U.S. Ductile Iron Pipes Market

U.S. Ductile Iron Pipes Market Analysis, By Diameter (DN 100–300, DN 350–1000, DN 1000 & Above), By Joint Type, By Application, By Sales Channel, By External Protection, and Region - Market Insights 2025 to 2035

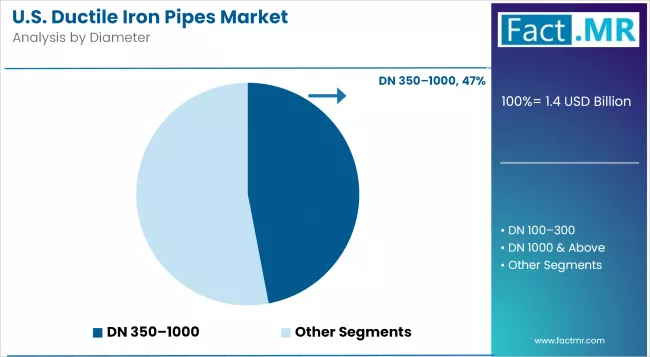

The DN 350–1000 Segment Is Projected To Grow At A CAGR Of 5.4%, Whereas Another Segment DN 1000 & Above Based Is Likely To Grow At 4.7%. In Terms Of States Texas Is Projected To Grow At 4.1%, Followed By California 3.8% And New York To Grow At 3.5%

U.S. Ductile Iron Pipes Market Outlook 2025 to 2035

The global U.S. ductile iron pipes market is expected to reach USD 2.2 billion by 2035, up from USD 1.4 billion in 2025. During the forecast period 2025 to 2035, the industry is projected to expand at a CAGR of 4.7%.

The U.S. ductile iron pipes market is driven by the factors of increasing urbanization, recent growth of the water infrastructure, and restoration of the old/aging pipelines. Their advantage is that they are strong, durable, and very anti-corrosive, hence suitable in municipal water and wastewater pipes. Moreover, the growing rates of investments towards smart water management and strict environmental demands are promoting demands in terms of durability and sustainability of the piping solutions.

Quick Stats for U.S. Ductile Iron Pipes Market

- Industry Value (2025): USD 1.4 Billion

- Projected Value (2035): USD 2.2 Billion

- Forecast CAGR (2025 to 2035): 4.7%

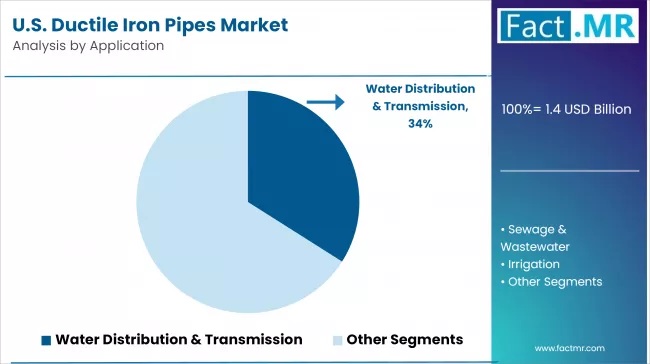

- Leading Segment (2025): Water Distribution & Transmission (34% Market Share)

- Fastest Growing Country (2025-2035): Texas (4.1% CAGR)

- Top Key Players: U.S. Pipe, AMERICAN Cast Iron Pipe Company, Saint-Gobain PAM, Jindal SAW Ltd., and Tata Metaliks

What are the drivers of the U.S. Ductile Iron Pipes Market?

U.S. ductile iron pipes market has been witnessing stable gains on a combination of pipeline renewal and water conservation strategies and regulatory requirements of sustainable city building. Increasing investments in wastewater and water pipelines rehabilitation in municipalities are being motivated by the old out-of-date infrastructure and requirements on corrosion-free long-handed materials.

Recyclability, its high strength, as well as impact resistance provides the ductile iron as a good alternative to the traditional materials. The move to smart cities and data driven utility networks is influencing the use of ductile iron pipes with monitoring technologies that enable detection of leaks and optimum flow.

In addition, increasing inspection of pipeline safety criteria and federal budgetary programs under initiatives such as the Infrastructure Investment and Jobs Act (IIJA) are hastening the purchasing process and the provision of an updated network of water systems in society.

What are the regional trends of the U.S. Ductile Iron Pipes Market?

The American market of ductile iron pipes provides high demand in the regions due to regulations related to infrastructure restoration, climate-resistant, and water quality. States with highly urbanized areas like California, Texas and New York are leading the way in replacing cast iron and asbestos cement pipe systems with ductile iron to allow better service life and reduced life cycle costs.

Areas of Midwest are also adopting ductile iron to enhance supplying of water in the rural areas with entire extensively the storm water resistance to flooding in the riskiest areas. Suburban sprawl and population growth are driving water distribution network installations in the Southeast, and the utilities in the Pacific Northwest are incorporating seismic-resistant ductile iron pipes in the high-earthquake-prone locales. In a national water management practice on water boards and public utilities, settings are getting harmonized with the standards of EPA and AWWA to adopt corrosion and environmentally friendly solutions of pipes.

What are the challenges and restraining factors of the U.S. Ductile Iron Pipes Market?

The U.S. ductile iron pipes market is affected by the main prohibitive factors that revolve around the complexities of installation, weight, and costs of procurement in comparison with other substitute products such as PVC or HDPE. More transportation and labor costs are incurred due to the expensive material making it unsuitable in small scale projects or even some remotely located projects. As well, access to the well-trained workforces in the conventional jointing and trenching techniques is increasingly a challenge to execution.

There are also regulatory barriers to the adoption of trenchless technology and permitting which delay the replacement timelines. The implications of the manufacturing processes, being energy intensive in nature, and carbon emissions add pressure on the sector to severe greener manufacturing processes. Fragmentation between local utility procurement processes and regional specification variations compound the task of nationwide standardization resulting in inconsistent demand cycles. These structural issues need to be dealt with in order to enjoy all the full lifecycle and performance advantages of ductile iron pipelines.

State-Wise Insights

| States | CAGR (2025 to 2035) |

|---|---|

| Texas | 4.1% |

| California | 3.8% |

| New York | 3.5% |

New York serves as a Northeast hub for resilient pipe infrastructure

Comprehensive water works and continued rehabilitation within the state have established a long-term demand of the ductile iron piping solutions. The manufacturing potential in New York has the advantage of the presence of industrial corridors and the access to the stream of material recycling with the support of the state.

Urban water network congestion and infrastructure age determine replacement initiatives in municipal infrastructure. Tactical transportation routing and port support facilitates efficient distribution throughout the Northeast region. The environmental policies and infrastructure investment planning of New York include the introduction of long-lasting pipeline materials.

The long term management of water system infrastructure and the emphasis of resilience incorporated into the state goals is a factor in encouraging the continuation of the use of ductile iron pipe products in the upgrading and large rehabilitation projects.

California A National Leader in Sustainable Ductile Iron Pipe Infrastructure

The presence of water infrastructure program and environmental regulations in California is supportive to its position in ductile iron pipe markets. The agencies that manage water in this state are keen on putting in place sustainable, long-lasting piping systems in both municipal and agricultural use. The market conditions of California in manufacturing capacity are encouraged by well-established industrial areas and the availability of recycled materials by the state-based recycling programs.

In California, long-term pipe replacement programs are being undertaken by the public water agencies especially in the urban systems which are aging. Efficient transport of materials is enabled by the freight network and port infrastructure facilities of the state. The adoption of resilient water infrastructure by the state of California is connected to climate resiliency efforts in the state, which is why high-performance ductile iron pipes that must achieve high environmental standards in California is a continuously-growing market.

Texas drives high ductile iron pipe demand through rapid infrastructure growth

Texas is amongst the greatest end use markets of ductile iron pipes in the U.S because of the high rate of urbanization, infrastructure development, and modernization of water supply and wastewater facilities. Though primary manufacturing foundries are few in the state, it sells and uses a lot of pipes. The regional demand is tied to continuous municipal renovations particularly in the cities having outdated infrastructure.

The landscape and weather conditions demand corrosion-resistant and long-lasting piping expertise such as ductile iron because of the intensity and richness of the weather in this state. As investments in flood-proof and long distance water transportation hikes, Texas remains an allure to the pipe manufacturing and fabricators to the commercial as well as non-commercial sector.

Category-Wise Analysis

U.S. leads ductile iron adoption in municipal water networks

The largest share of the U.S ductile iron pipes market is held by distribution and transmission of the water, as the country is undergoing a large program of infrastructure repair and because in cities, there is an increasing demand to provide a steady flow of supply networks. Ductile iron pipes have high pressure-carrying capacity and strength making them the preferred pipes when it comes to municipal water systems.

Corrosion-resistant lining integration and trenchless technology compatibility helps them function over the long term. Funding from the government through IIJA is also speeding up the improvements of existing pipes that are already at an old age stage, and utilities are busy following the value or affordability of the life cycle of ductile iron.

Dutiful iron raises are being incorporated into contemporary water infrastructure systems through the use of ductile iron pipes as a structural foundation of network modernizations in municipalities through increasing network capacities and mitigating non-revenue water loss.

DN 350-1000 preferred for urban and industrial pipelines

The DN 3501000 pipes category constitutes the core of the medium- to large-scale water transmission infrastructure, fitting the currently expanding urban infrastructure needs. These are the best combination of flow rate, strength and ease of installation and hence this range is adored by cities, industrial areas and extensive utility systems.

Engineering standards and compliance with the AWWA are used to reinforce their adoption in the U.S jurisdictions. The growing investments in waste water reuse systems, storm water resilience and industrial water loop further drive the growth in demand of this diameter category and will make it the most commercially and functionally viable diameter to use ductile iron in latest U.S. projects as well.

Push-on joints dominate for quick, low-cost pipe installations

Socket & Spigot (Push-on) joint is still the most popular joint in the U. S. marketplace because of their simplicity, their resistance to leaks and their inhibitory ability to adapt to varied terrain. These joints also make little labor and special tools resulting in decreased installation time and expense which is especially important when it comes to municipal projects and rapid-replacement ones.

The fact that it can be used together with the trenchless approach and fits into the seismic zones contributes to its popularity as well. Contractors and engineers specify push-on joints because they mean a smoother deployment in an urban as well as in a peri-urban environment and guarantee both reliability and the achievement of performance standards.

They have a track record of thousands of products that they have been able to complete in the United States, which makes them the most prized jointing system in the market.

Competitive Analysis

Key players in the U.S. Ductile Iron Pipes Market include U.S. Pipe, AMERICAN Cast Iron Pipe Company, Saint-Gobain PAM, Jindal SAW Ltd., Tata Metaliks, McWane, Kubota Corporation, Duktus (Wetzlar) GmbH & Co. KG, Electrosteel Steels Ltd.

U.S. ductile iron pipes market is characterized by the influx of intensified competition due to availability of infrastructure funding, material innovation as well as meeting the regulatory compliance. Major producers are working on zinc-coated, ceramic epoxy and polymer-lined pipe technologies in order to extend the life of operation by reducing corrosion. As the urban infrastructure trend moves to sustainable solutions, businesses are focusing on recyclable, lifecycle compatibility and environmental certificates.

Competition is based on strategic location like merges, expanding in the regions where the foundry is located and optimizing the supply chain. The effectiveness of vertical integration in design, casting, and distribution is making it possible to fast track project execution and specifications. Technological differentiation and efficient delivery are becoming determining success factors as procurement takes a more performance-oriented nature.

Recent Development

- In January 2025, ACIPCO purchased C&B Piping, Inc., a ductile iron and steel piping systems manufacturer and supplier based in Leeds, Alabama. C&B, founded in Gilbert, Arizona and Amherst, Virginia, is a company which deals with the manufacture of ductile iron and steel products (pipe, linings, and coatings).

- In January 2025, a project called Next Generation Melt Project was announced by ACIPCO, the company would be spending a sum of USD 285 million towards converting its ductile iron pipe operations to furnaces run on electricity. This project would substitute the existing single cupola furnace to include the four coreless induction furnace that will increase the melting capacity by 25% and lower the CO 2 emissions by 62%.

- In February 2025, McWane Ductile completed a project of river crossing along with local distributors and contractors in Massachusetts and connected the cities of Saugus and Lynn by interconnecting waterlines.

Fact.MR has provided detailed information about the price points of key manufacturers of U.S. Ductile Iron Pipes Market positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Methodology and Industry Tracking Approach

The U.S. Ductile Iron Pipes Market report by Fact.MR has interviewed 7800 participants in 20 states with the minimum of 250 respondents in each region. End users accounted (approximately 70 percent) as public utilities, municipal engineers, and infrastructure contractors and 30 percent account of supply chain experts, material scientists, and regulators. The requirement was realized through the collection of data between July 2025 and June 2026 to receive the pattern of demand, the project investments, procuring behavior, and the influence of the regulations. The work also used more than 200 reliable sources: design reports, bureau of procurement, EPA reports, and engineering databases, and verified it through statistical techniques like multivariate analysis. Even representation of regional infrastructure processes and adoption rates was achieved through weighting of responses.

With Fact.MR monitoring consumer behavior, product efficacy, industry trends, and market opportunities since 2018, this report is becoming an authoritative source of information that stakeholders can rely on.

Segmentation of U.S. Ductile Iron Pipes Market

-

By Diameter :

- DN 100-300

- DN 350-1000

- DN 1000 & Above

-

By Joint Type :

- Socket & Spigot (Push-on

- Flanged Joints

- Mechanical Joints

- Ball & Socket Joints

-

By Application :

- Water Distribution & Transmission

- Sewage & Wastewater

- Irrigation

- Industrial Use

-

By Sales Channel :

- Direct Procurement (Public Utilities & Municipal Contracts)

- Distributors & Suppliers

-

By External Protection :

- Zn/Zn-Al + Bitumen/Epoxy Ductile Iron Pipes

- PE Ductile Iron Pipes

- PU Ductile Iron Pipes

- Ceramic Epoxy Ductile Iron Pipes

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- United States Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- United States Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- United States Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By Daimeter

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Daimeter, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Daimeter, 2025-2035

- DN 100–300

- DN 350–1000

- DN 1000 & Above

- Y-o-Y Growth Trend Analysis By Daimeter, 2020-2024

- Absolute $ Opportunity Analysis By Daimeter, 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By Joint Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Joint Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Joint Type, 2025-2035

- Socket & Spigot (Push-on)

- Flanged Joints

- Mechanical Joints

- Ball & Socket Joints

- Y-o-Y Growth Trend Analysis By Joint Type, 2020-2024

- Absolute $ Opportunity Analysis By Joint Type, 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Application, 2025-2035

- Water Distribution & Transmission

- Sewage & Wastewater

- Irrigation

- Industrial Use

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By Sales Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Sales Channel, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Sales Channel, 2025-2035

- Direct Procurement (Public Utilities & Municipal Contracts)

- Distributors & Suppliers

- Y-o-Y Growth Trend Analysis By Sales Channel, 2020-2024

- Absolute $ Opportunity Analysis By Sales Channel, 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By External Protection

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By External Protection, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By External Protection, 2025-2035

- Zn/Zn-Al + Bitumen/Epoxy Ductile Iron Pipes

- PE Ductile Iron Pipes

- PU Ductile Iron Pipes

- Ceramic Epoxy Ductile Iron Pipes

- Y-o-Y Growth Trend Analysis By External Protection, 2020-2024

- Absolute $ Opportunity Analysis By External Protection, 2025-2035

- United States Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Tons) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Tons) Analysis and Forecast By Region, 2025-2035

- Northeast U.S.

- Southeast U.S.

- Midwest U.S.

- Southwest U.S.

- West U.S.

- Market Attractiveness Analysis By Region

- Northeast U.S. Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- New York

- Pennsylvania

- Massachusetts

- Rest of Northeast

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- By Country

- Market Attractiveness Analysis

- By Country

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Key Takeaways

- Southeast U.S. Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Alabama

- Florida

- Georgia

- Kentucky

- North Carolina

- Rest of Southeast

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- By Country

- Market Attractiveness Analysis

- By Country

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Key Takeaways

- Midwest U.S. Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Illinois

- Indiana

- Michigan

- Minnesota

- Missouri

- Ohio

- Wisconsin

- Rest of Midwest

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- By Country

- Market Attractiveness Analysis

- By Country

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Key Takeaways

- Southwest U.S. Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Arizona

- Texas

- Rest of Southwest

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- By Country

- Market Attractiveness Analysis

- By Country

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Key Takeaways

- West U.S. Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- California

- Colorado

- Nevada

- Oregon

- Washington

- Rest of West

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- By Country

- Market Attractiveness Analysis

- By Country

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Key Takeaways

- Key Countries Market Analysis

- New York

- Pricing Analysis

- Market Share Analysis, 2024

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Florida

- Pricing Analysis

- Market Share Analysis, 2024

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Texas

- Pricing Analysis

- Market Share Analysis, 2024

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- California

- Pricing Analysis

- Market Share Analysis, 2024

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Massachusetts

- Pricing Analysis

- Market Share Analysis, 2024

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- New York

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Daimeter

- By Joint Type

- By Application

- By Sales Channel

- By External Protection

- Competition Analysis

- Competition Deep Dive

- Electrosteel Steels Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- AMERICAN Cast Iron Pipe Company

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Saint-Gobain PAM

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Jindal SAW Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Tata Metaliks

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- McWane

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Kubota Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Duktus (Wetzlar) GmbH & Co. KG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Electrosteel Steels Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Electrosteel Steels Ltd.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: United States Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: United States Market Volume (Tons) Forecast by Region, 2020 to 2035

- Table 3: United States Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 4: United States Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 5: United States Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 6: United States Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 7: United States Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 8: United States Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 9: United States Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 10: United States Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 11: United States Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 12: United States Market Volume (Tons) Forecast by External Protection, 2020 to 2035

- Table 13: Northeast U.S. Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: Northeast U.S. Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 15: Northeast U.S. Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 16: Northeast U.S. Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 17: Northeast U.S. Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 18: Northeast U.S. Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 19: Northeast U.S. Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 20: Northeast U.S. Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 21: Northeast U.S. Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 22: Northeast U.S. Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 23: Northeast U.S. Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 24: Northeast U.S. Market Volume (Tons) Forecast by External Protection, 2020 to 2035

- Table 25: Southeast U.S. Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Southeast U.S. Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 27: Southeast U.S. Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 28: Southeast U.S. Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 29: Southeast U.S. Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 30: Southeast U.S. Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 31: Southeast U.S. Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 32: Southeast U.S. Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 33: Southeast U.S. Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 34: Southeast U.S. Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 35: Southeast U.S. Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 36: Southeast U.S. Market Volume (Tons) Forecast by External Protection, 2020 to 2035

- Table 37: Midwest U.S. Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 38: Midwest U.S. Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 39: Midwest U.S. Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 40: Midwest U.S. Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 41: Midwest U.S. Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 42: Midwest U.S. Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 43: Midwest U.S. Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 44: Midwest U.S. Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 45: Midwest U.S. Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 46: Midwest U.S. Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 47: Midwest U.S. Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 48: Midwest U.S. Market Volume (Tons) Forecast by External Protection, 2020 to 2035

- Table 49: Southwest U.S. Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Southwest U.S. Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 51: Southwest U.S. Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 52: Southwest U.S. Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 53: Southwest U.S. Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 54: Southwest U.S. Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 55: Southwest U.S. Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 56: Southwest U.S. Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 57: Southwest U.S. Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 58: Southwest U.S. Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 59: Southwest U.S. Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 60: Southwest U.S. Market Volume (Tons) Forecast by External Protection, 2020 to 2035

- Table 61: West U.S. Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 62: West U.S. Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 63: West U.S. Market Value (USD Bn) Forecast by Daimeter, 2020 to 2035

- Table 64: West U.S. Market Volume (Tons) Forecast by Daimeter, 2020 to 2035

- Table 65: West U.S. Market Value (USD Bn) Forecast by Joint Type, 2020 to 2035

- Table 66: West U.S. Market Volume (Tons) Forecast by Joint Type, 2020 to 2035

- Table 67: West U.S. Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 68: West U.S. Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 69: West U.S. Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 70: West U.S. Market Volume (Tons) Forecast by Sales Channel, 2020 to 2035

- Table 71: West U.S. Market Value (USD Bn) Forecast by External Protection, 2020 to 2035

- Table 72: West U.S. Market Volume (Tons) Forecast by External Protection, 2020 to 2035

List Of Figures

- Figure 1: United States Market Volume (Tons) Forecast 2020 to 2035

- Figure 2: United States Market Pricing Analysis

- Figure 3: United States Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: United States Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 5: United States Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 6: United States Market Attractiveness Analysis by Daimeter

- Figure 7: United States Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 8: United States Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 9: United States Market Attractiveness Analysis by Joint Type

- Figure 10: United States Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 11: United States Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 12: United States Market Attractiveness Analysis by Application

- Figure 13: United States Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 14: United States Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 15: United States Market Attractiveness Analysis by Sales Channel

- Figure 16: United States Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 17: United States Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 18: United States Market Attractiveness Analysis by External Protection

- Figure 19: United States Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 20: United States Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 21: United States Market Attractiveness Analysis by Region

- Figure 22: Northeast U.S. Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: Southeast U.S. Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Midwest U.S. Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Southwest U.S. Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: West U.S. Market Incremental $ Opportunity, 2025 to 2035

- Figure 27: Northeast U.S. Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Northeast U.S. Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 29: Northeast U.S. Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 30: Northeast U.S. Market Attractiveness Analysis by Daimeter

- Figure 31: Northeast U.S. Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 32: Northeast U.S. Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 33: Northeast U.S. Market Attractiveness Analysis by Joint Type

- Figure 34: Northeast U.S. Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 35: Northeast U.S. Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 36: Northeast U.S. Market Attractiveness Analysis by Application

- Figure 37: Northeast U.S. Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 38: Northeast U.S. Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 39: Northeast U.S. Market Attractiveness Analysis by Sales Channel

- Figure 40: Northeast U.S. Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 41: Northeast U.S. Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 42: Northeast U.S. Market Attractiveness Analysis by External Protection

- Figure 43: Southeast U.S. Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Southeast U.S. Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 45: Southeast U.S. Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 46: Southeast U.S. Market Attractiveness Analysis by Daimeter

- Figure 47: Southeast U.S. Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 48: Southeast U.S. Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 49: Southeast U.S. Market Attractiveness Analysis by Joint Type

- Figure 50: Southeast U.S. Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 51: Southeast U.S. Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 52: Southeast U.S. Market Attractiveness Analysis by Application

- Figure 53: Southeast U.S. Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 54: Southeast U.S. Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 55: Southeast U.S. Market Attractiveness Analysis by Sales Channel

- Figure 56: Southeast U.S. Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 57: Southeast U.S. Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 58: Southeast U.S. Market Attractiveness Analysis by External Protection

- Figure 59: Midwest U.S. Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 60: Midwest U.S. Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 61: Midwest U.S. Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 62: Midwest U.S. Market Attractiveness Analysis by Daimeter

- Figure 63: Midwest U.S. Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 64: Midwest U.S. Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 65: Midwest U.S. Market Attractiveness Analysis by Joint Type

- Figure 66: Midwest U.S. Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 67: Midwest U.S. Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 68: Midwest U.S. Market Attractiveness Analysis by Application

- Figure 69: Midwest U.S. Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 70: Midwest U.S. Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 71: Midwest U.S. Market Attractiveness Analysis by Sales Channel

- Figure 72: Midwest U.S. Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 73: Midwest U.S. Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 74: Midwest U.S. Market Attractiveness Analysis by External Protection

- Figure 75: Southwest U.S. Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 76: Southwest U.S. Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 77: Southwest U.S. Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 78: Southwest U.S. Market Attractiveness Analysis by Daimeter

- Figure 79: Southwest U.S. Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 80: Southwest U.S. Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 81: Southwest U.S. Market Attractiveness Analysis by Joint Type

- Figure 82: Southwest U.S. Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 83: Southwest U.S. Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 84: Southwest U.S. Market Attractiveness Analysis by Application

- Figure 85: Southwest U.S. Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 86: Southwest U.S. Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 87: Southwest U.S. Market Attractiveness Analysis by Sales Channel

- Figure 88: Southwest U.S. Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 89: Southwest U.S. Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 90: Southwest U.S. Market Attractiveness Analysis by External Protection

- Figure 91: West U.S. Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: West U.S. Market Value Share and BPS Analysis by Daimeter, 2025 and 2035

- Figure 93: West U.S. Market Y-o-Y Growth Comparison by Daimeter, 2025 to 2035

- Figure 94: West U.S. Market Attractiveness Analysis by Daimeter

- Figure 95: West U.S. Market Value Share and BPS Analysis by Joint Type, 2025 and 2035

- Figure 96: West U.S. Market Y-o-Y Growth Comparison by Joint Type, 2025 to 2035

- Figure 97: West U.S. Market Attractiveness Analysis by Joint Type

- Figure 98: West U.S. Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 99: West U.S. Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 100: West U.S. Market Attractiveness Analysis by Application

- Figure 101: West U.S. Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 102: West U.S. Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 103: West U.S. Market Attractiveness Analysis by Sales Channel

- Figure 104: West U.S. Market Value Share and BPS Analysis by External Protection, 2025 and 2035

- Figure 105: West U.S. Market Y-o-Y Growth Comparison by External Protection, 2025 to 2035

- Figure 106: West U.S. Market Attractiveness Analysis by External Protection

- Figure 107: United States Market = Tier Structure Analysis

- Figure 108: United States Market - Company Share Analysis

- FAQs -

What was the Global U.S. Ductile Iron Pipes Market Size Reported by Fact.MR for 2025?

The Global U.S. Ductile Iron Pipes Market was valued at USD 1.36 billion in 2025.

Who are the Major Players Operating in the U.S. Ductile Iron Pipes Market?

Prominent players in the market are U.S. Pipe, AMERICAN Cast Iron Pipe Company, Saint-Gobain PAM, Jindal SAW Ltd., Tata Metaliks, McWane, Kubota Corporation, Duktus (Wetzlar) GmbH & Co. KG, Electrosteel Steels Ltd. among others.

What is the Estimated Valuation of the U.S. Ductile Iron Pipes Market in 2035?

The market is expected to reach a valuation of USD 2.2 billion in 2035.

What Value CAGR did the U.S. Ductile Iron Pipes Market Exhibit Over the Last Five Years?

The historic growth rate of the U.S. Ductile Iron Pipes Market was 4.1% from 2020-2024.