Usage Insurance Market

Usage Insurance Market Size and Share Forecast Outlook 2025 to 2035

The Global Usage Insurance Market Is Forecasted To Reach USD 10.7 Billion In 2025, And Further To USD 28.8 Billion By 2035, Expanding At A 10.4% CAGR. The Pay-As-You-Drive Type Of Usage Insurance Will Be The Leading Segment, With Private Cars As The Key End-User.

Usage Insurance Market Size and Share Forecast Outlook 2025 to 2035

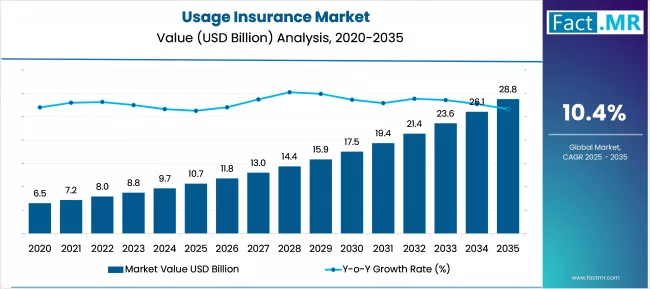

The global usage insurance market is projected to increase from USD 10.7 billion in 2025 to USD 28.8 billion by 2035, with a CAGR of 10.4% during the forecast period. Growth is driven by increased telematics adoption, rising demand for personalized premium models, and advances in data analytics. Consumers and insurers benefit from real-time driving behavior insights, which promote safer driving habits and cost-effective policies.

Quick Stats of Usage Insurance Market

- Usage Insurance Market Size (2025): USD 10.7 billion

- Projected Usage Insurance Market Size (2035): USD 28.8 billion

- Forecast CAGR of Usage Insurance Market (2025 to 2035): 10.4%

- Leading Type Segment of Usage Insurance Market: Pay-As-You-Drive

- Leading End-User Segment of Usage Insurance Market: Private Cars

- Key Growth Regions of Usage Insurance Market: United Kingdom, Malaysia, South Africa

- Prominent Players in the Usage Insurance Market: Insure the Box, AllState Insurance Company, State Farm, Uniqa, Groupama, Generalli, Progressive, and Others.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 10.7 billion |

| Industry Size (2035F) | USD 28.8 billion |

| CAGR (2025-2035) | 10.4% |

The global Usage-Based Insurance (UBI) market is expected to increase from USD 10.7 billion in 2025 to USD 28.8 billion by 2035, at a CAGR of 10.4%. The market is rapidly expanding as insurers and consumers adopt technology-driven policies. Advances in IoT, telematics, and mobile applications enable the collection of accurate driving data, thereby expanding the reach of UBI into shared mobility and autonomous vehicles.

From 2025 to 2027, the market is expected to grow from USD 10.7 billion to USD 11.8 billion and USD 13.0 billion, respectively, as connected vehicle adoption accelerates. Usage-Based Insurance is expected to reach USD 14.3 billion and USD 15.8 billion in 2028 and 2029, respectively, driven by higher vehicle ownership rates and the expansion of enhanced telematics infrastructure.

The market is expected to grow to USD 17.5 billion and USD 19.3 billion by 2030 and 2031, respectively, driven by rising demand for pay-as-you-drive models and the increasing preference of cost-conscious customers. Continued innovation in telematics and smartphone integration will propel the market to USD 21.3 billion in 2032 and $23.5 billion in 2033, reinforcing personalized pricing models.

UBI is expected to reach USD 26.0 billion in 2034, with a peak of USD 28.8 billion in 2035. Demand is driven by its ability to reduce costs for safe drivers, provide accurate risk assessments, and boost customer engagement. The government's support for digital mobility solutions, as well as insurer investments in real-time data analytics, are driving the adoption of these solutions.

According to IMS Tech, approximately 20 million of the world's 875 million auto insurance policies are already usage-based, indicating a growing consumer preference for flexible, data-driven insurance products that match premiums to actual driving behavior.

Key Usage Insurance Market Dynamics

The usage-based insurance market is experiencing rapid growth due to several key factors. The growing use of telematics and connected car technologies enables insurers to collect real-time driving data, thereby improving risk assessment and pricing accuracy. Customer demand for personalized and flexible insurance premiums is also driving growth, as they seek cost-effective policies tailored to their driving habits.

Additionally, a growing emphasis on road safety and risk-based pricing is encouraging greater acceptance of such models.

However, data privacy and security concerns pose significant challenges, and high implementation and infrastructure costs may deter smaller insurers. Additionally, low consumer awareness in emerging markets continues to hinder broader adoption, thereby limiting the market's full potential.

Rising Adoption of Telematics and Connected Car Technologies

The integration of telematics devices and connected car systems has transformed the insurance industry by allowing real-time monitoring of driver behaviour. Insurers can now track speed, braking patterns, mileage, and driving locations, allowing them to create more accurate risk profiles. As consumers become more comfortable with digital ecosystems embedded in modern vehicles, the adoption of UBI accelerates.

As the number of connected vehicles grows, insurance companies will be able to use large datasets to optimize premium calculations and reward safe drivers with discounts. Automakers and technology companies are also working with insurers to strengthen the ecosystem for telematics-based insurance offerings.

Increasing Demand for Personalized and Flexible Insurance Premiums

Consumers are shifting away from traditional one-size-fits-all policies and toward insurance plans that are tailored to their driving habits and lifestyle. UBI enables insurers to provide personalized pricing models, resulting in lower premiums for safe drivers and greater flexibility in managing insurance costs. This approach appeals to younger, tech-savvy drivers who expect personalized service.

The flexibility of UBI also allows for short-term and pay-as-you-drive options, which are particularly appealing to people who use vehicles infrequently. Such models enhance customer loyalty by directly aligning insurance costs with usage patterns, resulting in a mutually beneficial situation for both insurers and policyholders.

Growing Emphasis on Road Safety and Risk-Based Pricing

Governments, insurers, and consumers are all prioritizing road safety. UBI encourages safer driving by incentivizing responsible behavior with lower premiums, fostering a culture of accountability on the road. Insurers encourage drivers to practice safe driving by linking insurance costs to driving behavior.

Risk-based pricing, enabled by telematics, ensures system fairness. Low-risk drivers benefit from significant savings, while high-risk drivers are charged appropriately, resulting in greater transparency in premium structures. Over time, this dynamic can help reduce accident rates, lower insurer claims costs, and support global regulatory initiatives aimed at improving road safety.

Data Privacy and Security Concerns

The collection and use of driver data raise significant privacy challenges for insurers. Many consumers are apprehensive about sharing sensitive location and behavior data, fearing misuse, unauthorized access, or lack of transparency in how information is stored and utilized. These concerns create resistance to UBI adoption.

Cybersecurity threats further compound the issue, as insurers must protect large volumes of personal and driving data from potential breaches. To address these risks, insurance companies are investing in encryption, compliance with data protection laws, and transparent communication strategies to build consumer trust, but concerns still remain a major hurdle.

High Implementation and Infrastructure Costs

Setting up UBI programs requires significant investments in telematics devices, data management platforms, and analytics systems. This upfront cost can be prohibitively expensive for insurers, especially in markets with low premium volumes. Installation, maintenance, and data integration increase overall costs, slowing the adoption of new systems among smaller insurers.

On the consumer side, the additional costs associated with installing telematics devices may deter prospective policyholders. While smartphone-based telematics apps have emerged as a cost-effective alternative, the need for robust infrastructure and ongoing technological development remains a significant challenge, particularly in price-sensitive markets.

Limited Consumer Awareness in Emerging Markets

In emerging economies, awareness and understanding of UBI are limited. Many consumers are unfamiliar with usage-based pricing or believe it is overly complex when compared to traditional insurance. Despite the potential cost savings, adoption is slowed by a lack of knowledge.

Cultural factors, low digital literacy, and limited access to advanced telematics technologies all impede growth in these areas. To address these issues, insurers must invest in educational campaigns, strategic partnerships with automakers, and simplified product offerings that make UBI more accessible and appealing to a wider audience.

Analyzing the Usage Insurance Market by Key Regions

North America remains a dominant market for UBI, owing to the high adoption rate of telematics technologies and a favorable regulatory environment. The United States and Canada are the leaders in this region, with numerous insurers offering UBI products. The strong presence of leading telematics providers, combined with increased consumer awareness of UBI benefits, are key drivers of this growth.

Europe is another significant market for UBI, driven by stringent safety regulations and the increasing adoption of connected vehicle technologies. Countries such as the United Kingdom, Germany, and Italy are at the forefront of UBI adoption, with an increasing number of insurers providing telematics-based policies. The emphasis on road safety and the growing popularity of electric vehicles are key drivers of the UBI market in Europe.

The Asia-Pacific region is expected to provide significant growth opportunities for the UBI market, driven by the rapid adoption of connected car technologies and rising awareness of the benefits of UBI. China, Japan, and South Korea are leading the way in this region, with an increasing number of consumers opting for telematics-based insurance policies. The expanding automotive market and increasing use of telematics devices are key drivers of this growth.

Country-Wise Outlook

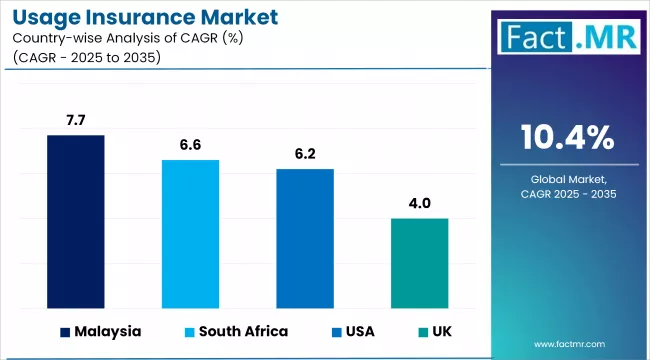

| Country | CAGR (2025-2035) |

|---|---|

| United Kingdom | 4.0% |

| Malaysia | 7.7% |

| South Africa | 6.6% |

United Kingdom Usage-Based Insurance Growth Driven by Telematics and Flexible Models

The United Kingdom’s usage-based insurance (UBI) market is gaining traction as telematics and connected technologies become mainstream. Younger drivers are the largest adopters, seeking affordable alternatives through pay-as-you-drive or pay-how-you-drive models. Rising fuel costs and increasing urban congestion are also prompting consumers to opt for flexible insurance options that reward safe and efficient driving.

Regulatory frameworks have created a strong foundation for growth. The Financial Conduct Authority has encouraged insurers to adopt fairer pricing structures, while the Information Commissioner’s Office enforces strict data protection requirements. These measures ensure transparency and accountability in telematics-driven insurance models, building consumer trust.

Government and organizational initiatives are further supporting adoption. The Department for Transport has actively promoted road safety campaigns highlighting the benefits of telematics in reducing accidents. Meanwhile, the Association of British Insurers has encouraged insurers to expand UBI offerings, emphasizing their role in reducing fraud and aligning premiums with actual risk profiles. Together, these efforts are shaping a market that strikes a balance between innovation, consumer protection, and long-term sustainability.

- Younger drivers and rising urban costs fuel demand for flexible, telematics-based insurance

- Strong regulations from FCA and ICO ensure fair pricing and data protection

- Government and industry bodies promote UBI for road safety, fraud reduction, and risk-based pricing

Malaysia’s Usage-Based Insurance Market Shows Strong Growth Potential

Malaysia's usage-based insurance (UBI) market is still in its early stages, but it is showing great promise, due to rising vehicle ownership and increased adoption of digital mobility solutions. Consumers, particularly younger drivers and ride-hailing service operators, are increasingly drawn to flexible insurance models that lower upfront costs while linking premiums to actual driving behavior. This shift reflects broader lifestyle changes in urban areas, were affordability and efficiency influence purchasing decisions.

Malaysian trends are shaped by the country's rapid adoption of connected technologies. Telematics devices and mobile applications are becoming increasingly available, enabling insurers to collect real-time driving data and offer pay-as-you-drive or pay-how-you-drive plans. The expansion of 5G infrastructure contributes to this transformation by providing faster and more reliable connectivity for vehicle telematics.

Regulatory frameworks are evolving to allow for insurance innovation. To enhance accessibility and transparency, the central regulatory body, Bank Negara Malaysia, has introduced risk-based capital frameworks and encouraged the adoption of digital insurance products. These steps make room for UBI to grow while protecting consumers.

- Rising vehicle ownership boosts UBI demand

- Telematics and 5G enable flexible models

- Supportive regulations drive market growth

South Africa’s Usage-Based Insurance Market Driven by Affordable and Flexible Motor Coverage

South Africa's usage-based insurance (UBI) market is expanding in response to rising demand for low-cost, flexible motor insurance. With rising vehicle ownership and economic pressures on household budgets, pay-as-you-drive and behavior-based models are becoming more appealing to both private drivers and fleet operators.

Telematics-based insurance solutions are particularly appealing in the logistics industry, where companies aim to reduce accident rates and improve fuel efficiency through driver monitoring.

Another major factor driving insurers toward UBI models is the country's high rate of road accidents. By rewarding safe driving with lower premiums, insurers address safety concerns while also increasing customer loyalty. Consumers, particularly younger and more cost-conscious drivers, are beginning to recognise the benefits of aligning insurance costs with driving behaviour, making UBI a viable option in a market sensitive to affordability.

Government and industry initiatives are also contributing to this shift. The Department of Transport has emphasized the role of telematics in improving road safety outcomes, while the South African Insurance Association has pushed for greater adoption of digital and risk-based insurance models. Together, these efforts are creating an environment in which UBI can thrive as a sustainable, consumer-friendly segment of the country's insurance industry.

- Rising demand for affordable, flexible motor insurance fuels UBI adoption

- High road accident rates drive insurers to reward safe driving

- Government and industry initiatives promote telematics and digital insurance growth

Category-wise Analysis

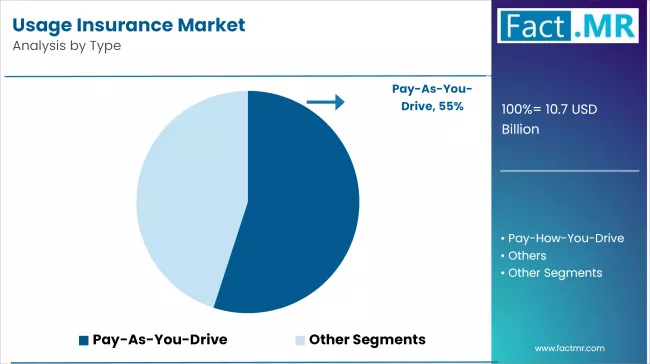

Pay-As-You-Drive (PAYD) to Exhibit Leading Share by Type

In 2025, the Pay-As-You-Drive (PAYD) segment dominates the Usage-Based Insurance (UBI) market, accounting for more than 45% of the total. This significant market share can be attributed to the direct relationship between insurance costs and actual vehicle usage, which appeals to a wide range of consumers.

PAYD models are especially popular among drivers who use their vehicles infrequently because they provide a low-cost alternative to traditional flat-rate insurance policies. Insurers can attract customers who seek financial flexibility and fairness by charging premiums based on distance driven.

PAYD's dominance is also reinforced by a growing consumer preference for digital and mobile platforms that enable real-time data tracking and sharing. Insurers can now implement PAYD systems more easily and affordably thanks to technological advancements. These systems use telematics devices installed in vehicles or mobile apps to monitor driving distance and, in some cases, driving behaviors.

- System-level twins dominate due to integration of multiple assets

- Widely deployed in oil and gas, automotive, and aerospace sectors

- Enhance real-time coordination, testing, and operational oversight

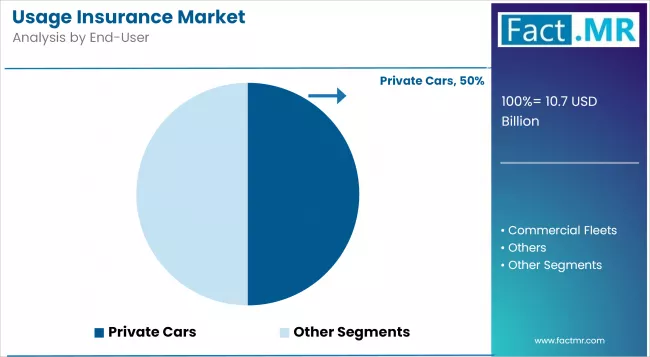

Private Cars to Exhibit Leading by End-User

The private cars segment leads the usage-based insurance market, as car owners seek more flexible and cost-effective insurance options. Rising fuel prices, maintenance costs, and economic pressures have pushed drivers to adopt pay-as-you-drive or behaviour-based policies that tie premiums to actual driving patterns. This approach is particularly appealing to middle-class families and younger consumers looking to reduce financial burdens.

Telematics devices, smartphone apps, and connected vehicle systems have all contributed to the growth of this market segment. Insurers use real-time data to personalize coverage, offer discounts for safe driving, and boost customer engagement. These innovations, combined with rising urbanization and vehicle ownership, are fueling strong growth in the private car segment.

- Rising costs drive demand for flexible, pay-as-you-drive insurance

- Telematics and apps enable personalized coverage and discounts

- Urbanization and vehicle ownership fuel private car segment growth

Competitive Analysis

The UBI market's competitive landscape is defined by the presence of a number of key players, including both established insurance companies and specialized telematics providers. These companies are making significant investments in technology and innovation in order to provide more accurate and personalized UBI products.

The market is also witnessing an increase in partnerships and collaborations among insurers, automakers, and telematics providers, all aimed at enhancing the overall UBI ecosystem. The competitive landscape is constantly changing, with new entrants and startups introducing innovative solutions to the market.

Progressive Corporation is a leading company in the UBI market, offering its Snapshot program to consumers nationwide. Progressive collects driving data using OBD-II devices and mobile apps and then offers personalized insurance premiums. The company places a strong emphasis on consumer education and marketing, making it one of the most well-known names in the UBI industry. Progressive's commitment to innovation and customer satisfaction has established it as a leader in the industry.

Another major player in the UBI market is Allstate Insurance Company, which offers the Drivewise program. Allstate uses smartphone technology and telematics devices to provide personalized insurance policies based on driver behavior. The company has a strong presence in North America and is expanding its UBI offerings into other markets. Allstate's emphasis on technology and customer engagement has helped it gain a sizable market share in the UBI space.

Key Players in the Market

- Insure the Box

- AllState Insurance Company

- State Farm

- Uniqa

- Groupama

- Generalli

- Progressive

- Metromile

- Root Insurance

- State Farm Drive Safe

- Uniposai

- Liberty Mutual

- Allianz SE

Recent Developments

- In April 2024, Allstate announced the findings of a study conducted in collaboration with Arity, a mobile data and analytics company, which highlighted the advantages of using its Drivewise application for vehicles. According to the 16th 'Allstate America's Best Drivers Report,' customers who use Drivewise have a 25% lower risk of being involved in a serious collision than those who do not use this feature. The user-based insurance solution provides users with feedback on safe driving after each trip, allowing them to save on their policy.

- In November 2023, Progressive Corporation's Snapshot program is gaining popularity, with drivers saving an average of $231 per year. Progressive's strong presence in the UBI market demonstrates the appeal of data-driven pricing models that reward safe driving habits.

Segmentation of Usage Insurance Market

-

By Type :

- Pay-As-You-Drive

- Pay-How-You-Drive

- Others

-

By End-User :

- Private Cars

- Commercial Fleets

- Others

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Billion) & Units Analysis, 2020-2024

- Current and Future Market Size Value (USD Billion) & Units Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Billion) & Units Analysis By Type, 2020-2024

- Current and Future Market Size Value (USD Billion) & Units Analysis and Forecast By Type, 2025-2035

- Pay-As-You-Drive

- Pay-How-You-Drive

- Others

- Y-o-Y Growth Trend Analysis By Type, 2020-2024

- Absolute $ Opportunity Analysis By Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End-User

- Introduction / Key Findings

- Historical Market Size Value (USD Billion) & Units Analysis By End-User, 2020-2024

- Current and Future Market Size Value (USD Billion) & Units Analysis and Forecast By End-User, 2025-2035

- Private Cars

- Commercial Fleets

- Others

- Y-o-Y Growth Trend Analysis By End-User, 2020-2024

- Absolute $ Opportunity Analysis By End-User, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Billion) & Units Analysis By Region, 2020-2024

- Current Market Size Value (USD Billion) & Units Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- U.K.

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Europe

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- South Asia & Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia & Pacific

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Billion) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Billion) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-User

- Key Takeaways

- Key Countries Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- U.K.

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Nordic

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- BENELUX

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Balkan & Baltics

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-User

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By End-User

- Competition Analysis

- Competition Deep Dive

- Insure the Box

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- AllState Insurance Company

- State Farm

- Uniqa

- Groupama

- Generalli

- Progressive

- Metromile

- Root Insurance

- State Farm Drive Safe

- Uniposai

- Liberty Mutual

- Allianz SE

- Insure the Box

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Billion) Forecast by Region, 2020 to 2035

- Table 2: Global Market Units Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 4: Global Market Units Forecast by Type, 2020 to 2035

- Table 5: Global Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 6: Global Market Units Forecast by End-User, 2020 to 2035

- Table 7: North America Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 8: North America Market Units Forecast by Country, 2020 to 2035

- Table 9: North America Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 10: North America Market Units Forecast by Type, 2020 to 2035

- Table 11: North America Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 12: North America Market Units Forecast by End-User, 2020 to 2035

- Table 13: Latin America Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Units Forecast by Country, 2020 to 2035

- Table 15: Latin America Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 16: Latin America Market Units Forecast by Type, 2020 to 2035

- Table 17: Latin America Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 18: Latin America Market Units Forecast by End-User, 2020 to 2035

- Table 19: Western Europe Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Units Forecast by Country, 2020 to 2035

- Table 21: Western Europe Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 22: Western Europe Market Units Forecast by Type, 2020 to 2035

- Table 23: Western Europe Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 24: Western Europe Market Units Forecast by End-User, 2020 to 2035

- Table 25: Eastern Europe Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Units Forecast by Country, 2020 to 2035

- Table 27: Eastern Europe Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 28: Eastern Europe Market Units Forecast by Type, 2020 to 2035

- Table 29: Eastern Europe Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 30: Eastern Europe Market Units Forecast by End-User, 2020 to 2035

- Table 31: East Asia Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 32: East Asia Market Units Forecast by Country, 2020 to 2035

- Table 33: East Asia Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 34: East Asia Market Units Forecast by Type, 2020 to 2035

- Table 35: East Asia Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 36: East Asia Market Units Forecast by End-User, 2020 to 2035

- Table 37: South Asia & Pacific Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 38: South Asia & Pacific Market Units Forecast by Country, 2020 to 2035

- Table 39: South Asia & Pacific Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 40: South Asia & Pacific Market Units Forecast by Type, 2020 to 2035

- Table 41: South Asia & Pacific Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 42: South Asia & Pacific Market Units Forecast by End-User, 2020 to 2035

- Table 43: Middle East & Africa Market Value (USD Billion) Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Units Forecast by Country, 2020 to 2035

- Table 45: Middle East & Africa Market Value (USD Billion) Forecast by Type, 2020 to 2035

- Table 46: Middle East & Africa Market Units Forecast by Type, 2020 to 2035

- Table 47: Middle East & Africa Market Value (USD Billion) Forecast by End-User, 2020 to 2035

- Table 48: Middle East & Africa Market Units Forecast by End-User, 2020 to 2035

List Of Figures

- Figure 1: Global Market Units Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Billion) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Type

- Figure 7: Global Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by End-User

- Figure 10: Global Market Value (USD Billion) Share and BPS Analysis by Region, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Region

- Figure 13: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: South Asia & Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 21: North America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 22: North America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 23: North America Market Attractiveness Analysis by Type

- Figure 24: North America Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by End-User

- Figure 27: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Latin America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 29: Latin America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 30: Latin America Market Attractiveness Analysis by Type

- Figure 31: Latin America Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 32: Latin America Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 33: Latin America Market Attractiveness Analysis by End-User

- Figure 34: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 35: Western Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 36: Western Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 37: Western Europe Market Attractiveness Analysis by Type

- Figure 38: Western Europe Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 39: Western Europe Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 40: Western Europe Market Attractiveness Analysis by End-User

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 42: Eastern Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 43: Eastern Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 44: Eastern Europe Market Attractiveness Analysis by Type

- Figure 45: Eastern Europe Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 46: Eastern Europe Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 47: Eastern Europe Market Attractiveness Analysis by End-User

- Figure 48: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 49: East Asia Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 50: East Asia Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 51: East Asia Market Attractiveness Analysis by Type

- Figure 52: East Asia Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 53: East Asia Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 54: East Asia Market Attractiveness Analysis by End-User

- Figure 55: South Asia & Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 56: South Asia & Pacific Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 57: South Asia & Pacific Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 58: South Asia & Pacific Market Attractiveness Analysis by Type

- Figure 59: South Asia & Pacific Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 60: South Asia & Pacific Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 61: South Asia & Pacific Market Attractiveness Analysis by End-User

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: Middle East & Africa Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 64: Middle East & Africa Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 65: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 66: Middle East & Africa Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 67: Middle East & Africa Market Y-o-Y Growth Comparison by End-User, 2025 to 2035

- Figure 68: Middle East & Africa Market Attractiveness Analysis by End-User

- Figure 69: Global Market - Tier Structure Analysis

- Figure 70: Global Market - Company Share Analysis

- FAQs -

What is the Global Usage Insurance Market size in 2025?

The usage insurance market is valued at USD 10.7 billion in 2025.

Who are the Major Players Operating in the Usage Insurance Market?

Prominent players in the market include Insure the Box, AllState Insurance Company, State Farm, Uniqa, Groupama, Generalli, and Progressive.

What is the Estimated Valuation of the Usage Insurance Market by 2035?

The market is expected to reach a valuation of USD 28.8 billion by 2035.

What Value CAGR Did the Usage Insurance Market Exhibit over the Last Five Years?

The historic growth rate of the usage insurance market is 10.4% from 2020-2024.