Mass Flow Controllers Market

Mass Flow Controllers Market Analysis- Size, Share and Forecast Outlook 2025 to 2035

The global mass flow controllers market is likely to reach USD 945.8 million in 2025, and will total USD 1,693.8 million in 2035, growing at a CAGR of 6.0%. Semiconductor is the dominant industry for mass flow controllers’ usage.

Mass Flow Controllers Market Outlook 2025 to 2035

The global mass flow controllers market is forecast to reach USD 1,693.8 million by 2035, up from USD 945.8 million in 2025. During the forecast period, the industry is projected to register at a CAGR of 6.0%.

The rise in investments in semiconductor and electronics production, along with the increasing interest in hydrogen fuel cells as renewable energy sources, drives demand for the mass flow controller market. Additionally, manufacturers of mass flow controllers are innovating to ensure their products can connect with the IoT ecosystem.

Quick Stats of Mass Flow Controllers Market

- Mass Flow Controllers Market Size (2025): USD 945.8 million

- Projected Mass Flow Controllers Market Size (2035): USD 1,693.8 million

- Forecast CAGR of Mass Flow Controllers Market (2025 to 2035): 6.0%

- Leading Industry Segment of Mass Flow Controllers Market: Semiconductor

- Key Growth Regions of Mass Flow Controllers Market: United States, China, Japan

- Key Players of the Mass Flow Controllers Market: Hitachi Ltd., Parker Hannifin Corporation, Omega Engineering, Inc., Horiba Ltd., Hitachi Metals, Ltd., Others

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 945.8 million |

| Industry Size (2035F) | USD 1,693.8 million |

| CAGR (2025-2035) | 6.0% |

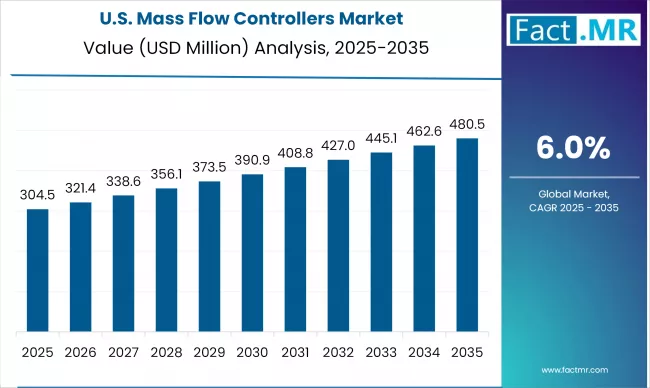

The mass flow controllers market is anticipated to grow from USD 945.8 million in 2025 to USD 1,265.7 million by 2030, reflecting a CAGR of 6.0%. Annual growth is projected at approximately 6 percent, with dollar additions increasing from around USD 56.7 million in 2026 to USD 71.6 million by 2030 due to compounding effects.

Demand is driven by expansions in wafer fabrication, enhanced gas delivery control in specialty chemicals, and increased compliance requirements in pharmaceutical bioprocessing. Profit pools are more advantageous for premium digital controllers, diagnostics, and calibration contracts compared to low-cost hardware.

Competitive dynamics are influenced by qualification barriers, original equipment manufacturer (OEM) design wins, and the proximity of services to fabrication plants and good manufacturing practice (GMP) facilities, which grant pricing power to incumbents. Regulatory pressure from cleanroom, emissions, and data integrity standards increases specification and service attachment rates.

Continued compounding brings the industry to USD 1,693.8 million in 2035. The mix is likely to evolve toward better precision, multi-gas, and software-enabled controllers with embedded self-diagnostics, resulting in increased lifecycle service revenue and wider margins for integrated vendors.

The profit pool is projected to shift further toward calibration labs, remote monitoring, and long-term service agreements, while the commodities tier suffers price pressure from regional entrants. The regulatory impact is significant, as improvements to SEMI and GMP advice, metrology traceability, and cybersecurity requirements drive replacement and recalibration cycles.

Competitive intensity may rise because of selective consolidation and localized manufacturing; however, entrenched validation, installed base lock-in, and aftermarket capabilities should sustain premium segments and support consistent year-on-year growth near the headline rate over the forecast horizon.

Top Mass Flow Controllers Market Dynamics

The mass flow controllers business is undergoing significant growth due to its essential function in maintaining precise management of gas and liquid flow across various sectors.

The increasing automation, elevated quality standards, and precision demands in industries including semiconductors, chemicals, medicines, and renewable energy have established MFCs as critical components of process control.

Adoption is bolstered by their incorporation into modern manufacturing processes and nascent clean energy applications, while technological advancements like MEMS-based designs are shaping competitive dynamics.

Nonetheless, elevated acquisition expenses, recurrent maintenance demands, and constraints in handling intricate gas combinations pose operational and financial challenges, particularly for smaller entities.

Rising Demand for Precise Engine Control in Key Industries

The mass flow controllers (MFCs) market is growing because of the rising demand for precise control of gases and liquids in various industries. From semiconductor manufacturing to chemical processing and pharmaceuticals, companies face increasing pressure to maintain strict quality standards and reproducibility.

MFCs provide accurate flow regulation, helping businesses achieve consistent results in critical applications. This demand is also driven by the increasing shift towards automation, where real-time monitoring and control are essential.

Increasing Frequency of Semiconductor and Electronics Manufacturing

The rise in semiconductor and electronics manufacturing is providing traction to market growth. The miniaturization of chips and complex multi-layer fabrication processes require precise gas flow control in vacuum deposition, etching, and cleaning tasks.

As global demand for electronics, wearables, and electric vehicle chips grows, manufacturers are investing in advanced MFCs to improve yield and throughput. There is also a growing preference for MEMS-based MFCs with faster response times, changing the competitive landscape.

Burgeoning Investments in Renewable Energy Projects to Bode Well

The growth of clean energy projects, especially green hydrogen and fuel cell technologies, is significantly increasing MFC use. In electrolyzers and hydrogen purification systems, mass flow controllers ensure optimal gas ratios and safety, which are crucial in high-pressure environments.

Governments' focus on carbon neutrality and clean fuel initiatives supports research and development, as well as commercial adoption of these systems, creating strong momentum for the MFC market.

Growing Applications in Multiple End Use Industries

In life sciences and biotechnology, where sterile conditions and controlled environments are essential, MFCs play a key role in gas mixing, fermentation, and dosing. The pharmaceutical sector has increased its investments in automated drug production lines following COVID.

Similarly, the food and beverage industry are using MFCs for carbonation and packaging processes. These specific applications together contribute to a wider upturn in market growth.

High Cost of Advanced Devices

One of the main challenges facing the mass flow controllers (MFCs) market is the high cost of advanced devices, especially those made for ultra-high precision applications. Installing and calibrating these devices needs careful integration with existing process systems, which can use a lot of resources.

For small-scale manufacturers or new players in the market, this large capital investment is a major hurdle, delaying adoption even though the operational benefits are clear.

Frequent Maintenance Cycles Due to Pressure and Temperature Fluctuations

Mass flow controllers are affected by environmental conditions like pressure changes, temperature swings, and gas contamination. In tough industrial settings, these factors can impact device accuracy and lifespan.

Hence, frequent maintenance and recalibration are needed to maintain performance, which adds to the overall ownership cost. These operational challenges limit their use in rugged or decentralized systems that prioritize remote access and low maintenance.

Challenges in Managing Complex Gas Mixtures

Although MFC technology has improved, managing complex gas mixtures or high-flow rates with complete accuracy is still a technical issue. The ability to handle multiple gases requires advanced sensor design and control algorithms, which not all manufacturers can offer. Industries with highly variable process conditions may find existing MFC options lacking in flexibility, making them consider other flow measurement technologies.

Top Regions Driving Mass Flow Controllers Market Expansion

In North America, the mass flow controllers market is heavily shaped by progress in semiconductor manufacturing, biotechnology, and aerospace industries. The region has a strong research and development infrastructure, and the rise in smart manufacturing initiatives drives the use of high-precision flow control devices.

Europe’s focus on energy transition and sustainability has led to widespread use of MFCs in hydrogen production, alternative fuels, and clean chemical synthesis. Countries across the region are investing in industrial decarbonization and green hydrogen projects that depend on accurate gas flow management.

Asia-Pacific remains the most active market for mass flow controllers, boosted by rapid growth in semiconductor fabrication and consumer electronics manufacturing. Countries like China, Japan, South Korea, and Taiwan are home to some of the world’s top chip manufacturers.

These nations are increasingly adopting MFCs to meet the high purity and precision demands of modern fabs. Additionally, the region's growing pharmaceutical and specialty chemical industries are using MFCs to support batch processing and automation.

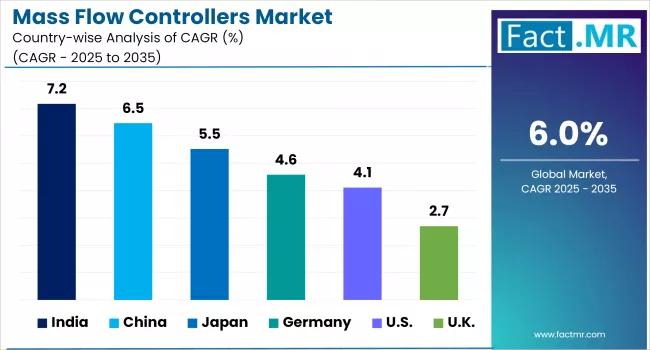

Country-Wise Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

| China | 6.5% |

| Japan | 5.5% |

United States Mass Flow Controllers Market Grows Amid Semiconductor Leadership, Biotech Scale-Up, and Precision Manufacturing

The United States is seeing steady growth in the mass flow controllers (MFCs) market. This growth mainly comes from its strong position in semiconductor manufacturing, industrial automation, and biotech innovation.

MFCs are essential for ensuring consistent results and controlling processes, particularly in applications like atomic layer deposition and chemical vapor deposition. With major chipmakers investing in new fabrication facilities, the demand for precise gas flow systems is increasing rapidly.

Biopharma production is another significant driver of growth, as the U.S. remains a leader in developing therapeutics and vaccines. Mass flow controllers are vital for maintaining sterile conditions during fermentation, cell culture, and downstream processing. Their capability for real-time monitoring fits well with the FDA’s focus on adopting Process Analytical Technology (PAT).

A key trend in the U.S. market is the integration of digital and IoT-enabled MFCs in smart factories. American manufacturers are moving toward predictive maintenance and data-driven workflows. This shift is leading to a transition from analog to digital mass flow systems. MEMS-based controllers and Ethernet-compatible MFCs are gaining popularity in various sectors.

Many opportunities exist in areas like hydrogen energy, aerospace, and food and beverage. The U.S. Department of Energy's push for a hydrogen economy is creating new demand, particularly for high-pressure, corrosion-resistant controllers.

Additionally, the need for zero-defect production in the defense and food sectors is increasing MFC usage, making the U.S. a key market for advanced flow technologies.

China Mass Flow Controllers Market Accelerates on the Back of Industrialization, Export Growth, and Policy-Backed Expansion

China’s mass flow controllers market is growing quickly because of the country’s strong industrialization, expansion in tech manufacturing, and reliance on exports. MFCs are commonly used in semiconductor fabs, LED production, solar panel assembly, and lithium-ion battery production, all of which are seeing double-digit growth. Major electronics companies in China are investing heavily in precision equipment to cut down on imports and improve yields.

Government-supported programs like "Made in China 2025" and subsidies for chip-making facilities are increasing demand for MFCs. China aims to become a self-sufficient tech leader, which is leading local fabs and foundries to adopt the latest flow control systems. MFCs play a key role in maintaining consistent gas flow during etching, doping, and deposition stages, which directly affects device quality.

A significant trend in China’s market is the rise of domestic MFC manufacturers who provide competitive prices and local service networks. While international companies lead in high-end applications, Chinese manufacturers are becoming more prominent in mid-tier and high-volume markets. This is making the market more accessible in Tier 2 and Tier 3 cities.

There are growth opportunities in clean energy, chemical processing, and medical device manufacturing. With the government promoting hydrogen vehicles and goals for carbon neutrality, the demand for ultra-high-purity gas control is increasing. Additionally, China’s efforts to enhance pharmaceutical quality standards are boosting MFC use in formulation, packaging, and lab systems, indicating a positive outlook.

Japan Mass Flow Controllers Market Strengthens Through Precision Engineering, Life Sciences Innovation, and Clean Tech Focus

Japan’s MFC market remains strong because of its solid foundation in precision engineering, process control technologies, and life sciences. The country has a history of producing high-end semiconductors, specialty chemicals, and medical equipment, which highlights its need for reliable and consistent flow control. Mass flow controllers play a key role in managing micro-processes that define the quality standards of Japanese manufacturing.

Top companies in Japan’s electronics sector are increasing production of image sensors, memory chips, and display panels, which require high gas purity and consistent flow. Mass flow controllers create high-yield, contamination-free environments that are vital for success in these ultra-cleanroom operations. The trend toward smaller semiconductor devices also increases the demand for compact, high-performance MFCs.

A strong focus on automation and robotics in industries such as pharmaceuticals, automotive, and food processing is driving market growth. The move toward unmanned, zero-contamination production facilities, especially after the pandemic in the pharma and food and beverage sectors, is leading to a greater need for digitally integrated MFC systems.

There are also emerging opportunities in hydrogen infrastructure and carbon capture solutions. Japan’s leadership in hydrogen-powered mobility and its ambitious decarbonization goals are boosting investments in electrolyzers and fuel cell plants, where precise flow control is crucial. As these industries develop, Japan’s MFC market is likely to evolve with increased use of IoT-enabled, AI-optimized flow technologies.

Analyzing Mass Flow Controllers Market by Leading Segments

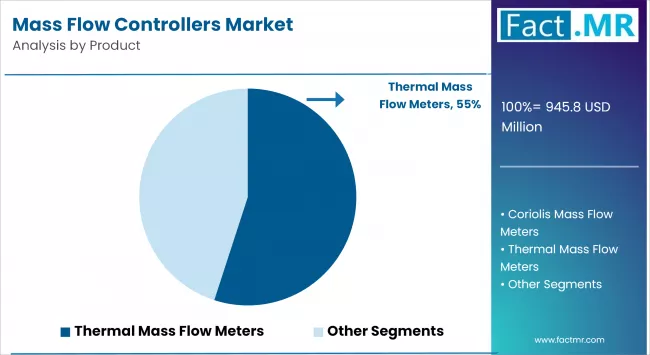

Thermal Mass Flow Meters Dominate Owing to Cost-Effectiveness and Versatile Applications

Thermal mass flow meters lead the mass flow controllers market because they are reliable, inexpensive, and suitable for various gases. Many industries, including chemical processing, pharmaceuticals, and environmental monitoring, widely use these meters.

They need precise and stable gas flow, making thermal meters a preferred choice. Their non-intrusive design and low maintenance requirements also support continuous flow measurement. Additionally, they work well in low-pressure and low-flow applications, which is important for critical process industries.

Coriolis mass flow meters are becoming the fastest-growing segment due to their exceptional accuracy in measuring liquids and dense gases. These meters directly measure mass flow without needing temperature and pressure adjustments, making them perfect for high-precision fields like oil and gas, food and beverage, and chemical manufacturing. As manufacturers focus on accuracy, zero-drift performance, and digital integration, Coriolis meters are increasingly used. They can operate in tough conditions while maintaining strong data output and control quality.

Stainless Steel Continues as the Material of Choice for Mass Flow Controllers

Stainless steel is the top choice for mass flow controllers because of its great resistance to corrosion, durability, and compatibility with many gases and liquids. It is commonly used in industries like semiconductors, pharmaceuticals, chemicals, and food processing where hygiene, chemical resistance, and structural integrity are crucial. The material’s ability to handle high temperatures and pressures reinforces its position in both regular and tough process environments.

Exotic alloys are seeing the fastest growth in the MFC market, especially in applications involving highly corrosive or high-temperature materials. Industries such as petrochemicals, specialty chemicals, and nuclear energy are increasingly choosing Hastelloy, Inconel, and titanium because of their outstanding resistance to harsh chemicals and thermal stress. These materials are perfect for extreme environments where stainless steel may not perform well.

Low Flow Rate Segment Leads Due to Precision-Critical Applications

The low flow rate segment leads the mass flow controllers market. This is mainly due to its use in applications that require precise control, such as in semiconductor manufacturing, pharmaceuticals, and laboratory research. These controllers are crucial for gas mixing, dosing, and inerting processes, where even small variations can affect product quality.

Their capability to manage microflows with high consistency makes them vital in cleanroom and high-purity settings. As miniaturization and nanotechnology progress, the need for low flow rate MFCs remains strong across high-tech industries.

High flow rate mass flow controllers are becoming the fastest-growing segment. This growth is driven by their increasing use in large-scale industrial processes, including chemical manufacturing, oil and gas refining, and clean hydrogen production. These systems require strong flow control for large volumes, often under high pressure and extreme conditions.

MFCs that can handle high flow accurately are being prioritized as industries expand their operations. The global movement toward decarbonization and green hydrogen initiatives is also boosting demand in this segment, making high-capacity MFCs more important.

Semiconductor Industry Dominates on the Back of Precision-Driven Gas Control Needs

The semiconductor industry leads the mass flow controllers market. This is due to its critical need for precise gas flow control in chip fabrication processes like etching, doping, and chemical vapor deposition. Fabs require contamination-free, stable, and repeatable flows, making MFCs standard equipment. The growth of fabs worldwide, along with the rise in advanced node technologies, ensures steady demand. Continuous innovation and strict process tolerances keep this industry as the dominant force in the market.

The pharmaceutical industry is quickly becoming the fastest-growing segment. This growth is fueled by the global boom in biotechnology, vaccine production, and sterile drug manufacturing. Mass flow controllers play a key role in providing accurate gas delivery in fermentation, cell culture, and cleanroom environments. Investments after COVID in flexible, automated drug manufacturing systems have increased MFC adoption. In addition, the demand for high-quality standards, real-time monitoring, and regulatory compliance is pushing pharmaceutical companies to adopt advanced flow control technologies in their production lines.

Competitive Analysis

The mass flow controllers (MFC) market is moderately consolidated. It features a mix of established global companies and emerging regional manufacturers competing for leadership and market share. Key players, including HORIBA, Brooks Instrument (ITW), Bronkhorst High-Tech, MKS Instruments, and Sierra Instruments, dominate the market through strong research and development, diverse product lines, and solid channel partnerships.

Leading firms emphasize precision, digitalization, and integration with smart systems. They offer IoT-enabled MFCs, MEMS-based devices, and multi-gas calibration options that address changing customer needs. Integration with Industry 4.0 systems has become an important factor as industries focus on automation and real-time diagnostics. Innovations in materials, such as corrosion-resistant alloys, along with improved flow accuracy, are setting new standards in performance.

Regional dynamics also impact the market significantly. North America and Europe continue to be strong markets for premium, high-accuracy MFCs. Meanwhile, Asia-Pacific, especially China, Japan, and South Korea, is a major manufacturing hub and rapidly growing market, driven by booming semiconductor and electronics sectors. Regional players in Asia challenge global companies on price, customization, and delivery speed, especially in mid-tier applications.

Competitive strategies include acquisitions, partnerships with original equipment manufacturers (OEMs), and vertical integration to support key industries like semiconductors, pharmaceuticals, chemicals, and clean energy. Furthermore, companies invest in service networks and tailored solutions to enhance customer relationships and increase lifecycle value.

Key players in the market are Hitachi Ltd., Parker Hannifin Corporation, Omega Engineering, Inc., Horiba Ltd., Hitachi Metals, Ltd., MKS Instruments, Inc., Christian Burkert GmbH & Co. KG, Kobold Messring GmbH, Axetris AG, Bronkhorst High-Tech B.V., Brooks Instrument, Aircom Pneumatik GmbH, Oval Corporation, Malema Engineering Corporation, Flexible Industriemesstechnik GmbH (FLEXIM), and other players.

Recent Developments

- In April 2025, Alicat Scientific, based in Tucson, Arizona, is a leader in laminar differential pressure technology for mass flow. The company is expanding its mass flow capabilities by designing new components that enable precise, consistent measurement and quick control of gas flows up to 12,000 SLPM. Alicat’s main line of mass flow products has received strong support from lab users due to their fast PID control, great communication options, high turn-down ratio, and ability to collect multivariate data.

- In January 2025, HORIBA STEC, Co., Ltd. announced the launch of the DZ-107 on January 14th. This model is the latest in its series of ultra-thin mass flow controllers. It increases full-scale flow by about seven times that of earlier models and achieves a maximum mass flow of 20 SLM, the highest in its class, while keeping an ultra-thin width of 10 mm. The DZ-107 also raises the maximum operating temperature from 45°C to 60°C to accommodate gases used in the precision manufacturing of cutting-edge semiconductors.

Segmentation of Mass Flow Controllers Market

-

By Product :

- Coriolis Mass Flow Meters

- Differential Pressure Flow Meters

- Thermal Mass Flow Meters

-

By Material :

- Stainless Steel

- Exotic Alloys

-

By Flow Rate :

- Low

- Medium

- High

-

By Industry :

- Semiconductors

- Chemicals

- Pharmaceuticals

- Oil & Gas

- Food & Beverages

- Water & Wastewater Treatment

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Mass Flow Controllers Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Product

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis By Product, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Units) Analysis and Forecast By Product, 2025-2035

- Coriolis Mass Flow Meters

- Differential Pressure Flow Meters

- Thermal Mass Flow Meters

- Y-o-Y Growth Trend Analysis By Product, 2020-2024

- Absolute $ Opportunity Analysis By Product, 2025-2035

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Material

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis By Material, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Units) Analysis and Forecast By Material, 2025-2035

- Stainless Steel

- Exotic Alloys

- Y-o-Y Growth Trend Analysis By Material, 2020-2024

- Absolute $ Opportunity Analysis By Material, 2025-2035

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Flow Rate

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis By Flow Rate, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Units) Analysis and Forecast By Flow Rate, 2025-2035

- Low

- Medium

- High

- Y-o-Y Growth Trend Analysis By Flow Rate, 2020-2024

- Absolute $ Opportunity Analysis By Flow Rate, 2025-2035

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Industry

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis By Industry, 2020-2024

- Current and Future Market Size Value (USD Mn) & Volume (Units) Analysis and Forecast By Industry, 2025-2035

- Semiconductors

- Chemicals

- Pharmaceuticals

- Oil & Gas

- Food & Beverages

- Water & Wastewater Treatment

- Y-o-Y Growth Trend Analysis By Industry, 2020-2024

- Absolute $ Opportunity Analysis By Industry, 2025-2035

- Global Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Mn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Mn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- Latin America Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- Western Europe Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- East Asia Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- South Asia Pacific Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- Eastern Europe Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- Middle East & Africa Mass Flow Controllers Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Product

- By Material

- By Flow Rate

- By Industry

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Material

- By Flow Rate

- By Industry

- Key Takeaways

- Key Countries Mass Flow Controllers Market Analysis

- Value (USD Mn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- Value (USD Mn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Material

- By Flow Rate

- By Industry

- Value (USD Mn) & Volume (Units)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product

- By Material

- By Flow Rate

- By Industry

- Competition Analysis

- Competition Deep Dive

- Hitachi Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Parker Hannifin Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Omega Engineering, Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Horiba Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- MKS Instruments, Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Christian Burkert GmbH & Co. KG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Kobold Messring GmbH

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Axetris AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Bronkhorst High-Tech B.V

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Brooks Instrument

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Aircom Pneumatik GmbH

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Oval Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Malema Engineering Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hitachi Ltd

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Mass Market Value (USD Mn) Forecast by Region, 2020 to 2035

- Table 2: Global Mass Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 4: Global Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 5: Global Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 6: Global Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 7: Global Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 8: Global Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 9: Global Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 10: Global Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 11: North America Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 12: North America Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 13: North America Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 14: North America Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 15: North America Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 16: North America Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 17: North America Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 18: North America Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 19: North America Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 20: North America Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 21: Latin America Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 22: Latin America Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 23: Latin America Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 24: Latin America Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 25: Latin America Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 26: Latin America Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 27: Latin America Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 28: Latin America Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 29: Latin America Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 30: Latin America Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 31: Western Europe Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 32: Western Europe Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: Western Europe Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 34: Western Europe Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 35: Western Europe Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 36: Western Europe Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 37: Western Europe Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 38: Western Europe Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 39: Western Europe Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 40: Western Europe Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 41: East Asia Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 42: East Asia Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: East Asia Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 44: East Asia Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 45: East Asia Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 46: East Asia Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 47: East Asia Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 48: East Asia Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 49: East Asia Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 50: East Asia Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 51: South Asia Pacific Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 52: South Asia Pacific Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 53: South Asia Pacific Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 54: South Asia Pacific Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 55: South Asia Pacific Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 56: South Asia Pacific Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 57: South Asia Pacific Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 58: South Asia Pacific Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 59: South Asia Pacific Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 60: South Asia Pacific Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 61: Eastern Europe Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 62: Eastern Europe Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: Eastern Europe Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 64: Eastern Europe Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 65: Eastern Europe Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 66: Eastern Europe Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 67: Eastern Europe Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 68: Eastern Europe Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 69: Eastern Europe Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 70: Eastern Europe Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

- Table 71: Middle East & Africa Mass Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 72: Middle East & Africa Mass Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Middle East & Africa Mass Market Value (USD Mn) Forecast by Product, 2020 to 2035

- Table 74: Middle East & Africa Mass Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 75: Middle East & Africa Mass Market Value (USD Mn) Forecast by Material, 2020 to 2035

- Table 76: Middle East & Africa Mass Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 77: Middle East & Africa Mass Market Value (USD Mn) Forecast by Flow Rate, 2020 to 2035

- Table 78: Middle East & Africa Mass Market Volume (Units) Forecast by Flow Rate, 2020 to 2035

- Table 79: Middle East & Africa Mass Market Value (USD Mn) Forecast by Industry, 2020 to 2035

- Table 80: Middle East & Africa Mass Market Volume (Units) Forecast by Industry, 2020 to 2035

List Of Figures

- Figure 1: Global Mass Market Volume (Units) Forecast 2020–2035

- Figure 2: Global Mass Market Pricing Analysis

- Figure 3: Global Mass Market Value (USD Mn) Forecast 2020–2035

- Figure 4: Global Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 5: Global Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 6: Global Mass Market Attractiveness Analysis by Product

- Figure 7: Global Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 8: Global Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 9: Global Mass Market Attractiveness Analysis by Material

- Figure 10: Global Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 11: Global Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 12: Global Mass Market Attractiveness Analysis by Flow Rate

- Figure 13: Global Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 14: Global Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 15: Global Mass Market Attractiveness Analysis by Industry

- Figure 16: Global Mass Market Value (USD Mn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 17: Global Mass Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 18: Global Mass Market Attractiveness Analysis by Region

- Figure 19: North America Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: Latin America Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Western Europe Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: East Asia Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: South Asia Pacific Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Eastern Europe Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Middle East & Africa Mass Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: North America Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: North America Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 28: North America Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 29: North America Mass Market Attractiveness Analysis by Product

- Figure 30: North America Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 31: North America Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 32: North America Mass Market Attractiveness Analysis by Material

- Figure 33: North America Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 34: North America Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 35: North America Mass Market Attractiveness Analysis by Flow Rate

- Figure 36: North America Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 37: North America Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 38: North America Mass Market Attractiveness Analysis by Industry

- Figure 39: Latin America Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 40: Latin America Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 41: Latin America Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 42: Latin America Mass Market Attractiveness Analysis by Product

- Figure 43: Latin America Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 44: Latin America Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 45: Latin America Mass Market Attractiveness Analysis by Material

- Figure 46: Latin America Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 47: Latin America Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 48: Latin America Mass Market Attractiveness Analysis by Flow Rate

- Figure 49: Latin America Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 50: Latin America Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 51: Latin America Mass Market Attractiveness Analysis by Industry

- Figure 52: Western Europe Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Western Europe Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 54: Western Europe Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 55: Western Europe Mass Market Attractiveness Analysis by Product

- Figure 56: Western Europe Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 57: Western Europe Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 58: Western Europe Mass Market Attractiveness Analysis by Material

- Figure 59: Western Europe Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 60: Western Europe Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 61: Western Europe Mass Market Attractiveness Analysis by Flow Rate

- Figure 62: Western Europe Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 63: Western Europe Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 64: Western Europe Mass Market Attractiveness Analysis by Industry

- Figure 65: East Asia Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 66: East Asia Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 67: East Asia Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 68: East Asia Mass Market Attractiveness Analysis by Product

- Figure 69: East Asia Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 70: East Asia Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 71: East Asia Mass Market Attractiveness Analysis by Material

- Figure 72: East Asia Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 73: East Asia Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 74: East Asia Mass Market Attractiveness Analysis by Flow Rate

- Figure 75: East Asia Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 76: East Asia Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 77: East Asia Mass Market Attractiveness Analysis by Industry

- Figure 78: South Asia Pacific Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 79: South Asia Pacific Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 80: South Asia Pacific Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 81: South Asia Pacific Mass Market Attractiveness Analysis by Product

- Figure 82: South Asia Pacific Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 83: South Asia Pacific Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 84: South Asia Pacific Mass Market Attractiveness Analysis by Material

- Figure 85: South Asia Pacific Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 86: South Asia Pacific Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 87: South Asia Pacific Mass Market Attractiveness Analysis by Flow Rate

- Figure 88: South Asia Pacific Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 89: South Asia Pacific Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 90: South Asia Pacific Mass Market Attractiveness Analysis by Industry

- Figure 91: Eastern Europe Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: Eastern Europe Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 93: Eastern Europe Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 94: Eastern Europe Mass Market Attractiveness Analysis by Product

- Figure 95: Eastern Europe Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 96: Eastern Europe Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 97: Eastern Europe Mass Market Attractiveness Analysis by Material

- Figure 98: Eastern Europe Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 99: Eastern Europe Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 100: Eastern Europe Mass Market Attractiveness Analysis by Flow Rate

- Figure 101: Eastern Europe Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 102: Eastern Europe Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 103: Eastern Europe Mass Market Attractiveness Analysis by Industry

- Figure 104: Middle East & Africa Mass Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 105: Middle East & Africa Mass Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 106: Middle East & Africa Mass Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 107: Middle East & Africa Mass Market Attractiveness Analysis by Product

- Figure 108: Middle East & Africa Mass Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 109: Middle East & Africa Mass Market Y-o-Y Growth Comparison by Material, 2025 to 2035

- Figure 110: Middle East & Africa Mass Market Attractiveness Analysis by Material

- Figure 111: Middle East & Africa Mass Market Value Share and BPS Analysis by Flow Rate, 2025 and 2035

- Figure 112: Middle East & Africa Mass Market Y-o-Y Growth Comparison by Flow Rate, 2025 to 2035

- Figure 113: Middle East & Africa Mass Market Attractiveness Analysis by Flow Rate

- Figure 114: Middle East & Africa Mass Market Value Share and BPS Analysis by Industry, 2025 and 2035

- Figure 115: Middle East & Africa Mass Market Y-o-Y Growth Comparison by Industry, 2025 to 2035

- Figure 116: Middle East & Africa Mass Market Attractiveness Analysis by Industry

- Figure 117: Global Mass Market – Tier Structure Analysis

- Figure 118: Global Mass Market – Company Share Analysis

- FAQs -

What is the Global Mass Flow Controllers Market size in 2025?

The mass flow controllers market is valued at USD 945.8 million in 2025.

Who are the Major Players Operating in the Mass Flow Controllers Market?

Prominent players in the market include Hitachi Ltd., Parker Hannifin Corporation, Omega Engineering, Inc., Horiba Ltd., Hitachi Metals, Ltd., and MKS Instruments, Inc.

What is the Estimated Valuation of the Mass Flow Controllers Market by 2035?

The market is expected to reach a valuation of USD 1693.8 million by 2035.

At what CAGR is the Mass Flow Controllers Market slated to grow during the study period?

The growth rate of the mass flow controllers market is 6.0% from 2025-2035.