Hydrant Dispensers Market

Hydrant Dispensers Market Size and Share Forecast Outlook 2025 to 2035

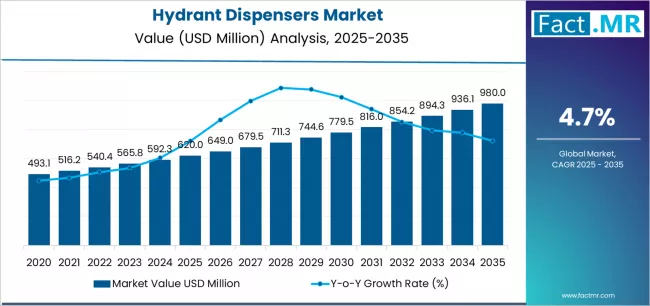

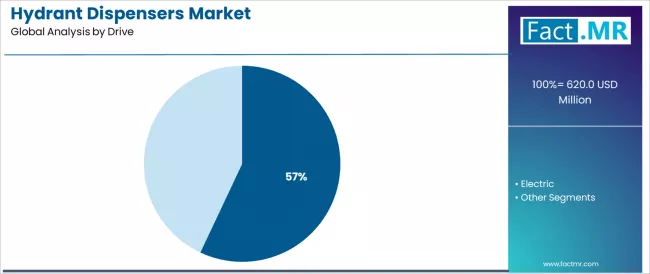

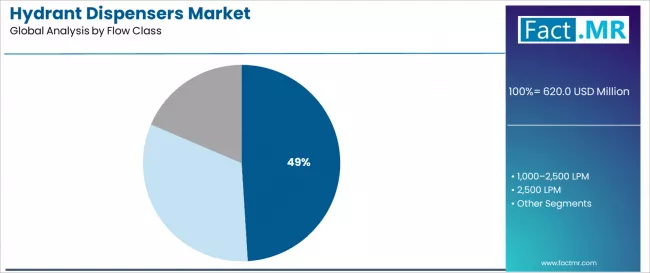

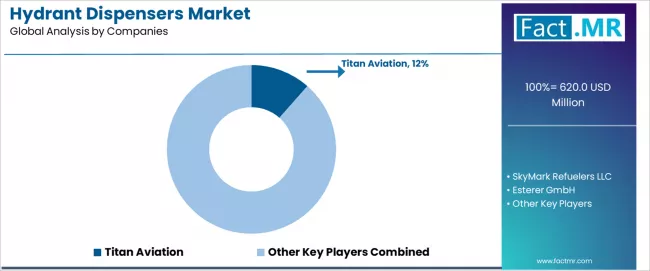

Hydrant dispensers market is projected to grow from USD 620.0 million in 2025 to USD 980.0 million by 2035, at a CAGR of 4.7%. Diesel will dominate with a 57.0% market share, while ≤1,000 lpm will lead the flow class segment with a 49.0% share.

Hydrant Dispensers Market Forecast and Outlook 2025 to 2035

The global hydrant dispensers market is valued at USD 620.0 million in 2025. It is slated to reach USD 980.0 million by 2035, recording an absolute increase of USD 360.0 million over the forecast period. This translates into a total growth of 58.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.7% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.58X during the same period, supported by increasing demand for efficient fuel handling systems, growing aviation fuel infrastructure development, and rising emphasis on advanced fuel management solutions across diverse airports, fuel farms, and military installations.

Quick Stats for Hydrant Dispensers Market

- Hydrant Dispensers Market Value (2025): USD 620.0 million

- Hydrant Dispensers Market Forecast Value (2035): USD 980.0 million

- Hydrant Dispensers Market Forecast CAGR: 4.7%

- Leading Drive Type in Hydrant Dispensers Market: Diesel

- Key Growth Regions in Hydrant Dispensers Market: North America, Europe, and Asia Pacific

- Key Players in Hydrant Dispensers Market: Titan Aviation, SkyMark Refuelers, Esterer, Garsite, Westmor, Weihai Guangtai

The hydrant dispensers market is poised for steady expansion as global air traffic continues to surge, driving the need for advanced and efficient aircraft refueling systems. Airports worldwide are focusing on minimizing turnaround times and improving ground handling efficiency, which has directly boosted the adoption of hydrant dispensers. These systems offer faster fueling, reduced manual intervention, and enhanced safety compared to conventional fuel trucks, making them a preferred choice for major commercial and defense airports alike. The ongoing modernization of airport fueling infrastructure, particularly in emerging economies such as India, China, and Indonesia, is expected to significantly contribute to market growth over the next decade.

Moreover, the push toward sustainability in the aviation sector is reshaping the technological landscape of hydrant dispenser systems. Manufacturers are developing next-generation dispensers with improved energy efficiency, integrated flow monitoring, and digital pressure management systems to minimize fuel losses and environmental risks. The integration of automation and IoT technologies allows for real-time diagnostics, predictive maintenance, and centralized control, helping operators ensure compliance with stringent aviation fuel safety standards. Such innovations are driving the transition from conventional mechanical systems to intelligent, semi-automated fuel dispensing units that enhance both operational precision and safety.

Regional market trends further highlight the concentration of demand in key aviation hubs. North America and Europe collectively account for a dominant share, driven by large-scale airport expansions, upgrades to existing fueling networks, and early adoption of automated refueling technologies. Meanwhile, Asia-Pacific is projected to exhibit the fastest growth rate during the forecast period, fueled by rapid air travel growth, the construction of new airports, and government investments in air logistics infrastructure. The Middle East is also emerging as a lucrative market, supported by the presence of major international carriers and continuous infrastructure investment in countries such as the UAE, Qatar, and Saudi Arabia.

Leading market players are increasingly focusing on strategic collaborations, mergers, and long-term contracts with airport authorities and fuel management service providers to strengthen their global footprint. Companies are also emphasizing aftersales services, component standardization, and modular design upgrades to ensure system reliability and ease of maintenance. As aviation traffic continues to recover and expand post-pandemic, the global hydrant dispensers market is set to witness steady technological evolution, underpinned by efficiency, safety, and environmental sustainability as its core growth pillars.

Between 2025 and 2030, the hydrant dispensers market is projected to expand from USD 620.0 million to USD 785.0 million, resulting in a value increase of USD 165.0 million, which represents 45.8% of the total forecast growth for the decade.

This phase of development will be shaped by increasing airport modernization and fuel infrastructure upgrades, rising adoption of advanced fuel handling technologies, and growing demand for efficient fuel dispensing solutions in aviation and fuel management applications.

Fuel handling equipment manufacturers and aviation service providers are expanding their hydrant dispenser capabilities to address the growing demand for reliable and efficient fuel management solutions that ensure operational excellence and fuel safety optimization.

Hydrant Dispensers Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 620.0 million |

| Forecast Value in (2035F) | USD 980.0 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

From 2030 to 2035, the market is forecast to grow from USD 785.0 million to USD 980.0 million, adding another USD 195.0 million, which constitutes 54.2% of the overall ten-year expansion.

This period is expected to be characterized by the expansion of automated fuel management systems and digital monitoring technologies, the development of next-generation fuel dispensing technologies, and the growth of specialized applications in sustainable aviation fuel handling and precision fuel management.

The growing adoption of environmental compliance practices and fuel efficiency strategies will drive demand for hydrant dispensers with enhanced precision and eco-friendly operational capabilities.

Between 2020 and 2025, the hydrant dispensers market experienced steady growth from USD 440.0 million to USD 620.0 million, driven by increasing aviation fuel demand and growing recognition of advanced fuel handling equipment as essential infrastructure for enhancing fuel operations and providing comprehensive aviation fuel support in diverse airport and fuel facility applications.

The market developed as aviation operators and fuel management professionals recognized the potential for advanced fuel dispensing technology to enhance operational efficiency, improve fuel handling reliability, and support sustainable fuel management objectives while meeting aviation safety requirements.

Technological advancement in flow control systems and automated dispensing began emphasizing the critical importance of maintaining operational effectiveness and safety standards in challenging fuel handling environments.

Why is the Hydrant Dispensers Market Growing?

Market expansion is being supported by the increasing global aviation fuel consumption and airport infrastructure development driven by air traffic growth and modernization initiatives, alongside the corresponding demand for advanced fuel handling equipment that can enhance operational efficiency, enable rapid fuel dispensing, and maintain safety standards across various airports, fuel farms, military installations, and aviation service centers.

Modern aviation operators and fuel management providers are increasingly focused on implementing hydrant dispenser solutions that can improve fuel handling reliability, enhance operational efficiency, and provide consistent performance in demanding fuel management conditions.

The growing emphasis on fuel efficiency and environmental compliance is driving demand for hydrant dispensers that can support emission reduction initiatives, enable efficient fuel operations, and ensure comprehensive operational effectiveness.

Aviation fuel industry manufacturers' preference for integrated fuel management platforms that combine operational excellence with environmental sustainability and workflow efficiency is creating opportunities for innovative hydrant dispenser implementations.

The rising influence of cost optimization and operational efficiency metrics is also contributing to increased adoption of hydrant dispensers that can provide superior performance outcomes without compromising operational reliability or environmental compliance.

Segmental Analysis

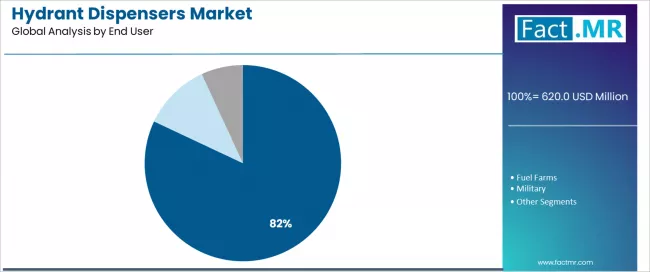

The market is segmented by drive, flow class, and end user. By drive, the market is divided into diesel and electric. Based on flow class, the market is categorized into ≤1,000 LPM, 1,000–2,500 LPM, and >2,500 LPM. By end user, the market is split between airports, fuel farms, and military.

By Drive, the Diesel Segment Leads the Market

Diesel drives are projected to maintain its leading position in the hydrant dispensers market in 2025 with a 57.0% market share, reaffirming its role as the preferred technology for reliable fuel dispensing and comprehensive fuel management operations.

Aviation operators and fuel management professionals increasingly utilize diesel-powered hydrant dispensers for their superior power output capabilities, excellent operational reliability, and proven performance in fuel dispensing across various flow requirements while maintaining operational efficiency and safety standards.

Diesel’s proven effectiveness and operational versatility directly address the fuel management requirements for consistent power delivery and reliable operational outcomes across diverse fuel handling applications and operational settings.

The diesel drive segment forms the foundation of modern fuel management operations, as it represents the technology with the greatest contribution to reliable fuel dispensing and established operational record across multiple aviation fuel applications and operational protocols. Aviation fuel industry investments in advanced fuel handling technologies continue to strengthen adoption among operators and service providers.

With increasing demand for reliable operational solutions and proven performance capabilities, diesel-powered hydrant dispensers align with both operational objectives and safety requirements, making them the central component of comprehensive fuel management strategies.

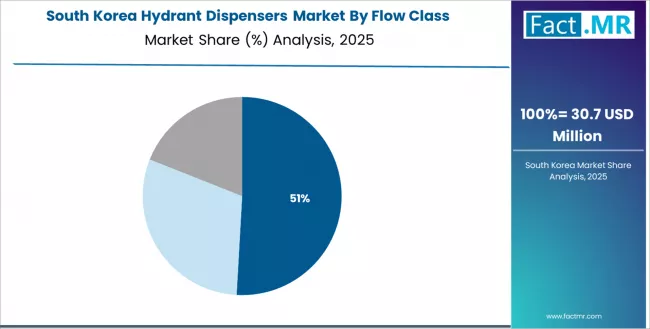

By Flow Class, the ≤1,000 LPM Segment Dominates Market Demand

The ≤1,000 LPM flow class segment is projected to represent the largest share of hydrant dispenser demand in 2025 with a 49.0% market share, underscoring its critical role as the primary configuration for fuel dispensing applications across general aviation, regional airports, and smaller fuel handling operations.

Fuel management operators prefer ≤1,000 LPM hydrant dispensers for fuel handling applications due to their exceptional operational flexibility, comprehensive flow control options, and ability to support precise fuel dispensing while maintaining operational standards and cost efficiency objectives. Positioned as essential equipment for modern fuel management services, ≤1,000 LPM hydrant dispensers offer both operational advantages and economic benefits.

The segment is supported by continuous innovation in flow control technology and the growing availability of integrated fuel management platforms that enable superior operational performance with enhanced safety and improved workflow coordination.

Additionally, fuel facilities are investing in comprehensive fuel handling programs to support increasingly demanding aviation standards and operational requirements for efficient and precise fuel dispensing.

As fuel management operational standards advance and efficiency requirements increase, the ≤1,000 LPM segment will continue to dominate the market while supporting advanced hydrant dispenser utilization and operational optimization strategies.

By End User, the Airports Segment Commands Market Leadership

The airports end user segment is projected to maintain the largest share of hydrant dispenser applications in 2025 with an 82.0% market share, highlighting its fundamental role in aviation fuel operations, operational efficiency, and fuel management optimization. Aviation operators prefer airport applications for their comprehensive operational benefits, extensive fuel handling requirements, and proven effectiveness in supporting various aircraft fueling needs with superior reliability profiles and consistent operational outcomes. This segment represents the backbone of hydrant dispenser demand across multiple aviation fuel settings and fuel management protocols.

The airports segment benefits from ongoing technological advancement in fuel handling methods and the expanding adoption of efficiency-focused operations in critical aviation fuel applications. Airport demand continues to grow due to increasing air traffic volumes, rising operational efficiency requirements, and the need for fuel handling equipment that can support rapid aircraft refueling while maintaining operational effectiveness. As aviation fuel operations become more efficiency-focused and performance requirements increase, the airports segment will continue to drive market growth while supporting advanced hydrant dispenser adoption and fuel management optimization strategies.

What are the Drivers, Restraints, and Key Trends of the Hydrant Dispensers Market?

The hydrant dispensers market is advancing steadily due to increasing aviation fuel consumption and airport infrastructure development driven by air traffic growth and modernization programs, growing adoption of efficient fuel handling technologies that require advanced equipment providing enhanced operational reliability and safety across diverse airports, fuel farms, military installations, and aviation fuel centers.

However, the market faces challenges, including high equipment costs and maintenance requirements, complex regulatory compliance for aviation fuel handling equipment, and competition from alternative fuel dispensing methods and integrated fuel systems. Innovation in electric propulsion and automated fuel management continues to influence product development and market expansion patterns.

Expansion of Electric and Automated Fuel Technologies

The growing adoption of sustainable fuel handling approaches is driving demand for advanced fuel dispensing equipment that address environmental compliance requirements including reduced emissions, improved energy efficiency, and enhanced operational sustainability in airport and fuel facility settings.

Electric and automated applications require advanced hydrant dispensers that deliver superior environmental performance across multiple operational parameters while maintaining reliability and operational effectiveness.

Aviation fuel operators are increasingly recognizing the competitive advantages of sustainable fuel handling equipment integration for environmental compliance and operational efficiency, creating opportunities for innovative technologies specifically designed for next-generation sustainable fuel operations.

Integration of Digital Monitoring and Smart Fuel Systems

Modern aviation fuel operators are incorporating digital fuel management systems and smart monitoring technologies to enhance operational precision, address complex fuel handling requirements, and support comprehensive operational objectives through optimized workflows and intelligent fuel management guidance.

Leading companies are developing automated platforms, implementing digital monitoring systems, and advancing smart fuel dispensing equipment that maximize operational effectiveness while supporting predictive maintenance approaches.

These technologies improve operational outcomes while enabling new market opportunities, including automated fuel handling applications, digital monitoring systems, and precision aviation fuel dispensing.

Development of Next-Generation Flow Control and Precision Technologies

The expansion of advanced flow control systems, precision dispensing technologies, and intelligent fuel management capabilities is driving demand for hydrant dispensers with enhanced flow accuracy and specialized operational capabilities.

These advanced applications require specialized equipment platforms with precise flow control and exceptional operational reliability that exceed traditional fuel handling requirements, creating premium market segments with differentiated operational propositions.

Manufacturers are investing in advanced flow control capabilities and precision system development to serve emerging aviation fuel applications while supporting innovation in advanced fuel dispensing equipment and sustainable aviation fuel sectors.

Analysis of the Hydrant Dispensers Market by Key Countries

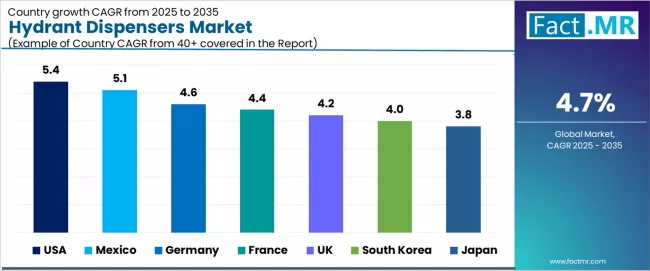

| Country | CAGR (2025-2035) |

|---|---|

| USA | 5.4% |

| Mexico | 5.1% |

| Germany | 4.6% |

| France | 4.4% |

| UK | 4.2% |

| South Korea | 4.0% |

| Japan | 3.8% |

The hydrant dispensers market is experiencing solid growth globally, with the USA leading at a 5.4% CAGR through 2035, driven by expanding aviation fuel infrastructure and growing fuel handling volumes, alongside increasing investment in advanced fuel dispensing technologies and operational efficiency initiatives.

Mexico follows at 5.1%, supported by aviation fuel modernization programs, expanding airport infrastructure, and increasing demand for advanced fuel handling equipment in domestic and regional markets.

Germany shows growth at 4.6%, emphasizing fuel technology innovation, operational excellence, and advanced fuel handling development. France demonstrates 4.4% growth, supported by aviation fuel system advancement and fuel handling technology adoption.

The UK records 4.2%, focusing on fuel innovation and fuel handling technology development. South Korea exhibits 4.0% growth, emphasizing fuel modernization and fuel handling applications. Japan shows 3.8% growth, emphasizing quality standards and specialized fuel handling applications.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

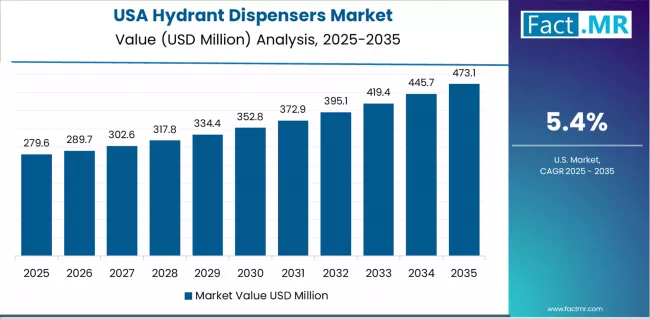

USA Leads Global Market Growth with Aviation Fuel Infrastructure and Technology Advancement

Revenue from hydrant dispensers in the USA is projected to exhibit strong growth with a CAGR of 5.4% through 2035, driven by expanding aviation fuel infrastructure and rapidly growing fuel handling equipment sector supported by increasing fuel consumption and advanced fuel technology adoption.

The country's substantial aviation fuel system and increasing investment in fuel handling technologies are creating substantial demand for hydrant dispenser solutions. Major fuel handling equipment manufacturers and aviation service providers are establishing comprehensive hydrant dispenser capabilities to serve both domestic markets and export opportunities.

- Strong aviation fuel expansion and growing fuel handling volumes are driving demand for hydrant dispensers throughout major aviation fuel regions including California, Texas, and the Northeast fuel corridors, supporting both commercial airports and military fuel facilities.

- Growing fuel infrastructure modernization and operational efficiency initiatives are supporting the rapid adoption of hydrant dispenser technologies among fuel operators seeking enhanced operational capabilities and fuel handling excellence in competitive aviation fuel markets.

Mexico Demonstrates Aviation Fuel Integration with Infrastructure Development

Revenue from hydrant dispensers in Mexico is expanding at a CAGR of 5.1%, supported by aviation fuel modernization initiatives, growing fuel infrastructure, and strategic position as an aviation fuel hub for Latin American markets.

Mexico's fuel development and fuel handling technology advancement are driving sophisticated hydrant dispenser capabilities throughout aviation fuel sectors. Leading fuel operators and fuel handling companies are establishing extensive operational facilities to address growing domestic aviation fuel and regional market demand.

- Aviation fuel modernization and expanding fuel infrastructure are creating opportunities for hydrant dispenser adoption across airports, fuel farms, and fuel service centers in major fuel regions including Mexico City and fuel development zones.

- Growing fuel sector and fuel handling technology expansion are supporting the adoption of advanced fuel technologies among operators seeking to serve both domestic and international markets while maintaining fuel standards and operational effectiveness.

Germany Demonstrates Fuel Technology Excellence with Fuel Handling Innovation

Revenue from hydrant dispensers in Germany is expanding at a CAGR of 4.6%, driven by the country's fuel technology leadership, fuel handling innovation capabilities, and precision manufacturing excellence supporting high-performance hydrant dispenser applications.

Germany's fuel expertise and fuel handling technology innovation are driving demand for specialized hydrant dispenser solutions throughout fuel sectors. Leading fuel handling manufacturers and fuel operators are establishing comprehensive innovation programs for next-generation fuel technologies.

- Advanced fuel technology development and fuel handling innovation requirements are creating demand for specialized hydrant dispensers among fuel operators and fuel handling companies seeking enhanced operational performance and reliability in competitive European markets.

- Strong fuel industry expertise and fuel handling technology leadership are supporting the adoption of advanced hydrant dispenser technologies and operational optimization across fuel facilities throughout major fuel regions including Bavaria and North Rhine-Westphalia.

France Shows Fuel Excellence and Fuel Handling Technology Innovation Leadership

Revenue from hydrant dispensers in France is expanding at a CAGR of 4.4%, supported by the country's fuel system excellence, fuel handling technology innovation leadership, and pioneering fuel advancement initiatives including sustainable operations and precision fuel handling development.

France's fuel heritage and fuel handling expertise are supporting investment in advanced hydrant dispenser technologies. Major fuel operators and fuel handling technology companies are establishing comprehensive operational programs incorporating hydrant dispenser advancement and fuel innovation.

- Advanced fuel innovation and fuel handling technology capabilities are creating demand for premium hydrant dispenser products supporting operational excellence, fuel advancement, and fuel handling optimization throughout major fuel and technology regions.

- Strong fuel focus and fuel handling technology leadership are driving the adoption of advanced fuel technologies and operational enhancement throughout fuel facilities across fuel excellence clusters and innovation zones.

UK Focuses on Fuel Innovation and Fuel Handling Technology Development

Revenue from hydrant dispensers in the UK is growing at a CAGR of 4.2%, driven by the country's fuel innovation, fuel handling technology development initiatives, and emphasis on advanced fuel solutions for commercial and military applications.

The UK's fuel research excellence and operational commitments are supporting investment in advanced hydrant dispenser technologies. Major fuel operators and fuel handling technology companies are establishing comprehensive operational programs incorporating advanced hydrant dispenser configurations.

- Fuel innovation and fuel handling development requirements are creating demand for high-performance hydrant dispensers supporting fuel advancement, operational innovation, and fuel handling optimization throughout major fuel and technology regions.

- Strong research capabilities and fuel mandates are driving the adoption of advanced fuel handling technologies and operational enhancement supporting superior fuel performance and operational leadership in competitive global markets.

South Korea Demonstrates Fuel Leadership with Fuel Handling Technology Focus

Revenue from hydrant dispensers in South Korea is expanding at a CAGR of 4.0%, supported by the country's fuel modernization, fuel handling technology expertise, and strong emphasis on advanced fuel solutions for comprehensive commercial and military applications.

South Korea's fuel sophistication and operational innovation focus are driving sophisticated hydrant dispenser capabilities throughout fuel sectors. Leading fuel operators and fuel handling technology companies are investing extensively in advanced fuel technologies.

- Advanced fuel development and fuel handling technology innovation are creating demand for specialized hydrant dispenser products throughout fuel applications, fuel systems, and operational facilities in major fuel regions including Seoul Capital Area and fuel innovation zones.

- Strong fuel industry and operational expertise are supporting the adoption of innovative fuel handling technologies and operational optimization for next-generation applications requiring superior operational performance and fuel excellence.

Japan Shows Quality Excellence Focus with Specialized Fuel Applications

Revenue from hydrant dispensers in Japan is expanding at a CAGR of 3.8%, supported by the country's quality excellence standards, specialized fuel capabilities, and strong emphasis on high-specification fuel handling technologies for advanced commercial and military fuel sectors.

Japan's quality sophistication and fuel excellence are driving demand for premium hydrant dispenser products. Leading fuel operators and fuel handling technology companies are investing in specialized capabilities for advanced fuel applications.

- Advanced fuel processing and quality manufacturing requirements are creating opportunities for high-quality hydrant dispenser products throughout specialized fuel production, fuel handling manufacturing, and operational applications meeting stringent quality and performance standards.

- Strong fuel industry and operational sector are driving adoption of specialized hydrant dispenser devices and advanced fuel handling technologies supporting innovation in fuel operations, operational advancement, and fuel sectors requiring superior operational performance and consistency.

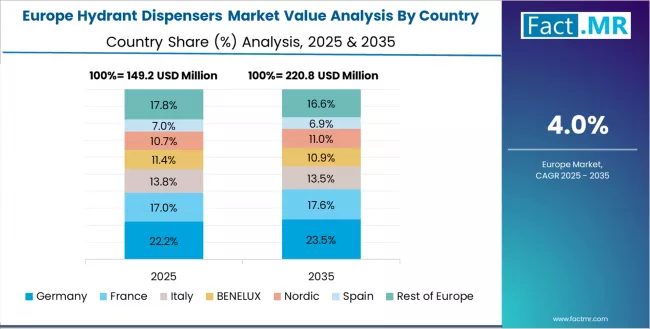

Europe Market Split by Country

The hydrant dispensers market in Europe is projected to grow from USD 186.0 million in 2025 to USD 294.0 million by 2035, registering a CAGR of 4.7% over the forecast period. Germany is expected to maintain its leadership position with a 26.4% market share in 2025, declining slightly to 26.0% by 2035, supported by its advanced fuel technology industry and fuel handling innovation capabilities.

France follows with a 21.0% share in 2025, projected to reach 21.3% by 2035, driven by comprehensive fuel development and fuel handling technology applications. The United Kingdom holds a 19.1% share in 2025, expected to decrease to 18.8% by 2035 due to market diversification. Italy commands a 13.4% share, while Spain accounts for 10.0% in 2025.

The rest of Europe is anticipated to gain momentum, expanding its collective share from 10.1% to 10.6% by 2035, attributed to increasing fuel handling technology adoption in Nordic countries and emerging Eastern European fuel systems implementing advanced operational technologies.

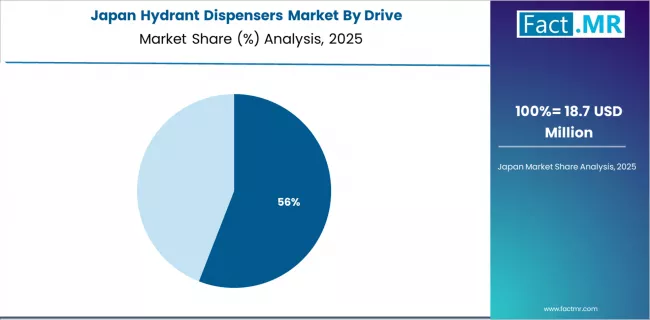

Diesel Applications Dominate Fuel Operations in Japan

The Japanese hydrant dispensers market demonstrates a mature and precision-focused landscape, characterized by advanced integration of diesel technologies with existing fuel infrastructure across fuel facilities, fuel handling networks, and operational systems.

Japan's emphasis on quality excellence and operational precision drives demand for high-reliability hydrant dispenser solutions that support comprehensive fuel initiatives and regulatory requirements in fuel handling operations.

The market benefits from strong partnerships between international fuel handling providers like Titan Aviation, SkyMark Refuelers, and domestic fuel leaders, including established fuel operators and fuel companies, creating comprehensive service ecosystems that prioritize operational quality and fuel precision programs.

Fuel centers in major operational regions showcase advanced hydrant dispenser implementations where fuel handling systems achieve operational improvements through integrated fuel programs.

Airport Applications Lead Fuel Services in South Korea

The South Korean hydrant dispensers market is characterized by strong international airport application presence, with companies like Esterer, Garsite, and Westmor maintaining dominant positions through comprehensive system integration and operational services capabilities for fuel modernization and fuel handling applications.

The market is demonstrating a growing emphasis on localized operational support and rapid deployment capabilities, as Korean fuel operators increasingly demand customized solutions that integrate with domestic fuel infrastructure and advanced fuel handling systems deployed across major fuel centers and operational facilities.

Local fuel companies and regional fuel handling integrators are gaining market share through strategic partnerships with global providers, offering specialized services including operational training programs and certification services for fuel specialists.

The competitive landscape shows increasing collaboration between multinational fuel handling companies and Korean fuel specialists, creating hybrid service models that combine international fuel expertise with local market knowledge and operational relationship management.

Competitive Landscape of the Hydrant Dispensers Market

The hydrant dispensers market is characterized by competition among established fuel handling equipment manufacturers, specialized aviation fuel equipment producers, and diversified fuel technology companies.

Companies are investing in advanced fuel handling technology development, sustainable innovation, product portfolio expansion, and application-specific equipment development to deliver high-performance, operationally reliable, and environmentally efficient hydrant dispenser solutions.

Innovation in electric propulsion advancement, automated systems integration, and digital monitoring technologies is central to strengthening market position and competitive advantage.

Titan Aviation leads the market with an 11.5% share, offering comprehensive hydrant dispenser solutions with a focus on operational reliability, advanced flow control systems, and integrated fuel handling platforms across diverse airport and fuel facility distribution channels.

The company has announced major technology advancement initiatives and investments in sustainable fuel technologies to support growing global demand for advanced fuel handling equipment and efficient operational solutions.

Other key players including SkyMark Refuelers provide innovative fuel handling solutions with emphasis on operational excellence and reliability technologies, while Esterer delivers specialized fuel equipment with focus on efficient operations and operational applications.

Garsite offers comprehensive fuel handling solutions with hydrant dispenser offerings for multiple operational categories, and Westmor provides advanced fuel technologies with emphasis on automated systems and operational optimization.

Weihai Guangtai, Textron GSE, ShinMaywa, Rampmaster, and Flightline Support contribute to market competition through specialized fuel handling capabilities and fuel equipment expertise.

Hydrant Dispensers Market - Stakeholder Contribution Framework

Hydrant dispensers represent a specialized fuel handling equipment segment within aviation and fuel management applications, projected to grow from USD 620.0 million in 2025 to USD 980.0 million by 2035 at a 4.7% CAGR.

These fuel handling equipment products, primarily diesel and electric configurations for multiple applications, serve as critical operational tools in airports, fuel farms, military installations, and fuel service centers where operational reliability, safety, and efficiency are essential.

Market expansion is driven by increasing aviation fuel consumption, growing fuel handling equipment adoption, expanding fuel infrastructure modernization, and rising demand for advanced fuel solutions across diverse commercial, military, fuel storage, and fuel service sectors.

How Aviation Fuel Regulators Could Strengthen Fuel Handling Equipment Standards and Safety?

- Fuel Handling Equipment Standards: Establish comprehensive technical specifications for hydrant dispensers, including safety requirements, performance standards, operational validation protocols, and quality guidelines that ensure consistent performance across airports, fuel farms, military installations, and fuel service centers.

- Fuel Safety Integration: Develop regulatory frameworks that incentivize advanced fuel technology practices, requiring manufacturers to implement quality management systems, utilize operational validation protocols, incorporate safety procedures, and achieve measurable safety improvements in hydrant dispenser development.

- Quality Assurance Requirements: Implement mandatory quality control standards for hydrant dispenser manufacturing, including operational testing protocols, safety verification measures, and performance validation systems that ensure equipment effectiveness and operational safety across diverse fuel handling applications.

- Aviation Fuel Grade Guidelines: Create specialized regulations for aviation-grade hydrant dispensers used in complex operations, addressing stringent safety specifications, operational requirements, and regulatory validation specific to fuel handling applications requiring enhanced reliability and safety protection.

- Innovation Support Programs: Provide regulatory facilitation and research incentives for development of next-generation fuel handling technologies that improve operational outcomes, enhance safety, and enable emerging applications in sustainable fuel handling and precision operations.

How Industry Associations Could Advance Fuel Handling Technology Standards and Market Development?

- Fuel Handling Best Practices: Develop comprehensive technical guidelines for hydrant dispenser selection, operational optimization, and performance validation techniques that maximize operational effectiveness, ensure safety, and maintain cost-effectiveness across airports, fuel farms, and fuel handling applications.

- Safety Benchmarking: Establish industry-wide metrics for operational performance, including efficiency assessment, safety measurement, operational outcome evaluation, and fuel application documentation that enable comparative analysis and drive continuous improvement toward operational optimization objectives.

- Professional Training Programs: Create specialized education initiatives for fuel technicians, fuel handling operators, and fuel professionals covering hydrant dispenser characteristics, operational applications, safety requirements, and technical procedures across diverse fuel handling applications.

- Operational Standardization: Develop standardized testing methodologies for hydrant dispenser evaluation, including performance assessment, safety analysis, operational validation, and application-specific performance metrics that facilitate objective equipment comparison and operational validation.

- Fuel Industry Collaboration: Facilitate partnerships between hydrant dispenser suppliers, fuel operators, research institutions, and industry organizations to advance fuel handling technology development, address emerging operational challenges, and accelerate innovation in aviation fuel handling applications.

How Hydrant Dispenser Manufacturers Could Drive Innovation and Market Leadership?

- Advanced Fuel Handling Technologies: Invest in flow control enhancement, automated operation integration, operational optimization, and safety improvement initiatives that enhance operational effectiveness while maintaining reliability and regulatory compliance in global markets.

- Specialized Equipment Development: Develop specialized hydrant dispensers with enhanced operational characteristics, including optimized flow control, improved operational efficiency, increased reliability, and application-specific performance attributes for emerging fuel handling segments.

- Operational Quality Integration: Implement intelligent quality control systems with real-time performance monitoring, predictive maintenance assessment, automated efficiency verification, and data analytics that optimize equipment performance, ensure operational reliability, and reduce operational complexity.

- Operational Support Services: Establish comprehensive customer service capabilities providing technical consultation, training assistance, operational troubleshooting, and fuel expertise that strengthen customer relationships and enable successful fuel handling implementation.

- Global Fuel Excellence: Develop regional service networks, specialized operational support management, reliable technical support systems, and responsive customer service that ensure consistent equipment availability, maintain operational quality, and support customer fuel requirements worldwide.

How End-User Industries Could Optimize Operational Performance and Fuel Success?

- Strategic Equipment Selection: Conduct comprehensive assessments of operational requirements, fuel needs, regulatory constraints, and operational considerations to optimize hydrant dispenser selection and achieve desired operational characteristics while managing total fuel costs and operational outcomes.

- Operational Workflow Optimization: Implement advanced operational methodologies utilizing performance validation, outcome evaluation, and systematic performance assessment to maximize hydrant dispenser operational benefits, minimize operational complexity, and optimize overall fuel effectiveness and operational satisfaction.

- Safety Management: Develop optimized operational protocols, safety control procedures, and outcome validation that ensure effective hydrant dispenser utilization, maximize operational benefits, and maintain consistent operational performance throughout fuel operations.

- Quality Operations Integration: Incorporate operational best practices, safety principles, and fuel quality considerations into operational planning and fuel handling processes that support comprehensive fuel objectives and operational excellence.

- Strategic Fuel Partnerships: Establish strategic partnerships with hydrant dispenser suppliers for joint operational programs, performance optimization initiatives, and co-innovation projects that address specific fuel challenges and accelerate fuel handling technology commercialization.

How Research Institutions Could Enable Fuel Handling Technology Advancement?

- Fuel Research Programs: Conduct fundamental investigations into hydrant dispenser technology, operational mechanisms, performance optimization, and fuel applications that advance fuel understanding and enable breakthrough innovations in fuel handling technology and fuel science.

- Fuel Handling Technology Development: Develop novel operational methods, including advanced operational techniques, automated approaches, and performance enhancement technologies that improve operational performance while maintaining safety and cost effectiveness.

- Fuel Application Innovation: Investigate emerging applications for hydrant dispensers in precision operations, automated procedures, sustainable fuel handling, and specialized operational applications that create new market opportunities and expand fuel potential.

- Operational Validation Services: Provide advanced operational research services utilizing performance validation, operational testing, fuel assessment, and operational evaluation methodologies that enable detailed understanding of hydrant dispenser properties and fuel applications.

- Fuel Technology Transfer: Facilitate technology commercialization through licensing agreements, startup incubation programs, operational publications, and collaborative research projects that accelerate fuel handling technology innovation adoption and strengthen industry-academia partnerships.

How Investors and Financial Enablers Could Support Fuel Handling Technology Market Growth?

- Fuel Infrastructure Investment: Provide capital for hydrant dispenser manufacturing facility construction, production capacity expansion, and technology upgrade projects that address growing fuel demand while improving operational efficiency and performance.

- Fuel Handling Innovation Financing: Fund research and development of breakthrough hydrant dispenser technologies, including advanced operational methods, automated systems, and novel fuel applications that address current market limitations and create competitive advantages.

- Operational Development Support: Finance fuel handling technology innovation initiatives, operational validation programs, regulatory development, and fuel advancement that enhance operational capabilities and position manufacturers for long-term market acceptance and growth.

- Fuel Market Expansion: Support strategic acquisitions, market entry initiatives, distribution network development, and customer operational service capabilities that accelerate geographic expansion and strengthen competitive positions in high-growth fuel markets.

- Global Fuel Development: Provide financing and technical assistance for hydrant dispenser facilities in developing economies, creating new fuel handling technology supply capabilities, supporting local fuel development, and expanding global market access for fuel solutions.

Key Players in the Hydrant Dispensers Market

- Titan Aviation

- SkyMark Refuelers LLC

- Esterer GmbH

- Garsite LLC

- Westmor Industries LLC

- Weihai Guangtai Airport Equipment Co., Ltd.

- Textron GSE (Textron Inc.)

- ShinMaywa Industries Ltd.

- Rampmaster, Inc.

- Flightline Support Ltd.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 620.0 Million |

| Drive | Diesel, Electric |

| Flow Class | ≤1,000 LPM, 1,000–2,500 LPM, >2,500 LPM |

| End User | Airports, Fuel farms, Military |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, France, UK, Japan, South Korea, Mexico, and 40+ countries |

| Key Companies Profiled | Titan Aviation, SkyMark Refuelers, Esterer, Garsite, Westmor, Weihai Guangtai |

| Additional Attributes | Dollar sales by drive and end user category, regional demand trends, competitive landscape, technological advancements in fuel handling production, operational development, fuel innovation, and operational performance optimization |

Hydrant Dispensers Market by Segments

-

Drive :

- Diesel

- Electric

-

Flow Class :

- ≤1,000 LPM

- 1,000–2,500 LPM

- 2,500 LPM

-

End User :

- Airports

- Fuel Farms

- Military

-

Region :

-

North America

- United States

- Canada

- Mexico

-

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Netherlands

- Nordic

- BENELUX

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Taiwan

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Argentina

- Chile

- Rest of Latin America

-

Middle East & Africa

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkey

- South Africa

- Other African Union

- Rest of Middle East & Africa

-

Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

-

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Drive

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Drive , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Drive , 2025 to 2035

- Diesel

- Electric

- Y to o to Y Growth Trend Analysis By Drive , 2020 to 2024

- Absolute $ Opportunity Analysis By Drive , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Flow Class

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Flow Class, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Flow Class, 2025 to 2035

- ≤1,000 LPM

- 1,000–2,500 LPM

- 2,500 LPM

- Y to o to Y Growth Trend Analysis By Flow Class, 2020 to 2024

- Absolute $ Opportunity Analysis By Flow Class, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End User

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By End User, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By End User, 2025 to 2035

- Airports

- Fuel Farms

- Military

- Y to o to Y Growth Trend Analysis By End User, 2020 to 2024

- Absolute $ Opportunity Analysis By End User, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Drive

- By Flow Class

- By End User

- By Country

- Market Attractiveness Analysis

- By Country

- By Drive

- By Flow Class

- By End User

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Drive

- By Flow Class

- By End User

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Drive

- By Flow Class

- By End User

- Competition Analysis

- Competition Deep Dive

- Titan Aviation

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- SkyMark Refuelers LLC

- Esterer GmbH

- Garsite LLC

- Westmor Industries LLC

- Weihai Guangtai Airport Equipment Co., Ltd.

- Textron GSE (Textron Inc.)

- ShinMaywa Industries Ltd.

- Rampmaster, Inc.

- Flightline Support Ltd.

- Titan Aviation

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by End User, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Drive , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Flow Class, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by End User, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Drive

- Figure 6: Global Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Flow Class

- Figure 9: Global Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by End User

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Drive

- Figure 26: North America Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Flow Class

- Figure 29: North America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by End User

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Drive

- Figure 36: Latin America Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Flow Class

- Figure 39: Latin America Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by End User

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Drive

- Figure 46: Western Europe Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Flow Class

- Figure 49: Western Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by End User

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Drive

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Flow Class

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by End User

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Drive

- Figure 66: East Asia Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Flow Class

- Figure 69: East Asia Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by End User

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Drive

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Flow Class

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by End User

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Drive , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Drive , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Drive

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Flow Class, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Flow Class, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Flow Class

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by End User, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by End User, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by End User

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the hydrant dispensers market in 2025?

The global hydrant dispensers market is estimated to be valued at USD 620.0 million in 2025.

What will be the size of hydrant dispensers market in 2035?

The market size for the hydrant dispensers market is projected to reach USD 980.0 million by 2035.

How much will be the hydrant dispensers market growth between 2025 and 2035?

The hydrant dispensers market is expected to grow at a 4.7% CAGR between 2025 and 2035.

What are the key product types in the hydrant dispensers market?

The key product types in hydrant dispensers market are diesel and electric.

Which flow class segment to contribute significant share in the hydrant dispensers market in 2025?

In terms of flow class, ≤1,000 lpm segment to command 49.0% share in the hydrant dispensers market in 2025.