Excavator Market

Excavator Market Analysis, By Type, By Vehicle Weight, By Engine Capacity, By Drive Type, By Application, and Region - Market Insights 2025 to 2035

Analysis Of Excavator Market Covering 30+ Countries Including Analysis Of US, Canada, UK, Germany, France, Nordics, GCC Countries, Japan, Korea And Many More

Excavator Market Outlook 2025 to 2035

The global excavator market is projected to increase from USD 81.2 billion in 2025 to USD 138.7 billion by 2035, with a CAGR of 5.5% during the forecast period. Growth is driven by growing demand for excavators in construction and public works due to rising infrastructure and urbanization projects. Technological advancements and eco-friendly models are boosting adoption of electric, hybrid, and autonomous excavators.

2025-to-2035.webp)

What are the Drivers of Excavator Market?

The global excavator market is experiencing strong growth driven primarily by rapid infrastructure development and urban expansion across emerging economies. Governments worldwide are investing heavily in public infrastructure, roads, bridges, smart cities, and transportation networks, creating consistent demand for construction machinery like excavators.

Additionally, population growth and migration to urban centers are fueling the need for residential and commercial buildings, especially in countries like India, China, and Southeast Asian nations. This expansion in the real estate and infrastructure sectors directly correlates with increased sales of crawler, wheeled, and mini excavators.

Another major driving factor is the advancement in technology and the push toward automation and sustainability. Leading manufacturers are integrating intelligent systems like GPS-based grade control, telematics, AI-powered automation, and remote diagnostics to enhance operational efficiency, reduce fuel consumption, and improve safety. This trend is especially impactful in regions with skilled labor shortages or where operating conditions are hazardous.

Simultaneously, environmental regulations are accelerating the shift toward electric and hybrid excavators, which offer lower emissions, reduced noise levels, and lower operational costs, benefits particularly attractive for urban construction and utility projects.

The resurgence of global mining activities is further propelling demand for high-performance excavators, especially in regions with rich mineral reserves. As demand for critical raw materials such as lithium, copper, and iron ore, rises due to the energy transition and industrial growth, mining companies are investing in advanced, large-capacity excavators for efficient material handling. Similarly, the growing adoption of mini and compact excavators for small-scale and urban projects such as landscaping, pipe-laying, and road maintenance, is expanding the market’s scope across diverse applications and geographies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 81.2 billion |

| Industry Size (2035F) | USD 138.7 billion |

| CAGR (2025-2035) | 5.5% |

What are the Regional Trends of Excavator Market?

The Asia-Pacific (APAC) region dominates the global excavator market, driven by rapid urbanization, massive infrastructure development, and strong industrial growth. Countries such as China and India are at the forefront, with large-scale investments in highways, railways, smart cities, and residential construction. China's Belt and Road Initiative and India’s Gati Shakti National Master Plan are fueling demand for earthmoving equipment across sectors.

North America represents a mature but innovation-driven market, with steady demand stemming from housing development, commercial construction, and infrastructure renewal. The U.S. is experiencing an uptick in demand for technologically advanced excavators due to its focus on productivity, emissions compliance, and labor efficiency. Electric and hybrid excavators are gaining traction, supported by government incentives and green building standards.

In Europe, environmental sustainability and urban revitalization projects are the key market drivers. The region's strong regulatory framework, particularly the EU's emission reduction mandates, is accelerating the shift toward electric and low-noise excavators, especially in Western and Northern Europe. Countries like Germany, the U.K., France, and the Nordics are increasingly adopting compact and wheeled excavators for work in dense, aging urban areas.

The Middle East & Africa and Latin America represent emerging but high-potential markets. In the Middle East, growth is fueled by megaprojects like Saudi Arabia's NEOM and infrastructure expansion in the UAE and Egypt. In Africa, excavator demand is driven by resource extraction, mining, and foreign-funded infrastructure development, though equipment financing and supply chain challenges remain constraints. Latin America, led by Brazil, Chile, and Mexico, is seeing rising excavator use in mining and urban development, with the rental market playing a vital role in expanding access.

What are the Challenges and Restraining Factors of Excavator Market?

One of the most significant constraints is the high initial cost of excavators. These machines require substantial capital investment, particularly the technologically advanced or hybrid/electric models. For many small and medium contractors or operators in developing countries, the cost of acquisition, ownership, and maintenance can be prohibitive. Additionally, associated expenses such as fuel, skilled operators, spare parts, and insurance further inflate the total cost of ownership, discouraging some potential buyers.

Another critical challenge is the shortage of skilled labor to operate and maintain modern excavators. As equipment becomes more advanced, with features like telematics, autonomous navigation, and GPS-enabled controls, the demand for technically proficient operators and maintenance personnel increases. However, many regions, especially in developing markets, lack sufficient training infrastructure and qualified manpower. This skills gap can result in underutilization of machinery capabilities, higher downtime, and increased operational costs, particularly in remote or labor-constrained environments.

Environmental and regulatory pressures also pose challenges. While the industry is moving toward cleaner technologies, many countries still rely heavily on diesel-powered excavators. Emission regulations, such as the European Stage V and U.S. Tier 4 Final standards, require manufacturers to continually invest in R&D and reengineer their products to remain compliant. This adds to production costs, which are often passed on to end-users. Moreover, compliance challenges in regions with weak enforcement or inconsistent regulatory frameworks can create market fragmentation and slow down the adoption of green technologies.

Country-Wise Outlook

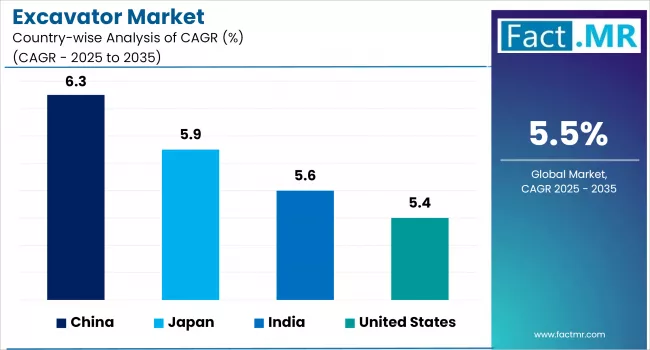

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 5.4% |

| China | 6.3% |

| Japan | 5.9% |

U.S. Excavator Market sees Growth Driven by Urban Development

2025-to-2035.webp)

The U.S. excavator market is witnessing steady growth, fueled by ongoing investments in infrastructure, urban development, and residential construction. This expansion is largely driven by the U.S. federal government's commitment to infrastructure upgrades under the Bipartisan Infrastructure Law, which includes funding for roadways, bridges, water systems, and energy-efficient projects. The continuous growth in both private and public sector construction activities is creating sustained demand for excavators of all sizes and configurations.

A notable trend shaping the U.S. market is the rising adoption of electric, hybrid, and technologically advanced excavators. With stringent emission regulations and growing emphasis on ESG goals, contractors are increasingly opting for cleaner and more efficient equipment. Advanced features like GPS-enabled grade control, real-time diagnostics, and AI-based automation are becoming standard in mid- to large-size models.

To meet rising demand and strengthen supply chain resilience, major OEMs are increasingly localizing production. With continued infrastructure spending, rising technological adoption, and supportive policy frameworks, the U.S. excavator market is expected to maintain a robust growth trajectory over the coming years.

China witnesses Rapid Market Growth Backed by Urbanization and Industrial Expansion

The China excavator market is experiencing steady growth, driven by continued investments in large-scale infrastructure development, urbanization, and industrial expansion. Excavators account for over half of China’s construction equipment industry revenue, making them the most dominant machinery type in the segment. Key projects under China’s urban transit expansion, smart city plans, and the “Belt and Road Initiative” continue to fuel consistent demand across both domestic and export markets.

The shortfall was largely attributed to the ongoing slowdown in China’s real estate sector and tighter environmental regulations impacting diesel engine sales. However, the demand remains strong in sectors like public infrastructure, energy, and mining, which continue to receive government support and investment.

Looking ahead, electrification and intelligent automation are expected to be key growth drivers. With China’s strong R&D capabilities, government-backed green initiatives, and global OEM presence, the country is poised to remain one of the most influential players in the global excavator market.

Japan sees Infrastructure Modernization Fuels Demand for Excavators

The Japan excavator market is poised for strong growth, supported by infrastructure modernization, urban redevelopment, and a national push toward automation and decarbonization. This growth is largely fueled by large-scale infrastructure renewal projects involving aging bridges, roads, railways, and public utilities, along with preparations for international events like Expo 2025 in Osaka. These government-backed initiatives have triggered steady demand for both large and compact excavators across urban and rural job sites.

Technological innovation is playing a significant role in shaping Japan’s excavator market. Leading domestic OEMs such as Komatsu, Hitachi Construction Machinery, Kubota, and Yanmar, are integrating smart features like GPS-enabled grade control, autonomous driving systems, and telematics into their machines. Japan is also seeing early adoption of battery-electric excavators, such as Volvo’s EC230 Electric, introduced in 2024, as stricter emission norms and urban noise regulations push contractors toward sustainable equipment. These advancements not only improve efficiency and reduce emissions but also help address the country’s growing labor shortages.

Despite the growth potential, the market faces challenges such as high equipment costs, tight Stage V emission compliance, and increasing pressure on OEMs to innovate rapidly. Japan’s shrinking population and aging workforce may also limit construction output in certain regions, even as urban centers continue to invest in renewal and seismic resilience projects. Nonetheless, with a strong manufacturing base, forward-looking policy support, and a clear shift toward electrification and automation, Japan’s excavator market is well-positioned for long-term, sustainable growth.

Category-wise Analysis

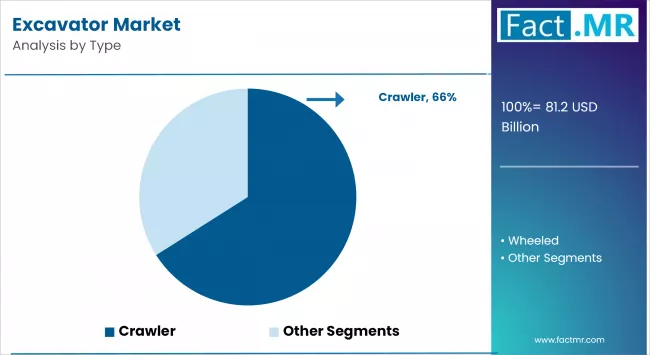

Crawler to Exhibit leading by Type

The crawler excavator segment dominates the excavator market, due to its superior stability, high digging power, and ability to operate in challenging terrains such as mud, slopes, and uneven surfaces. These machines are widely used in heavy-duty applications like mining, large-scale infrastructure projects, and road construction, particularly in countries with underdeveloped or rugged landscapes such as China, India, Brazil, and parts of Africa. The availability of a broad range of operating weights (from compact to ultra-large models) and the integration of advanced technologies like telematics, GPS-based grade control, and fuel-efficient engines, have further strengthened the segment’s dominance.

The wheeled excavator segment is the fastest-growing globally, driven by increasing urbanization, infrastructure upgrades, and rising demand for mobile and flexible construction machinery. Wheeled excavators are gaining popularity in developed regions such as Europe and North America, where road-friendly, maneuverable, and low-impact equipment is preferred for city-based projects, utilities, and light construction. Their ability to travel quickly between job sites without the need for additional transport equipment reduces downtime and boosts efficiency.

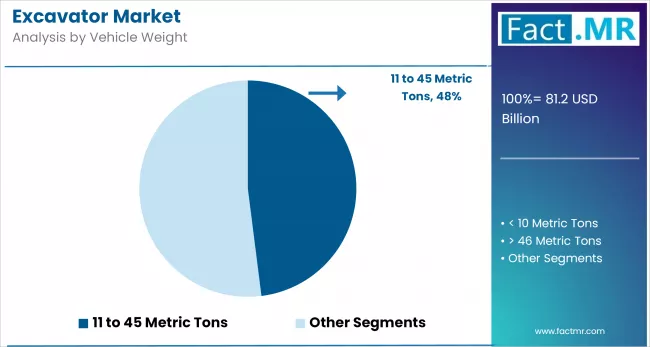

11 to 45 Metric to Exhibit leading by Vehicle Weight

The 11 to 45 metric tons segment dominates revenue share in the excavator market, due to its suitability for mid-sized projects in construction, mining, and road development. These machines strike a balance between operational power and fuel efficiency, making them ideal for large-scale public and private infrastructure projects. Their compatibility with a variety of attachments and applications enhances their utility across diverse end-user sectors, particularly in urban and semi-urban development initiatives.

Lightweight equipment (<10 metric tons) is the fastest-growing segment, fueled by increasing adoption in residential construction, landscaping, and agriculture. Compact machines are gaining popularity due to their maneuverability in tight spaces, ease of transport, and lower capital investment. Growing urbanization and the rise of mini-construction projects across developed and emerging economies contribute to demand. Additionally, the rental sector favors smaller equipment for short-duration, task-specific usage, further propelling segment expansion.

200 to 500 HP to Exhibit Leading by Engine Capacity

Heavy equipment with 250 to 500 HP capacity dominates the excavator market, catering to mid- and large-scale projects in mining, infrastructure, and heavy-duty construction. These machines offer a superior blend of power, fuel efficiency, and multifunctional capabilities, supporting demanding workloads. Their strong operational efficiency and reliability in long-duration projects make them the preferred choice for contractors globally, particularly in regions with ongoing mega construction projects and industrial expansion.

Equipment under 250 HP is the fastest-growing segment, due to rising demand in urban development, small-scale construction, and farming operations. These machines are more economical, easy to maintain, and compatible with compact job sites. Increased adoption of mini and compact loaders, backhoes, and agricultural machinery in emerging countries is fueling this segment. Government subsidies and mechanization incentives in rural regions further drive the adoption of lower horsepower equipment for productive and cost-effective labor.

ICE to Exhibit Leading by Drive Type

Internal combustion engine (ICE) equipment dominates the excavator market, due to its proven power output, refueling convenience, and operational familiarity. ICE machines are well-suited for off-grid, large-scale infrastructure and mining operations where access to electric infrastructure is limited. The existing fleet dominance and long lifecycle of diesel-based equipment further reinforce its market hold. Additionally, contractors in cost-sensitive markets continue to favor ICE machines for their power delivery and field reliability.

Electric heavy equipment is the fastest-growing segment, driven by increasing environmental regulations, urban emissions policies, and demand for low-noise, low-maintenance machinery. Governments and large infrastructure developers are incentivizing the shift to electrified construction vehicles to meet sustainability targets. Battery and hybrid-electric innovations are making these machines more viable for longer operational hours and heavier loads. As charging infrastructure expands and total cost of ownership declines, electric adoption is expected to surge across regions.

Construction to Exhibit Leading by Application

The construction segment dominates the excavator market, driven by the surge in infrastructure development, urban expansion, and real estate projects across both developed and emerging economies. Governments worldwide are investing heavily in roadways, airports, rail systems, housing, and energy infrastructure, particularly in regions like Asia-Pacific, the Middle East, and parts of Africa. Excavators are indispensable in such projects for tasks including earthmoving, trenching, site grading, and demolition. Their versatility, combined with technological advancements like GPS-enabled automation and hybrid engines, has further enhanced their appeal in the construction industry, solidifying this segment's leadership position.

The rental segment is the fastest-growing application segment in the excavator market, propelled by cost-efficiency, flexibility, and increasing access to technologically advanced equipment without the burden of ownership. Small and medium-sized contractors, especially in emerging markets, prefer renting excavators to reduce capital expenditure and maintenance liabilities. Rental companies are expanding their fleets with fuel-efficient and smart excavator models, and OEMs are increasingly offering leasing and rental-focused solutions, further accelerating this segment’s growth globally.

Competitive Analysis

The global excavator market is becoming increasingly competitive, with a mix of international heavyweights and regional players striving to expand their footprint through innovation, partnerships, and geographic expansion. Key global manufacturers include Caterpillar Inc. (U.S.), Komatsu Ltd. (Japan), Hitachi Construction Machinery (Japan), Volvo Construction Equipment (Sweden), and Hyundai Doosan Infracore (South Korea). These companies dominate due to their extensive product portfolios, global distribution networks, and continuous investments in R&D, particularly around automation, telematics, fuel efficiency, and electrification.

Caterpillar maintains a strong global presence, especially in North America, Latin America, and Africa, supported by its robust dealer network and advanced machine control systems. Komatsu and Hitachi have deep roots in Asia-Pacific and are known for their innovation in hybrid and autonomous excavators, with a growing emphasis on environmentally friendly machinery.

Volvo CE is a frontrunner in the electric excavator space and has made notable progress in sustainability and digital construction technologies, especially in Europe. Meanwhile, Hyundai Doosan Infracore has expanded aggressively into the Middle East and Southeast Asia, leveraging cost-effective models and enhanced customer support infrastructure.

Emerging players from China, such as XCMG, SANY, and LiuGong, are also increasingly competitive, particularly in price-sensitive markets. These manufacturers have capitalized on government-backed infrastructure projects within China and expanded to Latin America, Africa, and parts of Asia by offering affordable, durable equipment with improved after-sales services. Their rapid production cycles and price competitiveness pose a growing threat to Western and Japanese OEMs, especially in the mid- and lower-end excavator segments.

In response to market dynamics, many leading players are forming strategic partnerships and acquisitions to bolster technological capabilities and expand product offerings. For example, Komatsu’s investments in automation startups, Caterpillar’s focus on remote operations and zero-emission machines, and Volvo’s collaboration with Skanska on emission-free construction sites highlight a strategic shift toward innovation-led competition.

Key players in the market include Atlas Copco, Caterpillar Inc., CNH Global NV, Doosan, Escorts Group, Hitachi Construction Machinery, Hyundai Heavy Industries Ltd, JC Bamford Excavators Ltd., John Deere, Kobelco, Komatsu Ltd., Liebherr-International AG, Manitou Group, Mitsubishi, Sany Heavy Industries Co Ltd., Sumitomo Heavy Industries Ltd, Terex Corporation, Volvo Construction Equipment AB, and other players.

Recent Development

- In June 2025, Volvo Construction Equipment announced a $260 million investment to expand crawler‑excavator production across Asia (South Korea), Europe (Sweden), and North America (Pennsylvania, USA). The move supports a new assembly line in Shippensburg, PA, set to begin operations in the first half of 2026, aiming to reduce lead times and buffer against supply‑chain risks via regional localization.

Segmentation of Excavator Market

-

By Type :

- Wheeled

- Crawler

-

By Vehicle Weight :

- < 10 Metric Tons

- 11 to 45 Metric Tons

- 46 Metric Tons >

-

By Engine Capacity :

- Up to 250 HP

- 250 to 500 HP

-

By Drive Type :

- Electric

- ICE

-

By Application :

- Construction

- Forestry & Agriculture

- Mining

- Rental

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Components Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Type, 2025-2035

- Wheeled

- Crawler

- Y-o-Y Growth Trend Analysis By Type, 2020-2024

- Absolute $ Opportunity Analysis By Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Vehicle Weight

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Vehicle Weight, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Vehicle Weight, 2025-2035

- < 10 Metric Tons

- 11 to 45 Metric Tons

- 46 Metric Tons >

- Y-o-Y Growth Trend Analysis By Vehicle Weight, 2020-2024

- Absolute $ Opportunity Analysis By Vehicle Weight, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Engine Capacity

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Engine Capacity, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Engine Capacity, 2025-2035

- Up to 250 HP

- 250 to 500 HP

- Y-o-Y Growth Trend Analysis By Engine Capacity, 2020-2024

- Absolute $ Opportunity Analysis By Engine Capacity, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Drive Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Drive Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Drive Type, 2025-2035

- Electric

- ICE

- Y-o-Y Growth Trend Analysis By Drive Type, 2020-2024

- Absolute $ Opportunity Analysis By Drive Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Application, 2025-2035

- Construction

- Forestry & Agriculture

- Mining

- Rental

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Key Takeaways

- Key Countries Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By Vehicle Weight

- By Engine Capacity

- By Drive Type

- By Application

- Competition Analysis

- Competition Deep Dive

- Atlas Copco

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Caterpillar Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- CNH Global NV

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Doosan

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Escorts Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hitachi Construction Machinery

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hyundai Heavy Industries Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- JC Bamford Excavators Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- John Deere

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Kobelco

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Komatsu Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Liebherr-International AG

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Manitou Group

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Mitsubishi

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Sany Heavy Industries Co Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Sumitomo Heavy Industries Ltd

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Terex Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Volvo Construction Equipment AB

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Atlas Copco

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 9: Global Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 10: Global Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 11: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 12: Global Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 17: North America Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 18: North America Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 19: North America Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 20: North America Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 21: North America Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 22: North America Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 23: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 24: North America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 25: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 27: Latin America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 28: Latin America Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 29: Latin America Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 30: Latin America Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 31: Latin America Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 32: Latin America Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 33: Latin America Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 34: Latin America Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 35: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 36: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 37: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 38: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 39: Western Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 40: Western Europe Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 41: Western Europe Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 42: Western Europe Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 43: Western Europe Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 44: Western Europe Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 45: Western Europe Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 46: Western Europe Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 47: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 48: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 49: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 51: East Asia Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 52: East Asia Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 53: East Asia Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 54: East Asia Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 55: East Asia Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 56: East Asia Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 57: East Asia Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 58: East Asia Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 59: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 60: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 61: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 62: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: South Asia Pacific Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 64: South Asia Pacific Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 65: South Asia Pacific Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 66: South Asia Pacific Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 67: South Asia Pacific Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 68: South Asia Pacific Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 69: South Asia Pacific Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 70: South Asia Pacific Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 71: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 72: South Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 73: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 74: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 75: Eastern Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 76: Eastern Europe Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 77: Eastern Europe Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 78: Eastern Europe Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 79: Eastern Europe Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 80: Eastern Europe Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 81: Eastern Europe Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 82: Eastern Europe Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 83: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 84: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 85: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 86: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 87: Middle East & Africa Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 88: Middle East & Africa Market Volume (Units) Forecast by Type, 2020 to 2035

- Table 89: Middle East & Africa Market Value (USD Bn) Forecast by Vehicle Weight, 2020 to 2035

- Table 90: Middle East & Africa Market Volume (Units) Forecast by Vehicle Weight, 2020 to 2035

- Table 91: Middle East & Africa Market Value (USD Bn) Forecast by Engine Capacity, 2020 to 2035

- Table 92: Middle East & Africa Market Volume (Units) Forecast by Engine Capacity, 2020 to 2035

- Table 93: Middle East & Africa Market Value (USD Bn) Forecast by Drive Type, 2020 to 2035

- Table 94: Middle East & Africa Market Volume (Units) Forecast by Drive Type, 2020 to 2035

- Table 95: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 96: Middle East & Africa Market Volume (Units) Forecast by Application, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Type

- Figure 7: Global Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Vehicle Weight

- Figure 10: Global Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Engine Capacity

- Figure 13: Global Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Drive Type

- Figure 16: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 17: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 18: Global Market Attractiveness Analysis by Application

- Figure 19: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 20: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 21: Global Market Attractiveness Analysis by Region

- Figure 22: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 24: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 25: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 27: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 28: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 29: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 30: North America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by Type

- Figure 33: North America Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 34: North America Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 35: North America Market Attractiveness Analysis by Vehicle Weight

- Figure 36: North America Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 37: North America Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 38: North America Market Attractiveness Analysis by Engine Capacity

- Figure 39: North America Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 40: North America Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 41: North America Market Attractiveness Analysis by Drive Type

- Figure 42: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 43: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 44: North America Market Attractiveness Analysis by Application

- Figure 45: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 46: Latin America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 47: Latin America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 48: Latin America Market Attractiveness Analysis by Type

- Figure 49: Latin America Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 50: Latin America Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 51: Latin America Market Attractiveness Analysis by Vehicle Weight

- Figure 52: Latin America Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 53: Latin America Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 54: Latin America Market Attractiveness Analysis by Engine Capacity

- Figure 55: Latin America Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 56: Latin America Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 57: Latin America Market Attractiveness Analysis by Drive Type

- Figure 58: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 59: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 60: Latin America Market Attractiveness Analysis by Application

- Figure 61: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Western Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 63: Western Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 64: Western Europe Market Attractiveness Analysis by Type

- Figure 65: Western Europe Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 66: Western Europe Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 67: Western Europe Market Attractiveness Analysis by Vehicle Weight

- Figure 68: Western Europe Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 69: Western Europe Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 70: Western Europe Market Attractiveness Analysis by Engine Capacity

- Figure 71: Western Europe Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 72: Western Europe Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 73: Western Europe Market Attractiveness Analysis by Drive Type

- Figure 74: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 75: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 76: Western Europe Market Attractiveness Analysis by Application

- Figure 77: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 78: East Asia Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 79: East Asia Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 80: East Asia Market Attractiveness Analysis by Type

- Figure 81: East Asia Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 82: East Asia Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 83: East Asia Market Attractiveness Analysis by Vehicle Weight

- Figure 84: East Asia Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 85: East Asia Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 86: East Asia Market Attractiveness Analysis by Engine Capacity

- Figure 87: East Asia Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 88: East Asia Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 89: East Asia Market Attractiveness Analysis by Drive Type

- Figure 90: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 91: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 92: East Asia Market Attractiveness Analysis by Application

- Figure 93: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 94: South Asia Pacific Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 95: South Asia Pacific Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 96: South Asia Pacific Market Attractiveness Analysis by Type

- Figure 97: South Asia Pacific Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 98: South Asia Pacific Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 99: South Asia Pacific Market Attractiveness Analysis by Vehicle Weight

- Figure 100: South Asia Pacific Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 101: South Asia Pacific Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 102: South Asia Pacific Market Attractiveness Analysis by Engine Capacity

- Figure 103: South Asia Pacific Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 104: South Asia Pacific Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 105: South Asia Pacific Market Attractiveness Analysis by Drive Type

- Figure 106: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 107: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 108: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 109: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 110: Eastern Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 111: Eastern Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 112: Eastern Europe Market Attractiveness Analysis by Type

- Figure 113: Eastern Europe Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 114: Eastern Europe Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 115: Eastern Europe Market Attractiveness Analysis by Vehicle Weight

- Figure 116: Eastern Europe Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 117: Eastern Europe Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 118: Eastern Europe Market Attractiveness Analysis by Engine Capacity

- Figure 119: Eastern Europe Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 120: Eastern Europe Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 121: Eastern Europe Market Attractiveness Analysis by Drive Type

- Figure 122: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 123: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 124: Eastern Europe Market Attractiveness Analysis by Application

- Figure 125: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 126: Middle East & Africa Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 127: Middle East & Africa Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 128: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 129: Middle East & Africa Market Value Share and BPS Analysis by Vehicle Weight, 2025 and 2035

- Figure 130: Middle East & Africa Market Y-o-Y Growth Comparison by Vehicle Weight, 2025 to 2035

- Figure 131: Middle East & Africa Market Attractiveness Analysis by Vehicle Weight

- Figure 132: Middle East & Africa Market Value Share and BPS Analysis by Engine Capacity, 2025 and 2035

- Figure 133: Middle East & Africa Market Y-o-Y Growth Comparison by Engine Capacity, 2025 to 2035

- Figure 134: Middle East & Africa Market Attractiveness Analysis by Engine Capacity

- Figure 135: Middle East & Africa Market Value Share and BPS Analysis by Drive Type, 2025 and 2035

- Figure 136: Middle East & Africa Market Y-o-Y Growth Comparison by Drive Type, 2025 to 2035

- Figure 137: Middle East & Africa Market Attractiveness Analysis by Drive Type

- Figure 138: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 139: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 140: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 141: Global Market - Tier Structure Analysis

- Figure 142: Global Market - Company Share Analysis

- FAQs -

What is the Global Excavator Market size in 2025?

The excavator market is valued at USD 81.2 billion in 2025.

Who are the Major Players Operating in the Excavator Market?

Prominent players in the market include Atlas Copco, Caterpillar Inc., CNH Global NV, Doosan, and Escorts Group.

What is the Estimated Valuation of the Excavator Market by 2035?

The market is expected to reach a valuation of USD 138.7 billion by 2035.

What Value CAGR Did the Excavator Market Exhibit over the Last Five Years?

The historic growth rate of the excavator market is 5.5% from 2020-2024.