Smart Meter Data Management Market

Smart Meter Data Management Market Size and Share Forecast Outlook 2025 to 2035

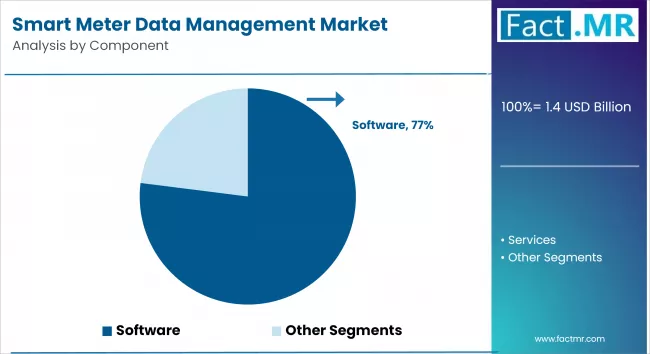

The Global Smart Meter Management Market Is Forecasted To Total USD 1.4 Billion By 2025, Further Expected To Rise To USD 7.0 Billion By 2035, Advancing At A CAGR Of 17.4%. On-Premises Remains The Preferred Deployment Mode While Software Is The Leading Component Segment.

Smart Meter Data Management Market Outlook (2025 to 2035)

The global smart meter data management market is projected to increase from USD 1.4 billion in 2025 to USD 7.0 billion by 2035, with a CAGR of 17.4%. The need for advanced solutions to handle the enormous amounts of data generated and the growing global deployment of smart metering infrastructure are the main drivers of the trend.

Quick Stats on Smart Meter Data Management Market

- Smart Meter Data Management Market Size (2025): USD 1.4 billion.

- Projected Smart Meter Data Management Market Size (2035): USD 7.0 billion

- Forecast CAGR of Smart Meter Data Management Market (2025 to 2035): 17.4%

- Leading Component Segment of Smart Meter Data Management Market: Software

- Leading Deployment Mode Segment of Smart Meter Data Management Market: On-premises

- Key Growth Regions of Smart Meter Data Management Market: United States, China, Japan

- Prominent Players in the Smart Meter Data Management Market: ABB Ltd, Aclara Technologies, Eaton, Honeywell, Itron, Siemens, Others

2025-to-2035.webp)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Size (2035F) | USD 7.0 billion |

| CAGR (2025-2035) | 17.4% |

With the market valued at USD 1.4 billion in 2025, smart meter data management enters a foundational expansion phase. By 2029, revenue is expected to cross USD 3 billion as utilities and energy distributors focus on building advanced data infrastructures to support millions of connected meters.

Year-on-year growth hovers in the 16 to 18% range, underpinned by regulatory mandates for smart grid modernization in North America and Europe and expanding electrification projects in Asia-Pacific.

Utilities emphasize integration of data management platforms with customer billing, outage detection, and energy efficiency programs. Interoperability challenges and cybersecurity concerns persist, yet government incentives for digital grid upgrades counterbalance such barriers.

Partnerships between software vendors and energy utilities become more frequent, while investments in cloud-based analytics gain traction. The emphasis remains on deployment scale-up and system integration, rather than optimization.

By 2030, the market shifts into a more sophisticated stage with revenue growth averaging 17-19 percent annually, reaching USD 7.0 billion by 2035. The emphasis transitions from meter data collection to value extraction through AI-driven predictive load management, automated demand response, and decentralized energy trading.

Utilities increasingly monetize real-time consumption insights, offering dynamic pricing models and supporting distributed renewable generation at scale. Macroeconomic factors such as rising renewable penetration, electrification of transport, and stricter emission-reduction commitments fuel demand for advanced data management.

Cloud-first platforms with edge computing integration dominate, reducing latency in grid balancing and peak demand prediction. Vendor consolidation intensifies, with large energy tech providers acquiring niche analytics firms to strengthen portfolios. Regulatory alignment across regions fosters interoperability standards, making advanced meter data management a strategic asset for utilities in global energy transitions.

What are the Drivers of the Smart Meter Data Management Market?

The growing global deployment of smart meters for gas, water, and electricity is the primary factor propelling the SMDM market. To modernize aging grid infrastructure, increase billing accuracy, lower non-technical losses (like theft), and improve overall operational efficiency, governments and utility companies around the world are putting smart metering initiatives into practice.

Advanced data management systems are required to handle, process, and extract actionable insights from the massive amount of real-time consumption data, outage notifications, and grid performance metrics that come with the installation of millions of smart meters. The widespread use of Advanced Metering Infrastructure (AMI) is driving up demand for SMDM solutions to levels never seen before.

One important driver is the need for grid modernization, which is frequently connected to national energy policies and smart city projects. SMDM is being used by utilities to create intelligent, bidirectional networks from their conventional, unidirectional grids. Demand response, the integration of distributed energy resources (DER) (such as wind and solar), proactive outage management, and improved energy efficiency initiatives are all made possible by this.

Utilities can identify inefficient areas, forecast consumption trends, and optimize load balancing by evaluating detailed smart meter data. This results in significant energy and cost savings. The need for strong data management is directly supported by the shift to smarter, more resilient grids.

What are the Regional Trends of the Smart Meter Data Management Market?

The market for smart meter data management shows a variety of regional trends that correspond to different investment levels, regulatory frameworks, and smart grid adoption stages:

In the global market for smart meter data management, North America continues to hold a leading position. Widespread deployments of smart meters, large continuous investments in smart grid infrastructure upgrades, and a focus on using data analytics to improve operational efficiency and customer engagement serve as the foundation for this leadership.

Due to efforts to improve grid resilience, incorporate renewable energy, and assist demand response programs, the United States, in particular, makes a significant contribution. Cloud-based MDM solutions are being adopted by utilities in the region more frequently due to their scalability and advanced analytics capabilities, and cybersecurity is becoming more and more important to safeguard sensitive energy data. Although the market is mature, it is still expanding due to the expansion of data-driven services and cycles of technological refreshes.

With strict EU regulations urging widespread smart meter deployments and energy efficiency goals, Europe is the second-largest market for SMDM. Large-scale smart meter installations have occurred in nations like France, Spain, Italy, and the UK. The need for advanced data management to balance grid loads and optimize energy flow is further fueled by the region's dedication to decarbonization and the integration of renewable energy sources.

The smart meter data management market is expected to grow at the fastest rate in the Asia Pacific region, which includes China. The main causes of this rapid expansion are the extensive smart meter deployment programs in densely populated nations like China and India, which are meant to lower energy losses, increase billing accuracy, and facilitate the fast urbanization and industrialization of these nations.

With rising investments in smart grid projects and modernizing utility infrastructure, especially in nations like Brazil and Mexico, Latin America is a developing market for SMDM that is expanding steadily. The adoption of smart meters and related data management solutions is being driven by the region's increasing energy demand as well as initiatives to minimize technical and non-technical losses.

There is a clear path towards using smart meter data to enhance operational efficiency and resource management, even though we are still in the early stages when compared to developed regions.

Although its share is currently smaller, the MEA region is expected to grow significantly over the next several years. Rapid infrastructure development, rising urbanization, and an increased emphasis on energy efficiency and diversification in nations like Saudi Arabia and the United Arab Emirates are the main drivers of this growth.

Opportunities for the deployment of smart meters and the ensuing demand for SMDM solutions are being created by government initiatives to modernize utility networks and create smart cities. The need for advanced data management platforms will rise steadily as the region makes more investments in smart grid technologies.

What are the Challenges and Restraining Factors of the Smart Meter Data Management Market?

It takes a significant initial financial outlay to deploy a complete smart metering infrastructure, which includes smart meters, communication networks, and Meter Data Management Systems (MDMS). For utilities, particularly smaller ones or those in developing nations, this high upfront cost can be a major deterrent, as they may find it difficult to obtain the required funding.

Because the benefits (such as decreased losses, increased efficiency, and improved customer service) may take time to materialize, it can be difficult to demonstrate a clear and quick return on investment (ROI) from SMDM solutions.

Sensitive information about consumer behavior and activities in homes and businesses can be gleaned from the massive amounts of detailed consumption data that smart meters gather. This presents serious privacy and data security issues. Strong cybersecurity measures must be in place at utilities to shield this data from hacking, breaches, and illegal access.

Because utilities must put strict protocols in place for data anonymization, storage, and access, complying with changing data protection laws (such as the CCPA and GDPR) increases complexity and costs. The adoption of smart meters and the expansion of the SMDM market may be seriously hampered by public mistrust or well-publicized security incidents.

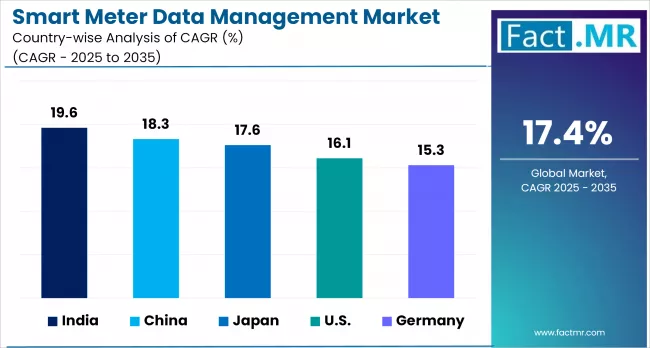

Country-Wise Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 16.1% |

| China | 18.3% |

| Japan | 17.6% |

United States Smart Meter Data Management Market Sees Sustained Growth Driven by Advanced Infrastructure and Digital Transformation

2025-to-2035.webp)

The US continues to hold the top spot in the smart meter data management market. The U.S. utility industry's ongoing digital transformation projects are making significant investments in advanced metering infrastructure (AMI) and the complex data management systems needed to handle the influx of data that results. The need for increased grid resilience against extreme weather events, the incorporation of renewable energy sources, and a strong emphasis on improving customer engagement through tailored energy insights are some of the main motivators.

Cloud-based MDM solutions and advanced analytics software are widely used in the U.S. market, allowing utilities to enhance outage response, optimize grid operations, and create creative demand-response programs. Investment in safe data management systems is fueled by cybersecurity's continued high priority.

China Witnesses Explosive Growth Fueled by Massive Smart Meter Deployments and Smart City Initiatives

China is a vital hub in the Asia Pacific region due to its rapidly expanding smart meter data management market. The government's massive smart meter rollout programmes and ambitious smart city initiatives, which aim to improve resource allocation, reduce transmission losses, and increase energy efficiency across its vast urban areas, are the main drivers of this rapid expansion. Smart gas, electricity, and increasingly water meters are being widely adopted as a result of China's national policies that prioritize modernizing its energy infrastructure.

The market gains from significant domestic investment in creating cutting-edge MDM solutions, which frequently use big data analytics and cloud computing to handle the massive amounts of data produced by millions of meters nationwide. This quick deployment and technical development are greatly aided by regional manufacturers and solution suppliers.

Japan Sees Steady Evolution with Focus on Energy Conservation and Aging Infrastructure Modernization

The market for smart meter data management in Japan is growing steadily, albeit more slowly. Key motivators include the nation's steadfast dedication to environmental sustainability, energy conservation, and the modernization of its aging utility infrastructure.

With continued efforts in smart gas and water metering, the extensive rollout of smart electricity meters is almost finished. Utilizing SMDM solutions to boost grid stability, increase operational efficiency, and assist demand-side management initiatives is a top priority for Japanese utilities. The use of smart meter data for accurate energy management in an aging society is also becoming increasingly popular in Japan due to demographic trends. High dependability, strong data security, and smooth integration with current utility systems are prioritized by the market, which frequently favors custom solutions made to meet national requirements.

Category-wise Analysis

Software to Exhibit Leading Share by Component

In the market for smart meter data management, the software segment is anticipated to hold the largest share by component. This dominance results from software's essential function in converting unprocessed smart meter data into intelligence that can be use. The intricate procedures of data ingestion, validation, cleaning, and storage are managed by Core Meter Data Management Systems (MDMS). Furthermore, to get the most out of the data, advanced analytics software, integration of billing and customer information systems (CIS), visualization tools, and cybersecurity software are essential.

The demand for advanced, scalable, and intelligent software platforms that can handle, process, and interpret this data for a range of utility operations from billing to grid optimization and customer engagement will only increase as smart meter deployments produce exponential amounts of data. This will further solidify software's position as the industry leader. This market is also driven by MDMS's growing integration of AI/ML capabilities.

On-premises to Exhibit Leading Share by Deployment Mode

In the market for smart meter data management, the on-premises deployment mode is anticipated to hold the largest share by deployment mode. Major utilities' current investments in their secure data centers and IT infrastructure, as well as their strong desire to keep direct control over sensitive operational and customer data for security and compliance purposes, are primarily to blame for this.

On-premises solutions are preferred by many large utility companies, particularly those with extensive legacy systems, because they are thought to offer higher security, more customization options, and compliance with regulatory requirements that require data residency. The cloud deployment mode is anticipated to grow at the fastest rate as more utilities realize the advantages of scalability, flexibility, lower capital expenditure, simpler updates, and improved accessibility provided by cloud-native SMDM solutions, even though on-premises still has the largest market share now. On-premises will continue to dominate for a while due to the lengthy utility investment cycles, but the shift to the cloud is quickening.

Electric Meters Category to Hold Leading Share in Smart Meter Data Management Market by Application

According to the application, the smart meter data management market is expected to be dominated by the electric meter category. Compared to gas and water meters, the global rollout of smart electricity meters has been much more extensive and on a larger scale. Smart electric meters generate a vast amount of data, making sophisticated MDM solutions necessary.

These goals include increasing energy efficiency, lowering transmission and distribution losses, enabling demand response programs, and integrating renewable energy sources into the grid. Accurate billing, outage management, grid analytics, and supporting the intricate workings of contemporary electrical grids all depend on these systems. The established and large base of smart electric meters guarantees this segment's continued dominance in the overall SMDM market, even though smart gas and water meter deployments are picking up steam and showing faster growth rates.

Competitive Analysis

The smart meter data management (SMDM) market is highly competitive, with major players such as ABB Ltd, Aclara Technologies, Eaton, Honeywell, Itron, and Siemens vying for market dominance. Companies are focusing on developing comprehensive, integrated SMDM platforms that cover the entire data lifecycle, from collection to customer engagement, often incorporating AI/ML for advanced analytics and cloud-native architectures for scalability.

Strategic partnerships with technology providers, communication network operators, and cloud service providers like AWS and Azure are common to deliver integrated, scalable solutions. Mergers and acquisitions (M&A) are also prevalent, allowing firms to expand their technological capabilities and market presence.

As data security is crucial, companies invest heavily in robust cybersecurity measures and ensure compliance with data privacy regulations to build trust with utilities and consumers. Additionally, geographic expansion into rapidly growing regions such as Asia Pacific and Latin America is a key focus, with companies tailoring solutions to local market needs. Many also emphasize service offerings, providing consulting, implementation, and managed services to foster long-term customer relationships and generate recurring revenue.

Recent Development

- In 2025, Honeywell International Inc. and Verizon Business announced a significant collaboration to integrate Verizon 5G connectivity into Honeywell smart meters. This partnership aims to provide utilities and end-users with highly reliable and secure cellular network capabilities for remote data access, enabling better energy usage management, streamlined operations, and improved grid reliability.

- In 2025, ABB Ltd launched its new ABB Smart EMS (Energy Management Solution). This solution is designed to put homeowners in control of their energy use by automating energy flows, optimizing consumption for efficiency and cost savings, and seamlessly integrating with existing smart home systems.

Segmentation of Smart Meter Data Management Market

-

By Component :

- Software

- Services

-

By Deployment Mode :

- On-premises

- Cloud

-

By Application :

- Electric Meters

- Gas Meters

- Water Meters

-

By Region :

- North America

- Latin America

- Europe

- Asia Pacific & China

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Mn) Analysis, 2020-2024

- Current and Future Market Size Value (USD Mn) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Component

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) Analysis By Component, 2020-2024

- Current and Future Market Size Value (USD Mn) Analysis and Forecast By Component, 2025-2035

- Software

- Services

- Y-o-Y Growth Trend Analysis By Component, 2020-2024

- Absolute $ Opportunity Analysis By Component, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Deployment Mode

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) Analysis By Deployment Mode, 2020-2024

- Current and Future Market Size Value (USD Mn) Analysis and Forecast By Deployment Mode, 2025-2035

- On-premises

- Cloud

- Y-o-Y Growth Trend Analysis By Deployment Mode, 2020-2024

- Absolute $ Opportunity Analysis By Deployment Mode, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Mn) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Mn) Analysis and Forecast By Application, 2025-2035

- Electric Meters

- Gas Meters

- Water Meters

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Mn) Analysis By Region, 2020-2024

- Current Market Size Value (USD Mn) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Mn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Mn) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Component

- By Deployment Mode

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Component

- By Deployment Mode

- By Application

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Mn)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- Value (USD Mn)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Component

- By Deployment Mode

- By Application

- Value (USD Mn)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Component

- By Deployment Mode

- By Application

- Competition Analysis

- Competition Deep Dive

- ABB

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Aclara Technologies LLC

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Eaton

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ElectSolve Technology Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Arad Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Honeywell International Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ABB

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Mn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 3: Global Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 4: Global Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 5: North America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 7: North America Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 8: North America Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 9: Latin America Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 11: Latin America Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 12: Latin America Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 13: Western Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 15: Western Europe Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 16: Western Europe Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 17: East Asia Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 18: East Asia Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 19: East Asia Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 20: East Asia Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 21: South Asia Pacific Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 22: South Asia Pacific Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 23: South Asia Pacific Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 24: South Asia Pacific Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 25: Eastern Europe Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 27: Eastern Europe Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 28: Eastern Europe Market Value (USD Mn) Forecast by Application, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Mn) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Mn) Forecast by Component, 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Mn) Forecast by Deployment Mode, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Mn) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Mn) Forecast 2020 to 2035

- Figure 3: Global Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 4: Global Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 5: Global Market Attractiveness Analysis by Component

- Figure 6: Global Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 7: Global Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 8: Global Market Attractiveness Analysis by Deployment Mode

- Figure 9: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 10: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 11: Global Market Attractiveness Analysis by Application

- Figure 12: Global Market Value (USD Mn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 24: North America Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 25: North America Market Attractiveness Analysis by Component

- Figure 26: North America Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 27: North America Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 28: North America Market Attractiveness Analysis by Deployment Mode

- Figure 29: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 30: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 31: North America Market Attractiveness Analysis by Application

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 34: Latin America Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 35: Latin America Market Attractiveness Analysis by Component

- Figure 36: Latin America Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 37: Latin America Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 38: Latin America Market Attractiveness Analysis by Deployment Mode

- Figure 39: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 40: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 41: Latin America Market Attractiveness Analysis by Application

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 44: Western Europe Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 45: Western Europe Market Attractiveness Analysis by Component

- Figure 46: Western Europe Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 47: Western Europe Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 48: Western Europe Market Attractiveness Analysis by Deployment Mode

- Figure 49: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 50: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 51: Western Europe Market Attractiveness Analysis by Application

- Figure 52: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: East Asia Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 54: East Asia Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 55: East Asia Market Attractiveness Analysis by Component

- Figure 56: East Asia Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 57: East Asia Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 58: East Asia Market Attractiveness Analysis by Deployment Mode

- Figure 59: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 60: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 61: East Asia Market Attractiveness Analysis by Application

- Figure 62: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 64: South Asia Pacific Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 65: South Asia Pacific Market Attractiveness Analysis by Component

- Figure 66: South Asia Pacific Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 67: South Asia Pacific Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 68: South Asia Pacific Market Attractiveness Analysis by Deployment Mode

- Figure 69: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 70: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 71: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 72: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 74: Eastern Europe Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 75: Eastern Europe Market Attractiveness Analysis by Component

- Figure 76: Eastern Europe Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 77: Eastern Europe Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 78: Eastern Europe Market Attractiveness Analysis by Deployment Mode

- Figure 79: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 80: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 81: Eastern Europe Market Attractiveness Analysis by Application

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Component, 2025 and 2035

- Figure 84: Middle East & Africa Market Y-o-Y Growth Comparison by Component, 2025 to 2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Component

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Deployment Mode, 2025 and 2035

- Figure 87: Middle East & Africa Market Y-o-Y Growth Comparison by Deployment Mode, 2025 to 2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Deployment Mode

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 90: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

What is the Global Smart Meter Data Management Market Size in 2025?

The smart meter data management market is valued at USD 1.4 billion in 2025.

Who are the Major Players Operating in the Smart Meter Data Management Market?

Prominent players in the smart meter data management market include ABB Ltd, Aclara Technologies LLC, Eaton, ElectSolve Technology Inc, Arad Group, Honeywell International Inc, and others.

What is the Estimated Valuation of the Smart Meter Data Management Market by 2035?

The smart meter data management market is expected to reach a valuation of USD 7.0 billion by 2035.

What Value CAGR Did the Smart Meter Data Management Market Exhibit over the Last Five Years?

The historic growth rate of the smart meter data management market was 13.7% from 2020-2024.