Waste Management Equipment Market

Waste Management Equipment Market Size and Share Forecast Outlook 2025 to 2035

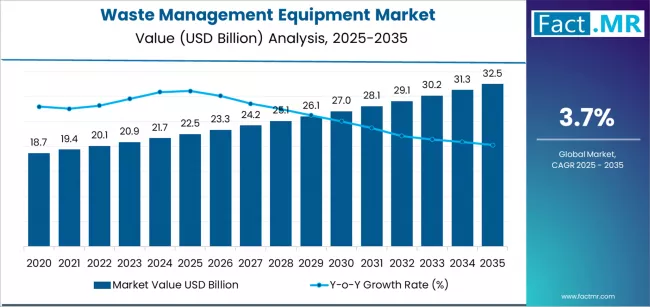

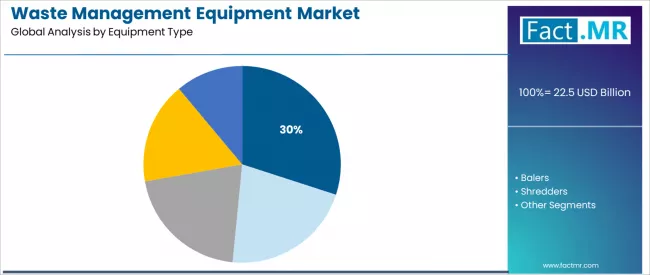

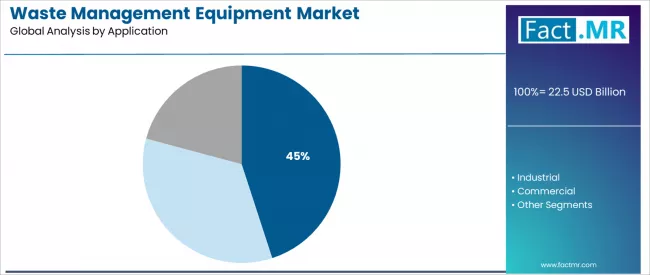

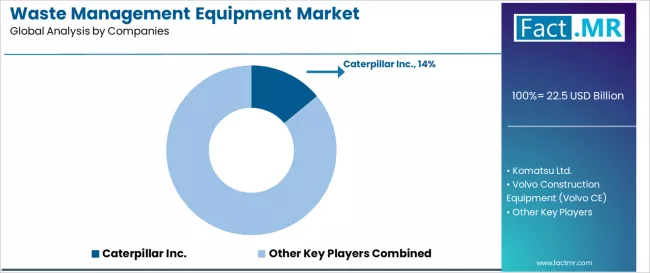

Waste management equipment market is projected to grow from USD 22.5 billion in 2025 to USD 32.5 billion by 2035, at a CAGR of 3.7%. Compactors will dominate with a 30.0% market share, while municipal will lead the application segment with a 45.0% share.

Waste Management Equipment Market Forecast and Outlook 2025 to 2035

The global waste management equipment market is projected to reach USD 32.5 billion by 2035, recording an absolute increase of USD 10.0 billion over the forecast period. The market is valued at USD 22.5 billion in 2025 and is set to rise at a CAGR of 3.7% during the assessment period.

The overall market size is expected to grow by nearly 1.4 times during the same period, supported by increasing demand for automated waste processing solutions and environmental compliance requirements worldwide, driving demand for specialized equipment technologies and increasing investments in waste treatment expansion and efficiency enhancement capabilities globally. However, high capital costs and maintenance complexities may pose obstacles to market expansion.

Quick Stats for Waste Management Equipment Market

- Waste Management Equipment Market Value (2025): USD 22.5 billion

- Waste Management Equipment Market Forecast Value (2035): USD 32.5 billion

- Waste Management Equipment Market Forecast CAGR: 3.7%

- Leading Equipment Type in Waste Management Equipment Market: Compactors

- Key Growth Regions in Waste Management Equipment Market: Asia Pacific, North America, and Europe

- Top Players in Waste Management Equipment Market: Caterpillar, Komatsu, Volvo CE, Doosan, Terex, CNH Industrial, JCB, Wastequip, SSI Shredding, Marathon

Between 2025 and 2030, the waste management equipment market is projected to expand from USD 22.5 billion to USD 27.2 billion, resulting in a value increase of USD 4.7 billion, which represents 47.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for automated waste processing systems and environmental compliance solutions, product innovation in equipment technologies and efficiency enhancement methods, as well as expanding integration with municipal waste facilities and industrial processing systems. Companies are establishing competitive positions through investment in specialized manufacturing capabilities, automation systems, and strategic market expansion across municipal, industrial, and commercial applications.

From 2030 to 2035, the market is forecast to grow from USD 27.2 billion to USD 32.5 billion, adding another USD 5.3 billion, which constitutes 53.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized applications, including smart waste processing systems and advanced recycling equipment tailored for specific waste management requirements, strategic collaborations between equipment manufacturers and waste management companies, and an enhanced focus on automation and environmental performance standards. The growing emphasis on circular economy principles and waste-to-energy conversion will drive demand for high-performance waste management equipment across diverse municipal and industrial applications.

Waste Management Equipment Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 22.5 billion |

| Market Forecast Value (2035) | USD 32.5 billion |

| Forecast CAGR (2025-2035) | 3.7% |

Why is the Waste Management Equipment Market Growing?

The waste management equipment market grows by enabling waste management companies and municipalities to access advanced processing technologies while meeting environmental regulations for waste treatment without substantial operational complexity investment.

Municipal waste authorities and industrial facility managers face mounting pressure to develop efficient waste processing systems and environmental compliance solutions while managing complex waste stream requirements, with specialized equipment typically providing 40-60% better processing efficiency compared to manual alternatives, making automated waste management essential for competitive operational positioning.

The waste management industry's need for volume reduction and application-specific processing capabilities creates demand for comprehensive equipment solutions that can provide superior waste handling capacity, maintain consistent processing standards, and ensure reliable operation without compromising environmental compliance or operational efficiency.

Environmental regulation trends promoting waste reduction and recycling requirements drive adoption in municipal, industrial, and commercial applications, where processing efficiency has a direct impact on operational costs and regulatory compliance.

However, equipment maintenance constraints during continuous operation and the expertise requirements for proper system operation and maintenance may limit accessibility among smaller waste management facilities and developing regions with limited infrastructure for sophisticated waste processing systems.

Segmental Analysis

The market is segmented by equipment type, application, waste type, and region. By equipment type, the market is divided into compactors, balers, shredders, crushers, and others.

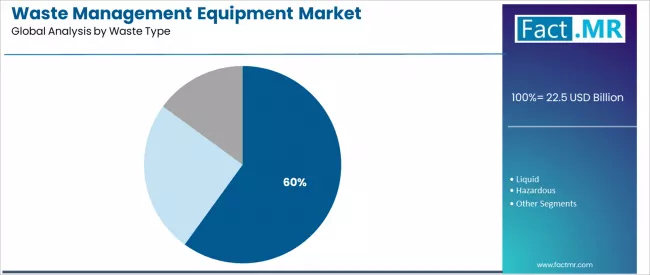

Based on application, the market is categorized into municipal, industrial, and commercial sectors. By waste type, the market includes solid, liquid, and hazardous waste applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

By Equipment Type, the Compactors Segment Accounts for a Dominant Market Share

The compactors segment represents the dominant force in the waste management equipment market, capturing approximately 30.0% of total market share in 2025. This established equipment category encompasses solutions featuring volume reduction capabilities and space optimization features, including hydraulic compression systems and automated loading mechanisms that enable superior waste density improvements and operational efficiency across all waste management applications.

The compactors segment's market leadership stems from its superior versatility, with equipment capable of addressing diverse waste stream requirements while maintaining consistent compression performance and operational reliability across all processing environments.

The balers segment maintains a substantial 25.0% market share, serving recycling applications that require material bundling with enhanced transportation efficiency for paper, plastic, and metal recycling operations.

Compactors offer material optimization capabilities for recycling-focused operations while providing sufficient compression force to meet processing and transportation demands. The shredders segment accounts for approximately 20.0% of the market, serving applications requiring specific size reduction or specialized material processing parameters. The crushers segment represents 15.0% of the market, while others account for 10.0%.

Key technological advantages driving the compactors segment include:

- Established compression technology with integrated control systems that enhance processing consistency and ensure reliable volume reduction performance throughout operational cycles

- Cost-effective operation methods allowing efficient waste handling across different facility scales without extensive power requirements

- Enhanced automation features enabling precise loading control while maintaining system durability and operational reliability

- Superior application acceptance providing optimal performance-cost balance for various municipal and commercial waste management applications

By Application, the Municipal Segment Accounts for the Largest Market Share

Municipal applications dominate the waste management equipment market with approximately 45.0% market share in 2025, reflecting the critical role of public waste management in supporting urban infrastructure requirements and environmental compliance worldwide. The municipal segment's market leadership is reinforced by increasing urbanization trends, waste volume growth requirements, and rising needs for automated waste processing alternatives in developed and emerging municipal markets.

The industrial segment represents the second-largest application category, capturing 35.0% market share through specialized requirements for manufacturing waste processing, production byproduct handling, and industrial facility operations. This segment benefits from growing industrial waste management demand that requires specific processing protocols, efficiency optimization, and environmental compliance in industrial markets.

The commercial segment accounts for 20.0% market share, serving retail facilities, office complexes, and commercial waste processing applications across various business sectors.

Key market dynamics supporting application growth include:

- Municipal expansion driven by urbanization growth and waste volume increases, requiring automated processing solutions in public waste management markets

- Industrial modernization trends require efficient, reliable equipment systems for competitive waste processing optimization and environmental compliance

- Integration of smart waste technologies enabling advanced processing capabilities and operational management systems

- Growing emphasis on processing efficiency driving demand for specialized, high-performance waste equipment without traditional manual processing limitations

By Waste Type, the Solid Segment Accounts for the Largest Market Share

Solid waste applications dominate the waste management equipment market with approximately 60.0% market share in 2025, reflecting the predominant role of solid waste processing in supporting municipal and commercial waste management operations worldwide. The solid waste segment's market leadership is reinforced by increasing waste generation trends, recycling requirements, and established processing infrastructure in waste management markets.

The liquid segment represents a significant waste type category, capturing 25.0% market share through specialized requirements for liquid waste treatment, industrial effluent processing, and specialized liquid handling applications. This segment benefits from growing environmental compliance demand that requires specific treatment protocols, containment systems, and regulatory adherence in liquid waste markets.

The hazardous segment accounts for 15.0% market share, serving specialized hazardous waste processing, contaminated material handling, and regulated waste treatment applications across various industrial sectors.

What are the Drivers, Restraints, and Key Trends of the Waste Management Equipment Market?

Environmental compliance requirements and waste reduction mandates create increasing demand for automated processing equipment, with waste management regulations expanding 20-25% annually in major developed markets worldwide, requiring comprehensive waste processing infrastructure.

Urbanization growth and waste generation increases drive increased adoption of efficient processing systems, with many municipalities implementing equipment-based waste management and processing programs by 2030.

Technological advancements in automation and processing efficiency enable more reliable and cost-effective waste handling solutions that improve operational performance while reducing labor costs and processing complexity.

Market restraints include high capital investment requirements and maintenance costs for advanced equipment systems that can challenge market participants in developing cost-effective processing solutions, particularly in regions where municipal budgets remain limited and uncertain.

Technical complexity of proper equipment selection and operational requirements pose another significant challenge, as waste processing systems demand specialized knowledge and maintenance expertise, potentially affecting installation costs and operational efficiency.

Equipment durability constraints due to harsh operating conditions create additional operational challenges for facilities, demanding ongoing investment in maintenance infrastructure and replacement programs.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly India and China, where urbanization expansion and environmental regulations drive comprehensive waste management equipment adoption.

Technology integration trends toward automated control with enhanced monitoring capabilities, advanced sorting systems, and integrated processing platforms enable scalable waste management approaches that optimize efficiency and minimize operational risks.

However, the market thesis could face disruption if significant advances in waste-to-energy technologies or major changes in waste management policies reduce reliance on traditional mechanical processing methods.

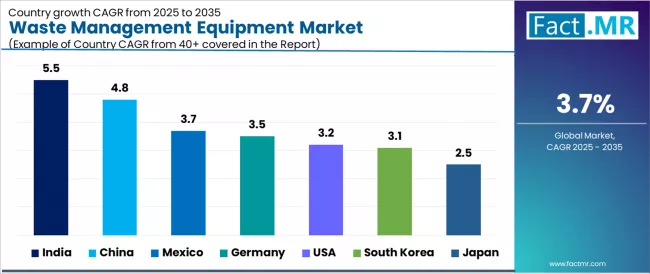

Analysis of the Waste Management Equipment Market by Key Country

| Country | CAGR (%) |

|---|---|

| India | 5.5% |

| China | 4.8% |

| Mexico | 3.7% |

| Germany | 3.5% |

| United States | 3.2% |

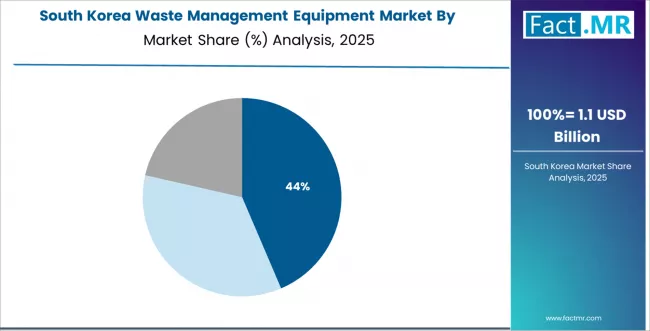

| South Korea | 3.1% |

| Japan | 2.5% |

The global waste management equipment market is expanding steadily, with India leading at a 5.5% CAGR through 2035, driven by rapid urbanization, municipal infrastructure development, and increasing environmental awareness. China follows at 4.8%, supported by urban expansion, waste management modernization, and environmental policy implementation. Mexico records 3.7%, reflecting growing municipal infrastructure and industrial waste management development.

Germany advances at 3.5%, anchored by environmental regulations and waste processing innovation. The United States posts 3.2%, emphasizing municipal waste management and equipment replacement markets, while South Korea grows at 3.1%, focusing on waste processing technology advancement. Japan grows at 2.5%, emphasizing system efficiency and precision waste management.

India Leads Global Market Expansion

India demonstrates the strongest growth potential in the waste management equipment market with a CAGR of 5.5% through 2035. The country's leadership position stems from rapid urbanization, municipal infrastructure development, and comprehensive waste management modernization driving the adoption of advanced processing equipment.

Growth is concentrated in major urban and industrial centers, including Mumbai, Delhi, Bangalore, and Chennai, where municipal authorities and waste management companies are implementing advanced equipment systems for solid waste processing, recycling operations, and municipal waste facilities.

Distribution channels through equipment dealers and municipal contractors expand reach across urban waste management and industrial processing segments. The country's Ministry of Environment provides policy support for waste management advancement, including comprehensive Swachh Bharat programs.

Key market factors:

- Urban infrastructure development concentrated in metropolitan areas and industrial zones with comprehensive waste management expansion programs

- Government support through waste management initiatives and environmental compliance requirements

- Comprehensive municipal ecosystem, including established waste management networks with proven equipment integration capabilities

- Environmental policy trends featuring waste processing improvement, recycling technology adoption systems, and pollution control preferences

China Emerges as High-Growth Market

In major urban and industrial centers including Beijing, Shanghai, Guangzhou, and Shenzhen, the adoption of advanced waste processing equipment and municipal waste management systems is accelerating across municipal and industrial segments, driven by urbanization growth and government environmental protection programs. The market demonstrates strong growth momentum with a CAGR of 4.8% through 2035, linked to comprehensive waste management modernization and increasing focus on environmental compliance. Chinese companies are implementing advanced equipment systems and processing platforms to enhance waste management capabilities while meeting growing demand in expanding urban and industrial sectors. The country's carbon neutrality initiatives create robust demand for waste processing technology development, while increasing emphasis on circular economy drives adoption of advanced waste management systems.

Key development areas:

- Municipal facilities and processing centers leading equipment adoption with comprehensive waste management modernization programs

- Urban services providing integrated processing solutions with 85% waste processing compliance rates

- Municipal partnerships between equipment companies and waste management enterprises expanding market reach

- Integration of smart waste technology and traditional waste management knowledge systems

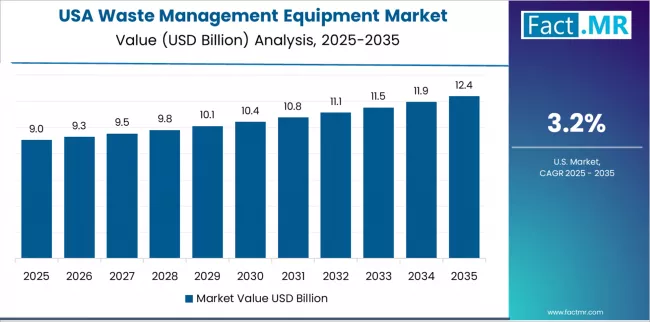

United States Shows Municipal Leadership

The United States market expansion is driven by municipal waste management demand and industrial processing requirements across urban and commercial segments. The country demonstrates strong growth potential with a CAGR of 3.2% through 2035, supported by established waste management infrastructure and mature municipal service networks. American companies benefit from environmental regulation frameworks and established waste management market presence, requiring strategic development approaches and partnerships with equipment manufacturers and waste management contractors. However, growing automation trends and environmental regulations create compelling business cases for equipment adoption, particularly in municipal segments where processing efficiency has a direct impact on operational costs and environmental compliance.

Market characteristics:

- Municipal waste management showing robust growth with 30% annual increase in automated equipment utilization

- Environmental trends focused on waste reduction and recycling optimization in municipal operations

- Regulatory framework development indicates growing acceptance and standardization of advanced waste processing technologies

- Growing emphasis on operational efficiency and environmental compliance in waste management operations

Germany Demonstrates Environmental Leadership

The Germany market leads in environmental compliance and waste processing technology based on integration with circular economy principles and premium waste management system preferences. The country shows strong potential with a CAGR of 3.5% through 2035, driven by the modernization of waste processing infrastructure and the expansion of recycling segments in major urban areas, including Baden-Württemberg, Bavaria, North Rhine-Westphalia, and Lower Saxony. German companies are adopting advanced waste processing equipment for environmental compliance and operational applications, particularly in regions with strict environmental requirements and applications demanding comprehensive recycling upgrades. Distribution channels through established waste management contractors and environmental service providers expand coverage across environmentally-conscious municipalities and commercial waste processing applications.

Leading market segments:

- Environmental compliance modernization projects in major urban centers implementing comprehensive waste processing equipment categories

- Municipal partnerships with equipment providers, achieving 95% processing efficiency improvement rates

- Strategic collaborations between equipment manufacturers and environmental service operators expanding market presence

- Focus on environmental certification systems and specialized waste processing requirements

Mexico Emphasizes Infrastructure Development

In Mexico City, Monterrey, Guadalajara, and other major urban centers, municipalities and waste management companies are implementing advanced processing solutions to modernize existing waste facilities and improve operational performance, with documented case studies showing a 45% improvement in processing efficiency through equipment integration. The market shows strong growth potential with a CAGR of 3.7% through 2035, linked to ongoing modernization of municipal infrastructure, waste management networks, and emerging environmental compliance adoption in major regions. Mexican companies are adopting advanced equipment products and waste management enhancement platforms to improve operational outcomes while maintaining standards demanded by quality-conscious municipal operations. The country's established urban infrastructure creates ongoing demand for waste management development and modernization solutions that integrate with existing municipal and industrial systems.

Market development factors:

- Municipal development and urban growth leading advanced equipment adoption across Mexico

- Infrastructure modernization programs providing investment support for municipal upgrades and waste management improvements

- Strategic partnerships between Mexican municipal operators and international equipment providers expanding technical capabilities

- Emphasis on operational efficiency and waste processing optimization across municipal applications

South Korea Emphasizes Technology Integration

South Korea's waste management equipment market demonstrates sophisticated application focused on technology advancement and automation integration, with documented implementation of smart waste systems achieving 40% improvement in processing performance across municipal and industrial facilities. The country maintains steady growth momentum with a CAGR of 3.1% through 2035, driven by waste management emphasis on technology excellence and operational precision that align with Korean municipal standards applied to waste processing operations. Major urban areas, including Seoul, Busan, Daegu, and Incheon, showcase advanced equipment deployment where waste processing systems integrate seamlessly with existing municipal infrastructure and comprehensive automation management programs.

Key market characteristics:

- Municipal facilities and processing centers driving advanced equipment requirements with emphasis on automation technology and system integration

- Technology partnerships enabling 98% processing compliance with comprehensive waste management programs

- Municipal collaboration between Korean companies and international equipment providers expanding system capabilities

- Emphasis on technology integration requirements and automation optimization methodologies

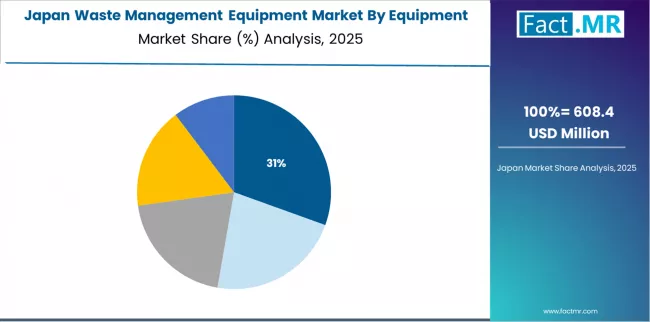

Japan Shows Quality System Leadership

Japan's waste management equipment market demonstrates mature and precision-focused development, characterized by sophisticated integration of high-efficiency equipment with existing waste management infrastructure across municipal facilities, industrial networks, and processing initiatives. Japan's emphasis on operational reliability and processing precision drives demand for premium equipment products that support comprehensive waste management applications and performance requirements in municipal operations. The market benefits from strong partnerships between international suppliers and domestic waste management companies, creating comprehensive distribution networks that prioritize quality assurance and system performance programs. Municipal centers in major urban regions showcase advanced equipment implementations where systems achieve efficiency improvements through integrated waste management programs.

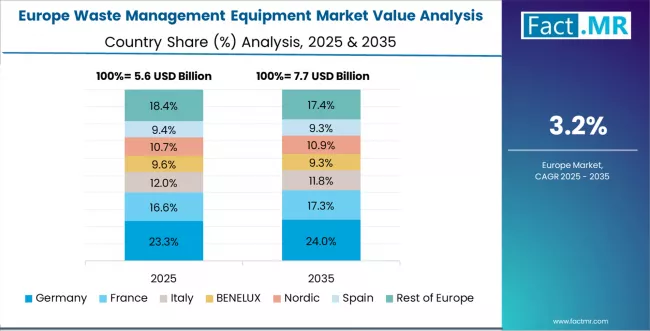

Europe Market Split by Country

The waste management equipment market in Europe is projected to grow from USD 22.5 billion in 2025 to USD 32.5 billion by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, projected to reach 23.7% by 2035, supported by its extensive environmental compliance infrastructure, advanced waste processing systems, and comprehensive municipal networks serving major European markets.

United Kingdom follows with a 16.9% share in 2025, projected to reach 17.1% by 2035, driven by comprehensive municipal waste applications in major urban regions implementing advanced processing systems. France holds a 14.2% share in 2025, expected to maintain 14.0% by 2035 through ongoing development of waste facilities and environmental processing segments. Italy commands an 11.1% share, while Spain accounts for 9.3% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 24.5% to 24.7% by 2035, attributed to increasing waste processing adoption in Nordic countries and emerging Eastern European markets implementing waste management modernization programs.

Advanced Processing Systems Drive Applications in Japan

The Japanese waste management equipment market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of high-performance equipment with existing waste management infrastructure across municipal facilities, industrial networks, and processing initiatives. Japan's emphasis on operational excellence and system precision drives demand for premium equipment products that support comprehensive waste management applications and performance requirements in municipal operations. The market benefits from strong partnerships between international suppliers and domestic waste management companies, including established municipal and industrial providers, creating comprehensive distribution networks that prioritize quality assurance and processing satisfaction programs. Municipal centers in major urban regions showcase advanced equipment implementations where systems achieve efficiency improvements through integrated waste management programs.

Municipal Infrastructure Expansion Leads Development in South Korea

The South Korean waste management equipment market is characterized by strong municipal infrastructure presence, with companies like advanced waste processing providers and environmental engineering companies maintaining dominant positions through comprehensive equipment networks and processing capabilities for municipal and industrial applications. The market is demonstrating growing emphasis on technology positioning and automation integration, as Korean companies increasingly demand systems that integrate with domestic waste management patterns and environmental trends deployed across major municipal centers and industrial facilities. Local waste management companies and regional equipment distributors are gaining market share through strategic partnerships with international suppliers, offering specialized services including technology education programs and precision processing methods for efficiency-focused operations. The competitive landscape shows increasing collaboration between international equipment suppliers and Korean waste management specialists, creating hybrid distribution models that combine global technology expertise with local market knowledge and municipal relationship management.

Competitive Landscape of the Waste Management Equipment Market

The waste management equipment market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 25-35% of global market share through established equipment portfolios and extensive waste management industry relationships. Competition centers on equipment reliability, processing efficiency, and service capability rather than price competition alone.

Market leaders include Caterpillar, Komatsu, and Volvo CE, which maintain competitive advantages through comprehensive waste processing equipment portfolios, advanced technology capabilities, and deep expertise in municipal and industrial sectors, creating high switching costs for customers. These companies leverage established dealer relationships and ongoing service partnerships to defend market positions while expanding into adjacent waste processing and recycling applications.

Challengers encompass Doosan and Terex, which compete through specialized equipment technologies and strong presence in key regional markets. Equipment specialists, including CNH Industrial, JCB, and Wastequip, focus on specific equipment categories or vertical applications, offering differentiated capabilities in processing systems, specialized machinery, and application-specific solutions.

Regional players and emerging technology companies create competitive pressure through innovative equipment approaches and rapid development capabilities, particularly in high-growth markets including Asia-Pacific regions, where local presence provides advantages in cost optimization and service relationship management. Market dynamics favor companies that combine advanced equipment technologies with comprehensive service systems that address the complete product lifecycle from equipment design through ongoing maintenance assurance and customer support.

Global Waste Management Equipment Market - Stakeholder Contribution Framework

Waste management equipment represents a critical municipal infrastructure solution that enables waste management companies, municipalities, and industrial facilities to enhance processing performance and environmental compliance without substantial operational complexity investment, typically providing 40-60% better processing efficiency compared to manual alternatives while ensuring automated positioning and operational benefits. With the market projected to grow from USD 22.5 billion in 2025 to USD 32.5 billion by 2035 at a 3.7% CAGR, these systems offer compelling advantages - superior processing performance, enhanced operational efficiency, and automation capabilities - making them essential for compactors applications (30.0% market share), municipal operations (45.0% share), and diverse waste management applications seeking automated processing solutions. Scaling market penetration and equipment capabilities requires coordinated action across environmental policy, processing standards, equipment providers, waste management companies, and municipal institutions.

How Governments Could Spur Local Development and Adoption?

- Waste Management Infrastructure Programs: Include processing equipment in national waste management initiatives, providing targeted funding for specialized equipment facilities in municipal regions and supporting local waste companies through innovation grants and development support.

- Tax Policy & Environmental Support: Implement accelerated depreciation schedules for waste processing equipment, provide tax incentives for companies investing in advanced waste management and environmental technologies, and establish favorable municipal accounting standards that encourage automated processing over manual approaches.

- Quality Framework Development: Create streamlined certification processes for waste management equipment across municipal and industrial applications, establish clear performance standards and frameworks for specialized processing, and develop international harmonization protocols that facilitate cross-border waste technology trade.

- Skills Development & Training: Fund vocational programs for equipment technicians, processing specialists, and waste management professionals. Invest in technology transfer initiatives that bridge municipal expertise with commercial waste management development and efficiency optimization systems.

- Market Access & Competition: Establish procurement policies that favor advanced processing equipment for government waste facilities, support waste management industry development through equipment modernization programs, and create regulatory environments that encourage innovation in waste processing technologies.

How Industry Bodies Could Support Market Development?

- Processing Standards & Certification: Define standardized performance metrics for waste management equipment across municipal, industrial, and commercial applications, establish universal quality control and processing protocols, and create certification programs for equipment performance that companies can rely on.

- Market Education & Best Practices: Lead messaging that demonstrates equipment advantages, emphasizing improved processing performance, enhanced operational efficiency, and superior automation capabilities compared to manual processing alternatives.

- Technology Integration Standards: Develop interoperability standards for equipment systems, waste management compliance guidelines, and municipal platforms, ensuring seamless integration across different waste processing environments and regulatory requirements.

- Professional Development: Run certification programs for equipment specialists, processing technicians, and waste management service teams on optimizing processing performance, regulatory compliance, and system effectiveness in competitive waste management markets.

How Manufacturers and Technology Players Could Strengthen the Ecosystem?

- Advanced Equipment Development: Develop next-generation processing platforms with enhanced automation capabilities, improved efficiency features, and application-specific characteristics that enhance waste management quality while reducing operational complexity.

- Control Management Platforms: Provide comprehensive equipment software that integrates performance monitoring, processing tracking, waste analytics, and maintenance optimization, enabling companies to maximize equipment efficiency and regulatory compliance effectiveness.

- Service & Support Networks: Offer flexible support programs for waste management companies and municipalities, including technical training options, processing consultation services, and equipment optimization pathways that keep processing systems current with waste management demands.

- Research & Development Networks: Build comprehensive R&D capabilities, collaborative equipment innovation programs, and waste management development systems that ensure processing technologies maintain high performance standards and consistent operation across diverse waste processing environments.

How Suppliers Could Navigate the Shift?

- Diversified Equipment Portfolios: Expand waste management offerings across compactors applications (30.0% equipment dominance), municipal operations (45.0% share), and industrial applications, with particular focus on municipal services and specialized solutions for waste processing requirements.

- Geographic Market Development: Establish operations in high-growth markets like India (5.5% CAGR) and China (4.8% CAGR), while strengthening presence in established markets like Mexico (3.7% CAGR) and Germany (3.5% CAGR) through regional manufacturing capabilities and local partnerships.

- Technology-Enabled Equipment: Implement advanced control systems with real-time monitoring, automated processing optimization, and predictive maintenance management capabilities that differentiate equipment offerings and improve customer satisfaction and retention.

- Flexible Equipment Models: Develop standard, high-efficiency, and specialized waste management solutions that accommodate varying municipal and industrial needs, from cost-effective processing to high-performance applications for demanding waste management and environmental requirements.

How Investors and Financial Enablers Could Unlock Value?

- Equipment Technology Expansion Financing: Provide growth capital for established companies like Caterpillar, Komatsu, and Volvo CE to expand manufacturing capacity and development capabilities, particularly in emerging markets with growing waste management demands.

- Innovation Investment: Back startups developing advanced processing systems, next-generation automation technologies, and intelligent waste management systems that enhance municipal efficiency and competitive positioning.

- Regional Market Development: Finance market entry and expansion strategies for equipment companies establishing operations in high-growth regions, supporting localization initiatives that reduce equipment costs while maintaining performance standards.

- Consolidation & Scale Opportunities: Support strategic acquisitions and market consolidation that create economies of scale, improve equipment capabilities, and enhance competitive positioning against fragmented regional providers across multiple geographic markets.

Key Players in the Waste Management Equipment Market

- Caterpillar

- Komatsu

- Volvo CE

- Doosan

- Terex

- CNH Industrial

- JCB

- Wastequip

- SSI Shredding

- Marathon

- Vecoplan

- Metso Outotec

- CP Manufacturing

- Bandit

- Morbark

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 22.5 Billion |

| Equipment Type | Compactors, Balers, Shredders, Crushers, Others |

| Application | Municipal, Industrial, Commercial |

| Waste Type | Solid, Liquid, Hazardous |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Mexico, and 40+ countries |

| Key Companies Profiled | Caterpillar, Komatsu, Volvo CE, Doosan, Terex, CNH Industrial, JCB, Wastequip, SSI Shredding, Marathon, Vecoplan, Metso Outotec, CP Manufacturing, Bandit, Morbark |

| Additional Attributes | Dollar sales by equipment type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with waste management equipment manufacturers and municipal companies, equipment requirements and specifications, integration with waste management and environmental initiatives and municipal platforms, innovations in waste processing equipment technology and automation systems, and development of specialized applications with performance optimization and processing efficiency capabilities. |

Waste Management Equipment Market by Segments

-

Equipment Type :

- Compactors

- Balers

- Shredders

- Crushers

- Others

-

Application :

- Municipal

- Industrial

- Commercial

-

Waste Type :

- Solid

- Liquid

- Hazardous

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Chile

- Rest of Latin America

- Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Union

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Equipment Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Equipment Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Equipment Type , 2025 to 2035

- Compactors

- Balers

- Shredders

- Crushers

- Others

- Y to o to Y Growth Trend Analysis By Equipment Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Equipment Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- Municipal

- Industrial

- Commercial

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Waste Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Waste Type, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Waste Type, 2025 to 2035

- Solid

- Liquid

- Hazardous

- Y to o to Y Growth Trend Analysis By Waste Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Waste Type, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Equipment Type

- By Application

- By Waste Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Equipment Type

- By Application

- By Waste Type

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Equipment Type

- By Application

- By Waste Type

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Equipment Type

- By Application

- By Waste Type

- Competition Analysis

- Competition Deep Dive

- Caterpillar Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Komatsu Ltd.

- Volvo Construction Equipment (Volvo CE)

- Doosan Infracore Co., Ltd.

- Terex Corporation

- CNH Industrial N.V.

- JCB (J.C. Bamford Excavators Ltd.)

- Wastequip, LLC

- SSI Shredding Systems, Inc.

- Marathon Equipment Company

- Vecoplan, LLC

- Metso Outotec Corporation

- CP Manufacturing, Inc.

- Bandit Industries, Inc.

- Morbark LLC

- Caterpillar Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Equipment Type , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Waste Type, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Equipment Type

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Waste Type

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Equipment Type

- Figure 26: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Application

- Figure 29: North America Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by Waste Type

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Equipment Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Application

- Figure 39: Latin America Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by Waste Type

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Equipment Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Application

- Figure 49: Western Europe Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by Waste Type

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Equipment Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Application

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Waste Type

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Equipment Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Application

- Figure 69: East Asia Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by Waste Type

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Equipment Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Waste Type

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Equipment Type , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Equipment Type , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Equipment Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Waste Type, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Waste Type, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Waste Type

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the waste management equipment market in 2025?

The global waste management equipment market is estimated to be valued at USD 22.5 billion in 2025.

What will be the size of waste management equipment market in 2035?

The market size for the waste management equipment market is projected to reach USD 32.5 billion by 2035.

How much will be the waste management equipment market growth between 2025 and 2035?

The waste management equipment market is expected to grow at a 3.7% CAGR between 2025 and 2035.

What are the key product types in the waste management equipment market?

The key product types in waste management equipment market are compactors, balers, shredders, crushers and others.

Which application segment to contribute significant share in the waste management equipment market in 2025?

In terms of application, municipal segment to command 45.0% share in the waste management equipment market in 2025.