Alpha Olefin Sulfonates Market

Alpha Olefin Sulfonates Market Analysis, By Product (Powder/Needles, Liquid (35%-42% active matter), Paste (≤70% active matter)), By Application, By End Use Industry, and Region – Market Insights 2025 to 2035

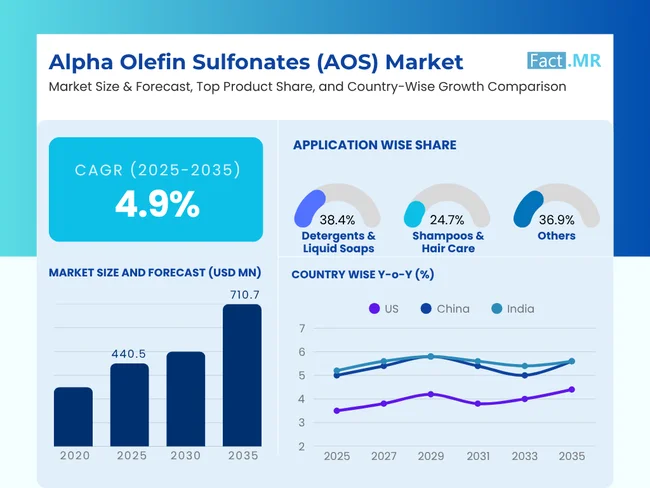

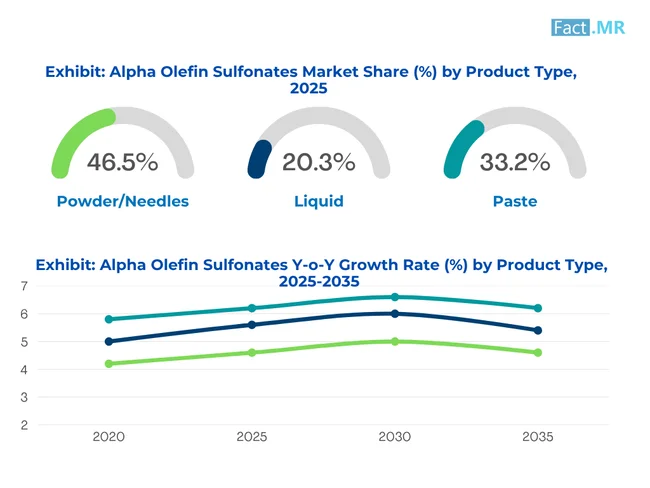

The powder/needles segment projected to grow at a CAGR of 4.2%, whereas the paste (≤70% active matter) segment is likely to grow at 5.8%. In terms of countries, China projected to grow at 5.0%, followed by US at 3.5%

Alpha Olefin Sulfonates (AOS) Market Outlook (2025 to 2035)

The global alpha olefin sulfonates market is expected to reach USD 710.7 million by 2035, up from USD 421.1 million in 2024. During the forecast period (2025 to 2035), the industry is projected to grow at a CAGR of 4.9%.

The market is being propelled by rising demand for sustainable surfactants, such as biodegradable and sulfate-free variants, regulatory pushes for eco-labeling, and the appealing balance of mildness and effectiveness offered by AOS. Consumptions are being facilitated by trends such as clean-label personal care, enzyme-friendly detergents, and low-cost bulk formulations in emerging markets, where AOS can be a core ingredient in sustainable, next-gen production.

What are the drivers of the alpha olefin sulfonates market?

The alpha olefin sulfonates (AOS) industry is characterized by a combination of regulatory requirements, functional features, and changing customer preferences. The growing need for biodegradable and non-sulfate-based surfactants in personal care and hygiene products is a key driver of growth. Incidence of skin sensitivity and the focus on clean-label ingredients is driving the ascendancy of AOS over more traditional sulfates such as SLS and SLES due to it being considered milder and highly effective at cleansing.

The AOS is being incorporated into the household and industrial cleaning industries because it offers better foam control, is tolerant to hard water, and has a low potential to irritate the skin. It is a versatile ingredient in cleaners and washing products since it is compatible with most builders and enzymes. Its market attractiveness furthermore extends across applications through the interest in products to be sold, which are considered as eco-certified, i.e., USDA BioPreferred and EU Ecolabeling.

The AOS adoption is also being favored by affordability on a per-bulk-dosing basis and rising demand in the developing economies. As surfactant manufacturers continue to pursue cost-effective yet sustainable surfactants, AOS presents performance and regulatory safety. Expanding the global presence of the market, which supports the future development and production of next-generation surfactant products, is characterized by heightened growth in organized retail, e-commerce, and personal label manufacture.

What are the regional trends of the alpha olefin sulfonates market?

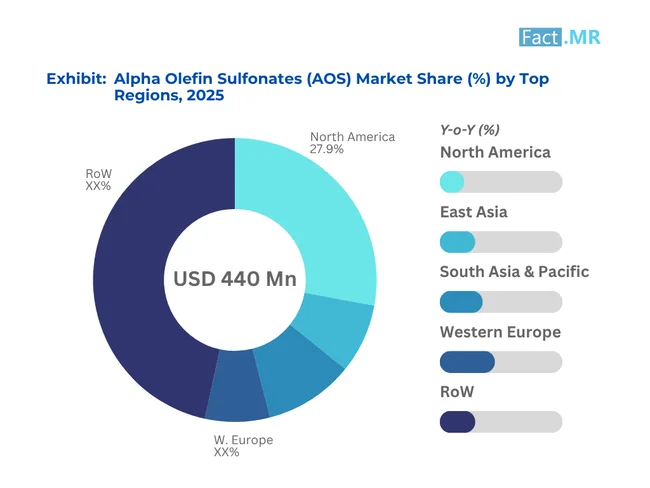

The Asia-Pacific region primarily dominates the Alpha Olefin Sulfonates (AOS) market. Factors such as rapid urbanization, an increase in the number of middle-class consumers, and the rise in the concept of hygiene in countries like India, China, Indonesia, and Vietnam can be attributed to this growth. There is a strong demand of sulfate free personal care coupled with affordable detergents, which has resulted in intense consumption and supports the move of regional production capacity by both local and international players.

The recent trend in North America has been the Intentionally-Designed Clean Label, where clean-label, sulfate-free cosmetic and hygiene products are replacing traditional surfactants, such as SLS and SLES, with AOS. The regulatory arguments on the use of AOS are further being reinforced by EPA and USDA Bio Preferred certifications. The regulatory pressure that has been exerted on Europe also involves REACH and Ecolabel compliance, which has influenced brands to include biodegradable ingredients in their personal and home care products.

One of the regions that is becoming increasingly promising due to economic development and the growth of the detergent industry is Latin America, the Middle East, and Africa. Several countries, including Brazil, South Africa, and Saudi Arabia, are experiencing a growing demand for high-performance, affordable surfactants. Multinational companies are keen on investing in these areas so that they can penetrate them and exploit the increasing consumption.

What are the challenges and restraining factors of the alpha olefin sulfonates market?

The raw material dependency issue, especially on petrochemical-derived raw materials such as ethylene and alpha olefins, is bound to cause trouble to the alpha olefin sulfonates (AOS) market. The effect on the producers of goods in the developed and the emerging markets is the volatile cost of production, which in turn hinders pricing and profit margins of the manufacturers due to fluctuating prices and supply chain issues with crude oil prices.

The other major limitation is that some locations do not have much supply of high-purity alpha olefins, and thus, uniformity of AOS and large quantities may not be possible. Although AOS is perceived as less aggressive in comparison with classical surfactants, it can irritate sensitive types of skin, which reduces its applicability in high-quality skin and baby care products. This has paved the way to alternative bio based surfactants with milder profile.

Additionally, the AOS market share is facing pressure due to the rise of alternatives in the surfactant market, including plant-derived surfactants and bio-surfactants, which are gaining popularity due to their clean-label formulations. Compliance with evolving environmental and chemical safety regulations also adds complexity and cost for manufacturers. These factors collectively influence long-term scalability, regulatory approval timelines, and market positioning of AOS-based solutions.

Country-Wise Insights

United States’ Dominance Continues with Clean-Label Surfactant Boom

The US AOS market could be attributed to high customer demand with regard to sulfate-free, environmentally friendly products in their personal care and home cleaning. Manufacturers are also acting due to the regulatory backing of the EPA and USDA BioPreferred programs to remove SLS and SLES in the formulation of products such as shampoos, facial washes, and dish detergent liquids in favor of AOS.

The increasing knowledge on the skin sensitivities and the growing concern over sustainability is an aspect that is driving the market of the biodegradable surfactants in both the retail and industrial sector.

The country also has strong R&D and formulation facility that AOS enjoys. Some of the best-selling personal care brands are incorporating AOS into new products that are dermatologically safe and fit into the clean-label taste. Growth in e-commerce and the need to have transparent labeling further brightens the future of AOS in the U.S market.

India’s Dominance Continues with Affordable Hygiene Product Boom

Urbanization, rising disposable income and better levels of hygiene awareness is making India a key growth engine to AOS. There is a booming demand of the market of the cheap, high-foaming detergents and the sodium sulfate-free personal care products and it is highly booming among the middle-income consumers. AOS is also a low cost performing surfactant, which fits the specifications of hard water- a characteristic feature of most households in India.

The local and multinational companies are investing in the supply chain to facilitate increased production of AOS domestically to support the increase in volume demands. The penetration in the market is further boosted by growth on the organized retail areas and FMCG areas as well as the government programs that support hygiene and sanitation. The emerging consumer base in the country is turning towards milder, safer systems of surfactants, which is without a doubt a guarantee of their continuing demand.

China’s Dominance Continues with Green Chemical Reformulation Boom

-2025-to-2035.webp)

Tighter environmental limits and customer switch to sulfate free and biodegradable non-ionic surfactants present opportunities to the AOS market in China. The government policies on more green chemicals and restricting the standards of traditional surfactants are driving formulators to use AOS in personal care, household, and institutional cleaning products.

AOS offers the best of both worlds, as it is both highly useful and biodegradable, making it a suitable choice for current market times.

The local producers are expanding to produce for both domestic and export markets and innovating in terms of blending to cater to the sensitivity of the consumers. Along with transparency, performance, and eco-safety, Chinese brands are underlining marketing by focusing on ingredient reformulation.

Category-Wise Analysis

Liquid-Based AOS Dominates Due to Formulation Flexibility and Cost Efficiency

The most common form of product is liquid AOS (35%-42% active matter) because of ease of mixing, solubility and scale of liquid-based formulations. It is economical and convenient to process, making it suitable for large-scale manufacturing of detergents and personal care products, especially in developing markets where liquid-based systems are well-supported by infrastructure.

This form is very compatible with enzymes, builders, and other surfactants, which allows manufacturers to use applications by formulating their products depending on foaming, cleaning, and emulsifying applications. The mild nature of liquid AOS, its biodegradability and stable viscosity in water-based recipes are some of the main reasons to use liquid AOS in dishwashing liquids and shampoos, as well as hand washes.

The demand for liquid detergents and sulfate-free cleansers is surging owing to the rapid adoption in the Asian- Pacific and Latin America regions. This format is used by brands because of its low irritation profile and high formulation adaptability. Its increasing application into personal and household care products has maintained the liquid AOS as a powerful and expandable niche in the world market.

Detergents & Liquid Soaps Lead with High Volume and Everyday Utility

Detergents and liquid soaps present the highest consumption of AOS and this has been necessitated by their domestic use as well as their capacity to accommodate large volumes. AOS gives good foam production, emulsification and cleaning off the soils properties and can therefore be used in laundry detergents, dishwashing liquids and soap as hand wash. Its functionality is also good in the element of hard water.

Detergents based on AOS are chosen for preferred non-toxic, biodegradable and sulfate-alternate solutions. They respond to the increased need of green cleaning agent and they can be used with modern washing machines and on eco-labelled product ranges.

Boost in urbanization of population and rise in hygiene consciousness in developing markets, particularly in Asia-Pacific, Africa and Latin America are also contributing to the segment. With the global brands continually widening their clean-label and eco-friendly product ranges, AOS remains a key ingredient in detergent development, underpinning its industry leadership in high-volume, performance-critical uses.

Competitive Analysis

Key players in the alpha olefin sulfonates industry include Aarti Industries Ltd., AK ChemTech Co., Ltd., Clariant AG, Godrej Industries Ltd., INEOS Group, Kao Corporation, Nouryon, Pilot Chemical Company, Sinolight Shaoxing Chemicals Co., Ltd., Solvay S.A., Stepan Company, and Zanyu Technology Group Co., Ltd.

Alpha Olefin Sulfonates (AOS) market is slightly fragmented with a blend of global and regional players in the market based on their formulation research, manufacturing capabilities and regulatory appraisal. Advanced surfactant chemistry is a means by which companies are distinguishing themselves, with customizable blends available to personal care, household and industrial uses. Competitive positioning is being determined by investment in R&D, eco-certification and proprietary technologies.

The main strategies are strategic alliances, backward integration and expansion in the region to ensure accessibility to raw materials and cost effectiveness. Players are also using digital tools to help them conform with customer-specific formulations and faster product release. The preference in sulfate-free, biodegradable solutions as well as the adherence to REACH, EPA, and Ecolabel standards further narrows the competitive advantage.

Recent Development

- In June 2025, Stepan Company declared that production of Alpha Olefin Sulfonates on its Northbrook facility in Illinois has increased by 25 percent after capital improvements. This was used to increase the level of security in the supply of sulfate-free detergents and personal-care products and use less amount of energy, which supports the sustainability principles of Stepan.

- In January 2025, Pilot Chemical Company reported a non-exclusive collaboration with the Kao Corporation of Japan, to commercialize Bio IOS bio-based internal olefin sulfonate technology in North America. Pilot planned to establish full-scale sulfonation capabilities at its Middletown, Ohio complex, serving as the sole regional marketing channel.

Fact.MR has provided detailed information about the price points of key manufacturers of the Alpha Olefin Sulfonates Market positioned across regions, sales growth, production capacity, and speculative technological expansion, in the recently published report.

Methodology and Industry Tracking Approach

The 2025 alpha olefin sulfonates market report by Fact.MR is grounded in feedback from 6,800 stakeholders across 27 countries, with a minimum of 200 respondents from each region. Of the total participants, 58% represented end users, including detergent manufacturers, personal care formulators, and industrial cleaning solution providers. The remaining 42% comprised procurement experts, R&D chemists, and sustainability compliance officers.

Data was collected between July 2024 and April 2025, concentrating on surfactant performance, formulation stability, raw material fluctuations, equipment compatibility, and regulatory compliance shifts. A regionally weighted sampling model was employed to ensure balanced insights across all major global markets.

Over 190 verified sources were analyzed, including technical white papers, regulatory updates, formulation patents, and audited financial records.

Fact.MR applied advanced tools such as regression modeling to ensure analytical precision. With continuous industry monitoring since 2018, this report stands as a definitive guide for stakeholders pursuing growth, innovation, and strategic investments in the sector.

Segmentation of Alpha Olefin Sulfonates Market

-

By Product Type :

- Powder/Needles

- Liquid (35%-42% active matter)

- Paste (≤70% active matter)

-

By Application :

- Detergents & Liquid Soaps

- Shampoos & Hair Care

- Industrial Cleaners

- Emulsifiers & Wetting Agents

- Others

-

By End Use Industry :

- Household Care

- Personal Care & Cosmetics

- Industrial & Institutional Cleaning

- Textile & Leather Processing

- Agrochemicals

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Market Trends and Success Factors

- Market Dynamics

- Recent Industry Developments

- Global Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Pricing Analysis

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Product Type

- Application

- End-User Industry

- By Product Type

- Powder/Needles

- Liquid (35%-42% active matter)

- Paste (≤70% active matter)

- By Application

- Detergents & Liquid Soaps

- Shampoos & Hair Care

- Industrial Cleaners

- Emulsifiers & Wetting Agents

- Others

- By End-User Industry

- Household Care

- Personal Care & Cosmetics

- Industrial & Institutional Cleaning

- Textile & Leather Processing

- Agrochemicals

- By Region

- North America

- Latin America

- Western Europe

- South Asia

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast 2025 to 2035 by Product Type, Application, and End-User Industry for 30 Countries

- Competition Outlook

- Market Structure Analysis

- Company Share Analysis by Key Players

- Competition Dashboard

- Company Profile

- Aarti Industries Ltd.

- AK ChemTech Co., Ltd.

- Clariant AG

- Godrej Industries Ltd.

- INEOS Group

- Kao Corporation

- Nouryon

- Pilot Chemical Company

- Sinolight Shaoxing Chemicals Co., Ltd.

- Solvay S.A.

- Stepan Company

- Zanyu Technology Group Co., Ltd.

List Of Table

- Table 1: Global Market Value (US$ Mn) & unit Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 3: Global Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 4: Global Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 5: North America Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 7: North America Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 8: North America Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 9: Latin America Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 11: Latin America Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 12: Latin America Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 13: Western Europe Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 15: Western Europe Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 16: Western Europe Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 17: South Asia Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 18: South Asia Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 19: South Asia Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 20: South Asia Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 21: East Asia Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 23: East Asia Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 24: East Asia Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 25: Eastern Europe Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 27: Eastern Europe Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 28: Eastern Europe Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

- Table 29: Middle East & Africa Market Value (US$ Mn) & unit Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (US$ Mn) & unit Forecast by Product Type, 2020 to 2035

- Table 31: Middle East & Africa Market Value (US$ Mn) & unit Forecast by Application, 2020 to 2035

- Table 32: Middle East & Africa Market Value (US$ Mn) & unit Forecast by End- User Industry, 2020 to 2035

List Of Figures

- Figure 1: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 2: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 3: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 4: Global Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Region, 2020 to 2035

- Figure 5: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 6: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 7: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 8: North America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 9: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 10: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 11: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 12: Latin America Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 13: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 14: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 15: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 16: Western Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 17: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 18: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 19: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 20: South Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 21: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 22: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 23: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 24: East Asia Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 25: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 26: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 27: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 28: Eastern Europe Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- Figure 29: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Product Type, 2020 to 2035

- Figure 30: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Application, 2020 to 2035

- Figure 31: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by End- User Industry, 2020 to 2035

- Figure 32: Middle East & Africa Market Value Share (%), Growth Rate (Y-o-Y), and Value (US$ Mn) & unit Projection by Country, 2020 to 2035

- FAQs -

What was the Global Alpha Olefin Sulfonates Market Size Reported by Fact.MR for 2025?

The global alpha olefin sulfonates market was valued at USD 440.5 million in 2025.

Who are the Major Players Operating in the Alpha Olefin Sulfonates Market?

Prominent players in the market are Aarti Industries Ltd., AK ChemTech Co., Ltd., Clariant AG, Godrej Industries Ltd., among others.

What is the Estimated Valuation of the Alpha Olefin Sulfonates Market in 2035?

The market is expected to reach a valuation of USD 710.7 million in 2035.

What Value CAGR did the Alpha Olefin Sulfonates Market Exhibit Over the Last Five Years?

The historic growth rate of the alpha olefin sulfonates market was 4.4% from 2020 to 2024.