Propylene Glycol Market

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

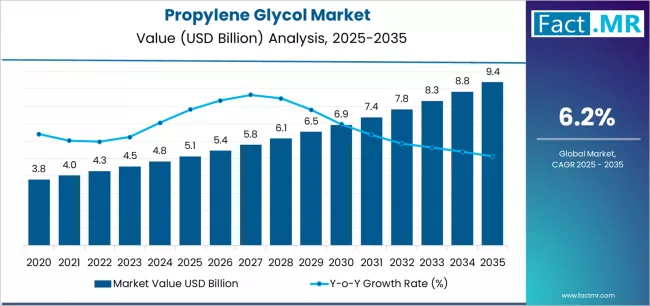

Propylene glycol market is projected to grow from USD 5.1 billion in 2025 to USD 9.4 billion by 2035, at a CAGR of 6.2%. Petroleum-based will dominate with a 71.2% market share, while industrial grade will lead the grade segment with a 63.3% share.

Propylene Glycol Market Forecast and Outlook 2025 to 2035

The global propylene glycol market is projected to reach USD 9.38 billion by 2035, recording an absolute increase of USD 4.25 billion over the forecast period. The market is valued at USD 5.13 billion in 2025 and is set to rise at a CAGR of 6.2% during the assessment period.

Quick Stats for Propylene Glycol Market

- Propylene Glycol Market Value (2025): USD 5.13 billion

- Propylene Glycol Market Forecast Value (2035): USD 9.38 billion

- Propylene Glycol Market Forecast CAGR: 6.2%

- Leading Source in Propylene Glycol Market: Petroleum-based (71.2%)

- Key Growth Regions in Propylene Glycol Market: Asia Pacific, North America, and Europe

- Top Players in Propylene Glycol Market: Dow, BASF SE, ADM, INEOS, Shell Plc, Adeka Corporation, Huntsman International LLC, LyondellBasell, Covestro, SK Capital / Monument Chemical

The overall market size is expected to grow by approximately 1.8 times during the same period, supported by increasing demand for unsaturated polyester resins in construction applications and expanding use in aircraft de-icing formulations across transportation sectors worldwide, driving demand for versatile chemical intermediates and increasing investments in bio-based production technologies with sustainable manufacturing capabilities across pharmaceutical, food processing, and industrial applications globally.

Chemical manufacturers face mounting pressure to develop safer and more environmentally responsible products while meeting stringent regulatory requirements and consumer preferences, with modern propylene glycol formulations providing documented performance benefits including low toxicity profiles, excellent solvent properties, and superior hygroscopic characteristics compared to alternative glycols and conventional chemical intermediates alone.

Rising adoption of sustainable aviation practices and expanding construction activity in emerging markets enabling infrastructure modernization create substantial opportunities for manufacturers and chemical distributors. However, raw material price volatility and regulatory compliance complexity may pose obstacles to consistent profit margins and market expansion.

The petroleum-based propylene glycol segment dominates market activity, driven by established production infrastructure and cost-effective manufacturing processes delivering reliable supply across diverse industrial applications worldwide. Industries increasingly recognize the performance benefits of petroleum-derived propylene glycol, with typical product offerings providing consistent quality and competitive pricing at commercial scale through established petrochemical production networks.

The industrial grade segment demonstrates robust market presence, supported by extensive consumption in unsaturated polyester resins, antifreeze formulations, and industrial coolant applications requiring technical performance without pharmaceutical-grade specifications.

Construction emerges as the dominant end-use sector, reflecting widespread adoption of propylene glycol in composite materials and building products supporting infrastructure development. China represents the fastest-growing market, driven by massive construction activity and expanding transportation sector supporting increased propylene glycol consumption.

Regional dynamics show Asia Pacific maintaining strong growth momentum, supported by rapid industrialization and infrastructure investment programs driving propylene glycol demand across construction and manufacturing applications. India demonstrates robust expansion potential driven by urbanization initiatives and domestic manufacturing growth requiring chemical intermediates, while USA emphasizes diverse end-use applications spanning pharmaceuticals, food processing, and industrial sectors.

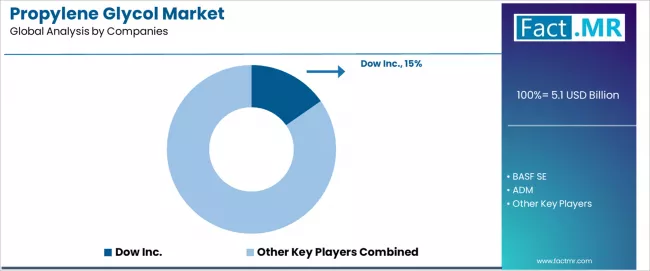

Germany leads European consumption through advanced industrial manufacturing and stringent quality standards, followed by Saudi Arabia supported by petrochemical infrastructure and regional construction development. The competitive landscape features moderate concentration with Dow maintaining market leadership position at 15.3% market share, while established players including BASF SE, ADM, INEOS, and Shell Plc compete through integrated production capabilities and comprehensive distribution networks across diverse industrial applications.

Propylene Glycol Market Year-over-Year Forecast 2025 to 2035

Between 2025 and 2029, the propylene glycol market is projected to expand from USD 5.13 billion to USD 6.59 billion, resulting in a value increase of USD 1.46 billion, which represents 34.4% of the total forecast growth for the period. This phase of development will be shaped by rising demand for unsaturated polyester resins in construction materials and composite manufacturing, product innovation in bio-based propylene glycol production with renewable feedstock utilization and reduced carbon footprint, as well as expanding applications in pharmaceutical excipients and food-grade humectant formulations. Companies are establishing competitive positions through investment in production capacity expansion, sustainable manufacturing technologies, and strategic market development across construction materials, automotive antifreeze, and consumer product channels.

From 2029 to 2035, the market is forecast to grow from USD 6.59 billion to USD 9.38 billion, adding another USD 2.79 billion, which constitutes 65.6% of the overall expansion. This period is expected to be characterized by the expansion of specialized applications, including aircraft de-icing fluids for aviation safety and heat transfer fluids for renewable energy systems tailored for specific performance requirements, strategic collaborations between propylene glycol producers and end-use manufacturers, and an enhanced focus on circular economy principles and renewable feedstock integration. The growing emphasis on sustainable aviation fuels infrastructure and rising adoption of environmentally preferred chemicals will drive demand for bio-based propylene glycol with certified sustainability credentials across pharmaceutical, food processing, and industrial end-use segments.

Propylene Glycol Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5.13 billion |

| Market Forecast Value (2035) | USD 9.38 billion |

| Forecast CAGR (2025-2035) | 6.2% |

Why is the Propylene Glycol Market Growing?

The propylene glycol market grows by enabling diverse industrial applications and consumer product formulations to achieve superior performance characteristics and regulatory compliance while addressing sustainability objectives and safety requirements without compromising functionality and cost-effectiveness.

Chemical manufacturers face mounting pressure to deliver versatile intermediates for construction composites, pharmaceutical formulations, and food processing applications while meeting stringent regulatory standards, with modern propylene glycol products typically providing essential properties including moisture retention, antifreeze protection, and solvent capabilities compared to alternative glycols and conventional chemical solutions alone, making propylene glycol essential for comprehensive industrial and consumer applications.

The construction industry's need for durable composite materials and high-performance resins creates demand for specialized propylene glycol products that can provide excellent reactivity, processing characteristics, and final product properties without compromising structural integrity or long-term performance. End-user specifications and regulatory approvals drive adoption in pharmaceutical environments, food processing facilities, and industrial manufacturing operations, where product purity and safety profiles have direct impact on regulatory compliance and consumer acceptance.

The increasing emphasis on sustainable aviation operations and aircraft safety, affecting airlines and airport operators across transportation sectors, creates expanding propylene glycol consumption supporting de-icing requirements. Rising awareness about bio-based alternatives and environmental sustainability enables informed sourcing decisions and adoption of renewable propylene glycol formulations. Competition from alternative glycols including ethylene glycol and glycerol may limit market share among certain applications with different performance requirements or cost considerations.

Segmental Analysis

The market is segmented by source, grade, end-use, and region. By source, the market is divided into petroleum-based and bio-based. Based on grade, the market is categorized into industrial grade and USP grade. By end-use, the market includes construction, transportation, food & beverages, pharmaceuticals, cosmetics & personal care, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

By Source, Which Segment Accounts for the Dominant Market Share?

The petroleum-based propylene glycol segment represents the dominant force in the propylene glycol market, capturing 71.2% of total market share in 2025. This established source category encompasses solutions featuring conventional petrochemical production processes and proven manufacturing infrastructure, including advanced catalytic oxidation technologies and efficient purification systems that enable cost-effective production and consistent quality across industrial, pharmaceutical, and food-grade applications worldwide.

The petroleum-based segment's market leadership stems from its superior production economics, with solutions capable of delivering high-volume supply and competitive pricing while maintaining required purity specifications and regulatory compliance standards across diverse end-use markets and geographic regions.

The bio-based propylene glycol segment maintains a substantial market share at 28.8%, serving sustainability-focused applications requiring renewable feedstock content and reduced environmental impact across consumer products, pharmaceutical formulations, and industrial applications where corporate sustainability objectives and regulatory preferences drive procurement decisions.

These solutions offer superior environmental credentials for demanding sustainability requirements while providing sufficient performance to justify premium pricing. The bio-based segment demonstrates strong growth potential, driven by expanding regulatory support for renewable chemicals and increasing corporate commitments to sustainable sourcing practices.

Key production advantages driving the petroleum-based segment include:

- Established manufacturing infrastructure with proven production economics enabling large-scale supply and consistent product availability without capacity constraints

- Cost-effective production processes allowing competitive pricing structures while maintaining required quality standards and regulatory compliance

- Reliable supply chains providing optimal inventory management and distribution efficiency across global markets and diverse customer segments

- Technical expertise supporting application development and customer service across pharmaceutical, food, and industrial end-use applications

By Grade, Which Segment Accounts for the Largest Market Share?

Industrial grade dominates the propylene glycol grade landscape with 63.3% market share in 2025, reflecting the critical role of technical-grade propylene glycol in supporting high-volume industrial applications including unsaturated polyester resins, antifreeze formulations, and industrial coolants across manufacturing facilities worldwide.

The industrial grade segment's market leadership is reinforced by extensive consumption volumes, diverse application portfolios, and cost-sensitive purchasing patterns that prioritize functional performance over pharmaceutical-grade purity specifications.

Within this segment, unsaturated polyester resin production represents the primary consumption category, driven by construction materials, marine applications, and composite manufacturing requiring reactive diluent properties. This sub-segment benefits from established formulation protocols and continuous construction activity supporting consistent demand patterns.

The USP grade segment represents an important category at 36.7% market share with robust growth potential, demonstrating strong expansion through specialized requirements for pharmaceutical excipients, food-grade humectants, and personal care formulations. This segment benefits from stringent regulatory compliance and premium pricing structures supporting pharmaceutical and food processing applications.

Key market dynamics supporting grade segment growth include:

- Industrial grade expansion driven by construction sector growth and composite materials demand, requiring high-volume supply and reliable quality standards

- USP grade category trends requiring pharmaceutical-grade purity and comprehensive regulatory documentation for human consumption applications

- Integration of quality management systems enabling USP certification and food-grade compliance across production facilities

- Growing emphasis on application-specific grades driving specialized product development for targeted end-use requirements

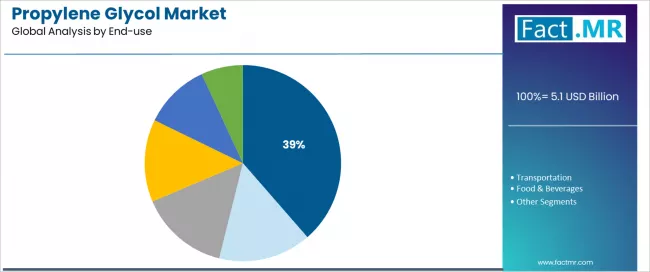

By End-use, Which Segment Accounts for a Significant Market Share?

Construction represents the leading end-use segment in the propylene glycol market with approximately 38.6% market share in 2025, reflecting the fundamental importance of propylene glycol in unsaturated polyester resin production and composite materials supporting infrastructure development and building applications.

The construction segment demonstrates consistent demand driven by the need for durable, lightweight materials in structural applications, architectural components, and construction panels across residential, commercial, and infrastructure projects.

The transportation segment emerges as an important end-use category at 20.4% market share with substantial growth potential, driven by extensive applications in aircraft de-icing fluids, automotive antifreeze, and heat transfer systems requiring effective freeze protection and thermal management. Transportation applications require specialized formulations capable of supporting safety-critical operations and meeting stringent performance specifications for aviation and automotive sectors.

Within end-use applications, food & beverages demonstrates steady consumption for humectant and preservative functions in processed foods and beverages. Pharmaceuticals addresses critical applications as excipients and solvent carriers in drug formulations, while cosmetics & personal care serves moisturizing and solvent functions in beauty and hygiene products.

Key end-use dynamics include:

- Construction requirements accelerating across infrastructure projects with emphasis on composite materials and durable building products

- Transportation applications driving demand for de-icing fluids and antifreeze formulations supporting aviation safety and automotive performance

- Food processing prioritizing food-grade humectants and preservative systems through regulatory-compliant formulations

- Pharmaceutical sector emphasizing high-purity excipients and solvent systems addressing drug delivery and formulation stability

What are the Drivers, Restraints, and Key Trends of the Propylene Glycol Market?

The market is driven by three concrete demand factors tied to industrial development outcomes. First, rising global construction activity and expanding infrastructure investment create increasing propylene glycol consumption across unsaturated polyester resin production and composite materials manufacturing, with chemical intermediates representing essential inputs for construction materials in structural applications, requiring consistent supply availability. Second, growing air travel and aviation safety requirements drive systematic adoption and fleet-wide implementation, with aircraft de-icing fluids demonstrating significant benefits in operational safety, flight schedule reliability, and passenger protection through effective ice prevention by 2030. Third, increasing pharmaceutical production and food processing activity enable expanding applications that drive propylene glycol consumption while supporting population health and nutrition requirements.

Market restraints include raw material price volatility and propylene oxide cost fluctuations that can challenge profit margins and pricing stability, particularly in commodity-grade products where competitive pressures limit ability to pass through cost increases and margin compression proves inevitable. Regulatory complexity and varying international standards for food-grade and pharmaceutical applications pose another significant obstacle, as propylene glycol consumption depends on compliance with diverse regulatory frameworks across geographic markets, potentially affecting market access and product qualification requirements. Competition from alternative glycols including ethylene glycol for antifreeze applications and glycerol for humectant functions create additional challenges for market share retention, demanding clear value demonstration and application-specific advantages.

Key trends indicate accelerated bio-based propylene glycol adoption in developed markets, particularly North America and Europe, where end-users and brand owners demonstrate growing commitment to renewable chemicals offering reduced carbon footprint, sustainable sourcing credentials, and alignment with corporate sustainability objectives. Green chemistry trends toward renewable feedstock utilization with corn-derived or biomass-based production pathways enable regulatory preference and consumer acceptance. However, the market thesis could face disruption if significant advances in alternative chemical intermediates or major shifts in construction material technologies reduce reliance on traditional propylene glycol-based formulations.

Analysis of the Propylene Glycol Market by Key Countries

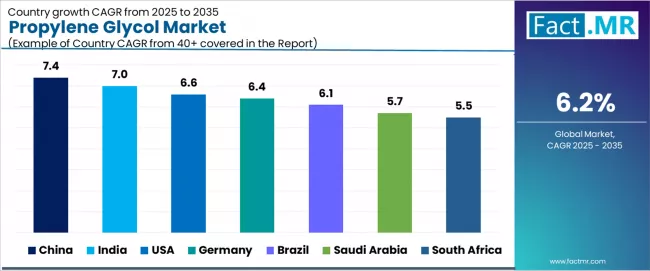

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 7.0% |

| USA | 6.6% |

| Germany | 6.4% |

| Brazil | 6.1% |

| Saudi Arabia | 5.7% |

| South Africa | 5.5% |

The global propylene glycol market is expanding robustly, with China leading at a 7.4% CAGR through 2035, driven by strong transport, aircraft de-icing, and construction sector growth supporting infrastructure development and manufacturing expansion. India follows at 7.0%, supported by fast construction growth and manufacturing expansion promoting industrial chemical consumption. USA records 6.6%, reflecting diverse applications in automotive, de-icing fluids, and pharmaceuticals supporting established market demand.

Germany advances at 6.4%, leveraging demand in UPR resins and industrial coolants for manufacturing applications. Brazil posts 6.1%, focusing on growth in food processing and construction sectors, while Saudi Arabia grows steadily at 5.7%, emphasizing large infrastructure and HVAC demand. South Africa demonstrates 5.5% growth, anchored by urbanization and industrial applications.

How is China Leading Global Market Expansion?

China demonstrates the strongest growth potential in the propylene glycol market with a CAGR of 7.4% through 2035. The country's leadership position stems from massive construction sector activity, rapidly expanding aviation infrastructure under Belt and Road initiatives, and comprehensive manufacturing capacity driving propylene glycol demand across unsaturated polyester resins, antifreeze formulations, and industrial applications.

Growth is concentrated in major industrial regions and manufacturing hubs, including Jiangsu, Shandong, Guangdong, and Zhejiang, where chemical producers are increasingly supplying propylene glycol for construction materials and transportation applications beyond conventional industrial uses.

Distribution channels through chemical distributors, construction material suppliers, and automotive aftermarket networks expand product accessibility across manufacturing facilities and end-use industries. The country's growing emphasis on domestic aviation expansion and infrastructure modernization provides strong momentum for propylene glycol consumption, including comprehensive adoption across airport de-icing operations and construction composite manufacturing seeking reliable performance.

Key market factors:

- Construction activity concentrated in urban development zones with extensive infrastructure investment programs

- Manufacturing capacity expansion through integrated petrochemical complexes and chemical production facilities

- Comprehensive aviation sector growth, including airport construction and airline fleet expansion with proven de-icing requirements

- Domestic production presence featuring international chemical companies and state-owned enterprises offering competitive supply

Why is India Emerging as a High-Growth Market?

In major industrial regions including Gujarat, Maharashtra, Tamil Nadu, and Uttar Pradesh, the consumption of propylene glycol products is accelerating across construction projects, driven by rapid urbanization and increasing emphasis on infrastructure development programs. The market demonstrates strong growth momentum with a CAGR of 7.0% through 2035, linked to comprehensive construction sector expansion trends and increasing adoption of modern composite materials in building applications.

Indian manufacturers are implementing propylene glycol-based formulations integrated with construction specifications to enhance material performance while meeting growing expectations in durability and cost-effectiveness. The country's expanding pharmaceutical manufacturing sector and food processing industry create ongoing demand for USP-grade propylene glycol products, while increasing emphasis on Make in India initiatives drives domestic chemical production capacity development.

Key development areas:

- Construction projects and infrastructure development leading propylene glycol consumption with emphasis on composite materials and building products

- Distribution expansion through both chemical distributor networks and direct supply arrangements with major consumers

- Manufacturing capacity development enabling domestic production addressing import dependence and supply security

- Growing pharmaceutical industry requiring USP-grade propylene glycol alongside industrial-grade products for construction applications

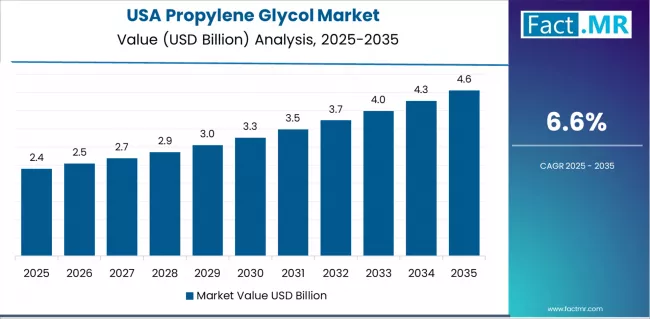

What Drives USA Market Diversification?

USA market expansion is driven by diverse application portfolios, including automotive antifreeze formulations in transportation sectors and pharmaceutical excipients across healthcare industries. The country demonstrates steady growth potential with a CAGR of 6.6% through 2035, supported by continuous innovation from established chemical manufacturers and specialty producers.

American facilities face implementation challenges related to environmental regulations and sustainability requirements, necessitating bio-based product development and renewable feedstock integration strategies. However, established consumption patterns across pharmaceutical, food processing, and industrial sectors create stable baseline demand for propylene glycol products, particularly among facilities pursuing regulatory compliance where USP-grade specifications drive primary purchasing considerations.

Market characteristics:

- Pharmaceutical and food processing industries showing robust demand with substantial annual consumption across formulation applications

- Regional consumption patterns varying between industrial applications in manufacturing states and pharmaceutical production in specialized clusters

- Future projections indicate continued bio-based product adoption with emphasis on renewable content and sustainability credentials

- Growing emphasis on aircraft de-icing applications and aviation safety supporting winter operations at northern airports

How does Germany Demonstrate Industrial Excellence Leadership?

The market in Germany leads in high-performance propylene glycol applications based on integration with advanced manufacturing processes and stringent quality requirements for industrial and pharmaceutical end-uses. The country shows strong potential with a CAGR of 6.4% through 2035, driven by sophisticated chemical industry infrastructure and automotive sector presence in major industrial regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony.

German manufacturers are adopting propylene glycol formulations through comprehensive quality management systems and regulatory compliance frameworks for enhanced product performance, particularly in unsaturated polyester resin production and industrial coolant applications demanding rigorous specification adherence. Distribution channels through chemical distributors and integrated supply chains expand coverage across automotive suppliers and industrial manufacturers.

Leading market segments:

- Unsaturated polyester resin production in major chemical centers implementing high-quality propylene glycol specifications

- Industrial coolant applications achieving reliable performance through automotive-grade formulations

- Strategic collaborations between chemical producers and end-use manufacturers expanding application development and technical support

- Focus on pharmaceutical-grade production including USP certification and comprehensive quality documentation

What Positions Brazil for Food Processing and Construction Growth?

In major industrial regions including São Paulo, Minas Gerais, Rio de Janeiro, and Paraná, facilities are implementing propylene glycol products through diverse application portfolios and comprehensive supply networks, with documented case studies showing substantial performance benefits through food-grade humectants in processed foods and industrial-grade products in construction materials.

The market shows steady growth potential with a CAGR of 6.1% through 2035, linked to ongoing food processing sector expansion, construction activity growth, and emerging pharmaceutical manufacturing in major industrial centers. Industries are adopting propylene glycol formulations with application-specific characteristics to enhance product quality while maintaining standards demanded by regulated industries and consumer markets. The country's established food processing sector and expanding construction industry create ongoing opportunities for propylene glycol applications that differentiate through regulatory compliance and technical performance.

Market development factors:

- Food processing facilities leading adoption of USP-grade propylene glycol across Brazil

- Construction sector applications providing growth opportunities in composite materials and building products

- Strategic partnerships between chemical suppliers and food manufacturers expanding technical collaboration

- Emphasis on domestic production capacity addressing import costs and supply chain efficiency

How does Saudi Arabia Show Infrastructure and HVAC Focus?

Saudi Arabia's propylene glycol market demonstrates substantial consumption focused on large infrastructure projects and HVAC system applications, with documented integration of industrial-grade propylene glycol achieving reliable thermal management in demanding climate conditions across construction developments and building systems.

The country maintains solid growth momentum with a CAGR of 5.7% through 2035, driven by mega-project development and comprehensive infrastructure investment emphasizing modern building systems that align with urbanization requirements applied to Saudi Arabian construction standards.

Major development regions, including Riyadh, Jeddah, Eastern Province, and NEOM, showcase extensive propylene glycol consumption where heat transfer fluids integrate seamlessly with sophisticated HVAC systems and comprehensive climate control installations.

Key market characteristics:

- Infrastructure projects and construction developments driving demand for industrial-grade propylene glycol products

- HVAC systems requiring reliable heat transfer fluids for cooling and thermal management applications

- Petrochemical infrastructure supporting domestic production capacity and regional supply networks

- Focus on mega-project specifications addressing performance requirements in extreme climate conditions

What Characterizes South Africa's Urbanization-Driven Growth?

In major industrial centers including Gauteng, Western Cape, and KwaZulu-Natal, the consumption of propylene glycol products serves diverse applications across construction projects and industrial manufacturing, driven by ongoing urbanization and infrastructure development initiatives. The market demonstrates steady growth potential with a CAGR of 5.5% through 2035, linked to construction sector activity and industrial chemical consumption supporting manufacturing operations.

South African industries are implementing propylene glycol formulations capable of supporting construction applications to enhance material performance while meeting operational expectations in building projects and industrial processes. The country's expanding construction sector and established chemical industry create ongoing demand for industrial-grade propylene glycol products, while increasing pharmaceutical manufacturing drives adoption of USP-grade formulations.

Key development areas:

- Construction projects utilizing composite materials and unsaturated polyester resins incorporating propylene glycol

- Industrial manufacturing operations requiring chemical intermediates and processing aids

- Distribution networks serving both urban construction markets and industrial chemical consumers

- Integration of imported products and regional production addressing supply requirements and cost considerations

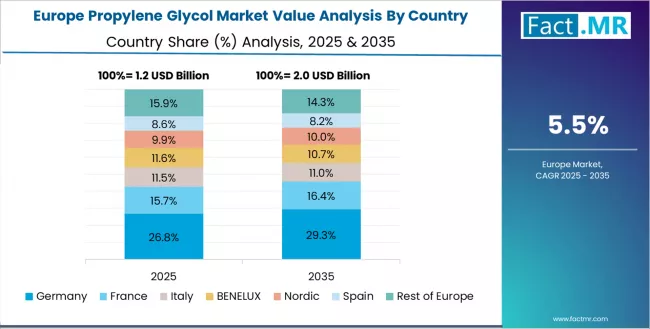

Europe Market Split by Country

The propylene glycol market in Europe is projected to grow from USD 1.22 billion in 2025 to USD 2.11 billion by 2035, registering a CAGR of 5.6% over the forecast period. Germany is expected to maintain its leadership position with a 28.7% market share in 2025, adjusting to 29.3% by 2035, supported by its extensive chemical manufacturing infrastructure, advanced unsaturated polyester resin production, and comprehensive pharmaceutical industry serving major European markets.

France follows with a 19.4% share in 2025, projected to reach 19.1% by 2035, driven by comprehensive food processing sector and pharmaceutical manufacturing presence in major industrial regions implementing quality-focused production standards. UK holds a 17.8% share in 2025, expected to maintain 17.6% by 2035 through ongoing pharmaceutical production and industrial chemical consumption.

Italy commands a 15.2% share, while Spain accounts for 11.5% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 7.4% to 8.3% by 2035, attributed to increasing propylene glycol consumption in Nordic industrial facilities and emerging Eastern European pharmaceutical manufacturing implementing modern production practices.

Competitive Landscape of the Propylene Glycol Market

The propylene glycol market features approximately 20-30 meaningful players with moderate concentration, where the top three companies control roughly 30-40% of global market share through integrated production facilities, established distribution networks, and comprehensive product portfolios. Competition centers on production efficiency, product quality, and supply reliability rather than pricing competition alone.

Market leaders include Dow Inc., maintaining a 15.3% market share, BASF SE, and ADM, which maintain competitive advantages through vertically integrated operations spanning propylene oxide production through propylene glycol manufacturing, comprehensive grade offerings including industrial and USP specifications, and deep relationships with construction, pharmaceutical, and food processing customers, creating stable demand patterns among end-users seeking reliable supply. These companies leverage global production footprints and ongoing process optimization to defend market positions while expanding into bio-based propylene glycol production for sustainability-focused applications.

Challengers encompass established petrochemical companies including INEOS, Shell Plc, and specialty chemical producers including Huntsman International LLC and LyondellBasell, which compete through regional production advantages and technical service capabilities supporting customer applications.

Diversified chemical manufacturers, including Adeka Corporation, Covestro, and specialized producers including SK Capital / Monument Chemical, focus on specific market segments or product grades, offering differentiated capabilities in USP-grade production, bio-based formulations, and application-specific solutions.

Emerging bio-based producers and regional manufacturers create competitive pressure through renewable feedstock utilization and localized supply advantages, particularly in regions including North America and Europe, where sustainability preferences provide market differentiation opportunities.

Market dynamics favor companies that combine reliable production capacity with consistent product quality that addresses diverse customer requirements from pharmaceutical manufacturers through construction material producers and food processors.

Strategic emphasis on sustainability initiatives, bio-based product development, and technical application support enables differentiation in increasingly quality-driven and environmentally conscious propylene glycol market segments across pharmaceutical, food, and industrial applications.

Global Propylene Glycol Market — Stakeholder Contribution Framework

Propylene glycol represents a critical versatile chemical intermediate that enables diverse industrial applications and consumer product formulations to achieve superior performance characteristics and regulatory compliance while addressing sustainability objectives and safety requirements without compromising functionality and cost-effectiveness, typically providing essential properties including moisture retention, antifreeze protection, and solvent capabilities compared to alternative glycols and conventional chemical solutions alone while ensuring improved product performance and comprehensive application versatility outcomes.

With the market projected to grow from USD 5.13 billion in 2025 to USD 9.38 billion by 2035 at a 6.2% CAGR, these products offer compelling advantages for construction applications, petroleum-based production, and diverse end-use sectors seeking reliable chemical intermediates. Scaling market development and sustainable growth requires coordinated action across production technology, quality standards, chemical manufacturers, end-use industries, and regulatory frameworks.

How Could Governments Spur Local Development and Adoption?

- Chemical Industry Development Programs: Include propylene glycol in domestic manufacturing strategies, providing targeted support for production capacity establishment and feedstock infrastructure development and supporting technology transfer through development grants and investment incentives.

- Tax Policy & Investment Support: Implement favorable tax treatment for chemical manufacturing investments, provide incentives for companies developing bio-based production technologies and renewable feedstock utilization, and establish import duty structures that encourage local production over imports.

- Standards & Quality Framework Development: Create product quality standards for propylene glycol across industrial and pharmaceutical applications, establish testing protocols and specification guidelines for consumer protection, and develop harmonization initiatives that facilitate international trade.

- Sustainability & Renewable Chemicals: Fund initiatives promoting bio-based chemical production and renewable feedstock integration, invest in agricultural infrastructure supporting feedstock availability, and establish clear definitions for renewable content certification.

- Research & Innovation Support: Establish public-private partnerships for advanced chemical process research, support collaborative development investigating production efficiency improvements and sustainable manufacturing technologies, and create regulatory frameworks that encourage green chemistry innovation.

How Could Industry Bodies Support Market Development?

- Technical Standards & Specifications: Define standardized product grades for propylene glycol across industrial, USP, and food-grade applications, establish universal quality benchmarks and analytical methods, and create specification frameworks that end-use manufacturers can reference.

- Market Education & Best Practices: Lead initiatives demonstrating propylene glycol applications, emphasizing performance advantages, safety profiles, and appropriate use recommendations compared to alternative chemicals.

- Quality Assurance Programs: Develop guidelines for manufacturing excellence, quality control procedures, and regulatory compliance documentation, ensuring product reliability across production and distribution operations.

- Professional Development: Run technical programs for formulators, quality managers, and regulatory specialists on optimizing propylene glycol applications, compliance strategies, and quality assurance approaches in diverse end-use industries.

How Could Manufacturers and Chemical Producers Strengthen the Ecosystem?

- Advanced Production Technologies: Develop next-generation manufacturing processes with enhanced efficiency, reduced environmental impact, and improved product quality that support competitive positioning while addressing sustainability objectives.

- Product Quality Excellence: Provide consistent high-purity propylene glycol products, comprehensive quality documentation, and regulatory support that serve pharmaceutical, food, and industrial customer requirements.

- Technical Application Support: Offer formulation assistance, performance optimization consultation, and regulatory guidance that help customers maximize propylene glycol effectiveness and compliance outcomes.

- Research & Development Networks: Build comprehensive R&D capabilities, collaborative testing programs, and pilot-scale facilities that ensure propylene glycol products meet evolving application requirements and enable new market development.

How Could End-Use Manufacturers and Formulators Navigate the Market?

- Product Formulation Optimization: Incorporate optimized propylene glycol specifications into product designs, with particular focus on pharmaceutical excipients, food-grade humectants, and industrial formulations for comprehensive performance optimization.

- Supply Chain Management: Establish reliable propylene glycol procurement strategies addressing quality consistency, regulatory compliance, and inventory management through optimized supplier relationships and qualification systems.

- Regulatory Compliance Programs: Implement comprehensive documentation addressing pharmacopeial standards, food-grade specifications, and safety data requirements through structured quality management and certification processes.

- Sustainability Integration: Develop sourcing strategies incorporating bio-based propylene glycol addressing corporate sustainability objectives, renewable content targets, and environmental performance goals.

How Could Investors and Financial Enablers Unlock Value?

- Production Capacity Financing: Provide growth capital for established producers like Dow, BASF SE, and emerging manufacturers to fund capacity expansion, technology upgrades, and bio-based production facility development.

- Bio-Based Technology Investment: Back companies developing renewable feedstock utilization, fermentation-based production processes, and sustainable manufacturing technologies that enhance environmental performance.

- Market Expansion Funding: Finance distribution network development strategies for propylene glycol producers establishing operations in high-growth regions including China and India, supporting infrastructure that addresses supply chain requirements.

- Vertical Integration Support: Enable strategic acquisitions combining feedstock production with propylene glycol manufacturing and downstream formulation capabilities, creating integrated business models with enhanced competitive positioning.

Key Players in the Propylene Glycol Market

- Dow Inc.

- BASF SE

- ADM

- INEOS

- Shell Plc

- Adeka Corporation

- Huntsman International LLC

- LyondellBasell

- Covestro

- SK Capital / Monument Chemical

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units | USD 5.13 Billion |

| Source | Petroleum-based, Bio-based |

| Grade | Industrial Grade, USP Grade |

| End-use | Construction, Transportation, Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, USA, Germany, Brazil, Saudi Arabia, South Africa, and 40+ countries |

| Key Companies Profiled | Dow, BASF SE, ADM, INEOS, Shell Plc, Adeka Corporation, Huntsman International LLC, LyondellBasell, Covestro, SK Capital / Monument Chemical |

| Additional Attributes | Dollar sales by source and grade categories, consumption trends across Asia Pacific, Europe, and North America, competitive landscape with chemical manufacturers and integrated producers, product specifications and quality requirements, compatibility with pharmaceutical, food-grade, and industrial applications, innovations in bio-based production technologies and renewable feedstock utilization, and development of specialized formulations with enhanced performance characteristics and sustainable manufacturing capabilities. |

Propylene Glycol Market by Segments

-

Source :

- Petroleum-based

- Bio-based

-

Grade :

- Industrial Grade

- USP Grade

-

End-use :

- Construction

- Transportation

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

-

Region :

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia Pacific

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Rest of Europe

- North America

- USA

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Rest of Middle East & Africa

- Asia Pacific

Table of Content

- Executive Summary

- USA Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- USA Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- USA Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- USA Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Source, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Source, 2025 to 2035

- Petroleum-based

- Bio-based

- Y to o to Y Growth Trend Analysis By Source, 2020 to 2024

- Absolute $ Opportunity Analysis By Source, 2025 to 2035

- USA Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Grade

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Grade, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Grade, 2025 to 2035

- Industrial Grade

- USP Grade

- Y to o to Y Growth Trend Analysis By Grade, 2020 to 2024

- Absolute $ Opportunity Analysis By Grade, 2025 to 2035

- USA Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-use

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End-use, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End-use, 2025 to 2035

- Construction

- Transportation

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

- Y to o to Y Growth Trend Analysis By End-use, 2020 to 2024

- Absolute $ Opportunity Analysis By End-use, 2025 to 2035

- USA Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- USA

- Market Attractiveness Analysis By Region

- USA Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- By Source

- By Grade

- By End-use

- Market Attractiveness Analysis

- By Country

- By Source

- By Grade

- By End-use

- Key Takeaways

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Source

- By Grade

- By End-use

- Competition Analysis

- Competition Deep Dive

- Dow Inc.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- BASF SE

- ADM

- INEOS

- Shell Plc

- Adeka Corporation

- Huntsman International LLC

- LyondellBasell

- Covestro

- SK Capital / Monument Chemical

- Dow Inc.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: USA Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: USA Market Value (USD Million) Forecast by Source, 2020 to 2035

- Table 3: USA Market Value (USD Million) Forecast by Grade, 2020 to 2035

- Table 4: USA Market Value (USD Million) Forecast by End-use, 2020 to 2035

- Table 5: USA Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: USA Market Value (USD Million) Forecast by Source, 2020 to 2035

- Table 7: USA Market Value (USD Million) Forecast by Grade, 2020 to 2035

- Table 8: USA Market Value (USD Million) Forecast by End-use, 2020 to 2035

List Of Figures

- Figure 1: USA Market Pricing Analysis

- Figure 2: USA Market Value (USD Million) Forecast 2020 to 2035

- Figure 3: USA Market Value Share and BPS Analysis by Source, 2025 and 2035

- Figure 4: USA Market Y to o to Y Growth Comparison by Source, 2025 to 2035

- Figure 5: USA Market Attractiveness Analysis by Source

- Figure 6: USA Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 7: USA Market Y to o to Y Growth Comparison by Grade, 2025 to 2035

- Figure 8: USA Market Attractiveness Analysis by Grade

- Figure 9: USA Market Value Share and BPS Analysis by End-use, 2025 and 2035

- Figure 10: USA Market Y to o to Y Growth Comparison by End-use, 2025 to 2035

- Figure 11: USA Market Attractiveness Analysis by End-use

- Figure 12: USA Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: USA Market Y to o to Y Growth Comparison by Region, 2025 to 2035

- Figure 14: USA Market Attractiveness Analysis by Region

- Figure 15: USA Market Incremental Dollar Opportunity, 2025 to 2035

- Figure 16: USA Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 17: USA Market Value Share and BPS Analysis by Source, 2025 and 2035

- Figure 18: USA Market Y to o to Y Growth Comparison by Source, 2025 to 2035

- Figure 19: USA Market Attractiveness Analysis by Source

- Figure 20: USA Market Value Share and BPS Analysis by Grade, 2025 and 2035

- Figure 21: USA Market Y to o to Y Growth Comparison by Grade, 2025 to 2035

- Figure 22: USA Market Attractiveness Analysis by Grade

- Figure 23: USA Market Value Share and BPS Analysis by End-use, 2025 and 2035

- Figure 24: USA Market Y to o to Y Growth Comparison by End-use, 2025 to 2035

- Figure 25: USA Market Attractiveness Analysis by End-use

- Figure 26: USA Market - Tier Structure Analysis

- Figure 27: USA Market - Company Share Analysis

- FAQs -

How big is the propylene glycol market in 2025?

The global propylene glycol market is estimated to be valued at USD 5.1 billion in 2025.

What will be the size of propylene glycol market in 2035?

The market size for the propylene glycol market is projected to reach USD 9.4 billion by 2035.

How much will be the propylene glycol market growth between 2025 and 2035?

The propylene glycol market is expected to grow at a 6.2% CAGR between 2025 and 2035.

What are the key product types in the propylene glycol market?

The key product types in propylene glycol market are petroleum-based and bio-based.

Which grade segment to contribute significant share in the propylene glycol market in 2025?

In terms of grade, industrial grade segment to command 63.3% share in the propylene glycol market in 2025.