Europe Electrical Steel Market

Europe Electrical Steel Market Analysis, By Product Type, By Application, By End-use, and Countries - Market Insights 2025 to 2035

Analysis of Europe Electrical Steel Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Europe Electrical Steel Market Outlook (2025 to 2035)

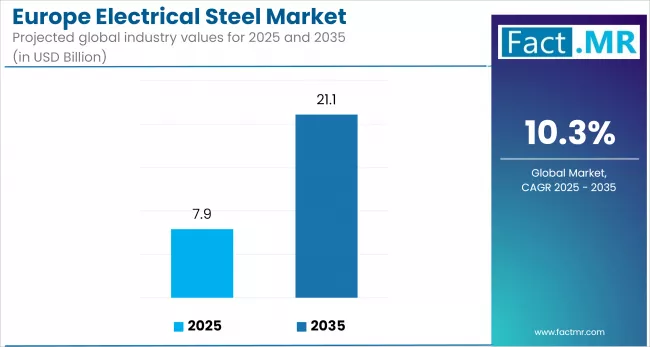

The Europe Electrical Steel Market is projected to increase from USD 7.9 billion in 2025 to USD 21.1 billion by 2035, at a growth rate of 10.3%, driven by rising demand for electric vehicles, renewable energy infrastructure, and energy-efficient power distribution systems.

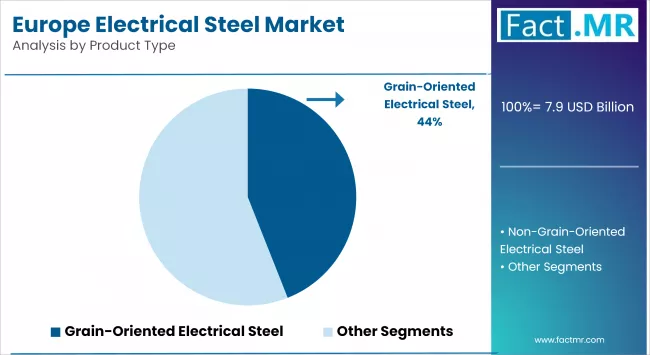

Increased use of grain-oriented and non-grain-oriented electrical steel in transformers and EV motors, in Germany, France, and the Netherlands, reflects Europe’s broader push toward electrification and carbon reduction.

What are the Drivers of the Europe Electrical Steel Market?

A combination of industrial transformation, energy transition policies, and technological innovation drives the growth of the European electrical steel market.

One of the primary drivers is the surge in electric vehicle (EV) production, especially in Germany, France, and the Nordic countries. Electrical steel, non-grain-oriented (NGO) grades, is essential for manufacturing efficient electric motors used in EVs. As automakers scale up their EV offerings to meet EU emission targets and consumer demand, the need for high-performance electrical steel continues to rise.

In the energy sector, expanding investments in renewable energy infrastructure such as wind and solar are fueling demand for grain-oriented (GO) electrical steel. These steels are crucial for power transformers, which enable grid stability and efficient electricity transmission. Upgrades to aging grid infrastructure and the development of smart grids across the region further support this trend.

Another key factor is the modernization of industrial equipment, where efficiency regulations are pushing manufacturers to adopt motors with lower energy loss. Electrical steel's magnetic properties make it a preferred material for building compact, efficient machinery across manufacturing, HVAC, and automation sectors.

EU policies are also influencing the market focused on decarbonization and energy efficiency, including the European Green Deal and the Fit for 55 packages. These frameworks promote the use of low-loss electrical steel in energy-intensive systems and support research and development in next-generation magnetic materials.

Additionally, growth in rail and public transit systems and high-speed rail projects is contributing to demand for durable electrical steel used in traction motors and auxiliary systems.

What are the Country Trends of the Europe Electrical Steel Market?

The European electrical steel market reflects varying growth dynamics across key countries, shaped by industrial priorities, electrification strategies, and infrastructure investments.

Germany leads in demand, driven by its advanced automotive sector and leadership in electric vehicle production. Major OEMs like Volkswagen, BMW, and Mercedes-Benz are scaling up EV manufacturing, which requires large volumes of non-grain-oriented (NGO) electrical steel for high-efficiency traction motors. Additionally, Germany’s energy transition policies (Energiewende) are accelerating upgrades in power grids and transformer networks, further boosting grain-oriented (GO) electrical steel consumption.

France is experiencing steady growth, driven by its robust power generation sector and national plans to modernize transmission infrastructure. The country’s increasing investment in nuclear and renewable energy has raised the demand for high-performance transformer cores and electric machinery applications, where GO electrical steel plays a central role.

Italy is a significant consumer of electrical steel in industrial automation, home appliance manufacturing, and the automotive sector. The country is also expanding smart grid infrastructure and investing in energy-efficient systems under its national recovery plan, adding momentum to both NGO and GO steel demand.

The United Kingdom is seeing rising consumption of electrical steel through grid modernization projects and EV adoption. With initiatives such as the Net Zero Strategy and support for offshore wind expansion, electrical steel is gaining significance in transformer manufacturing and energy storage systems.

Spain is emerging as a growing market due to the rapid deployment of solar and wind power projects, which require electrical steel for power conversion and grid integration systems. Spain’s increasing focus on energy-efficient public transport is also contributing to the uptake of electrical steel in rail and metro systems.

Poland and the Czech Republic are also showing rising demand, supported by growing automotive production and foreign direct investment in EV component manufacturing. These markets are becoming attractive hubs for suppliers of electrical steel and related magnetic materials.

What are the Challenges and Restraining Factors of the Europe Electrical Steel Market?

The European electrical steel market faces challenges that could hinder its growth despite strong demand across the automotive, energy, and industrial sectors. High production costs, largely due to Europe’s elevated energy prices and the energy-intensive nature of electrical steel manufacturing, are impacting competitiveness in countries like Germany and Italy.

Additionally, the region remains dependent on imported raw materials such as high-purity iron ore and silicon, exposing it to global supply chain disruptions and price volatility. A shortage of regional capacity for advanced grades, especially non-grain-oriented steel used in electric vehicle motors, has further increased reliance on imports from Asia, leading to longer lead times and cost pressures. Small and mid-sized manufacturers often lack the technical and financial resources to integrate premium electrical steel into their products, slowing the adoption of energy-efficient technologies.

At the same time, environmental regulations and carbon pricing under the EU Green Deal are raising compliance costs for steel producers, delaying capacity expansions. Competitive pricing from low-cost Asian imports adds further pressure on local suppliers. Moreover, infrastructure modernization in Central and Eastern Europe continues to lag, limiting uniform demand across the region. These factors collectively present structural and economic hurdles for the electrical steel market in Europe.

Country-Wise Outlook

Germany Electrical Steel Market Sees Strong Momentum Driven by EV Expansion and Grid Modernization

Germany’s electrical steel market is expanding steadily, driven by rising electric vehicle production and grid modernization efforts. Major automakers like Volkswagen and BMW are boosting demand for non-grain-oriented electrical steel used in EV motors.

At the same time, the country’s energy transition is accelerating the need for grain-oriented steel in transformers and renewable energy infrastructure. Domestic producers are investing in advanced manufacturing to meet efficiency targets, though high energy costs and regulatory pressures pose ongoing challenges. Overall, Germany remains a key driver of electrical steel demand in the European market.

France Electrical Steel Market Shows Strategic Expansion Through Industrial Investment and Renewable Integration

France’s electrical steel market is expanding steadily, driven by strong government support, industrial upgrades, and increasing demand from the electric mobility and power sectors. The country's push for energy transition is creating a rising need for both grain-oriented and non-grain-oriented electrical steel used in transformers, EV motors, and rotating machines.

A major boost came with ArcelorMittal’s commissioning of a new electrical steel plant in Mardyck in 2024. Backed by the France 2030 recovery plan, the facility focuses on producing high-grade NGO electrical steel for electric vehicles and industrial applications, reducing the nation’s reliance on imports and enhancing domestic supply chains.

In parallel, France is rapidly scaling up renewable energy infrastructure, solar and wind power. This is increasing the demand for grain-oriented electrical steel used in transformers and high-voltage equipment required for grid integration. As the country modernizes its power infrastructure and electrifies transport systems, the need for efficient, low-loss magnetic materials is accelerating.

France’s integrated approach, combining local manufacturing expansion, renewable energy development, and support for clean technology, is positioning its electrical steel market for continued growth and regional leadership in sustainable industrial transformation.

Italy Electrical Steel Market Advances with Industrial Upgrades and EV Growth

Italy’s electrical steel market is progressing steadily, supported by modernization in manufacturing, expanding EV production, and renewable energy development. Demand for non-grain-oriented electrical steel is rising in sectors like automotive and home appliances, especially in industrial hubs such as Turin and Modena. Meanwhile, growth in solar and wind power is increasing the need for grain-oriented steel in transformers and grid equipment.

Backed by the National Recovery and Resilience Plan, investments in smart grids and local processing capabilities are strengthening Italy’s role in Europe’s electrical steel supply chain.

Category-wise Analysis

Non-Grain-Oriented Electrical Steel to Exhibit Leading Share by Product Type

Non-grain-oriented (NGO) electrical steel is anticipated to hold the leading share by product type in the European market, propelled by its wide-ranging applications in electric motors, generators, household appliances, and industrial equipment. Unlike grain-oriented steel, NGO variants offer uniform magnetic properties in all directions, making them ideal for rotating machinery and dynamic energy systems.

The growing adoption of electric vehicles across Europe is a key factor reinforcing this trend. OEMs and Tier 1 suppliers increasingly rely on high-grade NGO electrical steel to improve motor efficiency, reduce energy losses, and meet stringent emissions and energy performance standards. Countries such as Germany, France, and the Netherlands are witnessing a sharp rise in EV production, which directly correlates with increased consumption of NGO materials.

Beyond automotive, NGO electrical steel is widely used in HVAC systems, pumps, and compressors, sectors undergoing rapid electrification and efficiency upgrades. Demand is also supported by policy-driven transitions toward smart appliances and low-energy equipment under EU EcoDesign regulations.

With ongoing advancements in processing technologies, such as improved coating techniques and precision lamination, NGO electrical steel is becoming efficient and cost-effective, securing its position as the preferred product type for high-performance electrical applications across Europe.

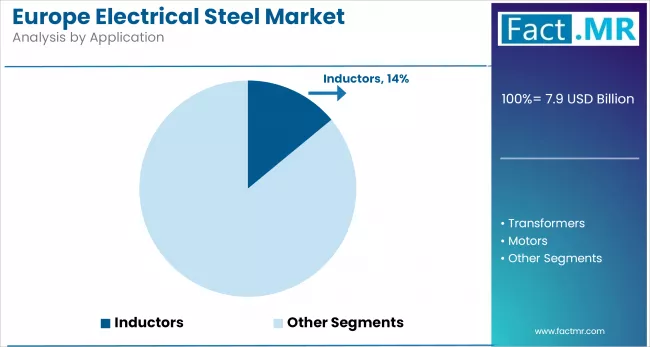

Motors to Exhibit Leading Share by Application

Motors are poised to dominate the European electrical steel market, driven by increasing electric vehicle production, industrial automation, and stricter energy efficiency regulations. Non-grain-oriented steel is essential for motors in EVs, HVAC systems, and factory equipment.

With major automakers and industries upgrading to high-efficiency motor systems, demand continues to grow. Renewable energy projects also contribute, using motors in turbines and generators. Supported by EU sustainability policies and design innovation, the motor segment is expected to remain the primary application for electrical steel across the region.

Automotive Sector to Hold Leading Share in Europe Electrical Steel Market

The automotive industry is set to hold the largest share of Europe’s electrical steel market, driven by rapid expansion in electric vehicle (EV) production and stricter energy efficiency standards. Major automakers like Volkswagen, BMW, and Renault are increasing demand for non-grain-oriented electrical steel used in motors and inverters.

Government incentives and EU climate policies further accelerate the shift. In addition to EVs, hybrid models and charging infrastructure are boosting consumption, making the automotive sector a key driver of electrical steel demand across the region.

Competitive Analysis

Europe’s electrical steel market is shaped by major producers and technology providers responding to rising demand across EVs, energy, and industrial sectors. ArcelorMittal leads with new capacity in France focused on EV and machinery applications, while Thyssenkrupp AG supplies a broad range of grades for automotive and power sectors.

NLMK, Voestalpine, and Aperam offer advanced NGO and GO steels for motors, transformers, and automation systems. Cogent Power (Tata Steel) supports grid modernization, and regional players like Acciaieria Arvedi, SMS Group, and Severstal meet localized needs. These companies are central to Europe’s electrification and efficiency goals.

Recent Development

- In 2024, ArcelorMittal commissioned a new high-tech electrical steel unit at Mardyck, France, which tripled local capacity and created over 100 jobs. The €300 million facility supports EV motors and industrial machinery, complementing its Saint-Chély plant.

- In 2025, Thyssenkrupp Steel unveiled its Bluemint Powercore GO electrical steel series at CWIEME Berlin, featuring up to 50% reduced CO₂ footprint and applications in axial‑flux motors and transformers

Segmentation of the Europe Electrical Steel Market

-

By Product Type :

- Grain-Oriented Electrical Steel

- Non-Grain-Oriented Electrical Steel

- Fully-Processed

- Semi-Processed

-

By Application :

- Inductors

- Transformers

- Transmission

- Portable

- Distribution

- Motors

- 1hp - 100hp

- 101hp - 200hp

- 201hp - 500hp

- 501hp - 1000hp

- Above 1000hp

-

By End-use Industry :

- Automotive

- Manufacturing

- Energy

- Household Appliances

- Others (Construction, Fabrication)

-

By Countries :

- Germany

- Italy

- France

- Spain

- UK

- Russia

- BENELUX

- Rest of Europe

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis, 2020 to 2024

- Current and Future Market Size Value (US$ Bn) & Volume (Units) Projections, 2025 to 2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Introduction / Key Findings

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis By Product Type, 2020 to 2024

- Current and Future Market Size Value (US$ Bn) & Volume (Units) Analysis and Forecast By Product Type, 2025 to 2035

- Grain-Oriented Electrical Steel

- Non-Grain-Oriented Electrical Steel

- Fully-Processed

- Semi-Processed

- Y-o-Y Growth Trend Analysis By Product Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Product Type, 2025 to 2035

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis By Application, 2020 to 2024

- Current and Future Market Size Value (US$ Bn) & Volume (Units) Analysis and Forecast By Application, 2025 to 2035

- Inductors

- Transformers

- Transmission

- Portable

- Distribution

- Motors

- Y-o-Y Growth Trend Analysis By Application, 2020 to 2024

- Absolute $ Opportunity Analysis By Application, 2025 to 2035

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Motor Type

- Introduction / Key Findings

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis By Motor Type, 2020 to 2024

- Current and Future Market Size Value (US$ Bn) & Volume (Units) Analysis and Forecast By Motor Type, 2025 to 2035

- 1hp - 100hp

- 101hp - 200hp

- 201hp - 500hp

- 501hp - 1000hp

- Above 1000hp

- Y-o-Y Growth Trend Analysis By Motor Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Motor Type, 2025 to 2035

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-use Industry

- Introduction / Key Findings

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis By End-use Industry, 2020 to 2024

- Current and Future Market Size Value (US$ Bn) & Volume (Units) Analysis and Forecast By End-use Industry, 2025 to 2035

- Automotive

- Manufacturing

- Energy

- Household Appliances

- Others

- Y-o-Y Growth Trend Analysis By End-use Industry, 2020 to 2024

- Absolute $ Opportunity Analysis By End-use Industry, 2025 to 2035

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (US$ Bn) & Volume (Units) Analysis By Region, 2020 to 2024

- Current Market Size Value (US$ Bn) & Volume (Units) Analysis and Forecast By Region, 2025 to 2035

- Germany

- Italy

- France

- UK

- Russia

- BENELUX

- Rest of Europe

- Market Attractiveness Analysis By Region

- Germany Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- Italy Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- France Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- UK Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- Russia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- BENELUX Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- Rest of Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (US$ Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (US$ Bn) & Volume (Units) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Market Attractiveness Analysis

- By Country

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Key Takeaways

- Key Countries Market Analysis

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Value (US$ Bn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Germany

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product Type

- By Application

- By Motor Type

- By End-use Industry

- Competition Analysis

- Competition Deep Dive

- Novolipetsk Steel (NMLK)

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ArcelorMittal

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Cogent Power Limited

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Phoenix Mecano AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Thyssenkrupp AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Voestalpine Camtec GmbH

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Aperam S.A.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- SMS Group GmbH

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Acciaieria Arvedi

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Arconic International GmbH

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Erdemir Romania S.R.L.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Severstal

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Novolipetsk Steel (NMLK)

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Market Value (US$ Bn) Forecast by Region, 2020 to 2035

- Table 2: Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 4: Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 5: Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 6: Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 7: Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 8: Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 9: Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 10: Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 11: Germany Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 12: Germany Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 13: Germany Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 14: Germany Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 15: Germany Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 16: Germany Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 17: Germany Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 18: Germany Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 19: Germany Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 20: Germany Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 21: Italy Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 22: Italy Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 23: Italy Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 24: Italy Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 25: Italy Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 26: Italy Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 27: Italy Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 28: Italy Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 29: Italy Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 30: Italy Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 31: France Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 32: France Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: France Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 34: France Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 35: France Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 36: France Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 37: France Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 38: France Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 39: France Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 40: France Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 41: UK Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 42: UK Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: UK Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 44: UK Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 45: UK Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 46: UK Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 47: UK Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 48: UK Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 49: UK Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 50: UK Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 51: Russia Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 52: Russia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 53: Russia Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 54: Russia Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 55: Russia Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 56: Russia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 57: Russia Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 58: Russia Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 59: Russia Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 60: Russia Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 61: BENELUX Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 62: BENELUX Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: BENELUX Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 64: BENELUX Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 65: BENELUX Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 66: BENELUX Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 67: BENELUX Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 68: BENELUX Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 69: BENELUX Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 70: BENELUX Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

- Table 71: Rest of Europe Market Value (US$ Bn) Forecast by Country, 2020 to 2035

- Table 72: Rest of Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Rest of Europe Market Value (US$ Bn) Forecast by Product Type, 2020 to 2035

- Table 74: Rest of Europe Market Volume (Units) Forecast by Product Type, 2020 to 2035

- Table 75: Rest of Europe Market Value (US$ Bn) Forecast by Application, 2020 to 2035

- Table 76: Rest of Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 77: Rest of Europe Market Value (US$ Bn) Forecast by Motor Type, 2020 to 2035

- Table 78: Rest of Europe Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 79: Rest of Europe Market Value (US$ Bn) Forecast by End-use Industry, 2020 to 2035

- Table 80: Rest of Europe Market Volume (Units) Forecast by End-use Industry, 2020 to 2035

List Of Figures

- Figure 1: Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Market Pricing Analysis

- Figure 3: Market Value (US$ Bn) Forecast 2020 to 2035

- Figure 4: Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 5: Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 6: Market Attractiveness Analysis by Product Type

- Figure 7: Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 8: Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 9: Market Attractiveness Analysis by Application

- Figure 10: Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 11: Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 12: Market Attractiveness Analysis by Motor Type

- Figure 13: Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 14: Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 15: Market Attractiveness Analysis by End-use Industry

- Figure 16: Market Value (US$ Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 17: Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 18: Market Attractiveness Analysis by Region

- Figure 19: Germany Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: Italy Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: France Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: UK Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: Russia Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: BENELUX Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: Rest of Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: Germany Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Germany Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 28: Germany Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 29: Germany Market Attractiveness Analysis by Product Type

- Figure 30: Germany Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 31: Germany Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 32: Germany Market Attractiveness Analysis by Application

- Figure 33: Germany Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 34: Germany Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 35: Germany Market Attractiveness Analysis by Motor Type

- Figure 36: Germany Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 37: Germany Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 38: Germany Market Attractiveness Analysis by End-use Industry

- Figure 39: Italy Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 40: Italy Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 41: Italy Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 42: Italy Market Attractiveness Analysis by Product Type

- Figure 43: Italy Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 44: Italy Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 45: Italy Market Attractiveness Analysis by Application

- Figure 46: Italy Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 47: Italy Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 48: Italy Market Attractiveness Analysis by Motor Type

- Figure 49: Italy Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 50: Italy Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 51: Italy Market Attractiveness Analysis by End-use Industry

- Figure 52: France Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: France Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 54: France Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 55: France Market Attractiveness Analysis by Product Type

- Figure 56: France Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: France Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 58: France Market Attractiveness Analysis by Application

- Figure 59: France Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 60: France Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 61: France Market Attractiveness Analysis by Motor Type

- Figure 62: France Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 63: France Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 64: France Market Attractiveness Analysis by End-use Industry

- Figure 65: UK Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 66: UK Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 67: UK Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 68: UK Market Attractiveness Analysis by Product Type

- Figure 69: UK Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 70: UK Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 71: UK Market Attractiveness Analysis by Application

- Figure 72: UK Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 73: UK Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 74: UK Market Attractiveness Analysis by Motor Type

- Figure 75: UK Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 76: UK Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 77: UK Market Attractiveness Analysis by End-use Industry

- Figure 78: Russia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 79: Russia Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 80: Russia Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 81: Russia Market Attractiveness Analysis by Product Type

- Figure 82: Russia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 83: Russia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 84: Russia Market Attractiveness Analysis by Application

- Figure 85: Russia Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 86: Russia Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 87: Russia Market Attractiveness Analysis by Motor Type

- Figure 88: Russia Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 89: Russia Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 90: Russia Market Attractiveness Analysis by End-use Industry

- Figure 91: BENELUX Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: BENELUX Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 93: BENELUX Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 94: BENELUX Market Attractiveness Analysis by Product Type

- Figure 95: BENELUX Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 96: BENELUX Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 97: BENELUX Market Attractiveness Analysis by Application

- Figure 98: BENELUX Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 99: BENELUX Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 100: BENELUX Market Attractiveness Analysis by Motor Type

- Figure 101: BENELUX Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 102: BENELUX Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 103: BENELUX Market Attractiveness Analysis by End-use Industry

- Figure 104: Rest of Europe, Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 105: Rest of Europe, Market Value Share and BPS Analysis by Product Type, 2025 and 2035

- Figure 106: Rest of Europe, Market Y-o-Y Growth Comparison by Product Type, 2025 to 2035

- Figure 107: Rest of Europe, Market Attractiveness Analysis by Product Type

- Figure 108: Rest of Europe, Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 109: Rest of Europe, Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 110: Rest of Europe, Market Attractiveness Analysis by Application

- Figure 111: Rest of Europe, Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 112: Rest of Europe, Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 113: Rest of Europe, Market Attractiveness Analysis by Motor Type

- Figure 114: Rest of Europe, Market Value Share and BPS Analysis by End-use Industry, 2025 and 2035

- Figure 115: Rest of Europe, Market Y-o-Y Growth Comparison by End-use Industry, 2025 to 2035

- Figure 116: Rest of Europe, Market Attractiveness Analysis by End-use Industry

- Figure 117: Market - Tier Structure Analysis

- Figure 118: Market - Company Share Analysis

- FAQs -

What is the Global Europe Electrical Steel Market Size in 2025?

The Europe Electrical Steel market is valued at USD 7.9 billion in 2025.

Who are the Major Players Operating in the Europe Electrical Steel Market?

Prominent players in the Europe Electrical Steel market include Novolipetsk Steel (NMLK), ArcelorMittal, Thyssenkrupp AG, Acronic International GmbH, Erdemir Romania S.R.L., and others.

What is the Estimated Valuation of the Europe Electrical Steel Market by 2035?

The Europe Electrical Steel market is expected to reach a valuation of USD 21.1 billion by 2035.

What Value CAGR Did the Europe Electrical Steel Market Exhibit over the Last Five Years?

The historic growth rate of the Europe Electrical Steel market was 7.8% from 2020 to 2024.