Graphite Coatings Market

Graphite Coatings Market Analysis, By Application, By End-use Industry, and Region - Market Insights 2025 to 2035

Analysis Of Graphite Coatings Market Covering 30+ Countries Including Analysis Of US, Canada, UK, Germany, France, Nordics, GCC Countries, Japan, Korea And Many More

Graphite Coatings Market Outlook (2025 to 2035)

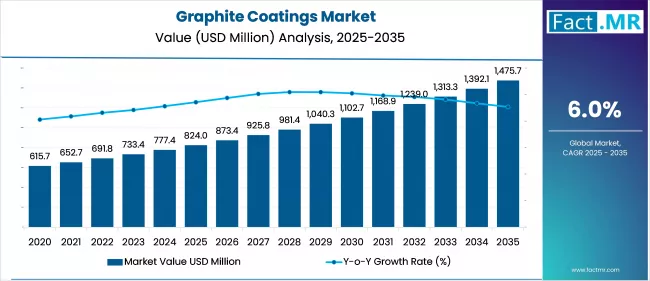

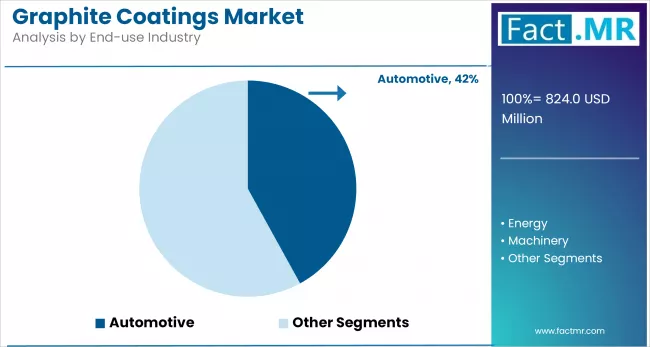

The global graphite coatings market is projected to increase from USD 824 million in 2025 to USD 1,476 million by 2035, with a CAGR of 6% during the forecast period. Growth is driven by an increase in demand for nanomaterials following advances in nanotechnology. Their use makes them ideal for high-temperature, wear-resistant, and low-friction applications across industries such as automotive, aerospace, electronics, and energy.

Quick Facts about Graphite Coatings Market

- Industry Value (2025): USD 824 Million

- Projected Value (2035): USD 1,476 Million

- Forecast CAGR (2025 to 2035): 6%

- Leading Segment (2025): Automotive (42% Market Share)

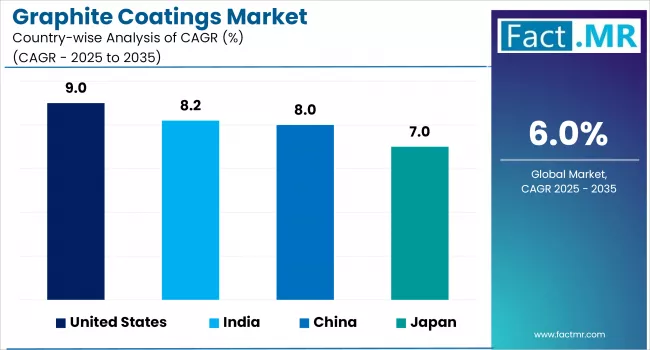

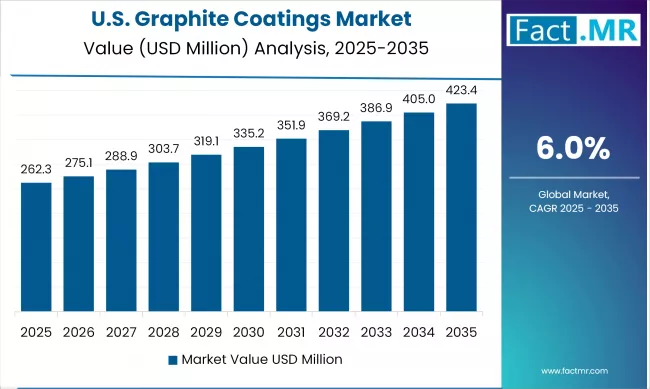

- Country Growth Rate (2025 to 2035): U.S. (9% CAGR)

- Top Key Players: Final Advanced Materials, CONDAT Corporation, and Elcora Advanced Materials Corp.

What are the Drivers of Graphite Coatings Market?

The growth of the graphite coatings market is primarily driven by the automotive industry's increased dependence on advanced materials in engine and brake systems. Graphite coatings provide superior lubrication and heat resistance, enhancing fuel efficiency and extending the lifespan of components, making them essential for both electric vehicles (EVs) and internal combustion engine (ICE) vehicles.

In the realm of digital infrastructure, semiconductors serve as the connective tissue, while graphite coatings are gaining importance for their roles in heat dissipation and electrical conductivity. Their thermal and electrical conductivity, used in various fields of microelectronics, printed circuit board (PCB) coatings, and electromagnetic interference (EMI) shielding, will make a big impact.

Industries such as aerospace, metallurgy, and glass are seeing increased demand for graphite coatings, largely due to their durability in the face of extreme heat. These coatings provide surface protection and reduce wear, while also improving energy efficiency for processing equipment used in high-temperature applications.

Graphite coatings play a vital role in lithium-ion battery manufacturing, fuel cells, and solar technologies. As global clean energy investment continues to grow, so will the demand for advanced coatings with superior thermal and electrical properties to enhance battery life and system efficiency.

Graphite coatings are increasingly utilized in mold release agents, die-casting, and crucibles employed in metal processing. With the global resurgence of infrastructure and construction, foundry and metallurgical processes are increasing, and this assures that coating consumption will increase.

What are the Regional Trends of Graphite Coatings Market?

Asia-Pacific is a dominant region in the graphite coatings market, with China, India, Japan, and South Korea leading the way. The strong automotive production, new battery manufacturing centers, and steel-dominant applications in the region continue to push significant demand. Water-based, heat-resistant coatings are gaining traction now that EV and renewable projects are ramping up.

North America has strong stability, as there is clear market maturity around established aerospace, automotive, and electronics sectors in the U.S. The U.S. market is heavily innovation-based, and government funding is available to promote alternative coatings with the performance of low-VOC, eco-friendly coatings. The trend toward conductive coatings for semiconductor and defense end-use applications is adding to the forward movement in the region.

Sustainability regulations, green manufacturing regulations, and environmental certification procedures have made Europe a leader in environmentally acceptable graphite coatings.

Germany, France, and the Nordic countries are leading the charge for water-based and non-toxic alternatives in the automotive, aviation and energy sectors. European OEMs are also investigating the use of nanostructured graphite in pursuit of next-generation lightweight designs.

Latin American nations are slowly beginning to adopt graphite coatings as their regional investment into metallurgy, mining, and infrastructure projects increases. Furthermore, local manufacturing capacities in Brazil, Mexico, and other nations are expected soon, creating new prospects for novel heat-resistant and other protective coatings for steel and automotive applications.

What are the Challenges and Restraining Factors of Graphite Coatings Market?

The changing prices of graphite due to mining limitations, geopolitical issues, and supply chain issues are a major challenge. Because graphite is a high input material, cost fluctuations negatively affect gross profit margin throughout our value chain and directly impacts smaller manufacturers who are working with tight budgets.

Although graphite coatings offer several performance advantages, solvent-based formulations have trouble adapting to new environmental requirements. Compliance with VOC emissions regulations in Europe, Northern America, and parts of Asia, will require expensive reformulation or transition to water-based formulations, which is complicated and costly, and further adds to R & D costs.

Even though graphite coatings offer a functional and performance advantage, we believe they have not gained market traction in traditional or low-tech industries due to a lack of awareness, the higher spend upfront, or compatibility restrictions. Industries that still emphasize conventional lubricants or metallic coatings are likely to remain slow to adopt any type of graphite-based solution.

Graphite coatings also still do not have good levels of adhesion and durability on the substrate plastics, ceramics, or composites. This absence of durability prohibits any proliferation of graphite coatings used in diverse applications unless there are specialized primers or specialty coatings that could be introduced, which would increase delivery timelines and, therefore, costs.

Country-Wise Outlook

U.S. Graphite Coatings Market sees Growth Driven by Innovation and Localization

The U.S. graphite coatings market is experiencing rapid growth during the forecast period, fueled by increasing investments in electric vehicles, aerospace, and the semiconductor sector. The impetus for local production capacity and innovation in this sector comes from the recent reshoring of critical mineral supply chains, which have involved a heavy reliance on Chinese graphite suppliers. The popularity of water-based and low-VOC coatings also speaks to the regulatory nature of materials selection as well as sustainability objectives for future manufacturing.

Some notable trends include the increasing use of nano-graphite coating technologies to better manage thermal outputs or thermal management of electronics and batteries. Additionally, the Department of Energy's clean energy/grants for battery materials are supporting innovations in non-toxic, high-performing coating technologies.

The U.S. has some good opportunities in scaling new generation graphite coating technologies for extreme high-temperature and conductive applications. Domestically, manufacturers can leverage unique roles in value-added processes/niches for fuel cell systems, defense electronics, and microchip packaging with these newer technologies. If the policy supports the industry's creation and scale, provides R&D grants, and there is a market demand for sustainable materials. The U.S. will lead the high-performance graphite coatings space globally.

China witnesses Rapid Market Growth Backed by Through Scale, Integration, and Electrification

China is a key player in the global graphite coatings market because of its significant infrastructure for graphite mining, purification, and battery anode production. Given that the world's largest EV and battery industries are located in China, there is a rising domestic demand for coatings that provide thermal management, lubrication, and corrosion protection, particularly in gigafactories, steel mills, and die-casting facilities.

A significant driver is the country's commitment to "dual carbon" objectives, which leads to more extensive use of graphite coatings in the clean energy verticals (hydrogen, solar, and energy storage systems). As graphite coatings are absorbed into renewable infrastructure and high-end electronics manufacturing, their use in large-scale sustainable manufacturing ecosystems is expanding.

China's strength is its ability to drive the entire value chain from raw graphite to refined products. This full-value chain track record provides Chinese firms a large ability to deliver lower-cost, customer tailored solutions.

However, as global concern over export controls increases, Chinese firms also perceive new opportunities related to exporting environmentally friendly, water-based graphite coating technologies and establishing strategic partnerships outside of China. The application of innovation associated with nanotech and graphene-based coatings may also elevate China's advantage.

Japan sees Specialization in Precision, Clean Energy, and Advanced Materials

The graphite coatings market in Japan is characterized by demanding applications in fuel-cell vehicles, lithium-ion batteries, and high-end semiconductors. Japan is known for its top-quality synthetic graphite and, because of its manufacturing know-how, can fulfill the requirements of top OEMs like Toyota, Honda, and Panasonic.

Japan is investing in hydrogen-powered transportation, clean ammonia, and battery recycling, with all three areas relying on high-performance coatings. Innovations like nano-structured graphite and enhanced thermal management, corrosion resistance, and conductivity will also influence future applications as they impact areas like aerospace, defense, and semiconductor fabrication.

Japan's opportunities come from advanced R&D and exporting high-quality coatings in critical industries. Japan's capabilities in clean energy technologies are well-positioned in line with increasing demand globally for enhanced durability, sustainability, and high-temperature coatings.

Additionally, integrating new graphite coatings into future powertrains and energy storage systems provides growth opportunities at home and abroad. International opportunities can also bolster Japan’s reputation for innovation as a global leader in providing precision coating materials.

Category-wise Analysis

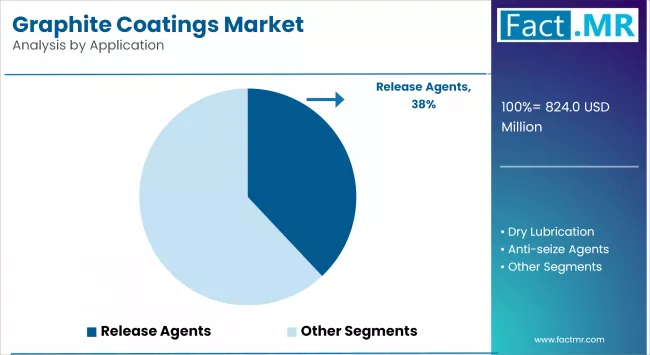

Release Agents to Exhibit Leading by Application

Dry lubrication remains the dominant application in the graphite coatings industry based on performance in extreme conditions. Dry lubricants are the only form of lubrication that can operate in extreme high-temperature, high-pressure and dust conditions. Dry lubricants are essential in sectors like automotive, aerospace, or heavy machinery, these coatings are able to reduce the friction in engines, valves, gears, etc. while keeping lubricants free from contaminants. As industries strive to develop maintenance-free systems and cleaner alternatives to oil-based lubricants, dry graphite coatings are becoming a common choice for long-lasting durability and operational efficiency.

Release agents are the fastest-growing segment in the graphite coatings market. The release agent segment has the opportunity to gain traction as industries are now putting more emphasis on precision casting and projects involving precisely molded components.

Graphite coatings are becoming a more common choice in foundries, rubber processing, and plastic molding as they release cleanly from molds and are robust in thermal conditions. Dry lubricants coated onto molds not only prolong the life of molds by preventing sticking, but they also enhance the surface finish, which is especially important in wealth-generating sectors like automotive, aerospace, and electronics.

Automotive to Exhibit Leading by End-Use Industry

Graphite coatings dominate the graphite coatings market due to the use of graphite coatings in energy technologies. These coatings enhance conductivity, thermal stability, and corrosion resistance properties, especially in lithium battery and nuclear applications. As investments in renewable energy, hydrogen systems, and energy storage infrastructure rise quickly, the demand for high-performance graphite coatings is rapidly increasing.

In addition, the energy sector continues to emphasize energy efficiency and durability in emerging energy systems, which makes graphite coatings critical for shaping the next generation of clean and resilient power systems.

The automotive sector is the fastest-growing end-use sector for graphite coatings, largely due to the global shift towards electric mobility and lightweight design. Typically, graphite coatings are used extensively in engine components, brake systems, and battery packs because of their lubricating, thermal, and anti-corrosion properties.

As we see a tremendous increase in electric vehicle production worldwide, manufacturers are looking at more coatings containing graphite to enhance efficiency, safety, and lifecycle performance. As new models converge sustainability and performance around high-tech coatings, an increasing demand for advanced, sustainable coating options is quickly emerging across the global supply chain.

Competitive Analysis

The graphite coatings market is becoming increasingly competitive, with a mix of multinational manufacturers, regional coating specialists and niche technology innovators. Companies are competing primarily on coating performance, eco-friendliness and application-related customization.

Because of the transformation from solvent-based to water-based formulations, R&D is increasing greatly to facilitate innovations of non-toxic, high-temperature resistant and electrically conductive coating offerings.

At the basic product level there are relatively low technological barriers, but differentiation is found in proprietary dispersion processes, nano-structuring processes and adhesion technologies regarding substrate specific applications. Companies that maintain superior in-house formulation capabilities, vertically integrated supply chains and a diversified application portfolio are in the best strategic position.

The market is also seeing more collaborations between coating manufacturers and the end-user industry, such as automotive OEMs, battery manufacturers, aerospace suppliers and electronic component manufacturers. The collaborations will lead to high-performance coatings being co-developed for the high demands of emerging requirements in EV batteries, fuel cells and microelectronics.

In terms of geographic and economic factors, the Asia-Pacific region dominates in terms of both volume and price, while North America and Europe are more sustainable, compliant, and/or differentiated product-related. Companies situated in North America and Europe have invested in environmentally compliant, low-VOC, and REACH-compliant coatings.

Key players in the graphite coatings industry include Final Advanced Materials, CONDAT Corporation, Elcora Advanced Materials Corp., Mersen, and Van Sickle Paint Mfg. Company: Whitford, Imerys Graphite & Carbon, Asbury Carbons, BECHEM.

Recent Development

- In June 2023, Graphite One Inc., which is working to establish a complete domestic U.S. supply chain for advanced graphite materials, announced a teaming agreement with Vorbeck Materials Corp., a leader in graphene production and advanced graphene applications based in Jessup, Maryland.

- In February 2023, Universal Matter UK Limited, a subsidiary of Universal Matter Inc., agreed to acquire all shares of Applied Graphene Materials UK Limited and Applied Graphene Materials LLC. These entities are the primary operating subsidiaries of Applied Graphene Materials plc. The total consideration for the acquisition was US$ 1.3 million.

Segmentation of Graphite Coatings Market

-

By Application :

- Dry Lubrication

- Anti-seize Agents

- Release Agents

-

By End-use Industry :

- Energy

- Automotive

- Machinery

- Electrical & Electronics

- Textiles

- Medical

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Materials Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Mn) & Volume (Tons) Analysis, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Tons) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Tons) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Tons) Analysis and Forecast By Application, 2025-2035

- Dry Lubrication

- Anti-seize Agents

- Release Agents

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End-use Industry

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Tons) Analysis By End-use Industry, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Tons) Analysis and Forecast By End-use Industry, 2025-2035

- Energy

- Automotive

- Machinery

- Electrical & Electronics

- Textiles

- Medical

- Y-o-Y Growth Trend Analysis By End-use Industry, 2020-2024

- Absolute $ Opportunity Analysis By End-use Industry, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Mn) & Volume (Tons) Analysis By Region, 2020-2024

- Current Market Size Value (USD Mn) & Volume (Tons) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Tons) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Tons) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Application

- By End-use Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By End-use Industry

- Key Takeaways

- Key Countries Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By End-use Industry

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By End-use Industry

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By End-use Industry

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By End-use Industry

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By End-use Industry

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Application

- By End-use Industry

- Competition Analysis

- Competition Deep Dive

- Final Advanced Materials

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- CONDAT Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Elcora Advanced Materials Corp.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Mersen

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Final Advanced Materials

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Mn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Tons) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 4: Global Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 5: Global Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 6: Global Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 7: North America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 8: North America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 9: North America Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 10: North America Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 11: North America Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 12: North America Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 13: Latin America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 15: Latin America Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 16: Latin America Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 17: Latin America Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 18: Latin America Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 19: Western Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 21: Western Europe Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 22: Western Europe Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 23: Western Europe Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 24: Western Europe Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 25: East Asia Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 26: East Asia Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 27: East Asia Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 28: East Asia Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 29: East Asia Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 30: East Asia Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 31: South Asia Pacific Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 32: South Asia Pacific Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 33: South Asia Pacific Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 34: South Asia Pacific Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 35: South Asia Pacific Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 36: South Asia Pacific Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 37: Eastern Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 38: Eastern Europe Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 39: Eastern Europe Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 40: Eastern Europe Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 41: Eastern Europe Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 42: Eastern Europe Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

- Table 43: Middle East & Africa Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Volume (Tons) Forecast by Country, 2020 to 2035

- Table 45: Middle East & Africa Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 46: Middle East & Africa Market Volume (Tons) Forecast by Application, 2020 to 2035

- Table 47: Middle East & Africa Market Value (USD Mn) Forecast by End-use Industry, 2020 to 2035

- Table 48: Middle East & Africa Market Volume (Tons) Forecast by End-use Industry, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Tons) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Mn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Application

- Figure 7: Global Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by End-use Industry

- Figure 10: Global Market Value (USD Mn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Region

- Figure 13: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 21: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 22: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 23: North America Market Attractiveness Analysis by Application

- Figure 24: North America Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by End-use Industry

- Figure 27: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 29: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 30: Latin America Market Attractiveness Analysis by Application

- Figure 31: Latin America Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 32: Latin America Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 33: Latin America Market Attractiveness Analysis by End-use Industry

- Figure 34: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 35: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 36: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 37: Western Europe Market Attractiveness Analysis by Application

- Figure 38: Western Europe Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 39: Western Europe Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 40: Western Europe Market Attractiveness Analysis by End-use Industry

- Figure 41: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 42: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 43: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 44: East Asia Market Attractiveness Analysis by Application

- Figure 45: East Asia Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 46: East Asia Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 47: East Asia Market Attractiveness Analysis by End-use Industry

- Figure 48: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 49: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 50: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 51: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 52: South Asia Pacific Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 53: South Asia Pacific Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 54: South Asia Pacific Market Attractiveness Analysis by End-use Industry

- Figure 55: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Application

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 60: Eastern Europe Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End-use Industry

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 64: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 65: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 66: Middle East & Africa Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 67: Middle East & Africa Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 68: Middle East & Africa Market Attractiveness Analysis by End-use Industry

- Figure 69: Global Market Tier Structure Analysis

- Figure 70: Global Market Company Share Analysis

- FAQs -

What is the Global Graphite Coatings Market size in 2025?

The graphite coatings market is valued at USD 824 million in 2025.

Who are the Major Players Operating in the Graphite Coatings Market?

Prominent players in the market include Final Advanced Materials, CONDAT Corporation, Elcora Advanced Materials Corp., Mersen.

What is the Estimated Valuation of the Graphite Coatings Market by 2035?

The market is expected to reach a valuation of USD 1,476 million by 2035.

What Value CAGR Did the Graphite Coatings Market Exhibit over the Last Five Years?

The historic growth rate of the graphite coatings market is 5.3% from 2020-2024.