Whiskey Market

Whiskey Market Analysis, By Grain Type (Malt, Wheat, Rye, Corn, Blended, and Others), By Price Tier, By Packaging, and Region - Market Insights 2025 to 2035

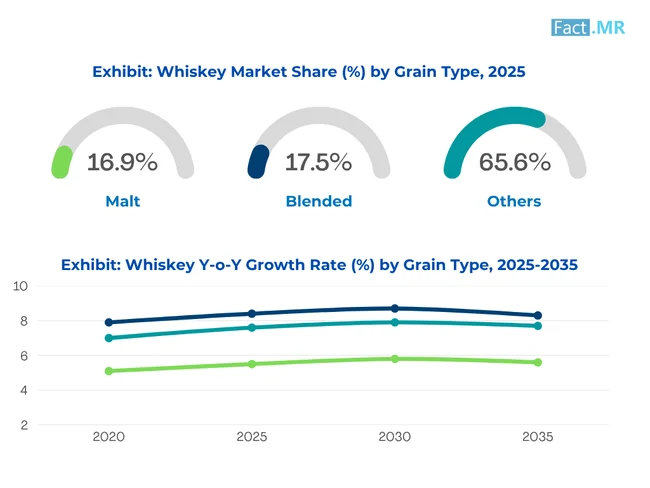

The Malt segment projected to grow at a CAGR of 5.1%, whereas another segment Wheat is likely to grow at 5.8%. In terms of countries US is projected to grow at 6.8%, followed by Japan at 8.3% and Scotland to grow at 8.1%

Whiskey Market Outlook (2025 to 2035)

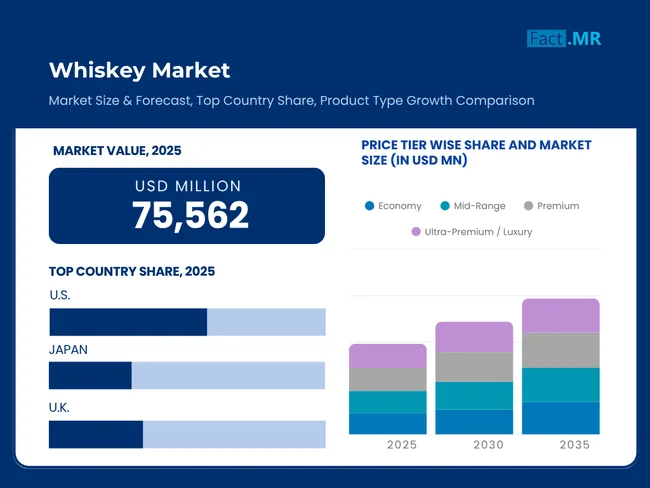

The global whiskey market is expected to reach USD 148,642 million by 2035, up from USD 70,877 million in 2024. During the forecast period (2025-2035), the industry is projected to register a CAGR of 7.0%, driven by the increasing trends in premium products, changing consumer demands and the demand for craft and single malt spirits around the globe.

In addition, rising disposable income levels, tourism, the luxury gifting attraction, advancements in distillation, online marketing, and suitable trade laws are propelling it into global markets.

What are the drivers of Whiskey Market?

Globally, the whiskey market is driven by an upsurge in premium products, a shifting consumer palate, and expanding demand for craft and single malt spirits worldwide. The newer generations, particularly millennials and Gen Z, are interested in more unique, artisanal brands, driving innovation and experimentation in the distilling of whiskey.

High disposable incomes, especially in emerging economies such as India, China, and Brazil, have widened the consumer base. Brand visibility and loyalty are also encouraged through tourism and whiskey-tasting experiences. Whiskey has become a popular gift, due to the elite and prestige associated with it.

The flavor profile of whiskey is also being enhanced with technological innovations in distillation and aging methods, and production time is being reduced, making the drink more accessible. Escalating spending on internet marketing and direct-to-consumer platforms is expanding the reach of brands worldwide.

Changes in regulations that affect major markets, such as the reduction of tariff rates on spirits in some trade agreements, are also further fueling the cross-border trade of whiskey and enhancing its profitability equally.

What are the regional trends of Whiskey Market?

The North American market boasts outstanding leadership in the whiskey business, particularly in the U.S., where bourbon and Tennessee whiskey have a vital domestic and export presence. The number of craft distilleries in the region is growing as consumers become increasingly interested in local and authentic spirits.

Scotland and Ireland continue to preserve their reputation as wholesome whiskey manufacturers in Europe. Scotch whisky is a major export product, whereas Irish whiskey has found new life through modern branding and silky flavors. There are major consumers, as well as emerging bottlers of whiskey, such as those in France and Germany.

India and Japan are the markets that are growing at a fast rate in Asia Pacific. India, the second-largest consumer of whiskey in the world, is shifting towards higher-revenue commodities. The unique whisky-making in Japan has carved out a niche market of global fans, which has culminated in a scarcity of supply and high prices.

In the meantime, countries in Latin America and the Middle East are becoming increasingly interested in importing whiskey, due to the expansion of their middle classes, as well as the emergence and growth of on-trade consumption.

What are the challenges and restraining factors of Whiskey Market?

Although the demand for whiskey is very high, this market also faces numerous challenges that may deter future growth of the industry. Strict regulatory policies, such as the imposition of high excise taxes and other severe labeling regulations in several countries, tend to escalate production and decrease profits.

Aged whiskey has been a significant bottleneck due to disruptions in supply chains. Premium variants have a limited aging time, which restricts their proportionality and capability to respond to surge demands. Influence on climate will also have an impact on the maturation of oak cask,s with consequences on consistency and production.

There is a risk that counterfeit and adulterated whiskey products endanger consumer confidence and affect the authentic brand equity, especially in emerging markets. In addition, the health-conscious trend on one hand and growing awareness of the risks involved in consuming alcohol may curb consumption in some of the segments of the consumers.

Such external environmental factors and issues as excessive water consumption and carbon emissions in distilleries are prompting brands to implement sustainable operations, which come at increased operational costs.

Country-Wise Outlook

Premium and craft culture fuel U.S. whiskey boom

-2025-to-2035.webp)

U.S. is the whiskey market leader through a blend of history and innovation. Fueled by intense demand for high-end and craft spirits, the industry thrives on long-established traditions in bourbon and Tennessee whiskey, as well as a burgeoning craft distillery sector now encompassing over 2,700 entities nationwide. Positive regulatory environments, including the lowering of the federal excise tax on small distillers, have also enhanced market participation.

Consumer interest in aged varieties, single-barrel varieties and small-batch varieties has been on the rise, and thus, high margins are opportunities. Online sales and direct-to-consumer or “DTC” avenues are growing in scope at a very fast rate, particularly in states where laws of distribution of alcohol have been modernized. The field is also being influenced by technology as distillers pursue the use of blockchain to track provenance and AI to predict barrel aging.

Heritage and GI protections anchor Scotland’s whiskey supremacy

Scotland is the world standard for whiskey quality, and it is expected that the export of Scotch whisky will surpass the figure of £ 6 billion in 2024, with Asia and North America being the most robust markets. It has robust Geographical Indication (GI) protection, maturation periods, and a diverse product range, ranging from Islay peated whiskies to Speyside single malts.

Sustainability is on the rise, and distilleries are turning waste into biofuel or aiming to be net-zero in operations, as in the case of Diageo. The use of digital storytelling, immersive tourism in distilleries, QR codes-assisted traceable package, and other structures is making heritage brands stay relatable to the younger generations.

Innovation and precision craftsmanship elevate Japanese whiskey

Japan has been at the forefront of the international whiskey market, renowned for its perfection in production and a balanced flavor profile. Led by brands such as Suntory and Nikka, Japanese whiskey has gained recognition worldwide and enjoys higher price tags, particularly with older and limited drops.

The industry is a fusion of Scottish heritage and Japanese precision, featuring aging warehouses with climate control, a mineral water source, and meticulous methods of blending. Such authenticity was added in clarity in determining what can be called Japanese Whisky, which was introduced in 2021. Brand marketing that aligns with Japanese aesthetics and luxury culture, particularly in the Chinese and European markets, increases exports.

Category-Wise Analysis

Malt whisky drives authenticity and heritage appeal in the grain type segment

Malt whisky is the guardian of a premium and craft spirit story, and its strength lies in old distillation processes and a heavy-weight flavor profile. Usually made of malted barley, this category appeals to the gourmets and heritage paying people who would like to experience authentic flavors.

Scotland, Japan, and nascent micro-distillers in South Asia are such markets, where the demands are made especially when terroir and craftsmanship are the determinants. Regulation also comes in the form of regulatory bodies like the Scotch Whisky Association standards that may give even more validity to the grain-type classification by lending credence to malt as a standard of quality.

Economy tier whiskies tap mass market with volume-led strategies

The economy tier provides the strategic entry point for cost-sensitive consumers, especially in developing economies, where affordability is the key driving factor of consumption. Such whiskies can be concentrated on mass production in the form of common blends and easy aging, which makes them rather scalable.

Companies operating in this segment typically focus on market penetration, utilizing extensive retail distribution and local branding. Excise rules and price capping in major markets such as India and Southeast Asia also affect the volume generation of this tier, hence it is a crucial volume driver, though the profit margin is also narrow.

Glass bottles reinforce premium perception across pricing tiers

Glass bottled packaging remains to be king in all price ranges, giving it a sense of quality, durability and appeal in retail situations. In the economy tier, there is a psychological trigger to the use of glass bottles that conveys a sense of reality and authenticity as opposed to a plastic or Tetra Pak bottle. Sustainable tendencies and recyclability certificates are also increasing the popularity of glass, especially in environmentally friendly markets such as Europe. In the meantime, embossed logos, labels, and touchy surfaces make the opportunities for branding that is not justified in glass material the best selection to optimize visual styling and consumer confidence.

Competitive Analysis

The international whisky industry operates in a highly fragmented and geographically dispersed competitive environment, comprising kin heritage brands, mini distillery distillates, and new craft producers. These factors are mainly product innovation, ageing, raw materials and geographical identity. Scotch, the U.S., Japan and Ireland continue to have strongholds on traditional craftsmanship, whereas new entrants are India, Taiwan and Australia who possess distinct climatic maturation opportunities.

Even more producers are turning to the use of local ingredients, ecologically friendly operations, and exploratory cask aging in their efforts to sway a younger audience that seeks the tastes of the genuine and the new. The premium has increased the demand for small-batch products, single malt, and limited-edition products. Competition is also growing with the use of e-commerce and direct-to-consumer outlets, allowing smaller brands to enjoy a global consumer base-not once readily available with the use of a conventional distributor.

There is also innovation in whiskey ready-to-drink (RTD) products and flavored versions on the market, which is changing consumption habits. Strategic partnerships with bars, mixologists, and tourism-related brand experiences will prove to be an important means of differentiation. In total, competitiveness is generally influenced by a balance between heritage-based quality, brand writing, and the ability to adjust to changing customer preferences.

Key players in the whiskey industry include Diageo, Chivas Brothers, William Grant & Sons, Bacardi, La Martiniquaise, The Edrington Group, Belvedere, Beam Suntory, Whyte & Mackay, Inver House, LVMH, Loch Lomond, and other notable companies.

Recent Development

- In June 2025, Japanese beverage giant Suntory renewed its interest in acquiring the Imperial Blue whisky brand from Pernod Ricard, aiming to strengthen its presence in the Indian spirits market.

- In June 2024, Amrut Distilleries secured the title of "World's Best Whiskey" at the 2024 International Spirits Challenge in London. Their flagship single malt, Amrut Fusion, played a pivotal role in this achievement, earning five gold medals in the "World Whisky Category."

Fact.MR has provided detailed information about the price points of key manufacturers of the whiskey market positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Methodology and Industry Tracking Approach

In 2025, Fact.MR conducted a comprehensive global investigation of the Whiskey market, comprising at least 4,200 verified professional contributions in 18 countries. Respondents belonged to the following sectors: distillation of spirits of artisanal type, distribution of aged spirits, barrels of oak trees design and exporting of alcoholic beverages compliance. Each of the countries included in the research managed to draw at least 80 professionals from the field of fermentation innovation, luxury spirits branding, and sensory quality control.

The development of cask aging techniques, the increasing pace of small-batch and single-origin whiskey introductions, and the rising standards of the beverage industry in terms of geographic indication, labeling authenticity, and carbon neutrality within the industry were observed between June 2024 and May 2025. It was the highly desired intensity in the demand of the regions flavors as well as low-ABV premium blends and experimental cask finishes with sherry, rum, or even wine barrels.

Up until the year 2018, Fact.MR has monitored the growth of the whiskey segment in terms of comparing efficiency of distillation, the time cycle of flavor maturation, and the strategy of sourcing raw materials per the global supply chain. This study also justifies the radical transition to clear storytelling, environmentally friendly packs, and high-performance whiskey innovation. The future of the whiskey market has gradually shifted its focus to a time when the new definition of premium includes authenticity, artisanal excellence and sustainable production.

Segmentation of Whiskey Market

-

By Grain Type :

- Malt

- Wheat

- Rye

- Corn

- Blended

- Other Grain Type

-

By Price Tier :

- Economy

- Mid-Range

- Premium

- Ultra-Premium / Luxury

-

By Packaging :

- Glass Bottles

- Cans

- Miniatures

- Bulk Packaging

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction

- Taxonomy and Market Definition

- Trends and Success Factors

- Market Dynamics

- Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Grain Type

- Price Tier

- Packaging

- By Grain Type

- Malt

- Wheat

- Rye

- Corn

- Blended

- Other Grain Type

- By Price Tier

- Economy

- Mid-Range

- Premium

- Ultra-Premium / Luxury

- By Packaging

- Glass Bottles

- Cans

- Miniatures

- Bulk Packaging

- By Region

- North America

- Latin America

- Western Europe

- South Asia & Pacific

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia & Pacific Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast to 2035 by Grain Type, Price Tier, and Packaging for 30 Countries

- Competitive Assessment

- Company Share Analysis by Key Players

- Competition Dashboard

- Company Profile

- Diageo

- Chivas Brothers

- William Grant & Sons

- Bacardi

- La Martiniquaise

- The Edrington Group

- Belvedere

- Beam Suntory

- Whyte & Mackay

- Inver House

List Of Table

- Table 1: Global Market Value (USD Mn) & Units Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 3: Global Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 4: Global Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 5: North America Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 7: North America Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 8: North America Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 9: Latin America Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 11: Latin America Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 12: Latin America Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 13: Western Europe Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 15: Western Europe Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 16: Western Europe Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 17: South Asia & Pacific Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 18: South Asia & Pacific Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 19: South Asia & Pacific Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 20: South Asia & Pacific Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 21: East Asia Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 23: East Asia Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 24: East Asia Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 25: Eastern Europe Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 27: Eastern Europe Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 28: Eastern Europe Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Mn) & Units Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Mn) & Units Forecast by Grain Type, 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Mn) & Units Forecast by Price Tier, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Mn) & Units Forecast by Packaging, 2020 to 2035

List Of Figures

- Figure 1: Global Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 2: Global Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 3: Global Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 4: Global Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Region, 2020 to 2035

- Figure 5: North America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 6: North America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 7: North America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 8: North America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 9: Latin America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 10: Latin America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 11: Latin America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 12: Latin America Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 13: Western Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 14: Western Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 15: Western Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 16: Western Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 17: South Asia & Pacific Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 18: South Asia & Pacific Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 19: South Asia & Pacific Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 20: South Asia & Pacific Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 21: East Asia Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 22: East Asia Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 23: East Asia Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 24: East Asia Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 25: Eastern Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 26: Eastern Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 27: Eastern Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 28: Eastern Europe Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- Figure 29: Middle East & Africa Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Grain Type, 2020 to 2035

- Figure 30: Middle East & Africa Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Price Tier, 2020 to 2035

- Figure 31: Middle East & Africa Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Packaging, 2020 to 2035

- Figure 32: Middle East & Africa Value Share (%), Growth Rate (Y-o-Y), and Units Projection by Country, 2020 to 2035

- FAQs -

What was the global Whiskey market size reported by Fact.MR for 2025?

The Global Whiskey market was valued at USD 75,562 Million in 2025.

Who are the major players operating in the Whiskey market?

Prominent players in the market are Diageo, Chivas Brothers, William Grant & Sons, Bacardi, La Martiniquaise, The Edrington Group, Belvedere, Beam Suntory, Whyte & Mackay, Inver House, LVMH, and Loch Lomond.

What is the Estimated Valuation of the Whiskey market in 2035?

The market is expected to reach a valuation of USD 148,642 Million in 2035.

What value CAGR did the Whiskey market exhibit over the last five years?

The historic growth rate of the Whiskey market was 6.2% from 2020 to 2024.