Hip Reconstruction Devices Market

Hip Reconstruction Devices Market Analysis- Size, Share, and Forecast Outlook 2025 to 2035

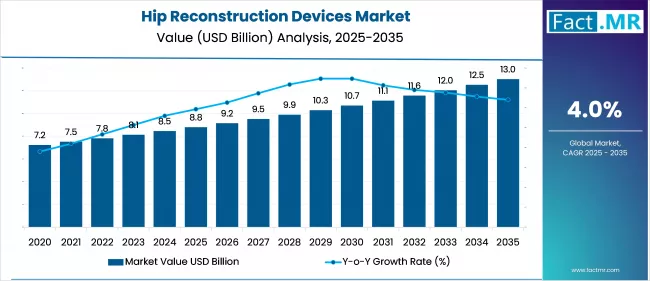

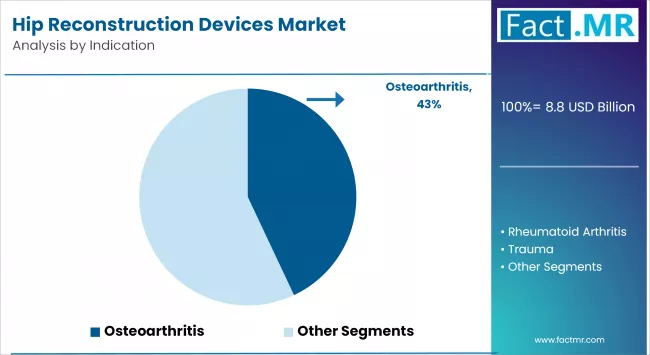

The hip reconstruction devices market will likely total to USD 8.8 billion in 2025, and is projected to be valued at USD 13.0 billion by 2035, growing at a CAGR of 4.0%. Osteoarthritis indication dominate, while partial hip reconstruction devices remain the key product type.

Hip Reconstruction Devices Market Outlook 2025 to 2035

The global hip reconstruction devices market is forecast to reach USD 13.0 billion by 2035, up from USD 8.8 billion in 2025. During the forecast period, the industry is projected to register at a CAGR of 4.0%.

Growing osteoarthritis cases due to aging populations, minimally invasive surgeries for faster recovery, and durable implant materials drive the hip reconstruction devices market. Emerging markets with improved healthcare infrastructure have opportunities for orthopedic surgery and patient access.

Quick Stats of Hip Reconstruction Devices Market

- Hip Reconstruction Devices Market Size (2025): USD 8.8 billion

- Projected Hip Reconstruction Devices Market Size (2035): USD 13.0 billion

- Forecast CAGR of Hip Reconstruction Devices Market (2025 to 2035): 4.0%

- Leading Indication Segment of Hip Reconstruction Devices Market: Osteoarthritis

- Key Growth Regions of Hip Reconstruction Devices Market: Canada, China, United States

- Key Players of the Hip Reconstruction Devices Market: Braun Melsungen AG, Corin Group PLC, DePuy Synthes, Exactech Inc., MicroPort Scientific Corporation, Smith & Nephew PLC, Others.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.8 billion |

| Industry Size (2035F) | USD 13.0 billion |

| CAGR (2025-2035) | 4.0% |

The hip reconstruction devices market is expected to experience steady growth from 2025 to 2030, influenced by regulatory oversight, changing cost structures, and an evolving global value chain. In the initial stages, regulatory frameworks in developed markets, including the FDA’s PMA/510(k) and the EU MDR, guarantee device safety and efficacy. While these regulations elevate market entry costs, they also enhance clinical confidence.

Pricing pressure in regions such as China, due to volume-based procurement, alters the competitive landscape, necessitating both multinational and domestic manufacturers to optimize operations and implement local manufacturing strategies.

The value chain exhibits increased integration, spanning from material suppliers to surgical delivery, alongside a transition towards high-wear-resistant materials such as highly cross-linked polyethylene and ceramics.

Ecosystem partnerships, including collaborations among device manufacturers, hospital networks, and digital surgery platform providers, facilitate precision-based, minimally invasive procedures. This period is characterized by the expansion of orthopedic clinics and ambulatory surgical centers, enhancing access and impacting procurement and distribution efficiencies.

From 2030 to 2035, the market is likely to witness data integration, device customization, and outcome-based reimbursement models. Regulatory bodies prioritize post-market surveillance and clinical performance tracking, expediting product approvals and changes using real-world evidence.

Advanced manufacturing methods like 3D printing enable on-demand, patient-specific implants, reduce inventory, and increase surgeon acceptance, affecting cost structures. The value chain will become more digital with predictive analytics in supply planning and AI-assisted surgical tools in operation protocols.

Emerging market companies with R&D certifications compete in premium segments traditionally dominated by established brands, intensifying global competition. ;

Telehealth and remote surgical training platforms increase surgeon expertise in neglected areas. Ecosystem collaborations become joint innovation hubs where device engineering, software integration, and clinical research merge, improving healthcare provider procedural success and efficiency.

Top Hip Reconstruction Devices Market Dynamics

The global demand for advanced orthopedic interventions is bolstering the constant growth trajectory of the hip reconstruction devices industry. The eligible patient pool is being expanded in both developed and emergent markets due to the rising prevalence of osteoarthritis, trauma-related hip damage, and age-associated joint degeneration.

The integration of computer-assisted surgical systems, the incorporation of minimally invasive techniques, and the advancements in implant materials are resulting in improved clinical outcomes and shorter recovery periods. Procedural development is additionally influenced by the expansion of orthopedic care and the enhancement of healthcare infrastructure in developing regions.

Competitive positioning is being influenced by regulatory compliance, pricing strategies, and cost efficiencies from a market structure perspective. Developed regions maintain a competitive advantage as a result of their mature healthcare systems and robust reimbursement frameworks, while cost-sensitive markets capitalize on strategic partnerships and localized manufacturing.

The adoption rates will continue to be determined by the interplay between the availability of skilled surgical personnel, the innovation of medical devices, and the evolution of procurement policies. This dynamic environment is cultivating an ecosystem in which technology, affordability, and accessibility are becoming more interconnected.

Rising Incidence of Hip Injuries

The demand for hip repair options is increasing as the number of hip injuries rises. Such injuries are frequently caused by overstretching or injuring the hip joint's supporting muscles.

Surgical procedures such as hip replacement can help relieve pain and stiffness caused by arthritis, avascular necrosis, or other degenerative disorders. Projections from the United States National Library of Medicine in August 2024 predict 3-11 million yearly cases by 2030 and up to 21 million by 2050, depending on forecasting assumptions.

Effect of Obesity on Surgical Demand

Obesity adds significantly to the rising demand for hip repair. Excess body weight accelerates the wear and tear on hip joints, resulting in pain, limited mobility, and ultimately joint degeneration.

Obese patients with hip difficulties benefit from surgical repair, which improves their functionality and quality of life. According to the Government Digital Service in May 2023, obesity among 18-year-olds in England reached 25.9% in 2021-2022, a 25.2% increase, highlighting the growing patient pool.

Advances in Minimally Invasive Surgery Techniques

The popularity of minimally invasive hip replacement operations is growing due to their benefits of less pain, faster recovery, and decreased complication rates. This trend encourages healthcare facilities to implement modern technologies like robotics and computer-assisted systems, which improve surgical precision and outcomes.

As hospitals and surgical centers prioritize patient-centered recovery and procedural efficiency, the integration of these technologies has emerged as a crucial growth driver.

High Cost of Hip Reconstruction Surgery and Implants

The high expense of hip reconstruction surgeries and modern implant systems remains a significant obstacle to adoption, especially in poor economies. Many patients find the cost prohibitively exorbitant, limiting access to high-quality surgical procedures and decreasing total market penetration in cost-sensitive nations.

Limited Reimbursement Coverage for Advanced Solutions

Reimbursement regulations frequently limit coverage for premium implants and newer surgical technologies, deterring patients and doctors from choosing high-performance options.

Insufficient public health insurance coverage in many areas limits the adoption of novel equipment that could improve surgical outcomes and long-term patient satisfaction.

Risk of Device Recalls and Postoperative Complications

Device recalls and consequences such as infection, implant loosening, or the necessity for revision operations cause concern among patients and doctors. These negative results damage confidence, invite increased regulatory scrutiny, and increase compliance requirements for firms, resulting in longer approval times and higher operational expenses.

Dearth of Skilled Orthopedic Surgeons in Certain Regions

A scarcity of skilled orthopedic surgeons capable of conducting sophisticated surgeries like total hip arthroplasty limits market growth, especially in rural and disadvantaged locations. This constraint not only reduces procedural numbers but also slows the adoption of innovative surgical technology in areas with significant unmet demand.

Top Regions Driving Hip Reconstruction Devices Market Growth

North America dominates the hip reconstruction devices market, driven by sophisticated medical infrastructure, elevated procedural volumes, and robust insurance coverage, especially in the United States.

The region possesses a well-developed surgical ecosystem, swift integration of robotic-assisted and computer-navigated procedures, and established regulatory frameworks that guarantee device quality.

Europe experiences growth propelled by public and private research and development investments, heightened demand for partial replacements, and a rising number of facilities implementing advanced surgical technologies, including robotic systems.

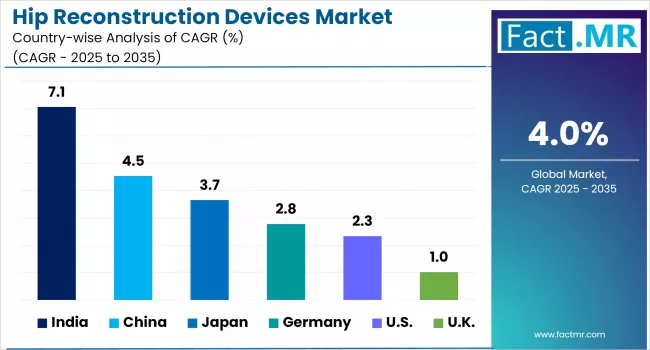

Asia Pacific is anticipated to experience the highest growth rate, driven by the enhancement of healthcare infrastructure, increased access to procedures, and strategic efforts by both local and international stakeholders. The Volume-Based Procurement program in China has enhanced affordability, while also fostering local competition and driving product innovation.

Country-Wise Outlook

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| China | 5.7% |

| Canada | 3.5% |

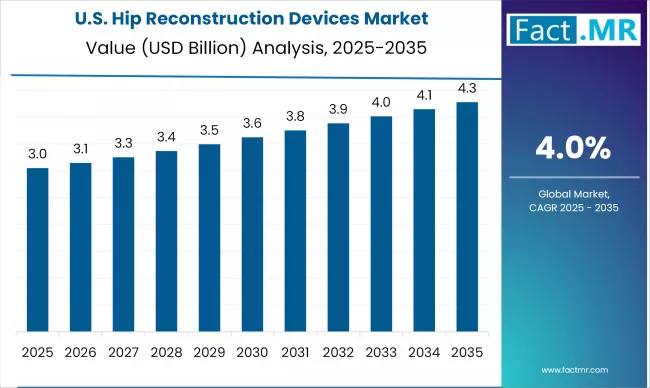

Rising Obesity and Osteoarthritis Incidence driving demand in the United States

The United States dominates the global hip reconstruction device market due to its aging population, high prevalence of osteoarthritis, and rising obesity rates. With over 450,000 complete hip replacements performed each year, the procedure volume remains among the highest in the world.

The FDA's strict regulatory scrutiny through the PMA and 510(k) pathways protects device quality, but it also increases development schedules and costs. Technological innovation, such as robotic-assisted operations and 3D-printed implants, is frequently used in hospitals and surgical centers to improve outcomes. The industry also benefits from extensive insurance coverage, however cost containment remains a top priority for providers and payers.

- High annual procedure volume caused by osteoarthritis and obesity prevalence.

- The advanced regulatory structure ensures quality and safety.

- Strong adoption of robotic-assisted and 3D-printed implants.

China's Volume-Based Procurement Reform Improves Hip Reconstruction Accessibility

China's hip reconstruction market is rapidly developing, driven by government-led healthcare reforms and rising procedural demand. The Volume-Based Procurement (VBP) initiative has drastically decreased implant pricing, increasing accessibility in public hospitals while putting pressure on manufacturer margins.

Local companies, such as AK Medical, are gaining market share with cheap, anatomically customized products, aided by favorable regulatory paths and increased R&D investment. The National Medical Products Administration (NMPA) strictly enforces Class III standards, which improves product quality and clinical trust. Rising middle-class healthcare spending and hospital capacity expansion bolster demand.

- VBP policy enhances affordability and procedural access.

- Local manufacturers gain from customized product design and cost advantages.

- Increased hospital infrastructure and middle-class healthcare spending

Canada's Aging Population Driving Demand for Hip Reconstruction Devices

A rapidly aging population and an increasing incidence of osteoarthritis are driving Canada's hip reconstruction business forward. These devices are classified as Class III by Health Canada, which requires strong clinical evidence and continuing supervision, in accordance with US and EU criteria.

Efforts to spread orthopedic treatment into rural locations, such as the Canadian rural Access Telehealth program, increase accessibility. This promotes the use of portable surgical kits and modular implant systems, especially in impoverished settings. Rising procedural demand is predicted to continue when the proportion of persons 65 and older exceeds 23% by 2031.

- Aging demographics are driving increased surgery volumes.

- Stringent regulatory control in accordance with worldwide standards.

- Telehealth and mobile surgical units improve rural access.

Analyzing Hip Reconstruction Devices Market by Leading Segments

The hip reconstruction devices market is divided into four categories: indication, product type, material, and end-user, with each representing unique clinical demands and adoption motivations. Osteoarthritis continues to dominate procedural demand, with trauma patients accounting for a sizable portion, particularly in emergency settings.

The product segmentation demonstrates a balance of total, partial, and revision surgeries, with each influenced by patient demographics, injury severity, and surgeon preference. Material selection is influenced by wear resistance, biocompatibility, and patient lifestyle, while end-user distribution is shifting toward orthopedic clinics and ambulatory surgery facilities for specialized and cost-effective care.

Osteoarthritis to Remain Most Prominent Indication in Hip Reconstruction

Osteoarthritis remains the primary indication requiring hip reconstruction, particularly in older adults. Severe cases often necessitate total hip arthroplasty, driving demand for durable implants.

Technological advances, including minimally invasive procedures and improved biomaterials, specifically target this high-prevalence segment. As populations age, the number of osteoarthritis-related hip replacements is set to rise steadily.

- Most common indication driving hip replacement demand

- Focus on durable implants and advanced surgical techniques

- Aging population directly increasing procedural volumes

Hip Reconstruction Devices for Trauma Indications Gaining Traction

Trauma focused hip reconstruction devices are gaining popularity. Fractures and dislocations, often from accidents or falls in elderly patients with osteoporosis require the use of these devices.

Additionally, rising road accidents among younger individuals and fall-related injuries in seniors are expanding this segment. High demand exists for modular implants and fixation systems that provide quick, reliable surgical outcomes.

- Driven by accident-related and fall-induced injuries

- Strong demand for modular implants and fixation systems

- Need for rapid, reliable surgical solutions

Partial Hip Reconstruction Devices for Targeted Treatment

Partial hip reconstruction devices cater to patients needing replacement of only part of the hip joint, such as in hemiarthroplasty procedures. These devices are popular among patients with localized damage or fractures, offering faster recovery than total hip replacements. Growing preference for less invasive treatments supports this segment’s expansion.

- Suitable for localized damage or fractures

- Faster recovery compared to total hip replacement

- Increasing preference for less invasive options

Revision Hip Reconstruction for Corrective Procedures

Revision devices are used in patients requiring corrective surgery after a previous hip replacement. Common triggers include implant loosening, wear, infection, or dislocation. As the number of primary surgeries rises, the volume of revision procedures follows, creating a steady growth opportunity in this segment.

- Addresses complications from prior hip replacements

- Demand tied to rising primary procedure volumes

- Focus on improved implant longevity and stability

Demand for Metal-on-Polyethylene (MoP) Hip Reconstruction Devices to Surge

Metal-on-polyethylene (MoP) implants lead due to their wear resistance and biocompatibility, particularly with highly cross-linked polyethylene. Ceramic-on-polyethylene (CoP) and ceramic-on-ceramic (CoC) options are gaining interest for their high biocompatibility and low wear rates, especially in younger, active patients. Advances in ceramic manufacturing aim to reduce fracture risks and extend longevity.

- MoP implants dominate for balanced durability and safety

- CoP and CoC appeal to younger, active patient profiles

- Advances in ceramic materials improving safety and longevity

Competitive Analysis

The hip reconstruction devices market is highly competitive, with a focus on continuous innovation, technological integration, and growing demand for advanced orthopedic solutions. An aging global population, rising incidences of osteoarthritis and hip fractures, and an increase in the global number of hip replacement procedures all drive competition. The market structure includes both global medical device manufacturers and regionally active orthopedic companies.

One of the distinguishing features of competition is the emphasis on product innovation. Companies are constantly developing minimally invasive surgical devices, enhanced biomaterials like titanium and ceramic composites, and personalized implants using 3D printing. These advancements aim to improve surgical outcomes, shorten recovery time, and increase implant durability, which is a key selling point in developed markets such as the United States, Germany, and Japan.

Cost-effectiveness and reimbursement policies both influence market competition. Price competitiveness, distribution efficiency, and local partnerships are critical in cost-sensitive regions such as Latin America and Asia-Pacific. To break into these markets, some companies focus on providing basic implant systems at lower prices, while others invest in surgeon training and local manufacturing facilities to increase acceptance.

Key players in the market are B. Braun Melsungen AG, Corin Group PLC, DePuy Synthes, Exactech, Inc., MicroPort Scientific Corporation, Smith & Nephew PLC, Stryker Corporation, United Orthopedic Corporation, Waldemar Link GmbH & Co. KG, Zimmer Biomet Holdings, Inc. and other players.

Recent Developments

- In July 2024, Smith & Nephew announced that the United States Food and Drug Administration has granted 510(k) clearance for its new CATALYSTEM Primary Hip System. The system was created to meet the changing needs of primary hip surgery, such as the increased use of anterior approach procedures and the growing role of ambulatory surgery centers (ASCs).

- In February 2025, Hydrix Limited announced that Gyder Surgical, which is part of its Ventures portfolio, has received FDA 510(k) clearance for the GYDER Hip System, paving the way for commercialization in the United States. This milestone demonstrates Hydrix's expertise in medical product development and strengthens Gyder's market position, increasing Hydrix Ventures' investment value to $2.65 million.

Segmentation of Hip Reconstruction Devices Market

-

By Indication :

- Osteoarthritis

- Rheumatoid Arthritis

- Trauma

-

By Product :

- Primary Hip Reconstruction Devices

- Partial Hip Reconstruction Devices

- Revision Hip Reconstruction Devices

- Hip Resurfacing Devices

-

By Material :

- Metal-on-metal

- Metal-on-polyethylene

- Ceramic-on-polyethylene

- Ceramic-on-metal

- Ceramic-on-ceramic

-

By End-User :

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Supply Side Participants and their Roles

- Producers

- Mid-Level Participants (Traders/ Agents/ Brokers)

- Wholesalers and Distributors

- Value Added and Value Created at Node in the Supply Chain

- List of Component Suppliers

- List of Existing and Potential Buyers

- Supply Side Participants and their Roles

- Investment Feasibility Matrix

- Value Chain Analysis

- Profit Margin Analysis

- Wholesalers and Distributors

- Retailers

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- By Key Regions

- By Key Countries

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Hip Reconstruction Devices Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Indication

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Indication, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Indication, 2025-2035

- Osteoarthritis

- Rheumatoid Arthritis

- Trauma

- Y-o-Y Growth Trend Analysis By Indication, 2020-2024

- Absolute $ Opportunity Analysis By Indication, 2025-2035

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Product

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Product, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Product, 2025-2035

- Primary Hip Reconstruction Devices

- Partial Hip Reconstruction Devices

- Revision Hip Reconstruction Devices

- Hip Resurfacing Devices

- Y-o-Y Growth Trend Analysis By Product, 2020-2024

- Absolute $ Opportunity Analysis By Product, 2025-2035

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Material

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Material, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Material, 2025-2035

- Metal-on-metal

- Metal-on-polyethylene

- Ceramic-on-polyethylene

- Ceramic-on-metal

- Ceramic-on-ceramic

- Y-o-Y Growth Trend Analysis By Material, 2020-2024

- Absolute $ Opportunity Analysis By Material, 2025-2035

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By End-User

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By End-User, 2020-2024

- Current and Future Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By End-User, 2025-2035

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Y-o-Y Growth Trend Analysis By End-User, 2020-2024

- Absolute $ Opportunity Analysis By End-User, 2025-2035

- Global Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Volume (Units) Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Volume (Units) Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- East Asia

- South Asia Pacific

- Eastern Europe

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- Latin America Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- Western Europe Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- BENELUX

- Rest of Europe

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- East Asia Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- South Asia Pacific Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN Countries

- Australia & New Zealand

- Rest of South Asia Pacific

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- Eastern Europe Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- Middle East & Africa Hip Reconstruction Devices Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Volume (Units) Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Volume (Units) Forecast By Market Taxonomy, 2025-2035

- By Country

- KSA

- Other GCC Countries

- Turkiye

- South Africa

- Rest of MEA

- By Indication

- By Product

- By Material

- By End-User

- By Country

- Market Attractiveness Analysis

- By Country

- By Indication

- By Product

- By Material

- By End-User

- Key Takeaways

- Key Countries Hip Reconstruction Devices Market Analysis

- Value (USD Bn) & Volume (Units)ed States

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- Value (USD Bn) & Volume (Units)ed Kingdom

- Pricing Analysis

- Market Share Analysis, 2024

- By Indication

- By Product

- By Material

- By End-User

- Value (USD Bn) & Volume (Units)ed States

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Indication

- By Product

- By Material

- By End-User

- Competition Analysis

- Competition Deep Dive

- B. Braun Melsungen

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Corin Group PLC

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- DePuy Synthes

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Exactech, Inc

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- MicroPort Scientific Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Smith & Nephew PLC

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Stryker Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Value (USD Bn) & Volume (Units)ed Orthopedic Corporation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Waldemar Link GmbH & Co

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Zimmer Biomet Holdings

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- B. Braun Melsungen

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 4: Global Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 6: Global Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 8: Global Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 9: Global Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 10: Global Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 12: North America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 14: North America Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 16: North America Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 17: North America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 18: North America Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 19: North America Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 20: North America Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 22: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 24: Latin America Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 25: Latin America Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 26: Latin America Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 27: Latin America Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 28: Latin America Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 29: Latin America Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 30: Latin America Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: Western Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 33: Western Europe Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 34: Western Europe Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 35: Western Europe Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 36: Western Europe Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 37: Western Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 38: Western Europe Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 39: Western Europe Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 40: Western Europe Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 41: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: East Asia Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 43: East Asia Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 44: East Asia Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 45: East Asia Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 46: East Asia Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 47: East Asia Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 48: East Asia Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 49: East Asia Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 50: East Asia Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 51: South Asia Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 52: South Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 53: South Asia Pacific Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 54: South Asia Pacific Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 55: South Asia Pacific Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 56: South Asia Pacific Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 57: South Asia Pacific Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 58: South Asia Pacific Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 59: South Asia Pacific Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 60: South Asia Pacific Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 61: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 62: Eastern Europe Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 63: Eastern Europe Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 64: Eastern Europe Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 65: Eastern Europe Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 66: Eastern Europe Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 67: Eastern Europe Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 68: Eastern Europe Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 69: Eastern Europe Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 70: Eastern Europe Market Volume (Units) Forecast by End-User, 2020 to 2035

- Table 71: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 72: Middle East & Africa Market Volume (Units) Forecast by Country, 2020 to 2035

- Table 73: Middle East & Africa Market Value (USD Bn) Forecast by Indication, 2020 to 2035

- Table 74: Middle East & Africa Market Volume (Units) Forecast by Indication, 2020 to 2035

- Table 75: Middle East & Africa Market Value (USD Bn) Forecast by Product, 2020 to 2035

- Table 76: Middle East & Africa Market Volume (Units) Forecast by Product, 2020 to 2035

- Table 77: Middle East & Africa Market Value (USD Bn) Forecast by Material, 2020 to 2035

- Table 78: Middle East & Africa Market Volume (Units) Forecast by Material, 2020 to 2035

- Table 79: Middle East & Africa Market Value (USD Bn) Forecast by End-User, 2020 to 2035

- Table 80: Middle East & Africa Market Volume (Units) Forecast by End-User, 2020 to 2035

List Of Figures

- Figure 1: Global Market Volume (Units) Forecast 2020–2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020–2035

- Figure 4: Global Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Indication,

- Figure 6: Global Market Attractiveness Analysis by Indication

- Figure 7: Global Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Product,

- Figure 9: Global Market Attractiveness Analysis by Product

- Figure 10: Global Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Material,

- Figure 12: Global Market Attractiveness Analysis by Material

- Figure 13: Global Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by End-User,

- Figure 15: Global Market Attractiveness Analysis by End-User

- Figure 16: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 17: Global Market Y-o-Y Growth Comparison by Region,

- Figure 18: Global Market Attractiveness Analysis by Region

- Figure 19: North America Market Incremental $ Opportunity,

- Figure 20: Latin America Market Incremental $ Opportunity,

- Figure 21: Western Europe Market Incremental $ Opportunity,

- Figure 22: East Asia Market Incremental $ Opportunity,

- Figure 23: South Asia Pacific Market Incremental $ Opportunity,

- Figure 24: Eastern Europe Market Incremental $ Opportunity,

- Figure 25: Middle East & Africa Market Incremental $ Opportunity,

- Figure 26: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: North America Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Indication,

- Figure 29: North America Market Attractiveness Analysis by Indication

- Figure 30: North America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Product,

- Figure 32: North America Market Attractiveness Analysis by Product

- Figure 33: North America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 34: North America Market Y-o-Y Growth Comparison by Material,

- Figure 35: North America Market Attractiveness Analysis by Material

- Figure 36: North America Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 37: North America Market Y-o-Y Growth Comparison by End-User,

- Figure 38: North America Market Attractiveness Analysis by End-User

- Figure 39: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 40: Latin America Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Indication,

- Figure 42: Latin America Market Attractiveness Analysis by Indication

- Figure 43: Latin America Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 44: Latin America Market Y-o-Y Growth Comparison by Product,

- Figure 45: Latin America Market Attractiveness Analysis by Product

- Figure 46: Latin America Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 47: Latin America Market Y-o-Y Growth Comparison by Material,

- Figure 48: Latin America Market Attractiveness Analysis by Material

- Figure 49: Latin America Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 50: Latin America Market Y-o-Y Growth Comparison by End-User,

- Figure 51: Latin America Market Attractiveness Analysis by End-User

- Figure 52: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Western Europe Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 54: Western Europe Market Y-o-Y Growth Comparison by Indication,

- Figure 55: Western Europe Market Attractiveness Analysis by Indication

- Figure 56: Western Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 57: Western Europe Market Y-o-Y Growth Comparison by Product,

- Figure 58: Western Europe Market Attractiveness Analysis by Product

- Figure 59: Western Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 60: Western Europe Market Y-o-Y Growth Comparison by Material,

- Figure 61: Western Europe Market Attractiveness Analysis by Material

- Figure 62: Western Europe Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 63: Western Europe Market Y-o-Y Growth Comparison by End-User,

- Figure 64: Western Europe Market Attractiveness Analysis by End-User

- Figure 65: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 66: East Asia Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 67: East Asia Market Y-o-Y Growth Comparison by Indication,

- Figure 68: East Asia Market Attractiveness Analysis by Indication

- Figure 69: East Asia Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 70: East Asia Market Y-o-Y Growth Comparison by Product,

- Figure 71: East Asia Market Attractiveness Analysis by Product

- Figure 72: East Asia Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 73: East Asia Market Y-o-Y Growth Comparison by Material,

- Figure 74: East Asia Market Attractiveness Analysis by Material

- Figure 75: East Asia Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 76: East Asia Market Y-o-Y Growth Comparison by End-User,

- Figure 77: East Asia Market Attractiveness Analysis by End-User

- Figure 78: South Asia Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 79: South Asia Pacific Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 80: South Asia Pacific Market Y-o-Y Growth Comparison by Indication,

- Figure 81: South Asia Pacific Market Attractiveness Analysis by Indication

- Figure 82: South Asia Pacific Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 83: South Asia Pacific Market Y-o-Y Growth Comparison by Product,

- Figure 84: South Asia Pacific Market Attractiveness Analysis by Product

- Figure 85: South Asia Pacific Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 86: South Asia Pacific Market Y-o-Y Growth Comparison by Material,

- Figure 87: South Asia Pacific Market Attractiveness Analysis by Material

- Figure 88: South Asia Pacific Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 89: South Asia Pacific Market Y-o-Y Growth Comparison by End-User,

- Figure 90: South Asia Pacific Market Attractiveness Analysis by End-User

- Figure 91: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 92: Eastern Europe Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 93: Eastern Europe Market Y-o-Y Growth Comparison by Indication,

- Figure 94: Eastern Europe Market Attractiveness Analysis by Indication

- Figure 95: Eastern Europe Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 96: Eastern Europe Market Y-o-Y Growth Comparison by Product,

- Figure 97: Eastern Europe Market Attractiveness Analysis by Product

- Figure 98: Eastern Europe Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 99: Eastern Europe Market Y-o-Y Growth Comparison by Material,

- Figure 100: Eastern Europe Market Attractiveness Analysis by Material

- Figure 101: Eastern Europe Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 102: Eastern Europe Market Y-o-Y Growth Comparison by End-User,

- Figure 103: Eastern Europe Market Attractiveness Analysis by End-User

- Figure 104: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 105: Middle East & Africa Market Value Share and BPS Analysis by Indication, 2025 and 2035

- Figure 106: Middle East & Africa Market Y-o-Y Growth Comparison by Indication,

- Figure 107: Middle East & Africa Market Attractiveness Analysis by Indication

- Figure 108: Middle East & Africa Market Value Share and BPS Analysis by Product, 2025 and 2035

- Figure 109: Middle East & Africa Market Y-o-Y Growth Comparison by Product,

- Figure 110: Middle East & Africa Market Attractiveness Analysis by Product

- Figure 111: Middle East & Africa Market Value Share and BPS Analysis by Material, 2025 and 2035

- Figure 112: Middle East & Africa Market Y-o-Y Growth Comparison by Material,

- Figure 113: Middle East & Africa Market Attractiveness Analysis by Material

- Figure 114: Middle East & Africa Market Value Share and BPS Analysis by End-User, 2025 and 2035

- Figure 115: Middle East & Africa Market Y-o-Y Growth Comparison by End-User,

- Figure 116: Middle East & Africa Market Attractiveness Analysis by End-User

- Figure 117: Global Market – Tier Structure Analysis

- Figure 118: Global Market – Company Share Analysis

- FAQs -

What is the Global Hip Reconstruction Devices Market size in 2025?

The hip reconstruction devices market is valued at USD 8.8 billion in 2025.

Who are the Major Players Operating in the Hip Reconstruction Devices Market?

Prominent players in the market include Smith & Nephew PLC, Stryker Corporation, United Orthopedic Corporation, Waldemar Link GmbH & Co. KG, and Zimmer Biomet Holdings Inc.

What is the Estimated Valuation of the Hip Reconstruction Devices Market by 2035?

The market is expected to reach a valuation of USD 13.0 billion by 2035.

At what CAGR is the Hip Reconstruction Devices Market slated to grow during the study period?

The growth rate of the Hip Reconstruction Devices market is 4.0% from 2025-2035.