Multi-Stress Resilience Focused Nutrient Blend Market

Multi-Stress Resilience Focused Nutrient Blend Market Size and Share Forecast Outlook 2026 to 2036

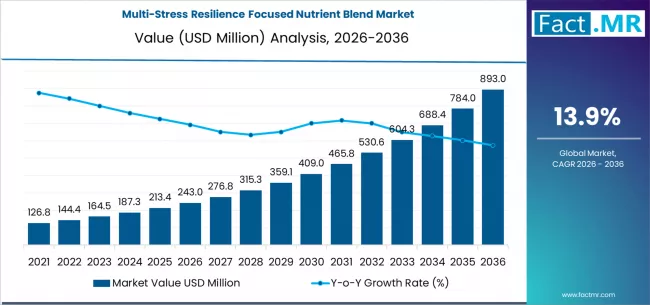

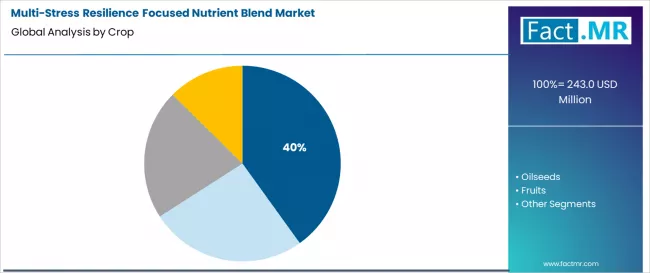

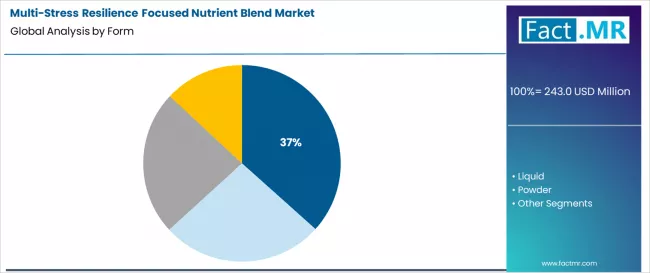

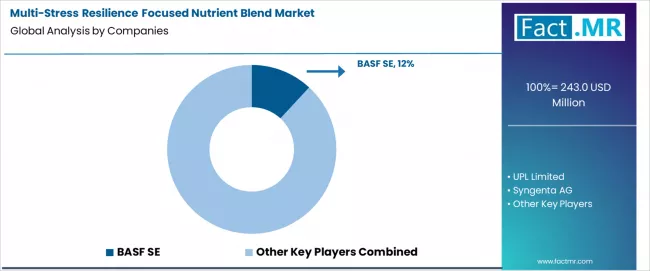

Multi-stress resilience focused nutrient blend market is projected to grow from USD 243.0 million in 2026 to USD 893.0 million by 2036, at a CAGR of 13.9%. Cereals will dominate with a 40.1% market share, while granular will lead the form segment with a 36.6% share.

Multi-Stress Resilience Focused Nutrient Blend Market Forecast and Outlook 2026 to 2036

The global market for multi-stress resilience focused nutrient blends is projected to grow from USD 243.01 million in 2026 to USD 893.01 million by 2036, advancing at a CAGR of 13.9%. This market represents the next frontier in plant nutrition, moving beyond addressing single nutrient deficiencies toward engineered formulations that enhance a crop's innate capacity to tolerate concurrent abiotic and biotic stresses.

Key Takeaways from the Multi-Stress Resilience Focused Nutrient Blend Market

- Market Value for 2026: USD 243.01 Million

- Market Value for 2036: USD 893.01 Million

- Forecast CAGR (2026-2036): 13.9%

- Leading Crop Type Segment (2026): Cereals (40%)

- Leading Form Segment (2026): Granular (37%)

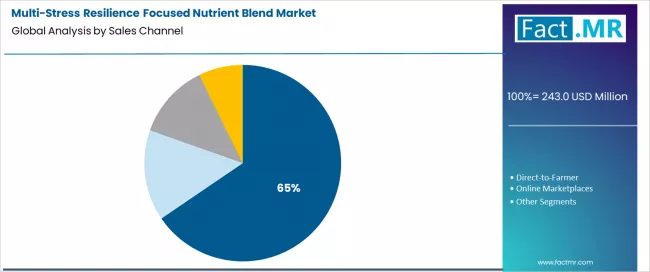

- Leading Sales Channel Segment (2026): Ag-Retailers (65%)

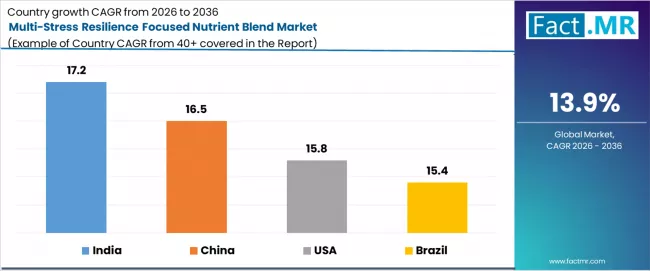

- Key Growth Countries: India (17.2% CAGR), China (16.5% CAGR), USA (15.8% CAGR), Brazil (15.4% CAGR)

- Key Players in the Market: BASF SE, UPL Limited, Syngenta AG, Nutrien, Yara International ASA

These specialized blends are designed to mitigate the compounded yield losses caused by combinations of drought, heat, salinity, and pest or disease pressure, which are becoming more frequent and severe due to climate volatility.

Growth is propelled by the escalating economic impact of climate-induced yield instability and the limitations of traditional crop protection and nutrition strategies. Farmers face unpredictable seasons where multiple stressors converge, demanding a more holistic plant health approach.

These resilience blends typically integrate essential macronutrients with specific micronutrients, signaling compounds like silicon or selenium, and biostimulants that activate systemic acquired resistance and antioxidant pathways. This systemic fortification helps maintain physiological function and yield potential under sub-optimal growing conditions, protecting significant input investments.

The market’s evolution is centered on advanced plant physiology and predictive stress modeling. Success depends on developing scientifically validated formulations that deliver measurable improvements in field performance under real-world, multi-stress scenarios.

This requires deep collaboration between plant scientists, nutritionists, and farmers to create adaptable solutions that build crop resilience into the foundation of production systems, offering a proactive risk management tool for an uncertain agricultural future.

Metric

| Metric | Value |

|---|---|

| Market Value (2026) | USD 243.01 Million |

| Market Forecast Value (2036) | USD 893.01 Million |

| Forecast CAGR (2026-2036) | 13.9% |

Category

| Category | Segments |

|---|---|

| Crop Type | Cereals, Oilseeds, Fruits, Vegetables |

| Form | Granular, Liquid, Powder, Suspension |

| Sales Channel | Ag-Retailers, Direct-to-Farmer, Online Marketplaces, Cooperatives |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, MEA |

Segmental Analysis

By Crop Type, Which Systems Face the Most Complex Stress Combinations?

Cereals, while showing a 40% share, is critically important for its vast acreage and vulnerability. Crops like corn, wheat, and rice often experience heat during flowering coupled with water stress or disease pressure.

The economic scale of loss from these concurrent stresses drives investment in resilience blends. These products aim to stabilize critical yield components like grain filling and standability under pressure, offering a risk management tool for the world's most extensive cropping systems.

By Form, Which Provides Stability for Complex Formulations?

Granular form leads with a 37% share. The processing of granular blends allows for the homogeneous integration of diverse components from potassium and zinc to silicon and microbial metabolites into a stable, slow-release matrix.

This ensures consistent availability of resilience-inducing elements throughout key stress periods. Granular application also aligns with standard broadacre equipment, facilitating adoption without requiring major changes to existing farm logistics.

By Sales Channel, Where is Stress-Specific Agronomy Critical?

Ag-retailers dominate as the sales channel, holding a commanding 65% share. Diagnosing the predominant and interacting stresses in a local area requires expert, field-level agronomy. Retailer consultants are essential for recommending the correct blend based on the season's stress profile. Their trusted advisory role is crucial for matching a complex product to a specific, dynamic field challenge.

What are the Drivers, Restraints, and Key Trends of the Multi-Stress Resilience Focused Nutrient Blend Market?

The paramount driver is the observed increase in the frequency of compound climate extremes that overwhelm single-mode solutions. The rising economic cost of crop failure and the need to maintain productivity on marginal lands further propel demand. Advances in plant omics and stress physiology provide the scientific backbone for formulating effective blends, while digital agriculture tools help predict stress events and time applications for maximum benefit.

A major restraint is the higher per-unit cost of these advanced blends compared to standard fertilizers, requiring clear proof of return on investment. The complexity of field testing under naturally variable multi-stress conditions can also make it challenging to generate consistent, replicable performance data, potentially slowing farmer confidence and adoption. Regulatory pathways for novel, multi-functional nutrient products can also be ambiguous in some regions.

Key trends include the development of stress-signature specific blends, tailored to regional patterns like terminal heat and saline soils or excessive rainfall and root disease. Integration with digital stress monitoring platforms is rising, using satellite and sensor data to trigger applications. There is also a strong trend toward combining nutritional and biological resilience inducers in a single product, offering a synergistic plant health solution.

Analysis of the Multi-Stress Resilience Focused Nutrient Blend Market by Key Countries

| Country | CAGR (2026-2036) |

|---|---|

| India | 17.2% |

| China | 16.5% |

| USA | 15.8% |

| Brazil | 15.4% |

How is India's Extreme Climate and Smallholder Vulnerability Catalyzing Demand?

India’s leading CAGR of 17.2% is driven by its agriculture's exposure to extreme combinations of heat, drought, and erratic monsoons. The vulnerability of millions of smallholders to climate shocks creates a powerful need for accessible risk-mitigation tools.

Government and NGO programs promoting climate-resilient farming are increasingly highlighting balanced nutrition and soil health as foundational strategies, driving awareness and creating a vast potential market for stress-resilience blends tailored to local crops like rice, wheat, and pulses.

What is the Impact of China's Intensive Agriculture and Environmental Stresses?

China’s 16.5% growth reflects the intense pressures on its high-productivity systems, including soil salinity, recurring drought in the north, and heat stress. The national push for green development and sustainable intensification supports technologies that maintain yields with fewer inputs under stress.

State-backed agricultural research actively develops and promotes stress-tolerant practices and inputs, creating a conducive environment for the adoption of advanced resilience-focused nutrient strategies.

Why is the USA's High-Value Cropping and Risk Management a Key Driver?

The USA’s 15.8% growth is fueled by the high capital intensity of its farming and the prevalence of crop insurance. Farmers are incentivized to adopt practices that stabilize yields and reduce claim risks.

In regions like the Plains and the Midwest, multi-stress blends are positioned as yield-loss mitigation tools. The strong private sector R&D and extensive distribution network facilitate rapid innovation and market penetration.

How is Brazil's Tropical Agriculture and Expansion Frontier Influencing the Market?

Brazil’s 15.4% CAGR is linked to the unique stresses of its tropical and Cerrado agriculture, including aluminum toxicity, low soil organic matter, and variable rainfall. As production expands into more challenging environments, the demand for inputs that help crops overcome these compounded barriers grows. Brazilian farmers are early adopters of integrated management, making them receptive to innovative nutrient blends that address multiple constraints simultaneously, particularly in high-value soy and maize production.

Competitive Landscape of the Multi-Stress Resilience Focused Nutrient Blend Market

Global agriscience companies with deep R&D capabilities in plant physiology and formulation science define the competitive landscape. Competition is intense around proprietary blends, protected ingredient technologies such as specific chelates or biostimulant compounds, and robust field validation data across diverse stress environments.

Success requires building strong technical partnerships with agricultural universities for independent trialing and developing a compelling narrative that connects product use to tangible risk reduction and yield stability for farmers.

Key Players in the Multi-Stress Resilience Focused Nutrient Blend Market

- BASF SE

- UPL Limited

- Syngenta AG

- Nutrien

- Yara International ASA

Scope of Report

| Items | Values |

|---|---|

| Quantitative Units | USD Million |

| Crop Type | Cereals, Oilseeds, Fruits, Vegetables |

| Form | Granular, Liquid, Powder, Suspension |

| Sales Channel | Ag-Retailers, Direct-to-Farmer, Online Marketplaces, Cooperatives |

| Key Countries | USA, China, India, Brazil |

| Key Companies | BASF SE, UPL Limited, Syngenta AG, Nutrien, Yara International ASA |

| Additional Analysis | Physiological mode-of-action analysis for key blend components; meta-analysis of yield stability data under combined stress; economic modeling of ROI in high-risk vs. stable environments; review of breeding programs for stress tolerance and their interaction with nutrition; regulatory landscape for multi-functional nutrient products. |

Market by Segments

-

Crop Type :

- Cereals

- Oilseeds

- Fruits

- Vegetables

-

Form :

- Granular

- Liquid

- Powder

- Suspension

-

Sales Channel :

- Ag-Retailers

- Direct-to-Farmer

- Online Marketplaces

- Cooperatives

-

Region :

-

North America

- USA

- Canada

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Western Europe

- Germany

- UK

- France

- Spain

- Italy

- BENELUX

- Rest of Western Europe

-

Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

-

East Asia

- China

- Japan

- South Korea

- Rest of East Asia

-

South Asia & Pacific

- India

- ASEAN

- Australia

- Rest of South Asia & Pacific

-

MEA

- Saudi Arabia

- UAE

- Turkiye

- Rest of MEA

-

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2021 to 2025 and Forecast, 2026 to 2036

- Historical Market Size Value (USD Million) Analysis, 2021 to 2025

- Current and Future Market Size Value (USD Million) Projections, 2026 to 2036

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2021 to 2025 and Forecast 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Crop

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Crop, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Crop, 2026 to 2036

- Cereals

- Oilseeds

- Fruits

- Vegetables

- Cereals

- Y to o to Y Growth Trend Analysis By Crop, 2021 to 2025

- Absolute $ Opportunity Analysis By Crop, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Form, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Form, 2026 to 2036

- Granular

- Liquid

- Powder

- Suspension

- Granular

- Y to o to Y Growth Trend Analysis By Form, 2021 to 2025

- Absolute $ Opportunity Analysis By Form, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Sales Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Sales Channel, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Sales Channel, 2026 to 2036

- Ag-Retailers

- Direct-to-Farmer

- Online Marketplaces

- Cooperatives

- Ag-Retailers

- Y to o to Y Growth Trend Analysis By Sales Channel, 2021 to 2025

- Absolute $ Opportunity Analysis By Sales Channel, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2021 to 2025

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2026 to 2036

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- USA

- Canada

- Mexico

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Latin America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Western Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Eastern Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- East Asia Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- China

- Japan

- South Korea

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- South Asia and Pacific Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Middle East & Africa Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Canada

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Mexico

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Brazil

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Chile

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Germany

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- UK

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Italy

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Spain

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- France

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- India

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- China

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Japan

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- South Korea

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Russia

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Poland

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Hungary

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- South Africa

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Crop

- By Form

- By Sales Channel

- Competition Analysis

- Competition Deep Dive

- BASF SE

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- UPL Limited

- Syngenta AG

- Nutrien

- Yara International ASA

- BASF SE

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2021 to 2036

- Table 2: Global Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 3: Global Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 4: Global Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 5: North America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 6: North America Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 7: North America Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 8: North America Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 10: Latin America Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 11: Latin America Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 12: Latin America Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 14: Western Europe Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 15: Western Europe Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 16: Western Europe Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 22: East Asia Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 23: East Asia Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 24: East Asia Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2021 to 2036

- Figure 3: Global Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 4: Global Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 5: Global Market Attractiveness Analysis by Crop

- Figure 6: Global Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 7: Global Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 8: Global Market Attractiveness Analysis by Form

- Figure 9: Global Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 10: Global Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 11: Global Market Attractiveness Analysis by Sales Channel

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2026 and 2036

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2026 to 2036

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 23: North America Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 24: North America Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 25: North America Market Attractiveness Analysis by Crop

- Figure 26: North America Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 27: North America Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 28: North America Market Attractiveness Analysis by Form

- Figure 29: North America Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 30: North America Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 31: North America Market Attractiveness Analysis by Sales Channel

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 33: Latin America Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 35: Latin America Market Attractiveness Analysis by Crop

- Figure 36: Latin America Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 38: Latin America Market Attractiveness Analysis by Form

- Figure 39: Latin America Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 41: Latin America Market Attractiveness Analysis by Sales Channel

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 43: Western Europe Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 45: Western Europe Market Attractiveness Analysis by Crop

- Figure 46: Western Europe Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 48: Western Europe Market Attractiveness Analysis by Form

- Figure 49: Western Europe Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 51: Western Europe Market Attractiveness Analysis by Sales Channel

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 55: Eastern Europe Market Attractiveness Analysis by Crop

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 58: Eastern Europe Market Attractiveness Analysis by Form

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 61: Eastern Europe Market Attractiveness Analysis by Sales Channel

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 63: East Asia Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 65: East Asia Market Attractiveness Analysis by Crop

- Figure 66: East Asia Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 68: East Asia Market Attractiveness Analysis by Form

- Figure 69: East Asia Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 71: East Asia Market Attractiveness Analysis by Sales Channel

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Crop

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Form

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Sales Channel

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Crop

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Sales Channel

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the multi-stress resilience focused nutrient blend market in 2026?

The global multi-stress resilience focused nutrient blend market is estimated to be valued at USD 243.0 million in 2026.

What will be the size of multi-stress resilience focused nutrient blend market in 2036?

The market size for the multi-stress resilience focused nutrient blend market is projected to reach USD 893.0 million by 2036.

How much will be the multi-stress resilience focused nutrient blend market growth between 2026 and 2036?

The multi-stress resilience focused nutrient blend market is expected to grow at a 13.9% CAGR between 2026 and 2036.

What are the key product types in the multi-stress resilience focused nutrient blend market?

The key product types in multi-stress resilience focused nutrient blend market are cereals, oilseeds, fruits and vegetables.

Which form segment to contribute significant share in the multi-stress resilience focused nutrient blend market in 2026?

In terms of form, granular segment to command 36.6% share in the multi-stress resilience focused nutrient blend market in 2026.