Wearable Air Conditioner Market

Wearable Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

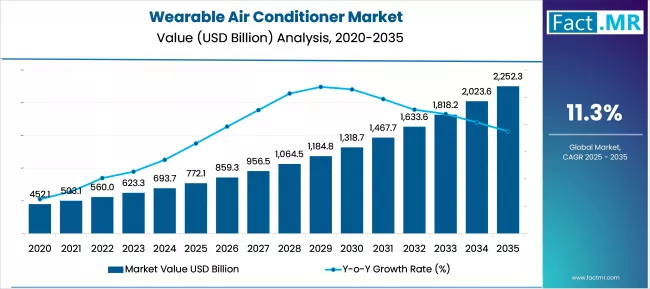

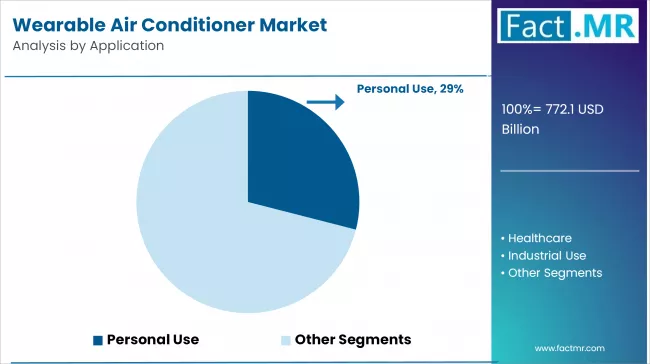

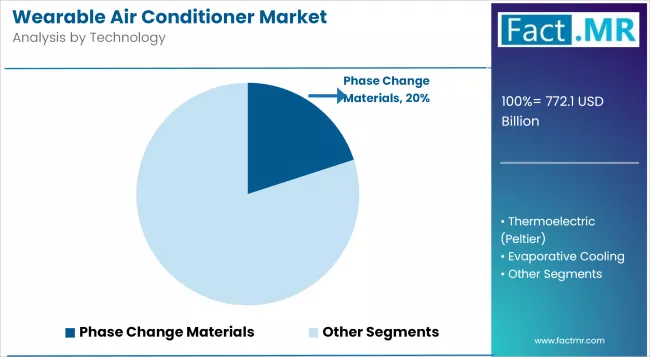

The global wearable air conditioner market is forecasted to reach USD 772.1 billion in 2025, and further to USD 2,244.5 billion by 2035, expanding at an 11.3% CAGR. In the wearable air conditioner market, personal use is projected to be the leading application segment, with thermoelectric (Peltier) technology serving as the key technology segment.

Wearable Air Conditioner Market Forecast Outlook 2025 to 2035

The global wearable air conditioner market is projected to increase from USD 772.1 billion in 2025 to USD 2,244.5 billion by 2035, with a CAGR of 11.3% during the forecast period. Rising global temperatures, frequent heatwaves, and increased consumer demand for personal comfort are propelling the wearable air conditioner market. Advances in battery and thermoelectric technologies enable portable, efficient cooling, driving adoption for outdoor, workplace, and recreational settings.

Quick Stats of Wearable Air Conditioner Market

- Wearable Air Conditioner Market Size (2025): USD 772.1 billion

- Projected Wearable Air Conditioner Market Size (2035): USD 2,244.5 billion

- Forecast CAGR of Wearable Air Conditioner Market (2025 to 2035): 11.3%

- Leading Application Segment of Wearable Air Conditioner Market: Personal Use

- Leading Technology Segment of Wearable Air Conditioner Market: Thermoelectric (Peltier)

- Key Growth Regions of Wearable Air Conditioner Market: China, United States, India

- Prominent Players in the Wearable Air Conditioner Market: Blaux, Embrlabs, G2T, Hobby Colin, IYunLife, Moocii, NORMIA RITA, and Others.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 772.1 billion |

| Industry Size (2035F) | USD 2,244.5 billion |

| CAGR (2025-2035) | 11.3% |

The global wearable air conditioner market is expected to grow significantly, from USD 772.1 billion in 2025 to USD 2,244.5 billion by 2035, at a CAGR of 11.3%. This strong growth is driven by rising global temperatures and the increasing frequency of heatwaves, prompting both consumers and businesses to seek personal cooling solutions.

The market is expected to grow steadily to USD 859.0 billion in 2026, USD 955.8 billion in 2027, and USD 1,063.4 billion in 2028, reflecting the growing adoption of wearable air conditioners in urban and high-heat regions.

Advancements in battery and thermoelectric technologies are hastening market growth by improving efficiency, portability, and user experience. By 2029, the market is expected to reach USD 1,183.2 billion, followed by USD 1,316.4 billion in 2030 and USD 1,464.7 billion in 2031, as industries such as construction, agriculture, and delivery adopt wearable cooling solutions to reduce worker heat stress.

Rising consumer awareness of heat-related health risks, as well as the demand for comfort in outdoor and commuting environments, are also driving long-term growth, with the market expected to reach USD 1,629.6 billion by 2032.

The market is expected to grow due to lifestyle trends that emphasize outdoor activities and mobility, with projections of USD 1,813.1 billion in 2033, USD 2,017.3 billion in 2034, and USD 2,244.5 billion by 2035.

Despite challenges such as high device costs, short battery life, and stringent regulatory and safety compliance requirements, the market presents significant opportunities for innovation, particularly in regions with rising temperatures and heightened health awareness.

As consumers and industries prioritize comfort, efficiency, and portability, wearable air conditioners are poised to become a key component of personal cooling solutions globally.

Key Wearable Air Conditioner Market Dynamics

The market for wearable air conditioners is mostly driven by the need for personal cooling solutions, which has increased due to frequent heatwaves and rising global temperatures. Customers are increasingly seeking portable electronics that provide convenience and comfort in outdoor, office, and commuting settings.

The performance of wearable air conditioners has been further enhanced by technological advancements, particularly in the areas of thermoelectric cooling and battery efficiency, which have increased their utility and appeal.

Nevertheless, the market is subject to certain limitations, such as the comparatively high price of these devices, which may prevent price-conscious consumers from adopting them. Additionally, issues such as portability and short battery life, as well as the need to comply with strict safety and regulatory requirements, continue to hinder market expansion and scalability.

Rising Global Temperatures and Frequent Heatwaves

Rising global temperatures and frequent heatwaves are driving the growth of the wearable air conditioner market. With climate change contributing to increasingly extreme weather events, consumers are seeking personal cooling solutions to stay comfortable and mitigate heat-related health risks. Outdoor workers, commuters, and urban dwellers are increasingly preferring wearable devices that provide instant cooling without relying on traditional air conditioning.

These devices are especially beneficial in areas with long summers, providing relief during work, travel, and leisure activities. The growing awareness of the health and productivity consequences of heat fuels demand, making wearable air conditioners a practical and increasingly necessary solution.

Growing Demand for Personal Comfort and Portable Cooling Solutions

The growing demand for personal comfort and portable cooling solutions is another key driver. Modern lifestyles involve long hours in outdoor or poorly ventilated environments, prompting consumers to seek convenient, mobile devices that can regulate temperature individually.

Wearable air conditioners are lightweight, ergonomic, and adjustable, catering to individual preferences while offering a high degree of flexibility.

This trend is particularly strong among tech-savvy and wellness-conscious users who prioritize comfort, portability, and energy efficiency. The convenience of personal cooling on demand enhances consumer appeal and drives adoption in both professional and recreational settings.

Advances in Battery and Thermoelectric Technologies

Advances in battery and thermoelectric technologies are boosting market growth. Improvements in battery capacity and energy density allow wearable air conditioners to operate for longer periods while maintaining a lightweight form factor.

Thermoelectric cooling modules offer silent, efficient, and consistent temperature regulation without moving parts, thereby enhancing the user experience. Integration of smart technology, such as temperature control sensors and mobile connectivity, increases convenience and personalization.

These technological advancements make wearable air conditioners more reliable, efficient, and appealing to consumers, helping manufacturers overcome previous limitations and expand adoption across different demographics and geographic regions.

High Cost of Wearable Air Conditioner Devices

The high cost of wearable air conditioner devices remains a significant market constraint. Premium models with advanced thermoelectric modules, longer battery life, and ergonomic designs are frequently more expensive than traditional cooling solutions. Price sensitivity among consumers, especially in emerging markets, can limit widespread adoption.

Furthermore, the costs of research and development, as well as compliance with safety standards, contribute to increased retail prices. While prices are gradually falling due to technological advancements and mass production, affordability remains a barrier to broader market penetration, limiting the market to high-income segments and urban populations seeking personal comfort options.

Limited Battery Life and Portability Challenges

Limited battery life and portability issues further impede market growth. Despite technological advancements, many wearable air conditioners still only last a few hours before needing to be recharged, which may not be enough for full-day use. Users may find it inconvenient to have to replace batteries or recharge their devices frequently.

Additional concerns include portability and weight, as wearable devices must strike a balance between cooling efficiency, comfort, and usability. Bulkier designs and heavier modules reduce usability, especially for commuting or outdoor activities. These factors can impact consumer satisfaction, limiting adoption despite increased awareness and demand for personal cooling technologies.

Regulatory and Safety Compliance Requirements

Regulatory and safety compliance requirements are another significant impediment. Wearable air conditioners must comply with electrical safety standards, hazardous substance regulations, and energy efficiency standards in various countries. Manufacturers must ensure the safe performance of batteries to avoid hazards such as overheating and short circuits. Compliance can increase production costs and potentially delay product launches.

Additionally, specific workplace or public-use regulations may restrict the use of wearable devices in certain situations. Navigating these regulatory landscapes adds complexity for manufacturers and can limit market expansion, especially in regions with strict safety and environmental policies.

Analyzing the Wearable Air Conditioner Market by Key Regions

North America dominates the market, driven by the widespread adoption of wearable technologies, extreme summer weather, and demand from both consumers and industries.

Europe is experiencing steady growth, driven by increased awareness of personal cooling solutions, urban adoption, and the desire for comfort during increasingly hot summers.

Asia Pacific is expected to be the fastest-growing market, driven by rapid urbanization, a large consumer base, and increasing demand for portable cooling solutions in Japan, China, and India.

Latin America is experiencing a surge in demand for wearable air conditioners, particularly in Brazil and Mexico, where rising temperatures and the need for an outdoor workforce are driving the adoption of these devices.

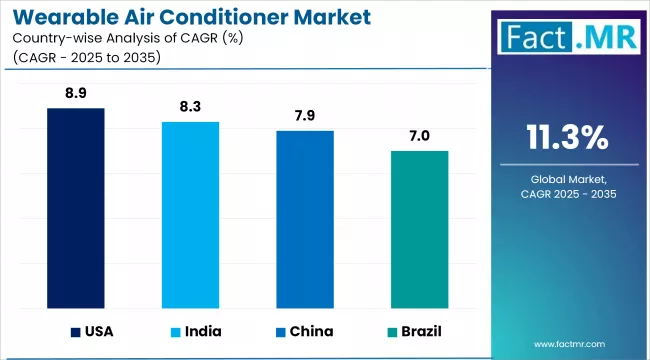

Country-Wise Outlook

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

| United States | 8.9% |

| India | 8.3% |

China Emerging as a Key Market for Wearable Cooling Devices

In China, rising summer temperatures and the urban heat island effect are driving up demand for personal cooling devices. Many city dwellers, outdoor workers, and commuters are looking for wearable solutions to stay cool without relying on centralized or room-based air conditioning systems. The country's dense population and growing middle class make portable cooling products appealing as part of a larger trend in comfort-oriented consumer electronics.

China's robust manufacturing ecosystem offers a significant competitive advantage in this market. Domestic companies are already experimenting with advanced wearable cooling systems, such as battery-powered cooling vests designed for protective gear that can maintain temperatures between 16 °C and 25°C for several hours. This reflects a focus on tailoring solutions to both consumer and industrial applications, while also highlighting large-scale innovation.

Regulatory policies governing energy efficiency and environmental standards influence product development. China's ban on hazardous substances and push for environmentally friendly refrigerants is encouraging manufacturers to develop safer and more sustainable wearable cooling technologies. This regulatory environment promotes higher product quality, enabling Chinese brands to compete in global markets.

Lifestyle changes, such as the rise of remote work, increased outdoor leisure activities, and greater awareness of heat-related health risks, are also driving demand. Consumers are prioritizing devices that offer customizable comfort, and rising disposable incomes have made premium products more affordable.

- Heat and urban density boost demand for wearable cooling

- China’s manufacturing drives innovation and scale

- Regulations and wellness trends favor eco-friendly devices

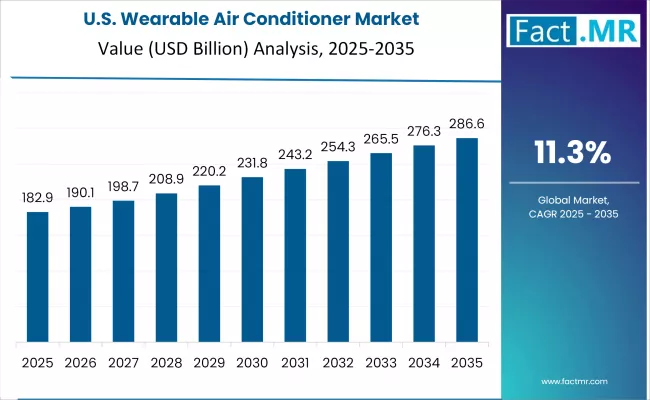

United States Sees Rising Demand for Wearable Cooling Amid Heatwave Risks

Rising summer heatwaves and the increasing frequency of extreme weather events in the United States are fueling interest in wearable air conditioning devices. Outdoor workers in industries such as construction, agriculture, and delivery services are significant consumers, as heat stress prevention has become a workplace safety priority.

Employers are incorporating wearable cooling systems into occupational safety programs to reduce risks and increase worker productivity. People are increasingly looking for portable cooling solutions for sports, outdoor recreation, and commuting. The popularity of personal wellness gadgets, combined with an active lifestyle culture, has made wearable cooling devices appealing to health-conscious buyers.

To meet demand, brands are using e-commerce platforms and direct-to-consumer sales strategies, with premium products providing quieter operation, longer battery life, and greater comfort.

U.S. regulatory oversight is heavily focused on battery-operated wearable safety standards and workplace compliance. Agencies such as OSHA have promoted heat illness prevention plans, prompting industries to adopt cutting-edge cooling technology. Consumer products must have electrical safety certifications and use environmentally friendly materials, which improves product quality and dependability.

- Heatwaves and safety needs fuel wearable cooling demand

- Wellness trends drive consumer adoption

- Strict standards push quality and innovation

India is Experiencing a Growing Demand for Wearable Cooling Devices

In India, rising summer temperatures and frequent heatwaves are driving demand for wearable air conditioning devices. The India Meteorological Department reports that extreme heat events are becoming more common, especially between April and June, with several regions experiencing severe heatwave conditions. Outdoor workers in agriculture, construction, and transportation are particularly vulnerable, making portable cooling solutions extremely useful.

Heat-related productivity declines are significant. According to the International Labour Organization, heat stress costs India 4.3% of its working hours in 1995, a figure that is expected to rise as temperatures rise.

To address this, the government has implemented Heat Action Plans in 23 states, which include early warnings, health advisories, and public awareness campaigns to help mitigate the effects of extreme heat.

Wearable air conditioners are gaining popularity as people become more aware of the health risks associated with heat. These devices offer a portable, energy-efficient alternative to traditional air conditioning, making them ideal for use in the workplace, outdoors, and during daily commutes.

The market is expanding as domestic and international companies introduce products tailored to Indian conditions, with affordability, durability, and ease of use being important factors.

Government initiatives, such as "Make in India," promote local manufacturing and innovation, enabling startups to develop and market wearable cooling solutions. With rising disposable incomes and lifestyle changes, India is a high-potential market for personal cooling technologies.

- Heatwaves and outdoor work drive wearable cooling demand

- Productivity losses and safety plans increase the need

- Local manufacturing and rising incomes support market growth

Category-wise Analysis

Personal Use Wearable Neck Air Conditioners Driving Market Growth

Personal wearable neck air conditioners are expected to be the dominant segment, accounting for a 29% market share by 2025. These devices are primarily intended for individual use, with lightweight, ergonomic designs and adjustable cooling settings.

The growing trend of remote working has increased interest in outdoor recreational activities, and greater awareness of personal well-being have all contributed to an increase in demand for personal wearable neck air conditioners.

Consumers are increasingly seeking solutions that offer immediate relief from heat without the limitations of traditional air-conditioning systems, making personal devices very appealing.

- Personal wearable neck ACs are set to lead the market

- Demand is driven by remote work, outdoor activities, and wellness awareness

- Consumers prefer portable cooling solutions over traditional AC systems

Thermoelectric Cooling Technology Driving Premium Comfort Solutions

Thermoelectric cooling technology, which uses the Peltier effect to transfer heat away from the body, is gaining popularity due to its ability to provide fast and consistent cooling without the use of moving parts. This technology is particularly popular in premium and high-performance models because it provides quiet operation and precise temperature control.

The miniaturization of thermoelectric modules, as well as advances in battery technology, have increased the feasibility and efficiency of these devices, making them a more popular choice among consumers looking for superior comfort

- Peltier-effect tech offers fast, consistent cooling without moving parts

- Quiet, precise temperature control drives demand in high-end models

Miniaturization and better batteries boost feasibility and adoption

Competitive Analysis

The wearable neck air conditioner market is characterized by intense competition, continuous innovation, and a dynamic landscape of established players and new entrants. Leading companies continually invest in R&D to enhance product performance, reduce costs, and introduce new features that differentiate their offerings in a crowded market.

Brand reputation, technological expertise, and distribution capabilities are all key factors in determining a company's competitive positioning. The market is also witnessing a trend of strategic collaborations, mergers, and acquisitions aimed at expanding product portfolios, entering new markets, and leveraging complementary strengths.

Sony has been a pioneer in personal cooling technology, with the Reon Pocket series becoming well-known for its innovative thermoelectric cooling system and sleek design.

Toshiba and LG Electronics have combined their expertise in consumer electronics to create advanced wearable cooling devices with intelligent features and extended battery life.

These companies are actively expanding their product portfolios, investing in sustainability initiatives, and exploring new application areas to capitalize on emerging opportunities. Strategic partnerships with retailers, sports organizations, and healthcare providers allow them to reach new customer segments and increase brand visibility.

Continuous innovation, customer-centric design, and a commitment to quality and reliability will remain key differentiators as competition intensifies and the market evolves.

Key Players in the Market

- Embr Labs

- Sony

- Blaux

- G2T

- Hobby Colin

- IYunLife

- Moocii

- NORMIA RITA

- Northfan

- TORRAS

- Vortec

- Toshiba

- Evapolar

- Coolala

- Zero Breeze

Recent Developments

- In May 2024, Sony unveiled Reon Pocket 5, a futuristic wearable air conditioner that can be discreetly tucked into a shirt. It utilises a thermos module and various sensors to detect your body temperature, humidity, and even motion. This data is then used to adjust the temperature, allowing for personalized cooling or heating on demand.

- In January 2024, TORRAS unveiled the COOLiFY Cyber, the next generation of its popular wearable air conditioner series. The COOLiFY Cyber is more than just a neck fan; it's a portable air conditioner designed to keep you cool while on the go. This device uses TORRAS's proprietary semiconductor technology and a powerful motor to provide an immediate cooling sensation on the back of your neck.

Segmentation of Wearable Air Conditioner Market

-

By Application :

- Personal Use

- Healthcare

- Industrial Use

- Others

-

By Technology :

- Phase Change Materials

- Thermoelectric (Peltier)

- Evaporative Cooling

- Hybrid Systems

- Others

-

By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Global Market Outlook

- Demand-side Trends

- Supply-side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Wearable Air Conditioner Market Analysis 2020-2024 and Forecast, 2025-2035

- Historical Market Size Value (USD Bn) & Units Analysis, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Projections, 2025-2035

- Y-o-Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Wearable Air Conditioner Market Pricing Analysis 2020-2024 and Forecast 2025-2035

- Global Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Application

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Units Analysis By Application, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Analysis and Forecast By Application, 2025-2035

- Personal Use

- Healthcare

- Industrial Use

- Others

- Y-o-Y Growth Trend Analysis By Application, 2020-2024

- Absolute $ Opportunity Analysis By Application, 2025-2035

- Global Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Technology

- Introduction / Key Findings

- Historical Market Size Value (USD Bn) & Units Analysis By Technology, 2020-2024

- Current and Future Market Size Value (USD Bn) & Units Analysis and Forecast By Technology, 2025-2035

- Phase Change Materials

- Thermoelectric (Peltier)

- Evaporative Cooling

- Hybrid Systems

- Others

- Y-o-Y Growth Trend Analysis By Technology, 2020-2024

- Absolute $ Opportunity Analysis By Technology, 2025-2035

- Global Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Region

- Introduction

- Historical Market Size Value (USD Bn) & Units Analysis By Region, 2020-2024

- Current Market Size Value (USD Bn) & Units Analysis and Forecast By Region, 2025-2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- U.S.

- Canada

- Mexico

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- Latin America Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- Western Europe Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Germany

- U.K.

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Europe

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- Eastern Europe Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltics

- Rest of Eastern Europe

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- East Asia Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- China

- Japan

- South Korea

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- South Asia & Pacific Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia & Pacific

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- Middle East & Africa Wearable Air Conditioner Market Analysis 2020-2024 and Forecast 2025-2035, By Country

- Historical Market Size Value (USD Bn) & Units Trend Analysis By Market Taxonomy, 2020-2024

- Market Size Value (USD Bn) & Units Forecast By Market Taxonomy, 2025-2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Application

- By Technology

- By Country

- Market Attractiveness Analysis

- By Country

- By Application

- By Technology

- Key Takeaways

- Key Countries Wearable Air Conditioner Market Analysis

- U.S.

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- U.K.

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Nordic

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- BENELUX

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Balkan & Baltics

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Application

- By Technology

- U.S.

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Application

- By Technology

- Competition Analysis

- Competition Deep Dive

- Embr Labs

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Sony

- Blaux

- G2T

- Hobby Colin

- IYunLife

- Moocii

- NORMIA RITA

- Northfan

- TORRAS

- Vortec

- Toshiba

- Evapolar

- Coolala

- Zero Breeze

- Embr Labs

- Assumptions & Acronyms Used

- Research Methodology

- Competition Deep Dive

List Of Table

- Table 1: Global Market Value (USD Bn) Forecast by Region, 2020 to 2035

- Table 2: Global Market Units Forecast by Region, 2020 to 2035

- Table 3: Global Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 4: Global Market Units Forecast by Application, 2020 to 2035

- Table 5: Global Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 6: Global Market Units Forecast by Technology, 2020 to 2035

- Table 7: North America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 8: North America Market Units Forecast by Country, 2020 to 2035

- Table 9: North America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 10: North America Market Units Forecast by Application, 2020 to 2035

- Table 11: North America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 12: North America Market Units Forecast by Technology, 2020 to 2035

- Table 13: Latin America Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 14: Latin America Market Units Forecast by Country, 2020 to 2035

- Table 15: Latin America Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 16: Latin America Market Units Forecast by Application, 2020 to 2035

- Table 17: Latin America Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 18: Latin America Market Units Forecast by Technology, 2020 to 2035

- Table 19: Western Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 20: Western Europe Market Units Forecast by Country, 2020 to 2035

- Table 21: Western Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 22: Western Europe Market Units Forecast by Application, 2020 to 2035

- Table 23: Western Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 24: Western Europe Market Units Forecast by Technology, 2020 to 2035

- Table 25: Eastern Europe Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 26: Eastern Europe Market Units Forecast by Country, 2020 to 2035

- Table 27: Eastern Europe Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 28: Eastern Europe Market Units Forecast by Application, 2020 to 2035

- Table 29: Eastern Europe Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 30: Eastern Europe Market Units Forecast by Technology, 2020 to 2035

- Table 31: East Asia Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 32: East Asia Market Units Forecast by Country, 2020 to 2035

- Table 33: East Asia Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 34: East Asia Market Units Forecast by Application, 2020 to 2035

- Table 35: East Asia Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 36: East Asia Market Units Forecast by Technology, 2020 to 2035

- Table 37: South Asia & Pacific Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 38: South Asia & Pacific Market Units Forecast by Country, 2020 to 2035

- Table 39: South Asia & Pacific Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 40: South Asia & Pacific Market Units Forecast by Application, 2020 to 2035

- Table 41: South Asia & Pacific Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 42: South Asia & Pacific Market Units Forecast by Technology, 2020 to 2035

- Table 43: Middle East & Africa Market Value (USD Bn) Forecast by Country, 2020 to 2035

- Table 44: Middle East & Africa Market Units Forecast by Country, 2020 to 2035

- Table 45: Middle East & Africa Market Value (USD Bn) Forecast by Application, 2020 to 2035

- Table 46: Middle East & Africa Market Units Forecast by Application, 2020 to 2035

- Table 47: Middle East & Africa Market Value (USD Bn) Forecast by Technology, 2020 to 2035

- Table 48: Middle East & Africa Market Units Forecast by Technology, 2020 to 2035

List Of Figures

- Figure 1: Global Market Units Forecast2020 to 2035

- Figure 2: Global Market Pricing Analysis

- Figure 3: Global Market Value (USD Bn) Forecast2020 to 2035

- Figure 4: Global Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 5: Global Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 6: Global Market Attractiveness Analysis by Application

- Figure 7: Global Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 8: Global Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 9: Global Market Attractiveness Analysis by Technology

- Figure 10: Global Market Value (USD Bn) Share and BPS Analysis by Region, 2025 and 2035

- Figure 11: Global Market Y-o-Y Growth Comparison by Region, 2025 to 2035

- Figure 12: Global Market Attractiveness Analysis by Region

- Figure 13: North America Market Incremental $ Opportunity, 2025 to 2035

- Figure 14: Latin America Market Incremental $ Opportunity, 2025 to 2035

- Figure 15: Western Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 16: Eastern Europe Market Incremental $ Opportunity, 2025 to 2035

- Figure 17: East Asia Market Incremental $ Opportunity, 2025 to 2035

- Figure 18: South Asia & Pacific Market Incremental $ Opportunity, 2025 to 2035

- Figure 19: Middle East & Africa Market Incremental $ Opportunity, 2025 to 2035

- Figure 20: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 21: North America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 22: North America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 23: North America Market Attractiveness Analysis by Application

- Figure 24: North America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 25: North America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 26: North America Market Attractiveness Analysis by Technology

- Figure 27: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 28: Latin America Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 29: Latin America Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 30: Latin America Market Attractiveness Analysis by Application

- Figure 31: Latin America Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 32: Latin America Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 33: Latin America Market Attractiveness Analysis by Technology

- Figure 34: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 35: Western Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 36: Western Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 37: Western Europe Market Attractiveness Analysis by Application

- Figure 38: Western Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 39: Western Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 40: Western Europe Market Attractiveness Analysis by Technology

- Figure 41: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 42: Eastern Europe Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 43: Eastern Europe Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 44: Eastern Europe Market Attractiveness Analysis by Application

- Figure 45: Eastern Europe Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 46: Eastern Europe Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 47: Eastern Europe Market Attractiveness Analysis by Technology

- Figure 48: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 49: East Asia Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 50: East Asia Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 51: East Asia Market Attractiveness Analysis by Application

- Figure 52: East Asia Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 53: East Asia Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 54: East Asia Market Attractiveness Analysis by Technology

- Figure 55: South Asia & Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 56: South Asia & Pacific Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 57: South Asia & Pacific Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 58: South Asia & Pacific Market Attractiveness Analysis by Application

- Figure 59: South Asia & Pacific Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 60: South Asia & Pacific Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 61: South Asia & Pacific Market Attractiveness Analysis by Technology

- Figure 62: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: Middle East & Africa Market Value Share and BPS Analysis by Application, 2025 and 2035

- Figure 64: Middle East & Africa Market Y-o-Y Growth Comparison by Application, 2025 to 2035

- Figure 65: Middle East & Africa Market Attractiveness Analysis by Application

- Figure 66: Middle East & Africa Market Value Share and BPS Analysis by Technology, 2025 and 2035

- Figure 67: Middle East & Africa Market Y-o-Y Growth Comparison by Technology, 2025 to 2035

- Figure 68: Middle East & Africa Market Attractiveness Analysis by Technology

- Figure 69: Global Market – Tier Structure Analysis

- Figure 70: Global Market – Company Share Analysis

- FAQs -

What is the Global Wearable Air Conditioner Market size in 2025?

The Wearable Air Conditioner market is valued at USD 772.1 billion in 2025.

Who are the Major Players Operating in the Wearable Air Conditioner Market?

Prominent players in the market include Blaux, Embrlabs, G2T, Hobby Colin, IYunLife, Moocii, and NORMIA RITA.

What is the Estimated Valuation of the Wearable Air Conditioner Market by 2035?

The market is expected to reach a valuation of USD 2,244.5 billion by 2035.

What Value CAGR Did the Wearable Air Conditioner Market Exhibit over the Last Five Years?

The historic growth rate of the wearable air conditioner market is 11.3% from 2020 to 2024.