Packaging Automation Solution Market

Packaging Automation Solution Market Analysis, By Product Type, By Function, By End Use Industry, and Region - Market Insights 2025 to 2035

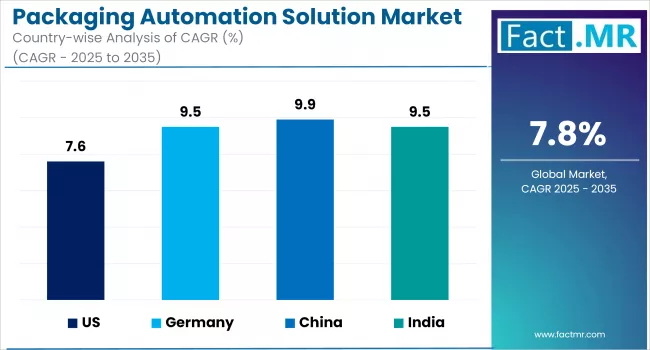

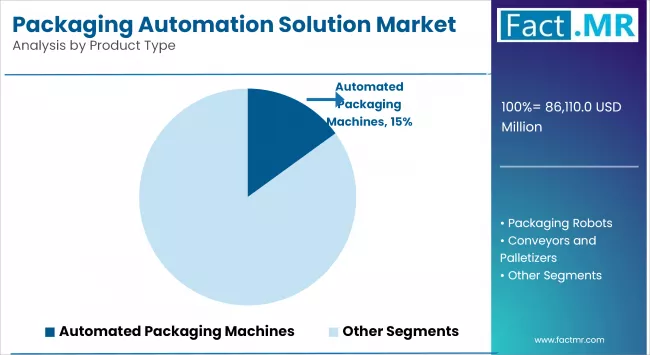

The Automated Packaging Machines segment projected to grow at a CAGR of 8.1%, whereas another segment Packaging Robots is likely to grow at 7.8%. In terms of countries USA is projected to grow at 7.6%, followed by Germany at 9.5% and China to grow at 9.9%.

Packaging Automation Solution Market Outlook (2025 to 2035)

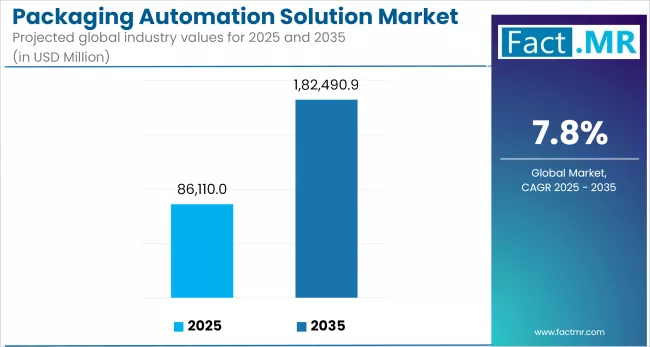

The global packaging automation solution market is expected to reach USD 182,491 Million by 2035, up from USD 80,341 million in 2024. During the forecast period 2025 to 2035, the industry is projected to register at a CAGR of 7.8%.

The market for packaging automation solutions is driven by the need to enhance operational efficiency, reduce labor costs, facilitate faster customization, and leverage Industry 4.0 innovations, including IoT, AI, and robotics. Market uptake in industries is also enhanced by invigorated labor shortages, improved hygiene standards, and favorable government initiatives.

What are the drivers of packaging automation solution market?

The packaging automation solution market is growing primarily due to the increasing demand for efficiency and consistency in manufacturing processes. Automation is useful in controlling labor expenses, eliminating erratic human error, and improving throughput, making it very appealing to the food and beverage industries, pharmaceutical industries, e-commerce industries, and even consumer product industries. This is also driven by rising consumer demand for quicker, more flexible, and customizable packaging to suit diverse consumer interests.

In addition, the automation of packaging lines through the use of IoT, AI, and robotics is transforming classical systems into smart, interconnected units of Industry 4.0. Such innovations enable predictive maintenance, real-time checks and intelligent quality checks, which reduce downtime and maximize ROI.

What are the regional trends of packaging automation solution market?

The region with the largest market share of packaging automation solutions in North America is characterized by high labor costs, a well-established industrial structure, and many manufacturers that have incorporated modern manufacturing technologies. Investment in automated packaging lines is especially prevalent in the USA, particularly in the food and beverage, and healthcare sectors.

Europe is right behind, with Germany, Italy, and the UK investing in sustainable and high-speed packaging solutions. The area consists of robust manufacturing of automotive and pharmaceutical products, and strict laws and regulations that force automation due to quality assurance requirements.

The Asia Pacific is the fastest-growing region, where growth is driven by the rise of manufacturing centers in China, India, and Southeast Asia. The high rate of industrialization, the availability of e-commerce, and the efforts of the government to establish smart factories are some of the factors that are driving demand for packaging automation.

What are the challenges and restraining factors of packaging automation solution market?

Excessive capital investment and very long payback periods are big discouraging factors for small and mid-sized enterprises, whereas installation, integration, and employee training costs further restrict general uptake.

The challenge is a complex system; in particular, integrating automation with existing legacy equipment requires customization and technical expertise, which in turn may slow down implementations and increase operational risk. Changes in consumer preferences regarding packaging occurring quite frequently, and flexible solutions are required of which would add to the cost of the system.

Another barrier to automation adoption could be social resistance from the workforce, fearing job losses. Manual packaging remains the preferred method in regions with low labor costs, such as certain parts of Asia and Africa, primarily because it is more cost-effective.

Data privacy and cybersecurity concerns associated with connected systems and smart packaging lines have become a tendency, so businesses are compelled to invest in secure platforms that add up to overall project costs and complexity.

Country-Wise Outlook

Smart Manufacturing and AI Drive the USA Packaging Automation Market

The most prominent automation in packaging has been achieved in the United States because of its very advanced manufacture-based structure and superior food & beverage sector. High labor costs act as a disincentive for employment, thereby accelerating the push toward automation.

Technology adoption is vigorous, integrating Artificial Intelligent vision systems, robotic pick and place units, and digital twin simulations for predictive maintenance. FDA and USDA regulations push toward traceability and sanitary design, which increases demand for automated inspection, coding, and labeling solutions.

Germany’s Precision Engineering Pushes Packaging Efficiency

Germany-Home of Packaging Automation-Has Engineering Traditions-That Has Dominated the Manufacturing Sector in the EU. Germany Is Home to Some of the Highest Exports of Packaging Machinery in the World, Backed by Companies. Industry 4.0 programs promote smart factories monitoring their operations in real-time and connected to autonomous transport system and energy-efficient automation solutions. Sustainability is also driving the implementation of robotic palletizing and recyclable material-handling systems in several German plants to comply with EU green mandates.

China Automates to Meet Scale and Speed Demands

China has begun an impressive endeavor in enhancing its packaging automation capabilities in response to rising demand for consumer goods, acute labor shortages, and governmental drives for industrial upgrading, programs like Made in China 2025 and the push toward intelligent manufacturing are geared to stimulating automation adoption in FMCG (fast-moving consumer goods), electronics, and pharma.

Companies focus on more affordable robotics and automated filling, sealing, and cartooning systems. The market also benefits from a large presence of vision-guided robotics, automated quality control systems, and 5G-enabled smart factory networks. In both Tier 1 cities and emerging inland industrial zones, foreign direct investment, coupled with regional government subsidies, have been fueling a rapid modernization of packaging lines.

Category-Wise Analysis

Automated packaging machines drive speed and precision in industrial production lines

Modern automated packaging machines, which form an integral part of packaging automation systems, provide a quantum leap in productivity and operation efficiency. These machines handle high-volume, repetitive tasks such as sealing, labeling, and palletizing, with minimal human involvement. Such integration results in reduced labor costs, fewer human errors, and consistent output quality.

With manufacturers in all industries gearing themselves to meet worldwide demand, at the same time maintaining safety standards, the role of automated packaging equipment continues to grow, especially in fast-paced industries.

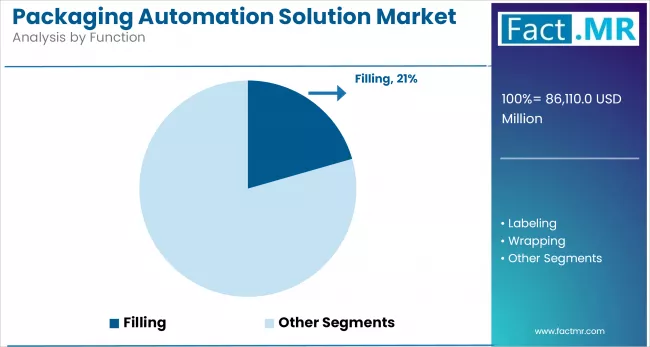

The filling function gains traction for hygienic, high-speed packaging in liquid and semi-solid products

The filling function in packaging automation solutions plays a crucial role in the production chain, accurately pouring products into containers. This function is extremely important for the food and beverage, as well as the pharmaceutical industry, where hygiene, dosage accuracy, and speed are always weighed more heavily than other concerns.

Advances in volumetric, gravimetric, and vacuum-based filling technologies enable the accurate handling of a wide range of substances, from liquids to powders. Automating the filling process not only helps maintain compliance with health regulations but also increases shelf life, all while promising better off-takes in both batch and continuous production.

Food & Beverage industry accelerates automation adoption for safety, consistency, and demand scaling

Automation is no longer optional in the food & beverage sector; it is a competitive necessity. Talents and capabilities in automated packaging are increasingly required to respond to stringent restrictions imposed by food safety regulations, the need for consistency in product quality, as well as fluctuating demand conditions from consumers. Automated packaging reduces contamination risk and facilitates rapid switching between SKUs and customized packaging to meet consumer preferences.

Automation, as it takes place, also brings equipment innovations to bear on emerging phenomena, such as ready-to-eat meals, functional beverages, and sustainability. North America and Europe continue to lead the region in adoption due to compliance pressures. At the same time, the Asia Pacific is projected to grow rapidly as its manufacturing sector expands and demands from urban consumers increase.

Competitive Analysis

As with most industries, notably food and beverage, pharmaceuticals, consumer goods, and logistics, demand for packaging to be faster, error-free, and cost-effective in operation has led to a fiercer market for packaging automation solutions. This has stimulated innovations from players, who have aggressively applied modern technologies such as IoT, AI, and robotics to enhance system intelligence and operational flexibility. These solutions are specifically designed for certain packaging formats and product types, further enhancing end-user customization and agility.

Entering markets that larger players traditionally dominated, the smaller firms have learned to exploit their niche capabilities, working compact systems for limited floor space or flexible machines to handle varied packaging sizes. They have also formed strategic collaborations with software and system integration partners, thereby providing an entire automation ecosystem rather than stand-alone equipment.

The Asia Pacific is the fastest-growing region in terms of further automation deployment in manufacturing hubs such as China, India, and Southeast Asia. On the other hand, developed markets in North America and Europe are upgrading these legacy systems to meet stricter sustainability and traceability demands, thereby impacting competitive dynamics towards environment-friendly smart packaging solutions that converge customization, intelligence, and sustainability.

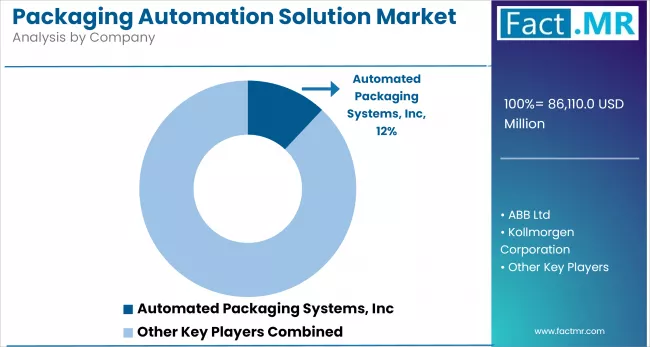

Key players in the packaging automation solution industry include Automated Packaging Systems, Inc., ABB Ltd., Kollmorgen Corporation, Beumer Group GmbH & Co. KG, Rockwell Automation, Inc., Emerson Electric Company, and other notable companies.

Recent Development

- In March 2025, Olympus Corporation commenced full-scale operation of J-RexS, an automatic height-adjustable packaging machine developed by Rengo Co., Ltd., at its Sagamihara Distribution Center in Kanagawa Prefecture. This system optimizes packaging sizes and enhances shipping efficiency, contributing to a 17% reduction in cargo volume shipments compared to 2023 levels.

- In December 2024, Researchers developed a battery-less smart packaging system that integrates a gas sensor and NFC antenna to monitor food freshness in real time. When spoilage is detected, it autonomously releases antioxidant and antibacterial compounds, extending the shelf life of fish products by up to 14 days.

Fact.MR has provided detailed information about the price points of key manufacturers in the Packaging Automation Solution Market, positioned across regions, including sales growth, production capacity, and speculative technological expansion, as recently published in the report.

Methodology and Industry Tracking Approach

In 2025, Fact.MR carried out a research study on the packaging automation solutions market, engaging with over 5,100 validated industry experts from 24 countries. Respondents in this research were senior professionals from sectors of smart packaging integration, deployment of robotic case packers, implementation of AI-enabled vision systems, and global packaging standards compliance management. Each participating country provisionally engaged no less than 90 professionals concerning developments in the optimization of packaging lines, transition to sustainable materials, and digitalization of production workflows.

The study cast transformative changes in the industry between June 2024 and May 2025. Some important changes included the rapid adoption of eco-friendly packaging lines, the increasing acceptance of IoT-enabled real-time diagnostics, and the demand for closed-loop automated systems that ensure traceability and reduce human error.

Since 2018, Fact.MR has been observing the evolution of automation in packaging, including deep-dive studies on programmable logic control efficiency, throughput benchmarks, and sourcing practices for mechatronic components within global supply frameworks. This ongoing expertise sets the tone for the 2025 study, which will focus on holistic innovation in intelligent system interoperability and the nexus of sustainability and performance.

Segmentation of Packaging automation solution market

-

By Product Type :

- Automated Packaging Machines

- Packaging Robots

- Conveyors and Palletizers

- Form-Fill-Seal Machines

- Wrapping & Bundling Machines

- Labeling Machines

- Case Packaging Machines

-

By Function :

- Filling

- Labeling

- Wrapping

- Palletizing

- Cartooning

- Capping

- Sealing

-

By End Use Industry :

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Consumer Electronics

- E-commerce & Logistics

- Chemicals

- Automotive

- Others (Textiles, Agriculture)

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Trends and Success Factors, Market Dynamics, and Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Product Type

- Function

- End Use Industry

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Automated Packaging Machines

- Packaging Robots

- Conveyors and Palletizers

- Form-Fill-Seal Machines

- Wrapping & Bundling Machines

- Labeling Machines

- Case Packaging Machines

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Function

- Filling

- Labeling

- Wrapping

- Palletizing

- Cartooning

- Capping

- Sealing

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Consumer Electronics

- E-commerce & Logistics

- Chemicals

- Automotive

- Others

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- South Asia & Pacific

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia & Pacific Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast to 2035 by Product Type, Function, and End Use Industry for 30 Countries

- Competitive Assessment, Company Share Analysis by Key Players, and Competition Dashboard

- Company Profile

- Automated Packaging Systems, Inc

- ABB Ltd

- Kollmorgen Corporation

- Beumer Group GmbH & Co. KG

- Rockwell Automation, Inc

- Emerson Electric Company

List Of Table

- Table 1: Global Market Value Forecast by Region, 2020 to 2035

- Table 2: Global Market Value Forecast by Product Type, 2020 to 2035

- Table 3: Global Market Value Forecast by Function, 2020 to 2035

- Table 4: Global Market Value Forecast by End Use Industry, 2020 to 2035

- Table 5: North America Market Value Forecast by Country, 2020 to 2035

- Table 6: North America Market Value Forecast by Product Type, 2020 to 2035

- Table 7: North America Market Value Forecast by Function, 2020 to 2035

- Table 8: North America Market Value Forecast by End Use Industry, 2020 to 2035

- Table 9: Latin America Market Value Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value Forecast by Product Type, 2020 to 2035

- Table 11: Latin America Market Value Forecast by Function, 2020 to 2035

- Table 12: Latin America Market Value Forecast by End Use Industry, 2020 to 2035

- Table 13: Western Europe Market Value Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value Forecast by Product Type, 2020 to 2035

- Table 15: Western Europe Market Value Forecast by Function, 2020 to 2035

- Table 16: Western Europe Market Value Forecast by End Use Industry, 2020 to 2035

- Table 17: South Asia & Pacific Market Value Forecast by Country, 2020 to 2035

- Table 18: South Asia & Pacific Market Value Forecast by Product Type, 2020 to 2035

- Table 19: South Asia & Pacific Market Value Forecast by Function, 2020 to 2035

- Table 20: South Asia & Pacific Market Value Forecast by End Use Industry, 2020 to 2035

- Table 21: East Asia Market Value Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value Forecast by Product Type, 2020 to 2035

- Table 23: East Asia Market Value Forecast by Function, 2020 to 2035

- Table 24: East Asia Market Value Forecast by End Use Industry, 2020 to 2035

- Table 25: Eastern Europe Market Value Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Value Forecast by Product Type, 2020 to 2035

- Table 27: Eastern Europe Market Value Forecast by Function, 2020 to 2035

- Table 28: Eastern Europe Market Value Forecast by End Use Industry, 2020 to 2035

- Table 29: Middle East & Africa Market Value Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value Forecast by Product Type, 2020 to 2035

- Table 31: Middle East & Africa Market Value Forecast by Function, 2020 to 2035

- Table 32: Middle East & Africa Market Value Forecast by End Use Industry, 2020 to 2035

List Of Figures

- Figure 1: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 2: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 3: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 4: Global Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Region, 2020 to 2035

- Figure 5: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 6: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 7: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 8: North America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 9: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 10: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 11: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 12: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 13: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 14: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 15: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 16: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 17: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 18: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 19: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 20: South Asia & Pacific Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 21: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 22: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 23: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 24: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 25: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 26: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 27: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 28: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 29: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Product Type, 2020 to 2035

- Figure 30: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Function, 2020 to 2035

- Figure 31: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by End Use Industry, 2020 to 2035

- Figure 32: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- FAQs -

What was the global Packaging automation solution market size reported by Fact.MR for 2025?

The Global Packaging automation solution market was valued at USD 86,110 Million in 2025.

Who are the major players operating in the packaging automation solution market?

Prominent players in the market are Automated Packaging Systems, Inc., ABB Ltd, Kollmorgen Corporation, Beumer Group GmbH & Co. KG, Rockwell Automation, Inc., and Emerson Electric Company.

What is the Estimated Valuation of the packaging automation solution market in 2035?

The market is expected to reach a valuation of USD 182,491 Million in 2035.

What value CAGR did the Packaging automation solution market exhibit over the last five years?

The historic growth rate of the Packaging automation solution market was 6.7% from 2020 to 2024.