IVF Devices Market

IVF Devices Market Analysis- Size, Share and Forecast Outlook 2025 to 2035

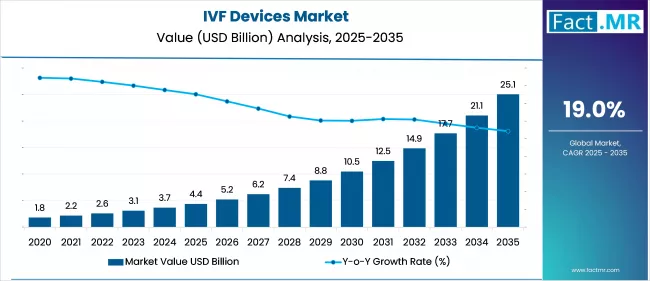

The global IVF devices market will total USD 4.4 billion in 2025, and is forecast to expand to USD 25.1 billion by 2035, advancing at a CAGR of 19.0%. Frozen Embryo IVF to be preferred technology while fertility clinics are the primary sites for treatment.

IVF Devices Market Size, Share, and Forecast Outlook 2025 to 2035

The global IVF devices market is forecast to reach USD 25.1 billion by 2035, up from USD 4.4 billion in 2025. During the forecast period, the industry is projected to register at a CAGR of 19.0%. Rising infertility rates are driving IVF demand as people's lifestyles change and they delay starting families.

Precision tools and automation are improving success rates as technology advances. Medical tourism is increasing access to IVF services worldwide. Favorable reimbursement policies and greater awareness of assisted reproductive technologies are driving market growth and accessibility.

Quick Stats of IVF Devices Market

- IVF Devices Market Size (2025): USD 4.4 billion

- Projected IVF Devices Market Size (2035): USD 25.1 billion

- Forecast CAGR of IVF Devices Market (2025 to 2035): 19.0%

- Leading Technology Segment of IVF Devices Market: Frozen Embryo IVF

- Key Growth Regions of IVF Devices Market: France, China, United States

- Key Players of the IVF Devices Market: Cook Group, CooperSurgical Fertility Company, FUJIFILM Irvine Scientific, Thermo Fisher Scientific, others.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.4 billion |

| Industry Size (2035F) | USD 25.1 billion |

| CAGR (2025-2035) | 19.0% |

The IVF devices market is projected to expand from USD 4.4 billion in 2025 to USD 10.5 billion by 2030, signifying an initial acceleration phase. This increase is anticipated to be bolstered by enhanced patient awareness, the expansion of insurance coverage, and a broader array of IVF procedures available in public and private fertility clinics. The growing utilization of time-lapse embryo imaging, microfluidics-based sperm sorting, and cryopreservation systems is expected to drive equipment sales in the coming years.

The significant double-digit growth indicates that clinics are likely to invest substantially in enhancing laboratory capabilities to distinguish themselves in a competitive environment. Regulatory approvals for advanced reproductive technologies across various regions will expedite adoption cycles, resulting in steady demand for devices.

From 2030 to 2035, the market is projected to increase from USD 10.5 billion to USD 25.06 billion, indicating a significant growth phase propelled by technological consolidation and the globalization of services. The shift towards comprehensive reproductive care centers will incorporate genetic testing, AI-assisted embryo selection, and automated culture systems, thereby elevating capital investment per clinic.

Emerging economies are expected to surpass developed regions in percentage growth due to the swift expansion of healthcare infrastructure. The year-on-year increases surpassing USD 3 billion in the final years indicate a maturity phase in which device replacement, rather than initial purchases, serves as a primary revenue driver.

Top IVF Devices Market Dynamics

The global IVF equipment market is expanding rapidly as infertility concerns gain traction and treatment choices become more accessible. Increased knowledge, supporting healthcare legislation, and expanded clinical infrastructure have made IVF a feasible option for couples seeking assisted reproduction. The incorporation of sophisticated technologies and improved procedural guidelines is helping to increase treatment success rates.

IVF equipment are crucial to ensure the precision, efficiency, and safety of reproductive treatments. From the first phases of gamete handling to embryo culture and transfer, sophisticated technology ensures the precision needed for the best patient outcomes. Continuous advancements in hardware and related technologies are making IVF procedures more predictable, successful, and scalable in both developed and emerging markets.

Rising Infertility Rates as a Primary Growth Catalyst

Increasing infertility rates will drive the IVF devices market. Infertility is the inability to conceive or carry a pregnancy after one year of regular, unprotected sexual activity. Infertility is rising due to lifestyle changes, delayed pregnancies, and stress.

Assisted reproductive technologies use IVF equipment for egg retrieval, embryo culture, and embryo transfer to help infertile couples conceive and become pregnant. The World Health Organization (WHO), a Switzerland-based UN agency that promotes health, keeps the world safe, and serves the vulnerable, reported in April 2023 that 17.5% of the global adult population, or 1 in 6 people, experience infertility.

Technological Innovations Enhancing IVF Success Rates

Innovations in IVF technologies also drive the market. ICSI, PGT, and time-lapse imaging have greatly improved IVF success rates. These innovations boost fertility treatments and lower offspring genetic disorder risks.

The use of advanced IVF incubators, imaging systems, and micromanipulators has improved precision and efficiency. Technological advancement is necessary to meet rising demand for effective and reliable fertility solutions, driving market growth.

Advanced Equipment Improving Precision and Treatment Outcomes

IVF technology improves fertility treatment success. These sophisticated tools improve IVF precision and efficacy. IVF relies on these devices, from cutting-edge incubators that mimic the human body to real-time imaging systems that track embryo development. Continuous innovation in IVF devices ensures they can handle modern fertility treatments, improving patient outcomes and giving hope to infertile patients.

Elevated Procedural Costs Render Treatments Unaffordable

One major concern is the high cost of IVF procedures and associated devices, which makes treatment inaccessible to many patients, particularly those in developing countries. For instance, in the United States, a single IVF cycle can cost between $12,000 and $14,000, not including medication, limiting adoption among middle-income populations.

Compliance with Stringent Regulatory Frameworks May Delay New Approaches

The market is subject to stringent regulatory frameworks that vary by region, which can lead to product approval delays and increased compliance costs. For example, the European Union's Medical Device Regulation (MDR) has imposed more stringent clinical and safety standards, affecting the time-to-market of innovative IVF solutions.

Limited Success Rates May Discourage Individuals from Opting for IVF Treatment

Another important constraint is the physical and emotional cost of IVF procedures. Multiple treatment cycles are frequently required, with no assurance of success. According to the CDC, IVF success rates in women under 35 are around 40%, and they drop significantly with age.

This, combined with the side effects of fertility drugs and potential complications such as ovarian hyper stimulation syndrome (OHSS), causes many patients to stop treatment.

Top Regions Driving IVF Treatment Devices Market Growth

North America is a leader in the global IVF devices market, due to high adoption rates of advanced fertility treatments, well-established healthcare infrastructure, and an increasing prevalence of infertility issues. The presence of major market players, as well as favourable reimbursement policies, helps to maintain the region's market dominance.

Europe is a significant market for IVF devices, driven by supportive government initiatives, rising demand for fertility treatments, and the presence of skilled healthcare professionals. Countries such as the United Kingdom, Germany, and France are making significant investments in IVF technology, which is driving regional market growth.

Asia Pacific is emerging as a lucrative market for IVF devices and consumables, driven by rising disposable income, heightened awareness of infertility treatments, and expanding healthcare infrastructure. Countries such as China, India, and Japan are experiencing a surge in demand for IVF procedures, leading to market expansion in the region.

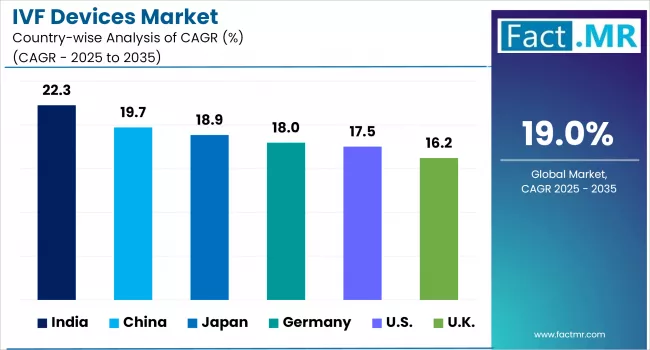

Country-Wise Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

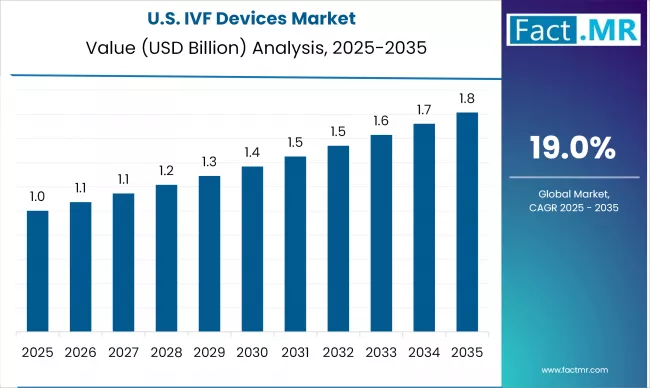

| United States | 17.5% |

| China | 19.7% |

| India | 22.3% |

United States A Mature and Expanding IVF Devices Market Driven by High Infertility Rates and ART Adoption

The United States is one of the world's largest and most mature markets for IVF devices, owing to high infertility rates, rising maternal age, and growing awareness of assisted reproductive technologies (ART). According to the Centers for Disease Control and Prevention (CDC), approximately one in every five married women aged 15 to 49 who have never had a child are unable to conceive after a year of trying, highlighting the significant patient pool that relies on fertility treatments.

Technological advancement continues to be a key growth driver in the US IVF devices market. The country is a global hub for medical innovation, with fertility clinics implementing cutting-edge technologies such as time-lapse embryo imaging, AI-powered embryo selection algorithms, and robotic-assisted micromanipulation systems. For example, clinics such as Boston IVF and CCRM are incorporating AI solutions to enhance embryo viability assessment and improve success rates.

The United States Food and Drug Administration (FDA) ensures that IVF devices meet stringent safety and efficacy standards. While this promotes patient trust, it also increases compliance costs and lengthens development timelines for manufacturers. However, recent fast-track approvals for fertility-related diagnostic tools suggest that the regulatory environment is favorable for innovations addressing reproductive health challenges.

China IVF Devices Market Accelerates Amid Policy Shifts and Fertility Challenges

China's IVF device market is rapidly expanding, driven by demographic shifts, government policy changes, and changing societal attitudes toward fertility. With the repeal of the one-child policy and the implementation of the three-child policy in 2021, the government has acknowledged declining birth rates. It is actively encouraging the use of assisted reproductive technologies (ART) to address population challenges. As of 2023, China's birth rate has reached its lowest level in decades, resulting in increased demand for fertility services and equipment.

A major driver is the high prevalence of infertility, with estimates indicating that 12-18% of Chinese couples experience fertility problems. This trend is exacerbated by a growing preference for delayed parenthood, particularly in urban areas, where women are increasingly opting to pursue careers before starting families. As a result, demand for IVF devices, including incubators, cryopreservation equipment, and micromanipulation systems, is increasing in fertility clinics throughout Tier 1 and Tier 2 cities, such as Beijing, Shanghai, and Chengdu.

The National Health Commission (NHC) closely monitors China's IVF regulatory framework, and fertility clinics are strictly licensed. Although this has established a baseline of care quality, it also restricts the number of facilities authorized to perform IVF, resulting in a supply-demand gap. Nonetheless, more than 520 IVF centers were operating legally as of 2022, a figure that has been steadily increasing.

France Public Healthcare Support Fueling Steady Growth in IVF Devices Market

France's IVF device market is expanding steadily, primarily driven by strong public healthcare support and widespread insurance coverage. The French social security system covers up to six IVF attempts for women under the age of 43, significantly reducing the financial burden on patients while also creating consistent demand for IVF equipment, accessories, and consumables.

The increasing availability of ART services is a major driver in the country. Recent bioethics law reforms have made it possible for single women and lesbian couples to access IVF, which was previously only available to heterosexual couples experiencing fertility issues. This policy change has broadened the patient base and encouraged increased use of IVF devices in both public and private clinics.

France also takes the lead in implementing quality and safety standards under the EU Medical Device Regulation (MDR). IVF devices undergo strict certification processes before being approved, which ensures safety but can create regulatory barriers for new entrants, particularly startups and smaller suppliers seeking to enter the French market.

Analyzing IVF Devices Market by Leading Segments

Accessories & Disposables High-Demand Segment Ensuring Safety and Efficiency in IVF Procedures

Accessories and disposables are among the most popular and widely used segments in the IVF (In-Vitro Fertilization) Devices Market due to their consistent demand and critical role in every IVF procedure. The popularity of this segment is largely driven by the demand for sterile, single-use products that reduce the risk of contamination and ensure regulatory compliance with safety standards.

Because IVF cycles are repeated and tailored to individual patients, clinics require a steady supply of high-quality disposables, making this a high-volume and high-revenue segment.

Reagents and media serve as the foundation for IVF procedures, providing the environment required for embryo fertilization and culture. This includes culture media, which provides the nutrients and conditions required for embryo growth, as well as cryoprotectants, which are used during the freezing and thawing processes.

Furthermore, specialized reagents such as sperm preparation solutions and hormonal supplements are critical in increasing the success rates of IVF treatments.

Frozen Embryo IVF Enhancing Flexibility and Pregnancy Outcomes While Minimizing OHSS Risk

Frozen Embryo IVF involves freezing embryos after fertilization for future use. This method allows for more flexibility in timing the embryo transfer, such as synchronizing with the woman's natural menstrual cycle or optimizing the uterine environment, which can increase the chances of implantation and pregnancy. Furthermore, frozen embryo transfer may reduce the risk of ovarian hyperstimulation syndrome (OHSS) caused by the use of fertility medications.

Donor Egg IVF is the use of eggs donated by another woman, usually when the intended mother is unable to produce viable eggs. This method offers an alternative for couples experiencing female infertility and has made a significant contribution to the global success of IVF treatments. Donor Egg IVF has helped many couples realize their dream of parenthood by utilizing donated eggs from healthy, young donors.

Fertility Clinics Driving IVF Market Growth through Specialized Services and Advanced Technologies

Fertility clinics are a major segment of the IVF market, providing specialized reproductive medicine services. These clinics offer a variety of IVF services, including fertility screenings, ovarian stimulation, egg retrieval, embryo transfer, and preimplantation genetic testing.

With the growing demand for assisted reproductive technologies (ART), fertility clinics are seeing an increase in patient traffic, which is driving the adoption of advanced IVF devices and consumables to improve success rates and patient outcomes.

Hospitals, particularly those with dedicated reproductive medicine departments, make up a sizable portion of the end-user segment. These institutions provide a variety of fertility treatments, including IVF, and are frequently outfitted with cutting-edge technology and experienced medical staff.

The incorporation of advanced IVF technologies into hospitals not only improves their service offerings, but also attracts a larger patient base seeking comprehensive fertility treatment. As hospitals continue to expand their reproductive health services, the demand for IVF devices and consumables is expected to increase significantly.

Competitive Analysis

The IVF (In-Vitro Fertilization) devices market is highly competitive and rapidly evolving, owing to rising infertility rates, delayed parenthood, and advances in assisted reproductive technologies. The market is fragmented, with both established medical device companies and emerging players innovating in areas like embryo culture, cryopreservation, and micromanipulation systems. Continuous investment in R&D is a critical competitive factor, as companies strive to create more efficient, less invasive, and accurate IVF tools.

Market competition is primarily driven by technological innovation, regulatory approvals, and clinical success rates. Companies that provide integrated IVF platforms, such as real-time imaging, AI-based embryo grading, and automated laboratory systems, are gaining traction because of their ability to improve outcomes and reduce human error. Disposable and consumable products, such as embryo transfer catheters and culture media, are also important battlegrounds because they generate recurring revenue and must meet stringent safety and sterility requirements.

The rising demand for cryopreservation techniques, particularly elective embryo freezing and fertility preservation, has fueled competition in the development of advanced freezing and thawing systems. Furthermore, regions such as Asia-Pacific and Latin America are seeing increased market entry as medical tourism and awareness grow, prompting global players to expand distribution networks and localize production.

Key players in the market include Cook Group, CooperSurgical Fertility Company, FUJIFILM Irvine Scientific, Thermo Fisher Scientific, Fertilis, EMD Serono Inc., Vitrolife AB, and other notable players.

Recent Developments

- In June 2025, Thermo Fisher Scientific introduced the Orbitrap Astral Zoom and Orbitrap Excedion Pro mass spectrometers at ASMS 2025, which are intended to improve proteomic profiling for fertility research.

- In April, 2025, Thermo Fisher Scientific has committed USD 2 billion over four years to expand its U.S. manufacturing and R&D facilities, including lines dedicated to reproductive health consumables.

- In May 2024, Cook Medical has signed a letter of intent with Astorg, a well-known private equity firm known for its successful global healthcare investments, to acquire Cook's Reproductive Health division, "Cook ART". The transaction includes products for in vitro fertilization (IVF) and assisted reproductive technology (ART).

Segmentation of IVF Devices Market

-

By Product :

- Instruments

- Accessories & Disposables

- Reagents & Media

-

By Technology :

- Fresh Embryo IVF

- Frozen Embryo IVF

- Donor Egg IVF

-

By End User :

- Hospitals

- Fertility Clinics

- Surgical Centers

- Clinical Research Institutes

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global IVF Devices Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global IVF Devices Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Product

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Product, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Product, 2025-2035

- Instruments

- Accessories & Disposables

- Reagents & Media

- Y-o-Y Growth Trend Analysis By Product, 2020-2024

- Absolute $ Opportunity Analysis By Product, 2025-2035

- Global IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Technology

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Technology, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Technology, 2025-2035

- Fresh Embryo IVF

- Frozen Embryo IVF

- Donor Egg IVF

- Y-o-Y Growth Trend Analysis By Technology, 2020-2024

- Absolute $ Opportunity Analysis By Technology, 2025-2035

- Global IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By End User

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By End User, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By End User, 2025-2035

- Hospitals

- Fertility Clinics

- Surgical Centers

- Clinical Research Institutes

- Y-o-Y Growth Trend Analysis By End User, 2020-2024

- Absolute $ Opportunity Analysis By End User, 2025-2035

- Global IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- Latin America IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- Western Europe IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- East Asia IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- South Asia Pacific IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- Eastern Europe IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- Middle East & Africa IVF Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Product

- By Technology

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Product

- By Technology

- By End User

- Key Takeaways

- Key Countries IVF Devices Market Analysis

- Value (USD Bn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- Value (USD Bn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Product

- By Technology

- By End User

- Value (USD Bn) & Volume (Units)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Product

- By Technology

- By End User

- Competition Analysis

- Competition Deep Dive

- Cook Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- CooperSurgical Fertility Company

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- FUJIFILM Irvine Scientific

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Thermo Fisher Scientific

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Fertilis

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- EMD Serono Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Vitrolife AB

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Cook Group

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 20: Latin America Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 22: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 24: Latin America Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 28: Western Europe Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 32: Western Europe Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 36: East Asia Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 37: East Asia Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 38: East Asia Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 39: East Asia Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 40: East Asia Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 41: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: South Asia Pacific Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 44: South Asia Pacific Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 45: South Asia Pacific Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 46: South Asia Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 47: South Asia Pacific Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 48: South Asia Pacific Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 52: Eastern Europe Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 54: Eastern Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 56: Eastern Europe Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 60: Middle East & Africa Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 62: Middle East & Africa Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 64: Middle East & Africa Market Volume (Units) Forecast by End User, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020-2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020-2035

- Figure 4: Global Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Product

- Figure 7: Global Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Technology

- Figure 10: Global Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by End User

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Product

- Figure 27: North America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Technology

- Figure 30: North America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by End User

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 36: Latin America Market Attractiveness Analysis by Product

- Figure 37: Latin America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 39: Latin America Market Attractiveness Analysis by Technology

- Figure 40: Latin America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by End User

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 46: Western Europe Market Attractiveness Analysis by Product

- Figure 47: Western Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 49: Western Europe Market Attractiveness Analysis by Technology

- Figure 50: Western Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 52: Western Europe Market Attractiveness Analysis by End User

- Figure 53: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: East Asia Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 55: East Asia Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 56: East Asia Market Attractiveness Analysis by Product

- Figure 57: East Asia Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 58: East Asia Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 59: East Asia Market Attractiveness Analysis by Technology

- Figure 60: East Asia Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 61: East Asia Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 62: East Asia Market Attractiveness Analysis by End User

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: South Asia Pacific Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 65: South Asia Pacific Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 66: South Asia Pacific Market Attractiveness Analysis by Product

- Figure 67: South Asia Pacific Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 68: South Asia Pacific Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 69: South Asia Pacific Market Attractiveness Analysis by Technology

- Figure 70: South Asia Pacific Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 71: South Asia Pacific Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 72: South Asia Pacific Market Attractiveness Analysis by End User

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: Eastern Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 75: Eastern Europe Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 76: Eastern Europe Market Attractiveness Analysis by Product

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 78: Eastern Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 79: Eastern Europe Market Attractiveness Analysis by Technology

- Figure 80: Eastern Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 81: Eastern Europe Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 82: Eastern Europe Market Attractiveness Analysis by End User

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Product, 2025 to 2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Product

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by Technology

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by End User

- Figure 93: Global Market - Tier Structure Analysis

- Figure 94: Global Market - Company Share Analysis

- FAQs -

What is the Global IVF Devices Market size in 2025?

The IVF devices market is valued at USD 4.4 billion in 2025.

Who are the Major Players Operating in the IVF Devices Market?

Prominent players in the market include Cook Group, CooperSurgical Fertility Company, FUJIFILM Irvine Scientific, Thermo Fisher Scientific.

What is the Estimated Valuation of the IVF Devices Market by 2035?

The market is expected to reach a valuation of USD 25.1 billion by 2035.

At what CAGR is the IVF Devices Market slated to grow during the study period?

The growth rate of the IVF devices market is 19.0% from 2025-2035.