Europe Copper Granulator Market

Europe Copper Granulator Market Size and Share Forecast Outlook 2025 to 2035

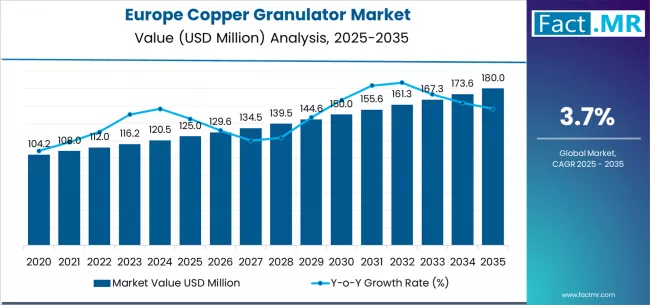

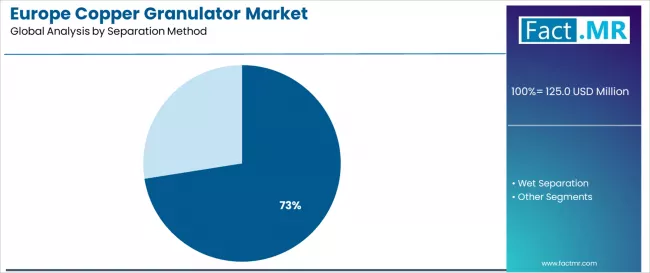

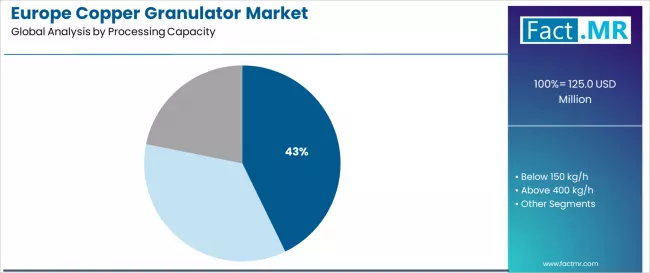

Europe copper granulator market is projected to grow from USD 125.0 million in 2025 to USD 180.0 million by 2035, at a CAGR of 3.7%. 150-400 kg/h will dominate with a 42.8% market share, while dry separation will lead the separation method segment with a 72.5% share.

Copper Granulator Sales Outlook in Europe, 2025 to 2035

The demand for copper granulators in Europe is projected to rise from USD 125 million in 2025 to nearly USD 180 million by 2035, an absolute gain of USD 55 million. This reflects overall growth of 44%, translating into a CAGR of 3.7% over the period.

Quick Stats for Copper Granulator in Europe

- Europe Copper Granulator Sales Value (2025): USD 125.0 million

- Europe Copper Granulator Industry Forecast Value (2035): USD 180.0 million

- Europe Copper Granulator Industry Forecast CAGR: 3.7%

- Leading Separation Method in Europe Copper Granulator Demand: Dry Separation (72.5%)

- Key Growth Countries in Europe Copper Granulator Demand: Poland, Germany, and Italy

- Poland Country Leadership: Poland holds 4.3% CAGR, leading country growth

- Top Key Players in Europe Copper Granulator Demand: Guidetti S.r.l., ELDAN Recycling A/S, Bronneberg, Forrec s.r.l., SUNY GROUP

Sales are anticipated to expand by around 1.44 times, supported by intensifying copper recycling activities, stricter environmental mandates for metal recovery, and a growing commitment to resource conservation across cable recycling, electronics processing, and waste management operations.

With its mature recycling infrastructure and stringent sustainability framework, the European copper granulator industry continues to demonstrate consistent growth potential underpinned by circular economy initiatives, cross-border recycling collaborations, and advancing copper-processing technologies.

Between 2025 and 2030, copper granulator sales in Europe are forecast to climb from USD 125 million to USD 150 million, accounting for nearly 45% of the decade’s total projected increase. This phase will be shaped by growing regional demand for efficient copper recovery systems, driven by tightening recycling regulations and evolving resource-efficiency goals. The adoption of advanced dry-separation and automated processing solutions is expanding rapidly, especially within specialized cable recycling facilities.

Equipment manufacturers are broadening their product portfolios to meet increasingly complex processing requirements and higher recovery-efficiency benchmarks. European recyclers are leading investments in granulation technology, automation, and intelligent process control to achieve superior output quality and throughput performance. Increasing collaboration between equipment suppliers and waste management operators is also fostering greater system integration and performance optimization.

From 2030 to 2035, demand is expected to advance from USD 150 million to USD 180 million, adding USD 30 million, or about 55% of the total ten-year growth. This period will likely be marked by deeper integration of smart processing systems, enhanced separation and quality-monitoring technologies, and the emergence of customized granulation solutions tailored to a wider range of cable materials.

As automation and digitalization reshape recycling operations across Europe, the industry is steadily transitioning toward next-generation copper granulator systems equipped with advanced monitoring, optimization, and predictive-maintenance capabilities. The emphasis on data-driven efficiency and energy optimization is expected to define this stage of growth, making copper granulators a core element of Europe’s green manufacturing and recycling ecosystem.

Between 2020 and 2025, the European copper granulator industry witnessed steady momentum, spurred by regulatory initiatives promoting copper recovery and recycling efficiency, alongside growing recognition of the economic gains from high-purity copper extraction. Equipment developers across the region responded to these shifts by refining granulator design and efficiency, ensuring high recovery rates with consistent metal purity.

Cable recyclers and electronics processors increasingly prioritized optimal equipment configuration and process management to capitalize on the expanding opportunities within Europe’s evolving circular resource framework. The focus on sustainable raw material sourcing and high-value metal reclamation continues to position copper granulators as a vital enabler of Europe’s long-term decarbonization and industrial resilience strategy.

Europe Copper Granulator Key Takeaways

| Metric | Value |

|---|---|

| Europe Copper Granulator Sales Value (2025) | USD 125.0 million |

| Europe Copper Granulator Industry Forecast Value (2035) | USD 180.0 million |

| Europe Copper Granulator Industry Forecast CAGR (2025-2035) | 3.7% |

Why are Copper Granulator Sales Rising Across Europe?

The steady rise in copper granulator sales across Europe is closely linked to the region’s accelerating environmental regulations and circular economy priorities. Europe continues to uphold its reputation as a global leader in sustainability, driving a growing need for efficient copper recovery solutions that combine processing effectiveness, purity optimization, and environmental compliance.

Within cable recycling, electronics dismantling, and waste management operations, modern facilities increasingly rely on advanced copper granulator systems to achieve optimal metal separation, high-purity output, and maximum recovery efficiency. These systems are being designed with greater versatility, offering a range of processing capacities, adaptable separation technologies, and diverse cable-handling capabilities to suit varying operational requirements and copper content profiles.

Heightened environmental awareness and strong policy frameworks emphasizing resource conservation are further amplifying equipment demand across the region. Operators are prioritizing copper granulators that deliver consistent separation accuracy, verifiable purity standards, and user-centric performance benefits, ensuring both operational efficiency and long-term reliability.

The preference for equipment that supports minimal downtime, energy efficiency, and simplified maintenance is reshaping procurement choices across recycling facilities. European manufacturers, known for their engineering precision and commitment to sustainability-driven innovation, continue to set performance benchmarks globally strengthening the region’s leadership in copper processing technology and reinforcing its role in advancing circular resource utilization.

Opportunity Pathways - Sales of Copper Granulator in Europe

The Europe copper granulator sector stands at a pivotal juncture of steady transformation and expansion. With demand projected to grow from USD 125.0 million in 2025 to USD 180.0 million by 2035, a solid 44.0% increase, the sector is being reshaped by recycling imperatives, resource conservation preferences, and the pursuit of operational efficiency with minimal processing complexity. As operators seek effective recovery solutions without compromising operational quality, copper granulators emerge as mission-critical recycling equipment rather than optional processing tools.

Europe, led by Poland (4.3% CAGR) and supported by Germany's manufacturing excellence, Italy's processing capabilities, France's recycling development, and Spain's operational efficiency, represents not just a geography of demand but a laboratory of innovation where processing reliability, purity optimization, and operational efficiency are moving from traditional copper recovery methods to advanced granulation solutions. The confluence of environmental regulations, copper value recovery requirements, and operational optimization creates fertile ground for copper granulator solutions that deliver effective metal recovery with maximum operational convenience.

Strategic pathways encompassing capacity optimization, separation technology advancement, cable type specialization, and end-user application development offer substantial performance enhancement opportunities, particularly for manufacturers and operators positioned at the copper recycling technology frontier.

- Pathway A - Dry Separation Technology and Processing Excellence. Dry separation systems representing 72.5% of separation method demand provide clean processing, environmental compliance, and superior copper purity appealing to operators prioritizing quality recovery and operational efficiency. Manufacturers offering advanced dry separation granulators with optimized air classification can command 15-25% purity premiums while capturing quality-focused operators across European facilities. Expected revenue pool: USD 90-130 million.

- Pathway B - Medium Capacity Processing and Operational Versatility. 150-400 kg/h capacity systems representing 42.8% of processing capacity demand provide optimal balance between throughput and operational flexibility appealing to operators seeking versatile processing solutions. Suppliers offering medium-capacity granulator systems with scalable design capabilities can maintain substantial processing advantages while supporting 20-30% efficiency benefits across mainstream recycling operations. Capacity opportunity: USD 55-85 million.

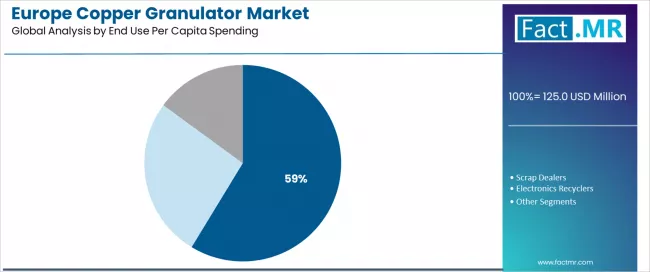

- Pathway C - Cable Recycling Facility Specialization and Per Capita Consumption Focus. Cable recycling applications representing 58.7% of end-user demand provide specialized positioning through telecommunications cable processing, power cable granulation, and industrial cable separation. Equipment manufacturers offering cable facility-specific granulation solutions with appropriate material handling can capture 25-35% specialization premiums in dedicated recycling segments. Specialization potential: USD 70-105 million.

- Pathway D - Communication Cable Processing and Technology Focus. Communication cable processing representing 43.6% of cable type demand create opportunities for specialized processing through fiber optic cable handling, data cable separation, and telecommunications infrastructure recycling. Equipment manufacturers offering communication-specific granulator systems with precise separation can command operational advantages while capturing technology-focused recycling facilities. Technology segment: USD 50-75 million.

- Pathway E - Power Cable Processing and Industrial Applications. Power cable systems representing 38.9% of cable type demand enable high-volume copper recovery and established processing economics serving industrial copper recycling requirements. Equipment manufacturers offering power cable-optimized granulator systems with enhanced separation can capture industrial processing occasions and high-volume material situations while generating 20-30% throughput premiums over communication-focused alternatives. Power opportunity: USD 45-70 million.

Segmental Analysis

The European copper granulator industry can be examined across several key parameters, including processing capacity, separation technology, cable type, and end-user spending behavior. By processing capacity, the industry is categorized into systems operating below 150 kg/h, between 150–400 kg/h, and above 400 kg/h. These categories highlight the range of operational scales—from compact units designed for small recycling setups to high-capacity installations supporting industrial-grade copper recovery.

By separation method, the industry is divided into dry separation and wet separation systems. Each method offers distinct advantages in terms of purity levels, processing speed, and adaptability to varying cable compositions. By cable type, the segmentation includes communication cables, power cables, and automotive cables. This reflects the diversity of applications across sectors where copper recovery is critical, with each segment demanding specialized granulation approaches to maximize efficiency and output quality.

By end-user spending behavior, demand is primarily concentrated among cable recycling plants, scrap dealers, and electronics recyclers. These stakeholders represent varying degrees of technological adoption, processing sophistication, and investment intensity within Europe’s copper recovery ecosystem. Geographically, the analysis covers major European countries such as Germany, Italy, France, the UK, Spain, the Netherlands, and Poland.

Which Separation Method Leads the European Copper Granulator Industry?

Dry separation technology is expected to account for nearly 72.5% of total utilization in 2025, making it the preferred method across Europe’s copper granulator landscape. This dominance reflects operators’ strong preference for clean, efficient systems that deliver superior copper purity, environmental compliance, and operational simplicity compared to wet separation alternatives.

Across the region, dry separation remains the method of choice due to its eco-friendly characteristics, simplified operations, and consistently high output quality. The technology enables manufacturers to integrate air classification, electrostatic separation, and vibration sorting mechanisms, resulting in highly efficient, low-waste processing systems. Ongoing innovations such as improved air-flow designs, enhanced electrostatic efficiency, and advanced dust collection systems continue to elevate dry separation performance.

Beyond technical advantages, dry separation also supports stricter environmental compliance goals, ensuring lower water usage and reduced waste discharge. These factors collectively reinforce its leadership position, as regulators and operators alike favor processing methods that align with sustainability objectives and high-purity copper recovery requirements.

- Strong environmental compliance and high-purity output underpin the dominance of dry separation across European applications.

- Clean operation, reduced waste generation, and process simplicity continue to strengthen operator preference for dry separation systems.

Which Processing Capacity Segment Holds the Largest Share?

Copper granulators with 150–400 kg/h processing capacity are anticipated to represent approximately 42.8% of total utilization in 2025, reflecting their central role in Europe’s copper recovery infrastructure. These medium-capacity systems offer an optimal balance between throughput, flexibility, and investment cost, making them the preferred configuration for both small and mid-scale recycling facilities.

Medium-capacity systems enable operators to achieve substantial processing output with moderate investment levels, manageable space requirements, and operational efficiency without compromising on performance. Their scalability and adaptability make them suitable for diverse operational settings—from independent recyclers to integrated waste management plants.

This segment’s continued strength is supported by growing demand for equipment that combines automation, separation precision, and easy maintenance within a cost-efficient framework. Across Europe, recyclers favor medium-capacity systems for their reliability, balanced economics, and ability to adapt to evolving recovery standards.

- Operational balance and investment efficiency sustain the leadership of medium-capacity systems across European copper granulator operations.

- European recyclers continue to prioritize throughput optimization and cost control through medium-capacity system adoption.

Which End Users Drive the Highest Demand?

Cable recycling facilities are projected to account for around 58.7% of total equipment utilization in 2025, underscoring their pivotal role in Europe’s copper recovery ecosystem. These facilities manage specialized operations such as telecommunications cable recycling, power system decommissioning, and high-volume copper recovery, all of which require precision equipment tailored for different cable structures and material compositions.

Cable recyclers depend on advanced granulation systems to achieve consistent separation, high recovery rates, and operational efficiency at scale. Their strong demand base is reinforced by Europe’s ongoing cable infrastructure renewal, expansion of broadband networks, and modernization of power grids—all of which generate steady volumes of recyclable copper materials.

Supported by established recycling networks and a mature operational ecosystem, cable recycling facilities continue to drive technological advancement and adoption across the region. Their specialized requirements for purity assurance, process automation, and material traceability are shaping new equipment standards and influencing design evolution across the European copper granulator industry.

- Specialized operations and high-volume processing sustain cable recycling facilities as the leading end-user segment in Europe.

- Continuous infrastructure renewal and established recycling networks reinforce their long-term demand stability and technological leadership.

What are the Key Drivers, Restraints, and Emerging Trends influencing Copper Granulator Demand in Europe?

The growing focus on environmental sustainability and stringent European regulations governing metal recovery are primary factors driving demand for copper granulators. Recycling facilities are increasingly investing in advanced processing equipment to comply with waste management directives, minimize landfill dependence, and optimize copper purity recovery.

The region’s commitment to circular economy principles, coupled with expanding cable recycling operations and e-waste management initiatives, continues to strengthen adoption. Additionally, the rising economic appeal of high-purity copper extraction is reinforcing technology upgrades and operational efficiency improvements across the recycling value chain.

Several challenges temper industry expansion. High upfront investment costs remain a key restraint, particularly for small and mid-sized recyclers with limited capital capacity. Variations in cable composition and insulation types also necessitate specialized processing configurations, adding to equipment customization requirements.

Operational complexity, maintenance costs, and skill dependencies present barriers for facilities with limited technical resources. These constraints underscore the need for scalable, user-friendly systems capable of delivering consistent recovery performance with reduced operational overhead.

Technological innovation and automation are shaping the next phase of development within the European copper granulator landscape. Manufacturers are introducing advanced systems integrating AI-driven process control, sensor-based sorting, and real-time quality monitoring to enhance separation precision and energy efficiency.

The industry is also witnessing a transition toward modular, digitally connected equipment designed to support predictive maintenance and minimize downtime. Growing emphasis on data-driven optimization, energy-efficient operation, and sustainable equipment design is expected to define the evolution of copper granulator systems across Europe over the coming decade.

Expansion of Circular Economy Policies and Copper Recovery Directives

The strengthening of circular economy frameworks across Europe continues to accelerate the adoption of high-efficiency copper recovery systems. Regulatory directives emphasizing resource conservation, metal recovery, and waste minimization are encouraging recyclers to invest in equipment capable of delivering superior performance without operational complexity. Copper granulators equipped with advanced separation and processing capabilities enable recycling facilities, electronics processors, and waste management operators to meet stringent compliance standards while optimizing recovery rates and production throughput.

These developments are particularly advantageous for equipment manufacturers offering integrated, compliance-ready processing solutions. Systems designed for maximum copper yield, complete material separation, and consistent operational reliability are gaining preference among European operators striving to align sustainability goals with cost-effective processing. The region’s evolving regulatory climate continues to favor technology providers capable of combining environmental compliance with measurable efficiency gains—cementing copper granulators as critical assets within Europe’s broader resource circularity initiatives.

Integration of Advanced Separation Technologies and Quality Monitoring Systems

Granulator manufacturers are increasingly focusing on intelligent processing solutions that combine advanced electrostatic separation, automated quality monitoring, and real-time performance optimization. These technologies enhance recovery efficiency, ensure consistent purity levels, and streamline operational workflows, key priorities for quality-driven recycling facilities. The integration of real-time control systems allows for automatic process adjustments, ensuring stable output even under variable input conditions.

Emerging solutions now feature AI-enabled optimization, predictive maintenance scheduling, and automated purity certification, marking a shift toward smart, connected granulation ecosystems. European manufacturers are at the forefront of this evolution, blending traditional processing reliability with cutting-edge automation and data-driven quality control. This convergence of engineering precision and digital innovation is reshaping operator expectations and influencing procurement decisions across the continent, as recyclers seek systems that deliver both operational dependability and continuous process intelligence.

How is the Copper Granulator Landscape evolving in Key European Countries?

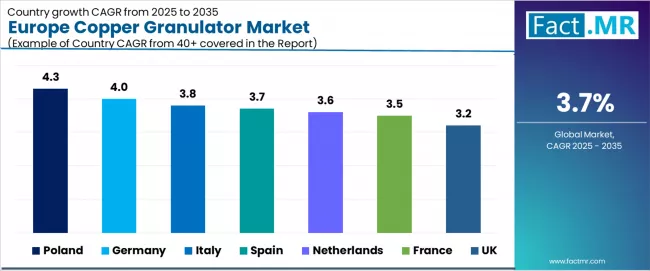

| Country | CAGR (2025-2035) |

|---|---|

| Poland | 4.3% |

| Germany | 4.0% |

| Italy | 3.8% |

| Spain | 3.7% |

| Netherlands | 3.6% |

| France | 3.5% |

| UK | 3.2% |

The Europe copper granulator industry continues to register steady expansion, underpinned by stringent environmental regulations, growing focus on copper recovery, and the adoption of advanced processing technologies across recycling ecosystems. Poland leads regional growth with a CAGR of 4.3%, reflecting robust recycling infrastructure, enhanced copper processing capacity, and strong policy support for metal recovery initiatives. Germany follows closely with a 4.0% CAGR, benefiting from its manufacturing excellence and integration of cutting-edge recycling technologies.

Italy exhibits a 3.8% growth rate, driven by expanding recycling networks and increased adoption of efficient processing systems. Spain maintains a 3.7% CAGR, supported by continuous recycling infrastructure development and broader processing modernization. The Netherlands, growing at 3.6%, leverages its environmental leadership and innovation-driven processing advancements. France records a 3.5% CAGR, while the UK posts 3.2%, both propelled by heightened regulatory compliance mandates and a persistent push toward operational efficiency improvement.

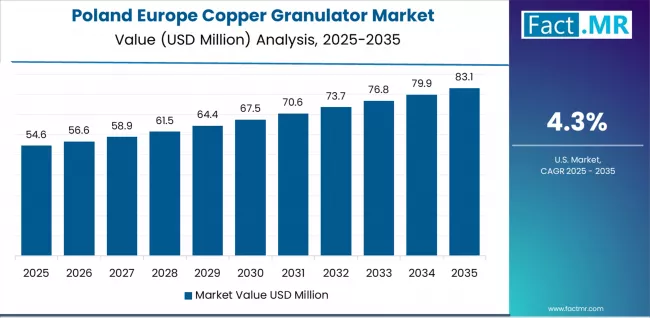

How is Poland leading Europe’s Copper Granulator Expansion through Recycling Infrastructure and Processing Capacity Development?

Sales of copper granulators in Poland are projected to record a 4.3% CAGR through 2035, underscoring the nation’s emergence as one of Europe’s fastest-growing copper recovery hubs. The country’s expanding recycling ecosystem—driven by urban development, policy-backed sustainability programs, and industrial modernization, is strengthening its material recovery capabilities. Continuous infrastructure expansion across municipal and private recycling centers is enabling high-capacity processing of cable waste and electronic scrap, aligning with the EU’s broader environmental sustainability objectives.

Poland’s rapid growth is further supported by policy alignment and regulatory clarity around circular economy targets, prompting operators to adopt automated granulation systems that enhance recovery precision and reduce processing losses. Facilities are increasingly equipped with systems that combine high separation accuracy and operational efficiency while maintaining low emissions and easy maintenance standards. These developments have positioned Poland at the forefront of Europe’s recycling reform, where copper granulators serve as critical enablers of economic and environmental efficiency.

Collaborations between local recyclers, municipalities, and equipment manufacturers are further advancing process innovation across the Polish recycling sector. This ecosystem approach is promoting both technology transfer and operational upskilling, allowing smaller facilities to adopt scalable, cost-effective copper granulation solutions. Collectively, these trends highlight Poland’s growing influence in Europe’s recycling transition and its commitment to sustainable metal recovery.

- Recycling infrastructure expansion and copper processing capacity development are driving robust copper granulator adoption across cable recycling, electronics recovery, and specialized waste management facilities.

- Regulatory compliance and recovery efficiency mandates are reinforcing technology upgrades and investment, positioning Poland as a key European hub for advanced recycling development.

How does Manufacturing Excellence and Technological Leadership Pivot Copper Granulator Sales in Germany?

Germany’s copper granulator adoption is advancing at a 4.0% CAGR, propelled by its legacy of engineering excellence, robust recycling networks, and industrial innovation culture. The nation’s facilities are characterized by precision manufacturing, advanced automation, and stringent quality control—traits that seamlessly translate into its growing demand for high-performance granulation systems.

German recyclers are integrating cutting-edge separation technologies such as automated electrostatic systems, vibration sorting, and real-time purity monitoring to achieve consistent recovery efficiency. The emphasis on data-driven processing optimization allows operators to maintain exceptional copper yield while minimizing operational downtime and environmental impact. These systems reflect Germany’s commitment to technological precision and sustainability, a combination that continues to shape the country’s leadership in copper recovery efficiency.

government-backed sustainability initiatives and R&D funding are accelerating the deployment of next-generation recycling technologies. Equipment suppliers and facility operators are jointly investing in energy-efficient, automation-ready systems that support Germany’s industrial decarbonization goals. This alignment of technology and policy ensures that the country remains a benchmark for operational reliability, productivity, and environmental compliance within Europe.

- Manufacturing excellence and continuous innovation are fostering widespread adoption of high-performance granulation systems across German recycling operations.

- Operational reliability and automation-driven processing optimization reinforce Germany’s leadership in sustainable, technology-enabled copper recovery.

Will Expanding Recycling Capabilities and Processing Infrastructure sustain Demand Expansion in Italy?

Italy is progressing at a 3.8% CAGR, supported by its expanding recycling infrastructure, manufacturing agility, and a growing commitment to waste reduction. The Italian recycling ecosystem is increasingly adopting copper granulators designed for optimal throughput and minimal material loss—particularly across the electrical, automotive, and construction recycling sectors.

The expansion of regional recycling hubs across Northern Italy is central to this growth. These hubs integrate modern material separation and cable recovery systems that maximize copper extraction efficiency. Local governments and industrial clusters are promoting collaborative initiatives that connect recyclers with equipment manufacturers, encouraging the diffusion of automation-driven granulation systems across mid- and large-scale facilities.

Italy’s environmental regulations continue to evolve in harmony with EU circular economy targets, emphasizing waste reduction, recovery optimization, and resource reuse. These reforms are incentivizing operators to invest in advanced granulation technology featuring modular setups and simplified maintenance protocols, ensuring operational scalability and cost efficiency.

- Expanding recycling infrastructure and processing modernization are driving Italy’s adoption of high-efficiency granulators across multiple industrial recycling segments.

- Policy alignment with EU sustainability objectives is accelerating technology investment and facility modernization throughout Italian operations.

What Factors Support Spain’s Steady Copper Granulator Expansion?

Spain’s copper granulator adoption is increasing at a 3.7% CAGR, supported by enhanced recycling infrastructure and rising awareness of sustainable waste management practices. The nation’s recycling operators are integrating technologically advanced systems to meet growing environmental mandates while improving material recovery efficiency across high-volume operations.

The Spanish recycling landscape is undergoing steady industrial transformation, particularly in regions such as Catalonia, Madrid, and Valencia, where processing centers are expanding capacity and upgrading to automation-ready systems. These facilities are embracing digital monitoring tools and precision separation technologies that optimize recovery yield and minimize contamination levels.

Spain’s government continues to enforce stringent waste management and recovery regulations, encouraging modernization across public and private recycling sectors. This focus on compliance and traceability has fostered investment in granulation equipment that balances cost-efficiency with technological reliability, ensuring consistent copper purity and reduced operational complexity.

- Recycling development and regulatory focus on traceable, efficient copper recovery are stimulating equipment adoption across Spanish operations.

- Growing investment in automation and process innovation is strengthening Spain’s position as a steadily advancing European recycling landscape.

How will Environmental Leadership and Processing Innovation influence Copper Granulator Sales in the Netherlands?

The Netherlands maintains a 3.6% CAGR, supported by its long-standing commitment to environmental excellence and circular economy integration. Dutch recycling operators emphasize the deployment of energy-efficient, low-emission granulation systems that align with the nation’s sustainability-first policy framework.

The country’s advanced waste management infrastructure and innovation culture are enabling facilities to adopt intelligent separation systems equipped with predictive maintenance, precision airflow management, and automated purity verification. These capabilities enhance operational transparency, reduce downtime, and improve copper recovery accuracy across diverse recycling applications.

Collaborations between academic institutions, industrial partners, and municipal bodies continue to drive the Netherlands’ leadership in recycling innovation. Joint research programs are fostering digitalization and system modularity in granulation technologies, ensuring that operations remain both scalable and environmentally compliant.

- Environmental stewardship and innovation-driven engineering continue to underpin copper granulator adoption across Dutch recycling facilities.

- Integration of predictive, modular, and AI-enhanced systems positions the Netherlands as a European leader in sustainable copper recovery technology.

What drives France’s Progress in the Copper Granulator Landscape?

France is advancing at a 3.5% CAGR, supported by national recycling reforms and a strategic push toward circular production. The country’s recycling ecosystem is evolving rapidly, emphasizing automation, quality assurance, and consistent recovery performance across electronic and industrial waste operations.

The rise of smart recovery facilities equipped with real-time purity monitoring, automated separation, and digital quality tracking is transforming the operational landscape. French recyclers are increasingly prioritizing process optimization and environmental compliance, driving the adoption of granulators capable of maintaining copper purity above regulatory thresholds.

Additionally, government-led programs and financial incentives for green equipment upgrades are stimulating technology adoption. Partnerships between local recyclers and European equipment manufacturers are resulting in the integration of AI-enabled and modular copper recovery systems tailored to France’s growing industrial recycling needs.

- Strengthening national recycling regulations and modernization incentives are propelling copper granulator adoption across France’s recycling facilities.

- Technological integration and environmental efficiency are defining factors sustaining France’s copper recovery momentum.

How is the UK Strengthening Its Copper Granulator Ecosystem?

The UK is registering a 3.2% CAGR, driven by the country’s evolving recycling ecosystem and its commitment to sustainable industrial practices. Post-Brexit policy restructuring has led to revised environmental standards that prioritize higher recovery rates and traceable waste management frameworks, promoting modernization across recycling facilities.

UK operators are adopting automation-driven granulation systems featuring AI-supported quality assessment, predictive maintenance, and automated process calibration. These systems enhance throughput consistency, improve purity levels, and reduce operating costs, aligning with the nation’s efficiency-focused industrial strategy.

The government’s emphasis on circular economy integration and industrial decarbonization is accelerating equipment investments. Collaborative initiatives between recycling associations, local authorities, and equipment developers are supporting infrastructure expansion and operational reliability across copper recovery operations.

- Efficiency-driven modernization and compliance alignment are reinforcing the UK’s adoption of advanced copper granulation systems.

- Strong policy support and technology integration are sustaining steady progress in the nation’s copper recovery and recycling advancement.

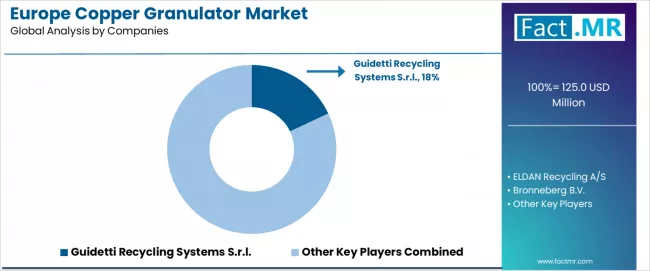

Competitive Landscape of Sales of Copper Granulator in Europe

Europe’s copper granulator segment is characterized by intense competition among specialized recycling equipment manufacturers, diversified metal recovery technology providers, and regional processing equipment developers catering to evolving copper recovery requirements.

Companies are prioritizing processing reliability, system efficiency, and automation integration to deliver advanced granulation systems suited for complex recycling operations. The focus remains on strengthening product differentiation through superior separation technology, simplified operation, and improved throughput efficiency, ensuring sustained demand across small- and large-scale recycling facilities.

Guidetti S.r.l., an Italian-based copper recycling specialist, maintains a strong European presence with an extensive product line covering dry separation and granulation systems. The company’s offerings are recognized for robust design, user-friendly operation, and high metal recovery precision. Its commitment to continuous R&D and process refinement enhances operational coverage across European recycling networks, reinforcing its leadership position in the copper processing equipment space.

ELDAN Recycling A/S, headquartered in Denmark, emphasizes technology-driven recycling excellence. Its copper granulation systems are engineered for energy efficiency, minimal material loss, and adaptability across varying feedstock compositions. The company’s ongoing focus on modular equipment configurations and automation upgrades allows recyclers to scale operations seamlessly while ensuring compliance with evolving environmental standards.

Bronneberg, a well-established European equipment producer, provides durable and reliable granulation solutions tailored for copper cable processing applications. The company’s systems combine robust engineering with straightforward maintenance and long operational lifespans, addressing the needs of both independent recyclers and integrated facilities. Similarly, Forrec s.r.l. focuses on maximizing recovery efficiency and minimizing downtime through process optimization, while SUNY GROUP extends diversified recycling system solutions emphasizing consistent output and cost-effective performance across different copper recovery applications.

Recent developments across the segment underline continued investment in automation, precision sorting, and enhanced recovery efficiency. Leading manufacturers are integrating smart control systems and IoT-enabled diagnostics to improve operational monitoring and minimize maintenance costs. This wave of innovation reflects a collective push toward achieving greater processing sustainability, reduced energy footprints, and higher material purity levels across Europe’s copper recycling infrastructure.

Key Players in Sales of Copper Granulator in Europe

- Guidetti Recycling Systems S.r.l.

- ELDAN Recycling A/S

- Bronneberg B.V.

- FOR REC S.r.l

- SUNY GROUP

- Zhengzhou Gofine Machine Equipment Co., Ltd.

- Amisy Metal Recycling Machinery Co., Ltd.

- Henan Doing Environmental Protection Technology Co., Ltd.

- San Lan Technologies Co., Ltd.

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 180.0 Million |

| Processing Capacity | Below 150 kg/h, 150-400 kg/h, above 400 kg/h |

| Separation Method | Dry separation, wet separation |

| Cable Type | Communication cable, power cable, automotive cable |

| End User Per Capita Spending | Cable recycling facilities, scrap dealers, electronics recyclers |

| Regions Covered | Europe |

| Countries Covered | Germany, Italy, France, United Kingdom, Spain, Netherlands, Poland |

| Key Companies Profiled | Guidetti S.r.l., ELDAN Recycling A/S, Bronneberg, Forrec s.r.l., SUNY GROUP, Zhengzhou Gofine Machine, Amisy Metal Recycling, Henan Doing Environmental Protection, San Lan Technologies |

| Additional Attributes | Dollar sales by processing capacity configuration, separation method technology, cable type processing, and end-user application, per capita spending trends across Germany, Italy, France, United Kingdom, Spain, Netherlands, and Poland, competitive landscape with international recycling equipment manufacturers and specialized copper processing producers, operator preferences for processing capabilities and recovery formats, integration with automation technologies and smart processing initiatives, innovations in dry separation systems and material optimization positioning, and adoption of efficient processing solutions, specialized configurations, and monitoring capabilities for enhanced operational access and recovery satisfaction across European cable recycling, scrap processing, and electronics recycling operations |

Sales of Copper Granulator in Europe by Segments

-

Processing Capacity :

- Below 150 kg/h

- 150-400 kg/h

- Above 400 kg/h

-

Separation Method :

- Dry Separation

- Wet Separation

-

Cable Type :

- Communication Cable

- Power Cable

- Automotive Cable

-

End User Per Capita Spending :

- Cable Recycling Facilities

- Scrap Dealers

- Electronics Recyclers

-

Region :

- Europe

- Germany

- Italy

- France

- United Kingdom

- Spain

- Netherlands

- Poland

- Europe

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Processing Capacity

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Processing Capacity, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Processing Capacity, 2025 to 2035

- 150-400 kg/h

- Below 150 kg/h

- Above 400 kg/h

- Y to o to Y Growth Trend Analysis By Processing Capacity, 2020 to 2024

- Absolute $ Opportunity Analysis By Processing Capacity, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Separation Method

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Separation Method, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Separation Method, 2025 to 2035

- Dry Separation

- Wet Separation

- Y to o to Y Growth Trend Analysis By Separation Method, 2020 to 2024

- Absolute $ Opportunity Analysis By Separation Method, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use Per Capita Spending

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End Use Per Capita Spending, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End Use Per Capita Spending, 2025 to 2035

- Cable Recycling Facilities

- Scrap Dealers

- Electronics Recyclers

- Y to o to Y Growth Trend Analysis By End Use Per Capita Spending, 2020 to 2024

- Absolute $ Opportunity Analysis By End Use Per Capita Spending, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- By Country

- Market Attractiveness Analysis

- By Country

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Processing Capacity

- By Separation Method

- By End Use Per Capita Spending

- Competition Analysis

- Competition Deep Dive

- Guidetti Recycling Systems S.r.l.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ELDAN Recycling A/S

- Bronneberg B.V.

- FOR REC S.r.l

- SUNY GROUP

- Zhengzhou Gofine Machine Equipment Co., Ltd.

- Amisy Metal Recycling Machinery Co., Ltd.

- Henan Doing Environmental Protection Technology Co., Ltd.

- San Lan Technologies Co., Ltd.

- Guidetti Recycling Systems S.r.l.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Processing Capacity, 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Separation Method, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by End Use Per Capita Spending, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Processing Capacity

- Figure 6: Global Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Separation Method

- Figure 9: Global Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Processing Capacity

- Figure 26: North America Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Separation Method

- Figure 29: North America Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Processing Capacity

- Figure 36: Latin America Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Separation Method

- Figure 39: Latin America Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Processing Capacity

- Figure 46: Western Europe Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Separation Method

- Figure 49: Western Europe Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Processing Capacity

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Separation Method

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Processing Capacity

- Figure 66: East Asia Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Separation Method

- Figure 69: East Asia Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Processing Capacity

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Separation Method

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Processing Capacity, 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Processing Capacity, 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Processing Capacity

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Separation Method, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Separation Method, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Separation Method

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by End Use Per Capita Spending, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by End Use Per Capita Spending, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by End Use Per Capita Spending

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the europe copper granulator market in 2025?

The global europe copper granulator market is estimated to be valued at USD 125.0 million in 2025.

What will be the size of europe copper granulator market in 2035?

The market size for the europe copper granulator market is projected to reach USD 180.0 million by 2035.

How much will be the europe copper granulator market growth between 2025 and 2035?

The europe copper granulator market is expected to grow at a 3.7% CAGR between 2025 and 2035.

What are the key product types in the europe copper granulator market?

The key product types in europe copper granulator market are 150-400 kg/h, below 150 kg/h and above 400 kg/h.

Which separation method segment to contribute significant share in the europe copper granulator market in 2025?

In terms of separation method, dry separation segment to command 72.5% share in the europe copper granulator market in 2025.