Ready to Eat Soup Market

Ready-to-eat Soup Market Size and Share Forecast Outlook 2025 to 2035

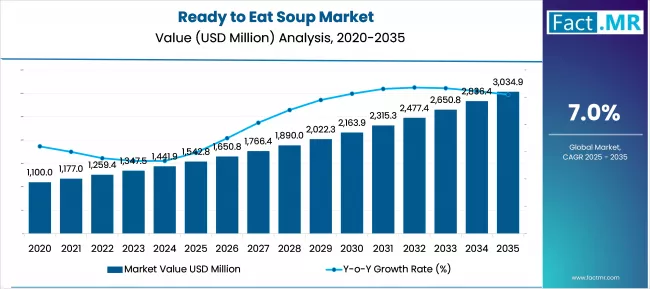

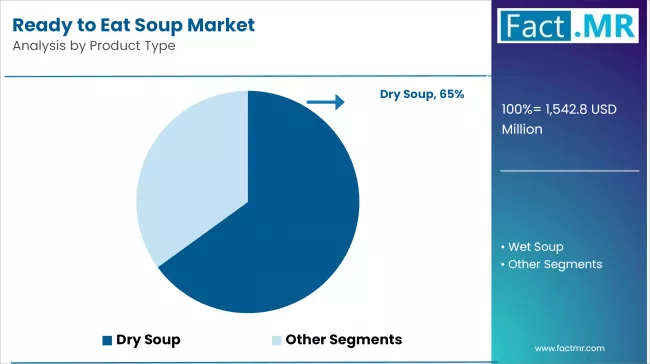

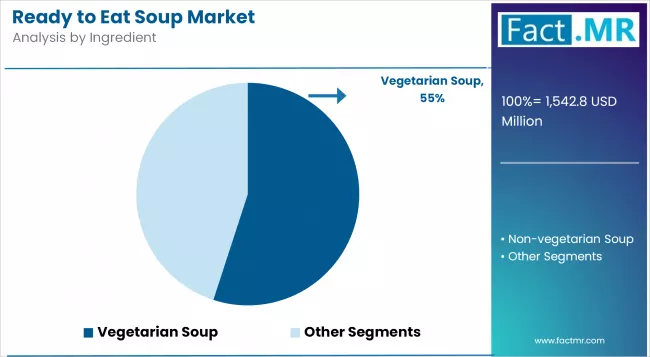

The ready-to-eat soup market will total USD 1,542.8 million in 2025, rising to USD 3,034.9 million by 2035, expanding at a 7.0% CAGR. By product type, dry soups are preferred whereas by ingredient, vegetarian soups will influence consumption patterns.

Ready-to-Eat Soup Market Outlook 2025 to 2035

The global ready-to-eat soup market is forecast to reach USD 3,034.9 million by 2035, up from USD 1,542.8 million in 2025. During the forecast period, the industry is projected to register at a CAGR of 7.0%. The rising demand for convenient meals to accommodate busy lifestyles drives the ready-to-eat soup market.

Healthy soups, such as those made with low-sodium and natural ingredients, are popular. Plant-based and organic products, as well as eco-friendly packaging, appeal to environmentally conscious consumers.

Quick Stats on Ready-to-Eat Soup Market

- Ready-to-Eat Soup Market Size (2025): USD 1,542.8 million

- Projected Ready-to-Eat Soup Market Size (2035): USD 3,034.9 million

- Forecast CAGR of Ready-to-Eat Soup Market (2025 to 2035): 7.0%

- Leading Product Type Segment of Ready-to-Eat Soup Market: Dry Soup

- Leading Ingredient Segment of Ready-to-Eat Soup Market: Vegetarian

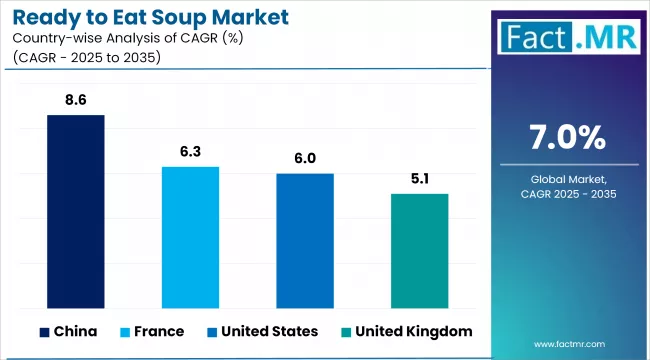

- Key Growth Regions of Ready-to-Eat Soup Market: United Kingdom, China, France

- Prominent Players in the Ready-to-Eat Soup Market: Amy’s Kitchen Inc., Baxters Food Group Limited, New Covent Garden Soup Co. Ltd, and Yorkshire Provender

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,542.8 million |

| Industry Size (2035F) | USD 3,034.9 million |

| CAGR (2025-2035) | 7.0% |

The global ready-to-eat soup market is poised for robust growth, with its size projected to increase from USD 1,542.8 million in 2025 to USD 3,034.9 million by 2035, representing a CAGR of 7.0%. The growth is primarily driven by evolving consumer lifestyles, increased urbanization, and the rising demand for convenient, nutritious, and on-the-go meal options. Busy professionals, students, and single-person households are increasingly favoring RTE soups as a time-saving alternative to traditional meal preparation.

Health-conscious consumer behavior is shaping the market significantly. Modern consumers are seeking clean-label, low-sodium, organic, and functional soups fortified with vitamins, minerals, or plant-based proteins.

This trend is encouraging manufacturers to innovate with high-quality ingredients and fortified blends that cater to immunity, digestive health, and overall wellness. Additionally, the growing popularity of plant-based diets and vegan lifestyles is driving the introduction of vegetable, legume, and pulse-based RTE soups in the market.

Technological advancements in food processing and preservation are further supporting market expansion. Sophisticated packaging solutions, such as retort pouches and microwavable containers, extend shelf life, maintain flavor and nutritional integrity, and ensure portability. These innovations also help reduce food waste, aligning with sustainability initiatives and consumer expectations for eco-friendly packaging.

North America and Europe are expected to maintain steady demand due to high disposable incomes, a fast-paced lifestyle, and well-established retail networks. Asia Pacific is emerging as a key growth hub, driven by rising urban populations, expanding supermarket chains, and increasing adoption of convenient foods among younger consumers.

The ready-to-eat soup market is set for sustained expansion over the next decade, fueled by consumer preference for convenient and healthy meal solutions, advancements in processing and packaging technologies, and an increasing focus on product innovation that meets dietary and lifestyle needs.

Analyzing Key Dynamics of the Ready-to-Eat Soup Market

The ready-to-eat soup market is influenced by a range of factors that either accelerate adoption or present hurdles for growth. While convenience, health trends, and innovation are driving increased consumption, challenges such as raw material costs, supply chain complexities, and competitive pressures continue to shape the market landscape. Understanding these drivers and challenges is essential for stakeholders to make informed investment, production, and marketing decisions.

Expanding Retail Networks and E-commerce Platforms

The proliferation of modern retail formats, including supermarkets, hypermarkets, and convenience stores, has made RTE soups more accessible to a wide range of consumers. Shoppers can easily purchase these products alongside other meal components, reinforcing habitual consumption and increasing market penetration. Retailers also offer promotional displays and product bundling that encourage trial and repeat purchases, particularly for new flavors and innovative offerings.

E-commerce has further amplified accessibility, allowing consumers to order RTE soups directly from online grocery platforms and have them delivered at home. Subscription services and online meal kits often include RTE soups as convenient meal options, catering to busy lifestyles. The integration of digital marketing and targeted online campaigns also helps brands reach health-conscious and time-constrained consumers more efficiently.

Rising Popularity of Functional, Nutrient-Enriched and Specialty Soups

Consumers are increasingly seeking foods that provide added health benefits beyond basic nutrition. Functional RTE soups enriched with proteins, antioxidants, probiotics, or plant-based nutrients are gaining traction as convenient wellness-focused options. Specialty soups catering to dietary restrictions, such as gluten-free, keto, or vegan variants, are further expanding the market’s appeal.

The trend toward functional foods is also encouraging manufacturers to experiment with novel ingredients and blends, creating differentiation opportunities. This shift helps brands target niche consumer segments willing to pay a premium for health-enhancing, ready-to-eat options. By aligning product innovation with wellness trends, companies can strengthen brand loyalty and capture a larger share of the growing functional foods market.

Innovation and Product Diversification as a Catalyst for Consumer Engagement and Market Expansion

Ready-to-eat soup manufacturers are constantly innovating with flavors, textures, and packaging formats to attract diverse consumer groups. Limited-edition flavors, regional specialties, and gourmet options appeal to adventurous eaters, while convenient formats such as microwavable bowls or single-serve pouches enhance usability.

Product diversification also allows brands to target multiple occasions, from quick lunches to on-the-go snacks, increasing overall consumption frequency. Continuous innovation in shelf-stable technologies, flavor retention, and portion sizing helps companies maintain a competitive edge, particularly in highly saturated markets where differentiation is critical.

Volatility in Raw Material Prices and Supply Chain Constraints

The RTE soup industry is highly sensitive to fluctuations in raw material costs, including vegetables, legumes, grains, and proteins. Price volatility can affect margins, particularly for manufacturers that prioritize high-quality or organic ingredients. Unexpected price increases may be passed on to consumers, which could reduce demand or slow market expansion.

Supply chain disruptions due to climate variability, transportation delays, or geopolitical factors can also impact ingredient availability. Maintaining a consistent supply of fresh and high-quality raw materials requires efficient sourcing and inventory management strategies, which can increase operational complexity and costs.

Maintaining Product Quality and Shelf-Life in Ready-to-Eat Formulations

Ensuring product safety, flavor, texture, and nutritional value over extended shelf lives remains a critical challenge for RTE soup manufacturers. Factors such as microbial stability, packaging integrity, and heat treatment processes must be carefully managed to maintain consumer trust.

Variability in storage conditions during transportation and at retail outlets can further compromise product quality. Manufacturers need to invest in advanced preservation techniques, such as aseptic processing or modified atmosphere packaging, to meet safety and sensory expectations, which can increase production costs.

Intense Competition and Brand Differentiation Pressures

The ready-to-eat soup market is highly competitive, with numerous domestic and international players offering similar products. Intense price competition and aggressive promotional campaigns make it challenging for brands to maintain profit margins while building brand loyalty.

Differentiating products in a crowded market requires continuous innovation, strong marketing strategies, and consistent quality. Smaller players may struggle to compete with established brands that benefit from economies of scale, extensive distribution networks, and significant marketing budgets, limiting their ability to grow market share.

Regional Trends of Ready-to-Eat Soup Market

North America holds the largest share of the global ready-to-eat soup market, driven by increasingly hectic lifestyles and a strong preference for convenient, ready-to-consume meals. Packaged soups that require minimal preparation are particularly popular, significantly contributing to value sales and overall market growth in the region.

Europe and Asia Pacific are also witnessing notable market expansion. In Europe, busy lifestyles and high per capita consumption in countries like Germany, France, and the United Kingdom are boosting packaged soup sales. Asia Pacific’s market is growing due to rising disposable incomes, urbanization, and the willingness of working professionals to invest in convenient meal options, supported by the presence of multiple local producers.

Country-Wise Outlook

| Countries | CAGR (2025-2035) |

|---|---|

| United Kingdom | 5.1% |

| China | 8.6% |

| France | 6.3% |

| United States | 6.0% |

United Kingdom Ready-to-Eat Soup Market Benefits from Busy Lifestyles and Health Awareness

The United Kingdom ready-to-eat soup market is expanding as consumers seek convenient meal solutions requiring minimal preparation, particularly among working professionals and students.

Health-conscious trends are driving demand for clean-label, low-sodium, and natural-ingredient soups. Updated regulatory standards, such as the UK Health Security Agency guidelines, ensure product safety and foster consumer trust, supporting overall market growth.

- Rising demand for quick-prep, convenient meals among urban professionals and students

- Health-focused consumers drive innovation in low-sodium, clean-label, and natural soups

- Compliance with updated safety regulations enhances consumer confidence and adoption

China Ready-to-Eat Soup Market Driven by Urbanization, Health Trends, and E-Commerce

The market in China is growing due to rapid urbanization and hectic lifestyles, especially among young professionals and students seeking affordable, time-saving meals. Health-conscious consumers are increasingly favoring low-sodium, preservative-free, and herbal soups inspired by Traditional Chinese Medicine.

E-commerce platforms like JD.com and Tmall are expanding access to premium and imported soups, while both Western and traditional Chinese flavors present strong growth potential.

- Urbanization and busy lifestyles boost demand for convenient, ready-to-eat meals

- Functional and herbal soups based on Traditional Chinese Medicine are gaining popularity

- E-commerce channels enable access to premium, imported, and niche soup products

France Ready-to-Eat Soup Market Supported by Culinary Tradition and Health Focus

France’s rich culinary heritage in soups provides a strong foundation for the ready-to-eat soup market. Convenience drives adoption among working professionals and elderly consumers, while health-conscious trends encourage demand for natural, organic, and locally sourced ingredients.

Low-salt and plant-based options are increasingly popular, and the rise of online grocery channels allows premium and niche brands to reach urban, health-conscious consumers effectively.

- Strong cultural familiarity with soups drives acceptance and repeat consumption

- Organic, low-salt, and plant-based soups are increasingly favored by health-conscious consumers

- E-commerce and premium niche brands expand reach beyond traditional retail channels

United States Ready-to-Eat Soup Market Fueled by Convenience and Functional Offerings

The United States ready-to-eat soup market is growing rapidly as consumers seek quick, ready-to-eat meals that fit busy lifestyles. Microwavable and single-serve soups are particularly popular, offering convenience without compromising quality.

Health-conscious trends, including organic, low-sodium, and high-protein options, are influencing product innovation, while strong distribution through supermarkets, convenience stores, and e-commerce platforms ensures wide market accessibility.

- High demand for convenient, ready-to-eat soups among busy professionals and single-person households

- Health-conscious trends drive innovation in organic, low-sodium, and high-protein soups

- Supermarkets, convenience stores, and e-commerce channels support broad market reach

Analyzing the Ready-to-Eat Soup Market by Key Segments

The global ready-to-eat soup market is shaped by diverse product formats, dietary preferences, and health-conscious trends. Different soup types, including dry, wet, vegetarian, non-vegetarian, organic, and conventional, cater to a wide range of consumer needs, from convenience and shelf life to nutrition and sustainability. Understanding the performance and growth drivers of each category is crucial for stakeholders to identify opportunities and tailor offerings to evolving market demands.

Dry Soup Consumption Dominates Due to Convenience and Long Shelf-Life

Dry soups are the largest segment in the RTE market, prized for their ease of preparation, long shelf stability, and resistance to oxidative and enzymatic degradation. Their lightweight and compact form makes them ideal for hotels, restaurants, and catering services, as well as individual consumers seeking quick meals. Standard, organic, and vegan varieties expand the appeal of dry soups to different consumer segments.

- Offers quick preparation and extended shelf life without refrigeration

- Lightweight, stable, and convenient for transport and storage

- Available in standard, organic, and vegan options to cater to diverse preferences

Wet Ready-to-Eat Soups Gaining Popularity Through Versatility and Portability

Wet soups, including condensed and ready-to-drink varieties, provide versatile meal options. Condensed soups offer a base for recipes, while ready-to-drink soups come in chilled, portable containers for on-the-go consumption. This segment is growing as consumers increasingly prefer convenient and flexible meal solutions suitable for busy lifestyles.

- Condensed soups serve as recipe bases for versatile meal preparation

- Ready-to-drink soups offer portability and convenience for active lifestyles

- Growth driven by consumer demand for quick, easy-to-consume meals

Vegetarian Soups Lead Market Growth Fueled by Plant-Based and Health Trends

Vegetarian soups dominate the market due to rising interest in plant-based diets and health-conscious eating. Consumers increasingly seek vegetable-based, vegan, and organic formulations, prompting manufacturers to expand flavor options and cater to niche dietary preferences.

- Popular among health-conscious and plant-based diet consumers

- Wide range of flavors and organic/vegan formulations available

- Growth driven by wellness trends and sustainability considerations

Non-Vegetarian Soups Remain Popular for Protein-Rich and Hearty Meals

Non-vegetarian soups continue to be widely consumed due to their protein content and hearty nature. High-quality meats and innovative flavor combinations maintain the segment’s appeal among traditional and modern consumers alike.

- Provides protein-rich, nutritious, and filling meal options

- Maintains popularity through innovative flavors and high-quality ingredients

- Appeals to consumers seeking both traditional tastes and modern culinary experiences

Organic Soups Experience Rising Demand Due to Health and Sustainability Awareness

Organic soups are growing as consumers prioritize health, wellness, and environmentally friendly production. Ingredients are sourced without synthetic pesticides, fertilizers, or GMOs, enhancing appeal among eco-conscious buyers.

- Uses natural, non-GMO ingredients for health and environmental benefits

- Attracts health-conscious and sustainability-focused consumers

- Growth supported by increasing awareness of clean-label and organic foods

Conventional Ready-to-Eat Soups Maintain Strong Market Presence Due to Affordability

Conventional soups remain significant in the market due to their accessibility, affordability, and variety of flavors. While they often contain preservatives to extend shelf life, their widespread availability ensures continued consumption across households.

- Affordable and widely available, making them accessible to mass consumers

- Offers diverse flavors catering to mainstream preferences

- Remains a staple in households due to convenience and consistent quality

Competitive Analysis

The ready-to-eat soup market is highly competitive, with many players vying for market share through product innovation, branding, and strategic partnerships. Major players in the market are constantly investing in research and development to introduce new flavors and formulations that cater to a wide range of consumer preferences.

These companies are also expanding their product portfolios to include health-conscious and premium options, in response to the growing demand for nutritious and convenient meal solutions. The presence of private-label brands and local manufacturers, which provide low-cost alternatives to established brands, adds to the competitive environment.

In recent years, key players have used mergers and acquisitions to increase their market presence and capabilities. Large corporations can strengthen their market position and diversify their product offerings by acquiring smaller companies with unique products or advanced technologies.

This trend is expected to continue as businesses look to capitalize on new opportunities and meet changing consumer demands. Collaborations with retailers and foodservice providers are also important for expanding distribution channels and raising brand awareness.

Key Players in the Market

- Campbell Soup Co.

- The Kraft Heinz Co.

- Nestle

- Premium Foods PLC

- Princes Ltd.

- Amy's Kitchen Inc.

- Baxters Food Group Limited

- New Covent Garden Soup Co. Ltd.

- Yorkshire Provender

Campbell Soup Company is well known for its iconic canned soups, and it has recently expanded its product line to include organic and low-sodium varieties.

Nestlé, known for its Maggi brand, is a key player in the market, particularly in regions with high demand for instant meal solutions.

Conagra Brands, through its Healthy Choice and Marie Callender's lines, caters to health-conscious consumers looking for convenient meal options.

Recent Developments

- In January 2025, Natural Grocers®, the largest family-owned organic and natural grocery retailer in the United States, has expanded its Natural Grocers® Brand Products line with six new savory soup varieties. Each option is certified organic, non-GMO, and contains only plant-based, gluten-free, and dairy-free ingredients.

- In November 2024, Amy's Kitchen, a national leader in organic and natural food, has introduced five new soups that highlight both international cuisines and traditional American Southern dishes. The soups are made with organic ingredients, including farm-fresh vegetables and grains.

Segmentation of Ready-to-eat Soup Market

-

By Product Type :

- Wet Soup

- Dry Soup

-

By Ingredient :

- Vegetarian Soup

- Tomato

- Mushroom

- Potato

- Onion

- Broccoli

- Other Ingredients

- Non-vegetarian Soup

- Chicken

- Beef

- Sea Food

- Other Ingredients

- Vegetarian Soup

-

By Nature :

- Organic

- Conventional

-

By Packaging Type :

- Bottles

- Cans

- Packets

-

By Sales Channel :

- HoReCa

- B2C

- Modern Trade

- Online Stores

- Drug Stores

- Departmental Stores

- Conventional Stores

- Convenience Stores

- Other Sales Channels

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Mn) & Units Analysis, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Product Type

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Units Analysis By Product Type, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Analysis and Forecast By Product Type, 2025-2035

- Wet Soup

- Dry Soup

- Y-o-Y Growth Trend Analysis By Product Type, 2020-2024

- Absolute $ Opportunity Analysis By Product Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Ingredient

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Units Analysis By Ingredient, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Analysis and Forecast By Ingredient, 2025-2035

- Vegetarian Soup

- Tomato

- Mushroom

- Potato

- Onion

- Broccoli

- Other Ingredients

- Non-vegetarian Soup

- Chicken

- Beef

- Sea Food

- Other Ingredients

- Vegetarian Soup

- Y-o-Y Growth Trend Analysis By Ingredient, 2020-2024

- Absolute $ Opportunity Analysis By Ingredient, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Nature

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Units Analysis By Nature, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Analysis and Forecast By Nature, 2025-2035

- Organic

- Conventional

- Y-o-Y Growth Trend Analysis By Nature, 2020-2024

- Absolute $ Opportunity Analysis By Nature, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Packaging Type

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Units Analysis By Packaging Type, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Analysis and Forecast By Packaging Type, 2025-2035

- Bottles

- Cans

- Packets

- Y-o-Y Growth Trend Analysis By Packaging Type, 2020-2024

- Absolute $ Opportunity Analysis By Packaging Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Sales Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) & Units Analysis By Sales Channel, 2020-2024

- Current and Future Market Size Value (USD Mn) & Units Analysis and Forecast By Sales Channel, 2025-2035

- HoReCa

- B2C

- Modern Trade

- Online Stores

- Drug Stores

- Departmental Stores

- Conventional Stores

- Convenience Stores

- Other Sales Channels

- Y-o-Y Growth Trend Analysis By Sales Channel, 2020-2024

- Absolute $ Opportunity Analysis By Sales Channel, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Mn) & Units Analysis By Region, 2020-2024

- Current Market Size Value (USD Mn) & Units Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- U.K.

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Europe

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- South Asia & Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Res of South Asia & Pacific

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Key Takeaways

- Key Countries Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- U.K.

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Nordic

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- BENELUX

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Balkan & Baltics

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product Type

- By Ingredient

- By Nature

- By Packaging Type

- By Sales Channel

- Competition Analysis

- Competition Deep Dive

- Campbell Soup Co.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- The Kraft Heinz Co.

- Nestle

- Premium Foods PLC

- Princes Ltd.

- Amy's Kitchen Inc.

- Baxters Food Group Limited

- New Covent Garden Soup Co. Ltd.

- Yorkshire Provender

- Campbell Soup Co.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Mn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Units Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 4: Global Market Units Forecast by Product Type, 2020 to 2035

- Table 5: Global Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 6: Global Market Units Forecast by Ingredient, 2020 to 2035

- Table 7: Global Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 8: Global Market Units Forecast by Nature, 2020 to 2035

- Table 9: Global Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 10: Global Market Units Forecast by Packaging Type, 2020 to 2035

- Table 11: Global Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 12: Global Market Units Forecast by Sales Channel, 2020 to 2035

- Table 13: North America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 14: North America Market Units Forecast by Country, 2020 to 2035

- Table 15: North America Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 16: North America Market Units Forecast by Product Type, 2020 to 2035

- Table 17: North America Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 18: North America Market Units Forecast by Ingredient, 2020 to 2035

- Table 19: North America Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 20: North America Market Units Forecast by Nature, 2020 to 2035

- Table 21: North America Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 22: North America Market Units Forecast by Packaging Type, 2020 to 2035

- Table 23: North America Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 24: North America Market Units Forecast by Sales Channel, 2020 to 2035

- Table 25: Latin America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 26: Latin America Market Units Forecast by Country, 2020 to 2035

- Table 27: Latin America Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 28: Latin America Market Units Forecast by Product Type, 2020 to 2035

- Table 29: Latin America Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 30: Latin America Market Units Forecast by Ingredient, 2020 to 2035

- Table 31: Latin America Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 32: Latin America Market Units Forecast by Nature, 2020 to 2035

- Table 33: Latin America Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 34: Latin America Market Units Forecast by Packaging Type, 2020 to 2035

- Table 35: Latin America Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 36: Latin America Market Units Forecast by Sales Channel, 2020 to 2035

- Table 37: Western Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 38: Western Europe Market Units Forecast by Country, 2020 to 2035

- Table 39: Western Europe Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 40: Western Europe Market Units Forecast by Product Type, 2020 to 2035

- Table 41: Western Europe Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 42: Western Europe Market Units Forecast by Ingredient, 2020 to 2035

- Table 43: Western Europe Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 44: Western Europe Market Units Forecast by Nature, 2020 to 2035

- Table 45: Western Europe Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 46: Western Europe Market Units Forecast by Packaging Type, 2020 to 2035

- Table 47: Western Europe Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 48: Western Europe Market Units Forecast by Sales Channel, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Units Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 52: Eastern Europe Market Units Forecast by Product Type, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 54: Eastern Europe Market Units Forecast by Ingredient, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 56: Eastern Europe Market Units Forecast by Nature, 2020 to 2035

- Table 57: Eastern Europe Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 58: Eastern Europe Market Units Forecast by Packaging Type, 2020 to 2035

- Table 59: Eastern Europe Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 60: Eastern Europe Market Units Forecast by Sales Channel, 2020 to 2035

- Table 61: East Asia Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 62: East Asia Market Units Forecast by Country, 2020 to 2035

- Table 63: East Asia Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 64: East Asia Market Units Forecast by Product Type, 2020 to 2035

- Table 65: East Asia Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 66: East Asia Market Units Forecast by Ingredient, 2020 to 2035

- Table 67: East Asia Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 68: East Asia Market Units Forecast by Nature, 2020 to 2035

- Table 69: East Asia Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 70: East Asia Market Units Forecast by Packaging Type, 2020 to 2035

- Table 71: East Asia Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 72: East Asia Market Units Forecast by Sales Channel, 2020 to 2035

- Table 73: South Asia & Pacific Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 74: South Asia & Pacific Market Units Forecast by Country, 2020 to 2035

- Table 75: South Asia & Pacific Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 76: South Asia & Pacific Market Units Forecast by Product Type, 2020 to 2035

- Table 77: South Asia & Pacific Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 78: South Asia & Pacific Market Units Forecast by Ingredient, 2020 to 2035

- Table 79: South Asia & Pacific Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 80: South Asia & Pacific Market Units Forecast by Nature, 2020 to 2035

- Table 81: South Asia & Pacific Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 82: South Asia & Pacific Market Units Forecast by Packaging Type, 2020 to 2035

- Table 83: South Asia & Pacific Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 84: South Asia & Pacific Market Units Forecast by Sales Channel, 2020 to 2035

- Table 85: Middle East & Africa Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 86: Middle East & Africa Market Units Forecast by Country, 2020 to 2035

- Table 87: Middle East & Africa Market Value (USD Mn) Forecast by Product Type, 2020 to 2035

- Table 88: Middle East & Africa Market Units Forecast by Product Type, 2020 to 2035

- Table 89: Middle East & Africa Market Value (USD Mn) Forecast by Ingredient, 2020 to 2035

- Table 90: Middle East & Africa Market Units Forecast by Ingredient, 2020 to 2035

- Table 91: Middle East & Africa Market Value (USD Mn) Forecast by Nature, 2020 to 2035

- Table 92: Middle East & Africa Market Units Forecast by Nature, 2020 to 2035

- Table 93: Middle East & Africa Market Value (USD Mn) Forecast by Packaging Type, 2020 to 2035

- Table 94: Middle East & Africa Market Units Forecast by Packaging Type, 2020 to 2035

- Table 95: Middle East & Africa Market Value (USD Mn) Forecast by Sales Channel, 2020 to 2035

- Table 96: Middle East & Africa Market Units Forecast by Sales Channel, 2020 to 2035

List Of Figures

- Figure 1: Global Market Units Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Mn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Product Type

- Figure 7: Global Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Ingredient

- Figure 10: Global Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Nature

- Figure 13: Global Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Packaging Type

- Figure 16: Global Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 17: Global Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 18: Global Market Attractiveness Analysis by Sales Channel

- Figure 19: Global Market Value (USD Mn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 20: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 21: Global Market Attractiveness Analysis by Region

- Figure 22: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 27: South Asia & Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 28: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 29: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 30: North America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by Product Type

- Figure 33: North America Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 34: North America Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 35: North America Market Attractiveness Analysis by Ingredient

- Figure 36: North America Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 37: North America Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 38: North America Market Attractiveness Analysis by Nature

- Figure 39: North America Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 40: North America Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 41: North America Market Attractiveness Analysis by Packaging Type

- Figure 42: North America Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 43: North America Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 44: North America Market Attractiveness Analysis by Sales Channel

- Figure 45: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 46: Latin America Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 47: Latin America Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 48: Latin America Market Attractiveness Analysis by Product Type

- Figure 49: Latin America Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 50: Latin America Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 51: Latin America Market Attractiveness Analysis by Ingredient

- Figure 52: Latin America Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 53: Latin America Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 54: Latin America Market Attractiveness Analysis by Nature

- Figure 55: Latin America Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 56: Latin America Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 57: Latin America Market Attractiveness Analysis by Packaging Type

- Figure 58: Latin America Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 59: Latin America Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 60: Latin America Market Attractiveness Analysis by Sales Channel

- Figure 61: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Western Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 63: Western Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 64: Western Europe Market Attractiveness Analysis by Product Type

- Figure 65: Western Europe Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 66: Western Europe Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 67: Western Europe Market Attractiveness Analysis by Ingredient

- Figure 68: Western Europe Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 69: Western Europe Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 70: Western Europe Market Attractiveness Analysis by Nature

- Figure 71: Western Europe Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 72: Western Europe Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 73: Western Europe Market Attractiveness Analysis by Packaging Type

- Figure 74: Western Europe Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 75: Western Europe Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 76: Western Europe Market Attractiveness Analysis by Sales Channel

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 78: Eastern Europe Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 79: Eastern Europe Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 80: Eastern Europe Market Attractiveness Analysis by Product Type

- Figure 81: Eastern Europe Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 82: Eastern Europe Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 83: Eastern Europe Market Attractiveness Analysis by Ingredient

- Figure 84: Eastern Europe Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 85: Eastern Europe Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 86: Eastern Europe Market Attractiveness Analysis by Nature

- Figure 87: Eastern Europe Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 88: Eastern Europe Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 89: Eastern Europe Market Attractiveness Analysis by Packaging Type

- Figure 90: Eastern Europe Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 91: Eastern Europe Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 92: Eastern Europe Market Attractiveness Analysis by Sales Channel

- Figure 93: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 94: East Asia Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 95: East Asia Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 96: East Asia Market Attractiveness Analysis by Product Type

- Figure 97: East Asia Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 98: East Asia Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 99: East Asia Market Attractiveness Analysis by Ingredient

- Figure 100: East Asia Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 101: East Asia Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 102: East Asia Market Attractiveness Analysis by Nature

- Figure 103: East Asia Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 104: East Asia Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 105: East Asia Market Attractiveness Analysis by Packaging Type

- Figure 106: East Asia Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 107: East Asia Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 108: East Asia Market Attractiveness Analysis by Sales Channel

- Figure 109: South Asia & Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 110: South Asia & Pacific Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 111: South Asia & Pacific Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 112: South Asia & Pacific Market Attractiveness Analysis by Product Type

- Figure 113: South Asia & Pacific Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 114: South Asia & Pacific Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 115: South Asia & Pacific Market Attractiveness Analysis by Ingredient

- Figure 116: South Asia & Pacific Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 117: South Asia & Pacific Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 118: South Asia & Pacific Market Attractiveness Analysis by Nature

- Figure 119: South Asia & Pacific Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 120: South Asia & Pacific Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 121: South Asia & Pacific Market Attractiveness Analysis by Packaging Type

- Figure 122: South Asia & Pacific Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 123: South Asia & Pacific Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 124: South Asia & Pacific Market Attractiveness Analysis by Sales Channel

- Figure 125: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 126: Middle East & Africa Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 127: Middle East & Africa Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 128: Middle East & Africa Market Attractiveness Analysis by Product Type

- Figure 129: Middle East & Africa Market Value Share and BPS Analysis by Ingredient, 2025 and 2035

- Figure 130: Middle East & Africa Market Y-o-Y Growth Comparison by Ingredient, 2025 to 2035

- Figure 131: Middle East & Africa Market Attractiveness Analysis by Ingredient

- Figure 132: Middle East & Africa Market Value Share and BPS Analysis by Nature, 2025 and 2035

- Figure 133: Middle East & Africa Market Y-o-Y Growth Comparison by Nature, 2025 to 2035

- Figure 134: Middle East & Africa Market Attractiveness Analysis by Nature

- Figure 135: Middle East & Africa Market Value Share and BPS Analysis by Packaging Type, 2025 and 2035

- Figure 136: Middle East & Africa Market Y-o-Y Growth Comparison by Packaging Type, 2025 to 2035

- Figure 137: Middle East & Africa Market Attractiveness Analysis by Packaging Type

- Figure 138: Middle East & Africa Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 139: Middle East & Africa Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 140: Middle East & Africa Market Attractiveness Analysis by Sales Channel

- Figure 141: Global Market - Tier Structure Analysis

- Figure 142: Global Market - Company Share Analysis

- FAQs -

What is the Global Ready-to-eat Soup Market size in 2025?

The ready-to-eat soup market is valued at USD 1,542.8 million in 2025.

Who are the Major Players Operating in the Ready-to-eat Soup Market?

Prominent players in the market include Amy’s Kitchen Inc., Baxters Food Group Limited, New Covent Garden Soup Co. Ltd, and Yorkshire Provender.

What is the Estimated Valuation of the Ready-to-eat Soup Market by 2035?

The market is expected to reach a valuation of USD 3,034.9 million by 2035.

At what CAGR is the Ready-to-eat Soup Market slated to grow during the study period?

The growth rate of the Ready-to-eat Soup market is 7.0% from 2025 to 2035.