Elastomeric Coatings Market

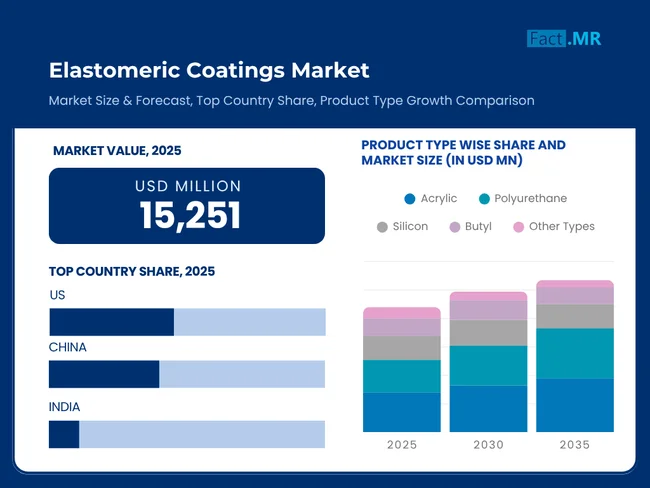

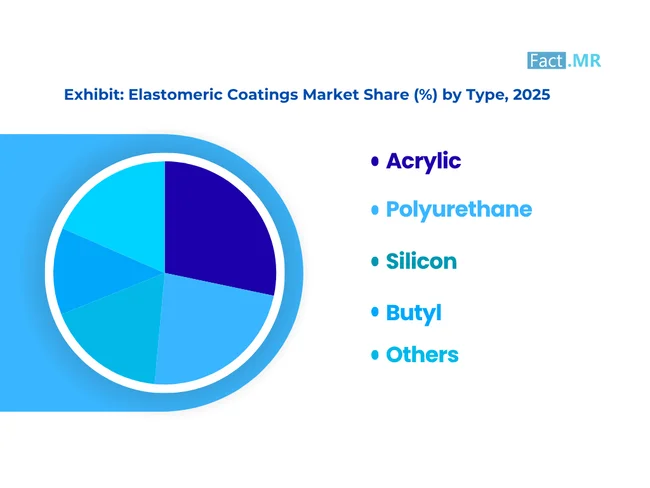

Elastomeric Coatings Market Analysis, By Product Type (Acrylic, Polyurethane, Silicon, Butyl, and Other Types), By Application (Wall Coatings, Floor/Horizontal Surface Coating, Roof Coating, and Other), and Region - Global Market Insights 2025 to 2035

Analysis of Elastomeric Coatings Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Elastomeric Coatings Market Outlook (2025 to 2035)

The global elastomeric coatings market is expected to reach USD 72,687 Million by 2035, up from USD Elastomeric Coatings million in 2024. During the forecast period (2025 to 2035), the industry is projected to register at a CAGR of 16.9%. Increased energy efficiency of buildings is causing a rise in demand of elastomeric coating since they are the best in terms of insulation and waterproofing.

They are used in preference over other building materials because they can withstand extreme weather and increase the lifespan of buildings constructed with the material.

What are the key drivers of future elastomeric coating’s demand?

In long-term construction, resistant and weather-resistant types of coatings are necessary; accordingly, elastomeric coatings are becoming one of the most commonly used options. Such durable and weather-resistant materials are in high demand due to the increasing investment in residential and commercial structures, as well as infrastructure development projects. Therefore, elastomeric coatings would be a good option for many construction activities because they possess great flexibility and crack resistance.

The coatings are increasingly being used for wall protection in the most vulnerable areas, as they fill even minor hairline cracks and prevent moisture from penetrating, thereby providing a measure of protection for building exteriors.

Waterproofed with elastomeric coatings in the basement and foundations, thus forming a barrier to water entry. They are even decorative applications with a function to protect concrete and masonry surfaces from environmental deterioration. Bringing about a variety of novel applications in both new construction and restoration projects, elastomeric coatings are gaining ground as one of the most promising emerging growth areas, with the construction industry now emphasizing the longevity and resilience of building materials.

Plastered above basement floors and waterproofed by elastomeric coatings, basements and foundations thus form a barrier to water entry. They can form decorative applications that function to protect the surfaces of concrete and masonry from environmental deterioration. The variety of new applications in both new build and rehabilitation projects brings elastomeric coatings to the forefront of some of the many major emerging growth areas, as the construction industry emphasizes the longevity and resilience of building materials.

What are the regional trends of elastomeric coatings market?

North America is the leading market region in the elastomeric coating market because of its construction dynamics, high regulatory standards on energy efficiency, and intense roof coatings. The U.S. market, specifically, is enjoying the regular replacement schedules and the large ratio in the incorporation of cool roof systems, which depend on the elastomeric coatings to minimize the energy expenditure.

In Asia Pacific, the current rate of urbanization and infrastructure development in China, India and Southeast Asia is the major growth driver. The growing commercial and residential real estate sectors in the region, along with an increasing focus on weatherproof and cost-efficient measures, also boost consumer demand.

In Europe, continual growth is being achieved with the back-up of the energy efficiency directives, particularly in Germany and the UK. Eco-friendly coatings are further being adopted through sustainable building certifications (i.e., BREEAM and LEED).

What are the main restrictions faced by the market competitors for elastomeric coatings?

While elastomeric coatings offer several advantages in terms of performance, their disposal substantially increases environmental risk. As they are often made of complex synthetic materials, traditional recycling processes have limited success. Furthermore, the disposal of potentially hazardous elastomers would pose an environmental risk. This seems particularly pertinent in light of the tightening of waste management norms.

Several factors contribute to the difficulties encountered in disposal and recycling. The complex chemical composition of elastomeric coatings renders them unsuitable for recycling using traditional waste breakdown techniques. Additionally, the solvents and other potentially hazardous components present in some formulations require specific disposal techniques to prevent environmental contamination, often in landfills designed for hazardous waste.

Country-wise Insights

Energy codes and resilient infrastructure drive U.S. demand

-2025-2035.webp)

The US has a mature market in elastomeric coatings, driven by strict energy efficiency standards (such as the IECC), the renovation of old buildings, and other factors. The reasons behind the rally towards sustainable building envelopes, particularly in the commercial and public infrastructure sectors, include the enhancement of elastomeric paint, especially in thermal insulation and waterproofing aspects.

Building adoption is also increasing in humid and hot places such as Florida and California, where deterioration is faster. Reflective elastomeric roofs are being incorporated into solar PV and intelligent roofs.

China banks on smart cities and green retrofitting

The market for elastomeric coatings in China is dynamically developing due to intensive urbanization, the program of smart cities, and the government's policy on building efficiency, as outlined in the Green Building Action Plan. The construction industry is booming, and many people are retrofitting old structures; therefore, there is a need for durable and weatherproof coatings.

Chinese producers are increasing the volume of high-performance coatings that should be produced to meet various climatic conditions that range in the south to the northeast, which is arid. Investment is increasing in nanotechnology-based coatings and elastomeric mixes that provide self-cleaning, ultraviolet resistance and air-purifying properties. Market penetration is also being fueled by public-private partnerships in the Tier 2 and Tier 3 cities, which are outside the country's megacities such as Beijing and Shanghai.

Japan leverages tech-integrated, aging-safe coatings

The evolving aging infrastructure and the seismic threat to Japan ensure that the elastomeric coating market is well entrenched in Japan. Society 5.0 Government programs aimed of generating elastomeric coatings to regulate thermal conditions, provide seismic resistance and maintain surface life are being promoted.

Japan focuses on a hybrid coatings portfolio of silicone and polyurethane with improved distances and protection towards weathering in the high-rise structures and community buildings. The spraying and precision coating systems that utilize robotics are emerging, particularly in metropolitan refurbishments. In addition, columnar integrated coatings involving antimicrobial and heat-insulating ceramic microspheres are becoming trending in the housing modification industry to support people in an aging society.

Category-Wise Insights

Dominating through durability: Polyurethanes hold a significant share elastomeric coating consumption

Polyurethane coatings are indeed excellent in gaining recognition and account for the majority of consumption in elastomeric coatings; after all, these coatings offer the best durability. In fact, polyurethanes resist the cracking and abrasion that occur under severe chemical attack better than any other elastomeric coating, such as acrylics. They are, therefore, suitable for high traffic areas, in an industrial environment, and for use where long periods of performance are necessary.

For instance, polyurethane coatings are typically applied to warehouse or manufacturing plant floors that experience high foot traffic, along with the rest of the surface wear caused by machinery traveling over it. In addition, they are generally highly resistant to chemicals and can therefore be used in applications that involve solvents, oils, or other aggressive substances.

Marine environments are a natural fit for elastomeric coatings.

Boats and offshore constructions are always under threat from harsh marine environments; therefore, they too need substantial protection. This is a key market growth sector due to the remarkable performance of elastomeric coatings in this field. Improved waterproofing and corrosion resistance offer essential defense against seawater, prolonged wet exposure, and inclement weather. As a result, this will save maintenance costs and increase the lifespan of marine assets.

It is anticipated that the markets will pay more attention to the rapidly expanding wind farms and other marine infrastructure projects, making elastomeric coatings and other long-lasting, dependable protective solutions essential to the success of these endeavors.

Competitive Landscape

The elastomeric coating market is moderately fragmented, characterized by stiff competition among regional and multinational manufacturers. Product performance, weather resistance, elasticity, durability, and cost-effectiveness are contributing elements to the company’s competitiveness. Low-VOC (volatile organic compounds), bio-based, and high-reflectivity coatings are particularly an area of innovation as a source of differentiation.

The market parties are enhancing their portfolios through research and development, focusing on improving adherence to a wide variety of substrates and UV stability, particularly in roofing and facades, as well as infrastructure replenishment. It is typical to have strategic partnerships with construction companies and contractors specializing in energy-efficiency work in order to gain access to retrofit and green building work.

Manufacturers are also leveraging new nanotechnology and polymer chemistry to develop hybrid elastomeric coatings with multifunctional performance, including waterproofing and thermal insulation. Additionally, local companies in the Asia Pacific and Latin America are gaining popularity and offering cost-effective solutions tailored to local weather conditions and regulations.

Leading companies in the elastomeric coating industry are BASF SE, Sherwin-Williams Company, PPG Industries, Teknos Group, Huntsman Corporation, The DOW Chemical Company, Axalta Coating Systems LLC, The Valspar Corporation, Kansai Nerolac Paints Limited, Progressive Paintings LLC, Nippon Paints, and Rodda Paints.

Recent Developments

- In December 2023, WEG developed WrapX technology a unique coating for use in severely corrosive environments that improve asset durability and increases longevity by up to four times over existing solutions. This coating technique has already been tested and implemented on several offshore platforms.

- In March 2023, Gaco™, part of the Holcim Building Envelope portfolio of brands, officially launched the GacoFlex A48 acrylic roofing coating. GacoFlex A48 is the first and only single-component, high-build acrylic roof coating that can be applied up to 80 wet mils (5 gal/SQ) in a single pass.

Fact.MR has provided detailed information about the price points of key manufacturers of elastomeric coatings, positioned across various regions, including sales growth, production capacity, and speculative technological expansion, in the recently published report.

Methodology and Industry Tracking Approach

Fact.MR has conducted an in-depth global analysis of the elastomeric coatings market in 2025. These findings are derived directly from more than 4,300 qualified respondents across 18 countries, with special emphasis placed on ensuring diverse regional representation and consistent cross-segment verification.

Spanning a comprehensive research period of 12 months from June 2024 to May 2025, the investigation evaluated seasonal variations in construction activity. Advancements in water-based and bio-elastomeric formulations, shifting consumer preferences toward high-performance coatings, regulatory developments around VOC emissions, and the evolving cost dynamics across supply chains from petrochemical derivatives (such as styrene, butadiene, and acrylic polymers) to commercial and industrial end-use sectors.

To preserve data integrity and ensure actionable accuracy, the findings were triangulated with insights from over 145 validated external sources. These included sustainability benchmarking reports, regional climate impact studies, building materials compliance databases, and applied polymer research journals.

Fact.MR has been closely monitoring this coatings segment since 2018, expanding its focus on long-term durability in harsh climatic conditions, energy-efficient building technologies, and the increased demand for eco-certified products. This ongoing assessment supports global industry stakeholders as they transition toward resilient, low-maintenance coating systems in both retrofit and new-build infrastructure landscapes.

Segmentation of Elastomeric Coatings Market

-

By Product Type :

- Acrylic

- Polyurethane

- Silicon

- Butyl

-

By Application :

- Wall Coatings

- Floor/Horizontal Surface Coating

- Roof Coating

- Other Applications

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Market Trends and Success Factors

- Macro-economic Factors

- Market Dynamics

- Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Historical Analysis

- Future Projections

- Pricing Analysis

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Product Type

- Application

- Global Market Analysis by Product Type

- Acrylic

- Polyurethane

- Silicon

- Butyl

- Global Market Analysis by Application

- Wall Coatings

- Floor/Horizontal Surface Coating

- Roof Coating

- Other Applications

- Global Market Analysis by Region

- North America

- Latin America

- Western Europe

- South Asia

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- Latin America Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- Western Europe Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- South Asia Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- East Asia Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- Eastern Europe Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- Middle East & Africa Sales Analysis by Key Segments and Countries (2020 to 2024, Forecast 2025 to 2035)

- Sales Forecast 2025 to 2035 by Product Type and Application for 30 Countries

- Competition Outlook

- Market Structure Analysis

- Company Share Analysis by Key Players

- Competition Dashboard

- Company Profile

- BASF SE

- Sherwin Williams Company

- PPG Industries

- Teknos Group

- Huntsman Corporation

- The DOW Chemical Company

- Axalta Coating Systems LLC

- The Valspar Corporation

- Kansai Nerolac Paints Limited

- Progressive Paintings LLC

- Nippon Paints

- Rodda Paints

List Of Table

Table 1: Global Market Value (US$ Mn) & Volume (Tons) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 3: Global Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 4: North America Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 5: North America Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 6: North America Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 7: Latin America Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 8: Latin America Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 9: Latin America Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 10: Western Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 11: Western Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 12: Western Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 13: South Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 14: South Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 15: South Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 16: East Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 17: East Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 18: East Asia Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 19: Eastern Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 20: Eastern Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 21: Eastern Europe Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

Table 22: Middle East & Africa Market Value (US$ Mn) & Volume (Tons) Forecast by Country, 2020 to 2035

Table 23: Middle East & Africa Market Value (US$ Mn) & Volume (Tons) Forecast by Product Type, 2020 to 2035

Table 24: Middle East & Africa Market Value (US$ Mn) & Volume (Tons) Forecast by Application, 2020 to 2035

List Of Figures

Figure 1: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 2: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 3: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Region, 2020 to 2035

Figure 4: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 5: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 6: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 7: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 8: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 9: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 10: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 11: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 12: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 13: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 14: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 15: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 16: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 17: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 18: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 19: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 20: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 21: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

Figure 22: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Product Type, 2020 to 2035

Figure 23: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Application, 2020 to 2035

Figure 24: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & Volume (Tons) Projection by Country, 2020 to 2035

- FAQs -

What was the global elastomeric coatings market size reported by Fact.MR for 2025?

The Global Elastomeric coatings market was valued at USD 15,251 Million in 2025.

Who are the major players operating in the elastomeric coatings market?

Prominent players in the market BASF SE, Sherwin Williams Company, PPG Industries, Teknos Group, Huntsman Corporation, The DOW Chemical Company, Axalta Coating Systems LLC, The Valspar Corporation, Kansai Nerolac Paints Limited, Progressive Paintings LLC, Nippon Paints, and Rodda Paints.

What is the Estimated Valuation of the elastomeric coatings market in 2035?

The market is expected to reach a valuation of USD 72,687 Million in 2035.

What Value CAGR did the elastomeric coatings market exhibit over the last five years?

The historic growth rate of the Elastomeric coatings market was 15.2% from 2020 to 2024.