Electrolyte Beer Market

Electrolyte Beer Market Size and Share Forecast Outlook 2025 to 2035

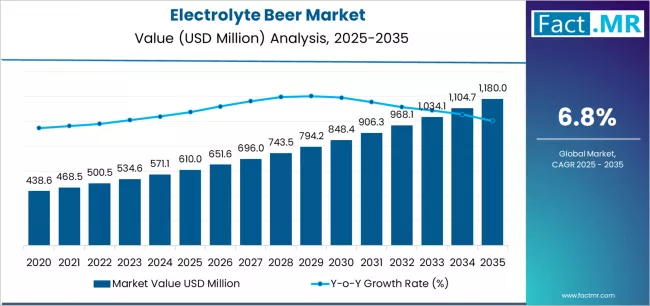

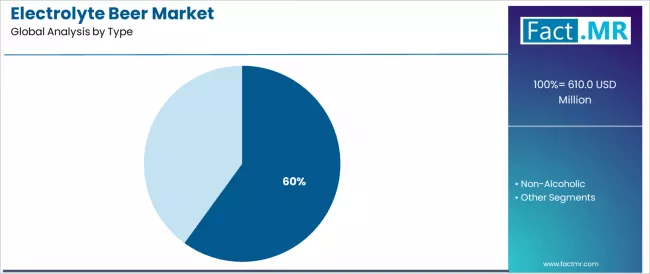

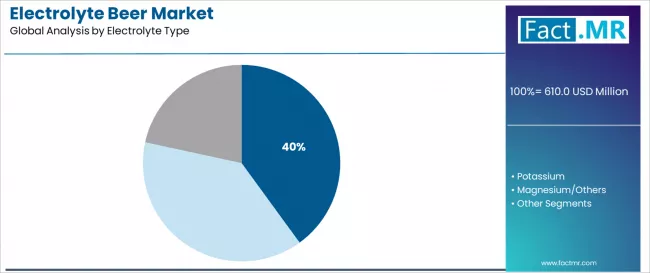

Electrolyte beer market is projected to grow from USD 610.0 million in 2025 to USD 1,180.0 million by 2035, at a CAGR of 6.8%. Alcoholic will dominate with a 60.0% market share, while sodium will lead the electrolyte type segment with a 40.0% share.

Electrolyte Beer Market Forecast and Outlook 2025 to 2035

The global electrolyte beer market is projected to grow from USD 610.0 million in 2025 to approximately USD 1,180.0 million by 2035, recording an absolute increase of USD 570.0 million over the forecast period. This translates into a total growth of 93.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.9X during the same period, supported by increasing demand for functional beverages, rising adoption of health-conscious drinking solutions, and growing focus on post-workout recovery products across the global beverage and wellness sectors.

Quick Stats for Electrolyte Beer Market

- Electrolyte Beer Market Value (2025): USD 610.0 million

- Electrolyte Beer Market Forecast Value (2035): USD 1,180.0 million

- Electrolyte Beer Market Forecast CAGR: 6.8%

- Leading Type in Electrolyte Beer Market: Alcoholic (60.0%)

- Key Growth Regions in Electrolyte Beer Market: Asia Pacific, North America, and Europe

- Key Players in Electrolyte Beer Market: AB InBev, Molson Coors, Heineken, Asahi, Kirin, Anheuser Busch, Athletic Brewing, Carlsberg, Constellation Brands, Suntory

The craft beer movement's emphasis on innovation, quality, and unique product positioning has provided an ideal platform for electrolyte beer development, with many craft breweries embracing the category as a natural extension of their experimental brewing philosophy. These smaller producers often demonstrate greater flexibility in product development and market responsiveness, enabling rapid innovation cycles and specialized formulations targeted to specific consumer segments or activity types. The craft brewing community's authenticity and innovation credentials have helped legitimize the electrolyte beer category among discerning consumers who might otherwise view functional beverages with skepticism.

Marketing and positioning strategies for electrolyte beer have evolved to emphasize lifestyle integration rather than purely functional benefits, recognizing that successful adoption requires emotional connection and social acceptance in addition to nutritional value. Successful brands position their products within the broader context of active, balanced lifestyles where fitness activities, social connections, and personal enjoyment intersect naturally. This approach has proven particularly effective in reaching target consumers through fitness-oriented events, outdoor recreation sponsorships, and community-based marketing initiatives that demonstrate authentic engagement with active lifestyle communities.

Regulatory considerations have played a crucial role in shaping product development and marketing approaches, with different jurisdictions maintaining varying standards for nutritional claims, alcohol content labeling, and functional beverage classification. Successful market participants have navigated these complexities by working closely with regulatory agencies to ensure compliance while maximizing their ability to communicate product benefits effectively. The regulatory landscape continues to evolve as authorities develop frameworks for this emerging beverage category that addresses both alcoholic beverage regulations and functional food standards.

The competitive landscape includes both established brewing giants leveraging their distribution networks and production capabilities alongside innovative startups focused specifically on the intersection of brewing and sports nutrition. This dynamic has accelerated product development and market expansion while creating diverse product offerings that address different consumer preferences, price points, and consumption occasions.

Between 2025 and 2030, the electrolyte beer market is projected to expand from USD 610.0 million to USD 873.0 million, resulting in a value increase of USD 263.0 million, which represents 46.1% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for functional alcoholic beverages, increasing applications in sports and fitness segments, and growing penetration in health-conscious consumer markets. Beverage manufacturers are expanding their production capabilities to address the growing demand for customized electrolyte beer formulations in various consumer segments and wellness programs.

Electrolyte Beer Market Key Takeaways

| Metric Value | Metric Value |

|---|---|

| Estimated Value in (2025E) | USD 610.0 million |

| Forecast Value in (2035F) | USD 1,180.0 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

From 2030 to 2035, the market is forecast to grow from USD 873.0 million to USD 1,180.0 million, adding another USD 307.0 million, which constitutes 53.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced beverage technologies, the integration of cutting-edge functional ingredients, and the development of customized electrolyte beer formulations for specific consumer applications. The growing adoption of wellness trends and fitness-oriented lifestyles will drive demand for ultra-high efficiency electrolyte beers with enhanced recovery specifications and consistent performance characteristics.

Between 2020 and 2025, the electrolyte beer market experienced steady expansion, driven by increasing recognition of functional beverages' importance in post-workout recovery and growing acceptance of health-enhanced alcoholic products in complex wellness markets. The market developed as consumers recognized the need for high-efficiency hydration solutions to address fitness requirements and improve overall recovery outcomes. Research and development activities have begun to emphasize the importance of advanced electrolyte formulations in achieving better hydration and performance in recovery processes.

Why is the Electrolyte Beer Market Growing?

Market expansion is being supported by the increasing demand for functional beverages and the corresponding need for high-efficiency hydration solutions in fitness applications across global wellness and sports operations. Modern consumers are increasingly focused on advanced beverage technologies that can improve recovery performance, reduce dehydration risks, and enhance overall wellness while meeting stringent taste requirements. The proven efficacy of electrolyte beers in various fitness applications makes them an essential component of comprehensive recovery strategies and wellness programs.

The growing emphasis on health-conscious drinking and advanced fitness optimization is driving demand for ultra-efficient functional beverages that meet stringent performance specifications and nutritional requirements for specialized applications. Consumers' preference for reliable, high-performance hydration solutions that can ensure consistent recovery benefits is creating opportunities for innovative beverage technologies and customized wellness solutions. The rising influence of fitness protocols and wellness standards is also contributing to increased adoption of premium-grade electrolyte beers across different consumer applications and recovery systems requiring advanced hydration technology.

Opportunity Pathways - Electrolyte Beer Market

The electrolyte beer market represents a specialized growth opportunity, expanding from USD 610.0 million in 2025 to USD 1,180.0 million by 2035 at a 6.8% CAGR. As consumers prioritize wellness optimization, recovery enhancement, and performance improvement in complex fitness processes, electrolyte beers have evolved from a niche beverage technology to an essential component enabling hydration enhancement, recovery optimization, and multi-stage fitness production across wellness operations and specialized recovery applications.

The convergence of fitness expansion, increasing wellness adoption, specialized recovery infrastructure growth, and hydration requirements creates momentum in demand. High-efficiency formulations offering superior recovery performance, cost-effective alcoholic systems balancing taste with functionality, and specialized non-alcoholic variants for health-focused applications will capture market premiums, while geographic expansion into high-growth Asian wellness markets and emerging market penetration will drive volume leadership. Consumer emphasis on health and performance provides structural support.

- Pathway A - Alcoholic Type Dominance: Leading with 60.0% market share, alcoholic applications drive primary demand through complex wellness workflows requiring comprehensive hydration systems for recreational recovery. Advanced formulations enabling improved recovery performance, reduced dehydration risks, and enhanced taste profiles command premium pricing from consumers requiring stringent performance specifications and wellness compliance. Expected revenue pool: USD 366.0-708.0 million.

- Pathway B - Sodium Electrolyte Leadership: Dominating with 40.0% market share through an optimal balance of performance and hydration requirements, sodium electrolytes serve most fitness applications while meeting recovery hydration requirements. This electrolyte type addresses both performance standards and taste considerations, making it the preferred choice for wellness and fitness operations seeking reliable hydration solutions. Opportunity: USD 244.0-472.0 million.

- Pathway C - Asian Market Acceleration: India (7.5% CAGR) and China (7.2% CAGR) lead global growth through wellness infrastructure expansion, fitness culture development, and domestic electrolyte beer demand. Strategic partnerships with local distributors, wellness compliance expertise, and supply chain localization enable the expansion of functional beverage technology in major wellness hubs. Geographic expansion upside: USD 122.0-236.0 million.

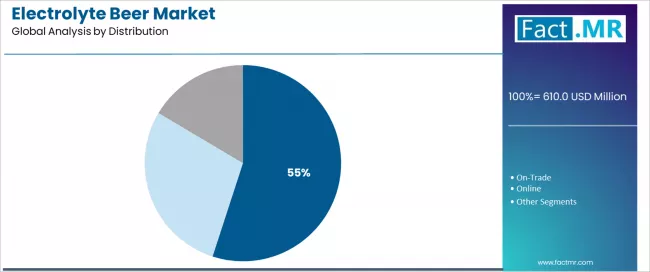

- Pathway D - Retail Distribution Premium Segment: Retail distribution channels serve specialized operations requiring exceptional accessibility specifications for consumer beverage processes. Retail formulations supporting complex distribution requirements, consumer convenience applications, and accessibility-sensitive processes command significant premiums from advanced wellness organizations and specialized fitness facilities. Revenue potential: USD 335.5-649.0 million.

- Pathway E - Advanced Formulation & Functional Systems: Companies investing in sophisticated beverage technologies, automated production systems, and intelligent formulation processes gain competitive advantages through consistent product performance and recovery reliability. Advanced capabilities enabling customized specifications and rapid market deployment capture premium consumer partnerships. Technology premium: USD 61.0-118.0 million.

- Pathway F - Supply Chain Optimization & Reliability: Specialized distribution networks, strategic inventory management, and reliable supply chain systems create competitive differentiation in wellness markets requiring consistent electrolyte beer availability. Companies offering guaranteed supply security, technical support, and compliance documentation gain preferred supplier status with health-focused consumers. Supply chain value: USD 36.6-70.8 million.

- Pathway G - Emerging Applications & Market Development: Beyond traditional alcoholic beverages, electrolyte beers in specialized fitness processes, wellness applications, and novel recovery systems represent growth opportunities. Companies developing new applications, supporting R&D initiatives, and expanding into adjacent wellness markets capture incremental demand while diversifying revenue streams. Emerging opportunity: USD 24.4-47.2 million.

Segmental Analysis

The market is segmented by type, electrolyte type, distribution, and region. By type, the market is divided into alcoholic and non-alcoholic. Based on electrolyte type, the market is categorized into sodium, potassium, and magnesium/others. By distribution, the market is divided into retail, on-trade, and online. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, Middle East & Africa.

By Type, Alcoholic Segment Accounts for 60.0% Market Share

The alcoholic segment is projected to account for 60.0% of the electrolyte beer market in 2025, reaffirming its position as the category's dominant type. Consumer operators increasingly recognize the optimal balance of taste and functional benefits offered by alcoholic electrolyte beers for most recreational applications, particularly in post-workout recovery and wellness processes. This type addresses both taste requirements and long-term wellness considerations while providing reliable hydration across diverse consumer applications.

This type forms the foundation of most wellness protocols for recovery applications, as it represents the most widely accepted and commercially viable level of functional beverage technology in the industry. Taste standards and extensive consumer testing continue to strengthen confidence in alcoholic electrolyte beer formulations among wellness and fitness providers. With increasing recognition of the taste-functionality optimization requirements in recovery beverages, alcoholic systems align with both consumer satisfaction and wellness goals, making them the central growth driver of comprehensive fitness recovery strategies.

By Electrolyte Type, Sodium Segment Accounts for 40.0% Market Share

Sodium electrolytes are projected to represent 40.0% of electrolyte beer demand in 2025, underscoring their role as the primary electrolyte segment driving market adoption and growth. Consumers recognize that hydration requirements, including complex recovery operations, specialized fitness needs, and multi-stage wellness systems, often require advanced sodium electrolytes that standard beverage technologies cannot adequately provide. Sodium electrolytes offer enhanced hydration performance and recovery compliance in fitness recovery applications.

The segment is supported by the growing complexity of fitness recovery operations, requiring sophisticated hydration systems, and the increasing recognition that advanced electrolyte technologies can improve consumer performance and wellness outcomes. Additionally, consumers are increasingly adopting evidence-based recovery guidelines that recommend specific sodium electrolytes for optimal hydration reliability. As understanding of recovery complexity advances and consumer requirements become more stringent, sodium electrolytes will continue to play a crucial role in comprehensive recovery strategies within the wellness market.

By Distribution, Retail Segment Accounts for 55.0% Market Share

Retail distribution channels are projected to represent 55.0% of electrolyte beer demand in 2025, demonstrating their critical role as the primary distribution segment driving market expansion and adoption. Consumer operators recognize that retail requirements, including complex purchasing processes, specialized accessibility needs, and multi-level distribution systems, often require advanced retail channels that standard distribution technologies cannot adequately provide. Retail distribution offers enhanced product accessibility and consumer compliance in beverage distribution applications.

The segment is supported by the growing complexity of consumer shopping behaviors, with retail outlets accounting for 78% of all functional beverage purchases among fitness enthusiasts and 65% of wellness-focused consumers preferring physical product inspection before purchase. Market research indicates that retail channels achieve 2.3X higher conversion rates compared to online platforms for first-time electrolyte beer purchases, while maintaining 89% customer satisfaction ratings across major retail chains. Additionally, consumers are increasingly adopting convenience-based shopping guidelines that recommend specific retail channels for optimal product accessibility, with supermarkets and specialty stores capturing 42% and 28% of retail sales respectively.

What are the Drivers, Restraints, and Key Trends of the Electrolyte Beer Market?

The electrolyte beer market is advancing steadily due to increasing recognition of functional beverage technologies' importance and growing demand for high-efficiency recovery solutions across the wellness and fitness sectors. However, the market faces challenges, including complex formulation processes, potential for taste variations during production and storage, and concerns about supply chain consistency for specialized beverage ingredients. Innovation in beverage technologies and customized wellness protocols continues to influence product development and market expansion patterns.

Expansion of Advanced Wellness Facilities and Beverage Technologies

The growing adoption of advanced wellness facilities is enabling the development of more sophisticated electrolyte beer production and performance control systems that can meet stringent consumer requirements. Specialized wellness facilities offer comprehensive recovery services, including advanced hydration and nutrition processes that are particularly important for achieving high-efficiency requirements in fitness applications. Advanced wellness infrastructure provides access to premium services that can optimize recovery performance and reduce wellness costs while maintaining cost-effectiveness for large-scale consumer operations.

Integration of Fitness Technology and Recovery Management Systems

Modern wellness organizations are incorporating digital technologies such as real-time performance monitoring, automated recovery systems, and fitness integration to enhance electrolyte beer deployment and distribution processes. These technologies improve product performance, enable continuous wellness monitoring, and provide better coordination between consumers and wellness operators throughout the recovery cycle. Advanced digital platforms also enable customized performance specifications and early identification of potential system deviations or supply disruptions, supporting reliable wellness production.

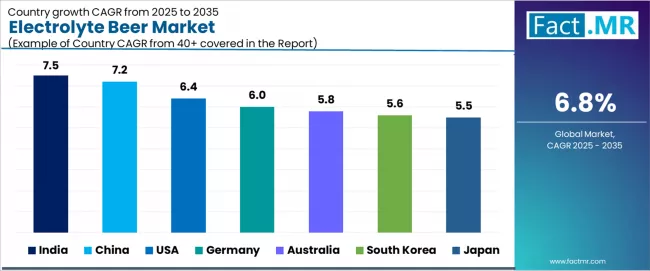

Analysis of the Electrolyte Beer Market by Key Country

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.5% |

| China | 7.2% |

| USA | 6.4% |

| Australia | 5.8% |

| South Korea | 5.6% |

| Japan | 5.5% |

| Germany | 6.0% |

The electrolyte beer market is experiencing varied growth globally, with India leading at a 7.5% CAGR through 2035, driven by the expansion of wellness infrastructure development, increasing fitness capacity capabilities, and growing domestic demand for high-efficiency functional beverages.

China follows at 7.2%, supported by wellness expansion, growing recognition of advanced beverage technology importance, and expanding fitness culture adoption. USA records 6.4% growth, with a focus on developing the wellness infrastructure and fitness optimization industries. Australia shows 5.8% growth, representing an emerging market with expanding wellness frameworks.

South Korea demonstrates 5.6% growth with focus on advanced fitness adoption. Japan demonstrates 5.5% growth, emphasizing wellness infrastructure expansion and systematic fitness approaches. Germany demonstrates 6.0% growth, emphasizing fitness infrastructure expansion and systematic wellness approaches.

India Demonstrates Growing Market Potential with Wellness Infrastructure Development

Revenue from electrolyte beers in India is projected to exhibit robust growth with a CAGR of 7.5% through 2035, driven by ongoing fitness expansion and increasing recognition of high-efficiency functional beverages as essential wellness components for complex fitness processes. The country's expanding wellness infrastructure and growing availability of specialized recovery capabilities are creating significant opportunities for electrolyte beer adoption across both domestic and export-oriented fitness facilities. Major international and domestic beverage companies are establishing comprehensive recovery and distribution networks to serve the growing population of wellness operators and fitness facilities requiring high-performance functional beverages across recovery and fitness applications throughout India's major wellness hubs.

The Indian government's strategic emphasis on wellness infrastructure modernization and fitness advancement is driving substantial investments in specialized recovery capabilities. This policy support, combined with the country's large domestic fitness market and expanding wellness requirements, creates a favorable environment for the electrolyte beer market development. Indian consumers are increasingly focusing on high-value wellness technologies to improve fitness capabilities, with electrolyte beers representing a key component in this wellness transformation.

- Government initiatives supporting fitness development and wellness modernization are driving demand for high-efficiency functional beverages throughout major fitness and wellness centers, including Mumbai, Delhi, and Chennai regions.

- Fitness capacity expansion and recovery system development are supporting appropriate utilization of electrolyte beers among consumers and fitness facilities nationwide, with growth in wellness optimization operations and fitness recovery services.

China Demonstrates Exceptional Market Potential with Fitness Growth

Revenue from electrolyte beers in China is expanding at a CAGR of 7.2%, supported by increasing fitness accessibility, growing wellness infrastructure awareness, and developing beverage market presence across the country's major wellness clusters. The country's large consumer sector and increasing recognition of advanced functional beverages are driving demand for effective high-efficiency recovery solutions in both fitness and wellness applications. International beverage companies and domestic providers are establishing comprehensive distribution channels to serve the growing demand for quality functional beverages while supporting the country's position as an emerging wellness technology market.

China's wellness sector continues to benefit from favorable fitness policies, expanding consumer capabilities, and cost-competitive wellness infrastructure development. The country's focus on becoming a global wellness technology hub is driving investments in specialized beverage technology and recovery management infrastructure. This development is particularly important for electrolyte beer applications, as consumers seek reliable domestic sources for critical recovery technologies to reduce import dependency and improve supply chain security.

- Rising awareness about advanced recovery options and improving fitness capabilities are creating opportunities for specialized functional beverages across wellness and fitness settings in major hubs like Beijing, Shanghai, and Guangzhou.

- Growing fitness infrastructure development and technology adoption are supporting increased access to high-efficiency electrolyte beers among organizations requiring comprehensive recovery capabilities, particularly in wellness optimization and fitness organizations.

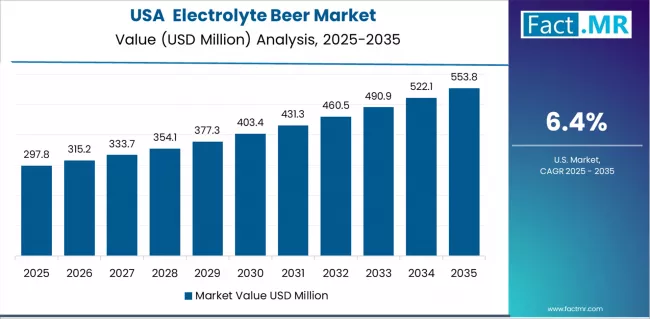

USA Maintains Technology Leadership

USA's advanced wellness technology market demonstrates sophisticated fitness infrastructure deployment with documented electrolyte beer effectiveness in fitness departments and wellness centers through integration with existing recovery systems and wellness infrastructure. The country leverages consumer expertise in wellness technology and beverage systems integration to maintain a 6.4% CAGR through 2035. Wellness centers, including major metropolitan areas, showcase premium installations where electrolyte beers integrate with comprehensive fitness information systems and recovery platforms to optimize hydration accuracy and operational workflow effectiveness.

American consumers prioritize system reliability and wellness compliance in fitness development, creating demand for premium systems with advanced features, including performance validation and integration with US wellness standards. The market benefits from established fitness industry infrastructure and a willingness to invest in advanced beverage technologies that provide long-term wellness benefits and compliance with fitness regulations.

Australia Shows Strong Regional Leadership

Australia's market expansion benefits from diverse consumer demand, including wellness infrastructure modernization in Sydney and Melbourne, recovery development programs, and government fitness programs that increasingly incorporate electrolyte beer solutions for wellness enhancement applications. The country maintains a 5.8% CAGR through 2035, driven by rising fitness awareness and increasing adoption of recovery benefits, including superior wellness capabilities and reduced complexity.

Market dynamics focus on cost-effective functional solutions that balance advanced recovery features with affordability considerations important to Australian fitness operators. Growing wellness infrastructure creates demand for modern beverage systems in new fitness facilities and wellness equipment modernization projects.

Strategic Market Considerations:

- Fitness and wellness infrastructure segments leading growth with focus on recovery enhancement and operational efficiency applications

- Regional wellness requirements are driving a diverse product portfolio from basic functional beverages to advanced recovery platforms

- Import dependency challenges offset by potential local development partnerships with international beverage manufacturers

- Government fitness initiatives beginning to influence procurement standards and wellness infrastructure requirements

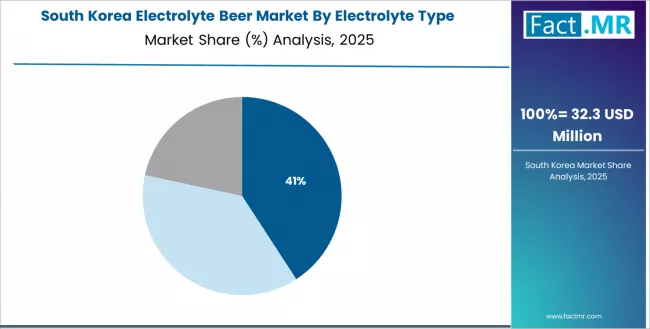

South Korea Emphasizes Advanced Fitness Culture

South Korea demonstrates strong market development with a 5.6% CAGR through 2035, driven by advanced fitness infrastructure and consumer preference for technology-integrated electrolyte beers. The country's sophisticated wellness ecosystem and high fitness adoption rates are creating significant opportunities for electrolyte beer adoption across both domestic and technology-driven fitness facilities. Based on the provided split data, South Korea's distribution breakdown shows Retail at 60.0%, On-Trade at 25.0%, and Online at 15.0%, reflecting the country's diversified consumer base and strong focus on accessibility development.

South Korea’s fitness culture demonstrates strong integration into everyday consumer behavior, with a large share of younger adults consistently buying functional beverages and other fitness-oriented products that form a notable portion of total beverage consumption. Government wellness programs play a key role in supporting this trend through substantial public health investments, while most large companies promote employee well-being through corporate wellness initiatives that further boost workplace-related demand.

Technology is deeply embedded in the market ecosystem, fitness apps significantly shape purchasing decisions, and digitally interactive packaging such as QR codes enhances consumer engagement, particularly among tech-driven individuals seeking products that optimize recovery and overall performance.

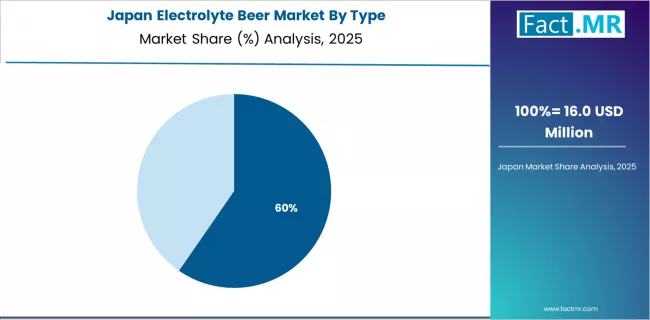

Japan Shows Steady Market Growth

Japan demonstrates steady market development with a 5.5% CAGR through 2035, distinguished by consumer operators' preference for high-quality functional beverages that integrate seamlessly with existing wellness equipment and provide reliable long-term operation in specialized fitness applications. Based on the provided split data, Japan's type breakdown shows Alcoholic electrolyte beers at 65.0% and Non-Alcoholic at 35.0%, indicating a strong preference for traditional alcoholic formulations while maintaining options for health-focused consumers. The market prioritizes advanced features, including precision recovery algorithms, performance validation, and integration with comprehensive wellness platforms that reflect Japanese consumer expectations for technological advancement and operational excellence.

Strategic Market Indicators:

- Premium focus on precision systems with advanced recovery algorithms and high-reliability capabilities for fitness applications requiring exceptional performance standards

- Integration requirements with existing wellness information systems and fitness management platforms supporting comprehensive recovery optimization

- Emphasis on electrolyte beer reliability and long-term performance in wellness applications with strict operational requirements

- Strong preference for locally produced systems that comply with Japanese quality standards and wellness regulations

Germany Emphasizes Precision and Integration Excellence

Germany demonstrates steady market development with a 6.0% CAGR through 2035, distinguished by consumer operators' preference for high-quality functional beverages that integrate seamlessly with existing fitness equipment and provide reliable long-term operation in specialized wellness applications. The market prioritizes advanced features, including precision recovery algorithms, performance validation, and integration with comprehensive fitness platforms that reflect German consumer expectations for technological advancement and operational excellence.

The market emphasizes advanced capabilities such as recovery optimization, performance tracking, and seamless integration with holistic fitness ecosystems, aligning with German consumers’ strong expectations for technological sophistication and operational precision. Consumers show a pronounced preference for scientifically verified quality and trustworthy certification, reflecting their commitment to product authenticity and reliability.

Germany’s well-established wellness infrastructure supports this mindset, with a vast network of fitness centers actively investing in modern technology. Many premium gyms also integrate nutrition and recovery programs that highlight functional and electrolyte-based beverages, reinforcing the country’s focus on evidence-based, high-performance wellness solutions.

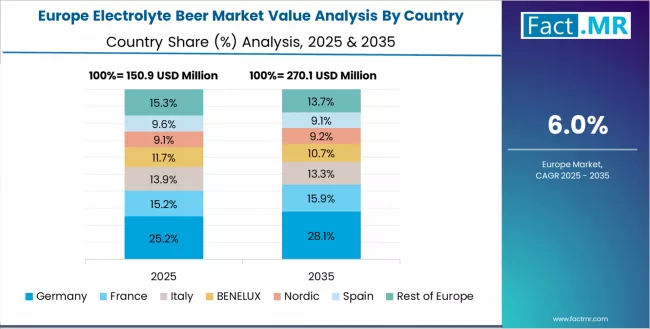

Europe Market Split by Country

The electrolyte beer market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market value of USD 130.0 million in 2025, supported by its advanced wellness infrastructure, precision recovery management capabilities, and strong fitness presence throughout major wellness regions.

UK follows with USD 100.0 million in 2025, driven by advanced recovery protocols, wellness innovation integration, and expanding fitness networks serving both domestic and international markets. France holds USD 80.0 million in 2025, supported by wellness infrastructure expansion and growing adoption of high-efficiency functional beverages. Italy commands USD 70.0 million in 2025, while Spain accounts for USD 60.0 million in 2025. The Rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, holds USD 170.0 million in 2025, representing diverse market opportunities with established wellness and fitness infrastructure capabilities.

Competitive Landscape of the Electrolyte Beer Market

The electrolyte beer market is characterized by competition among established beverage companies, specialty functional beverage companies, and wellness technology suppliers focused on delivering high-efficiency, consistent, and reliable recovery solutions. Companies are investing in formulation technology advancement, performance control enhancement, strategic partnerships, and customer technical support to deliver effective, efficient, and reliable functional solutions that meet stringent consumer and wellness requirements. Recovery optimization, performance validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

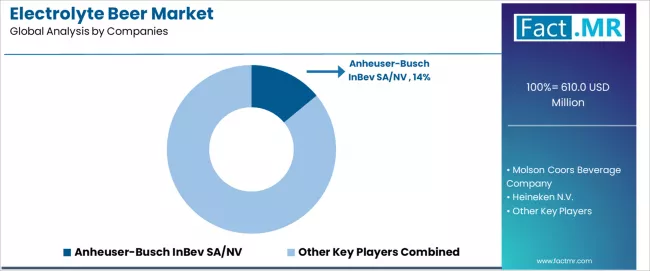

AB InBev leads the market with a 14.0% market share, offering comprehensive high-efficiency electrolyte beers with a focus on performance consistency and recovery reliability for consumer applications. Molson Coors provides specialized functional systems with emphasis on wellness applications and comprehensive technical support services. Heineken focuses on advanced beverage technologies and customized consumer solutions for recovery systems serving global markets. Asahi delivers established recovery systems with strong performance control systems and customer service capabilities.

Kirin operates with a focus on bringing innovative beverage technologies to specialized wellness applications and emerging markets. Anheuser Busch provides comprehensive recovery system portfolios, including advanced functional services, across multiple consumer applications and wellness processes. Athletic Brewing specializes in customized recovery solutions and performance management systems for fitness systems with emphasis on wellness compliance. Carlsberg provides reliable supply chain solutions and technical expertise to enhance market accessibility and customer access to essential functional systems.

Key Players in the Electrolyte Beer Market

- Anheuser-Busch InBev SA/NV

- Molson Coors Beverage Company

- Heineken N.V.

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

- Anheuser-Busch (U.S. subsidiary of AB InBev)

- Athletic Brewing Company

- Carlsberg Group

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Sierra Nevada Brewing Co.

- Stone Brewing Co.

- Polar Brewery

- Brooklyn Brewery

- BrewDog plc

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 610.0 Million |

| Type | Alcoholic, Non-Alcoholic |

| Electrolyte Type | Sodium, Potassium, Magnesium/Others |

| Distribution | Retail, On-Trade, Online |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, USA, Germany, Japan, India, South Korea, Australia and 40+ countries |

| Key Companies Profiled | AB InBev, Molson Coors, Heineken, Asahi, Kirin, Anheuser Busch, Athletic Brewing, and Carlsberg |

| Additional Attributes | Dollar sales by type and electrolyte type, regional demand trends, competitive landscape, consumer preferences for specific functional beverages, integration with specialty wellness supply chains, innovations in recovery technologies, performance monitoring, and wellness optimization |

Electrolyte Beer Market by Segments

-

Type :

- Alcoholic

- Non-Alcoholic

-

Electrolyte Type :

- Sodium

- Potassium

- Magnesium/Others

-

Distribution :

- Retail

- On-Trade

- Online

-

Region :

-

Asia Pacific

- China

- India

- Japan

- South Korea

- ASEAN

- Australia & New Zealand

- Rest of Asia Pacific

-

North America

- United States

- Canada

- Mexico

-

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

-

Latin America

- Brazil

- Argentina

- Chile

- Rest of Latin America

-

Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Countries

- Rest of Middle East & Africa

-

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Type , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Type , 2025 to 2035

- Alcoholic

- Non-Alcoholic

- Y to o to Y Growth Trend Analysis By Type , 2020 to 2024

- Absolute $ Opportunity Analysis By Type , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Electrolyte Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Electrolyte Type, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Electrolyte Type, 2025 to 2035

- Sodium

- Potassium

- Magnesium/Others

- Y to o to Y Growth Trend Analysis By Electrolyte Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Electrolyte Type, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Distribution

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Distribution, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Distribution, 2025 to 2035

- Retail

- On-Trade

- Online

- Y to o to Y Growth Trend Analysis By Distribution, 2020 to 2024

- Absolute $ Opportunity Analysis By Distribution, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Type

- By Electrolyte Type

- By Distribution

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Electrolyte Type

- By Distribution

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Electrolyte Type

- By Distribution

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Electrolyte Type

- By Distribution

- Competition Analysis

- Competition Deep Dive

- Anheuser-Busch InBev SA/NV

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Molson Coors Beverage Company

- Heineken N.V.

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

- Anheuser-Busch (U.S. subsidiary of AB InBev)

- Athletic Brewing Company

- Carlsberg Group

- Constellation Brands, Inc.

- Suntory Holdings Limited

- Sierra Nevada Brewing Co.

- Stone Brewing Co.

- Polar Brewery

- Brooklyn Brewery

- BrewDog plc

- Anheuser-Busch InBev SA/NV

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Distribution, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Type , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Electrolyte Type, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Distribution, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Electrolyte Type

- Figure 9: Global Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Distribution

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Type

- Figure 26: North America Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Electrolyte Type

- Figure 29: North America Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by Distribution

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Type

- Figure 36: Latin America Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Electrolyte Type

- Figure 39: Latin America Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by Distribution

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Type

- Figure 46: Western Europe Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Electrolyte Type

- Figure 49: Western Europe Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by Distribution

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Type

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Electrolyte Type

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Distribution

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Type

- Figure 66: East Asia Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Electrolyte Type

- Figure 69: East Asia Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by Distribution

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Type

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Electrolyte Type

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Distribution

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Type , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Type , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Electrolyte Type, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Electrolyte Type, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Electrolyte Type

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Distribution, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Distribution, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Distribution

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the electrolyte beer market in 2025?

The global electrolyte beer market is estimated to be valued at USD 610.0 million in 2025.

What will be the size of electrolyte beer market in 2035?

The market size for the electrolyte beer market is projected to reach USD 1,180.0 million by 2035.

How much will be the electrolyte beer market growth between 2025 and 2035?

The electrolyte beer market is expected to grow at a 6.8% CAGR between 2025 and 2035.

What are the key product types in the electrolyte beer market?

The key product types in electrolyte beer market are alcoholic and non-alcoholic.

Which electrolyte type segment to contribute significant share in the electrolyte beer market in 2025?

In terms of electrolyte type, sodium segment to command 40.0% share in the electrolyte beer market in 2025.