Pathology Instruments Market

Pathology Instruments Market Size and Share Forecast Outlook 2025 to 2035

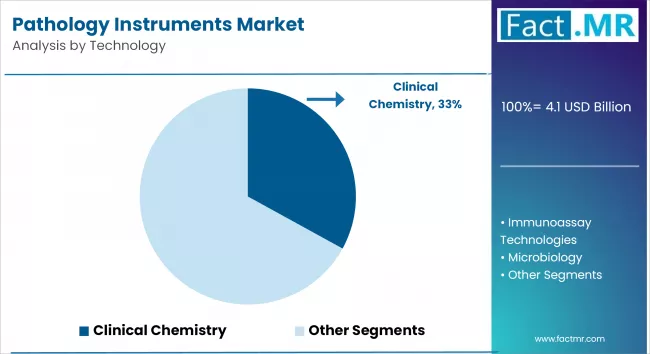

The pathology instruments market will likely total USD 4.1 billion in 2025, further expected to rise to USD 6.4 billion by 2035, at a CAGR of 4.5%. Clinical chemistry is the leading technology, while diagnostics remains the core application area.

Pathology Instruments Market Size and Share Forecast Outlook 2025 to 2035

The global pathology Instruments market is forecast to reach USD 6.4 billion by 2035, up from USD 4.1 billion in 2025. During the forecast period, the industry is projected to register at a CAGR of 4.5%. The need for accurate diagnosis, progress in personalized medicine, and rising healthcare costs.

Pathology instruments include histopathology devices, clinical microscopes, immunohistochemistry products, and more. Pathologists use these tools to examine body tissues and fluids to find the cause of diseases.

Quick Stats of Pathology Instruments Market

- Pathology Instruments Market Size (2025): USD 4.1 billion.

- Projected Pathology Instruments Market Size (2035): USD 6.4 billion

- Forecast CAGR of Pathology Instruments Market (2025 to 2035): 4.5%

- Leading Technology Segment of Pathology Instruments Market: Clinical Chemistry

- Leading Application Segment of Pathology Instruments Market: Diagnostics

- Key Growth Regions of Pathology Instruments Market: United States, China, Japan

- Prominent Players in the Pathology Instruments Market: Abbott Laboratories, Becton, Dickinson and Company, Bio-Rad Laboratories, Danaher Corporation, Definiens, Others.

2025-to-2035.webp)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.1 billion |

| Industry Size (2035F) | USD 6.4 billion |

| CAGR (2025-2035) | 4.5% |

The pathology instruments market is projected to grow from USD 4.1 billion in 2025 to USD 6.4 billion by 2035, registering a CAGR of 4.5%. Year-on-year growth is expected to range between 4.2% and 4.8% during the early years, supported by gradual adoption of digital pathology and automation in laboratories.

The pace will likely accelerate after 2028 as AI-driven diagnostics, precision medicine initiatives, and molecular pathology platforms become standard in both developed and emerging healthcare systems.

Regulatory incentives for early disease detection, particularly in cancer screening and chronic illness monitoring, will drive adoption in high-income markets, while policy-backed healthcare infrastructure expansion will stimulate uptake in developing regions.

Demand-supply dynamics will be influenced by the aging population in developed economies, requiring frequent diagnostics, and by increasing accessibility of advanced laboratory services in Asia-Pacific, Latin America, and parts of the Middle East.

Technology will remain the primary growth enabler. AI-powered image recognition, LIS integration, and robotics-based slide preparation are expected to enhance diagnostic throughput and accuracy. Decentralization trends will boost demand for compact, cloud-enabled pathology instruments suited for outpatient clinics and private diagnostic chains.

Cross-sector partnerships between medical device manufacturers, software vendors, and biotech companies will further accelerate innovation pipelines, ensuring steady year-on-year expansion.

Top Pathology Instruments Market Dynamics

The pathology instruments market is shaped by clinical demand for accurate diagnostics, technological innovation, and healthcare infrastructure upgrades. While multiple drivers, from AI-enabled workflows to global cancer screening programs are propelling adoption, high capital costs, talent shortages, and interoperability gaps remain significant constraints. Balancing these forces will be crucial for sustained market growth.

Rising Global Disease Burden to Encourage Pathology Instruments Uptake for Research

The rising prevalence of cancer, infectious diseases, and chronic conditions is increasing the number of diagnostic procedures performed globally. Hospitals, academic centers, and diagnostic chains are expanding their laboratory capacity to handle higher sample volumes without compromising on turnaround times or accuracy. Pathology instruments play a critical role in this expansion, offering automated slide processing, high-throughput analyzers, and standardized testing protocols that reduce errors and improve reliability.

In addition to increasing demand, disease-specific screening programs such as government-backed cancer detection campaigns and infectious disease surveillance are boosting instrument utilization rates. This consistent patient throughput creates a recurring demand for consumables and maintenance services, offering a stable revenue base for manufacturers and service providers.

Adoption of Digital Pathology and AI to Encourage Pathology Instruments Deployment

Digital pathology platforms are transforming diagnostic workflows by replacing conventional microscopes with high-resolution slide scanners, cloud-based image storage, and AI-powered analysis tools.

This shift allows pathologists to review cases remotely, collaborate in real-time, and integrate results directly into electronic health records (EHRs) and laboratory information systems (LIS). The reduction in manual handling not only increases efficiency but also supports better traceability and compliance with clinical quality standards.

AI integration is further enhancing diagnostic precision by identifying subtle cellular or molecular patterns that may be overlooked by human observation. In oncology, AI-assisted image recognition is improving the accuracy of tumor grading and biomarker assessment, which directly supports precision medicine strategies. These advances are accelerating adoption across both high-volume central labs and smaller decentralized facilities.

Expansion of Decentralized and Outpatient Testing

Decentralized diagnostic models, including urgent care centers, outpatient clinics, and specialized testing facilities, are growing in number as healthcare providers aim to improve patient access and reduce hospital congestion. These facilities require compact, easy-to-operate pathology instruments capable of delivering rapid results without the infrastructure demands of a large hospital lab.

Manufacturers are responding with modular, portable, and cloud-enabled instruments that maintain high accuracy while fitting within smaller operational footprints. Such systems are particularly attractive in emerging markets where healthcare infrastructure is still developing, allowing providers to expand services into rural or underserved areas without significant capital investment in centralized labs.

High Capital Investment Requirements Deters Small-Scale End Users

Advanced pathology systems, including digital slide scanners, automated immunohistochemistry platforms, and next-generation sequencing (NGS) instruments, require substantial upfront capital. For smaller and mid-sized laboratories, these costs can be prohibitive, often forcing them to rely on outdated manual methods.

Even when capital is available, justifying the investment requires a high and consistent patient volume to ensure return on investment. This dynamic favors large hospital networks and national diagnostic chains while limiting adoption in standalone facilities. To overcome this barrier, leasing models, reagent rental agreements, and shared lab facilities are emerging as viable financing solutions.

Shortage of Skilled Professionals to Operate Sophisticated Pathology Equipment

The operation of high-end pathology instruments demands specialized training in both hardware and software. Pathologists, laboratory technicians, and molecular biologists must be proficient in areas like digital slide interpretation, image analytics, and data security protocols. In many developing countries, the shortage of such skilled professionals limits the effective utilization of advanced instruments.

Without adequate training, there is also a risk of misinterpretation of AI-assisted diagnostics, which can undermine trust in new technologies. Addressing this challenge requires industry academia partnerships to embed digital pathology competencies into medical curricula and create continuous learning programs for existing staff.

Regulatory Complexity and Approval Delays

Pathology instruments, particularly those integrated with AI or molecular diagnostic capabilities, must meet stringent safety, performance, and interoperability standards before they can be used clinically. Regulatory requirements vary widely across geographies, creating challenges for manufacturers aiming for global market penetration.

Approval timelines can be long, especially for products involving novel technologies with no established regulatory pathway. This can delay commercial launches and erode competitive advantages. Companies that proactively engage with regulatory authorities and participate in standard-setting bodies are better positioned to streamline approvals and reduce time-to-market.

Interoperability and Data Security Concerns

Integrating advanced pathology systems with existing LIS, EHR, and hospital IT infrastructure remains a technical challenge. Differences in data formats, proprietary software protocols, and security compliance frameworks often necessitate expensive customization.

At the same time, the increasing use of cloud-based pathology platforms raises concerns about data privacy, cybersecurity risks, and compliance with regulations like HIPAA and GDPR. Manufacturers must prioritize open architecture designs, secure data handling protocols, and interoperability certifications to build customer confidence and facilitate broader adoption.

Top Regions in the Global Pathology Instruments Market

Regional growth in the pathology instruments market is defined by differing healthcare maturity levels, policy environments, and adoption speeds. North America remains at the forefront due to strong healthcare infrastructure, AI integration, and government funding for diagnostics.

Europe follows closely, leveraging national cancer screening programs and lab automation initiatives. Asia-Pacific is emerging as the fastest-growing region, driven by healthcare access expansion, public health investments, and local manufacturing capabilities.

Latin America and the Middle East & Africa, while growing at a slower pace, present niche opportunities through private sector investments and policy-driven modernization of diagnostic infrastructure.

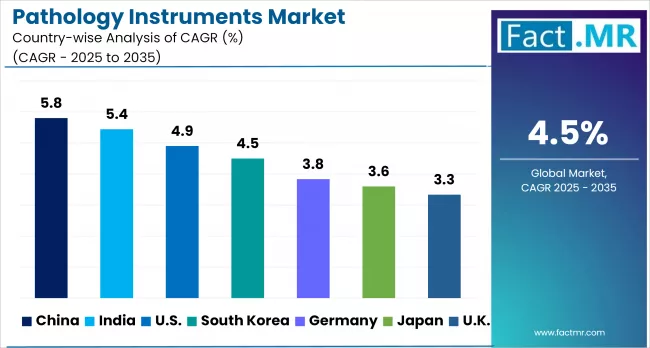

Country-Wise Outlook

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 4.9% |

| China | 5.8% |

| Japan | 3.6% |

AI-Powered Growth in Clinical Diagnostics to Stimulate Growth in the United States

2025-to-2035.webp)

The United States pathology instruments market benefits from a strong policy and funding environment, with initiatives like the Cancer Moonshot and NIH-backed research accelerating AI-integrated pathology solutions. Hospitals and private diagnostic chains are investing in automated slide scanners, cloud-based image archives, and LIS/EHR integration to streamline workflows.

The aging population is driving demand for regular screenings and chronic disease monitoring, while outpatient and ambulatory care centers are fueling the need for compact, portable instruments. Partnerships between academic institutions, tech startups, and major device manufacturers are fostering innovation in image analysis, companion diagnostics, and molecular pathology tools tailored to precision medicine.

- High federal and institutional funding for precision diagnostics

- Rapid uptake of AI-assisted slide interpretation and remote diagnostics

- Expanding outpatient diagnostic facilities equipped with compact systems

Policy-Driven Modernization and Local Manufacturing to Generate Pathology Instruments Demand in China

China’s Healthy China 2030 framework is reshaping its pathology landscape, prioritizing automation, AI integration, and widespread access to diagnostic services. Public–private partnerships are modernizing labs in both urban centers and tier II/III cities, while rural outreach programs extend pathology services to underserved populations.

Local manufacturers are increasingly producing cost-competitive pathology instruments, reducing dependence on imports and aligning with national self-reliance goals. Cloud-based data-sharing platforms are enabling collaboration between regional hospitals and centralized diagnostic hubs, ensuring consistent quality standards across the system.

- Government-backed lab automation and cancer screening programs

- Increasing domestic production of pathology instruments

- Growing use of cloud platforms for nationwide diagnostic data exchange

Adoption of Precision Medicine and Robotic Automation Drive Demand in Japan

The pathology instruments market in Japan benefits from its advanced healthcare infrastructure to meet the demands of an aging population and rising cancer incidence. Under the Society 5.0 initiative, hospitals are adopting robotic slide preparation systems, AI-based image recognition tools, and digital archiving platforms to improve throughput and accuracy.

There is a growing emphasis on retrofitting existing labs rather than building new facilities, allowing for faster integration of advanced technologies. Japan’s strong export capacity in medical devices is enabling domestic manufacturers to market high-precision pathology instruments in Southeast Asia, strengthening their global footprint.

- Deployment of robotic and AI-assisted pathology workflows

- Retrofits of traditional labs to accommodate digital platforms

- Export growth to Southeast Asian healthcare markets

Pathology Instruments Market Analysis by Key Categories

The pathology instruments market spans multiple technology segments, applications, and end-user groups, each contributing to the sector’s growth profile. Clinical chemistry remains indispensable for routine diagnostics, while molecular diagnostics is experiencing the fastest adoption due to its role in genomic medicine and personalized treatment strategies.

Diagnostics as an application continues to dominate, given the rising prevalence of cancer, infectious diseases, and genetic disorders. Drug discovery and development are seeing heightened integration of pathology tools for biomarker validation and clinical trial efficiency.

Among end users, diagnostic laboratories form the largest segment due to their high testing volumes, while pharmaceutical and biotechnology companies are the fastest-growing users, driven by R&D and precision oncology initiatives.

Clinical Chemistry the Core of Routine Diagnostics

Clinical chemistry analyzers remain the workhorse of diagnostic labs worldwide, providing essential information on metabolic functions, organ health, and disease progression through blood and fluid analysis. Their compatibility with automation systems makes them integral to high-volume laboratory workflows.

With the rise in preventive healthcare and chronic disease management, these instruments continue to see stable demand across both public and private healthcare settings.

- High throughput and reliability for daily operations

- Integration with automated sample handling systems

- Consistent demand in both advanced and emerging healthcare markets

Molecular Diagnostics Preferred Technology for Pathology Instruments

Molecular diagnostics is transforming the detection and monitoring of genetic conditions, cancers, and infectious diseases. Technologies like PCR, NGS, and CRISPR-based assays are enabling earlier and more precise disease identification.

Government-funded genomic medicine initiatives and increasing access to genetic testing services are accelerating adoption in hospitals, specialty clinics, and research institutes.

- Strong applicability in precision medicine and oncology

- Expanding use in infectious disease surveillance and outbreak control

- Integration with AI to enhance genomic data interpretation

Diagnostic Laboratories Primary End Users of Pathology Instruments

Diagnostic laboratories process thousands of samples daily, requiring highly automated systems to maintain speed and accuracy. Their role in public health surveillance, especially during pandemics, underscores their centrality in the pathology ecosystem. The adoption of AI-enabled workflow management tools is further enhancing operational efficiency in both centralized and decentralized lab networks.

- High reliance on automation for operational efficiency

- Integration of digital pathology for remote consultations

- Core role in national disease monitoring infrastructure

Competitive Analysis

The pathology instruments market is very competitive. It includes established medical technology companies, new digital pathology startups, and specialized diagnostic solution providers. The competition is fueled by fast technological changes, the use of AI, and a growing need for automation in diagnostic workflows.

Companies compete based on product innovation, pricing, integration abilities, services, and global reach. The most successful companies offer complete pathology ecosystems, from sample collection to image analysis, with smooth LIS integration and cloud connectivity. There is a noticeable shift toward compact, modular, and scalable systems that serve both high-volume labs and smaller, decentralized facilities.

The market also shows increased competition over digital pathology platforms, especially those using AI for image interpretation, remote diagnostics, and workflow improvement. Many companies are forming partnerships with software vendors and cloud service providers to improve diagnostic accuracy and speed. At the same time, regional players are gaining ground by providing affordable, localized solutions that meet specific regulatory and clinical needs.

Key Players in the Market

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Danaher Corporation

- Definiens

- Hamamatsu Photonics

- Mikroscan Technologies

- Ortho-Clinical Diagnostics

- Roche Diagnostics

- Thermo Fisher Scientific

- Others

Recent Developments

- In February 2024, Roche announced that it has entered into an agreement with PathAI, a global leader in artificial intelligence (AI)-powered technology for pathology. Under the terms of this agreement, PathAI will exclusively work with Roche Tissue Diagnostics (RTD) to develop AI-enabled digital pathology algorithms in the companion diagnostics space.

- In January 2025, Leica Biosystems, a global leader in anatomic and digital pathology solutions; and Indica Labs, a global leader in artificial intelligence (AI)-powered digital pathology software, announced that Leica Biosystems has agreed to make a significant strategic investment in Indica Labs. This partnership accelerates AI-enabled companion diagnostics (CDx) and support discoveries and treatments based on discrete or complex biomarker expression profiles which are not discernable by the human eye.

Segmentation of Pathology Instruments Market

-

By Technology :

- Clinical Chemistry

- Immunoassay Technologies

- Microbiology

- Molecular Diagnostics

-

By Application :

- Drug Discovery & Development

- Diagnostics

-

By End User :

- Pharmaceutical Companies

- Diagnostic Laboratories

- Academic Institutes

- Pharmaceutical & Biotechnology Companies

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Technology

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Technology, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Technology, 2025-2035

- Clinical Chemistry

- Immunoassay Technologies

- Microbiology

- Molecular Diagnostics

- Y-o-Y Growth Trend Analysis By Technology, 2020-2024

- Absolute $ Opportunity Analysis By Technology, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Application, 2025-2035

- Drug Discovery & Development

- Diagnostics

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End User

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By End User, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By End User, 2025-2035

- Pharmaceutical Companies

- Diagnostic Laboratories

- Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Y-o-Y Growth Trend Analysis By End User, 2020-2024

- Absolute $ Opportunity Analysis By End User, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Technology

- By Application

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Technology

- By Application

- By End User

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Bn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- Value (USD Bn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Technology

- By Application

- By End User

- Value (USD Bn) & Volume (Units)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Technology

- By Application

- By End User

- Competition Analysis

- Competition Deep Dive

- Abbott Laboratories

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Becton, Dickinson and Company

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Bio-Rad Laboratories

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Danaher Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Definiens

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Hamamatsu Photonics

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Mikroscan Technologies

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Ortho-Clinical Diagnostics

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Roche Diagnostics

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Thermo Fisher Scientific

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Abbott Laboratories

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 20: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 22: Latin America Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 24: Latin America Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 28: Western Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 30: Western Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 32: Western Europe Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 36: East Asia Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 37: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 38: East Asia Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 39: East Asia Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 40: East Asia Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 41: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: South Asia Pacific Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 44: South Asia Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 45: South Asia Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 46: South Asia Pacific Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 47: South Asia Pacific Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 48: South Asia Pacific Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 49: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 51: Eastern Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 52: Eastern Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 53: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 54: Eastern Europe Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 55: Eastern Europe Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 56: Eastern Europe Market Volume (Units) Forecast by End User, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 60: Middle East & Africa Market Volume (Units) Forecast by Technology, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 62: Middle East & Africa Market Volume (Units) Forecast by Application, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by End User, 2020 to 2035

- Table 64: Middle East & Africa Market Volume (Units) Forecast by End User, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Technology

- Figure 7: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Application

- Figure 10: Global Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by End User

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Technology

- Figure 27: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Application

- Figure 30: North America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by End User

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 36: Latin America Market Attractiveness Analysis by Technology

- Figure 37: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 39: Latin America Market Attractiveness Analysis by Application

- Figure 40: Latin America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by End User

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 46: Western Europe Market Attractiveness Analysis by Technology

- Figure 47: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 49: Western Europe Market Attractiveness Analysis by Application

- Figure 50: Western Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 52: Western Europe Market Attractiveness Analysis by End User

- Figure 53: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: East Asia Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 55: East Asia Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 56: East Asia Market Attractiveness Analysis by Technology

- Figure 57: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 58: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 59: East Asia Market Attractiveness Analysis by Application

- Figure 60: East Asia Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 61: East Asia Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 62: East Asia Market Attractiveness Analysis by End User

- Figure 63: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: South Asia Pacific Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 65: South Asia Pacific Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 66: South Asia Pacific Market Attractiveness Analysis by Technology

- Figure 67: South Asia Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 68: South Asia Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 69: South Asia Pacific Market Attractiveness Analysis by Application

- Figure 70: South Asia Pacific Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 71: South Asia Pacific Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 72: South Asia Pacific Market Attractiveness Analysis by End User

- Figure 73: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: Eastern Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 75: Eastern Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 76: Eastern Europe Market Attractiveness Analysis by Technology

- Figure 77: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 78: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 79: Eastern Europe Market Attractiveness Analysis by Application

- Figure 80: Eastern Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 81: Eastern Europe Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 82: Eastern Europe Market Attractiveness Analysis by End User

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Technology

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by End User, 2025 to 2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by End User

- Figure 93: Global Market - Tier Structure Analysis

- Figure 94: Global Market - Company Share Analysis

- FAQs -

What is the Global Pathology Instruments Market size in 2025?

The pathology instruments market is valued at USD 4.1 billion in 2025.

Who are the Major Players Operating in the Pathology Instruments Market?

Prominent players in the market include Abbott Laboratories, Becton, Dickinson and Company, Bio-Rad Laboratories, Danaher Corporation, and Definiens.

What is the Estimated Valuation of the Pathology Instruments Market by 2035?

The market is expected to reach a valuation of USD 6.4 billion by 2035.

At what CAGR is the Pathology Instruments Market slated to grow during the study period?

The growth rate of the pathology instruments market is 4.5% from 2025 to 2035.