Drone Motor Industry Analysis in Middle East & Africa

Drone Motor Market in Middle East & Africa, By Motor Type, By Power Capacity, By Velocity Constant (KV), By Drone Type, By Drone Category, By Sales Channel, and Region - Market Insights 2025 to 2035

Analysis Of Drone Motors Industry Covering Countries Includes Analysis Of GCC Countries, South Africa, Northern Africa, Türkiye, Rest Of Middle East & Africa

Drone Motor Market in Middle East & Africa Outlook (2025 to 2035)

The drone motor market in Middle East & Africa is projected to increase from USD 85.6 million in 2025 to USD 495.7 million by 2035, with a CAGR of 19.2%, is driven by rising demand for regional security and food. Their durability and heat resistance make these motors ideal for reliable drone operations in the Middle East & Africa’s harsh, extreme climate conditions.

Quick Facts about the Middle East & Africa Drone Motor Market

- Industry Value (2025): USD 85.6 Million

- Projected Value (2035): USD 495.7 Million

- Forecast CAGR (2025 to 2035): 19.2%

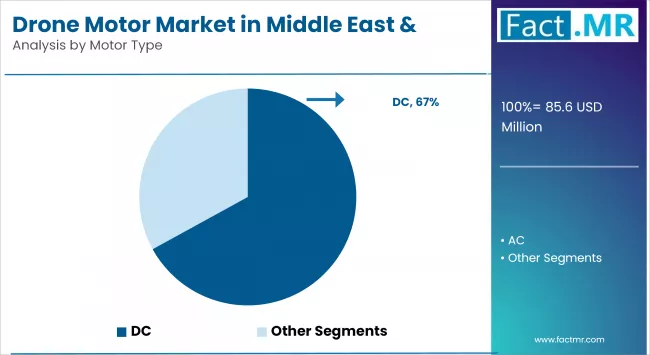

- Leading Segment (2025): DC (67% Market Share)

- Country Growth Rate (2025 to 2035): South Africa (18.4% CAGR)

- Top Key Players: SunnySky Motors, T-Motor, and EMAX MODEL Store

What are the Drivers of Drone Motor Market in Middle East & Africa?

The growing emphasis on defense modernization and surveillance is a major factor driving demand for drone motors in the Middle East. Countries such as the UAE and Saudi Arabia are using UAVs for border security, reconnaissance, and tactical operations, necessitating high-performance motors with improved thermal resistance and durability in desert environments.

The agriculture sector in Africa is rapidly adopting drone technology for crop monitoring, spraying, and yield optimization. Countries such as Kenya, Nigeria, and South Africa are incorporating UAVs into farming practices, necessitating the use of lightweight, efficient motors capable of longer flight durations and precise maneuvering over large fields.

Infrastructure monitoring and oil and gas inspection are also driving growth. Drones are increasingly being used for real-time inspections in large pipelines and remote industrial zones. This increases demand for motors that provide stable flight, dependability, and compatibility with sensor-heavy drone platforms used in hot climates throughout the Gulf and North Africa.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 85.6 million |

| Industry Size (2035F) | USD 495.7 million |

| CAGR (2025-2035) | 19.2% |

What are the Regional Trends of Drone Motor Market in Middle East & Africa?

Geographic, economic, and industrial factors influence the MEA drone motor market. GCC countries, particularly the UAE and Saudi Arabia, are rapidly adopting UAVs for defense, infrastructure monitoring, and smart city projects. Given the harsh desert conditions and long missions, these countries prioritize advanced drone systems with high-end brushless DC motors for thermal tolerance. Demand for locally integrated, high-performance motor systems is driven by the UAE's drone tech hub ambitions.

In North Africa, especially Egypt and Morocco, multirotor drones are being used in agriculture and construction, driving demand for affordable, efficient motors. The region is gradually regulating drones for commercial use.

The aftermarket and maintenance services are expanding across MEA, especially in regions with growing commercial and defense drone fleets. Online distribution and regional drone tech hubs are making supply gaps smaller, while localized manufacturing is growing in the Middle East & Africa.

What are the Challenges and Restraining Factors of Drone Motor Market in Middle East & Africa?

One major barrier is a lack of standardized drone regulations across the region. While some countries, such as the UAE, have advanced UAV policies, many others have either restrictive laws or no clear frameworks, causing uncertainty about drone adoption and market demand in sectors such as agriculture, logistics, and surveillance.

Another constraint is the high reliance on imports, as most drone motors, particularly high-performance brushless DC variants, are sourced in Asia or Europe. This leads to longer lead times, higher costs, and supply chain vulnerabilities, particularly in remote or underdeveloped African countries. Local manufacturing is still in its early stages and has limited scale.

Furthermore, the harsh climatic conditions in the Gulf and parts of Africa necessitate drone motors that are highly durable and thermally resistant. However, many motors in the market are not designed for prolonged use in extreme heat, dust, or humidity, resulting in performance degradation or failure. This reduces reliability and increases the need for maintenance.

Limited technical expertise and servicing infrastructure also impede market development. Many regions lack skilled personnel for drone assembly, repair, or motor integration, discouraging large-scale drone deployment, particularly among small and medium-sized enterprises.

Country-Wise Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| Nigeria | 17.6% |

| GCC Countries | 20.0% |

| South Africa | 18.4% |

Nigeria Rising Demand for Efficient Drone Motors in Agricultural Expansion

Nigeria is emerging as a key player in the Middle East & Africa drone motor industry, owing to its large population, vast agricultural landscape, and growing interest in UAV-enabled services. Drone adoption for precision agriculture is rapidly increasing, particularly for crops such as cassava, maize, and rice. This increase is driving demand for brushless DC motors that are lightweight and efficient, allowing for longer flight durations and high-resolution imaging payloads.

The Nigerian Civil Aviation Authority (NCAA) has begun to streamline drone regulations, providing greater clarity for commercial drone use. While some operations remain restricted, approvals are becoming more structured, allowing for the commercialization of drone services in both urban and rural areas.

Drones are increasingly being used in the infrastructure and energy sectors of Nigeria to inspect pipelines and monitor the country's extensive oil and gas installations. This necessitates rugged, high-performance motors capable of withstanding harsh conditions such as high temperatures and volatile environments.

GCC Countries Leading Drone Motor Innovation through Defense and Smart City Initiatives

GCC countries (Gulf Cooperation Council nations, which include the UAE, Saudi Arabia, Qatar, Oman, Kuwait, and Bahrain) are at the forefront of Middle Eastern drone motor industry development due to their advanced economies, defense priorities, and smart city initiatives. The UAE and Saudi Arabia, in particular, are leaders in drone adoption for military, civil, and commercial applications.

Regulatory frameworks in GCC countries have improved in recent years. The UAE's General Civil Aviation Authority (GCAA) and Saudi Arabia's General Authority of Civil Aviation (GACA) have both implemented structured policies for recreational and commercial drone use. These clear guidelines enable OEMs and component manufacturers, including motor producers, to enter the market with greater confidence.

Smart city projects such as Saudi Arabia's NEOM and the UAE's drone delivery pilots are increasing demand for motors designed for urban UAVs. These applications require motors that are compact, low-noise, and energy-efficient, particularly for last-mile delivery and infrastructure inspection.

South Africa Driving Drone Motor Demand through Agriculture, Conservation, and Infrastructure Surveillance

South Africa is a leading hub for drone motor adoption in Africa due to its diverse terrain, advanced agricultural sector, and robust research capabilities. The country is actively using drones for precision farming, wildlife conservation, and infrastructure surveillance, all of which require efficient and long-lasting motor solutions.

South Africa also has a significant commercial drone service industry, which provides aerial mapping and inspections for mining, utilities, and construction. The use of high-performance motors in rotary-wing and fixed-wing drones enables safe operation in harsh mining environments and urban areas.

The South African Civil Aviation Authority (SACAA) regulates drone use through RPAS (Remotely Piloted Aircraft Systems) legislation. While the licensing process is considered stringent, it has resulted in a well-organized environment for commercial drone operations. This regulatory maturity encourages original equipment manufacturers and component suppliers to enter the market with certified, compliant motor technologies.

Category-wise Analysis

DC to Exhibit Leading by Motor Type

DC motors, especially Brushless DC (BLDC) types, dominate regional drone applications due to their efficiency, compact size, and battery compatibility. Agriculture, infrastructure inspection, and defense surveillance favor these motors. Drones used for crop monitoring and security patrols in Nigeria and South Africa use BLDC motors due to their extended flight capability and low maintenance in remote or rugged environments.

AC motors are the fastest-growing segment in the drone motor market in the Middle East & Africa, as AC motors, such as synchronous and induction motors, are rare but used in heavier, industrial-grade drones for high power and constant speed. AC motors' durability and load-handling capacity benefit large fixed-wing drones used for military and oil infrastructure surveillance in the GCC. Some hybrid or tethered UAV systems use these motors for continuous, powerful propulsion in harsh conditions.

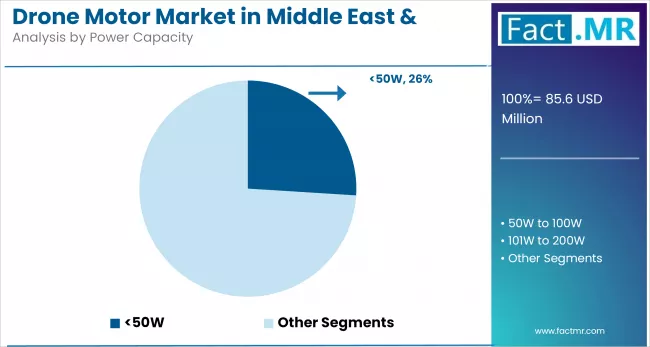

<50W to Exhibit Leading by Power Capacity

<50W motors dominate the Drone Motor Market in the Middle East & Africa, as these are commonly used in small consumer and training drones throughout the region. Because of their light weight and low cost, they are ideal for hobbyists and basic aerial photography. These drones are popular in educational programs and among new drone startups in countries like Kenya and Morocco, where affordability and simplicity are important.

101W to 200W is the fastest-growing segment in the Drone Motor Market in the Middle East & Africa, as these are used in precision agriculture, infrastructure monitoring, and wildlife surveillance drones. For medium-to-heavy payloads and longer flights, these motors balance power and efficiency. The UAE and South Africa use drones with motors in this range for anti-poaching, border monitoring, and crop health assessment over large farmlands. Trustworthiness and adaptability make them popular in commercial and semi-industrial settings.

Below 1,000 KV to Exhibit Leading by Velocity Constant

1,000 KV dominates the drone motor market in the Middle East & Africa due to the increasing use of large fixed-wing or hybrid drones for long-duration missions, as they use motors below 1,000 KV. High torque at low speeds makes these motors ideal for surveillance, environmental monitoring, and agriculture. These motors support oil pipeline inspection and border patrol in Nigeria and the UAE, which require stability, heavy payloads, and long flights.

1,000 to 2,000 KV motors are the fastest-growing segment in the Drone Motor Market in the Middle East & Africa, as these are used in multirotor drones performing agility and moderate endurance tasks like infrastructure inspection, delivery, and mapping. Their balanced torque and RPM make them popular for commercial and industrial UAVs. Wildlife tracking and power line inspection in remote South Africa are increasingly using KV drones.

Fixed-wing to Exhibit Leading by Drone Type

Fixed-wing drones dominate the Drone Motor Market in the Middle East & Africa due to their ability to cover long distances with minimal energy consumption. These drones are ideal for large-scale agricultural monitoring in Nigeria and long-range surveillance missions in the UAE. Their aerodynamic design and high-efficiency motors make them ideal for long-duration flights over deserts, forests, and agricultural fields.

Rotary-wing drones are the fastest-growing segment due to their rising use in urban and industrial applications due to their vertical take-off and landing (VTOL) capabilities. In South Africa, they are used for infrastructure inspections, mining surveys, and security missions. Their maneuverability in tight spaces, as well as compatibility with powerful brushless DC motors, makes them suitable for applications in both cities and remote industrial sites.

Military Sector to Exhibit Leading in the Drone Category

The military sector is dominant due to increased security concerns and defense modernization in countries such as the UAE and Saudi Arabia. These countries invest in tactical UAVs with tough, high-thrust motors for surveillance, border patrol, and ISR missions in desert and high-temperature environments.

Consumer and civil drones are the fastest-growing segment as these are rapidly spreading throughout the Middle East & Africa for recreational, aerial photography, and educational purposes. Drone motors, particularly <50W BLDC types, are popular in urban areas and startup ecosystems, such as Kenya, Egypt, and South Africa.

OEMs to Exhibit Leading by Sales Channel

OEMs (Original Equipment Manufacturers) dominate the Drone Motor Market in the Middle East & Africa as they provide motors directly to drone manufacturers in countries such as the UAE, South Africa, and Nigeria. Growing domestic drone production, particularly for defense and agriculture, has boosted demand for lightweight, high-efficiency brushless DC motors that can be integrated during initial drone assembly.

Commercial and military are the fastest-growing segments in the Drone Motor Market in the Middle East & Africa. As commercial and military drone fleets grow, the aftermarket segment expands as well. Due to harsh environmental conditions such as sand, heat, and moisture, motors and components must be replaced frequently. Local repair and customization needs in Saudi Arabia and Kenya are opening up new opportunities for aftermarket service providers.

Competitive Analysis

The drone motor market in the Middle East & Africa is becoming increasingly competitive, characterized by a mix of global manufacturers, regional suppliers, and emerging drone startups. Key players differentiate themselves through advanced motor technologies, such as high-efficiency brushless DC motors and integrated ESC systems tailored for harsh climatic conditions common in the region. Global service networks and compliance with aviation safety standards also serve as critical competitive differentiators.

Pipeline inspection, border monitoring, and aerial surveying by drones in the Gulf require motors with high thermal tolerance. In sub-Saharan Africa, especially Kenya and Nigeria, agricultural drone use is rising. These applications need lightweight, energy-efficient motors for longer flights over large farms and rugged terrain.

Aftermarket opportunities are growing with drone services. Drones used in harsh conditions need replacement motors, upgraded ESCs, and cooling upgrades. Regional electronic distributors and online sales channels are helping countries with limited drone hardware market access fill supply gaps.

Key players in the market include Sunshine Motors, T-Motor, EMAX MODEL Store, and others.

Recent Development

-

In January, 2025, Red Cat Holdings, Inc., a drone technology company, secured new orders for its Edge 130 drone from the Army National Guard and another U.S. Government Agency (OGA). These combined orders totaled $518,000 and represented the purchase of 12 Edge 130 drones.

-

In May 2024, Droneshield announced the release of DroneSentry C2 Next-Gen v1.00, an advanced command-and-control system that improves anti-drone capabilities by providing centralized monitoring and control functionalities. It enables users to effectively manage multiple sensors and countermeasures in order to safeguard critical infrastructure, public events, military installations, and other sensitive areas from potential drone threats.

Segmentation of Drone Motor Market in Middle East & Africa

-

By Motor Type :

- AC

- DC

- By Power Capacity :

- <50W

- 50W to 100W

- 101W to 200W

- >200W

- By Velocity Constant (KV) :

- Below 1,000

- 1,000 to 2,000

- 2,001 to 3,000

- Above 3,000

- By Drone Type :

- Fixed Wing

- Rotary Wing

- Hybrid

- By Drone Category :

- Consumer/Civil

- Commercial

- Military

- By Sales Channel :

- OEMs

- Aftermarket

- Online Sales

- Company Websites

- e-Commerce Websites

- Electronics Stores

- Others

- Online Sales

- By Region :

- GCC Countries

- South Africa

- Northern Africa

- Türkiye

- Rest of Middle East & Africa

Table of Content

- Executive Summary

- Middle East & Africa Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Middle East & Africa Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Middle East & Africa Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Motor Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Motor Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Motor Type, 2025-2035

- AC

- DC

- Y-o-Y Growth Trend Analysis By Motor Type, 2020-2024

- Absolute $ Opportunity Analysis By Motor Type, 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Power Capacity

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Power Capacity, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Power Capacity, 2025-2035

- <50W

- 50W to 100W

- 101W to 200W

- >200W

- Y-o-Y Growth Trend Analysis By Power Capacity, 2020-2024

- Absolute $ Opportunity Analysis By Power Capacity, 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Velocity Constant (KV)

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Velocity Constant (KV), 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Velocity Constant (KV), 2025-2035

- Below 1,000

- 1,000 to 2,000

- 2,001 to 3,000

- Above 3,000

- Y-o-Y Growth Trend Analysis By Velocity Constant (KV), 2020-2024

- Absolute $ Opportunity Analysis By Velocity Constant (KV), 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Drone Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Drone Type, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Drone Type, 2025-2035

- Fixed Wing

- Rotary Wing

- Hybrid

- Y-o-Y Growth Trend Analysis By Drone Type, 2020-2024

- Absolute $ Opportunity Analysis By Drone Type, 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Drone Category

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Drone Category, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Drone Category, 2025-2035

- Consumer/Civil

- Commercial

- Military

- Y-o-Y Growth Trend Analysis By Drone Category, 2020-2024

- Absolute $ Opportunity Analysis By Drone Category, 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Sales Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Sales Channel, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Sales Channel, 2025-2035

- OEMs

- Aftermarket

- Y-o-Y Growth Trend Analysis By Sales Channel, 2020-2024

- Absolute $ Opportunity Analysis By Sales Channel, 2025-2035

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- KSA

- Other GCC

- Turkiye

- South Africa

- Other African Union

- Rest of MEA

- Market Attractiveness Analysis By Region

- KSA Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- Other GCC Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- Turkiye Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- South Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- Other African Union Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- Rest of MEA Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Market Attractiveness Analysis

- By Country

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Key Takeaways

- Key Countries Market Analysis

- UAE

- Pricing Analysis

- Market Share Analysis, 2024

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Israel

- Pricing Analysis

- Market Share Analysis, 2024

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Egypt

- Pricing Analysis

- Market Share Analysis, 2024

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- UAE

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Motor Type

- By Power Capacity

- By Velocity Constant (KV)

- By Drone Type

- By Drone Category

- By Sales Channel

- Competition Analysis

- Competition Deep Dive

- SunnySky Motors

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- T-Motor

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- EMAX MODEL Store

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- SunnySky Motors

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Middle East & Africa Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Middle East & Africa Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Middle East & Africa Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 4: Middle East & Africa Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 5: Middle East & Africa Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 6: Middle East & Africa Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 7: Middle East & Africa Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 8: Middle East & Africa Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 9: Middle East & Africa Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 10: Middle East & Africa Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 11: Middle East & Africa Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 12: Middle East & Africa Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 13: Middle East & Africa Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 14: Middle East & Africa Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 15: KSA Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 16: KSA Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 17: KSA Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 18: KSA Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 19: KSA Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 20: KSA Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 21: KSA Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 22: KSA Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 23: KSA Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 24: KSA Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 25: KSA Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 26: KSA Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 27: KSA Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 28: KSA Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 29: Other GCC Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 30: Other GCC Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 31: Other GCC Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 32: Other GCC Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 33: Other GCC Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 34: Other GCC Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 35: Other GCC Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 36: Other GCC Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 37: Other GCC Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 38: Other GCC Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 39: Other GCC Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 40: Other GCC Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 41: Other GCC Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 42: Other GCC Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 43: Turkiye Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 44: Turkiye Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 45: Turkiye Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 46: Turkiye Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 47: Turkiye Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 48: Turkiye Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 49: Turkiye Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 50: Turkiye Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 51: Turkiye Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 52: Turkiye Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 53: Turkiye Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 54: Turkiye Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 55: Turkiye Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 56: Turkiye Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 57: South Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: South Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 59: South Africa Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 60: South Africa Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 61: South Africa Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 62: South Africa Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 63: South Africa Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 64: South Africa Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 65: South Africa Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 66: South Africa Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 67: South Africa Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 68: South Africa Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 69: South Africa Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 70: South Africa Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 71: Other African Union Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 72: Other African Union Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Other African Union Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 74: Other African Union Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 75: Other African Union Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 76: Other African Union Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 77: Other African Union Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 78: Other African Union Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 79: Other African Union Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 80: Other African Union Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 81: Other African Union Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 82: Other African Union Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 83: Other African Union Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 84: Other African Union Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

- Table 85: Rest of MEA Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 86: Rest of MEA Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 87: Rest of MEA Market Value (USD Bn) Forecast by Motor Type, 2020 to 2035

- Table 88: Rest of MEA Market Volume (Units) Forecast by Motor Type, 2020 to 2035

- Table 89: Rest of MEA Market Value (USD Bn) Forecast by Power Capacity, 2020 to 2035

- Table 90: Rest of MEA Market Volume (Units) Forecast by Power Capacity, 2020 to 2035

- Table 91: Rest of MEA Market Value (USD Bn) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 92: Rest of MEA Market Volume (Units) Forecast by Velocity Constant (KV), 2020 to 2035

- Table 93: Rest of MEA Market Value (USD Bn) Forecast by Drone Type, 2020 to 2035

- Table 94: Rest of MEA Market Volume (Units) Forecast by Drone Type, 2020 to 2035

- Table 95: Rest of MEA Market Value (USD Bn) Forecast by Drone Category, 2020 to 2035

- Table 96: Rest of MEA Market Volume (Units) Forecast by Drone Category, 2020 to 2035

- Table 97: Rest of MEA Market Value (USD Bn) Forecast by Sales Channel, 2020 to 2035

- Table 98: Rest of MEA Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

List Of Figures

- Figure 1: Middle East & Africa Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Middle East & Africa Market Pricing Analysis

- Figure 3: Middle East & Africa Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Middle East & Africa Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 5: Middle East & Africa Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 6: Middle East & Africa Market Attractiveness Analysis by Motor Type

- Figure 7: Middle East & Africa Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 8: Middle East & Africa Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 9: Middle East & Africa Market Attractiveness Analysis by Power Capacity

- Figure 10: Middle East & Africa Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 11: Middle East & Africa Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 12: Middle East & Africa Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 13: Middle East & Africa Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 14: Middle East & Africa Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 15: Middle East & Africa Market Attractiveness Analysis by Drone Type

- Figure 16: Middle East & Africa Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 17: Middle East & Africa Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 18: Middle East & Africa Market Attractiveness Analysis by Drone Category

- Figure 19: Middle East & Africa Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 20: Middle East & Africa Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 21: Middle East & Africa Market Attractiveness Analysis by Sales Channel

- Figure 22: Middle East & Africa Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 23: Middle East & Africa Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 24: Middle East & Africa Market Attractiveness Analysis by Region

- Figure 25: KSA Market Incremental $ Opportunity, 2025 to 2035

- Figure 26: Other GCC Market Incremental $ Opportunity, 2025 to 2035

- Figure 27: Turkiye Market Incremental $ Opportunity, 2025 to 2035

- Figure 28: South Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 29: Other African Union Market Incremental $ Opportunity, 2025 to 2035

- Figure 30: Rest of MEA Market Incremental $ Opportunity, 2025 to 2035

- Figure 31: KSA Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 32: KSA Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 33: KSA Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 34: KSA Market Attractiveness Analysis by Motor Type

- Figure 35: KSA Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 36: KSA Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 37: KSA Market Attractiveness Analysis by Power Capacity

- Figure 38: KSA Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 39: KSA Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 40: KSA Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 41: KSA Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 42: KSA Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 43: KSA Market Attractiveness Analysis by Drone Type

- Figure 44: KSA Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 45: KSA Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 46: KSA Market Attractiveness Analysis by Drone Category

- Figure 47: KSA Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 48: KSA Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 49: KSA Market Attractiveness Analysis by Sales Channel

- Figure 50: Other GCC Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 51: Other GCC Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 52: Other GCC Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 53: Other GCC Market Attractiveness Analysis by Motor Type

- Figure 54: Other GCC Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 55: Other GCC Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 56: Other GCC Market Attractiveness Analysis by Power Capacity

- Figure 57: Other GCC Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 58: Other GCC Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 59: Other GCC Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 60: Other GCC Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 61: Other GCC Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 62: Other GCC Market Attractiveness Analysis by Drone Type

- Figure 63: Other GCC Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 64: Other GCC Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 65: Other GCC Market Attractiveness Analysis by Drone Category

- Figure 66: Other GCC Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 67: Other GCC Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 68: Other GCC Market Attractiveness Analysis by Sales Channel

- Figure 69: Turkiye Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 70: Turkiye Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 71: Turkiye Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 72: Turkiye Market Attractiveness Analysis by Motor Type

- Figure 73: Turkiye Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 74: Turkiye Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 75: Turkiye Market Attractiveness Analysis by Power Capacity

- Figure 76: Turkiye Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 77: Turkiye Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 78: Turkiye Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 79: Turkiye Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 80: Turkiye Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 81: Turkiye Market Attractiveness Analysis by Drone Type

- Figure 82: Turkiye Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 83: Turkiye Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 84: Turkiye Market Attractiveness Analysis by Drone Category

- Figure 85: Turkiye Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 86: Turkiye Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 87: Turkiye Market Attractiveness Analysis by Sales Channel

- Figure 88: South Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 89: South Africa Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 90: South Africa Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 91: South Africa Market Attractiveness Analysis by Motor Type

- Figure 92: South Africa Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 93: South Africa Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 94: South Africa Market Attractiveness Analysis by Power Capacity

- Figure 95: South Africa Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 96: South Africa Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 97: South Africa Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 98: South Africa Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 99: South Africa Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 100: South Africa Market Attractiveness Analysis by Drone Type

- Figure 101: South Africa Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 102: South Africa Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 103: South Africa Market Attractiveness Analysis by Drone Category

- Figure 104: South Africa Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 105: South Africa Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 106: South Africa Market Attractiveness Analysis by Sales Channel

- Figure 107: Other African Union Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 108: Other African Union Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 109: Other African Union Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 110: Other African Union Market Attractiveness Analysis by Motor Type

- Figure 111: Other African Union Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 112: Other African Union Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 113: Other African Union Market Attractiveness Analysis by Power Capacity

- Figure 114: Other African Union Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 115: Other African Union Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 116: Other African Union Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 117: Other African Union Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 118: Other African Union Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 119: Other African Union Market Attractiveness Analysis by Drone Type

- Figure 120: Other African Union Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 121: Other African Union Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 122: Other African Union Market Attractiveness Analysis by Drone Category

- Figure 123: Other African Union Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 124: Other African Union Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 125: Other African Union Market Attractiveness Analysis by Sales Channel

- Figure 126: Rest of MEA Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 127: Rest of MEA Market Value Share and BPS Analysis by Motor Type, 2025 and 2035

- Figure 128: Rest of MEA Market Y-o-Y Growth Comparison by Motor Type, 2025 to 2035

- Figure 129: Rest of MEA Market Attractiveness Analysis by Motor Type

- Figure 130: Rest of MEA Market Value Share and BPS Analysis by Power Capacity, 2025 and 2035

- Figure 131: Rest of MEA Market Y-o-Y Growth Comparison by Power Capacity, 2025 to 2035

- Figure 132: Rest of MEA Market Attractiveness Analysis by Power Capacity

- Figure 133: Rest of MEA Market Value Share and BPS Analysis by Velocity Constant (KV), 2025 and 2035

- Figure 134: Rest of MEA Market Y-o-Y Growth Comparison by Velocity Constant (KV), 2025 to 2035

- Figure 135: Rest of MEA Market Attractiveness Analysis by Velocity Constant (KV)

- Figure 136: Rest of MEA Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 137: Rest of MEA Market Y-o-Y Growth Comparison by Drone Type, 2025 to 2035

- Figure 138: Rest of MEA Market Attractiveness Analysis by Drone Type

- Figure 139: Rest of MEA Market Value Share and BPS Analysis by Drone Category, 2025 and 2035

- Figure 140: Rest of MEA Market Y-o-Y Growth Comparison by Drone Category, 2025 to 2035

- Figure 141: Rest of MEA Market Attractiveness Analysis by Drone Category

- Figure 142: Rest of MEA Market Value Share and BPS Analysis by Sales Channel, 2025 and 2035

- Figure 143: Rest of MEA Market Y-o-Y Growth Comparison by Sales Channel, 2025 to 2035

- Figure 144: Rest of MEA Market Attractiveness Analysis by Sales Channel

- FAQs -

What is the Global Drone Motor Market in Middle East & Africa size in 2025?

The drone motor market in Middle East & Africa is valued at USD 85.6 million in 2025.

Who are the Major Players Operating in the Drone Motor Market in Middle East & Africa?

Prominent players in the market include SunnySky Motors, T-Motor, EMAX MODEL Store and other players.

What is the Estimated Valuation of the Drone Motor Market in Middle East & Africa by 2035?

The market is expected to reach a valuation of USD 495.7 million by 2035.

What Value CAGR Did the Drone Motor Market in Middle East & Africa Exhibit over the Last five Years?

The historic growth rate of the drone motor market in Middle East & Africa is 17.8% from 2020-2024.