Pulse Flour Market

Pulse Flour Market Analysis by Product Type, Application, Distribution Channel and Region: Forecast from 2025 and 2035

Analysis of Pulse Flour Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Pulse Flour Market Outlook from 2025 to 2035

The Pulse Flour Market is valued at USD 24.7 billion in 2025. As per Fact.MR's analysis, the Pulse Flour Market will grow at a CAGR of 10.5% and reach USD 67.5 billion by 2035.

The industry grew significantly in 2024, driven by rising consumer health and nutrition awareness. The demand for gluten-free and health-oriented food products and the popularity of plant-based diets were among the factors fueling the growth. The nutritional aspects of pulse flours with high protein and fiber levels also supported the growth of the industry.

The Pulse Flour industry is expected to grow at an upward trend throughout the projection period between 2025 and 2035. This growth is expected to be driven by the continued demand for plant-based proteins, the growing use of pulse flours in bakery and confectionery items, and the growing trend of gluten-free diets. In addition, developments in food processing technologies and product innovation are expected to drive the industry's growth opportunities.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 24.7 billion |

| Industry Value (2035F) | USD 67.5 billion |

| CAGR (%) | 10.5% |

Market Analysis

Fact.MR analysis revealed that the pulse flour industry is following a robust growth pattern, driven by increasing demand from consumers for gluten-free and plant-based nutrition. Companies targeting innovation in bakery, confectionery, and processed food segments are likely to benefit, whereas conventional wheat flour manufacturers could experience pressure. The growth of the industry is also underpinned by technological advancements in food processing, ensuring continued momentum up to 2035.

Top 3 Strategic Imperatives for Stakeholders

Enlarging Product Innovation and Diversification

Invest in R&D to create new pulse-based products serving gluten-free, high-protein, and functional food industries. Fact.MR research discovered that the demand for novel uses, such as plant-based dairy and meat alternatives, is gaining momentum, opening up avenues for differentiation.

Align with Shifting Consumer Tastes and Regulatory Requirements

Leverage increasing consumer demand for clean-label and sustainable food products by complying with changing health regulations. Fact.MR believes that brands emphasizing organic certifications, non-GMO labels, and sustainable sourcing will be competitive advantages in high-end industries.

Enhance Supply Chain and Strategic Partnerships

Improve procurement networks to source high-quality raw materials while streamlining logistics for optimal cost. Food processors, retailers, and e-commerce platforms can be partnered with to increase distribution reach and tap into increasing demand for pulse-based ingredients.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Raw Material Price Volatility | High Probability - High Impact |

| Regulatory and Compliance Challenges | Moderate Probability - High Impact |

| Supply Chain Disruptions | Moderate Probability - Moderate Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Enhance Product Portfolio | Invest in R&D to develop pulse-based functional ingredients for high-growth categories like plant-based dairy and meat substitutes. |

| Strengthen Regulatory Preparedness | Establish a compliance task force to track evolving food safety and labeling regulations across key industries. |

| Optimize Supply Chain Resilience | Secure long-term supplier contracts and explore alternative sourcing regions to mitigate raw material price volatility. |

For the Boardroom

To ensure long-term growth, leadership will need to focus on strategic investments in product innovation, regulatory flexibility, and supply chain reliability. Fact.MR analysis demonstrated that pulse-based ingredient demand is gaining momentum and necessitates a forward-looking category expansion strategy.

Deepening ties with strategic distributors and investment in digital selling platforms will be vital in taking advantage of upcoming consumer trends while mitigating threats arising from regulatory and supply chain dislocations.

Fact.MR survey with Pulse Flour Market Stakeholders

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, food processors, and retailers in the US, Western Europe, China, and Japan.)

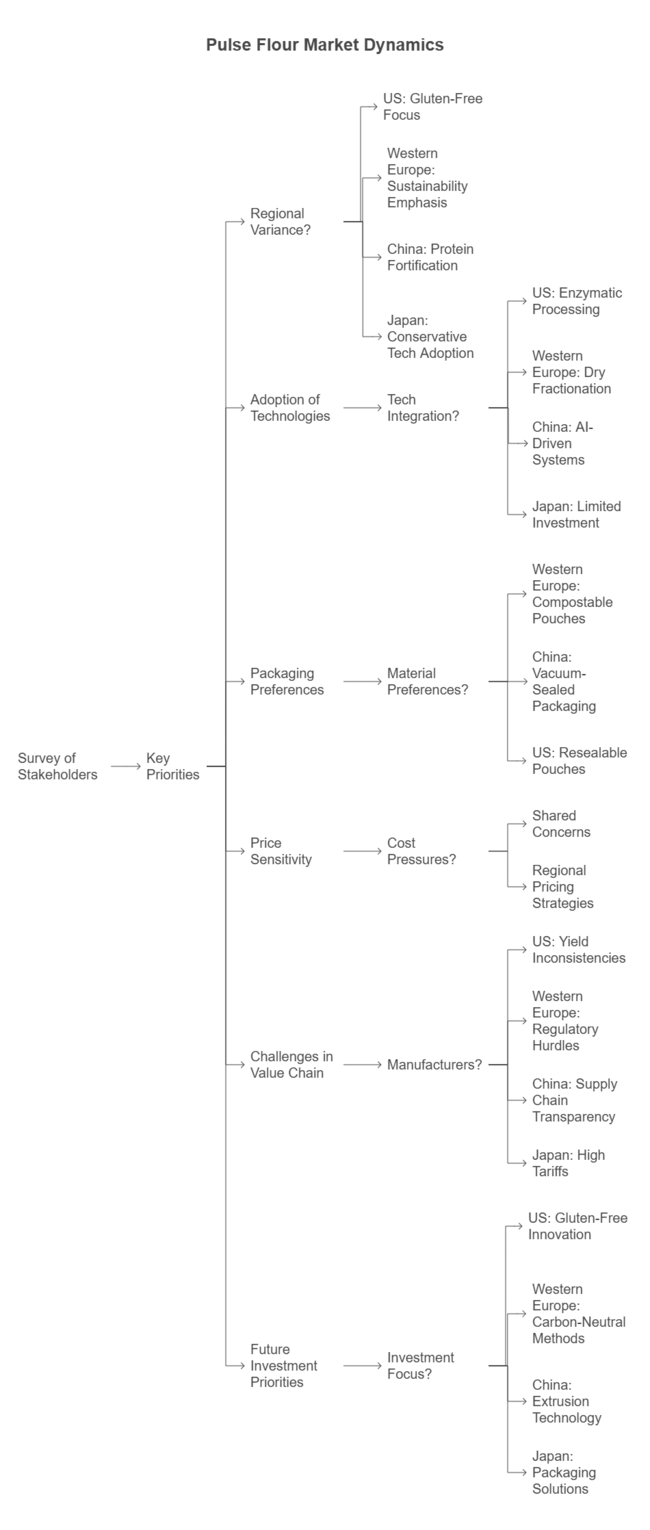

Key Priorities of Stakeholders

Nutritional Superiority:

- Fact.MR analysis found that 84% of stakeholders globally consider high-protein and fiber-rich content as a critical factor driving adoption.

Clean Label Demand:

- 79% prioritize non-GMO, organic-certified pulse flours to align with consumer health trends.

Regional Variance:

- US: 67% emphasize gluten-free certification due to rising celiac disease awareness, compared to 42% in Japan.

- Western Europe: 85% prioritize sustainability, with strong demand for regenerative agriculture practices, compared to 58% in the US.

- China: 62% focus on plant-based protein fortification to align with the surging demand for alternative meat products.

Adoption of Advanced Processing Technologies

High Variance in Technology Integration:

- US: 56% of manufacturers use enzymatic processing to improve pulse flour functionality, particularly in bakery applications.

- Western Europe: 48% invest in dry fractionation techniques to enhance protein concentration, with Germany (60%) leading the trend.

- China: 37% integrate AI-driven milling systems to improve production efficiency and cost control.

- Japan: 28% cite limited investment in advanced tech due to high capital costs and conservative industry demand.

Diverging ROI Perceptions:

- 73% of US stakeholders find automation in milling and blending "worth the investment," whereas only 34% in Japan prefer to maintain traditional processing methods.

Material Preferences in Packaging and Storage

Global Consensus:

- 64% prefer biodegradable and recyclable packaging to meet sustainability mandates.

Regional Variance:

- Western Europe: 55% favor compostable pouches to comply with EU Green Deal regulations (global adoption stands at 38%).

- China: 41% opt for vacuum-sealed packaging to preserve freshness in humid conditions.

- US: 68% rely on resealable pouches for retail convenience, with a 20% increase in demand from e-commerce brands.

Price Sensitivity and Cost Pressures

Shared Concerns:

- 87% cite rising raw material costs (pulse crop prices up 25% YoY) as a major challenge.

Regional Pricing Strategies:

- US/Western Europe: 60% are willing to pay a 15–18% premium for organic and functional flours.

- China: 74% prioritize affordability, with a growing demand for value-segment products priced under $3/kg.

- Japan: 47% prefer bulk purchasing discounts to offset high logistics costs.

Challenges in the Value Chain

Manufacturers:

- US: 54% struggle with inconsistent pulse crop yields due to climate unpredictability.

- Western Europe: 49% cite regulatory hurdles for organic certification as a key bottleneck.

- China: 61% highlight the need for better supply chain transparency in ingredient sourcing.

Distributors:

- US: 69% face inventory delays due to increased demand and limited milling capacity.

- Western Europe: 52% note competition from lower-cost imports affecting local pulse flour sales.

- Japan, 63% cite high import tariffs on specialty pulse flours as an industry constraint.

Retailers & Food Processors:

- US: 43% report high costs in reformulating traditional recipes with pulse flour.

- Western Europe: 38% struggle with consumer education on the benefits of pulse-based ingredients.

- China: 55% demand improved product standardization to ensure quality consistency.

Future Investment Priorities

Alignment Across Markets:

- 75% of global manufacturers plan to invest in R&D for high-protein pulse flour blends.

Regional Divergence:

- US: 63% focus on gluten-free innovation for bakery and snack applications.

- Western Europe: 58% prioritize carbon-neutral production methods to meet sustainability targets.

- China: 46% invest in extrusion technology to expand pulse flour applications in meat substitutes.

- Japan: 41% explore space-efficient packaging solutions for urban retail environments.

Regulatory Impact on Growth Strategy

- US: 66% cite FDA regulations on allergen labeling as a key factor influencing product formulation.

- Western Europe: 80% view EU sustainability policies as a long-term driver for premium-priced pulse flour.

- China/Japan: 39% see minimal regulatory impact on purchasing decisions due to less stringent enforcement.

Conclusion: Industry Dynamics and Strategic Insights

Global Consensus:

Nutritional value, sustainability, and cost control are primary growth drivers across all regions.

Key Variances:

- US: Industry expansion is driven by gluten-free and high-protein demand, requiring continuous innovation.

- Western Europe: Sustainability remains a top differentiator, necessitating investment in eco-friendly production.

- China/Japan: Affordability and supply chain efficiency define industry success, with an emphasis on cost-effective sourcing and localized manufacturing.

Strategic Takeaway:

A standardized strategy will not drive optimal growth. Regional adaptation-focusing on premium gluten-free products in the US, sustainability-driven flours in Europe, and cost-efficient solutions in Asia-will maximize penetration and profitability.

Government Regulations

| Country | Regulatory Impact and Mandatory Certifications |

|---|---|

| India | The Food Safety and Standards Authority of India (FSSAI) has streamlined food product certifications by eliminating the need for multiple approvals from agencies like the Bureau of Indian Standards (BIS) and AGMARK. Now, only FSSAI certification is mandatory for all food products, simplifying compliance for businesses. |

| United States | The Food and Drug Administration (FDA) oversees food safety regulations, including those for pulse flour products. While there are no specific mandatory certifications exclusive to pulse flours, compliance with FDA regulations on labeling, health claims, and food safety standards is required. Additionally, manufacturers often pursue certifications like USDA Organic or Non-GMO Project Verified to meet consumer preferences. |

| European Union | The European Food Safety Authority (EFSA) regulates food products, including pulse flours, ensuring they meet safety and labeling standards. While no specific mandatory certifications exist for pulse flours, products must comply with EU regulations on contaminants, additives, and labeling. Certifications such as EU Organic are commonly sought to appeal to health-conscious consumers. |

| Australia | Food Standards Australia New Zealand (FSANZ) sets the standards for food products, including pulse flours. Compliance with FSANZ regulations on food safety, labeling, and contaminants is mandatory. While not compulsory, certifications like Australian Certified Organic can enhance the sector’s potential. |

| Canada | Health Canada and the Canadian Food Inspection Agency (CFIA) regulate food products, including pulse flours. Compliance with Canadian food safety and labeling regulations is mandatory. Voluntary certifications such as Canada Organic are often pursued to meet consumer demand for organic products. |

Country-wise Analysis

United States

The U.S. is the primary growth impetus in the pulse flour industry, driven by a growing demand for plant-based protein, gluten-free foods, and functional food ingredients. Food producers are actively reformulating foods using chickpea, lentil, and pea flour to improve protein levels and address clean-label consumer needs. Growth in plant-based meat and dairy alternatives reinforces the industry.

Government assistance in the form of USDA funding for sustainable agriculture also favors pulse crop production. Retailers and food service chains are adding more pulse-based products, reflecting strong demand. Fact.MR analysis concluded that growing investments in milling and processing technology will further drive industry penetration.

Fact.MR opines that the U.S. pulse flour sales will grow at nearly 11.2% CAGR through 2025-2035.

United Kingdom

The UK pulse flour industry is growing because of increasing consumer demand for sustainable and protein-enriched diets. The increase in the uptake of plant-based diets, combined with greater investment in alternative sources of protein, is driving demand.

Policy regulation to reduce the use of artificial additives and enhance the consumption of fiber-enriched foods is driving industry growth.

Large food companies are adding lentil and chickpea flours to bakery and snack foods to meet health trends.

Supply chain issues and post-Brexit trade rules are obstacles to consistent growth. Direct-to-consumer brands selling organic and gluten-free pulse flour products are a key trend influencing the industry.

Fact.MR opines that the United Kingdom’s pulse flour sales will grow at nearly 8.9% CAGR through 2025-2035.

Germany

Germany dominates the European pulse flour industry with robust demand for clean-label and sustainable food ingredients. Consumers value high-protein, allergen-free, and organic-certified products, which lead manufacturers to incorporate pulse flours into meat substitutes, pasta, and bakery.

The government's initiative for plant-based innovation through funding programs under the EU Green Deal further boosts the industry. Regulations on food additives and labeling drive demand for naturally processed pulse flours.

But more expensive production and competition from lower-cost imports test domestic producers. An increased emphasis on regenerative agriculture is likely to support long-term supply stability.

Fact.MR opines that Germany’s pulse flour sales will grow at nearly 9.5% CAGR through 2025-2035.

France

The French pulse flour industry is experiencing strong growth driven by rising awareness of plant-based nutrition and government-supported programs for sustainability. The rising demand for alternative proteins has boosted the consumption of chickpea and lentil flours in food processing, such as in baked products and plant-based milk.

The EU's Farm to Fork Strategy promotes sustainable agriculture practices, favoring domestic pulse production.

Major food companies are reformulating traditional wheat-based products with pulse flour to address gluten-free and high-protein diet trends. Strong organic food demand in France further drives high-value pulse flour sales. Supply chain inefficiencies and seasonal fluctuations in crops, though, create uncertainty in raw material pricing.

Fact.MR opines that France’s pulse flour sales will grow at nearly 9.3% CAGR through 2025-2035.

Italy

Italy's pulse flour business is expanding gradually, fueled by growing demand for gluten-free and high-fiber versions in classic pasta and baked goods. The nutritional focus on legumes under the Mediterranean diet is fueling industry growth.

The food service industry, including upscale bakeries and plant-based pizzerias, is using pulse flours to boost the nutritional value of their products. Increased flexitarianism and health-based consumption drive innovation in pulse snack foods and ready-to-eat meals.

The opportunities notwithstanding, low domestic pulse production leads to import dependency and thus cost burdens. Support by the government towards sustainable agriculture will be the impetus for increased local production within the next few years.

Fact.MR opines that Italy’s pulse flour sales will grow at nearly 8.7% CAGR through 2025-2035.

Australia & New Zealand

Australia and New Zealand are becoming powerful industries for pulse flour, supported by a fast-growing plant-based food sector. Increasing exports of pea and chickpea flour to Asia and North America identify the region as a key part of the international supply chain.

Government support from Australia for growing pulse crops in the form of research grants and sustainable agriculture programs is building up production capacities. Pulse flours in New Zealand are increasing their strength in the value health-food space due to expanding demand for allergy-free foods.

Although there is strong consumer understanding, the marketplace has difficulty expanding distribution and controlling price sensitivity.

Fact.MR opines that Australia & New Zealand’s pulse flour sales will grow at nearly 9.1% CAGR through 2025-2035.

China

China is the most promising industry for pulse flour, motivated by the escalating consumption of plant protein in meat alternatives and functional food products. Large-scale investment into pulse processing by the government policies promoting domestic self-sufficiency in proteins from China provides an extra push to stimulate the demand further.

The high pace of urbanization and changing lifestyle dietary trends have pushed substantial interest to lentil and pea flours, particularly into bakery and snacks applications. Penetration further occurs with the growing expansion of online portals. Yet, volatility in the prices of imported pulse crops and strict food safety standards pose operational risks to manufacturers. Investments in sophisticated processing technology and localized procurement strategies are likely to offset these risks.

Fact.MR opines that China’s pulse flour sales will grow at nearly 12.8% CAGR through 2025-2035.

South Korea

South Korea's pulse flour industry is growing as consumers show greater interest in plant-based eating and functional nutrition. Demand for wheat flour alternatives with high protein and low glycemic content is stimulating product development.

The country's food security policies are also promoting the production of pulses locally to minimize dependence on imports. Pulse flour is increasingly popular in bakery, snack, and noodle applications in premium health-oriented product segments.

Emerging retail patterns, such as the growth of specialty health food shops and online businesses, are facilitating industry growth. Yet, the limited domestic planting of pulses and expensive imports pose price-related constraints.

Fact.MR opines that South Korea’s pulse flour sales will grow at nearly 9.8% CAGR through 2025-2035.

Japan

Japan's industry for pulse flour is growing moderately, led mainly by niche demand for gluten-free and high-fiber product types. Although traditional wheat-based products still lead the way, there is an emerging category of health-aware consumers pushing pulse flour adoption into functional food formats.

Food producers are using pea and chickpea flours in snack foods and substitute noodles, matching the trend for lower-carb options.

Government food labeling and transparency requirements facilitate the use of natural ingredients, but the overall industry is still bound by conservative consumer tastes and limited domestic pulse cultivation. Premium pricing and import dependency inhibit mass-industry take-up.

Fact.MR opines that Japan’s pulse flour sales will grow at nearly 7.5% CAGR through 2025-2035.

Segmentation-wise Analysis

By Source

Pulse flour is picking up speed as a central component of the plant-based and gluten-free food trend. Chickpea, lentil, pea, and fava bean flour take center stage, with high protein levels and functional benefits. Chickpea flour continues to lead the way with its adaptability in bakery and snack foods, while pea flour is gaining traction in plant-based dairy and meat substitutes. Lentil flour is increasing its presence in fortified foods, addressing increasing consumer interest in high-fiber and iron-based diets.

Companies are turning to sustainable sourcing and regenerative agriculture to fortify supply chains and address changing consumer tastes.

Fact.MR believes that the pulse flour industry by source will increase at a rate of close to 7.2% CAGR between 2025-2035.

By Application

The need for pulse flour is increasing in various applications, ranging from bakery and snacks to protein plant-based foods and pet foods.

The bakery industry is still the biggest consumer, fueled by the trend of going gluten-free and high in protein. Snack food processors are including pulse flour in chips, crackers, and extruders to improve their nutritional value.

The plant-based meat and dairy sector is using pulse flour for texturing and protein enrichment. Food companies that produce pet foods are also adding more pulse-based ingredients because they are digestible and provide functional benefits.

The industrial segment is also looking into pulse flour in biodegradable packaging and adhesives, which is part of sustainability drives.

Fact.MR believes the pulse flour industry by application will expand at a rate of close to 7.1% CAGR from 2025-2035.

By Distribution Channel

The pulse flour industry is changing with changes in distribution patterns, with retail and business-to-business channels increasing. Supermarkets and hypermarkets are still the major retailing outlets, responding to growing consumer demand for organic and gluten-free pulse flour. Internet shopping is increasing, offering direct connections to specialty brands and bulk purchasing.

The food service sector is incorporating pulse flour into menu innovations, mainly with health-oriented and plant-based eating dishes. Wholesale and bulk distribution remains an essential route for bulk food processors, while sustainability and traceability become vital decision-making criteria.

Fact.MR believes that the industry for pulse flour by distribution channel will increase at a rate of close to 6.9% CAGR during 2025-2035.

Competitive Landscape

Pulse flour is marked by a structure of fragmented industries and has many regional and global players, leading to a competitive environment. Major players are differentiating themselves through strategic pricing, innovation, partnerships, and expansion plans to gain a larger industrial share.

In 2024, there have been a few major developments in the industry. In March, Supplant Foods patented a method of making high-performance chickpea flour, strengthening its position in plant-based and gluten-free. In July, Ingredion Incorporated introduced Vitessence Pea 100 HD, a pea protein designed to strengthen cold-pressed bars, increasing its plant-based protein portfolio in the United States and Canada.

Also, in October, ADM launched a new line of pulse-based protein products to address the increasing number of vegans. These moves highlight the focus of the industry on innovation and collaboration to address changing consumer needs.

Market Share Analysis

- Ingredion Incorporated: A leading global ingredient solutions provider, Ingredion offers a diverse range of pulse flours catering to various applications in the food and beverage industry.

- Archer Daniels Midland Company (ADM): ADM is a prominent player in the nutrition industry, providing products and solutions related to human and animal nutrition, including a variety of pulse flours.

- AGT Food and Ingredients Inc.: Specializing in the processing and distribution of pulses, AGT Food and Ingredients offers a comprehensive portfolio of pulse-based products, including flours, to meet global demand.

- Avena Foods Limited: Avena Foods is a major market participant offering a range of products, including pulse ingredients, purity protocol oat ingredients, and specialty millet ingredients.

- Bob’s Red Mill Natural Foods: Known for its extensive line of whole-grain products, Bob’s Red Mill provides high-quality pulse flours that cater to health-conscious consumers seeking nutritious and gluten-free options.

Key Companies

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- AGT Food and Ingredients Inc.

- Avena Foods Limited

- Ardent Mills

- Bob’s Red Mill Natural Foods

- Anchor Ingredients Co. LLC

- Bunge Limited

- The Scoular Company

- Groupe Limagrain Holding SA

- Cargill, Incorporated

- Diefenbaker Spice & Pulse

- SunOpta Inc.

- Blue Ribbon LLC

- Ganesh Grains Limited

- Tata Consumer Products

- King Arthur Flour Company, Inc.

- Woodland Foods Ltd.

- Best Cooking Pulses Inc.

- CanMar Grain Products

- Parakh Agro Industries

- EHL Ingredients

- Bean Growers Australia Ltd.

- Great Western Grain Co. Ltd.

- Minsa Corporation

- The Buhler Holding AG

- Carrs Flour Mills Limited

- Grain Millers Inc.

- AGSPRING

- Puris Proteins LLC

- Doves Farm Foods Ltd.

- Vestkorn Milling AS

- The TradeLink International Group

- Great River Organic Milling

- SavourLife

Segmentation

By Product Type:

Chickpeas, Lentils, Peas, Beans, Fiber/Bran.

By Application:

Bakery & Confectionery, Extruded Products, Beverages, Animal Feed, Dairy Products.

By Distribution Channel:

Food Chain Services, Modern Trade, Convenience Stores, Departmental Stores, Online Stores.

By Region:

North America, Latin America, Europe, East Asia, South Asia & Oceania, Middle East & Africa.

Table of Content

- Global Market - Executive Summary

- Global Market Data - Introduction

- Key Market Trends

- Market Background and Associated Industry Indicators

- Global Market Volume Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market - Pricing Analysis

- Global Market Demand (US$ Mn) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Volume (Tons) Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Chickpea

- Lentils

- Pea

- Beans

- Fiber/Bran

- Other Product Types

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Application

- Bakery and Confectionery

- Extruded products

- Beverages

- Animal Feed

- Dairy Products

- Other Applications

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Distribution Channel

- Food Chain Services

- Modern Trade

- Convenience Store

- Departmental Store

- Online Store

- Other Distribution Channel

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, by Region

- North America

- Latin America

- Europe

- Asia Pacific Excluding Japan (APEJ)

- Japan

- Middle East and Africa (MEA)

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Excluding Japan Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Japan Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Structure Analysis

- Company Profiles

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- AGT Food and Ingredients Inc.

- Avena Foods Limited

- Ardent Mills

- Bob’s Red Mill Natural Foods

- Anchor Ingredients Co. LLC

- Bunge Limited

- The Scoular Company

- Groupe Limagrain Holding SA

- Cargill, Incorporated

- Diefenbaker Spice & Pulse

- SunOpta Inc.

- Blue Ribbon LLC

- Ganesh Grains Limited

- Tata Consumer Products

- King Arthur Flour Company, Inc.

- Woodland Foods Ltd.

- Best Cooking Pulses Inc.

- CanMar Grain Products

- Parakh Agro Industries

- EHL Ingredients

- Bean Growers Australia Ltd.

- Great Western Grain Co. Ltd.

- Minsa Corporation

- The Buhler Holding AG

- Carrs Flour Mills Limited

- Grain Millers Inc.

- AGSPRING

- Puris Proteins LLC

- Doves Farm Foods Ltd.

- Vestkorn Milling AS

- The TradeLink International Group

- Great River Organic Milling

- SavourLife

- Research Methodology

- Assumptions and Acronyms

List Of Table

List Of Figures

- FAQs -

What are the key drivers of growth in the pulse flour industry?

Rising demand for plant-based protein, clean-label trends, and gluten-free diets are fueling growth.

Which regions are expected to see the highest demand for pulse-based ingredients?

North America, Europe, and Asia-Pacific are leading due to health-conscious consumers and food innovation.

How are government regulations shaping the adoption of pulse flour?

Stringent labeling laws and sustainability policies are encouraging wider usage in food production.

What innovations are companies focusing on to improve product quality?

Enhanced milling techniques, fortification with nutrients, and improved texture for better functionality.

Which distribution channels are witnessing the fastest expansion for pulse-based products?

Online retail and modern trade are experiencing rapid growth due to convenience and wider product availability.