Bioactive Materials Market

Bioactive Materials Market Size and Share Forecast Outlook 2025 to 2035

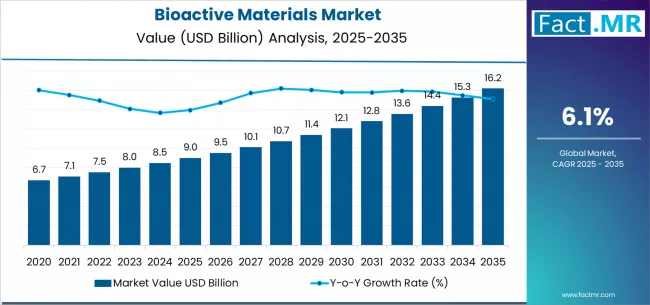

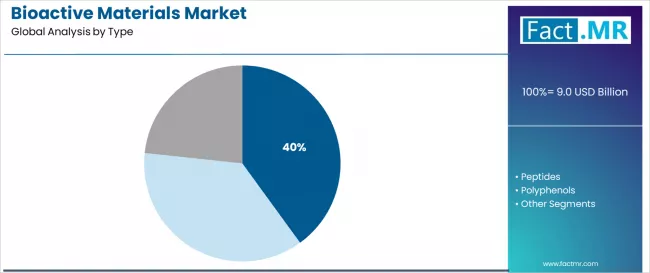

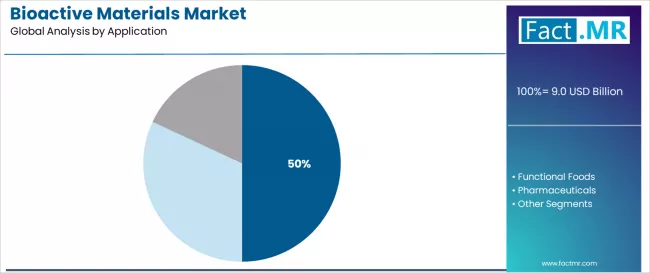

Bioactive materials market is projected to grow from USD 9.0 billion in 2025 to USD 16.2 billion by 2035, at a CAGR of 6.1%. Antioxidants will dominate with a 40.0% market share, while nutraceuticals will lead the application segment with a 50.0% share.

Bioactive Materials Market Forecast and Outlook 2025 to 2035

The global bioactive materials market is valued at USD 9.0 billion in 2025 and is set to reach USD 16.2 billion by 2035, recording an absolute increase of USD 7.2 billion over the forecast period. This translates into a total growth of 80.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2035.

The overall market size is expected to grow by approximately 1.8X during the same period, supported by increasing demand for health-focused materials, growing nutritional consciousness among consumers, and rising applications across nutraceutical, functional food, and pharmaceutical segments.

Quick Stats for Bioactive Materials Market

- Bioactive Materials Market Value (2025): USD 9.0 billion

- Bioactive Materials Market Forecast Value (2035): USD 16.2 billion

- Bioactive Materials Market Forecast CAGR: 6.1%

- Leading Product Category in Bioactive Materials Market: Antioxidants (40.0%)

- Key Growth Regions in Bioactive Materials Market: North America, Europe, Asia-Pacific

- Key Players in Bioactive Materials Market: DSM, Lonza, Ingredion, Kerry, Cargill

The global bioactive materials market represents a critical segment within the functional ingredients and health-focused materials industry, driven by the superior nutritional profile of bioactive compounds and the diverse functional properties of various bioactive material types. These specialized material products are produced through precision extraction processes, providing consistent bioactivity standards and standardized performance characteristics for various nutritional and pharmaceutical applications including dietary supplementation, food fortification, and specialized health formulations. The processing mechanism enables controlled bioactivity development, making these products particularly suitable for health-conscious consumers and applications requiring specific nutritional enhancement characteristics.

The market encompasses various material types, processing grades, and specialized extraction methods tailored for specific health requirements. Modern bioactive material production incorporates advanced extraction technology, compound optimization, and enhanced processing techniques that can deliver consistent quality across variable biological sources while maintaining nutritional integrity over extended storage periods. The integration of quality control systems, bioactivity protocols, and standardized processing parameters has further enhanced the value proposition of these material products among manufacturers seeking reliable ingredient performance and consistent health outcomes.

Market dynamics are significantly influenced by rising health awareness, particularly in developed markets where wellness concerns and health-focused consumption patterns drive demand for functional ingredient products. The health sector's increasing emphasis on bioactive materials, natural product formulations, and specialized nutritional applications has created substantial demand for high-quality bioactive material solutions in supplement applications, food fortification, and pharmaceutical preparation. Additionally, the growing trend toward preventive healthcare and functional nutrition has amplified the need for versatile material products capable of supporting diverse health requirements and nutritional applications.

Consumer purchasing patterns show a marked preference for certified bioactive material varieties that combine natural extraction methods with consistent bioactivity characteristics, multiple application options, and comprehensive health profiles for diverse nutritional applications. The market has witnessed significant technological advancement in extraction efficiency design, quality control systems, and processing solutions, making these products more suitable for demanding health conditions, extended stability requirements, and efficacy-critical health operations.

Between 2025 and 2030, the bioactive materials market is projected to expand from USD 9.0 billion to USD 12.2 billion, resulting in a value increase of USD 3.2 billion, which represents 44.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing functional ingredient adoption, rising demand for alternative health solutions, and growing availability of premium bioactive material varieties across health and nutrition channels.

Between 2030 and 2035, the market is forecast to grow from USD 12.2 billion to USD 16.2 billion, adding another USD 4.0 billion, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by the advancement of specialty bioactive material applications, the development of enhanced material products for health improvement, and the expansion of certified bioactive material availability across diverse health and nutrition segments. The growing emphasis on functional ingredients and natural health processing will drive demand for premium bioactive material varieties with enhanced functional properties, improved bioactivity characteristics, and superior performance profiles in specialized health applications.

Between 2020 and 2024, the bioactive materials market experienced steady growth, driven by increasing awareness of functional ingredient benefits and growing recognition of bioactive materials' effectiveness in health applications following extensive nutritional education campaigns. The market developed as manufacturers recognized the advantages of bioactive materials over traditional ingredient alternatives in health-sensitive applications and began seeking specialized products designed for specific bioactivity and nutritional requirements. Technological advancement in extraction technology and quality control began emphasizing the critical importance of maintaining nutritional integrity while enhancing functional performance and improving bioactivity across diverse bioactive material applications.

Bioactive Materials Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 9.0 billion |

| Forecast Value in (2035F) | USD 16.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

From 2030 to 2035, the market is forecast to grow from USD 12.2 billion to USD 16.2 billion, adding another USD 4.0 billion, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by the advancement of specialized processing techniques in material production systems, the integration of quality enhancement protocols for optimal bioactivity retention, and the development of customized material formulations for high-performance health applications. The growing emphasis on material functionality and product reliability will drive demand for premium varieties with enhanced processing capabilities, improved storage stability, and superior health performance characteristics.

Between 2020 and 2024, the bioactive materials market experienced robust growth, driven by increasing awareness of alternative ingredient benefits and growing recognition of specialized material systems' effectiveness in supporting diverse health operations across nutritional facilities and specialty health environments. The market developed as users recognized the potential for bioactive material products to deliver functional advantages while meeting modern requirements for natural ingredients and reliable health performance. Technological advancement in processing optimization and quality enhancement began emphasizing the critical importance of maintaining material consistency while extending product stability and improving user satisfaction across diverse bioactive material applications.

Why is the Bioactive Materials Market Growing?

Market expansion is being supported by the increasing global emphasis on functional health materials and the corresponding shift toward alternative ingredient systems that can provide superior bioactivity characteristics while meeting health requirements for natural ingredient solutions and cost-effective wellness options. Modern health companies are increasingly focused on incorporating material products that can enhance health performance while satisfying demands for consistent, precisely controlled bioactivity development and optimized nutritional profiles. Bioactive materials' proven ability to deliver health excellence, functional versatility, and diverse application possibilities makes them essential ingredients for health-focused consumers and quality-focused nutritional professionals.

The growing emphasis on functional ingredients and natural health processing is driving demand for high-performance bioactive material systems that can support distinctive health outcomes and comprehensive nutritional benefits across supplement applications, food fortification, and specialty health manufacturing. Health preference for material solutions that combine functional excellence with natural processing methods is creating opportunities for innovative implementations in both traditional and emerging health applications. The rising influence of wellness awareness and alternative health approaches is also contributing to increased adoption of bioactive material solutions that can provide authentic functional benefits and reliable bioactivity characteristics.

Segmental Analysis

The market is segmented by type, application, and region. By type, the market is divided into antioxidants, peptides, and polyphenols. Based on application, the market is categorized into nutraceuticals, functional foods, and pharmaceuticals. Regionally, the market is divided into North America, Europe, and Asia-Pacific.

Why do Antioxidants Account for the Largest Share of the Bioactive Materials Market?

The antioxidants segment is projected to account for 40.0% of the bioactive materials market in 2025, reaffirming its position as the leading material category. Health companies and nutritional professionals increasingly utilize antioxidant materials for their superior protective characteristics, established bioactivity properties, and essential functionality in diverse health applications across multiple nutritional sectors. Antioxidant material's proven performance characteristics and established cost-effectiveness directly address user requirements for reliable health protection and optimal processing precision in supplement and specialty health applications.

This material segment forms the foundation of modern functional health patterns, as it represents the bioactive material type with the greatest health versatility and established compatibility across multiple health systems. Health industry investments in alternative ingredient technology and application optimization continue to strengthen adoption among wellness-focused users. With processors prioritizing material reliability and functional consistency, antioxidant systems align with both performance objectives and health requirements, making them the central component of comprehensive wellness strategies.

What Makes Nutraceuticals a Dominant Application Area?

Nutraceuticals is projected to represent 50.0% of the bioactive materials market in 2025, underscoring its important role as a key application for performance-focused users seeking superior health benefits and enhanced nutritional credentials. Health facilities and supplement operations prefer nutraceutical applications for their established performance characteristics, proven bioactivity development, and ability to maintain exceptional health precision while supporting versatile application coverage during diverse supplement activities. Positioned as essential applications for quality-focused health processors, nutraceutical offerings provide both functional excellence and health optimization advantages.

The segment is supported by continuous improvement in health technology and the widespread availability of established performance standards that enable quality assurance and premium positioning at the health level. Additionally, health facilities are optimizing material selections to support application-specific requirements and comprehensive health strategies. As health technology continues to advance and facilities seek consistent material performance, nutraceutical applications will continue to drive market growth while supporting operational efficiency and quality optimization strategies.

What are the Drivers, Restraints, and Key Trends of the Bioactive Materials Market?

The bioactive materials market is advancing rapidly due to increasing functional ingredient adoption and growing need for alternative material solutions that emphasize superior bioactivity performance across health segments and specialty wellness applications. However, the market faces challenges, including competition from other alternative ingredient types, price volatility in raw material sources, and processing complexity considerations affecting production costs. Innovation in extraction technology enhancement and specialized material formulations continues to influence market development and expansion patterns.

Expansion of Natural and Certified Applications

The growing adoption of bioactive materials with natural certification and health positioning is enabling health companies to develop ingredient products that provide distinctive wellness benefits while commanding premium pricing and enhanced consumer appeal characteristics. Natural applications provide superior market positioning while allowing more sophisticated product differentiation features across various health categories. Health companies are increasingly recognizing the market advantages of natural material positioning for comprehensive wellness outcomes and premium-focused health marketing.

Integration of Bioactivity and Performance Enhancement Systems

Modern bioactive material manufacturers are incorporating advanced bioactivity enhancement, performance improvement capabilities, and health supplementation systems to enhance product functionality, improve wellness effectiveness, and meet consumer demands for enhanced health solutions. These systems improve product performance while enabling new applications, including specialty health programs and specialized wellness protocols. Advanced performance integration also allows manufacturers to support premium product positioning and health assurance beyond traditional material performance requirements.

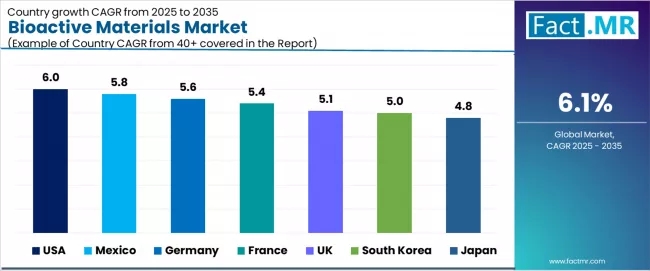

Analysis of the Bioactive Materials Market by Key Country

| Country | CAGR (2025-2035) |

|---|---|

| USA | 6.0% |

| UK | 5.1% |

| Germany | 5.6% |

| France | 5.4% |

| Japan | 4.8% |

| South Korea | 5.0% |

| Mexico | 5.8% |

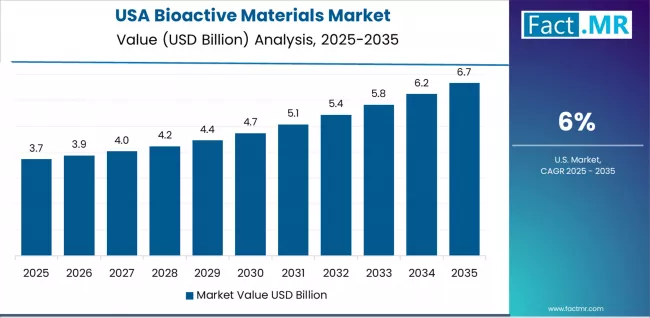

The bioactive materials market is experiencing robust growth globally, with USA leading at a 6.0% CAGR through 2035, driven by the expanding health ingredient sector, growing wellness consciousness, and increasing adoption of functional material products. Mexico follows at 5.8%, supported by rising health manufacturing capabilities, expanding wellness industry, and growing acceptance of bioactive ingredients.

Germany shows growth at 5.6%, emphasizing established health standards and comprehensive functional ingredient development. France records 5.4%, focusing on health industry modernization and wellness market growth. South Korea demonstrates 5.0% growth, prioritizing functional health technologies and bioactivity-focused wellness products.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

How is the Healthcare Industry determining Bioactive Materials Usage in USA?

Revenue from bioactive material consumption and sales in USA is projected to exhibit exceptional growth with a CAGR of 6.0% through 2035, driven by the country's rapidly expanding health ingredient sector, favorable wellness policies toward functional materials, and initiatives promoting bioactive material development across major health regions.

The USA's position as a global health leader and increasing focus on processed functional ingredients are creating substantial demand for high-quality bioactive materials in both domestic and international markets. Major health companies and ingredient distributors are establishing comprehensive material production capabilities to serve growing demand and emerging wellness opportunities.

- Established wellness culture and expanding health consciousness are driving demand for bioactive materials across health facilities, wellness-oriented companies, and comprehensive ingredient supply systems throughout American health markets.

- Strong health infrastructure and wellness adoption initiatives are supporting the rapid adoption of premium material varieties among health-focused processors seeking to meet evolving performance standards and quality requirements.

What are the Growth Prospects for Bioactive Materials in Mexico?

Revenue from bioactive material products in Mexico is expanding at a CAGR of 5.8%, supported by rising domestic health consumption, growing processing technology adoption, and expanding ingredient distributor capabilities.

The country's developing health infrastructure and increasing investment in processing technologies are driving demand for bioactive materials across both traditional and modern health applications. Global ingredient companies and domestic processors are establishing comprehensive operational networks to address growing market demand for alternative material products and efficient processing solutions.

- Rising health development and expanding processing capabilities are creating opportunities for material adoption across industrial health projects, modern processing developments, and distributor companies throughout major Mexican health regions.

- Growing wellness awareness initiatives and health technology advancement are driving the adoption of specialized material products and services among health users seeking to enhance their processing efficiency and meet increasing quality demand.

Will Advanced Processing Capabilities Open Opportunistic Doors for Bioactive Materials Manufacturers in Germany?

Revenue from bioactive material products in Germany is projected to grow at a CAGR of 5.6% through 2035, supported by the country's mature health processing standards, established functional ingredient regulations, and leadership in specialty material technology.

Germany's sophisticated wellness standards and strong support for alternative ingredients are creating steady demand for both traditional and innovative material varieties. Leading ingredient manufacturers and specialty distributors are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

- Advanced processing technology capabilities and established health-focused markets are driving demand for premium materials across health facilities, specialty companies, and comprehensive ingredient companies seeking superior quality profiles and processing innovation.

- Strong quality excellence culture and regulatory leadership are supporting the adoption of innovative material technology among users prioritizing processing reliability and ingredient precision in health applications.

How is France Consolidating its position in the Bioactive Materials Industry?

Revenue from bioactive material products in France is projected to grow at a CAGR of 5.4% through 2035, driven by the country's emphasis on health industry development, ingredient processing growth, and growing distributor capabilities.

French manufacturers and processing facilities consistently seek quality-focused ingredients that enhance product performance and support processing excellence for both traditional and modern health applications. The country's position as a European health leader continues to drive innovation in specialized ingredient applications and health processing standards.

- Expanding health culture and growing wellness markets are driving demand for industrial materials across processors, ingredient providers, and quality-focused distributors seeking superior processing control and distinctive performance profiles.

- Increasing focus on health processing efficiency and wellness modernization systems is supporting the adoption of specialty material varieties among users and distributors seeking authentic French processing-focused products in regional markets with established health expertise.

What is the scope for Bioactive Materials Demand in South Korea?

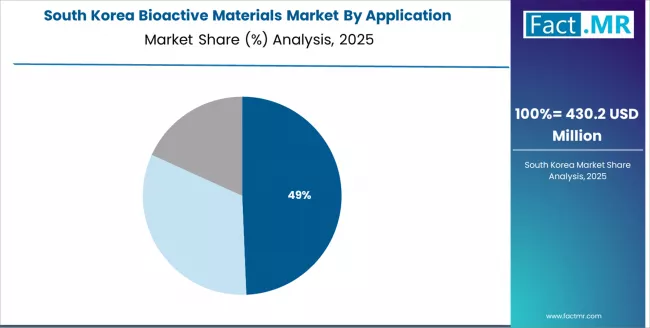

Revenue from bioactive material products in South Korea is projected to grow at a CAGR of 5.0% through 2035, supported by established health standards, mature wellness markets, and emphasis on functional alternatives across health and industrial sectors.

South Korean manufacturers and specialty processors prioritize quality ingredients and consistent performance, creating steady demand for premium material solutions. The country's comprehensive market innovation and established health practices support continued development in specialized applications.

- Established health markets and mature specialty industry are driving demand for quality materials across operations, facilities, and professional processing companies throughout Korean health regions.

- Strong emphasis on quality standards and wellness awareness is supporting the adoption of premium material varieties among users seeking proven performance and established health credentials in specialty applications.

How is the Bioactive Materials Ecosystem in the UK Expected to Grow?

Revenue from bioactive material products in the UK is projected to grow at a CAGR of 5.1% through 2035, supported by established health standards, mature wellness markets, and emphasis on functional alternatives across health and nutrition sectors.

British manufacturers and specialty processors prioritize quality ingredients and consistent performance, creating steady demand for premium material solutions. The country's comprehensive market maturity and established health practices support continued development in specialized applications.

- Established health markets and mature specialty industry are driving demand for quality materials across health operations, wellness facilities, and professional processing companies throughout British health regions.

- Strong emphasis on quality standards and wellness awareness is supporting the adoption of premium material varieties among users seeking proven performance and established health credentials in specialty applications.

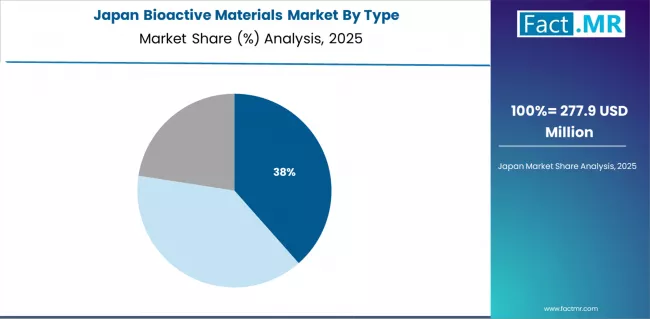

How are Prospects for Bioactive Materials in Japan likely to Improve?

Revenue from bioactive material products in Japan is projected to grow at a CAGR of 4.8% through 2035, supported by the country's emphasis on ingredient quality, health excellence, and advanced processing technology integration requiring efficient ingredient solutions.

Japanese health facilities and quality-focused operations prioritize technical performance and health precision, making specialized materials essential ingredients for both traditional and modern health applications. The country's comprehensive health leadership and advancing quality patterns support continued market expansion.

- Advanced health technology capabilities and growing technical applications are driving demand for materials across specialty health applications, modern formats, and technology-integrated processing programs serving domestic markets with increasing quality requirements.

- Strong focus on health precision and ingredient excellence is encouraging users and distributors to adopt material solutions that support health objectives and meet Japanese quality standards for processing applications.

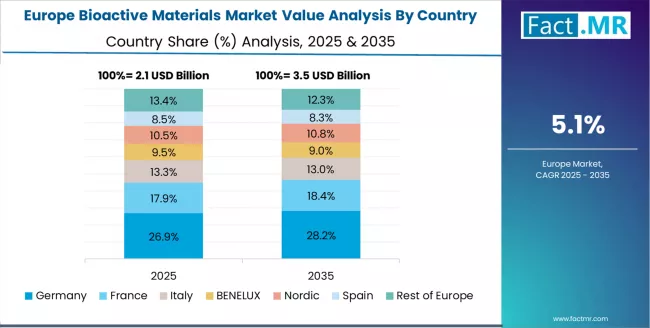

What is the Bioactive Materials Market Growth Profile in Key Countries in Europe?

The bioactive materials market in Europe is projected to grow from USD 3.15 billion in 2025 to USD 5.67 billion by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 30.0% market share in 2025, declining slightly to 29.5% by 2035, supported by its advanced health infrastructure and major wellness ingredient hubs including Berlin and Munich.

France follows with a 25.0% share in 2025, projected to reach 25.5% by 2035, driven by comprehensive health modernization programs and functional ingredient initiatives. The UK holds a 22.0% share in 2025, expected to decrease to 21.5% by 2035 due to market maturation.

Italy commands a 15.0% share, while Spain accounts for 8.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 0.0% to 0.5% by 2035, attributed to increasing material adoption in Nordic countries and emerging Eastern European markets implementing health technology programs.

Competitive Landscape of the Bioactive Materials Market

The bioactive materials market is characterized by competition among established ingredient manufacturers, specialized material companies, and integrated health processing providers. Companies are investing in advanced extraction technologies, specialized processing engineering, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable bioactive material products. Innovation in processing efficiency optimization, quality control advancement, and bioactivity-focused product development is central to strengthening market position and customer satisfaction.

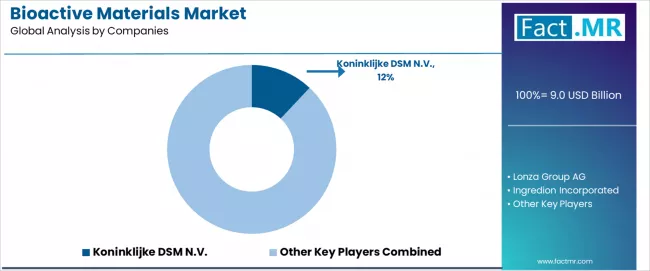

Koninklijke DSM N.V. leads the market with 12.0% share with a strong focus on ingredient technology innovation and comprehensive health solutions, offering health and specialty systems with emphasis on quality excellence and bioactivity heritage.

Lonza Group AG provides integrated functional ingredient solutions with a focus on health market applications and functional ingredient networks. Ingredion delivers comprehensive bioactive products with a focus on health positioning and nutritional quality.

Kerry Group Plc. specializes in ingredient-based material systems with an emphasis on health applications. Cargill Incorporated focuses on comprehensive ingredient processing with advanced extraction technology and health positioning capabilities.

Key Players in the Bioactive Materials Market

- Koninklijke DSM N.V.

- Lonza Group AG

- Ingredion Incorporated

- Kerry Group plc

- Cargill Incorporated

- BASF SE

- Chr. Hansen Holding A/S

- Novozymes A/S

- Evonik Industries AG

- Gelita AG

- Biosearch Life S.A.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 9.0 Billion |

| Type | Antioxidants, Peptides, Polyphenols |

| Application | Nutraceuticals, Functional Foods, Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific |

| Countries Covered | USA, UK, Germany, France, Japan, South Korea, Mexico, and 40+ countries |

| Key Companies Profiled | DSM, Lonza, Ingredion, Kerry, Cargill, and other leading bioactive material companies |

| Additional Attributes | Dollar sales by type, application, and region; regional demand trends, competitive landscape, technological advancements in material processing, quality optimization initiatives, bioactivity enhancement programs, and premium product development strategies |

Bioactive Materials Market by Segments

-

Type :

- Antioxidants

- Peptides

- Polyphenols

-

Application :

- Nutraceuticals

- Functional Foods

- Pharmaceuticals

-

Region :

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- North America

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Type , 2025 to 2035

- Antioxidants

- Peptides

- Polyphenols

- Y to o to Y Growth Trend Analysis By Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Application, 2025 to 2035

- Nutraceuticals

- Functional Foods

- Pharmaceuticals

- Y to o to Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Application

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Application

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Application

- Competition Analysis

- Competition Deep Dive

- Koninklijke DSM N.V.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Lonza Group AG

- Ingredion Incorporated

- Kerry Group plc

- Cargill Incorporated

- BASF SE

- Chr. Hansen Holding A/S

- Novozymes A/S

- Evonik Industries AG

- Gelita AG

- Biosearch Life S.A.

- Koninklijke DSM N.V.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 4: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 7: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 8: Latin America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 11: Western Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 12: Western Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Eastern Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 15: Eastern Europe Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 16: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 17: East Asia Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 18: East Asia Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 19: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 20: South Asia and Pacific Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 21: South Asia and Pacific Market Value (USD Million) Forecast by Application, 2020 to 2035

- Table 22: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 23: Middle East & Africa Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 24: Middle East & Africa Market Value (USD Million) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Application

- Figure 9: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 13: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 14: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 15: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 20: North America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 21: North America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 22: North America Market Attractiveness Analysis by Type

- Figure 23: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Application

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Latin America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 28: Latin America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 29: Latin America Market Attractiveness Analysis by Type

- Figure 30: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 31: Latin America Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 32: Latin America Market Attractiveness Analysis by Application

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Western Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 35: Western Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 36: Western Europe Market Attractiveness Analysis by Type

- Figure 37: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 38: Western Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 39: Western Europe Market Attractiveness Analysis by Application

- Figure 40: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 42: Eastern Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 43: Eastern Europe Market Attractiveness Analysis by Type

- Figure 44: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 45: Eastern Europe Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 46: Eastern Europe Market Attractiveness Analysis by Application

- Figure 47: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 48: East Asia Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 49: East Asia Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 50: East Asia Market Attractiveness Analysis by Type

- Figure 51: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 52: East Asia Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 53: East Asia Market Attractiveness Analysis by Application

- Figure 54: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 55: South Asia and Pacific Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 56: South Asia and Pacific Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 57: South Asia and Pacific Market Attractiveness Analysis by Type

- Figure 58: South Asia and Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 59: South Asia and Pacific Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 60: South Asia and Pacific Market Attractiveness Analysis by Application

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 63: Middle East & Africa Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 66: Middle East & Africa Market Y to o to Y Growth Comparison by Application, 2025-2035

- Figure 67: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

How big is the bioactive materials market in 2025?

The global bioactive materials market is estimated to be valued at USD 9.0 billion in 2025.

What will be the size of bioactive materials market in 2035?

The market size for the bioactive materials market is projected to reach USD 16.2 billion by 2035.

How much will be the bioactive materials market growth between 2025 and 2035?

The bioactive materials market is expected to grow at a 6.1% CAGR between 2025 and 2035.

What are the key product types in the bioactive materials market?

The key product types in bioactive materials market are antioxidants, peptides and polyphenols.

Which application segment to contribute significant share in the bioactive materials market in 2025?

In terms of application, nutraceuticals segment to command 50.0% share in the bioactive materials market in 2025.