Mineral Fillers Market

Mineral Fillers Market Analysis, By Type, By Application and By Region - Market Insights 2025 to 2035

Analysis of the Mineral Fillers Market Covering 30+ Countries Including Analysis of the US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea, and many more

Mineral Fillers Market Outlook (2025 to 2035)

The global mineral fillers market is expected to be valued at USD 28.4 billion by 2025, according to Fact.MR analysis indicates that mineral fillers will grow at a CAGR of 6.0% and reach USD 50.9 billion by 2035.

In 2024, the industry expanded to USD 26.8 billion from USD 25.3 billion in 2023, driven by growing consumption of plastics, rubber, and building materials. At a granular level, demand was driven by the plastics sector, particularly in the automotive industry, where lightweight, mineral-filled polymers were the norm for fuel-efficient parts.

Calcium carbonate led the market with projected USD 8.5 billion in revenues, driven by higher demand in the paper, packaging, and paint industries due to enhanced printability and opacity. The mica segment, at USD 3.4 billion, gained high demand in cosmetic-grade and insulation applications, particularly in East Asia.

The Asia Pacific, led by China, recorded the largest share (39.6%), driven by infrastructure expansion, increased construction, and local manufacturing capacity. China's mineral filler industry alone is expected to expand at 6.7% CAGR, which is above the global average.

Looking forward to 2025 and beyond, industry momentum is expected to gather pace, driven by sustainability pressures, the growing use of bio-composites, and the rising integration of renewable energy infrastructure, all of which demand mineral-filled materials for insulation, strength, and thermal characteristics. Additionally, regulatory incentives for light vehicles and green buildings will drive demand, particularly in emerging industries.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 28.4 billion |

| Industry Value (2035F) | USD 50.9 billion |

| Value-based CAGR (2025 to 2035) | 6.0% |

Fact.MR Survey on Mineral Fillers Industry

Fact.MR Stakeholder Survey Findings: Trends & Operational Insights

(Surveyed in Q4 2024 | n = 510 stakeholders among manufacturers, raw material suppliers, compounders, and end-users from the USA, Western Europe, China, Japan, and India)

Stakeholder Imperatives in Mineral Filler Usage

- Cost Minimization & Resin Optimization: 84% of the stakeholders surveyed identified cost minimization by way of improved filler loadings as a key operational priority.

- Consistency & Performance Repeatability: 71% insisted on precise control over particle size distribution and surface treatment for consistent processing behavior.

Regional Insights:

- USA: 65% placed prime importance on dual-functionality fillers (e.g., mechanical strength + thermal insulation).

- Western Europe: 81% required low-carbon and REACH-compliant fillers for green packaging and automotive segments.

- China/India: 76% insisted on cost-effective bulk fillers for building and infrastructure plastics.

- Japan: 58% underscored high-purity mineral feedstocks for applications in semiconductors and electronic coatings.

Technological Adoption: Fillers & Processing Synergies

- Global Trend: 53% had embraced surface-treated or functionalized products to increase resin compatibility.

Regional Trends:

- USA: 61% used silane-treated fillers in engineered thermoplastics and automobile polymers.

- Europe: 54% used low-dust, pre-compounded filler masterbatches.

- China: 49% implemented automated filler dosing systems for high-throughput production.

- India: 42% still made use of manual filler mixing, with increasing demand for semi-automated feeders.

- Japan: 38% utilized sub-micron grading and dispersion analytics for high-end coating applications.

ROI Attitudes:

- 72% in the US and 64% in Europe considered functional fillers to be cost-effective in the long run.

- Only 29% in India and 35% in China concurred, mentioning initial cost constraints.

Material Preferences: Regional Breakdown & Application Relevance

Top Materials Chosen:

- Calcium Carbonate (GCC/PCC): 69% (mainstream across applications)

- Talc: 43% (popular for barrier performance)

- Mica: 21% (applicable in electronics, automotive)

- Wollastonite/Kaolin/Barite: 27% (niche, performance-specific)

Regional Differences:

- USA: 75% preferred GCC for cost-performance balance in PVC, polyolefins, and rubbers.

- Europe: 49% applied PCC, stimulated by clean-label, high-brightness requirements in paints and food-grade packaging.

- China/India: 68% depended on locally produced, untreated GCC and talc.

- Japan: 46% opted for mica and kaolin hybrids, particularly in high-precision industries.

Pricing Sensitivities & Willingness to Pay

Raw Material Inflation:

- 89% mentioned rising costs of mined minerals and transportation charges as major supply chain issues.

- Talc: +24% YoY

- Mica: +19%

- PCC/GCC: +13%

Regional Variance in Premium Tolerance:

- USA/Europe: 66% accepted a 10-20% premium for value-added or pre-treated fillers.

- China/India: 79% preferred lower-cost, high-volume materials, with little acceptance of pricing premiums.

- Japan: 48% accepted smaller, high-performance lots at controlled premiums (5-10%).

Value Chain Challenges

Manufacturers:

- USA: 58% reported inconsistent raw material purity and high moisture content as process disruptions.

- Europe: 47% experienced delays due to EU safety certification and compliance audits.

- China/India: 62% indicated inconsistent mining yields and logistics hold-ups.

Distributors:

- Europe: 55% battled with lead time instability in supplies sourced from North Africa and Asia.

- Japan: 46% quoted inflexibility of packaging sizes as a logisitics barrier.

- China: 52% identified regional over-reliance on low-quality fillers curbing product diversification.

End-Users:

- USA: 43% stated wear and tear on equipment as a result of high-abrasion fillers.

- Europe: 41% were forced to retrofit existing mixing systems for improved filler integration.

- India: 56% experienced poor dispersion in masterbatch or film extrusion.

Future Investment Roadmap

Global Alignment:

- 71% intend to invest in treated products or formulated filler-resin systems for next-generation applications.

Regional Focus Areas:

- USA: 63% investigating composite materials via mineral-reinforced recyclates.

- Europe: 59% investing in budgeted bio-compatible products in packaging and medical.

- China/India: 53% planning to expand bulk handling and automated dosing systems.

- Japan: 47% investing in R&D for sub-micron fillers for electronic coatings and battery casings.

Regulatory Considerations

- USA: 67% driven by OSHA standards and EPA regulations, particularly for dust suppression and flame retardancy.

- Europe: 82% stated REACH compliance and EU Taxonomy encouraged demand for non-toxic, recyclable fillers.

- China/India: 33% stated weaker regulatory enforcement, though increased awareness was seen in packaging and construction.

- Japan: 55% synchronized filler choice with end-use certifications (e.g., RoHS, electronics export compliance).

Conclusion: Global Trends vs. Regional Realities

- Universal Alignment: Stakeholders concur that cost pressures, consistency, and resin compatibility continue to be prime themes.

Key Differences:

- USA/Europe: Pioneers in value-added, eco-compliant filler technologies.

- China/India: Focusing on cost and logistics, with increasing focus on automation.

- Japan: High-end purity and precision filler systems oriented.

Strategic Takeaway:

Global mineral filler strategies need to be decentralized. Emphasis on bulk capacity and affordability in Asia, sustainability in Europe, and functional innovation in the USA and Japan is required to capitalize on long-term demand growth and regulatory changes.

Government Regulations on the Mineral Fillers Industry

| Country | Policy & Regulatory Impact |

|---|---|

| USA |

|

| Canada |

|

| Germany |

|

| France |

|

| Italy |

|

| UK |

|

| China |

|

| Japan |

|

| South Korea |

|

Market Analysis

The worldwide industry is set to grow steadily up to 2034, led by increasing demand from plastics, construction, and automotive sectors for cost savings and performance improvement. Sustainability laws and lightweight material demands are driving adoption, particularly of calcium carbonate and environmentally friendly filler types. Companies with leading-edge processing facilities and robust regional supply chains will benefit, while those depending on traditional filler types and not being compliance-ready will lose ground.

Top 3 Strategic Imperatives for Stakeholders

Increase Capacity in High Purity, Multi-Functional Fillers

Invest in increasing capacity in high-performance products such as precipitated calcium carbonate, talc, and mica, marketed to the changing demands of end-use industries such as automotive, packaging, and green construction. Facilities should be located close to key demand areas, such as the Asia Pacific region, in order to minimize logistics costs and lead times.

Leverage the Sustainability and Regulatory Shift

Enhance product innovation to address increasingly stringent global environmental laws through the creation of low-carbon, recyclable, and biocompatible filler substitutes. Establish ESG compliance divisions to ensure consistency with evolving guidelines, including REACH (EU), Prop 65 (USA), and eco-labeling requirements in East Asia.

Construct Strategic Partnerships for Supply Chain Resilience

Secure long-term agreements and joint ventures with upstream mineral sources and downstream compounders to lock in raw material security and margin stability. Pursue M&A opportunities with regional distributors and specialty filler formulators to obtain niche applications access and enhance industry foothold.

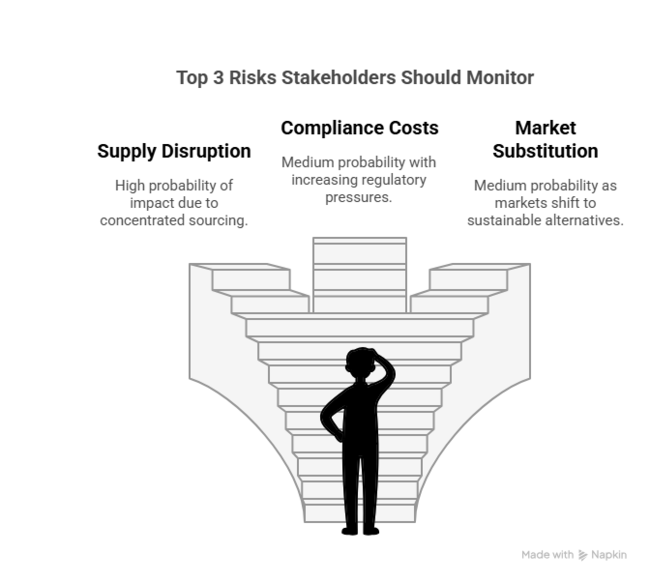

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

| Raw Material Supply Disruption: Many products such as calcium carbonate, talc, mica, and kaolin are sourced from geologically concentrated regions | High |

| Stringent Environmental Regulations Increasing Compliance Costs: Growing regulatory pressures such as REACH in the EU, EPA and Prop 65 in the USA, and China's Green Product Certification Scheme are demanding cleaner processing, safe waste management, and lower carbon footprints. | Medium |

| Substitution by Bio-based or Nano-fillers in Eco-Sensitive: In developed industry, especially in Europe and parts of North America, there is rising interest in sustainable, bio-based, or nano-scale alternatives that can offer similar or enhanced performance with a lower environmental footprint. | Medium |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Secure Critical Mineral Sourcing | Run feasibility studies on diversifying calcium carbonate and mica sourcing, especially outside China and India. |

| Accelerate Sustainable Product Development | Initiate cross-functional R&D task force to evaluate bio-compatible and low-carbon filler alternatives. |

| Strengthen OEM and Compounder Collaboration | Initiate OEM feedback loop to understand performance specs and evolving demand for hybrid or engineered fillers. |

For the Boardroom

To stay ahead in the evolving landscape, the client should immediately recalibrate its sourcing, innovation, and client engagement strategies. With regulatory pressure mounting across Europe and East Asia, and bio-based alternatives slowly gaining traction, the roadmap must now prioritize the development of low-carbon fillers, diversified raw material supply chains, and closer alignment with compounders and OEMs that demand enhanced performance and sustainability.

This intelligence signals a shift from volume-driven growth to value-driven differentiation, requiring R&D acceleration, certifications across high-growth regions, and readiness to pivot quickly in eco-sensitive sectors.

Segment-wise Analysis

By Type

The calcium carbonate segment is expected to register a 32.0% share in 2025. It is predominantly applied in plastics, paints, rubber, paper, and construction. Its lower cost and strength in improving brightness, opacity, and mechanical properties make it particularly suited for use across various industries.

Additionally, its compatibility with sustainable processes and cost savings further increases its demand. Especially within the polymer and packaging sectors, calcium carbonate is used to add stiffness and toughness. The building and construction sector applies it in adhesives and sealants to provide improved viscosity and shrinkage resistance. The segment will persist in its dominance based on performance and cost benefits.

By Application

The plastic and polymers segment is expected to register a 27.0% share in 2025. The demand is fueled by the increasing application of fillers such as calcium carbonate, talc, and silica to enhance mechanical strength, reduce raw material costs, and improve thermal stability.

The automotive, packaging, and consumer electronics sectors are among the most significant contributors to this trend. New applications in the bioplastics and sustainable polymer blends space are also driving filler adoption, which is expected to be the most rapid growth area over the next decade.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| USA | 5.8% |

| UK | 4.9% |

| France | 5.2% |

| Germany | 6.1% |

| Italy | 4.7% |

| South Korea | 6.4% |

| Japan | 5.5% |

| China | 7.2% |

USA

The US industry is expected to expand at a CAGR of 5.8% from 2025 to 2035, marginally higher than the global rate, driven by robust demand from the construction, automotive, and packaging sectors. The US is a developed industry with a well-established manufacturing and infrastructure base, assuring continuous consumption of mineral fillers such as calcium carbonate, talc, and kaolin.

The building construction sector, driven by government support through the Infrastructure Investment and Jobs Act, is expected to be one of the key growth drivers. Furthermore, the automotive industry's transition towards lighter materials to reduce fuel consumption will drive demand for mineral fillers in polymer composites. Trends toward sustainability also compel producers to use environmentally friendly products in packaging and consumer products.

UK

The UK industry is projected to expand at a CAGR of 4.9% from 2025 to 2035, marginally lower than the global average, driven by economic uncertainties and a relatively slow construction industry following Brexit. Nevertheless, the packaging and automotive sectors will continue to underpin demand.

The UK's rigorous environmental regulations are driving producers towards sustainable mineral fillers, especially in biodegradable plastics and recyclable packaging. The packaging and paper industry remains a key consumer, driven by the expansion of e-commerce. At the same time, the automotive industry's emphasis on lightweight composites will sustain demand for fillers.

France

France’s sales are expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2025 to 2035, driven by high demand from the automotive, construction, and cosmetics sectors. France is one of the most significant countries in Europe's automotive industry, where products are utilized in plastics and coatings to minimize weight while enhancing strength.

The building sector, supported by government infrastructure development, will lead demand for fillers in paints, adhesives, and concrete. France's cosmetics sector also uses high-purity talc and mica to support high-end filler applications.

Germany

Germany's sales are expected to expand at a strong compound annual growth rate (CAGR) of 6.1% between 2025 and 2035, ahead of the European average, due to its high industrial and automotive base. Germany, being the largest economy in Europe, is a hub for advanced manufacturing, which in turn boosts demand for high-performance fillers in plastics, coatings, and composites.

The automotive sector's shift towards electric vehicles (EVs) will increase filler consumption in lightweight components. Secondly, Germany's stringent sustainability legislation is expected to enhance demand for sustainable mineral fillers in the construction and packaging sectors.

Italy

The Italian industry is expected to grow at a CAGR of 4.7% from 2025 to 2035, driven by consistent demand from the ceramics, plastics, and construction sectors. Italy is a world leader in ceramics, where fillers such as feldspar and quartz are used heavily.

The construction industry, although slower than other European landscapes, will also support filler demand in paints and coatings. The automotive and packaging industries will also offer growth opportunities.

Economic uncertainty and high production costs may hinder growth, but Italy's rich manufacturing tradition and export base will support the industry.

South Korea

The South Korean industry is expected to grow at a compound annual growth rate (CAGR) of 6.4% during the forecast period. South Korea's automotive, plastic, and semiconductor industries depend extensively on high-purity mineral fillers.

Government incentives for electric vehicles (EVs) and renewable energy will also boost demand. Yet, Chinese competition and high raw material prices can be a concern. South Korea's economy, driven by innovation, guarantees solid industry prospects.

Japan

The Japanese industry is expected to expand at a compound annual growth rate (CAGR) of 5.5% during the forecast period, driven by the automotive, electronics, and construction sectors. Japan's aging population will slow down construction, but high-tech materials in automotive and electronics will maintain demand.

China

The industry in China is projected to expand at a high CAGR of 7.2% from 2025 to 2035, driven by significant construction, automotive, and industrial activity. Government infrastructure projects and the growth of electric vehicles (EVs) will drive demand.

Domestic production capacity offers cost benefits, but environmental laws may impact growth. China will be the biggest and fastest-growing industry.

Market Share Analysis

French-headquartered Imerys S.A.

Retains its position as the global leader, with an estimated 18-20% market share. The company offers a diverse range of products, including calcium carbonate, kaolin, talc, perlite, and bentonite, which are utilized in plastics, paints, and building materials.

Minerals Technologies Inc.,

The American specialty fillers leader holds a 10-12% global industry share. Focusing on precipitated calcium carbonate (PCC), talc, and bentonite, the firm is a leading player in the PCC segment, which is vital to the use of paper, packaging, and plastics. Its competitive advantage lies in a strong patent portfolio on surface-modified fillers. Among its prominent customers are Tesla, Ford, and PepsiCo, which utilize its green packaging solutions.

Switzerland's Omya AG enjoys a 12-14%

Share as the global industry leader in calcium carbonate expertise. Its ground calcium carbonate (GCC) products are critical ingredients in paint, coatings, and adhesives formulations. Omya's competitive edge stems from its full vertical integration, encompassing ownership of everything from mines to processing facilities and distribution networks. The company has gained special expertise in high-purity, food, and pharmaceutical-grade fillers.

Lhoist Group of Belgium retains a 7-9%

Share as the industry leader in lime-based fillers. Its product offerings consist of quicklime, hydrated lime, and dolomite and find application mainly in the steel, cement, and water treatment industries. With its network of over 200 mines and processing facilities worldwide, Lhoist has established notably strong positions in Europe (50% of turnover), North America (30%), and Latin America (15%).

Other Key Players

- Covia Corporation

- Elementis

- Hoffmann Minerals

- Huber Engineered Materials

- Imerys SA

- LKAB Minerals AB

- Omya International AG

- US Minerals

- Vanderbilt Chemicals

Segmentation

By Type:

- Calcium Carbonate

- Kaolin Clay

- Talc

- Mica

- Silica/Quartz

- Feldspar

- Alumina Trihydrate

- Others (Wollastonite, Diatomite, etc.)

By Application:

- Paper

- Plastics & Polymers

- Automotive

- Construction and Building

- Packaging

- Electrical and Electronics

- Consumer Goods

- Industrial Applications

- Medical and Healthcare

- Transportation

- Adhesives & Sealants

- Construction & Cement

- Rubber

- Others (Cosmetics, Pharma, etc.)

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Market Trends and Success Factors, including Macro-economic Factors, Market Dynamics, and Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035, including Historical Analysis and Future Projections

- Pricing Analysis

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Type

- Application

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Calcium Carbonate

- Kaolin Clay

- Talc

- Mica

- Silica/Quartz

- Feldspar

- Alumina Trihydrate

- Others (Wollastonite, Diatomite, etc.)

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Paper

- Plastics & Polymers

- Automotive

- Construction and Building

- Packaging

- Electrical and Electronics

- Consumer Goods

- Industrial Applications

- Medical and Healthcare

- Transportation

- Adhesives & Sealants

- Construction & Cement

- Rubber

- Others (Cosmetics, Pharma, etc.)

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- South Asia

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast 2025 to 2035 by Type and Application for 30 Countries

- Competition Outlook, including Market Structure Analysis, Company Share Analysis by Key Players, and Competition Dashboard

- Company Profile

- Covia Corporation

- Elementis

- Hoffmann Minerals

- Huber Engineered Materials

- Imerys SA

- LKAB Minerals AB

- Omya International AG

- US Minerals

- Vanderbilt Chemicals

- Other Major Players

- FAQs -

How big is the mineral filler market?

The market is anticipated to reach USD 28.4 billion in 2025.

What is the outlook on mineral filler sales?

The market is predicted to reach a size of USD 50.9 billion by 2035.

Who are the key mineral filler companies?

Prominent players include Covia Corporation, Elementis, Hoffmann Minerals, Huber Engineered Materials, Imerys SA, LKAB Minerals AB, Lhoist S.A., Minerals Technologies Inc., Omya International AG, US Minerals, and Vanderbilt Chemicals.

Which type of mineral filler is being widely used?

Calcium carbonate is widely used.

Which country is likely to witness the fastest growth in the mineral filler market?

China, set to grow at 7.2% CAGR during the forecast period, is poised for the fastest growth.