Geriatric Medicines Market

Geriatric Medicines Market Size and Share Forecast Outlook 2025 to 2035

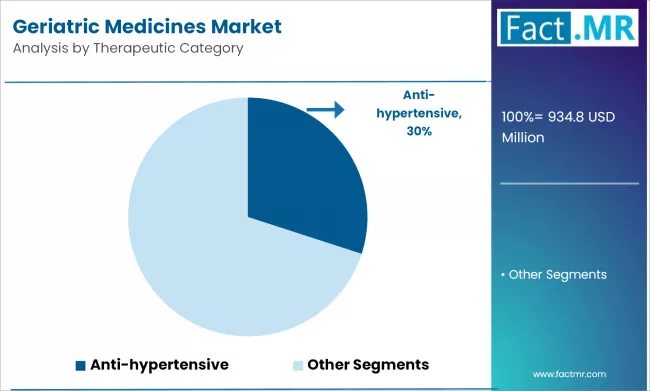

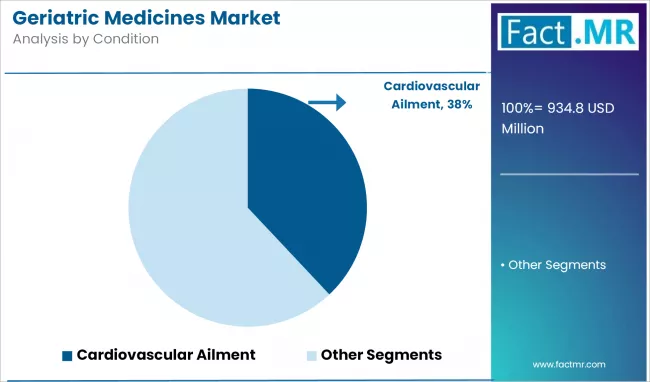

The Global Geriatric Medicines Market Will Total USD 934.8 Million In 2025, Forecasted To Advance At A 5.5% CAGR Until 2035 To Total USD 1,596.8 Million. By Therapeutic Category, Anti-Hypertensive Medicines Will Enjoy High Demand While Cardiovascular Ailments Will Be The Primary Condition For Treatment.

Geriatric Medicines Market Outlook 2025 to 2035

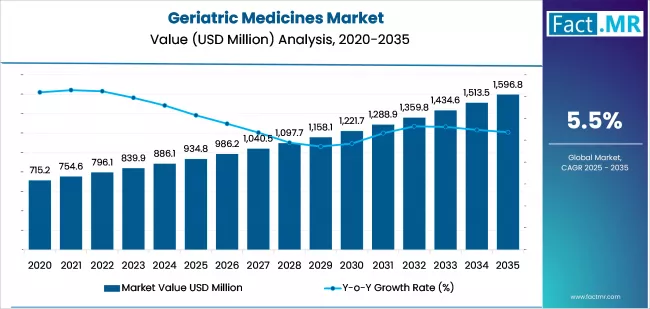

The global geriatric medicines market is forecast to reach USD 1,596.8 million by 2035, up from USD 934.8 million in 2025. During the forecast period, the industry is projected to register at a CAGR of 5.5%.

The elderly are more susceptible to having numerous medical conditions. For this reason, geriatric medicines are in higher demand. This age group also suffers more from chronic diseases, cardiovascular diseases, and diabetes, which require specialized medicines.

Quick Stats on Geriatric Medicines Market

- Geriatric Medicines Market Size (2025):USD 934.8 million

- Projected Geriatric Medicines Market Size (2035):USD 1,596.8 million

- Forecast CAGR of Geriatric Medicines Market (2025 to 2035):5.5%

- Leading Therapeutic Category Segment of Geriatric Medicines Market:Anti-hypertensive

- Leading Condition Segment of Geriatric Medicines Market:Cardiovascular Ailments

- Key Growth Regions of Geriatric Medicines Market:United States, China, Japan

- Prominent Players in the Geriatric Medicines Market:AstraZeneca, Merck & Co. Inc., Pfizer, Inc., Novartis AG, Bristol-Myers Squibb Company, Sanofi S.A, Others

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 934.8 million |

| Industry Size (2035F) | USD 1,596.8 million |

| CAGR (2025-2035) | 5.5% |

The global geriatric medicines market is projected to rise from USD 934.8 million in 2025 to USD 1,596.8 million by 2035 at a CAGR of 5.5%. This expansion adds USD 662 million in absolute value, driven by rising demand for therapies addressing chronic conditions prevalent in aging populations. The trajectory divides into two clear growth phases.

Between 2025 and 2029, the market increases steadily from USD 934.8 million to USD 1,158.1 million. Growth during this phase is largely supported by policy frameworks emphasizing geriatric care in developed regions such as North America and Europe. Healthcare reforms introduce structured reimbursement schemes, which improve patient access to medications for cardiovascular, neurological, and musculoskeletal disorders.

Regulatory agencies prioritize fast-track approvals for medicines addressing elderly-specific indications, encouraging manufacturers to accelerate pipeline development. Clinical trials for anti-Alzheimer’s drugs, arthritis therapies, and advanced pain management formulations reinforce optimism, though approval rates remain selective.

On the supply side, generic producers expand their presence, ensuring cost-efficient distribution in emerging economies. Competition is influenced by consolidation among established pharmaceutical firms and partnerships with healthcare providers to strengthen hospital and long-term care channels. This period is characterized by steady adoption, regulatory clarity, and structured supply chain strengthening.

From 2030 to 2035, the market advances from USD 1,221.8 million to USD 1,596.8 million, with annual increments widening due to compounding. By this phase, many of the clinical trials initiated earlier are expected to achieve commercialization, expanding treatment options across neurology, oncology, and metabolic disease management. Governments introduce broader geriatric-specific subsidy programs, particularly in Asia-Pacific, which significantly boost accessibility.

Competitive pressure heightens as global players compete with regional firms leveraging local distribution advantages. Demand-supply dynamics grow more complex, with raw material sourcing and manufacturing scalability shaping margins. Regulatory agencies tighten post-marketing surveillance requirements, compelling companies to invest in pharmacovigilance.

Hospitals, retail pharmacies, and telemedicine providers emerge as critical distribution channels, with digital health integration playing a stronger role in medicine adherence and monitoring.

Key Geriatric Medicines Market Dynamics Analyzed

The global geriatric medicines market is advancing at a steady pace, supported by rising healthcare needs of the elderly and policy frameworks aimed at enhancing access to chronic disease management therapies. While steady compounding is evident in its growth trajectory, the market is shaped by multiple forces that act both as accelerators and barriers.

Drivers largely emerge from structured healthcare reforms, regulatory support, and expanding therapeutic pipelines, while challenges stem from cost management, supply chain bottlenecks, and regulatory complexities. A closer examination of these drivers and challenges offers insights into the market’s expected direction between 2025 and 2035.

Healthcare Reforms and Government Support

Healthcare reforms implemented across major economies have been pivotal in shaping the demand for geriatric medicines. Countries in Europe and North America have expanded public healthcare coverage to include elderly-specific drug therapies for chronic conditions such as arthritis, cardiovascular disease, and neurodegenerative disorders.

These reforms ensure wider affordability and access, allowing pharmaceutical companies to benefit from predictable reimbursement frameworks. The inclusion of geriatric-specific subsidies also provides incentives for companies to expand product lines targeted at older demographics.

Beyond developed regions, emerging economies are investing in government-backed healthcare programs that prioritize elderly care. Nations in Asia-Pacific are creating schemes that subsidize essential medicines, thereby bridging the gap between affordability and access.

This policy-backed momentum drives long-term adoption and reduces dependency on fragmented out-of-pocket spending. The consistent role of public spending in healthcare is expected to remain a strong stabilizing factor for market expansion.

Advancements in Clinical Trials and Regulatory Approvals

Regulatory bodies have been accelerating approval processes for therapies that specifically address conditions prevalent among the elderly. Priority review pathways and orphan drug designations for neurodegenerative diseases like Alzheimer’s have encouraged companies to push forward with late-stage trials.

Such streamlined procedures not only shorten time-to-market but also stimulate investment in pipeline development, particularly in areas such as oncology and pain management where elderly patients represent a significant portion of the demand.

Clinical trial momentum across global pharmaceutical companies has also been a decisive growth driver. A number of ongoing trials focus on improving drug delivery mechanisms, such as slow-release formulations or fixed-dose combinations, which are well-suited to elderly patients requiring simplified regimens.

Successful trial outcomes are expected to transform treatment standards, reinforcing the market’s position as a priority therapeutic segment in the pharmaceutical industry.

Expansion of Generic and Specialty Medicines

The increasing penetration of generics in geriatric medicines is reducing treatment costs, thus supporting higher consumption volumes. As patent expirations continue to rise in cardiovascular and musculoskeletal therapies, generic drug makers are leveraging the opportunity to widen their portfolios and offer cost-effective alternatives.

This not only ensures market expansion in emerging economies but also provides competitive pressure in developed regions where healthcare providers actively encourage generic substitution. At the same time, specialty medicines for elderly conditions such as advanced oncology therapies or dementia-targeted drugs are carving out premium niches.

Pharmaceutical companies investing in these segments can secure higher margins while addressing unmet needs. The co-existence of generics and specialty drugs broadens the market scope, catering to both mass and niche segments of the elderly population.

High Treatment Costs and Pricing Pressure

Despite government-backed reimbursement programs, pricing pressure remains a major hurdle for geriatric medicines. Specialty drugs, particularly for oncology and advanced neurology, carry high price tags, limiting adoption outside developed healthcare systems.

This creates disparities in access, with elderly patients in lower-income regions unable to afford advanced treatments. Affordability issues also push governments to impose price controls, compressing margins for manufacturers.

Pharmaceutical firms are compelled to balance profitability with accessibility, which often restricts their ability to invest in newer product lines. With healthcare spending already under strain in many economies, the pressure to reduce drug costs is likely to persist. This pricing challenge could hinder innovation if revenue streams from premium therapies are compromised.

Supply Chain Limitations and Manufacturing Scalability

The demand-supply dynamics of geriatric medicines face persistent strain due to raw material sourcing challenges and global distribution bottlenecks. Active pharmaceutical ingredient (API) supply remains concentrated in select regions, particularly India and China, making the market vulnerable to geopolitical disruptions and trade restrictions. Any disruption in this chain can result in shortages, impacting availability of essential medicines for the elderly.

Scalability in manufacturing also presents difficulties. Geriatric medicines often require complex formulations such as modified-release tablets or injectables that demand specialized production infrastructure.

Smaller manufacturers struggle to meet these requirements, while larger companies face higher capital costs to expand capacity. This creates imbalances in global supply that could restrict smooth growth of the industry.

Regulatory and Compliance Complexities

Regulatory approvals have become faster for geriatric therapies, but post-marketing compliance and pharmacovigilance present rising challenges. Stringent requirements for continuous monitoring of safety profiles increase operational costs for pharmaceutical companies. Elderly patients are often more vulnerable to adverse drug reactions, necessitating robust follow-up mechanisms, which create additional compliance burdens.

Different regional frameworks further complicate the landscape. What is acceptable in one region may not be approved in another, forcing companies to adapt their formulations and regulatory strategies across multiple jurisdictions.

This fragmented compliance environment can delay global rollouts and elevate operational complexity, slowing down the pace of expansion despite favorable growth potential.

Analyzing the Geriatric Medicines Market by Key Regions

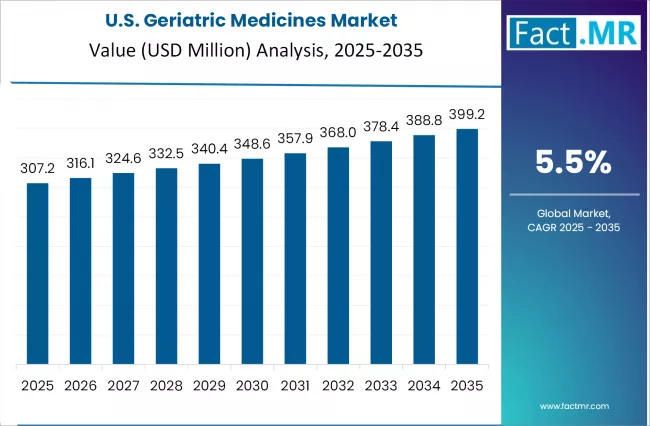

The geriatric medicines market demonstrates distinct regional patterns shaped by demographic trends and healthcare frameworks. In the United States, a large elderly population with high prevalence of chronic diseases such as cardiovascular conditions is supported by advanced healthcare systems and government-backed elderly care programs.

Growth is reinforced by active drug approvals and ongoing research initiatives that expand treatment options. Europe, with its significant older demographic, benefits from specialized geriatric care and robust insurance coverage policies that improve medicine accessibility, ensuring steady demand across key nations.

Asia Pacific is experiencing rapid expansion due to fast-aging populations in China, Japan, and India, coupled with rising income levels and broader healthcare access. These factors make geriatric therapies more attainable and encourage higher adoption.

The Middle East and Africa are witnessing rising life expectancy and chronic disease incidence, supported by improvements in healthcare infrastructure and stronger access to specialized treatments for seniors, gradually elevating the region’s role in global demand.

Country-Wise Outlook

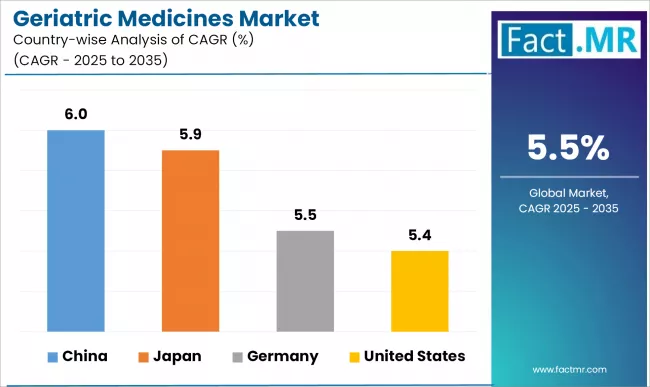

| Countries | CAGR (2025-2035) |

|---|---|

| United States | 5.4% |

| China | 6.0% |

| Japan | 5.9% |

An Expanding Geriatric Population Pool to Widen Scope for Geriatric Medicines in the United States

The healthcare market in the United States is significantly impacted by the population of aging adults. This demographic shift is creating a surge in the demand for medications that treat age-related health conditions. The availability of sophisticated healthcare facilities and robust R&D is also of critical importance.

The aging population in the United States suffers from a high prevalence of chronic conditions, such as cardiovascular diseases, diabetes, and several neurological disorders, which require ongoing treatment. This persistent demand drives the market for comprehensive geriatric medicines.

The United States geriatric medicines market is further driven by government policies and favorable reimbursement structures. These policies increase the affordability and availability of geriatric healthcare and medications for the elderly. They also motivate pharmaceutical manufacturers to invest in treatments targeting geriatric healthcare.

- Expanding elderly population with higher chronic disease burden creates consistent pharmaceutical demand

- Favorable reimbursement and supportive government policies enhance medicine affordability and availability

- Advanced healthcare system and active R&D pipeline accelerate treatment options for seniors

China: Expanding Aging Population Heavily Influences Geriatric Medicines’ Demand

The growth of the geriatric medicines market in China is attributed to the country’s rapidly advancing demographic shift. A large and increasing portion of the population is entering and reaching retirement age. This stimulates the demand for healthcare services. There is also greater government spending directed toward the healthcare services that improve the quality for its citizens.

The market is further fueled by the increasing awareness of hypertension and diabetes among the elderly. This allows the elderly and their families to afford and try to access better healthcare and specialized medicines. There is also expansion in the healthcare infrastructure, and thus, the growing population is able to access these services.

The rise in the prevalence of chronic diseases in the older population of China is specifically crucial. There is a high prevalence of diabetes and hypertension among the aging population. This increases the demand for cost-effective medicines targeted towards these persistent long-term diseases.

- Rapid demographic shift toward aging population drives long-term medicine demand

- Government spending and infrastructure expansion improve accessibility of geriatric care

- High prevalence of diabetes and hypertension fuels need for cost-effective therapies

Japan: Rapidly Aging Society Reinforcing Pharmaceutical Demand for Geriatric Medicines

Japan has the fastest aging population in the world, which also boosts the geriatric medicines market. This demographic trend leads to constant demand for specialized geriatric medicines. The country has one of the highest life expectancy rates, which leads to people living for longer periods of time with several chronic diseases.

The widespread suffering of chronic illnesses such as heart disease and other cardiovascular disorders, as well as some neurological disorders, is of paramount importance. It is known that Japan’s healthcare system is quite advanced in managing such illnesses, thereby creating a robust market for corresponding pharmaceuticals. Also, the market is spurred by the desire for preventive care and products aimed at promoting healthy aging.

Policies and expenditure devised by the government in relation to servicing the elderly population are key drivers. The Long-Term Care Insurance system helps reduce the financial burden of healthcare, while simultaneously supporting demand for pharmaceuticals tailored for seniors.

- World’s fastest aging population ensures steady and high geriatric medicine demand

- Advanced healthcare system effectively addresses cardiovascular and neurological conditions

- Government programs like Long-Term Care Insurance strengthen affordability and stimulate medicine usage

Category-wise Analysis of the Geriatric Medicines Market

The geriatric medicines market is segmented by therapeutic category, medical condition, and distribution channel. Each segment is shaped by prevalence of chronic diseases, government policies, and evolving patient needs.

While established segments like anti-hypertensive and cardiovascular therapies dominate in terms of volume, fast-growing segments such as anti-diabetic and oncology therapeutics highlight future growth prospects. Distribution remains dominated by retail pharmacies, though online channels are expanding at the fastest pace.

Anti-Hypertensive Remains the Preferred Therapeutic Category

Anti-hypertensive drugs account for the largest share due to the widespread prevalence of hypertension among the elderly. These medicines range from basic diuretics to advanced combination therapies, often taken daily for long-term management. Effective hypertension control reduces risks of severe events such as strokes or heart attacks, reinforcing demand.

- Hypertension is highly prevalent in aging populations and requires consistent, lifelong treatment

- Broad drug availability, from generics to advanced formulations, sustains market dominance

- Long-term use justified by prevention of severe cardiovascular complications

Anti-Diabetic Segment Expected to Expand Rapidly

The anti-diabetic category is projected to post the highest growth rate, driven by rising diabetes cases among older adults and lifestyle-related factors such as obesity. Innovative therapies and drug delivery methods are being developed to improve compliance and reduce long-term complications, reshaping the treatment landscape.

- Rising diabetes prevalence in the elderly population fuels expansion of this segment

- Growing need for therapies that address management complexities in older patients

- Introduction of innovative delivery systems and tailored medications drives rapid adoption

Cardiovascular Ailments Remain the Dominant Condition

Cardiovascular treatments remain the largest condition-based segment, covering heart failure drugs, statins, and blood thinners. With an increasing number of elderly patients living longer with chronic cardiovascular disorders, these medicines remain indispensable for disease management and prevention of acute episodes.

- Cardiovascular conditions remain highly prevalent among aging populations worldwide

- Established medications such as statins and anticoagulants maintain consistent demand

- Long-term disease management ensures this segment sustains leadership

Oncology Therapeutics Poised for Fastest Growth

Elderly oncology therapeutics are set to expand rapidly, driven by increasing cancer incidence and advancements in targeted treatment. The development of less toxic and more effective therapies has created stronger adoption among older patients, while personalized cancer care adds to growth prospects.

- Rising cancer incidence in older adults necessitates greater treatment availability

- Advancements in targeted and tailored therapies strengthen adoption among elderly patients

- Expanding use of combination treatments reshapes oncology care for seniors

Retail Pharmacies Remain the Largest Distribution Channel

Retail pharmacies capture the majority share of distribution due to convenience, accessibility, and the availability of pharmacists for guidance. Older patients often prefer in-person interactions, making pharmacies essential for medication adherence and prescription renewals.

- Strong patient trust in retail pharmacies ensures continued dominance

- Pharmacist counseling supports safe medication management for multi-prescription users

- Integration into local communities reinforces their role as primary access points

Online Pharmacies Exhibit the Fastest Growth

Online pharmacies are emerging as the fastest-growing channel, driven by delivery convenience, mobility limitations among seniors, and increasing digital adoption. Features such as automatic refills and competitive pricing attract elderly patients and their caregivers, signaling a long-term structural shift.

- Home delivery of prescriptions appeals to elderly patients with mobility challenges

- Wider selection and cost advantages drive adoption of online channels

- Digital familiarity among seniors and caregivers accelerates acceptance of online pharmacies

Competitive Analysis

The competitive structure of the geriatric medicines market is straightforward, indicating an ongoing effort to create new drugs to treat diseases that afflict the elderly. There is a surge of interest from research groups and businesses, especially in s chronic diseases that affect the elderly, including heart problems and Alzheimer’s. This is inclusive of the new dosages that are being developed to aid the elderly, which include dosages in one pill and other simpler methods of administration.

A primary consideration in determining competition is the entry into new developed markets. With the growing number of elderly people in the Asia Pacific and Latin America regions, companies are also looking to establish a foothold in these markets. This could mean crafting local partnerships and building distribution channels, as well as tailoring dosages to meet the health and economic demands of these areas. There is now a wider number of patients and a growing need for care, especially for the elderly.

Another significant aspect of competition encompasses mergers and acquisitions. Companies routinely purchase smaller, specialized firms to gain their novel technologies, promising drug pipelines, or specific therapeutic knowledge. This enables them to swiftly enhance their product offerings and reinforce their market position in critical disease areas. These moves strategically assist companies in dealing with competition and with ever-changing requirements from the aging population.

Key Players in the Market

- AstraZeneca

- Merck & Co Inc.

- Pfizer Inc.

- Novartis AG

- Bristol-Myers Squibb Company

- Sanofi S.A.

- GlaxoSmithKline Plc.

- Eli Lilly and Company

- Abbott Laboratories

- Boehringer Ingelheim GmbH

Recent Developments

- In August 2025, Merck announced that a late-stage clinical trial for its drug KEYTRUDA met its primary goal in treating patients with muscle-invasive bladder cancer.

- In July 2025, Sanofi announced the completion of its acquisition of Blueprint Medicines.

Segmentation of Geriatric Medicines Market

-

By Therapeutic Category :

- Analgesic

- Anti-Hypertensive

- Statin

- Anti-Diabetic

- Proton Pump Inhibitor

- Anticoagulant

- Anti-Psychotic

- Anti-Depressant

-

By Condition :

- Cardiovascular Ailments

- Arthritis

- Diabetes

- Neurological Disorders

- Cancer

- Osteoporosis

- Respiratory Disorders

- Others

-

By Distribution Channel :

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Units Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Therapeutic Category

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Units Analysis By Therapeutic Category, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Analysis and Forecast By Therapeutic Category, 2025-2035

- Analgesic

- Anti-Hypertensive

- Anti-Diabetic

- Proton Pump Ihibitor

- Anticoagulant

- Anti-Psychotic

- Anti-Depressant

- Y-o-Y Growth Trend Analysis By Therapeutic Category, 2020-2024

- Absolute $ Opportunity Analysis By Therapeutic Category, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Condition

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Units Analysis By Condition, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Analysis and Forecast By Condition, 2025-2035

- Cardiovascular Ailments

- Arthritis

- Diabetes

- Neurological Disorders

- Cancer

- Osteoporosis

- Respiratory Disorders

- Others

- Y-o-Y Growth Trend Analysis By Condition, 2020-2024

- Absolute $ Opportunity Analysis By Condition, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Distribution Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Units Analysis By Distribution Channel, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Analysis and Forecast By Distribution Channel, 2025-2035

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Y-o-Y Growth Trend Analysis By Distribution Channel, 2020-2024

- Absolute $ Opportunity Analysis By Distribution Channel, 2025-2035

- Global Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Units Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Units Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- Latin America Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- Western Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- U.K.

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Europe

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- Eastern Europe Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- East Asia Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- South Asia & Pacific Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Res of South Asia & Pacific

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- Middle East & Africa Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Therapeutic Category

- By Condition

- By Distribution Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Key Takeaways

- Key Countries Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- U.K.

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Nordic

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- BENELUX

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Balkan & Baltics

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Therapeutic Category

- By Condition

- By Distribution Channel

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Therapeutic Category

- By Condition

- By Distribution Channel

- Competition Analysis

- Competition Deep Dive

- AstraZeneca

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Merck & Co Inc.

- Pfizer Inc.

- Novartis AG

- Bristol-Myers Squibb Company

- Sanofi S.A.

- AstraZeneca

- Assumptions & Acronyms Used

- Research Methodology

- Competition Deep Dive

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Units Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 4: Global Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 6: Global Market Units Forecast by Condition, 2020 to 2035

- Table 7: Global Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 8: Global Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 10: North America Market Units Forecast by Country, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 12: North America Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 13: North America Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 14: North America Market Units Forecast by Condition, 2020 to 2035

- Table 15: North America Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 16: North America Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 18: Latin America Market Units Forecast by Country, 2020 to 2035

- Table 19: Latin America Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 20: Latin America Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 21: Latin America Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 22: Latin America Market Units Forecast by Condition, 2020 to 2035

- Table 23: Latin America Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 24: Latin America Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 25: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Western Europe Market Units Forecast by Country, 2020 to 2035

- Table 27: Western Europe Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 28: Western Europe Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 29: Western Europe Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 30: Western Europe Market Units Forecast by Condition, 2020 to 2035

- Table 31: Western Europe Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 32: Western Europe Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 33: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 34: Eastern Europe Market Units Forecast by Country, 2020 to 2035

- Table 35: Eastern Europe Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 36: Eastern Europe Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 37: Eastern Europe Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 38: Eastern Europe Market Units Forecast by Condition, 2020 to 2035

- Table 39: Eastern Europe Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 40: Eastern Europe Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 41: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 42: East Asia Market Units Forecast by Country, 2020 to 2035

- Table 43: East Asia Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 44: East Asia Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 45: East Asia Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 46: East Asia Market Units Forecast by Condition, 2020 to 2035

- Table 47: East Asia Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 48: East Asia Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 49: South Asia & Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 50: South Asia & Pacific Market Units Forecast by Country, 2020 to 2035

- Table 51: South Asia & Pacific Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 52: South Asia & Pacific Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 53: South Asia & Pacific Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 54: South Asia & Pacific Market Units Forecast by Condition, 2020 to 2035

- Table 55: South Asia & Pacific Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 56: South Asia & Pacific Market Units Forecast by Distribution Channel, 2020 to 2035

- Table 57: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 58: Middle East & Africa Market Units Forecast by Country, 2020 to 2035

- Table 59: Middle East & Africa Market Value (USD Bn) Forecast by Therapeutic Category, 2020 to 2035

- Table 60: Middle East & Africa Market Units Forecast by Therapeutic Category, 2020 to 2035

- Table 61: Middle East & Africa Market Value (USD Bn) Forecast by Condition, 2020 to 2035

- Table 62: Middle East & Africa Market Units Forecast by Condition, 2020 to 2035

- Table 63: Middle East & Africa Market Value (USD Bn) Forecast by Distribution Channel, 2020 to 2035

- Table 64: Middle East & Africa Market Units Forecast by Distribution Channel, 2020 to 2035

List Of Figures

- Figure 1: Global Market Units Forecast 2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast 2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Therapeutic Category

- Figure 7: Global Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Condition

- Figure 10: Global Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Distribution Channel

- Figure 13: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 14: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 15: Global Market Attractiveness Analysis by Region

- Figure 16: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 21: South Asia & Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 22: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 23: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 24: North America Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Therapeutic Category

- Figure 27: North America Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 28: North America Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 29: North America Market Attractiveness Analysis by Condition

- Figure 30: North America Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 31: North America Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 32: North America Market Attractiveness Analysis by Distribution Channel

- Figure 33: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 34: Latin America Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 35: Latin America Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 36: Latin America Market Attractiveness Analysis by Therapeutic Category

- Figure 37: Latin America Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 38: Latin America Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 39: Latin America Market Attractiveness Analysis by Condition

- Figure 40: Latin America Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 41: Latin America Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 42: Latin America Market Attractiveness Analysis by Distribution Channel

- Figure 43: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 44: Western Europe Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 45: Western Europe Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 46: Western Europe Market Attractiveness Analysis by Therapeutic Category

- Figure 47: Western Europe Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 48: Western Europe Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 49: Western Europe Market Attractiveness Analysis by Condition

- Figure 50: Western Europe Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 51: Western Europe Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 52: Western Europe Market Attractiveness Analysis by Distribution Channel

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 54: Eastern Europe Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 55: Eastern Europe Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 56: Eastern Europe Market Attractiveness Analysis by Therapeutic Category

- Figure 57: Eastern Europe Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 58: Eastern Europe Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 59: Eastern Europe Market Attractiveness Analysis by Condition

- Figure 60: Eastern Europe Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 61: Eastern Europe Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 62: Eastern Europe Market Attractiveness Analysis by Distribution Channel

- Figure 63: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 64: East Asia Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 65: East Asia Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 66: East Asia Market Attractiveness Analysis by Therapeutic Category

- Figure 67: East Asia Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 68: East Asia Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 69: East Asia Market Attractiveness Analysis by Condition

- Figure 70: East Asia Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 71: East Asia Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 72: East Asia Market Attractiveness Analysis by Distribution Channel

- Figure 73: South Asia & Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 74: South Asia & Pacific Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 75: South Asia & Pacific Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 76: South Asia & Pacific Market Attractiveness Analysis by Therapeutic Category

- Figure 77: South Asia & Pacific Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 78: South Asia & Pacific Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 79: South Asia & Pacific Market Attractiveness Analysis by Condition

- Figure 80: South Asia & Pacific Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 81: South Asia & Pacific Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 82: South Asia & Pacific Market Attractiveness Analysis by Distribution Channel

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 84: Middle East & Africa Market Value Share and BPS Analysis by Therapeutic Category, 2025 and 2035

- Figure 85: Middle East & Africa Market Y-o-Y Growth Comparison by Therapeutic Category, 2025 to 2035

- Figure 86: Middle East & Africa Market Attractiveness Analysis by Therapeutic Category

- Figure 87: Middle East & Africa Market Value Share and BPS Analysis by Condition, 2025 and 2035

- Figure 88: Middle East & Africa Market Y-o-Y Growth Comparison by Condition, 2025 to 2035

- Figure 89: Middle East & Africa Market Attractiveness Analysis by Condition

- Figure 90: Middle East & Africa Market Value Share and BPS Analysis by Distribution Channel, 2025 and 2035

- Figure 91: Middle East & Africa Market Y-o-Y Growth Comparison by Distribution Channel, 2025 to 2035

- Figure 92: Middle East & Africa Market Attractiveness Analysis by Distribution Channel

- Figure 93: Global Market - Tier Structure Analysis

- Figure 94: Global Market - Company Share Analysis

- FAQs -

What is the Global Geriatric Medicines Market size in 2025?

The geriatric medicines market is valued at USD 934.8 million in 2025.

Who are the Major Players Operating in the Geriatric Medicines Market?

Prominent players in the market include Bristol-Myers Squibb Company, Sanofi S.A., GlaxoSmithKline Plc.; Eli Lilly and Company, Abbott Laboratories, and Boehringer Ingelheim GmbH.

What is the Estimated Valuation of the Geriatric Medicines Market by 2035?

The market is expected to reach a valuation of USD 1,596.8 million by 2035.

At what CAGR is the Geriatric Medicines Market slated to grow during the study period?

The growth rate of the geriatric medicines market is 5.5% from 2025-2035.