Airless Tires Market

Airless Tires Market Size and Share Forecast Outlook 2025 to 2035

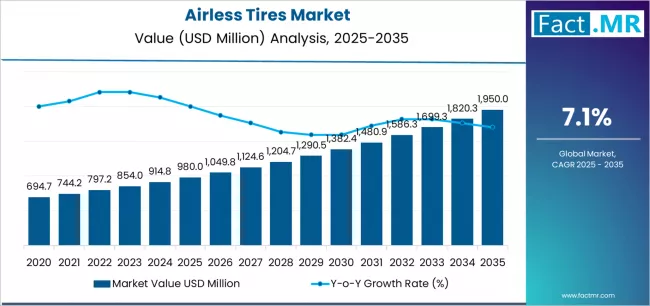

Airless tires market is projected to grow from USD 980.0 million in 2025 to USD 1,950.0 million by 2035, at a CAGR of 7.1%. Solid/Non-pneumatic will dominate with a 45.0% market share, while industrial/material handling will lead the vehicle segment with a 40.0% share.

Airless Tires Market Forecast and Outlook 2025 to 2035

The global airless tires market is projected to grow from USD 980.0 million in 2025 to approximately USD 1,950.0 million by 2035, recording an absolute increase of USD 970.0 million over the forecast period. This translates into a total growth of 99.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035

The overall market size is expected to grow by nearly 2.0X during the same period, supported by increasing demand for puncture-proof tire solutions, rising adoption of advanced mobility technologies, and growing focus on maintenance-free automotive systems across the global transportation and materials handling sectors.

Quick Stats for Airless Tires Market

- Airless Tires Market Value (2025): USD 980.0 million

- Airless Tires Market Forecast Value (2035): USD 1,950.0 million

- Airless Tires Market Forecast CAGR: 7.1%

- Leading Type in Airless Tires Market: Solid/Non-pneumatic (45.0%)

- Key Growth Regions in Airless Tires Market: Asia Pacific, North America, and Europe

- Key Players in Airless Tires Market: Michelin, Bridgestone, Continental, Goodyear, Hankook, Pirelli, Sumitomo Rubber, Trelleborg, Carlisle, Nokian, Resilient Technologies, ATP, Camso

The market dynamics driving airless tire adoption are fundamentally shaped by escalating tire maintenance costs, safety concerns related to tire failures, and the automotive industry's digital transformation toward autonomous and electric vehicle technologies. Traditional pneumatic tire limitations have intensified operational challenges across major transportation segments, compelling fleet operators and vehicle manufacturers to implement more sophisticated tire management strategies. Simultaneously, regulatory pressures and operational cost considerations in many jurisdictions increasingly incentivize durable tire solutions through safety mandates, environmental regulations, and total cost of ownership calculations that make airless tire systems economically attractive investments.

Technological advancement in materials science, manufacturing processes, and structural engineering has dramatically enhanced the capabilities and accessibility of airless tire systems. Modern airless tires leverage advanced polymer compounds, flexible spoke designs, and optimized tread patterns to provide performance characteristics comparable to conventional pneumatic tires while eliminating puncture risks and pressure maintenance requirements. The integration of specialized materials, structural optimization algorithms, and advanced manufacturing techniques enables these systems to deliver consistent performance characteristics regardless of operating conditions, resulting in significant operational cost savings and improved vehicle uptime.

The automotive sector's increasing adoption of electric and autonomous vehicle technologies has created substantial demand for integrated tire solutions that complement advanced vehicle architectures. Airless tires now interface seamlessly with vehicle monitoring systems, enabling comprehensive performance data collection and analysis that supports broader vehicle management processes. This integration capability has proven particularly valuable for fleet operations and commercial vehicle applications where coordinated management of multiple vehicles and predictable maintenance schedules require sophisticated monitoring and control capabilities.

Economic considerations increasingly favor airless tire adoption as vehicle operating costs continue rising and labor shortages affect transportation operations. Maintenance-free systems reduce labor requirements for tire management while improving vehicle reliability, creating compelling return-on-investment scenarios for commercial operators. The ability to eliminate unexpected tire failures, reduce maintenance scheduling complexity, and optimize vehicle availability based on predictable performance generates measurable cost savings that often justify initial equipment investments within relatively short payback periods.

Between 2025 and 2030, the airless tires market is projected to expand from USD 980.0 million to USD 1,380.0 million, resulting in a value increase of USD 400.0 million, which represents 41.2% of the total forecast growth for the decade.

This phase of development will be shaped by rising demand for puncture-resistant tire systems, increasing applications in electric vehicle and autonomous vehicle technologies, and growing penetration in emerging mobility automation markets.

Tire manufacturers are expanding their production capabilities to address the growing demand for customized airless solutions in various vehicle segments and specialty transportation programs.

Airless Tires Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 980.0 million |

| Forecast Value in (2035F) | USD 1,950.0 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

From 2030 to 2035, the market is forecast to grow from USD 1,380.0 million to USD 1,950.0 million, adding another USD 570.0 million, which constitutes 58.8% of the overall ten-year expansion.

This period is expected to be characterized by the expansion of advanced manufacturing infrastructure, the integration of cutting-edge materials technologies, and the development of customized airless systems for specific vehicle applications.

The growing adoption of electric vehicle standards and autonomous vehicle automation will drive demand for ultra-high performance airless tires with enhanced durability specifications and consistent performance characteristics.

Between 2020 and 2025, the airless tires market experienced steady expansion, driven by increasing recognition of maintenance-free tire solutions' importance in vehicle operations and growing acceptance of advanced tire systems in complex transportation markets.

The market developed as vehicle operators recognized the need for high-reliability tire systems to address operational requirements and improve overall vehicle productivity. Research and development activities have begun to emphasize the importance of advanced materials technologies in achieving better durability and performance in tire applications.

Why is the Airless Tires Market Growing?

Market expansion is being supported by the increasing demand for maintenance-free tire infrastructure and the corresponding need for high-reliability tire systems in vehicle applications across global transportation and materials handling operations.

Modern vehicle operators are increasingly focused on advanced tire technologies that can improve operational efficiency, reduce maintenance requirements, and enhance system performance while meeting stringent safety requirements.

The proven efficacy of airless tires in various vehicle applications makes them an essential component of comprehensive fleet management strategies and vehicle modernization programs.

The growing emphasis on vehicle automation and advanced reliability optimization is driving demand for ultra-reliable tire systems that meet stringent performance specifications and operational requirements for specialized applications.

Vehicle operators' preference for dependable, high-performance tire systems that can ensure consistent vehicle availability is creating opportunities for innovative materials technologies and customized mobility solutions.

The rising influence of electric vehicle protocols and autonomous vehicle standards is also contributing to increased adoption of premium-grade airless tires across different vehicle applications and transportation systems requiring advanced tire technology.

Opportunity Pathways - Airless Tires Market

The airless tires market represents a specialized growth opportunity, expanding from USD 980.0 million in 2025 to USD 1,950.0 million by 2035 at a 7.1% CAGR. As vehicle operators prioritize operational efficiency, maintenance reduction, and system performance in complex transportation processes, airless tires have evolved from a niche automotive technology to an essential component enabling fleet management, reliability optimization, and multi-stage vehicle operations across transportation systems and specialized mobility applications.

The convergence of vehicle electrification, increasing automation adoption, specialized transportation infrastructure growth, and safety requirements creates momentum in demand. High-performance formulations offering superior durability characteristics, cost-effective solid tire systems balancing performance with economics, and specialized foam-filled variants for demanding applications will capture market premiums, while geographic expansion into high-growth Asian automotive markets and emerging market penetration will drive volume leadership. Transportation emphasis on efficiency and performance provides structural support.

- Pathway A - Solid/Non-pneumatic Type Dominance: Leading with 45.0% market share, solid applications drive primary demand through complex transportation workflows requiring comprehensive tire reliability for maintenance-free operations. Advanced formulations enabling improved operational efficiency, reduced maintenance requirements, and enhanced performance characteristics command premium pricing from operators requiring stringent performance specifications and durability compliance. Expected revenue pool: USD 441.0-877.5 million.

- Pathway B - Industrial/Material Handling Vehicle Leadership: Dominating with 40.0% market share through an optimal balance of performance and durability requirements, industrial applications serve most material handling operations while meeting reliability requirements. This application addresses both performance standards and operational considerations, making it the preferred choice for industrial and material handling operations seeking dependable tire solutions. Opportunity: USD 392.0-780.0 million.

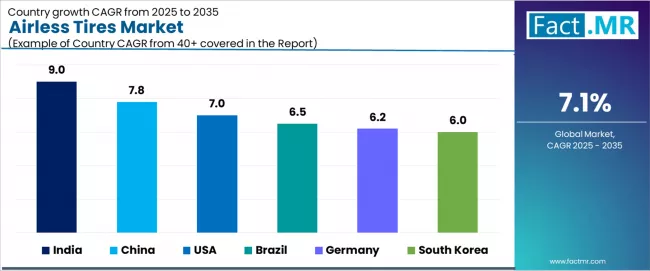

- Pathway C - Asian Market Acceleration: India (9.0% CAGR) and China (7.8% CAGR) lead global growth through automotive infrastructure expansion, electric vehicle development, and domestic airless tire demand. Strategic partnerships with local manufacturers, automotive compliance expertise, and supply chain localization enable the expansion of tire technology in major automotive hubs. Geographic expansion upside: USD 196.0-390.0 million.

- Pathway D - OEM End User Premium Segment: OEM end users serve specialized vehicle manufacturing requiring exceptional performance specifications for critical mobility applications. OEM formulations supporting complex vehicle integration requirements, automotive applications, and performance-sensitive processes command significant premiums from advanced automotive organizations and specialized manufacturing facilities. Revenue potential: USD 539.0-1,072.5 million.

- Pathway E - Advanced Materials & Manufacturing Systems: Companies investing in sophisticated materials technologies, automated manufacturing systems, and intelligent design processes gain competitive advantages through consistent tire performance and operational efficiency. Advanced capabilities enabling customized specifications and rapid deployment capture premium automotive partnerships. Technology premium: USD 98.0-195.0 million.

- Pathway F - Supply Chain Optimization & Reliability: Specialized distribution networks, strategic inventory management, and reliable supply chain systems create competitive differentiation in automotive markets requiring consistent airless tire availability. Companies offering guaranteed supply security, technical support, and compliance documentation gain preferred supplier status with efficiency-focused vehicle manufacturers. Supply chain value: USD 59.0-117.0 million.

- Pathway G - Emerging Applications & Market Development: Beyond traditional automotive installations, airless tires in aerospace applications, specialized mobility processes, and novel transportation systems represent growth opportunities. Companies developing new applications, supporting R&D initiatives, and expanding into adjacent automotive markets capture incremental demand while diversifying revenue streams. Emerging opportunity: USD 39.0-78.0 million.

Segmental Analysis

The market is segmented by type, vehicle, end use, and region. By type, the market is divided into solid/non-pneumatic, foam-filled, and hybrid. Based on vehicle, the market is categorized into industrial/material handling, passenger/light commercial, and off-highway. By end use, the market is divided into OEM and aftermarket. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, Middle East & Africa.

By Type, Solid/Non-pneumatic Segment Accounts for 45.0% Market Share

Solid/non-pneumatic airless tires are projected to account for 45.0% of the airless tires market in 2025. Automotive companies increasingly recognize the optimal balance of performance and durability reliability offered by solid airless tires for most transportation applications, particularly in materials handling and industrial processes. These airless tires address both performance requirements and long-term operational considerations while providing reliable service across diverse vehicle applications.

Solid/non-pneumatic airless tires provide the foundation of most industrial protocols for tire applications, as it represents the most widely accepted and commercially viable level of airless tire technology in the industry. Performance standards and extensive operational testing continue to strengthen confidence in solid airless tire formulations among transportation and vehicle providers. With increasing recognition of the performance-durability optimization requirements in vehicle management, solid systems align with both operational efficiency and reliability goals, making them the central growth driver of comprehensive transportation infrastructure strategies.

By Vehicle, Industrial/Material Handling Segment Accounts for 40.0% Market Share

Industrial/material handling is projected to represent 40.0% of airless tire demand in 2025, underscoring its role as the primary vehicle segment driving market adoption and growth. Operators recognize that industrial vehicle requirements, including complex warehouse operations, specialized material handling needs, and multi-stage logistics systems, often require advanced airless tires that standard tire technologies cannot adequately provide. Airless tires offer enhanced reliability and operational compliance in industrial vehicle applications.

The segment is supported by the growing complexity of material handling operations, requiring sophisticated tire systems, and the increasing recognition that advanced tire technologies can improve vehicle performance and operational outcomes. Additionally, operators are increasingly adopting evidence-based fleet management guidelines that recommend specific airless tires for optimal operational efficiency. As understanding of industrial complexity advances and vehicle requirements become more stringent, airless tires will continue to play a crucial role in comprehensive fleet management strategies within the industrial market.

By End Use, OEM Segment Accounts for 55.0% Market Share

OEM is projected to represent 55.0% of airless tire demand in 2025, demonstrating their critical role as the primary end use segment driving market expansion and adoption. Vehicle manufacturers recognize that OEM tire requirements, including complex vehicle integration processes, specialized performance needs, and multi-level quality systems, often require advanced airless tires that standard tire supply technologies cannot adequately provide. OEM-focused airless tires offer enhanced performance and operational compliance in vehicle manufacturing applications.

What are the Drivers, Restraints, and Key Trends of the Airless Tires Market?

The airless tires market is advancing steadily due to increasing recognition of maintenance-free tire technologies' importance and growing demand for high-reliability tire systems across the transportation and vehicle manufacturing sectors.

The market faces challenges, including complex manufacturing processes, potential for performance variations during operation, and concerns about supply chain consistency for specialized tire equipment. Innovation in materials technologies and customized vehicle protocols continues to influence product development and market expansion patterns.

Expansion of Advanced Vehicle Manufacturing and Tire Technologies

The growing adoption of advanced vehicle manufacturing is enabling the development of more sophisticated airless tire production and performance control systems that can meet stringent operational requirements.

Specialized manufacturing facilities offer comprehensive tire services, including advanced design and testing processes that are particularly important for achieving high-performance requirements in vehicle applications.

Advanced manufacturing infrastructure provides access to premium services that can optimize tire performance and reduce operational complexity while maintaining cost-effectiveness for large-scale vehicle operations.

Integration of Smart Vehicle Systems and Fleet Management Systems

Modern transportation organizations are incorporating digital technologies such as real-time performance monitoring, automated fleet systems, and vehicle integration to enhance airless tire deployment and distribution processes.

These technologies improve system performance, enable continuous operational monitoring, and provide better coordination between operators and vehicle manufacturers throughout the tire lifecycle. Advanced digital platforms also enable customized performance specifications and early identification of potential system deviations or supply disruptions, supporting reliable vehicle operations.

Analysis of the Airless Tires Market by Key Country

| Country | CAGR (2025-2035) |

|---|---|

| India | 9.0% |

| China | 7.8% |

| USA | 7.0% |

| Brazil | 6.5% |

| Germany | 6.2% |

| South Korea | 6.0% |

The global airless tires market is poised for differentiated regional growth over the forecast period, with India emerging as the fastest-growing market, projected to register a robust CAGR of 9.0% through 2035. This expansion is primarily driven by rapid automotive infrastructure development, rising domestic vehicle production capabilities, and the increasing adoption of durable, maintenance-free tire systems.

China is expected to follow closely, advancing at a CAGR of 7.8%, supported by strong automotive sector expansion, greater awareness of advanced tire technologies, and ongoing capacity enhancements across tire manufacturing facilities. The United States is anticipated to record steady growth at 7.0%, underpinned by significant investments in transportation infrastructure modernization and the accelerating shift toward electric mobility.

Brazil represents one of the key emerging markets, projected to grow at 6.5% CAGR owing to the progressive strengthening of its automotive manufacturing base. Germany is likely to maintain a healthy 6.2% growth rate, propelled by the country’s focus on premium vehicle innovation and adoption of next-generation tire technologies. South Korea is expected to expand at a 6.0% CAGR, supported by continued advancements in automotive infrastructure and systematic integration of sustainable vehicle technologies.

India Demonstrates Growing Market Potential with Automotive Infrastructure Development

Revenue from the airless tires market in India is projected to exhibit robust growth with a CAGR of 9.0% through 2035, driven by ongoing automotive expansion and increasing recognition of high-reliability tire systems as essential vehicle components for complex transportation processes. The country's expanding automotive infrastructure and growing availability of specialized manufacturing capabilities are creating significant opportunities for airless tire adoption across both domestic and export-oriented vehicle facilities.

Major international and domestic tire companies are establishing comprehensive manufacturing and distribution networks to serve the growing population of vehicle manufacturers and fleet operators requiring high-performance tire systems across materials handling and transportation applications throughout India's major automotive hubs.

The Indian government's strategic emphasis on automotive infrastructure modernization and manufacturing advancement is driving substantial investments in specialized production capabilities. This policy support, combined with the country's large domestic automotive market and expanding vehicle requirements, creates a favorable environment for the airless tire market development. Indian manufacturers are increasingly focusing on high-value tire technologies to improve manufacturing capabilities, with airless tires representing a key component in this automotive transformation.

Government initiatives supporting automotive development and manufacturing modernization are driving demand for high-reliability tire systems throughout major automotive and manufacturing centers, including Tamil Nadu, Maharashtra, and Gujarat regions. Vehicle capacity expansion and manufacturing system development are supporting appropriate utilization of airless tires among manufacturers and fleet operators nationwide, with growth in vehicle production operations and transportation services.

China Demonstrates Exceptional Market Potential with Automotive Growth

Revenue from the airless tires market in China is expanding at a CAGR of 7.8%, supported by increasing automotive accessibility, growing tire infrastructure awareness, and developing technology market presence across the country's major manufacturing clusters. The country's large automotive sector and increasing recognition of advanced tire systems are driving demand for effective high-performance tire solutions in both vehicle production and transportation applications. International automotive companies and domestic providers are establishing comprehensive distribution channels to serve the growing demand for quality tire systems while supporting the country's position as an emerging tire technology market.

China's automotive sector continues to benefit from favorable tire policies, expanding manufacturing capabilities, and cost-competitive tire infrastructure development. The country's focus on becoming a global automotive technology hub is driving investments in specialized tire technology and vehicle manufacturing infrastructure. This development is particularly important for airless tire applications, as manufacturers seek reliable domestic sources for critical tire technologies to reduce import dependency and improve supply chain security.

Rising awareness about advanced tire options and improving manufacturing capabilities are creating opportunities for specialized tire systems across vehicle manufacturing and transportation settings in major hubs like Beijing, Shanghai, and Shenzhen. Growing automotive infrastructure development and technology adoption are supporting increased access to high-performance airless tires among organizations requiring comprehensive tire capabilities, particularly in vehicle production and transportation organizations.

USA Maintains Technology Leadership

USA's advanced tire technology market demonstrates sophisticated automotive infrastructure deployment with documented airless tire effectiveness in transportation departments and vehicle centers through integration with existing vehicle systems and tire infrastructure. The country leverages automotive expertise in tire technology and vehicle systems integration to maintain a 7.0% CAGR through 2035. Vehicle centers, including major transportation areas, showcase premium installations where airless tires integrate with comprehensive vehicle information systems and fleet platforms to optimize tire accuracy and operational workflow effectiveness.

American operators prioritize system reliability and vehicle compliance in infrastructure development, creating demand for premium systems with advanced features, including performance validation and integration with US automotive standards. The market benefits from established vehicle industry infrastructure and a willingness to invest in advanced tire technologies that provide long-term operational benefits and compliance with transportation regulations.

Brazil Shows Strong Regional Leadership

Brazil's market expansion benefits from diverse automotive demand, including tire infrastructure modernization in São Paulo and Rio Grande do Sul, manufacturing development programs, and government automotive programs that increasingly incorporate airless tire solutions for infrastructure enhancement applications. The country maintains a 6.5% CAGR through 2035, driven by rising automotive awareness and increasing adoption of tire benefits, including superior performance capabilities and reduced complexity.

Market dynamics focus on cost-effective tire solutions that balance advanced performance features with affordability considerations important to Brazilian automotive operators. Growing automotive infrastructure creates demand for modern tire systems in new vehicle facilities and transportation equipment modernization projects.

Strategic Market Considerations:

Automotive and vehicle infrastructure segments leading growth with focus on performance enhancement and operational efficiency applications. Regional tire requirements are driving a diverse product portfolio from basic tire systems to advanced performance platforms. Import dependency challenges offset by potential local development partnerships with international tire manufacturers. Government automotive initiatives beginning to influence procurement standards and tire infrastructure requirements.

Germany Emphasizes Advanced Automotive Technology

Germany demonstrates steady market development with a 6.2% CAGR through 2035, distinguished by automotive operators' preference for high-quality tire systems that integrate seamlessly with existing vehicle equipment and provide reliable long-term operation in specialized automotive applications. The market prioritizes advanced features, including precision performance algorithms, reliability validation, and integration with comprehensive vehicle platforms that reflect German automotive expectations for technological advancement and operational excellence.

Strategic Market Indicators:

Premium focus on precision systems with advanced performance algorithms and high-reliability capabilities for automotive applications requiring exceptional performance standards. Integration requirements with existing automotive information systems and fleet management platforms supporting comprehensive vehicle automation. Emphasis on airless tire reliability and long-term performance in vehicle applications with strict operational requirements. Strong preference for locally manufactured systems that comply with German engineering standards and automotive regulations.

South Korea Emphasizes Advanced Manufacturing

South Korea demonstrates strong market development with a 6.0% CAGR through 2035, driven by advanced automotive infrastructure and vehicle preference for technology-integrated airless tires. The country's sophisticated automotive ecosystem and high automation adoption rates are creating significant opportunities for airless tire adoption across both domestic and technology-driven vehicle facilities. Based on the provided split data, South Korea's type breakdown shows Solid at 50.0%, Foam at 30.0%, and Hybrid at 20.0%, reflecting the country's strong focus on automotive infrastructure development.

Government initiatives supporting Industry 4.0 implementation and smart manufacturing are creating additional opportunities for airless tire adoption in automated manufacturing facilities and logistics operations. The country's focus on developing electric vehicle infrastructure and autonomous vehicle testing programs is generating specialized demand for maintenance-free tire solutions that can operate reliably in advanced vehicle systems. South Korea's strategic emphasis on becoming a global automotive technology leader continues to drive investments in advanced tire technologies and manufacturing capabilities that support both domestic market growth and export expansion opportunities.

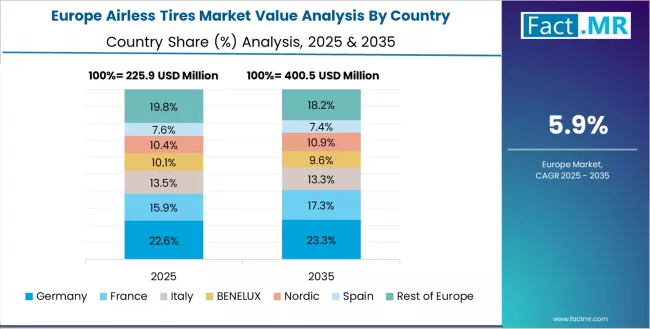

Europe Market Split by Country

The airless tires market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market value of USD 210.0 million in 2025, supported by its advanced automotive infrastructure, precision vehicle management capabilities, and strong manufacturing presence throughout major automotive regions.

The UK follows with USD 150.0 million in 2025, driven by advanced tire protocols, automotive innovation integration, and expanding vehicle networks serving both domestic and international markets. France holds USD 120.0 million in 2025, supported by automotive infrastructure expansion and growing adoption of high-performance tire systems.

Italy commands USD 95.0 million in 2025, while Spain accounts for USD 80.0 million in 2025. The rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, holds USD 235.0 million in 2025, representing diverse market opportunities with established automotive and tire infrastructure capabilities.

Competitive Landscape of the Airless Tires Market

The airless tires market is characterized by competition among established tire companies, specialty materials companies, and automotive technology suppliers focused on delivering high-performance, consistent, and reliable tire systems.

Companies are investing in materials technology advancement, performance enhancement, strategic partnerships, and customer technical support to deliver effective, efficient, and reliable tire solutions that meet stringent vehicle and transportation requirements. Performance optimization, reliability validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

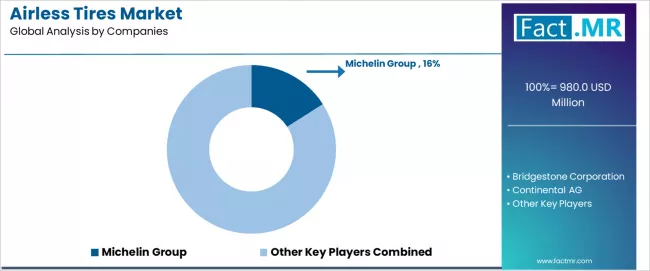

Michelin leads the market with a 16.0% market share, offering comprehensive high-performance airless tires with a focus on performance consistency and reliability for automotive applications. Bridgestone provides specialized tire systems with emphasis on vehicle applications and comprehensive technical support services.

Continental AG focuses on advanced tire technologies and customized automotive solutions for tire systems serving global markets. Goodyear delivers established tire systems with strong performance tire systems and customer service capabilities.

Hankook Tire & Technology Co. Ltd operates with a focus on bringing innovative tire technologies to specialized automotive applications and emerging markets. Pirelli provides comprehensive tire system portfolios, including advanced tire services, across multiple automotive applications and vehicle management processes.

Sumitomo Rubber specializes in customized tire solutions and performance management systems for automotive systems with emphasis on reliability compliance. Trelleborg provides reliable supply chain solutions and technical expertise to enhance market accessibility and customer access to essential tire systems.

Key Players in the Airless Tires Market

- Michelin Group

- Bridgestone Corporation

- Continental AG

- The Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Trelleborg AB

- Carlisle Companies Incorporated

- Nokian Tyres plc

- Resilient Technologies, LLC

- Amerityre Corporation (ATP)

- Camso Inc. (a Michelin Group Company)

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 980.0 Million |

| Type | Solid/Non-pneumatic, Foam-filled, Hybrid |

| Vehicle | Industrial/Material Handling, Passenger/Light Commercial, Off-highway |

| End Use | OEM, Aftermarket |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, USA, Germany, India, South Korea, Brazil and 40+ countries |

| Key Companies Profiled | Michelin, Bridgestone, Continental, Goodyear, Hankook, Pirelli, Sumitomo Rubber, and Trelleborg |

| Additional Attributes | Dollar sales by type and vehicle, regional demand trends, competitive landscape, vehicle provider preferences for specific tire systems, integration with specialty automotive supply chains, innovations in tire technologies, performance monitoring, and reliability optimization |

Airless Tires Market by Segments

-

Type:

- Solid/Non-pneumatic

- Foam-filled

- Hybrid

-

Vehicle:

- Industrial/Material Handling

- Passenger/Light Commercial

- Off-highway

-

End Use:

- OEM

- Aftermarket

-

Region:

- Asia Pacific

- China

- India

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

- Latin America

- Brazil

- Argentina

- Chile

- Rest of Latin America

- Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Countries

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Type , 2025 to 2035

- Solid/Non-pneumatic

- Foam-filled

- Hybrid

- Y to o to Y Growth Trend Analysis By Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Vehicle

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Vehicle, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Vehicle, 2025 to 2035

- Industrial/Material Handling

- Passenger/Light Commercial

- Off-highway

- Y to o to Y Growth Trend Analysis By Vehicle, 2020 to 2024

- Absolute $ Opportunity Analysis By Vehicle, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End Use, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End Use, 2025 to 2035

- OEM

- Aftermarket

- Y to o to Y Growth Trend Analysis By End Use, 2020 to 2024

- Absolute $ Opportunity Analysis By End Use, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By Vehicle

- By End Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle

- By End Use

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle

- By End Use

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Vehicle

- By End Use

- Competition Analysis

- Competition Deep Dive

- Michelin Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Bridgestone Corporation

- Continental AG

- The Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Trelleborg AB

- Carlisle Companies Incorporated

- Nokian Tyres plc

- Resilient Technologies, LLC

- Amerityre Corporation (ATP)

- Camso Inc. (a Michelin Group Company)

- Michelin Group

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by End Use, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by End Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Vehicle

- Figure 9: Global Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by End Use

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Type

- Figure 26: North America Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Vehicle

- Figure 29: North America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by End Use

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Vehicle

- Figure 39: Latin America Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by End Use

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Vehicle

- Figure 49: Western Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by End Use

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Vehicle

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End Use

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Vehicle

- Figure 69: East Asia Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by End Use

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Vehicle

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by End Use

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Vehicle, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Vehicle, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Vehicle

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by End Use, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by End Use, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by End Use

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the airless tires market in 2025?

The global airless tires market is estimated to be valued at USD 980.0 million in 2025.

What will be the size of airless tires market in 2035?

The market size for the airless tires market is projected to reach USD 1,950.0 million by 2035.

How much will be the airless tires market growth between 2025 and 2035?

The airless tires market is expected to grow at a 7.1% CAGR between 2025 and 2035.

What are the key product types in the airless tires market?

The key product types in airless tires market are solid/non-pneumatic, foam-filled and hybrid.

Which vehicle segment to contribute significant share in the airless tires market in 2025?

In terms of vehicle, industrial/material handling segment to command 40.0% share in the airless tires market in 2025.