Drone Delivery Services Market

Drone Delivery Services Market Size and Share Forecast Outlook 2025 to 2035

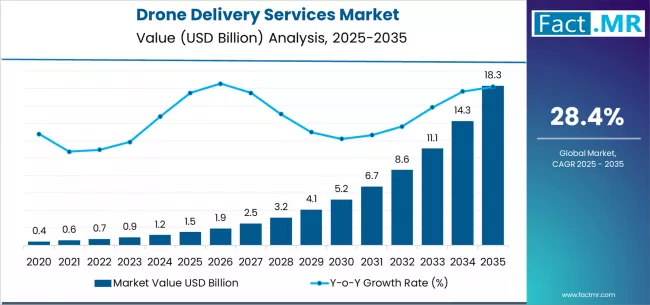

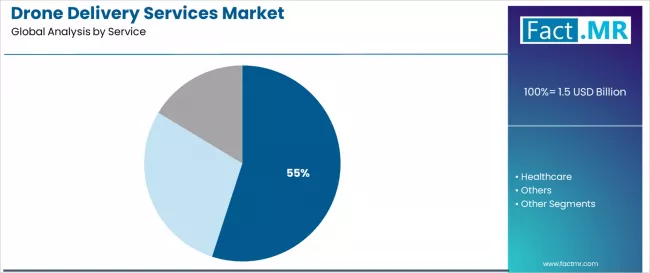

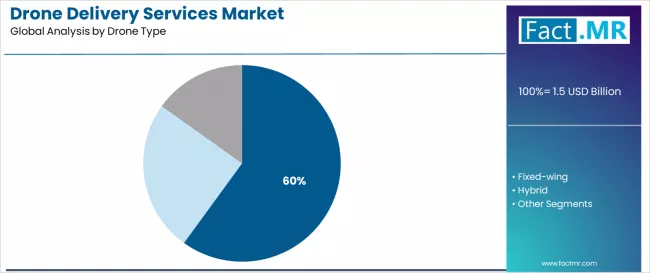

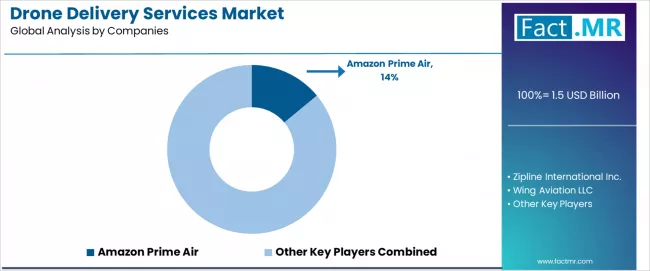

Drone delivery services market is projected to grow from USD 1.5 billion in 2025 to USD 18.3 billion by 2035, at a CAGR of 28.4%. E-commerce will dominate with a 55.0% market share, while multirotor will lead the drone type segment with a 60.0% share.

Drone Delivery Services Market Forecast and Outlook 2025 to 2035

The global drone delivery services market is valued at USD 1.5 billion in 2025 and is slated to reach USD 18.3 billion by 2035, recording an absolute increase of USD 16.8 billion over the forecast period. This translates into a total growth of 1120.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 28.4% between 2025 and 2035.

The overall market size is expected to grow by approximately 12.1X during the same period, supported by increasing demand for automated delivery solutions, growing adoption of unmanned aerial systems across e-commerce and healthcare sectors, and rising preference for last-mile delivery optimization in logistics applications.

Quick Stats for Drone Delivery Services Market

- Drone Delivery Services Market Value (2025): USD 1.5 billion

- Drone Delivery Services Market Forecast Value (2035): USD 18.3 billion

- Drone Delivery Services Market Forecast CAGR: 28.4%

- Leading Service in Drone Delivery Services Market: E-commerce (55.0%)

- Key Growth Regions in Drone Delivery Services Market: North America, Europe, Asia Pacific

- Key Players in Drone Delivery Services Market: Amazon Prime Air, Zipline, Wing, Matternet, DHL, Flytrex, Volansi, DroneUp, Flirtey, JD.com

The drone delivery services market represents a specialized segment of the global logistics and transportation industry, characterized by technological innovation and robust demand across e-commerce, healthcare, and logistics channels. Market dynamics are influenced by evolving regulatory frameworks toward commercial drone operations, growing interest in autonomous delivery technologies, and expanding partnerships between drone service providers and logistics companies in developed and emerging economies. Traditional ground delivery systems continue evolving as operators seek proven drone alternatives that offer enhanced delivery speed characteristics and reliable operational benefits.

Consumer behavior in the drone delivery services market reflects broader logistics trends toward automated, efficient systems that provide both speed benefits and extended operational improvements. The market benefits from the growing popularity of e-commerce applications, which are recognized for their superior delivery efficiency and service compatibility across retail and logistics applications. Additionally, the versatility of drone delivery services as both standalone logistics solutions and integrated delivery components supports demand across multiple commercial applications and service segments.

Regional adoption patterns vary significantly, with North American markets showing strong preference for e-commerce implementations, while European markets demonstrate increasing adoption of healthcare applications alongside conventional logistics systems. The delivery landscape continues to evolve with sophisticated and feature-rich drone services gaining traction in mainstream operations, reflecting operator willingness to invest in proven automation technology improvements and efficiency-oriented features.

The competitive environment features established logistics companies alongside specialized drone service providers that focus on unique flight capabilities and advanced delivery methods. Operational efficiency and technology development optimization remain critical factors for market participants, particularly as regulatory compliance and performance standards continue to evolve. Service strategies increasingly emphasize multi-channel approaches that combine traditional logistics supply chains with direct service partnerships through technology licensing agreements and custom delivery contracts.

Market consolidation trends indicate that larger logistics companies are acquiring specialty drone service providers to diversify their delivery portfolios and access specialized flight segments. Advanced automation integration has gained momentum as e-commerce companies seek to differentiate their offerings while maintaining competitive delivery standards. The emergence of specialized drone variants, including enhanced payload formulations and application-specific options, reflects changing logistics priorities and creates new market opportunities for innovative delivery system developers.

Between 2025 and 2030, the drone delivery services market is projected to expand from USD 1.5 billion to USD 5.8 billion, resulting in a value increase of USD 4.3 billion, which represents 25.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of e-commerce delivery systems, rising demand for automated logistics solutions, and growing emphasis on last-mile optimization features with advanced flight characteristics. Service facilities are expanding their operational capabilities to address the growing demand for specialized drone delivery implementations, advanced automation options, and application-specific offerings across logistics segments.

Drone Delivery Services Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 1.5 billion |

| Forecast Value (2035F) | USD 18.3 billion |

| Forecast CAGR (2025-2035) | 28.4% |

From 2030 to 2035, the market is forecast to grow from USD 5.8 billion to USD 18.3 billion, adding another USD 12.5 billion, which constitutes 74.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of healthcare applications, the integration of innovative flight solutions, and the development of specialized drone delivery implementations with enhanced automation profiles and extended operational capabilities. The growing adoption of advanced flight formulations will drive demand for drone delivery services with superior efficiency characteristics and compatibility with modern logistics technologies across commercial operations.

Between 2020 and 2025, the drone delivery services market experienced accelerated growth, driven by increasing demand for e-commerce delivery systems and growing recognition of automated logistics as essential components for modern retail and healthcare delivery across commercial and medical applications. The market developed as logistics operators recognized the potential for drone delivery solutions to provide both efficiency benefits and operational advantages while enabling streamlined delivery protocols. Technological advancement in flight processes and application-based development began emphasizing the critical importance of maintaining delivery quality and operational compatibility in diverse commercial environments.

Why is the Drone Delivery Services Market Growing?

Market expansion is being supported by the increasing global demand for advanced automated delivery systems and the corresponding need for drone technologies that can provide superior efficiency benefits and operational advantages while enabling enhanced logistics performance and extended compatibility across various e-commerce and healthcare applications.

Modern logistics operators and delivery specialists are increasingly focused on implementing proven automation technologies that can deliver effective last-mile optimization, minimize traditional delivery limitations, and provide consistent performance throughout complex logistics configurations and diverse operational conditions.

Drone delivery services proven ability to deliver exceptional delivery speed against traditional alternatives, enable advanced logistics integration, and support modern automation protocols makes it an essential component for contemporary e-commerce and healthcare operations.

The growing emphasis on delivery efficiency and logistics optimization is driving demand for services that can support large-scale commercial requirements, improve delivery outcomes, and enable advanced logistics systems.

Operator preference for services that combine effective automation with proven reliability and delivery enhancement benefits is creating opportunities for innovative drone delivery implementations.

The rising influence of digital commerce trends and automation awareness is also contributing to increased demand for drone delivery services that can provide advanced features, seamless logistics integration, and reliable performance across extended operational cycles.

Opportunity Pathways - Drone Delivery Services Market

The drone delivery services market is poised for exponential growth and technological advancement. As logistics facilities across North America, Europe, Asia-Pacific, and emerging markets seek services that deliver exceptional automation characteristics, advanced flight capabilities, and reliable delivery options, drone delivery solutions are gaining prominence not just as logistics services but as strategic enablers of automation technologies and advanced delivery functionality.

Rising e-commerce adoption in retail applications and expanding healthcare delivery enhancement initiatives globally amplify demand, while operators are leveraging innovations in flight engineering, advanced automation integration, and logistics optimization technologies.

- Pathway A - E-commerce Service Implementations. Premium retail and logistics companies increasingly require delivery solutions with e-commerce bases and advanced automation profiles for enhanced operational appeal and efficiency positioning capabilities. Service developers who develop e-commerce platforms with superior delivery standards can command premium pricing. Expected revenue pool: USD 5.0 billion - USD 7.6 billion.

- Pathway B - Healthcare Delivery Platforms. Growing demand for healthcare applications, high-speed capabilities, and unique delivery features drives need for advanced healthcare capabilities with specialized medical integration. Opportunity: USD 2.7 billion - USD 4.1 billion.

- Pathway C - Multirotor Technology Applications. Advanced multirotor formulations capable of meeting specific delivery requirements, payload compatibility, and specialized flight profiles enable market expansion and enhanced service appeal for delivery-focused operations. Revenue lift: USD 5.5 billion - USD 8.3 billion.

- Pathway D - Fixed-wing Integration. Expanding reach into fixed-wing applications with optimized delivery capability, advanced flight performance, and extended functionality features. Operators will seek partners who supply integrated fixed-wing solutions with complete delivery functionality. Pool: USD 2.3 billion - USD 3.4 billion.

- Pathway E - Geographic Expansion & Local Operations. Strong growth in APAC, particularly China, India, and Southeast Asia. Local operations lower costs, reduce regulatory complexity, and enable faster response to regional delivery preferences. Expected upside: USD 2.7 billion - USD 4.1 billion.

- Pathway F - Hybrid Drone Development. Increasing demand for hybrid flight systems, application-specific functionality, and specialized delivery profiles with validated performance characteristics for logistics facilities. USD 1.4 billion - USD 2.1 billion.

- Pathway G - Logistics Integration Services. Developing comprehensive logistics delivery solutions, custom flight services, and enhancement programs creates differentiation and addresses specialized requirements for large-scale delivery applications and facility operators. Growing demand from independent logistics services. Pool: USD 1.8 billion - USD 2.7 billion.

Segmental Analysis

The market is segmented by service, drone type, and region. By service, the market is divided into e-commerce, healthcare, and others categories. By drone type, it covers multirotor, fixed-wing, and hybrid segments. Regionally, the market is divided into North America, Europe, and Asia-Pacific.

Will E-commerce account for Maximum Deployment of Drone Delivery Services?

The e-commerce segment is projected to account for 55.0% of the drone delivery services market in 2025, reaffirming its position as the leading service category. Logistics facilities and delivery integrators increasingly utilize e-commerce implementations for their superior efficiency characteristics when operating across diverse delivery platforms, excellent automation properties, and widespread acceptance in applications ranging from basic package delivery to premium retail operations.

E-commerce delivery technology's established operational methods and proven efficiency capabilities directly address the facility requirements for dependable delivery solutions in complex logistics environments. This segment forms the foundation of modern retail adoption patterns, as it represents the implementation with the greatest market penetration and established operator acceptance across multiple delivery categories and automation segments.

Facility investments in e-commerce standardization and system consistency continue to strengthen adoption among retail producers and logistics companies. With operators prioritizing delivery speed and operational efficiency, e-commerce implementations align with both functionality preferences and cost expectations, making them the central component of comprehensive logistics automation strategies.

Why are Multirotor Drones preferred for Delivery Operations?

Multirotor drones are projected to represent 60.0% of drone delivery services demand in 2025, underscoring their critical role as the primary drone type for delivery enhancement across urban and suburban operations. Logistics facilities prefer multirotor drones for delivery services for their exceptional maneuverability characteristics, scalable flight options, and ability to enhance delivery precision while ensuring consistent operational quality throughout diverse logistics platforms and delivery operations.

Positioned as essential flight components for modern delivery systems, multirotor solutions offer both technological advantages and operational efficiency benefits. The segment is supported by continuous innovation in flight technologies and the growing availability of specialized implementations that enable diverse delivery requirements with enhanced precision uniformity and extended flight capabilities.

Logistics facilities are investing in advanced technologies to support large-scale flight integration and service development. As urban delivery trends become more prevalent and automation awareness increases, multirotor applications will continue to represent a major implementation market while supporting advanced logistics utilization and technology integration strategies.

Why are Healthcare Applications Gaining Traction?

The healthcare segment is expected to capture 30.0% of the drone delivery services market in 2025, driven by increasing demand for medical delivery systems that enhance patient care while maintaining operational efficiency.

Healthcare providers are increasingly adopting drone delivery services for medical supply transport, pharmaceutical delivery, and emergency response due to their superior speed and accessibility characteristics. The segment benefits from growing telemedicine requirements and continuous innovation in delivery formulations tailored for healthcare applications.

What are the Drivers, Restraints, and Key Trends of the Drone Delivery Services Market?

The drone delivery services market is advancing rapidly due to increasing demand for advanced automated delivery technologies and growing adoption of drone systems that provide superior efficiency characteristics and operational benefits while enabling enhanced logistics performance across diverse e-commerce and healthcare applications.

The market faces challenges, including complex regulatory requirements, evolving flight standards, and the need for specialized operational expertise and safety programs. Innovation in flight methods and advanced automation systems continues to influence service development and market expansion patterns.

Expansion of Automation Technologies and Logistics Integration

The growing adoption of advanced automation solutions, sophisticated flight capabilities, and logistics efficiency awareness is enabling service developers to produce advanced drone delivery solutions with superior automation positioning, enhanced flight profiles, and seamless integration functionalities.

Advanced automation systems provide improved logistics outcomes while allowing more efficient operational workflows and reliable performance across various commercial applications and delivery conditions. Developers are increasingly recognizing the competitive advantages of logistics integration capabilities for market differentiation and service positioning.

Integration of Advanced Flight Methods and Automation Engineering

Modern drone delivery service providers are incorporating advanced flight technology, automation integration, and sophisticated operational solutions to enhance service appeal, enable intelligent delivery features, and deliver value-added solutions to logistics customers.

These technologies improve drone delivery performance while enabling new market opportunities, including multi-stage flight systems, optimized automation treatments, and enhanced efficiency characteristics. Advanced flight integration also allows developers to support comprehensive logistics technologies and market expansion beyond traditional delivery approaches.

How will the Drone Delivery Services Market Expand in Key Countries?

| Country | CAGR (2025-2035) |

|---|---|

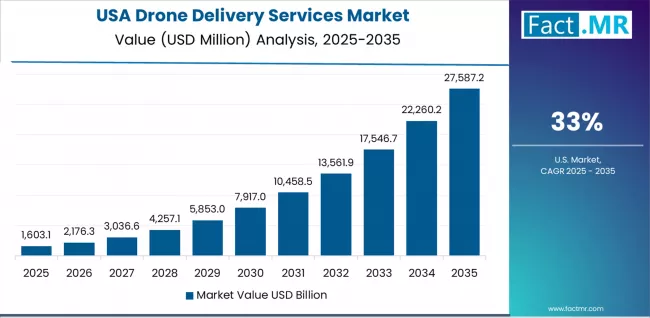

| USA | 33.0% |

| Mexico | 32.0% |

| South Korea | 30.0% |

| Germany | 30.0% |

| UK | 28.0% |

| France | 28.0% |

| Japan | 27.0% |

The drone delivery services market is experiencing explosive growth globally, with the USA leading at a 33.0% CAGR through 2035, driven by expanding e-commerce capacity, growing automated delivery programs, and significant investment in drone technology development. Mexico follows at 32.0%, supported by increasing logistics expansion, growing automation integration patterns, and expanding delivery infrastructure.

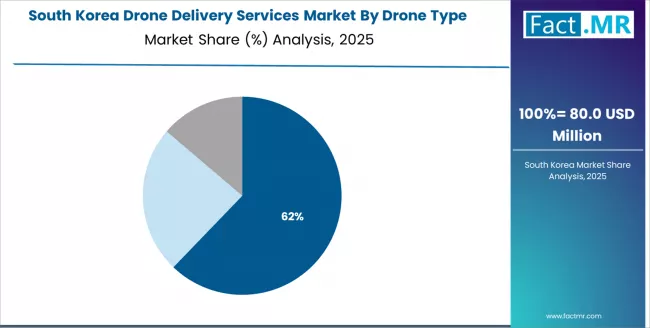

South Korea shows growth at 30.0%, emphasizing delivery technology leadership and service development. Germany records 30.0%, focusing on expanding logistics capabilities and automation technology modernization. The UK exhibits 28.0% growth, emphasizing automation innovation excellence and premium delivery development.

France demonstrates 28.0% growth, prioritizing advanced logistics technology development and quality-focused delivery patterns. Japan shows 27.0% growth, supported by automation initiatives and quality-focused service patterns.

How is the USA Emerging as the Global Hub for Drone Delivery Expansion?

The USA is positioned at the forefront of commercial drone delivery, advancing with a robust CAGR of 33.0% from 2025 to 2035. The country’s strong technology base, widespread e-commerce penetration, and high adoption of automated logistics are reshaping how goods move across cities and rural corridors. Large players such as Amazon Prime Air, Zipline, and UPS Flight Forward are transitioning from experimental projects to scalable commercial services, driven by consumer demand for same-day and one-hour delivery options.

Regulatory progress remains a decisive factor in the USA growth story. The FAA’s incremental approval for Beyond Visual Line of Sight (BVLOS) operations and UAS Traffic Management (UTM) corridors is opening the skies for high-frequency, low-altitude operations. Once these frameworks are standardized, logistics companies will scale cross-state networks connecting urban warehouses and suburban drop points.

Supporting infrastructure development autonomous charging hubs, software-based air traffic coordination, and advanced sensor technologies is further enabling operational continuity. Combined with private-public partnerships in healthcare logistics and emergency response, these efforts will cement the U.S. as the world’s proving ground for drone-based logistics.

Why is Mexico Rapidly Embracing Drone-Based Logistics?

Mexico’s impressive 32.0% growth trajectory stems from the urgent need to improve last-mile connectivity, especially across rural and semi-urban regions. The country’s rugged terrain and limited logistics infrastructure create a strong use case for aerial deliveries, particularly for essential supplies, healthcare items, and perishable goods. With increasing digitalization and surging e-commerce adoption, drone operations are fast emerging as an efficient alternative to unreliable or slow ground logistics.

Public-private initiatives, supported by state-level aviation authorities, are helping local operators gain operational clearances and technical know-how. Partnerships with medical service providers, agricultural co-operatives, and local retailers are creating a foundation for recurring demand. Regions like Jalisco and Nuevo León are already witnessing pilot programs that demonstrate the economic and social impact of faster, more reliable aerial logistics.

Affordability and local adaptation remain crucial. Drones optimized for hot climates and dusty terrain, along with modular maintenance support and technician training programs, are ensuring scalability. These measures collectively make Mexico one of the most promising emerging drone ecosystems in Latin America.

What makes South Korea a Technological Trailblazer in Drone Deliveries?

South Korea’s projected 30.0% CAGR reflects how its innovation-driven ecosystem fuels rapid adoption. Government-backed R&D, 5G connectivity, and urban planning aligned with smart mobility have made it an ideal testing ground for high-density drone operations. Companies are already piloting same-hour food, pharmacy, and e-commerce deliveries across cities like Seoul, Incheon, and Busan.

Regulatory alignment under the Ministry of Land, Infrastructure and Transport (MOLIT) and specialized drone corridors across urban airspace are enabling seamless BVLOS flights. The integration of drones into “smart city” infrastructure - such as automated vertiports and intelligent traffic systems further ensures operational safety and precision.

Industrial and emergency use cases will supplement consumer deliveries. From transporting automotive components within manufacturing clusters to reaching remote islands during natural disasters, South Korea’s strategic focus lies in leveraging drones to enhance both economic efficiency and social resilience.

How is Germany Leveraging Drones to Reinvent Logistics Efficiency?

Germany’s growth of 30.0% highlights its pragmatic yet high-value approach toward commercial drone deployment. Unlike countries focused solely on retail or e-commerce deliveries, Germany is emphasizing industrial applications such as transporting spare parts, lab samples, and high-value manufacturing components across campuses and regional hubs.

The country’s stringent aviation and safety norms are fostering confidence among operators and consumers alike. Collaboration between the European Union Aviation Safety Agency (EASA) and national regulators is enabling harmonized standards, laying the groundwork for scalable cross-border drone operations across Europe.

Adoption is being driven by large industrial groups, research institutes, and logistics service providers seeking to reduce downtime and operational costs. In urban areas, drones are being evaluated as part of low-emission transport networks, aligning with Germany’s broader environmental and digitalization goals.

Why is the UK Pioneering Healthcare and Community-Centric Drone Applications?

The UK’s estimated 28.0% growth is shaped by its early adoption of drone logistics in public services. Programs involving the National Health Service (NHS) have already proven how drones can cut delivery times for blood samples, vaccines, and medical supplies between hospitals and laboratories. The country’s insular geography, coupled with hard-to-reach islands and congested city centers, provides natural incentives for aerial logistics solutions.

Policy support from the Civil Aviation Authority (CAA) and government-sponsored test corridors in places like Cornwall and the Orkney Islands are paving the way for commercial-scale operations. These initiatives allow companies to demonstrate compliance and safety while building community acceptance.

The UK’s approach blends practicality with innovation focusing on improving essential services first before scaling to broader retail applications. As public awareness grows and vertiport infrastructure expands, commercial operators will likely build on these foundational successes to introduce wider urban and intercity networks.

What is Driving France Toward Strategic Drone Integration?

France’s 28.0% CAGR projection mirrors its focus on harmonizing advanced technology with social and environmental responsibility. Early deployments are centered on public services, healthcare logistics, and island deliveries, demonstrating clear societal benefits. With strong state support, French aerospace firms and startups are innovating drones suited for European weather conditions, safety standards, and quiet urban operations.

Government-backed frameworks under the Direction Générale de l’Aviation Civile (DGAC) emphasize public safety, airspace management, and localized licensing. These measures foster a controlled yet innovation-friendly ecosystem that allows both established companies and SMEs to thrive.

The country’s vision extends beyond logistics efficiency it aims to integrate drones as a sustainable component of its broader carbon reduction strategy. By coupling drone logistics with renewable energy initiatives and smart transportation systems, France is creating a balanced model that other EU members may emulate.

How is Japan Transforming Accessibility and Rural Connectivity through Drones?

Japan’s steady 27.0% CAGR reflects a well-coordinated strategy to address rural depopulation, aging logistics workforces, and island accessibility challenges. Drones are being used to deliver medical supplies, e-commerce parcels, and emergency provisions to remote mountain villages and isolated communities, bridging critical service gaps.

The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has created specialized airspace rules that facilitate autonomous drone operations while maintaining Japan’s hallmark safety standards. The country’s advanced robotics expertise ensures exceptionally reliable vehicles capable of precision flight in variable weather conditions.

Manufacturers, logistics operators, and regional governments are collaborating to develop integrated drone-delivery frameworks, combining landing lockers, automated recharging stations, and hybrid ground-air transport models. Japan’s emphasis on operational reliability and human-centered design ensures that aerial logistics evolve not just as a convenience, but as a social necessity.

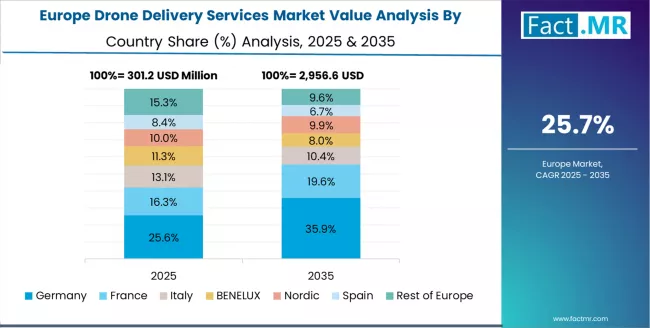

What is the outlook for Drone Delivery Services in Key European Countries?

The drone delivery services market in Europe is projected to grow from USD 0.5 billion in 2025 to USD 5.5 billion by 2035, registering a CAGR of 29.0% over the forecast period. Germany is expected to maintain its leadership position with a 32.0% market share in 2025, growing to 33.5% by 2035, supported by its strong logistics technology culture, sophisticated e-commerce capabilities, and comprehensive delivery sector serving diverse drone applications across Europe.

France follows with a 25.0% share in 2025, projected to reach 24.8% by 2035, driven by robust demand for logistics technologies in delivery applications, advanced automation development programs, and efficiency markets, combined with established e-commerce infrastructure and technology integration expertise. The United Kingdom holds a 22.0% share in 2025, expected to reach 21.2% by 2035, supported by strong delivery technology sector and growing premium logistics activities.

Italy commands a 12.0% share in 2025, projected to reach 11.5% by 2035, while Netherlands accounts for 6.0% in 2025, expected to reach 6.5% by 2035. The Rest of Europe region is anticipated to maintain momentum, with its collective share moving from 3.0% to 2.5% by 2035, attributed to increasing logistics modernization and growing technology penetration implementing advanced delivery programs.

Competitive Landscape of the Drone Delivery Services Market

The drone delivery services market is characterized by intense competition among established logistics companies, specialized drone service providers, and integrated delivery solution providers. Companies are investing in flight technology research, automation optimization, advanced operational system development, and comprehensive service portfolios to deliver consistent, high-quality, and application-specific drone delivery solutions. Innovation in advanced flight integration, automation enhancement, and logistics compatibility improvement is central to strengthening market position and competitive advantage.

Amazon Prime Air leads the market with a 14% market share, offering comprehensive delivery solutions including quality flight platforms and advanced automation systems with a focus on premium and e-commerce applications. Zipline provides specialized medical delivery capabilities with an emphasis on advanced drone implementations and innovative healthcare solutions.

Wing Aviation LLC delivers comprehensive logistics services with a focus on integrated platforms and large-scale delivery applications. Matternet specializes in advanced flight technologies and specialized drone implementations for premium applications. DHL focuses on logistics-oriented delivery integration and innovative automation solutions.

The competitive landscape is further strengthened by companies like Flytrex, which brings expertise in advanced urban delivery, while Volansi focuses on long-range delivery solutions for diverse applications. DroneUp emphasizes retail delivery systems and operational integration, and Flirtey specializes in last-mile delivery formulations. These companies continue to invest in research and development, strategic partnerships, and operational capacity expansion to maintain their market positions and capture emerging opportunities in the rapidly growing drone delivery services sector.

Key Players in the Drone Delivery Services Market

- Amazon Prime Air

- Zipline International Inc.

- Wing Aviation LLC

- Matternet Inc.

- DHL Express (Deutsche Post AG)

- Flytrex Aviation Ltd.

- Volansi Inc.

- DroneUp LLC

- Flirtey Holdings Inc.

- JD.com, Inc.

- Skycart Inc.

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Service | E-commerce; Healthcare; Others |

| Drone Type | Multirotor; Fixed-wing; Hybrid |

| Regions Covered | North America; Europe; Asia-Pacific |

| Countries Covered | USA; Mexico; South Korea; Germany; UK; France; Japan; and 40+ additional countries |

| Key Companies Profiled | Amazon Prime Air; Zipline; Wing; Matternet; DHL; Flytrex |

| Additional Attributes | Dollar sales by service and drone type category; regional demand trends; competitive landscape; technological advancements in flight engineering; advanced automation development; delivery innovation; logistics integration protocols |

Drone Delivery Services Market by Segments

-

Service :

- E-commerce

- Healthcare

- Others

-

Drone Type :

- Multirotor

- Fixed-wing

- Hybrid

-

Region :

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Nordic

- BENELUX

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- ASEAN

- Australia & New Zealand

- Rest of Asia-Pacific

- North America

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Service

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Service , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Service , 2025 to 2035

- E-commerce

- Healthcare

- Others

- Y to o to Y Growth Trend Analysis By Service , 2020 to 2024

- Absolute $ Opportunity Analysis By Service , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Drone Type

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Drone Type, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Drone Type, 2025 to 2035

- Multirotor

- Fixed-wing

- Hybrid

- Y to o to Y Growth Trend Analysis By Drone Type, 2020 to 2024

- Absolute $ Opportunity Analysis By Drone Type, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Service

- By Drone Type

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Drone Type

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Drone Type

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Service

- By Drone Type

- Competition Analysis

- Competition Deep Dive

- Amazon Prime Air

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Zipline International Inc.

- Wing Aviation LLC

- Matternet Inc.

- DHL Express (Deutsche Post AG)

- Flytrex Aviation Ltd.

- Volansi Inc.

- DroneUp LLC

- Flirtey Holdings Inc.

- JD.com, Inc.

- Skycart Inc.

- Amazon Prime Air

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 4: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 7: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 8: Latin America Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 11: Western Europe Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 12: Western Europe Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Eastern Europe Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 15: Eastern Europe Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 16: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 17: East Asia Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 18: East Asia Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 19: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 20: South Asia and Pacific Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 21: South Asia and Pacific Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

- Table 22: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 23: Middle East & Africa Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 24: Middle East & Africa Market Value (USD Million) Forecast by Drone Type, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Service

- Figure 6: Global Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Drone Type

- Figure 9: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Region

- Figure 12: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 13: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 14: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 15: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 20: North America Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 21: North America Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 22: North America Market Attractiveness Analysis by Service

- Figure 23: North America Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Drone Type

- Figure 26: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 27: Latin America Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 28: Latin America Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 29: Latin America Market Attractiveness Analysis by Service

- Figure 30: Latin America Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 31: Latin America Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 32: Latin America Market Attractiveness Analysis by Drone Type

- Figure 33: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Western Europe Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 35: Western Europe Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 36: Western Europe Market Attractiveness Analysis by Service

- Figure 37: Western Europe Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 38: Western Europe Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 39: Western Europe Market Attractiveness Analysis by Drone Type

- Figure 40: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 42: Eastern Europe Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 43: Eastern Europe Market Attractiveness Analysis by Service

- Figure 44: Eastern Europe Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 45: Eastern Europe Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 46: Eastern Europe Market Attractiveness Analysis by Drone Type

- Figure 47: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 48: East Asia Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 49: East Asia Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 50: East Asia Market Attractiveness Analysis by Service

- Figure 51: East Asia Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 52: East Asia Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 53: East Asia Market Attractiveness Analysis by Drone Type

- Figure 54: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 55: South Asia and Pacific Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 56: South Asia and Pacific Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 57: South Asia and Pacific Market Attractiveness Analysis by Service

- Figure 58: South Asia and Pacific Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 59: South Asia and Pacific Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 60: South Asia and Pacific Market Attractiveness Analysis by Drone Type

- Figure 61: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 63: Middle East & Africa Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 64: Middle East & Africa Market Attractiveness Analysis by Service

- Figure 65: Middle East & Africa Market Value Share and BPS Analysis by Drone Type, 2025 and 2035

- Figure 66: Middle East & Africa Market Y to o to Y Growth Comparison by Drone Type, 2025-2035

- Figure 67: Middle East & Africa Market Attractiveness Analysis by Drone Type

- Figure 68: Global Market - Tier Structure Analysis

- Figure 69: Global Market - Company Share Analysis

- FAQs -

How big is the drone delivery services market in 2025?

The global drone delivery services market is estimated to be valued at USD 1.5 billion in 2025.

What will be the size of drone delivery services market in 2035?

The market size for the drone delivery services market is projected to reach USD 18.3 billion by 2035.

How much will be the drone delivery services market growth between 2025 and 2035?

The drone delivery services market is expected to grow at a 28.4% CAGR between 2025 and 2035.

What are the key product types in the drone delivery services market?

The key product types in drone delivery services market are e-commerce, healthcare and others.

Which drone type segment to contribute significant share in the drone delivery services market in 2025?

In terms of drone type, multirotor segment to command 60.0% share in the drone delivery services market in 2025.