Sealed Air Corp., CDF Corporation, Aran Group, Optopack, Great Northern Corporation, BIBP sp. z o.o. |

| Additional Attributes | Dollar sales by component type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with flexible packaging manufacturers and barrier film producers, material specification requirements and filling equipment protocols, integration with beverage distribution networks and foodservice operations. |

Bag-in-Box Containers Market by Segments

-

Component Type :

- Bags

- Fitments (Taps & Dispensers)

-

Application :

- Food & Beverages

- Wine & Juices

- Other Food & Beverage Applications

- Industrial Liquids

- Lubricants & Oils

- Other Industrial Applications

- Household Products

- Cleaners & Detergents

- Other Household Applications

- Food & Beverages

-

Capacity :

- 1-5 Liters

- 5-10 Liters

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

- North America

- USA

- Canada

- Mexico

- Latin America

- Brazil

- Chile

- Rest of Latin America

- Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Union

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Component Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Component Type, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Component Type, 2025 to 2035

- Bags

- Fitments (Taps & Dispensers)

- Y to o to Y Growth Trend Analysis By Component Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Component Type, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- Food & Beverages

- Industrial Liquids

- Household Products

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Capacity

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Capacity, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Capacity, 2025 to 2035

- 1-5 Liters

- 5-10 Liters

- Y to o to Y Growth Trend Analysis By Capacity, 2020 to 2024

- Absolute $ Opportunity Analysis By Capacity, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Component Type

- By Application

- By Capacity

- By Country

- Market Attractiveness Analysis

- By Country

- By Component Type

- By Application

- By Capacity

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Component Type

- By Application

- By Capacity

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Component Type

- By Application

- By Capacity

- Competition Analysis

- Competition Deep Dive

- Amcor plc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Smurfit Westrock

- DS Smith Rapak

- SIG Combibloc

- Sealed Air Corp.

- CDF Corporation

- Aran Group

- Optopack

- Great Northern Corporation

- BIBP sp. z o.o.

- Scholle IPN

- Liqui-Box

- Vine Valley Ventures LLC

- TPS Rental Systems

- International Paper Company

- Amcor plc

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Capacity, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Component Type, 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Capacity, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020 to 2035

- Figure 3: Global Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 5: Global Market Attractiveness Analysis by Component Type

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 11: Global Market Attractiveness Analysis by Capacity

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025 to 2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 25: North America Market Attractiveness Analysis by Component Type

- Figure 26: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 28: North America Market Attractiveness Analysis by Application

- Figure 29: North America Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 31: North America Market Attractiveness Analysis by Capacity

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 35: Latin America Market Attractiveness Analysis by Component Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 38: Latin America Market Attractiveness Analysis by Application

- Figure 39: Latin America Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 41: Latin America Market Attractiveness Analysis by Capacity

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 45: Western Europe Market Attractiveness Analysis by Component Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 48: Western Europe Market Attractiveness Analysis by Application

- Figure 49: Western Europe Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 51: Western Europe Market Attractiveness Analysis by Capacity

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Component Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Application

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Capacity

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 65: East Asia Market Attractiveness Analysis by Component Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 68: East Asia Market Attractiveness Analysis by Application

- Figure 69: East Asia Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 71: East Asia Market Attractiveness Analysis by Capacity

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Component Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Capacity

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Component Type, 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Component Type, 2025 to 2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Component Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025 to 2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Capacity, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Capacity, 2025 to 2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Capacity

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the bag-in-box containers market in 2025?

The global bag-in-box containers market is estimated to be valued at USD 4.8 billion in 2025.

What will be the size of bag-in-box containers market in 2035?

The market size for the bag-in-box containers market is projected to reach USD 8.7 billion by 2035.

How much will be the bag-in-box containers market growth between 2025 and 2035?

The bag-in-box containers market is expected to grow at a 6.1% CAGR between 2025 and 2035.

What are the key product types in the bag-in-box containers market?

The key product types in bag-in-box containers market are bags and fitments (taps & dispensers).

Which application segment to contribute significant share in the bag-in-box containers market in 2025?

In terms of application, food & beverages segment to command 69.0% share in the bag-in-box containers market in 2025.