Drone Tower Inspection Market

Drone Tower Inspection Market Analysis, By Drone Type, By Operation, By End-Use Industry, and Region - Market Insights 2025 to 2035

Analysis of Drone Tower Inspection Market Covering 30+ Countries, Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

Drone Tower Inspection Market Outlook (2025 to 2035)

The global drone tower inspection market is valued at USD 406.27 million in 2025. As per Fact.MR analysis, the drone tower inspection will grow at a CAGR of 16.7% and reach USD 1903.37 million by 2035.

In 2024, the drone tower inspection industry structures continued to grow as businesses more widely applied drone technology in inspecting towers for power and communication transmissions. The reasons were the need for more effective, less costly, and safer ways of carrying out inspections.

Main developments included sensor technology supported by artificial intelligence to improve picture clarity and make the detection of faults quicker and more accurate. Regulation of using drones for industrial inspection purposes became more established, providing clearer guidance to operators and business entities alike.

By the last quarter of 2024, a significant surge in the deployment of drones for tower inspection was witnessed, especially in areas with high infrastructure investments like North America and Europe. Adoption increased tremendously across industries that value safety and efficiency, such as telecommunications, as well as utilities. This increased use of drones was also driven by the demand for more scalable and sustainable inspection solutions to minimize costs and downtime in tower maintenance.

Moving towards 2025 and beyond, tower inspection with drones is set to witness extensive growth with a forecasted CAGR of 16.7% from 2025 to 2035. The development will be catalyzed by increasing integration of automation and AI for greater accuracy as well as cost savings. By 2035, the industry will handle USD 1903.37 million, driven by demand from the telecommunication, energy, and utility industries looking to upgrade maintenance and inspection methodologies.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Size in 2025 | USD 406.27 Million |

| Projected Size in 2035 | USD 1903.37 Million |

| CAGR (2025 to 2035) | 16.7% |

Fact.MR Survey Results: Market Stakeholder Priorities & Pain Points

(Survey conducted Q4 2024, n=500 stakeholders across the USA, Western Europe, Japan, and South Korea - including drone OEMs, telecom infrastructure firms, inspection service providers, and civil aviation regulators)

Key Priorities of Stakeholders

Safety, Accuracy & Downtime Reduction:

- 87% of global stakeholders ranked safety risk mitigation as the top motivator for drone inspections, especially in high-voltage telecom and broadcast towers.

- 72% emphasized the need for sub-centimeter imaging resolution, particularly for detecting micro-cracks and corrosion in steel frameworks.

Regional Variance:

- USA: 64% prioritized faster tower clearance approvals under FAA Part 107 waivers.

- Western Europe: 81% demanded AI-enhanced anomaly detection, tied to ESG reporting mandates.

- Japan/South Korea: 58% emphasized autonomous flight path programming for efficient inspections in densely urban zones.

Adoption of Advanced Technologies

Autonomy, AI, and Real-time Analytics:

- 61% of USA providers have integrated real-time thermal imaging and LiDAR-based 3D reconstruction to boost accuracy.

- 68% of European respondents adopted AI-based defect classification, driven by the EU AI Act [European Commission, 2023].

Regional Adoption Patterns:

- Japan: 42% are piloting swarm drone configurations for large-scale tower networks.

- South Korea: 51% have adopted cloud-based analytics platforms integrated with telecom asset databases.

ROI Metrics:

- USA and Europe report 30-40% cost savings per inspection post-drone adoption compared to rope-based methods [PwC Drone Powered Solutions, 2023].

Material Preferences & Sustainability Trends

Drone Hardware Design:

- 59% globally favored carbon-fiber drone frames for durability and wind resistance during tower ascents.

- 31% used composite blends to reduce weight and increase battery efficiency.

Regional Preferences:

- Western Europe: 47% stressed eco-manufactured drone components, aligning with the Green Deal Industrial Plan [European Commission, 2023].

- Japan/South Korea: 36% are prioritizing battery reuse programs and modular drone builds to extend the lifecycle and reduce e-waste.

Price Sensitivity & Supply Chain Challenges

Cost Constraints & Procurement Models:

- 74% reported cost inflation in advanced sensors, with thermal camera units up 28% YoY [Allied Vision, 2024].

- 63% of USA and EU-based respondents are shifting toward drones-as-a-service (DaaS) to lower the CAPEX burden.

Regional Nuances:

- Japan: 66% prefer lease-based drone programs to avoid upfront hardware costs.

- South Korea: 52% of providers complained about long lead times for critical components like gimbap and AI chips.

Pain Points in the Value Chain

Manufacturers:

- USA: 57% cited FAA certification delays as a bottleneck to time-to-market.

- Western Europe: 49% flagged supply chain constraints in AI chipsets from Taiwan and the USA

- Japan/South Korea: 61% struggled with battery density limitations, curbing multi-tower missions.

Service Providers:

- USA: 68% face pilot shortage issues despite Part 107 license growth [FAA UAS Statistics, 2024].

- Europe: 55% noted client onboarding friction stemming from legacy processes at telecom giants.

- Japan: 60% reported urban signal interference, affecting drone-to-ground communication.

Future Investment Priorities

Innovation & Platform Integration:

- 76% globally plan to invest in AI-driven inspection algorithms over the next 3 years.

Region-wise Focus:

- USA: 63% plan to integrate drone data into telecom CMMS systems.

- Western Europe: 58% are prioritizing automated BVLOS (Beyond Visual Line of Sight) missions, pending EASA clearances.

- Japan/South Korea: 44% are investing in indoor inspection drones for small-cell 5G towers in tight spaces.

Regulatory Impact

Mandates, Certifications & Policy Influence:

- USA: 72% of stakeholders see FAA Part 107 and BVLOS waivers as limiting operational expansion; however, the FAA Reauthorization Act 2023 is expected to unlock commercial drone corridors.

- Western Europe: 84% cited the EU Drone Strategy 2.0 and EASA’s SORA framework as both a compliance burden and a tech innovation driver [EASA, 2023].

- Japan/South Korea: Only 36% felt regulatory frameworks were sufficiently clear; Japan’s Civil Aeronautics Act (2022 update) is still under interpretation by SMEs.

Conclusion: Variance vs. Consensus

- Fact.MR analysis found that safety, speed, and accuracy are non-negotiables for drone-based tower inspection. However, policy, platform integration, and pricing models vary distinctly:

- USA: Dominated by cost-efficiency pressures and regulatory complexity, yet leads in real-time analytics.

- Western Europe: Positioned as a tech-forward, regulation-driven hub with early AI uptake.

- Japan/South Korea: Cost-sensitive adopters of space-efficient, high-precision tools with a rising focus on modularity.

Strategic Insight:

Global players must align with region-specific regulations, platform standards, and AI-readiness levels. Success lies in balancing compliance with technological scalability, especially for providers targeting multinational telecom clients.

Impact of Government Regulations

| Country | Impact of Policies, Regulations & Mandatory Certifications |

|---|---|

| United States |

|

| United Kingdom |

|

| Germany |

|

| France |

|

| South Korea |

|

| Japan |

|

| China |

|

Market Analysis

The industry is poised for robust growth, driven by the increasing adoption of drones for safer, cost-efficient, and precise infrastructure inspections. Advancements in AI and automation will continue to enhance operational efficiency, benefiting industries such as telecommunications, energy, and utilities. Companies that invest early in these technologies stand to gain significantly, while those slow to adopt may struggle to compete in a rapidly evolving landscape.

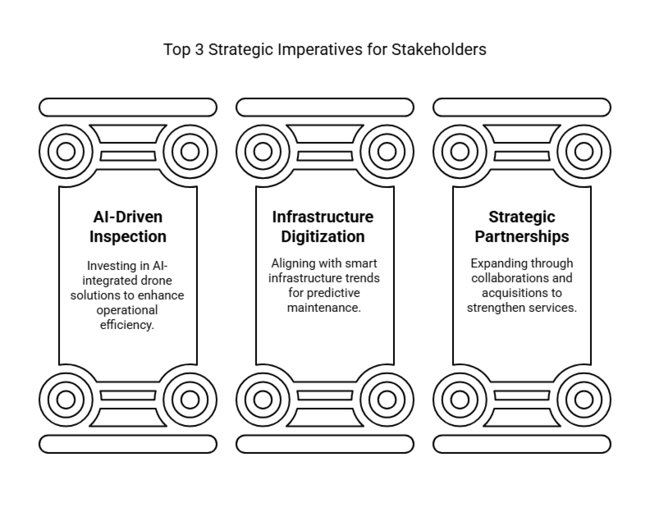

Top 3 Strategic Imperatives for Stakeholders

Accelerate AI-Driven Inspection Capabilities

Executives should invest in AI-integrated drone solutions to enhance anomaly detection, streamline data analytics, and reduce manual intervention in tower inspections. This will drive operational efficiency and create a competitive advantage in service delivery.

Align with Infrastructure Digitization Trends

Organizations must align offerings with the growing shift toward smart infrastructure and predictive maintenance, especially in telecommunications and energy. Collaborating closely with end-users to co-develop use-case-specific solutions will ensure long-term relevance.

Expand Through Strategic Partnerships and M&A

Companies should pursue partnerships with telecom operators, utility providers, and drone software innovators while considering acquisitions to strengthen end-to-end service capabilities. Building robust distribution networks and localized inspection teams will be key to scaling across high-growth regions.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability, Impact |

|---|---|

| Regulatory Restrictions - While more than 70 countries have drone regulations in place, inconsistent licensing frameworks, airspace limitations, and data compliance requirements are creating barriers to entry, especially in developing industries [Source: OECD]. | Medium Probability, High Impact |

| Skilled Workforce Shortage - A growing demand for certified drone operators is outpacing supply, with the global talent gap expected to exceed 15% in industrial inspection roles by 2025, limiting scalability in high-growth regions [Source: ILO]. | High Probability, Medium Impact |

| Cybersecurity Vulnerabilities - Drone inspections generate high volumes of sensitive data; over 45% of industrial drone users cited privacy risks as a key concern in 2023, raising alarms around cloud storage and data breaches. | Medium Probability, Medium Impact |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Evaluate AI-Driven Inspection Software | Run a feasibility study on integrating AI-enabled anomaly detection tools into existing drone platforms. |

| Strengthen Regulatory Navigation Strategy | Initiate cross-market legal review to map drone compliance pathways and unlock constrained regions. |

| Expand Pilot Training Capacity | Launch regional drone operator certification programs in partnership with local training institutes. |

For the Boardroom

To stay ahead, companies must prioritize investments in AI-enhanced analytics, regional pilot training programs, and regulatory compliance infrastructure. The sector is clearly shifting from manual or semi-automated methods to fully autonomous, data-driven inspection workflows.

Companies that adapt their roadmap to focus on smart integrations, talent pipelines, and cross-border operational readiness will not only capture early-mover advantages but also insulate themselves against evolving compliance risks and labor shortages. The next 12 months represent a critical inflection point; execution speed and strategic alignment will determine long-term dominance in this sector.

Segment-wise Analysis

By Drone Type

Fixed-wing drones are anticipated to increase at a CAGR of 6.1% during the forecast period. Fixed-wing drones are increasingly being used for tower inspections because they can travel long distances and have long endurance. In mega-infrastructure projects, including telecom towers and energy networks, fixed-wing drones provide speed as well as cost-effectiveness for long-distance inspections.

Demand for inspections in vast, remote geographies is the main driver for their growth. However, the take-up of fixed-wing drones is countered by their high capital expense and limited maneuverability within tight spaces. With technological improvements, these disadvantages are likely to be reduced, spurring growth.

By Operation

Remotely piloted drones, where human operators control the drone via a ground station, are expected to grow at a CAGR of 5.9%. This type of operation is still widely practiced with drone tower inspections because it permits high levels of control as well as decision-making during inspections. Remotely piloted drones are utilized in difficult or hazardous environments where human input is necessary.

Although fully autonomous drones are increasingly becoming popular, remotely piloted drones are the most used due to their extensive application and trustworthiness. This segment will continue to expand with new technology added, which will propel the movement toward autonomous systems in future applications.

By End-Use Industry

Telecom segment is likely to record a CAGR of 6.8% in the industry. Drones have growing uses for inspecting communication towers, offering cost and safer alternatives than the traditional method. As the demand for 5G networks increases, the need for routine tower testing is driving the use of drone inspection in the telecom industry.

Drones offer high-quality images and analytics, making it possible to have higher accuracy and speed of inspections. Their potential to reach out-of-way places and provide real-time information further enhances their worth in this industry. With development of telecom infrastructure already underway, drones are likely to have a major role to play in future tower maintenance and safety.

Country-wise Insights

USA

The USA will grow at a CAGR of 22% between 2025 and 2035, dominated by rising demand for effective telecom tower inspections. The growth of 5G infrastructure also boosts the demand for frequent as well as precise inspections.

The FAA guidelines are well-settled, offering precise regulations on drone operations, which promotes expansion in the industry. Major telecommunication players in the USA are embracing drones actively into their tower inspection activities, reducing operational costs immensely.

Improvements in automation and AI technologies enhance the capabilities of drones, increasing inspection speed and quality. Drones are becoming popular because they help reduce human risks and give real-time information, leading to a change in the standards of the industry [FAA, 2023].

UK

The UK is expected to grow at an 18% CAGR between 2025 and 2035, driven by the fast growth of telecom and 5G networks. Drones offer a cost-efficient and effective means for inspecting communication towers.

Drone usage for infrastructure inspection is increasing steadily with the regulations from the CAA and the UK Drone Code. Telecom operators are increasingly using drones to conduct inspections without interrupting service.

As construction of telecom towers is fast-tracked to meet the requirements of 5G, inspection through drones will also see increasing adoption. With drones now able to collect high-resolution data, surveys for tower conditions are being upgraded to new levels. [CAA, 2023].

France

The country intends to grow towards a CAGR of 15% between 2025 and 2035 as a result of government facilitated initiatives towards developing digital infrastructure including 5G towers. The use of drones in such infrastructures offers faster and more secure means of inspection.

DGAC has laid down a systematic framework of rules and regulations in which drones are allowed to operate for developing countries. Telecom companies use drones for low-cost and efficient maintenance of towers, hence removing the need for personnel for maintaining safety and speed.

France's regulatory environment, as well as the EU regulations, continues to favor the use of drones in commercial applications. With France deploying its 5G network, the need for drone inspections will be on the rise. [DGAC, 2023].

Germany

Germany is anticipated to expand at a CAGR of 17% from 2025 to 2035. The ever-increasing deployments of the 5G network compel telecom firms to adopt the use of drones for inspection owing to their speed and cost-effectiveness.

In Germany, the Luftfahrt-Bundesamt(LBA) has simple drone operation rules that support a stable regulatory framework. Slowly, the telecommunications industry is following suit with drone inspections to align with efficiency and safety standards.

It is mainly supported in Germany through an emphasis on digital infrastructure and innovation, which positions her to take the front in the industry for drone inspection. Emergence of AI-driven drones also augments tower inspection efficiency and reduces downtime [LBA, 2023].

Italy

Italy is expected to expand at a CAGR of 14% during 2025 to 2035, led by the development of 5G networks and the use of drones for inspecting infrastructure. Telecommunications companies are increasingly using drones for maintenance.

The ENAC (Italian Civil Aviation Authority) has established crisp rules of operation of drones, which simplify the use of drone technologies in tower inspection. These rules assure that drone activities are in line with safety principles.

Drones will be an important component in generating Italy's digitalization infrastructure in response to the demand for even faster as well as more reliable tower checks. With the ongoing development of AI, drone technology will continue to evolve as well as enhance data analysis [ENAC, 2023].

South Korea

South Korea is projected to boost a CAGR of 16% from 2025 to 2035 based on this country's efforts primarily geared towards 5G network rollouts and the adoption of drones in telecom infrastructure.

The Korea Civil Aviation Authority (KCAA) established a regulatory environment that favors the use of drones for commercial inspection. Telecom operators are embracing drones as they are cost-saving and highly efficient to operate.

Expansion of urbanized territories such as Seoul and Busan is promoting more drone usage since telecom firms apply drones for inspecting tall tower structures. The technology is also becoming popular through its incorporation with AI to enable improved data analysis. [KCAA, 2023].

Japan

Japan is likely to grow at 12% CAGR during the period from 2025 to 2035 owing to the demographic aging and accelerating deployment of 5G network infrastructure. Mobile operators are switching to drones due to their economic and precise nature of inspection.

Japan's Civil Aviation Bureau (CAB) has established guidelines for the use of drones to ensure safety and compliance. Although there are regulatory limitations, drone usage is becoming increasingly popular, especially in densely populated cities with high telecom tower installations.

Use of drones will grow due to the requirement for consistent, automated inspection procedures. As AI and machine learning technology improve, drone inspections will offer more advanced data analysis capabilities. [CAB, 2023].

China

China is projected to grow at a CAGR of 20% from 2025 to 2035, driven by the rapid growth of 5G networks and the adoption of drones for efficient infrastructure inspections.

Regulatory frameworks like the Civil Aviation Administration of China (CAAC) are facilitating the use of drones for telecom inspections. The government’s strong push for technological innovation, along with increasing demand for high-quality drone services, is boosting the sector.

China's telecom companies are accelerating their drone adoption as the demand for infrastructure inspection increases with 5G deployments. Drones offer reduced inspection time and improved accuracy, making them a preferred tool for telecom maintenance. [CAAC, 2023].

Australia-New Zealand

Australia-New Zealand is expected to grow at a CAGR of 14% from 2025 to 2035, fueled by the rising adoption of drones in telecom infrastructure. The need for efficient inspection methods aligns with the rollout of 5G technology.

The Civil Aviation Safety Authority (CASA) provides regulations for commercial drone operations, ensuring a safe operational environment for drone-based services to expand.

As telecom companies continue to adopt drones, the regulatory framework supports safer, more effective inspections and accelerates adoption across both nations.

Drones offer a viable solution for inspecting telecom towers in remote and rural areas, where traditional methods are less efficient. They enable quicker, more accurate inspections, which is essential as telecom infrastructure expands across both countries. [CASA, 2023].

Market Share Analysis

DJI Innovations: 25-35%

DJI will remain the world leader in the commercial drone industry, with its affordable, high-performance drones. Its push into enterprise inspection, especially in telecom and energy industries, will consolidate its leadership role. Its robust brand presence and scalability will bolster its dominant position in the drone tower inspection segment.

Skydio: 15-20%

Skydio leads the industry in autonomous drone inspection, especially in the energy and telecom industries. With AI navigation, the company is poised to take advantage of the increasing demand for fully autonomous inspection. Its ability to navigate through challenging environments like energy grids and telecom towers will continue to drive adoption growth.

Parrot Drones: 10-15%

Parrot Drones will be able to continue holding a sizable industry share of drone-based infrastructure inspection through its concentration on BVLOS (Beyond Visual Line of Sight) technology. Its reliable and secure drones are optimally suited to inspect towers located in remote areas. Parrot's safety-focused, efficient, and long-distance capabilities will result in its constant growth.

Cyberhawk Innovations: 8-12%

Cyberhawk Innovations is focused on AI-based drone inspections and analytics, with a strong footprint in the energy and telecom industries. The company's advanced inspection technologies, such as AI-based analytics and data processing, will continue to drive its expansion, particularly in the energy segment, where demand for automated inspection is increasing.

Flyability: 7-10%

Flyability is a pioneer in inspections of confined spaces, including cell towers and tanks, with its collision-tolerant drones. The growing need for efficient and safe inspection solutions in hard-to-reach places, coupled with the company's emphasis on safety and maneuverability, will continue to keep Flyability at the forefront in this industry.

AeroVironment, Inc.: 5-8%

AeroVironment, Inc. will continue to strengthen its footprint in industrial drone inspections, specifically in the defense and energy industries. The company's long-endurance drones and experience with both defense and commercial businesses will fuel industry growth. Strategic innovation through R&D and new product releases will further enhance its position.

Other Key Players

- Delair

- senseFly

- Quantum Systems

- Terra Drone Corporation

- DroneBase

- Strat Aero

- PrecisionHawk

- Trumbull Unmanned

- Sharper Shape

- HAZON Solutions

- SkySpecs

- Autel Robotics

- Aeryon Labs

- Vertical Technologies

- ABJ RENEWABLES

- Aerial and Drone Services

- CONNOR

- Dronegenuity

- Gale-Force Drone

- Intertek Group plc

- Mile High Drones LLC

- My Drone Services

- NADAR Drone Company

- Shulins' Solutions LLC

- Thermal Horizons

- USA Infrared Inspections

- Valmont Industries, Inc.

Drone Tower Inspection Market Segmentation

By Drone Type:

- Fixed Wing

- Hybrid

- Rotary

By Operation:

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By End-Use Industry:

- Telecommunication

- Energy and Power

- Construction and Mining

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

Table of Content

- Global Market - Executive Summary

- Market Overview

- Market Background and Foundation Data

- Global Market Value (USD million) Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- Global Market Analysis and Forecast, By Drone Type

- Fixed Wing

- Hybrid

- Rotary

- Global Market Analysis and Forecast, By Operation

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

- Global Market Analysis and Forecast, By End-Use Industry

- Telecommunication

- Energy and Power

- Construction and Mining

- Others

- Global Market Analysis and Forecast, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Oceania

- Middle East & Africa

- North America Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- Latin America Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- Europe Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- East Asia Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- South Asia & Oceania Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- Middle East & Africa Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- Country-level Market Analysis and Forecast (2020 to 2024 & 2025 to 2035)

- USA

- UK

- France

- Germany

- Italy

- South Korea

- Japan

- China

- Australia & New Zealand

- Market Structure Analysis

- Competitive Landscape & Product Launches in the Drone Tower Inspection Industry

- DJI Innovations

- Parrot Drones

- Delair

- senseFly

- Quantum Systems

- AeroVironment, Inc.

- Terra Drone Corporation

- DroneBase

- Flyability

- Strat Aero

- PrecisionHawk

- Skydio

- Trumbull Unmanned

- Cyberhawk Innovations

- Sharper Shape

- HAZON Solutions

- SkySpecs

- Autel Robotics

- Aeryon Labs

- Vertical Technologies

- ABJ RENEWABLES

- Aerial and Drone Services

- CONNOR

- Dronegenuity

- Gale-Force Drone

- Intertek Group plc

- Mile High Drones LLC

- My Drone Services

- NADAR Drone Company

- Shulins' Solutions LLC

- Thermal Horizons

- USA Infrared Inspections

- Valmont Industries, Inc.

- Assumptions & Acronyms Used

- Research Methodology

- FAQs -

What are the main uses of drones in tower inspections?

Drones are used to inspect infrastructure like telecom towers and energy grids, providing high-quality imaging and real-time data collection for efficient assessments.

How do drones enhance efficiency in tower inspections?

Drones can quickly cover large areas, capture high-resolution imagery, and conduct thermal scans, reducing time, cost, and risk compared to traditional methods.

Why are drones preferred over traditional inspection methods?

Drones eliminate the need for climbing or using cranes, reducing risks while offering detailed data through high-definition cameras and sensors for faster and more accurate assessments.

Are drones used in specific industries for inspections?

Drones are commonly used in telecommunications, energy, and construction sectors, inspecting cell towers, power lines, and other critical infrastructure for safety and maintenance.

What regulations govern drone inspections?

Drone inspections are regulated by various authorities, like the FAA in the USA, covering flight restrictions, safety protocols, and certification requirements for commercial operations.