Digital Twin Market

Digital Twin Market Size and Share Forecast Outlook 2025 to 2035

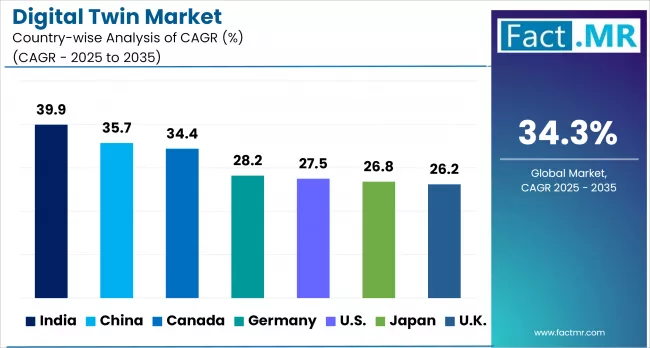

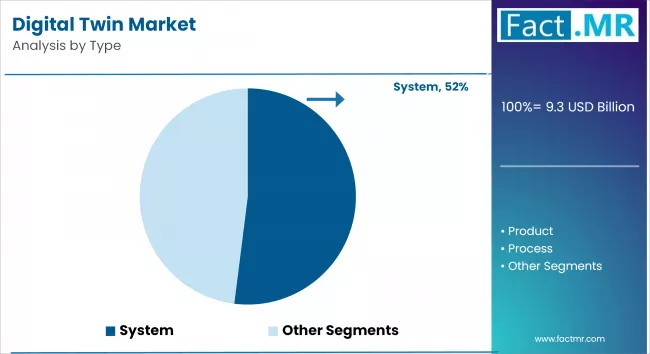

The Global Digital Twin Market Is Forecasted To Reach USD 9.3 Billion In 2025, And Further To USD 177.5 Billion By 2035, Expanding At A 34.3% CAGR. Digital Twin Systems Will Be The Leading Type Segment, While Automotive & Transport Will Be The Key End-Use Segment.

Digital Twin Market Size and Share Forecast Outlook 2025 to 2035

The global digital twin market is projected to increase from USD 9.3 billion in 2025 to USD 177.5 billion by 2035, with a CAGR of 34.3% during the forecast period. Growth is driven by IoT integration for real-time system monitoring, while AI and machine learning enable predictive analytics. Smart infrastructure and Industry 4.0 adoption offer virtual modeling opportunities to improve operational efficiency, reduce downtime, and support data-driven decision-making.

Quick Stats of Digital Twin Market

- Digital Twin Market Size (2025): USD 9.3 billion.

- Projected Digital Twin Market Size (2035): USD 177.5 billion

- Forecast CAGR of Digital Twin Market (2025 to 2035): 34.3%

- Leading Type Segment of Digital Twin Market: System

- Leading End-Use Segment of Digital Twin Market: Automotive & Transport

- Key Growth Regions of Digital Twin Market: France, China, Canada

- Prominent Players in the Digital Twin Market: ABB Ltd, Accenture plc, ANSYS Inc., AT&T Inc., AVEVA Group plc, Bentley Systems, Others.

2025-to-2035.webp)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.3 billion |

| Industry Size (2035F) | USD 177.5 billion |

| CAGR (2025-2035) | 34.3% |

The global digital twin market is forecast to expand from USD 9.3 billion in 2025 to USD 177.5 billion by 2035 at a CAGR of 34.3 percent. Growth begins with relatively modest value creation in 2025 and 2026, when early pilots and platform evaluations dominate.

Enterprises in manufacturing, energy, and transport invest in proof-of-concept deployments, while competition intensifies between PLM software providers, cloud hyperscalers, and industrial automation firms. The market crosses USD 16.8 billion by 2027, when scaling initiatives emerge and integration services become a critical profit pool, driven by shortages in system integration talent.

By 2028 and 2029, valuations climb past USD 22.5 billion and USD 30.3 billion respectively, reflecting increasing standardization and the adoption of common data models. Interoperability raises vendor stickiness, while safety-critical sectors demand certified and auditable digital twins, adding regulatory complexity and lengthening procurement cycles.

Entering 2030, the market reaches USD 40.6 billion as edge-to-cloud orchestration becomes routine, shifting revenue streams toward subscription models and data services. Consolidation accelerates after 2031, with horizontal capabilities becoming commoditized and vertical add-ons providing margin resilience.

Between 2032 and 2033, market size nearly doubles to USD 98.4 billion as outcome-based contracts and federated twins expand across supply chains, energy grids, and urban infrastructure.

Replacement cycles begin by 2034, with earlier adopters reconsidering platform choices, lowering switching barriers, and boosting competitive churn. The market ultimately peaks at USD 177.5 billion by 2035, when monetization strategies pivot toward model operations, industry-specific data marketplaces, and proprietary vertical IP.

Macroeconomic and regulatory factors shape this trajectory. Capital spending cycles and interest rates influence adoption velocity, while AI governance, data protection, and sector safety rules drive compliance costs but enable wider trust. Standards from ISO and IEC reduce integration risks, and labor shortages in operational technology keep service intensity high in early years, gradually giving way to software and data-driven profit pools.

Key Digital Twin Market Dynamics

The digital twin market is gaining momentum as industries move toward more data-centric operations. Enterprises are investing heavily in digital transformation to increase efficiency, reduce downtime, and improve predictive capabilities across their operations.

While manufacturing and healthcare stand at the forefront of adoption, the integration of IoT, analytics, and artificial intelligence is accelerating deployment across several verticals. Despite this progress, certain structural barriers, such as high implementation costs, data management challenges, and cybersecurity vulnerabilities, remain significant hurdles to widespread adoption and long-term scalability.

Rising Adoption of Digitalization in Manufacturing

Manufacturing has become the leading sector in embracing digital twins, largely driven by the need for greater efficiency and precision. Digitalization initiatives enable production plants to simulate entire processes, optimize workflows, and forecast maintenance schedules before breakdowns occur. By linking physical equipment with digital replicas, manufacturers are achieving reduced downtime, improved throughput, and enhanced flexibility in responding to fluctuating consumer preferences.

Market dynamics are also fueling demand, as manufacturers seek tools to remain competitive amid global supply chain disruptions and rising costs. More than half of global manufacturers are already investing in digital transformation technologies, and digital twins are increasingly viewed as foundational to Industry 4.0 strategies.

Growing Demand for Healthcare Applications

Healthcare organizations are exploring digital twin technology not only for equipment management but also for patient-centric care. Virtual models of hospital infrastructure, medical laboratories, and even human physiology allow for advanced scenario testing, helping providers anticipate patient flow, allocate resources, and identify inefficiencies in real time.

Digital twins in medicine are being used to simulate clinical treatments and optimize surgical planning, reducing both costs and risks. With 80% of healthcare executives planning to raise investments in intelligent digital twins, the sector is expected to see rapid deployment. The technology is positioned as a bridge between clinical data, operational data, and patient outcomes, making it a priority for forward-looking health systems.

Rising Need for Real-Time Data Analytics and IoT Integration

The exponential increase in connected devices has transformed digital twins from static representations into dynamic, continuously updated models. IoT sensors embedded in industrial equipment generate massive streams of data, which, when integrated with twin platforms, enable predictive maintenance and system optimization.

Real-time analytics enhance decision-making by identifying performance anomalies before they escalate into costly failures. Companies are using digital twins not only to reduce unplanned downtime but also to optimize energy usage and improve long-term asset life cycles.

The growing importance of predictive insights in sectors such as aerospace, logistics, and energy is making digital twins indispensable, with IoT and AI forming the backbone of this value proposition.

High Cost of Implementation

Despite its benefits, digital twin adoption remains expensive, creating barriers for small and medium-sized enterprises. Implementation requires significant upfront investment in sensors, IoT platforms, edge computing, cloud infrastructure, and cybersecurity protocols. Skilled professionals are also needed to design, manage, and maintain these systems, adding further expense.

For SMEs operating under tight margins, these costs often outweigh the short-term benefits, resulting in uneven adoption rates across industries. This cost disparity has created a digital divide where larger enterprises lead innovation, while smaller businesses struggle to participate.

Data Integration and Interoperability Issues

Digital twins thrive on seamless connectivity between physical assets and virtual environments, yet integration across disparate systems remains a persistent challenge. Many organizations continue to rely on legacy systems that are not designed for real-time interoperability. These outdated platforms hinder efficient data transfer, leading to incomplete or inaccurate models.

Fragmentation in data standards and protocols also complicates integration across vendors, industries, and geographies. As companies scale their digital twin deployments, these barriers increase operational complexity, slowing down deployment cycles and reducing overall effectiveness of the models.

Cybersecurity Risks and Lack of Standardization

With continuous data transmission between assets and their virtual counterparts, digital twins expose organizations to heightened cybersecurity risks. Any breach or manipulation of data flows can result in equipment failures, operational disruption, or compromised safety, particularly in sectors like energy, transportation, and healthcare. Cybersecurity concerns also raise compliance costs, as enterprises must invest in robust defenses and monitoring systems.

Adding to this challenge is the lack of global standards for implementing and governing digital twin ecosystems. Without uniform guidelines, companies face difficulties in benchmarking performance, ensuring cross-border compliance, and building interoperable solutions. This lack of standardization not only slows adoption but also increases operational risk in industries where accuracy and reliability are non-negotiable.

Analyzing the Digital Twin Market by Key Regions

North America is advancing rapidly in digital twin adoption, supported by AI, IoT, 5G connectivity, and cloud computing. Industries such as manufacturing, healthcare, AEC, and smart cities are deploying digital twins for predictive maintenance, operational optimization, and data-driven decision-making. The combination of strong technological infrastructure and large-scale enterprise investment ensures steady regional growth.

Europe is also experiencing strong uptake, with its industrial heritage and engineering strengths driving demand. Automotive and transportation sectors dominate usage, where digital twins enable advanced simulation, predictive modeling, and fleet efficiency. Government support for Industry 4.0 adoption is reinforcing digital twin penetration across the region.

Asia Pacific remains the fastest-expanding region, with China, India, Japan, and South Korea leading adoption. Smart city projects are central, using digital twins for urban planning, infrastructure development, and traffic optimization. The region’s large industrial base and government-backed initiatives position it as the growth engine of the global market.

Country-Wise Outlook

| Countries | CAGR (2025-35) |

|---|---|

| France | 33.2% |

| China | 35.7% |

| Canada | 34.4% |

France Strengthens Digital Twin Market through Industrial Innovation and Smart Manufacturing

France is positioning itself as a strong contender in the digital twin landscape through a combination of industrial innovation and government-backed modernization initiatives. The national "Industrie du Futur" program has been central to this progress, encouraging enterprises to integrate IoT, AI, and digital twins into their operations.

Leading automotive and aerospace firms, such as Airbus and Renault, have pioneered adoption to improve design accuracy, predictive maintenance, and supply chain efficiency. Government support has amplified these efforts through targeted grants and funding mechanisms, with institutions like Bpifrance offering financial assistance to SMEs and startups for R&D and deployment of digital twins in both manufacturing and infrastructure.

Energy transition is another growth catalyst, as utilities such as EDF are applying digital twin platforms for monitoring and predictive analysis of nuclear and renewable assets, improving both safety and operational outcomes.

The research community also plays a vital role, with organizations such as the Commissariat à l'Énergie Atomique (CEA) contributing to simulation tools and cyber-physical systems research. This collaboration between academia, industry, and government is fostering innovation across diverse applications, including transportation, healthcare, and urban planning, making France a key driver in Europe’s digital twin expansion.

- Government initiatives and grants strengthen adoption across sectors

- Strong uptake in aerospace, automotive, and energy industries

- Academic research institutions drive innovation and industry collaboration

China's Digital Twin Market Thrives on Government-Led Innovation and Smart Infrastructure Initiatives

China has emerged as a global frontrunner in digital twin adoption, fueled by government-led programs such as "Made in China 2025" and "New Infrastructure." These initiatives are designed to transform the country’s industrial base through digitalization, with digital twin technology playing a central role in building smart factories, intelligent equipment, and modernized transport networks.

Provinces such as Guangdong and Jiangsu have seen widespread deployment in manufacturing hubs, where companies in automotive, electronics, and heavy machinery leverage digital twins for process simulation, predictive maintenance, and efficiency optimization.

Policy support underpins this growth, with the Ministry of Industry and Information Technology (MIIT) encouraging cross-sector integration and standardization. Major technology players such as Huawei, Tencent, and Alibaba Cloud further bolster the ecosystem by offering scalable platforms that accelerate adoption across industries.

Combined with a vast industrial base and abundant data resources, China is building not just domestic capability but also a strong foundation for technology exports. This government-backed innovation, alongside private sector dynamism, ensures that China will continue to exert leadership in shaping the future of digital twins worldwide.

- National strategies embed digital twins in manufacturing transformation

- Leading technology firms strengthen cross-industry deployment

- Strong policy support and standardization initiatives drive scalability

Canada Advances in Digital Twin Market with Focus on Urban Planning and Sustainable Innovation

Canada’s digital twin market is advancing steadily with an emphasis on smart cities, clean energy, and infrastructure modernization. The Canada Infrastructure Bank’s Growth Plan has encouraged large-scale digitization across public utilities and transportation, creating demand for simulation and predictive analytics in city planning and resource allocation.

This governmental push is complemented by active research efforts from leading universities, such as McGill University and the University of Waterloo, which collaborate with industries to build advanced IoT and simulation frameworks.

Data governance is another critical enabler, with strong privacy regulations such as PIPEDA fostering trust in digital technologies. These safeguards are particularly relevant in sensitive sectors such as healthcare and urban infrastructure, where citizen data security is paramount.

By combining regulatory oversight, strong academic contributions, and public investment in smart infrastructure, Canada is carving out a niche as a stable and forward-looking market for digital twin deployment. While not expanding as aggressively as China, Canada’s focus on secure and sustainable applications makes its market both reliable and innovation-driven.

- Infrastructure digitization initiatives drive adoption in cities and utilities

- Strong academic-industry collaboration strengthens innovation ecosystem

- Data privacy laws foster confidence in healthcare and urban applications

Category-wise Analysis

System to Exhibit Leading Share by Type

The system segment holds the largest share within the digital twin market, as enterprises increasingly deploy system-level twins to model and monitor complex environments.

Unlike asset-based twins that focus on a single component, system twins integrate multiple elements, providing engineers with a comprehensive view of how different assets interact within a larger network.

This capability is widely used in industries such as oil and gas, aerospace, and automotive, where assembly lines, communication systems, and piping networks require close monitoring and coordination.

Real-time visibility into system performance helps reduce downtime, prevent bottlenecks, and ensure safe operation. System-level twins also enable testing of new configurations or upgrades in a simulated environment before deployment, reducing the risk of operational disruption.

With rising industrial automation and the need for end-to-end operational oversight, system twins are positioned to remain the backbone of digital twin adoption across asset-intensive sectors.

- System-level twins dominate due to integration of multiple assets

- Widely deployed in oil and gas, automotive, and aerospace sectors

- Enhance real-time coordination, testing, and operational oversight

Automotive & Transport to Exhibit Leading by End-Use

The automotive and transport sector remains the leading end-user of digital twin technology, reflecting its heavy reliance on simulation and predictive tools. Digital twins allow manufacturers to model vehicle performance, optimize designs, and simulate crash tests, all of which reduce development costs and improve safety.

Once vehicles are in operation, digital twins enable real-time monitoring of performance and predictive scheduling of maintenance, minimizing downtime and extending vehicle lifecycles.

Logistics and transport operators also leverage digital twins to optimize fleet management and supply chain efficiency, ensuring that assets remain productive and cost-effective.

Major automotive players are investing in digital twin solutions not only for product design but also for aftermarket services, creating new opportunities for recurring revenue. With electrification and autonomous vehicles advancing, digital twins are expected to play an even greater role in ensuring safety, reliability, and customer satisfaction.

- Automotive & transport leads due to safety, cost, and productivity gains

- Applications extend across design, maintenance, and fleet optimization

- Supports transition to EVs and autonomous mobility solutions

Competitive Analysis

The digital twin market is becoming increasingly competitive, with key players such as Microsoft, IBM, GE, and Oracle. These companies focus on strategic partnerships, acquisitions, and continuous R&D to enhance digital twin solutions, integrating AI, IoT, and cloud technologies. Rapid technological advancements, growing industrial automation, and the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning have all contributed to the fierce competition in the digital twin market.

The ability to provide scalable and customizable digital twin solutions is a significant competitive advantage. Vendors compete on how well their platforms model complex physical systems in real time and integrate with existing IT and operational technologies. Cloud-based solutions are gaining popularity due to their flexibility and ease of deployment, providing a competitive advantage to providers who offer strong cloud infrastructure or have partnerships with major cloud platforms.

Data integration and analytics capabilities are important differentiators. Companies that can ingest data from a variety of sources, sensors, ERP systems, and maintenance logs, and provide actionable insights via predictive analytics are in a better position. The use of artificial intelligence to improve real-time decision-making and automate responses is a growing trend that is changing the landscape of competition.

Key Players in the Market

- ABB Ltd

- Accenture plc

- ANSYS Inc.

- AT&T Inc.

- AVEVA Group plc

- Bentley Systems Incorporated

- General Electric (GE Digital)

- IBM Corporation

- Microsoft Corporation

Recent Developments

- In January 2025, Siemens unveiled several key innovations in industrial AI and digital twin technology, bringing AI to factory floors while providing secure access to large language models. JetZero chose Siemens Xcelerator for blended wing aircraft development, and Siemens collaborated with AWS to launch the Siemens for Startups program.

- In December 2024, ABB and Typhoon HIL launched DriveLab ACS880, a next-generation HIL-compatible digital twin solution. This technology streamlines customer development by addressing interoperability issues through Hardware-in-the-Loop (HIL) integration.

Segmentation of Digital Twin Market

-

By Type :

- System

- Product

- Process

-

By End-Use :

- Residential & Commercial

- Manufacturing

- Automotive & Transport

- Energy & Utilities

- Agriculture

- Healthcare & Life Sciences

- Other End Uses

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Raw Material Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Type

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) Analysis By Type, 2020-2024

- Current and Future Market Size Value (USD Bn) Analysis and Forecast By Type, 2025-2035

- System

- Product

- Process

- Y-o-Y Growth Trend Analysis By Type, 2020-2024

- Absolute $ Opportunity Analysis By Type, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By End-Use

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) Analysis By End-Use, 2020-2024

- Current and Future Market Size Value (USD Bn) Analysis and Forecast By End-Use, 2025-2035

- Residential & Commercial

- Manufacturing

- Automotive & Transport

- Energy & Utilities

- Agriculture

- Healthcare & Life Sciences

- Other End Uses

- Y-o-Y Growth Trend Analysis By End-Use, 2020-2024

- Absolute $ Opportunity Analysis By End-Use, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- South Asia Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Type

- By End-Use

- By Country

- Market Attractiveness Analysis

- By Country

- By Type

- By End-Use

- Key Takeaways

- Key Countries Market Analysis

- Value (USD Bn)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- Value (USD Bn)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Type

- By End-Use

- Value (USD Bn)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Type

- By End-Use

- Competition Analysis

- Competition Deep Dive

- ABB

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Accenture

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ANSYS, Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- AT&T Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- AVEVA Group plc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Bentley Systems

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- General Electric

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- IBM

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Microsoft Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- ABB

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 4: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 5: North America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 6: North America Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 7: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 8: Latin America Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 9: Latin America Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 10: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 11: Western Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 12: Western Europe Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 13: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: East Asia Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 15: East Asia Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 16: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 17: South Asia Pacific Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 18: South Asia Pacific Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 21: Eastern Europe Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

- Table 22: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 23: Middle East & Africa Market Value (USD Bn) Forecast by Type, 2020 to 2035

- Table 24: Middle East & Africa Market Value (USD Bn) Forecast by End-Use, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 3: Global Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 4: Global Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 5: Global Market Attractiveness Analysis by Type

- Figure 6: Global Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 7: Global Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 8: Global Market Attractiveness Analysis by End-Use

- Figure 9: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 10: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 13: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: South Asia Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 20: North America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 21: North America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 22: North America Market Attractiveness Analysis by Type

- Figure 23: North America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 24: North America Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 25: North America Market Attractiveness Analysis by End-Use

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Latin America Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 28: Latin America Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 29: Latin America Market Attractiveness Analysis by Type

- Figure 30: Latin America Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 31: Latin America Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 32: Latin America Market Attractiveness Analysis by End-Use

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Western Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 35: Western Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 36: Western Europe Market Attractiveness Analysis by Type

- Figure 37: Western Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 38: Western Europe Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 39: Western Europe Market Attractiveness Analysis by End-Use

- Figure 40: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 41: East Asia Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 42: East Asia Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 43: East Asia Market Attractiveness Analysis by Type

- Figure 44: East Asia Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 45: East Asia Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 46: East Asia Market Attractiveness Analysis by End-Use

- Figure 47: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 48: South Asia Pacific Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 49: South Asia Pacific Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 50: South Asia Pacific Market Attractiveness Analysis by Type

- Figure 51: South Asia Pacific Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 52: South Asia Pacific Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 53: South Asia Pacific Market Attractiveness Analysis by End-Use

- Figure 54: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 55: Eastern Europe Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 56: Eastern Europe Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 57: Eastern Europe Market Attractiveness Analysis by Type

- Figure 58: Eastern Europe Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 59: Eastern Europe Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 60: Eastern Europe Market Attractiveness Analysis by End-Use

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Type, 2025 and 2035

- Figure 63: Middle East & Africa Market Y-o-Y Growth Comparison by Type, 2025 to 2035

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Type

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by End-Use, 2025 and 2035

- Figure 66: Middle East & Africa Market Y-o-Y Growth Comparison by End-Use, 2025 to 2035

- Figure 67: Middle East & Africa Market Attractiveness Analysis by End-Use

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

What is the Global Digital Twin Market size in 2025?

The digital twin market is valued at USD 9.3 billion in 2025.

Who are the Major Players Operating in the Digital Twin Market?

Prominent players in the market include ABB Ltd, Accenture plc, ANSYS Inc., AT&T Inc., AVEVA Group plc, Bentley Systems, Incorporated, and General Electric (GE Digital).

What is the Estimated Valuation of the Digital Twin Market by 2035?

The market is expected to reach a valuation of USD 177.5 billion by 2035.

What Value CAGR Did the Digital Twin Market Exhibit over the Last Five Years?

The historic growth rate of the digital twin market is 34.3% from 2020-2024.