Commercial Vehicle Transmission Market

Commercial Vehicle Transmission Market Analysis, By Type, By Transmission Type, By Vehicle Class, By Application, and Region – Market Insights 2025 to 2035

Analysis Of Commercial Vehicle Transmission Market Covering 30+ Countries Including Analysis Of US, Canada, UK, Germany, France, Nordics, GCC Countries, Japan, Korea And Many More

Commercial Vehicle Transmission Market Outlook 2025 to 2035

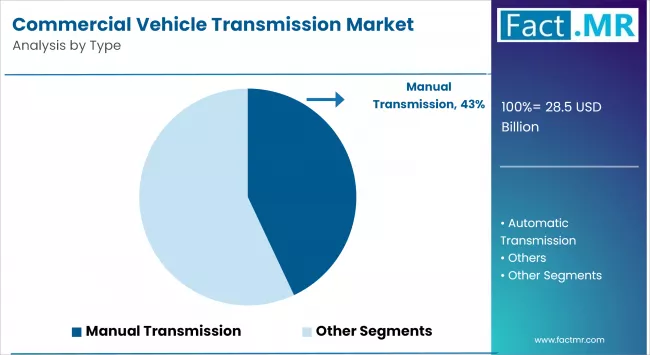

The global commercial vehicle transmission market is projected to rise from USD 28.5 billion in 2025 to USD 46.9 billion by 2035, growing at a CAGR of 5.1% during the forecast period. This growth is driven by the evolution of fleet efficiency standards, increasing demand for freight transportation, and global transition toward low-emission drivetrains. Additionally, the adoption of automatic and automated manual transmissions (AMTs) in heavy-duty commercial vehicles is boosting operational efficiency and driver comfort.

Transmission systems are pivotal to optimizing vehicle performance, fuel efficiency, and maintenance cost across light, medium, and heavy commercial vehicles. In recent years, regulatory pressures for fuel economy, combined with the need for smoother operation in urban logistics, have catalyzed investments into advanced and electrified transmission technologies. The push toward hybridization and electrification of commercial fleets, particularly in Europe and Asia, is also contributing to significant innovation in the market.

Metric Overview

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 28.5 billion |

| Market Size (2035F) | USD 46.9 billion |

| CAGR (2025-2035) | 5.1% |

2025-to-2035.webp)

What are the Key Drivers of the Commercial Vehicle Transmission Market?

The global rise in e-commerce and last-mile delivery services is directly increasing the number of light and medium-duty commercial vehicles on roads. This surge requires transmission systems that offer fuel economy, responsiveness in stop-and-go traffic, and minimal downtime.

Transmissions with higher torque conversion and smoother gear shifting help optimize these vehicle classes, which is accelerating the demand for more efficient and automated systems.

In addition, expanding road freight corridors in North America, India, and Southeast Asia are contributing to a larger pool of heavy-duty trucks, requiring robust transmission architectures for cross-country haulage.

There is a significant market shift from manual transmissions to automatic and automated manual transmissions (AMTs) in both medium and heavy-duty commercial vehicles. Automatic gearboxes improve fuel efficiency through real-time shift decisions and reduce driver fatigue. With growing shortages of skilled commercial drivers, fleets are favoring easier-to-operate transmission types.

Automated solutions are now being tailored for off-road, mining, and heavy-load environments markets historically dominated by manual systems due to recent improvements in heat management, clutch durability, and software calibration.

With mounting pressure to decarbonize transport, OEMs are incorporating hybrid-electric and fully electric transmissions for commercial applications. Hybrid CV transmissions integrate with regenerative braking and electric drive modules to lower emissions while offering the torque characteristics needed for freight.

Manufacturers like Allison Transmission and Eaton are introducing integrated electric axle and e-drive transmission solutions for electric buses and Class 6 8 trucks. These innovations are anticipated to transform the landscape of CV drivetrains by the end of the decade.

What are the Regional Trends of the Commercial Vehicle Transmission Market?

Asia-Pacific Dominates Global Market with Manufacturing and Demand Strength

Asia-Pacific, particularly China, India, and Japan, is the dominant region due to its large-scale commercial vehicle manufacturing, infrastructure growth, and logistics demand. China has embraced AMT systems for long-haul trucks to combat fuel inefficiencies, while India is gradually adopting automatic and hybrid CV transmissions amid regulatory changes and urban transport reforms. Japan leads in compact, hybrid-ready transmission units for commercial minivans and delivery fleets.

The presence of major domestic OEMs like Tata Motors, Foton, and Dongfeng, as well as international players like Isuzu and Hino, ensures stable transmission system demand across all classes of commercial vehicles.

North America Leverages Technology and Fleet Modernization

North America has seen rapid adoption of automatic and hybrid transmission technologies, especially in logistics, utility services, and school buses. Regulatory actions such as EPA's Phase 2 GHG regulations have forced OEMs to incorporate fuel-saving transmission systems.

Major truck manufacturers like Freightliner, Kenworth, and Navistar are incorporating AMTs and electric propulsion-ready transmissions. Regional investments in autonomous driving, particularly in Class 8 trucks, are spurring demand for shift-by-wire and integrated control transmission systems.

Europe Pushes Electrification and Emission-Optimized Transmissions

Europe’s strict carbon emission targets and urban mobility policies are pushing OEMs to integrate dual-clutch, AMT, and e-drive transmissions in commercial vehicles. Germany, the Netherlands, and France are at the forefront of adopting battery-electric trucks and buses, which use integrated powertrain systems to replace conventional transmissions.

Scandinavian countries are also promoting electric and hybrid buses in urban public transport networks, creating demand for lightweight, maintenance-free electric drivetrains with regenerative transmission features.

What are the Challenges and Restraining Factors of the Commercial Vehicle Transmission Market?

Automatic and AMT systems cost significantly more than manual transmission systems. Fleet operators in developing regions like Africa and parts of Southeast Asia still prefer manual CV transmissions due to cost constraints. The cost of electronic controllers, precision actuators, and maintenance for automatic systems discourages small fleet owners from adopting them, particularly in heavy-duty segments.

Although electric drivetrains eliminate traditional multi-speed gearboxes, integrating transmission systems in hybrid CVs requires advanced control algorithms, motor synchronizations, and compact design. Ensuring seamless communication between engine, battery, and transmission units remains a major hurdle. Component overheating and durability challenges under full payload in hybrid trucks reduce the scalability of these systems across all commercial vehicle categories.

Many regions still lack skilled technicians trained to handle diagnostic and servicing needs of AMTs or e-drive systems. This results in longer vehicle downtime and increased maintenance costs. Additionally, aftermarket access to genuine parts for electronically-controlled transmissions is limited in remote markets, reducing their operational reliability.

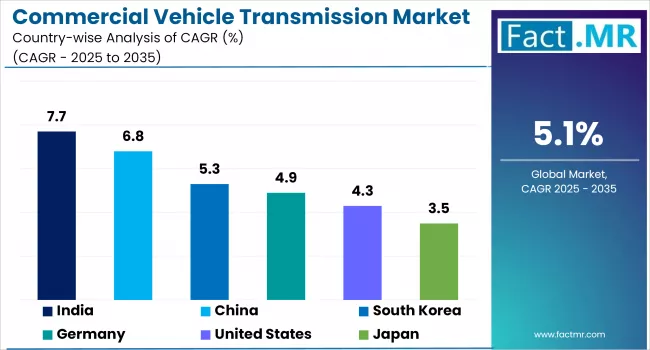

Country-Wise Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| China | 6.8% |

| Germany | 4.9% |

United States: Fleet Modernization and Electrification Leading the Shift

2025-to-2035.webp)

The U.S. is a key player in the commercial vehicle transmission market, owing to its extensive Class 6 8 truck fleet and rapid electrification in logistics and public services. The presence of leading transmission OEMs such as Allison Transmission, Eaton, and Dana supports domestic innovation.

Fleet operators are transitioning from manual to automated transmissions to comply with stringent fuel efficiency regulations under EPA Phase 2. The growth of last-mile delivery fleets operated by UPS and FedEx has also fueled demand for smoother and fuel-efficient transmission systems. Electrification pilots in cities such as Los Angeles and New York are creating demand for e-axles and multi-speed EV transmissions.

China: Dominance in Production and Technological Shift

China continues to lead the global commercial vehicle production volumes. With initiatives like the "New Energy Vehicles (NEV) policy", the government supports electric and hybrid trucks, driving demand for high-efficiency, low-emission transmissions.

Major Chinese OEMs including FAW, Dongfeng, and SAIC are localizing production of AMT and electric CV transmissions to reduce dependence on foreign technology. Heavy-duty AMT systems are also being deployed for inter-city freight to reduce driver fatigue and increase long-term fleet efficiency. Collaborations with global firms like ZF and Voith have improved the technical sophistication of domestically produced transmission systems.

Germany: Engineering Precision Drives Hybrid and EV Adoption

Germany is the innovation hub of Europe for both automotive and transmission system engineering. The market is witnessing growing integration of hybrid and e-drive transmissions in electric buses, municipal utility vehicles, and commercial vans.

Regulations under the EU Green Deal and Euro 7 standards are forcing OEMs to accelerate electrified transmission development. Companies like ZF Friedrichshafen and Voith are leading the development of modular and integrated transmission-electric motor systems for commercial vehicles. Germany also supports dedicated R&D funding for CV electrification under the “Mobility and Fuel Strategy” program.

Category-wise Analysis

Manual Transmission (MT): Economical but Losing Ground

Manual transmission continues to be used in regions with cost-sensitive markets and limited driver automation requirements. They are favored in agriculture, construction, and entry-level freight vehicles in Latin America, Africa, and parts of South Asia due to their simplicity and low maintenance cost.

However, MTs are gradually being phased out in developed markets due to driver fatigue, lower efficiency, and difficulty in operation for urban deliveries. OEMs are reducing MT options in new truck models in favor of AMTs or fully automatic units.

Automatic Transmission (AT): Urban Driving and Bus Transit Oriented

Automatic transmissions are the system of choice for urban bus fleets, school transport, and municipal utility vehicles due to seamless shifting, ease of training drivers, and consistent fuel consumption.

Cities across Europe, North America, and Japan are phasing out MT-equipped buses for fully automatic CVs. Recent innovations in torque converter lock-up mechanisms, shift logic optimization, and thermal efficiency have boosted AT reliability even in heavy-duty commercial applications.

Automated Manual Transmission (AMT): Blending Economy with Automation

AMTs combine the structure of a manual gearbox with electronic shifting and clutch control, providing the fuel efficiency of MTs with driver comfort of ATs. This hybrid approach is gaining rapid acceptance in both developed and developing countries.

In heavy-duty trucks, AMTs enable optimal fuel usage in long-distance transport. Their use is rising sharply in Class 7–8 trucks in North America, intra-city delivery vans in Europe, and mining dumpers in Asia. Leading manufacturers like ZF and Eaton are investing in multi-speed AMTs with real-time telemetry to support autonomous driving and remote diagnostics.

Electric and Hybrid Transmissions: Fastest Growing Segment

With the growth in electric buses, delivery vans, and drayage trucks, transmission systems are evolving into compact, single-speed or multi-speed integrated e-drives. These systems replace traditional gearboxes with direct motor-drive or e-axle assemblies.

Hybrid CVs also require dedicated power-split or dual-clutch e-transmissions to balance engine and battery input. These setups provide high starting torque and regenerative energy recovery in urban driving. As electric CV adoption grows across China, Europe, and the U.S., this category is expected to witness the fastest CAGR over the forecast period.

Competitive Analysis

The commercial vehicle transmission market is moderately consolidated, with global players competing on performance, cost, and integration capabilities. Leaders like Allison Transmission, ZF Friedrichshafen, Eaton Corporation, Voith, Dana Incorporated, and BorgWarner dominate due to technological know-how and strategic OEM partnerships.

Product innovations center on lightweight designs, electronic control units (ECUs), multi-speed hybrid architectures, and integrated e-axles. Companies are also embedding smart diagnostics and condition monitoring systems to support predictive maintenance and reduce unplanned downtime. Joint ventures, such as ZF’s partnership with Tata Motors and Eaton’s ventures in China, are facilitating regional product localization and cost competitiveness.

Recent Developments (2024–2025)

- Allison Transmission expanded its eGen Power® electric axle portfolio for heavy-duty vehicles and buses in 2025, incorporating two-speed gearboxes to improve performance.

- ZF commissioned a second production line for commercial vehicle gear systems and introduced the TraXon 2 Hybrid transmission in 2025.

- In 2024, Eaton introduced the Precision Gen2 AMT for Class 7–8 trucks, which boasts sophisticated shift logic and telematics systems.

- 2024–2025 – Voith advanced its VEDS with the Future Inverter Platform, introducing it into series production in 2024 (without DMU) and 2025 (with incorporated DMU).

- In 2024, Dana introduced the Spicer Electrified™ Zero-6 e-Transmission, which features patented shifting and lubrication technologies to produce high-torque e-transaxles.

Segmentation of Commercial Vehicle Transmission Market

-

By Type :

- Manual Transmission

- Automatic Transmission

- Automated Manual Transmission (AMT)

- Electric & Hybrid Transmission

-

By Transmission Type :

- Single-Speed

- Multi-Speed

-

By Vehicle Class :

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

-

By Application :

- Freight Transport

- Public Transit

- Construction & Mining

- Utility & Emergency Services

- Last-Mile Delivery

- Others

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Type, 2025-2035

- Manual Transmission

- Automatic Transmission

- Automated Manual Transmission (AMT)

- Electric & Hybrid Transmission

- Y-o-Y Growth Trend Analysis By Type, 2020-2024

- Absolute $ Opportunity Analysis By Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Transmission Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Transmission Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Transmission Type, 2025-2035

- Single-Speed

- Multi-Speed

- Y-o-Y Growth Trend Analysis By Transmission Type, 2020-2024

- Absolute $ Opportunity Analysis By Transmission Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Vehicle Class

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Vehicle Class, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Vehicle Class, 2025-2035

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

- Y-o-Y Growth Trend Analysis By Vehicle Class, 2020-2024

- Absolute $ Opportunity Analysis By Vehicle Class, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Application, 2025-2035

- Freight Transport

- Public Transit

- Construction & Mining

- Utility & Emergency Services

- Last-Mile Delivery

- Others

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Bn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Value (USD Bn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Value (USD Bn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Transmission Type

- By Vehicle Class

- By Application

- Competition Analysis

- Competition Deep Dive

- Allison Transmission

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ZF Friedrichshafen

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Eaton Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Voith

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Dana Incorporated

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- BorgWarner

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Allison Transmission

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 9: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 10: Global Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 17: North America Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 18: North America Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 19: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 20: North America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 22: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 24: Latin America Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 25: Latin America Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 26: Latin America Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 27: Latin America Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 28: Latin America Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 29: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 30: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: Western Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 34: Western Europe Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 35: Western Europe Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 36: Western Europe Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 37: Western Europe Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 38: Western Europe Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 39: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 40: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 41: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: East Asia Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 44: East Asia Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 45: East Asia Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 46: East Asia Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 47: East Asia Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 48: East Asia Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 49: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 50: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 51: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 52: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 53: South Asia Pacific Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 54: South Asia Pacific Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 55: South Asia Pacific Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 56: South Asia Pacific Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 57: South Asia Pacific Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 58: South Asia Pacific Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 59: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 60: South Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 61: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 62: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: Eastern Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 64: Eastern Europe Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 65: Eastern Europe Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 66: Eastern Europe Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 67: Eastern Europe Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 68: Eastern Europe Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 69: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 70: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 71: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 72: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Middle East & Africa Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 74: Middle East & Africa Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 75: Middle East & Africa Market Value (USD Bn) Forecast by Transmission Type, 2020 to 2035

- Table 76: Middle East & Africa Market Volume (Units) Forecast by Transmission Type, 2020 to 2035

- Table 77: Middle East & Africa Market Value (USD Bn) Forecast by Vehicle Class, 2020 to 2035

- Table 78: Middle East & Africa Market Volume (Units) Forecast by Vehicle Class, 2020 to 2035

- Table 79: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 80: Middle East & Africa Market Volume (Units) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Type

- Figure 7: Global Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Transmission Type

- Figure 10: Global Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Vehicle Class

- Figure 13: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Application

- Figure 16: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 17: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 18: Global Market Attractiveness Analysis by Region

- Figure 19: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: North America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Type

- Figure 30: North America Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by Transmission Type

- Figure 33: North America Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 34: North America Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 35: North America Market Attractiveness Analysis by Vehicle Class

- Figure 36: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 37: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 38: North America Market Attractiveness Analysis by Application

- Figure 39: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 40: Latin America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by Type

- Figure 43: Latin America Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 44: Latin America Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 45: Latin America Market Attractiveness Analysis by Transmission Type

- Figure 46: Latin America Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 47: Latin America Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 48: Latin America Market Attractiveness Analysis by Vehicle Class

- Figure 49: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 50: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 51: Latin America Market Attractiveness Analysis by Application

- Figure 52: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Western Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 54: Western Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 55: Western Europe Market Attractiveness Analysis by Type

- Figure 56: Western Europe Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 57: Western Europe Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 58: Western Europe Market Attractiveness Analysis by Transmission Type

- Figure 59: Western Europe Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 60: Western Europe Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 61: Western Europe Market Attractiveness Analysis by Vehicle Class

- Figure 62: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 63: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 64: Western Europe Market Attractiveness Analysis by Application

- Figure 65: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 66: East Asia Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 67: East Asia Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 68: East Asia Market Attractiveness Analysis by Type

- Figure 69: East Asia Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 70: East Asia Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 71: East Asia Market Attractiveness Analysis by Transmission Type

- Figure 72: East Asia Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 73: East Asia Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 74: East Asia Market Attractiveness Analysis by Vehicle Class

- Figure 75: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 76: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 77: East Asia Market Attractiveness Analysis by Application

- Figure 78: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 79: South Asia Pacific Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 80: South Asia Pacific Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 81: South Asia Pacific Market Attractiveness Analysis by Type

- Figure 82: South Asia Pacific Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 83: South Asia Pacific Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 84: South Asia Pacific Market Attractiveness Analysis by Transmission Type

- Figure 85: South Asia Pacific Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 86: South Asia Pacific Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 87: South Asia Pacific Market Attractiveness Analysis by Vehicle Class

- Figure 88: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 89: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 90: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 91: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: Eastern Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 93: Eastern Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 94: Eastern Europe Market Attractiveness Analysis by Type

- Figure 95: Eastern Europe Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 96: Eastern Europe Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 97: Eastern Europe Market Attractiveness Analysis by Transmission Type

- Figure 98: Eastern Europe Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 99: Eastern Europe Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 100: Eastern Europe Market Attractiveness Analysis by Vehicle Class

- Figure 101: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 102: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 103: Eastern Europe Market Attractiveness Analysis by Application

- Figure 104: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 105: Middle East & Africa Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 106: Middle East & Africa Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 107: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 108: Middle East & Africa Market Value Share and BPS Analysis by Transmission Type, 2025 and 2035

- Figure 109: Middle East & Africa Market Y-o-Y Growth Comparison by Transmission Type, 2025 to 2035

- Figure 110: Middle East & Africa Market Attractiveness Analysis by Transmission Type

- Figure 111: Middle East & Africa Market Value Share and BPS Analysis by Vehicle Class, 2025 and 2035

- Figure 112: Middle East & Africa Market Y-o-Y Growth Comparison by Vehicle Class, 2025 to 2035

- Figure 113: Middle East & Africa Market Attractiveness Analysis by Vehicle Class

- Figure 114: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 115: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 116: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 117: Global Market - Tier Structure Analysis

- Figure 118: Global Market - Company Share Analysis

- FAQs -

What is the size of the commercial vehicle transmission market in 2025?

The market is estimated at USD 28.5 billion in 2025.

What is the expected market value by 2035?

By 2035, the market is projected to reach USD 46.9 billion.

What is the compound annual growth rate (CAGR) of the market?

The market is expected to grow at a CAGR of 5.1?tween 2025 and 2035.

Which transmission type is expected to grow the fastest?

Electric and hybrid transmissions are expected to witness the fastest growth due to increasing electrification.

Who are the major players in the commercial vehicle transmission market?

Key players include Allison Transmission, Eaton Corporation, ZF Friedrichshafen, Voith, Dana Incorporated, and BorgWarner.