Professional Drone Services Market

Professional Drone Services Market Size and Share Forecast Outlook 2025 to 2035

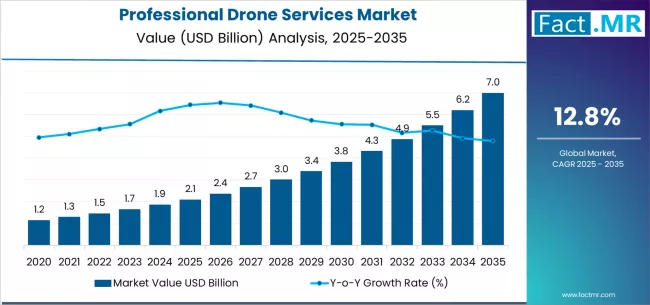

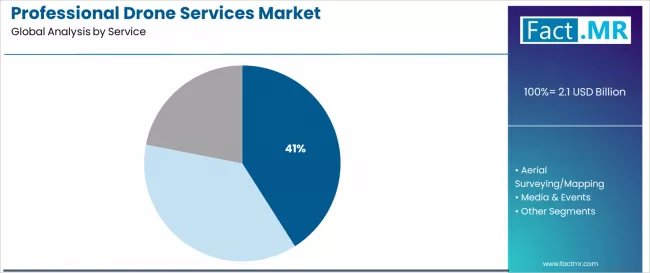

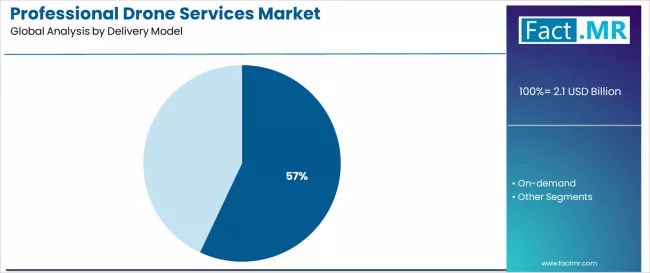

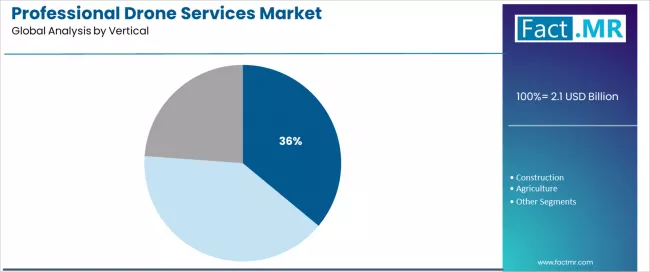

Professional drone services market is projected to grow from USD 2.1 billion in 2025 to USD 7.0 billion by 2035, at a CAGR of 12.8%. Inspections & Compliance will dominate with a 41.0% market share, while managed service contracts will lead the delivery model segment with a 57.0% share.

Professional Drone Services Market Forecast and Outlook 2025 to 2035

The global professional drone services market is valued at USD 2.1 billion in 2025. The market is slated to reach USD 7.0 billion by 2035. This records an absolute increase of USD 4.9 billion over the forecast period. The total growth amounts to 233.3%. The market forecast shows expansion at a compound annual growth rate (CAGR) of 12.8% between 2025 and 2035.

The overall market size is expected to grow by approximately 3.33X during the same period. Growth is supported by increasing demand for inspection services. Growing adoption of aerial surveying drives expansion. Rising preference for managed service contracts across energy applications supports market development. Construction applications show increased efficiency system adoption.

Quick Stats for Professional Drone Services Market

- Professional Drone Services Market Value (2025): USD 2.1 billion

- Professional Drone Services Market Forecast Value (2035): USD 7.0 billion

- Professional Drone Services Market Forecast CAGR: 12.8%

- Leading Service in Professional Drone Services Market: Inspections & compliance (41.0%)

- Key Growth Regions in Professional Drone Services Market: North America, Europe, and Asia-Pacific

- Key Players in Professional Drone Services Market: Sky-Futures, Heliguy, DroneDeploy, Firmatek, Zeitview, AgEagle Aerial Systems, Percepto, Delair, Terra Drone, Aerodyne

The professional drone services market represents a specialized segment of the global commercial aviation services industry. The market shows rapid technological advancement. Consistent demand exists across inspection services channels. Surveying efficiency channels drive growth. Market dynamics are influenced by changing operational requirements toward professional drone services. Growing interest in aerial data management shapes development. Expanding partnerships between service providers drive growth.

Industrial operators in developed economies show increased adoption. Emerging economies demonstrate growing demand patterns. Traditional surveying methods continue evolving. Operators seek proven aerial alternatives. Enhanced efficiency benefits attract industrial users. Reliable performance characteristics remain essential requirements.

Consumer behavior in the professional drone services market reflects broader digital services trends. Efficient aerial systems provide functional benefits. Effective systems deliver data accuracy. The market benefits from growing popularity of remote monitoring systems. These systems are recognized for sophisticated data integration.

Technical approach to aerial services gains acceptance. The versatility of professional drone services supports multiple applications. Standalone inspection services serve specific needs. Integrated monitoring system components expand market reach. Multiple industrial applications drive demand growth. Infrastructure segments show increased adoption patterns.

Regional adoption patterns vary significantly across global markets. North American markets show strong preference for standardized professional drone service implementations. European markets demonstrate similar standardization trends. Asian markets show increasing adoption of advanced aerial solutions.

Conventional surveying systems remain popular in developing regions. The industrial landscape continues evolving with sophisticated products. Quality-controlled professional drone service products gain traction in mainstream applications. Industrial applications reflect operator willingness to invest in improvements. Proven aerial system enhancements attract investment. Performance-oriented features drive adoption decisions.

The competitive environment features established service companies. Specialized aerial solution providers focus on unique capabilities. Advanced data methods drive differentiation. Service efficiency remains critical for market participants. Technology development optimization continues as key factor. Equipment costs create ongoing challenges. Quality standardization requirements fluctuate regularly. Service strategies emphasize multi-platform approaches. Traditional inspection supply chains combine with direct partnerships. Digital service platforms expand market reach. Service distribution agreements strengthen customer relationships.

Market consolidation trends indicate acquisition strategies by larger manufacturers. Service providers acquire specialized aerial companies. Technology portfolio diversification drives acquisition activity. Access to specialized monitoring system segments motivates purchases. Private label development has gained momentum. Industrial companies seek differentiation opportunities. Competitive pricing structures remain important considerations.

Specialized professional drone service variants emerge in the market. AI-powered options reflect changing operator priorities. Cloud-enabled options create new market opportunities. Innovative aerial system developers benefit from emerging trends. Service automation enables consistent delivery scaling. Quality control improvements maintain traditional performance characteristics. Operators expect established performance from service system brands.

Between 2025 and 2030, the professional drone services market projects expansion from USD 2.1 billion to USD 4.3 billion. This results in a value increase of USD 2.2 billion. The increase represents 44.9% of the total forecast growth for the decade. This development phase will be shaped by increasing adoption of managed service contracts.

Rising demand for aerial surveying drives growth. Inspection services gain market acceptance. Growing emphasis on compliance features supports expansion. Enhanced data characteristics attract users. Service operators expand technology capabilities. Growing demand for specialized professional drone service implementations continues. Advanced aerial options gain popularity. Digital offerings across industry segments increase.

Professional Drone Services Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 2.1 billion |

| Forecast Value (2035F) | USD 7.0 billion |

| Forecast CAGR (2025-2035) | 13.30% |

From 2030 to 2035, the market is forecast to grow from USD 4.3 billion to USD 7.0 billion. This adds another USD 2.7 billion. The addition constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of fully autonomous service platforms. Integration of advanced data analytics continues. Development of specialized professional drone service implementations occurs. Enhanced intelligence profiles gain importance. Extended automation capabilities attract users. Growing adoption of cloud computing will drive demand. Professional drone services with superior data characteristics gains acceptance. Compatibility with IoT technologies across industrial operations expands.

Between 2020 and 2025, the professional drone services market experienced exceptional growth. Increasing demand for aerial inspection drove development. Growing recognition of drone services as essential components supported expansion. Modern inspection automation programs across industrial applications gained momentum. Construction applications showed growth. The market developed as operators recognized potential benefits. Professional drone service solutions provide functional advantages. Data collection benefits enable convenient monitoring protocols. Technological advancement in aerial systems began development. Data-critical applications emphasize importance of maintaining performance. Consistency in diverse operational environments becomes critical.

Why is the Professional Drone Services Market Growing?

Market expansion is supported by increasing global demand for inspection services. Corresponding need for aerial systems provides superior efficiency benefits. Cost advantages enable enhanced operational outcomes. Extended compatibility across various industrial applications drives growth. Construction applications show expansion. Modern operators focus on implementing proven aerial solutions. Technology specialists seek effective monitoring support. Minimized inspection complexity appeals to users. Consistent performance throughout complex operational configurations attracts adoption. Diverse industrial environments require reliable solutions. Professional drone services deliver exceptional aerial efficacy against traditional alternatives. Advanced data integration capabilities support modern protocols. Essential components for contemporary infrastructure operations gain acceptance.

Growing emphasis on operational efficiency drives demand for aerial technology adoption. Professional drone services support large-scale monitoring requirements. Improved operational outcomes attract users. Advanced data systems gain acceptance. Operator preference for products combines effective monitoring support with proven performance. Efficiency benefits create opportunities for innovative implementations. Rising influence of Industry 4.0 trends contributes to increased demand. Digital awareness drives market growth. Professional drone services provide advanced reliability. Seamless technology integration appeals to users. Consistent performance across extended operation periods remains important.

Opportunity Pathways - Professional Drone Services Market

The professional drone services market shows potential for exceptional growth. Technological advancement continues development. Infrastructure operators across North America seek services delivering superior aerial quality. Europe shows similar trends. Asia-Pacific markets demonstrate growth potential. Emerging markets seek advanced data capabilities. Reliable performance options gain acceptance. Professional drone service solutions gain prominence beyond inspection services. Strategic enablers of industrial automation expand applications. Advanced efficiency functionality grows in importance.

Rising infrastructure monitoring adoption in Asia-Pacific amplifies demand. Expanding data initiatives globally support growth. Service providers leverage innovations in aerial engineering. Advanced technology integration gains momentum. Monitoring management technologies advance rapidly.

Pathways like high-precision implementations show promise for strong margin uplift. Specialized data platforms demonstrate potential. Advanced monitoring solutions target premium infrastructure segments. Geographic expansion captures volume opportunities. Service diversification addresses market needs. Local operator preferences become critical factors. Advanced efficiency adoption drives regional growth. Regulatory support around aerial services provides structural foundation. Data efficacy standards gain importance. Efficiency protocols strengthen market development.

- Pathway A - High-Precision Implementations. Energy operators require professional drone services with high-precision capabilities. Large infrastructure assets demand advanced data profiles for enhanced monitoring appeal. Premium positioning capabilities attract investment. Service developers creating high-precision platforms with superior data standards command premium pricing. Expected revenue pool: USD 1.47 billion to USD 1.89 billion.

- Pathway B - Specialized Data Platforms. Growing demand for specialized monitoring implementations drives market growth. Advanced efficiency capabilities attract users. Unique aerial features create demand for advanced technology capabilities. Specialized infrastructure integration opportunities exist. Revenue opportunity: USD 1.33 billion to USD 1.68 billion.

- Pathway C - Advanced Monitoring Solutions. Advanced professional drone service formulations meet specific infrastructure requirements. Data compatibility requirements grow. Specialized efficiency profiles enable market expansion. Enhanced operator appeal attracts technology-focused service providers. Revenue lift: USD 1.19 billion to USD 1.47 billion.

- Pathway D - Construction Applications. Expanding reach into construction platforms creates opportunities. Optimized service delivery gains importance. Advanced technology integration capabilities expand. Extended performance capabilities attract users. Operators seek partners supplying integrated solutions with complete data functionality. Pool: USD 1.26 billion to USD 1.58 billion.

- Pathway E - Geographic Expansion & Local Services. Strong growth in APAC markets continues. China shows particular potential. India demonstrates expansion opportunities. Southeast Asia markets develop rapidly. Local services lower costs. Supply complexity reduction enables faster response to regional preferences. Expected upside: USD 1.33 billion to USD 1.68 billion.

- Pathway F - Agriculture Development. Increasing demand for agricultural formulations grows. Crop monitoring functionality gains importance. Specialized aerial profiles with validated performance characteristics attract agricultural companies. Revenue opportunity: USD 1.05 billion to USD 1.33 billion.

- Pathway G - Media & Events Services. Developing comprehensive content solutions creates differentiation. Creative platform services expand applications. Aerial programs address specialized requirements for media operators. Entertainment companies show growing demand from professional aerial services. Pool: USD 0.91 billion to USD 1.12 billion.

Segmental Analysis

The market is segmented by service, delivery model, vertical, and region. By service, the market divides into Inspections & compliance, Aerial surveying/mapping, and Media & events categories. By delivery model, it covers Managed service contracts and On-demand segments. By vertical, it includes Energy & utilities, Construction, and Agriculture categories. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Service, the Inspections & Compliance Segment Accounts for 41.0% Market Share

The inspections & compliance segment projects to account for 41.0% of the professional drone services market in 2025. This reaffirms its position as the leading service category. Infrastructure operators utilize inspection implementations for superior compliance standards. Service system integrators prefer these systems when operating across diverse monitoring platforms. Excellent accuracy properties attract users. Widespread acceptance ranges from basic inspection operations to critical infrastructure processing. Inspection technology's advanced data methods address operator requirements for efficient monitoring solutions. Complex infrastructure environments benefit from these capabilities.

This service segment forms the foundation of modern infrastructure monitoring adoption patterns. The implementation offers greatest operational accuracy. Established market demand exists across multiple infrastructure categories. Monitoring segments show strong adoption. Operator investments in inspection standardization continue. Accuracy efficiency improvements strengthen adoption among infrastructure operators. Utility companies prioritize accuracy with operational reliability. Inspection implementations align with functionality preferences. Performance expectations make these systems central components of comprehensive infrastructure monitoring strategies.

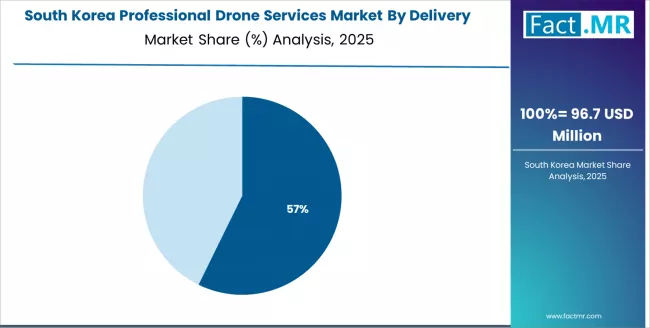

By Delivery Model, the Managed Service Contracts Segment Accounts for 57.0% Market Share

The managed service contracts applications project to represent 57.0% of professional drone services demand in 2025. This underscores their critical role as primary delivery model for service devices. Infrastructure operations use these systems across monitoring applications. Contract operations benefit from service capabilities. Industrial infrastructure applications show strong adoption. Operators prefer this delivery model for exceptional reliability characteristics. Scalable monitoring options appeal to users. Ability to handle diverse infrastructure demands while ensuring consistent service performance attracts adoption. Various infrastructure platforms benefit from contract methods. Essential delivery model for modern infrastructure operations offers functional advantages. Efficiency benefits remain important considerations.

The segment gains support from continuous innovation in service technologies. Growing availability of specialized implementations enables diverse infrastructure requirements. Enhanced service uniformity capabilities expand applications. Extended efficiency capabilities attract investment. Operators invest in advanced monitoring systems supporting large-scale infrastructure integration. Operational development drives growth. Infrastructure automation trends become prevalent. Operator efficiency awareness increases acceptance. Managed contract applications continue representing major implementation markets. Advanced infrastructure utilization strategies gain support. Service integration initiatives expand market reach.

By Vertical, the Energy & Utilities Segment Accounts for 36.0% Market Share

Energy & utilities applications project to represent 36.0% of professional drone services demand in 2025. This demonstrates significance as primary deployment vertical for service systems. Energy operations benefit from monitoring advantages. Utility facilities show strong adoption. Energy operators utilize professional drone services for exceptional inspection characteristics. Proven reliability in critical environments attracts users. Ability to maintain consistent service performance across diverse operational conditions appeals to operators. The segment's dominance reflects critical nature of monitoring in energy operations. Industry commitment to reliability standards drives adoption.

The energy sector drives innovation in service technology through demanding operational requirements. Stringent reliability regulations exist. Operators invest heavily in advanced service systems ensuring operational continuity. Quality compliance requirements grow. Increasing emphasis on operational efficiency supports market position. Reliability management initiatives expand. Energy & utilities applications maintain position as largest vertical segment. Technological advancement initiatives continue. Performance optimization across professional drone service markets gains momentum.

What are the Drivers, Restraints, and Key Trends of the Professional Drone Services Market?

The professional drone services market advances rapidly due to increasing infrastructure monitoring demand driven by asset aging acceleration. Operational efficiency programs support growth. Growing adoption of aerial systems provides superior data characteristics. Efficiency benefits enable enhanced operational outcomes across diverse infrastructure applications. Inspection applications expand market reach. The market faces challenges including complex regulatory requirements for drone operations. Weather dependency creates operational constraints. Specialized pilot requirements grow. Data processing programs become more sophisticated. Innovation in autonomous systems continues influencing service development. Cost-effective aerial methods drive market expansion patterns.

Expansion of Infrastructure Aging and Asset Management

Growing infrastructure aging sectors enable market development. Advanced asset management capabilities expand applications. Infrastructure monitoring awareness drives service providers to produce advanced professional drone service solutions. Superior data positioning attracts users. Enhanced reliability profiles gain acceptance. Seamless integration functionalities expand market reach. Advanced aerial systems provide improved operational outcomes. More efficient monitoring workflows develop. Reliable performance across various infrastructure applications continues. Operating conditions improve with advanced systems. Developers recognize competitive advantages of aerial solution integration capabilities. Market differentiation opportunities expand. Data positioning becomes increasingly important.

Integration of AI-Powered Analytics and Data Processing

Modern professional drone service providers incorporate advanced AI technology. Infrastructure system integration expands capabilities. Sophisticated data solutions enhance service appeal. Intelligent monitoring features develop rapidly. Value-added solutions for infrastructure customers gain acceptance. These technologies improve monitoring efficiency. New market opportunities emerge including standardized performance. Optimized data enhancement capabilities expand. Enhanced reliability characteristics attract users. Advanced AI integration allows developers supporting comprehensive infrastructure technologies. Market expansion beyond traditional aerial approaches continues.

Development of Regulatory Framework and Commercial Aviation Integration

Growing adoption of regulatory solutions enables market development. Advanced compliance management capabilities expand applications. Aviation integration awareness drives equipment manufacturers to produce advanced professional drone service solutions. Superior operational positioning attracts users. Enhanced safety profiles gain acceptance. Seamless integration functionalities expand market reach. Advanced service systems provide improved operational outcomes. More efficient compliance workflows develop. Reliable performance across various regulatory applications continues. Operating conditions improve with advanced systems. Developers recognize competitive advantages of regulatory solution integration capabilities. Market differentiation opportunities expand. Compliance positioning becomes increasingly important.

Analysis of the Professional Drone Services Market by Key Countries

professional-drone-services-market-south-korea-market-share-analysis-by-delivery-model

| Country | CAGR (2025-2035) |

|---|---|

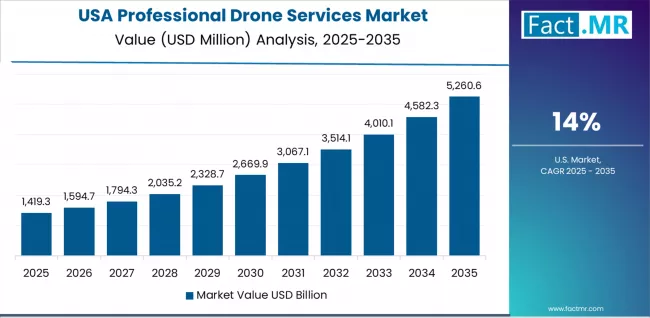

| USA | 14.0% |

| Mexico | 13.6% |

| Germany | 12.8% |

| France | 12.4% |

| UK | 11.5% |

| South Korea | 11.0% |

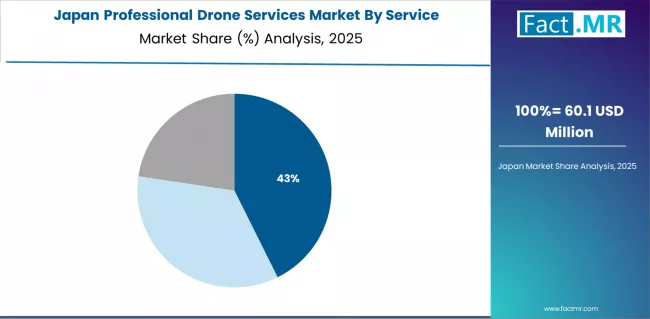

| Japan | 10.6% |

The professional drone services market experiences exceptional growth globally. The United States leads at 14.0% CAGR through 2035. Expanding infrastructure monitoring drives growth. Growing aerial programs support development. Significant investment in service advancement continues.

Mexico follows at 13.6%. Increasing industrial expansion supports growth. Growing technology adoption patterns develop. Expanding monitoring infrastructure drives demand. Germany shows growth at 12.8%. Engineering leadership emphasizes development. Aerial technology advancement continues.

France records 12.4% growth. Expanding infrastructure capabilities support market development. Aerial system integration modernization continues. The UK demonstrates 11.5% growth. Advanced aerial technology development occurs. Infrastructure monitoring adoption trends drive market expansion.

South Korea exhibits 11.0% growth. Aerial technology innovation emphasizes development. Infrastructure advancement continues. Japan shows 10.6% growth. Quality control initiatives support development. Technology-focused service patterns continue.

The report covers in-depth analysis of 40+ countries. Seven top-performing countries receive highlighting below.

United States Leads Global Market Growth with Infrastructure Services Excellence

Revenue from professional drone services in the United States projects exceptional growth with 14.0% CAGR through 2035. Expanding infrastructure monitoring capacity drives development. Rapidly growing aerial programs receive government initiative support promoting technology development. The country's strong position in drone technology supports growth. Increasing investment in service infrastructure creates substantial demand for advanced implementations. Major infrastructure companies establish comprehensive monitoring capabilities. Service system companies serve domestic infrastructure demand. Expanding technology markets drive growth.

The US leads global market growth due to its extensive infrastructure requiring professional monitoring services. The country benefits from advanced regulatory framework and technology leadership. Major factors include FAA Part 107 regulations enabling commercial drone operations. Major utilities and energy companies requiring inspection services. Strong construction industry needing surveying solutions. Advanced telecommunications networks supporting data transmission. Government infrastructure investment programs creating monitoring needs. Strong venture capital funding for drone service companies. Leading universities conducting drone research. Advanced agriculture sector adopting precision monitoring.

Government support for infrastructure modernization initiatives drives demand for advanced service systems. Major monitoring regions benefit from development. Infrastructure assets across the country show expansion needs. Strong technology growth occurs. Expanding network of aerial-focused providers supports rapid adoption. Infrastructure operators seek advanced service capabilities. Integrated monitoring technologies gain acceptance.

Mexico Demonstrates Industrial Growth with Technology Expansion

Revenue from professional drone services in Mexico expands at 13.6% CAGR. The country's growing industrial sector supports development. Expanding technology capacity drives growth. Increasing adoption of aerial technologies continues. Country initiatives promoting industrial modernization create demand. Growing technology awareness drives requirements for quality-controlled service systems. International service providers establish extensive capabilities. Domestic technology companies address growing demand for advanced aerial solutions.

Mexico shows exceptional growth potential driven by infrastructure development and industrial expansion. The country experiences rapid industrial growth supported by NAFTA/USMCA trade benefits. Key factors include growing oil & gas industry requiring pipeline monitoring. Expanding mining operations needing surveying services. Rising construction projects creating inspection opportunities. Government initiatives to modernize infrastructure capabilities. Growing adoption of international technology standards. Strategic location for serving North American markets. Increasing focus on operational efficiency through technology. Strong tourism sector driving media and event services.

Rising industrial requirements create opportunities for professional drone service adoption. Metropolitan development centers show growth. Progressive companies invest in modern aerial capabilities. Major industrial regions expand operations. Growing focus on technology integration drives adoption. Aerial features appeal to companies seeking enhanced operational capabilities. Advanced data delivery experiences attract investment.

Germany Demonstrates Engineering Leadership with Aerial Innovation

Revenue from professional drone services in Germany expands at 12.8% CAGR. The country's engineering heritage supports development. Strong emphasis on aerial technology continues. Robust demand for advanced service systems exists in infrastructure applications. Industrial applications drive growth. The nation's mature infrastructure sector supports development. Technology-focused operations drive sophisticated implementations throughout the aerial industry. Leading manufacturers invest extensively in technology development. Advanced aerial methods serve domestic markets. International markets benefit from German expertise.

Germany maintains its position as Europe's technology leader with strong Industry 4.0 initiatives. The country's advanced manufacturing culture drives aerial service adoption. Growth drivers include advanced infrastructure requiring monitoring services. Strong renewable energy sector with wind farms needing inspection. Industry 4.0 government initiatives promoting smart monitoring. Strong engineering education producing technology expertise. High R&D investment in aerial technologies. Excellent precision technology capabilities. Strong environmental regulations requiring monitoring compliance. Well-developed industrial automation infrastructure supporting aerial integration.

Rising demand for high-performance aerial technologies creates requirements for sophisticated solutions. Exceptional data capabilities appeal to quality-conscious operators. Enhanced infrastructure experiences gain acceptance. Advanced aerial methods attract investment. Strong engineering tradition supports growth. Growing investment in aerial technologies drives adoption. Quality platforms with advanced development methods appeal to users. Enhanced aerial profiles across infrastructure operations expand in major industrial regions.

France Focuses on Infrastructure Modernization and Aerial Integration

Revenue from professional drone services in France grows at 12.4% CAGR. The country's infrastructure modernization sector drives development. Growing aerial integration programs support expansion. Increasing investment in technology development continues. France's infrastructure supports market growth. Commitment to technological advancement drives demand for diverse service solutions. Multiple infrastructure segments benefit from development. Operators establish comprehensive aerial capabilities. Growing domestic market drives development. Expanding infrastructure opportunities support growth.

France demonstrates strong growth supported by government digitalization initiatives and infrastructure investment. The country experiences steady industrial growth supported by EU development programs. Key factors include major infrastructure projects requiring monitoring services. Advanced aerospace industry developing drone technologies. Government France 2030 investment plan supporting technology development. Growing focus on sustainable infrastructure requiring efficient monitoring. Strategic position as European technology hub driving service investment. Increasing emphasis on operational efficiency in infrastructure management. Strong construction sector requiring surveying solutions. Growing adoption of smart city concepts supporting aerial services.

Strong infrastructure expansion drives adoption of integrated aerial systems. Superior monitoring capabilities appeal to users. Advanced integration attracts large infrastructure operators. Progressive development companies invest in systems. Growing aerial diversity supports market expansion. Increasing infrastructure adoption drives advanced implementations. Seamless aerial profiles appeal to users. Modern service delivery throughout the country's infrastructure regions gains acceptance.

United Kingdom Emphasizes Technology Development and Infrastructure Innovation

Revenue from professional drone services in the UK expands at 11.5% CAGR. The country's advanced aerial technology sector supports development. Strategic focus on infrastructure solutions continues. Established technology capabilities drive growth. The UK's service system innovation leadership supports market expansion. Technology integration drives demand for specialized implementations in infrastructure applications. Industrial operations show growth. Advanced monitoring products expand market reach. Operators invest in comprehensive aerial development serving domestic specialty markets. International quality applications benefit from development.

The UK shows strong growth driven by infrastructure needs and technology leadership. Strong offshore wind industry creates inspection demand. Key factors include aging infrastructure requiring monitoring services. Advanced aerospace sector developing drone technologies. Government support for technology innovation through digital infrastructure programs. Strong position in artificial intelligence supporting smart analytics. CAA regulatory framework enabling commercial operations. Advanced telecommunications infrastructure supporting data services. Focus on operational efficiency to maintain competitiveness. Major infrastructure hubs requiring automated monitoring systems. Growing emphasis on climate monitoring and environmental compliance.

Infrastructure optimization and aerial technology advancement create opportunities for specialized service adoption in advanced systems. Monitoring services benefit from development. Technology-focused infrastructure operations among leading enterprises gain acceptance. Growing emphasis on advanced aerial delivery drives adoption. Service features support quality implementations with enhanced technology profiles. Integrated aerial management throughout the country's infrastructure technology sector expands market reach.

South Korea Demonstrates Technology Integration and Infrastructure Growth

Revenue from professional drone services in South Korea grows at 11.0% CAGR. The country's technology integration initiatives drive development. Expanding infrastructure sector supports growth. Strategic focus on service development continues. South Korea's advanced technology capabilities support market expansion. Commitment to infrastructure modernization drives investment in specialized technologies. Major development regions benefit from expansion. Industry leaders establish comprehensive technology integration systems. Domestic infrastructure operations benefit from advanced aerial applications.

South Korea exhibits strong growth driven by technology advancement and infrastructure development. The country experiences rapid digital transformation supported by government initiatives. Key drivers include major construction projects requiring surveying services. Strong technology sector developing aerial analytics. Government support for smart infrastructure development. Advanced manufacturing requiring monitoring solutions. High technology adoption culture supporting service innovation. Rising focus on export competitiveness through technology advancement. Strong shipbuilding industry needing specialized inspection services. Advanced telecommunications infrastructure supporting data transmission and processing.

Innovations in aerial platforms create demand for advanced implementations. Technology integration capabilities attract users. Exceptional aerial properties appeal to progressive infrastructure operators. Enhanced technology differentiation gains acceptance. Operational appeal drives adoption. Growing infrastructure adoption supports market development. Increasing focus on aerial innovation drives advanced platform adoption. Integrated service delivery gains acceptance. Infrastructure optimization across development enterprises throughout the country expands market reach.

Japan Shows Quality Focus and Technology-Driven Services

Revenue from professional drone services in Japan expands at 10.6% CAGR. The country's service system excellence initiatives support development. Growing aerial technology sector continues expansion. Strategic emphasis on advanced technology development drives market growth. Japan's advanced quality capabilities support demand. Integrated aerial systems drive demand for high-quality platforms in infrastructure operations. Industrial applications grow. Advanced technology applications expand market reach. Leading manufacturers invest in specialized capabilities. Technology-focused infrastructure requirements gain attention. Aerial industries demand sophisticated solutions.

Japan shows steady growth supported by precision technology culture and infrastructure needs. The country experiences stable development supported by advanced technology adoption. Growth factors include aging infrastructure requiring monitoring services. Strong emphasis on quality control and operational excellence (kaizen). Advanced technology capabilities supporting aerial development. Strong materials science expertise supporting equipment development. Focus on operational efficiency requiring aerial integration. Advanced disaster response capabilities requiring professional drone services. High precision manufacturing requiring quality monitoring. Growing focus on sustainable development practices requiring environmental monitoring.

Quality control advancement creates requirements for specialized solutions. Superior quality integration appeals to users. Exceptional aerial capabilities attract investment. Advanced precision features gain acceptance among quality-conscious infrastructure operations. Infrastructure operators seek sophisticated systems. Strong position in aerial technology innovation supports adoption. Advanced systems with validated aerial characteristics gain acceptance. Quality integration capabilities throughout the country's infrastructure technology sector expand market reach.

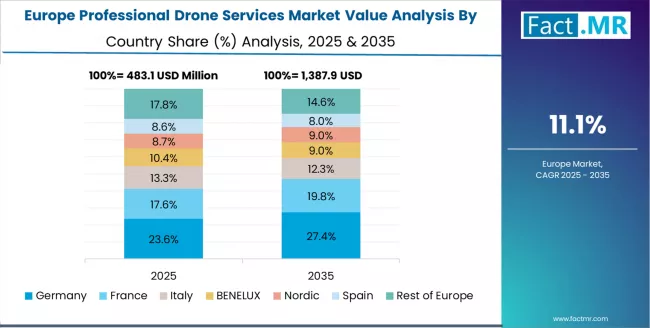

Europe Market Split by Country

The professional drone services market in Europe projects growth from USD 630.0 million in 2025 to USD 2.1 billion by 2035. This registers CAGR of 12.8% over the forecast period. Germany expects to maintain leadership position with 30.2% market share in 2025. This declines slightly to 29.9% by 2035. Support comes from strong engineering culture. Sophisticated aerial service capabilities continue. Comprehensive infrastructure sector serves diverse applications across Europe.

France follows with 27.8% share in 2025. This projects to reach 28.1% by 2035. Robust demand for advanced aerial technologies in infrastructure applications drives growth. Technology modernization programs support development. Aerial markets benefit from established infrastructure. Technology integration expertise continues. The United Kingdom holds 20.6% share in 2025. This expects to reach 20.8% by 2035. Strong aerial technology sector supports growth. Growing infrastructure monitoring activities drive development. Italy commands 12.7% share in 2025. This projects to reach 12.8% by 2035. Spain accounts for 7.1% in 2025. This expects to reach 7.2% by 2035. Rest of Europe region anticipates maintaining momentum. Collective share moves from 1.6% to 1.2% by 2035. Increasing aerial modernization in Eastern Europe drives development. Growing technology penetration in Nordic countries implementing advanced infrastructure programs supports expansion.

Competitive Landscape of the Professional Drone Services Market

The professional drone services market demonstrates intense competition among specialized service providers, technology companies, and integrated analytics developers. Companies invest heavily in aerial technology research, data analytics development, regulatory compliance capabilities, and comprehensive service platforms to deliver high-performance, reliable, and cost-effective professional drone service solutions. Innovation in AI-powered systems, cloud computing integration, and automated flight operations remains central to strengthening market position and competitive advantage across global markets.

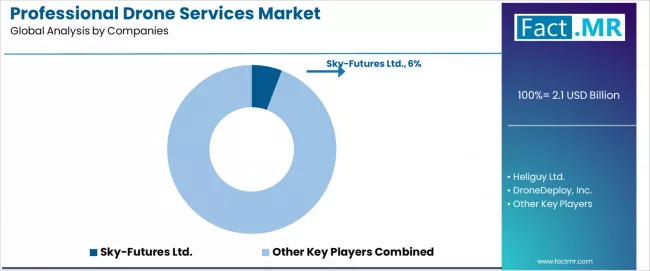

Sky-Futures leads the market with a 5.8% market share, offering comprehensive inspection services including quality monitoring platforms and advanced aerial systems with particular focus on energy and infrastructure applications. The company's strength lies in inspection expertise, providing integrated solutions that combine drone operations with advanced data processing. Heliguy provides specialized service capabilities with strong emphasis on advanced professional drone implementations and training solutions, particularly serving enterprise and industrial markets. DroneDeploy delivers comprehensive technology services with focus on mapping platforms and large-scale operations, combining software with specialized service capabilities.

Firmatek specializes in advanced service systems and analytics implementations for construction and mining applications, expanding market reach through comprehensive monitoring solutions. Zeitview focuses on on-demand services and innovative delivery solutions for various markets. AgEagle Aerial Systems offers advanced analytics platforms with emphasis on industrial and infrastructure applications, serving both energy and construction sectors. The competitive environment also includes significant players like Percepto, Delair, Terra Drone, and Aerodyne, each focusing on specific market segments and technological specializations in drone services and data analytics.

The competitive landscape reflects ongoing consolidation as larger technology companies acquire specialized service providers to expand their analytics portfolios and market reach. Companies focus on developing integrated solutions that combine professional drone services with AI systems, cloud computing platforms, and predictive analytics capabilities to differentiate offerings and capture higher-value market segments. Strategic partnerships between service providers and industrial companies drive innovation and market expansion, while increasing emphasis on autonomous operations and data intelligence creates opportunities for technology leaders to develop more sophisticated monitoring solutions that integrate seamlessly with existing industrial systems and operational workflows.

Key Players in the Professional Drone Services Market

- Sky-Futures Ltd.

- Heliguy Ltd.

- DroneDeploy, Inc.

- Firmatek, LLC

- Zeitview (formerly DroneBase, Inc.)

- AgEagle Aerial Systems Inc.

- Percepto Ltd.

- Delair SAS

- Terra Drone Corporation

- Aerodyne Group

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Service | Inspections & compliance; Aerial surveying/mapping; Media & events |

| Delivery Model | Managed service contracts; On-demand |

| Vertical | Energy & utilities; Construction; Agriculture |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Germany; France; United Kingdom; Japan; South Korea; Mexico; and 40+ additional countries |

| Key Companies Profiled | Sky-Futures; Heliguy; DroneDeploy; Firmatek; Zeitview; AgEagle Aerial Systems |

| Additional Attributes | Dollar sales by service and delivery model category; regional demand trends; competitive landscape; technological advancements in aerial engineering; advanced analytics development; efficiency innovation; infrastructure integration protocols |

Professional Drone Services Market by Segments

-

Service :

- Inspections & Compliance

- Aerial Surveying/Mapping

- Media & Events

-

Delivery Model :

- Managed Service Contracts

- On-demand

-

Vertical :

- Energy & Utilities

- Construction

- Agriculture

-

Region :

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Historical Market Size Value (USD Million) Analysis, 2020 to 2024

- Current and Future Market Size Value (USD Million) Projections, 2025 to 2035

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2020 to 2024 and Forecast 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Service

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Service , 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Service , 2025 to 2035

- Inspections & Compliance

- Aerial Surveying/Mapping

- Media & Events

- Y to o to Y Growth Trend Analysis By Service , 2020 to 2024

- Absolute $ Opportunity Analysis By Service , 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Delivery Model

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Delivery Model, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Delivery Model, 2025 to 2035

- Managed Service Contracts

- On-demand

- Y to o to Y Growth Trend Analysis By Delivery Model, 2020 to 2024

- Absolute $ Opportunity Analysis By Delivery Model, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Vertical

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Vertical, 2020 to 2024

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Vertical, 2025 to 2035

- Energy & Utilities

- Construction

- Agriculture

- Y to o to Y Growth Trend Analysis By Vertical, 2020 to 2024

- Absolute $ Opportunity Analysis By Vertical, 2025 to 2035

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2020 to 2024

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2025 to 2035

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- USA

- Canada

- Mexico

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- China

- Japan

- South Korea

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- South Asia and Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2020 to 2024

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2025 to 2035

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Service

- By Delivery Model

- By Vertical

- By Country

- Market Attractiveness Analysis

- By Country

- By Service

- By Delivery Model

- By Vertical

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Canada

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Mexico

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Brazil

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Chile

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Germany

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- UK

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Italy

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Spain

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- France

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- India

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- China

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Japan

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- South Korea

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Russia

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Poland

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Hungary

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- South Africa

- Pricing Analysis

- Market Share Analysis, 2024

- By Service

- By Delivery Model

- By Vertical

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Service

- By Delivery Model

- By Vertical

- Competition Analysis

- Competition Deep Dive

- Sky-Futures Ltd.

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Heliguy Ltd.

- DroneDeploy, Inc.

- Firmatek, LLC

- Zeitview (formerly DroneBase, Inc.)

- AgEagle Aerial Systems Inc.

- Percepto Ltd.

- Delair SAS

- Terra Drone Corporation

- Aerodyne Group

- Sky-Futures Ltd.

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

- Table 2: Global Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 3: Global Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 4: Global Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 6: North America Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 7: North America Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 8: North America Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 10: Latin America Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 11: Latin America Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 12: Latin America Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 14: Western Europe Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 15: Western Europe Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 16: Western Europe Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 22: East Asia Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 23: East Asia Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 24: East Asia Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Vertical, 2020 to 2035

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Service , 2020 to 2035

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Delivery Model, 2020 to 2035

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Vertical, 2020 to 2035

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2020-2035

- Figure 3: Global Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 4: Global Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 5: Global Market Attractiveness Analysis by Service

- Figure 6: Global Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 7: Global Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 8: Global Market Attractiveness Analysis by Delivery Model

- Figure 9: Global Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 10: Global Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 11: Global Market Attractiveness Analysis by Vertical

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2025 and 2035

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2025-2035

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2025-2035

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2025-2035

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2025-2035

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2025-2035

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2025-2035

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2025-2035

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 23: North America Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 24: North America Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 25: North America Market Attractiveness Analysis by Service

- Figure 26: North America Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 27: North America Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 28: North America Market Attractiveness Analysis by Delivery Model

- Figure 29: North America Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 30: North America Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 31: North America Market Attractiveness Analysis by Vertical

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 33: Latin America Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 35: Latin America Market Attractiveness Analysis by Service

- Figure 36: Latin America Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 38: Latin America Market Attractiveness Analysis by Delivery Model

- Figure 39: Latin America Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 41: Latin America Market Attractiveness Analysis by Vertical

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 43: Western Europe Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 45: Western Europe Market Attractiveness Analysis by Service

- Figure 46: Western Europe Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 48: Western Europe Market Attractiveness Analysis by Delivery Model

- Figure 49: Western Europe Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 51: Western Europe Market Attractiveness Analysis by Vertical

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 55: Eastern Europe Market Attractiveness Analysis by Service

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 58: Eastern Europe Market Attractiveness Analysis by Delivery Model

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 61: Eastern Europe Market Attractiveness Analysis by Vertical

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 63: East Asia Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 65: East Asia Market Attractiveness Analysis by Service

- Figure 66: East Asia Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 68: East Asia Market Attractiveness Analysis by Delivery Model

- Figure 69: East Asia Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 71: East Asia Market Attractiveness Analysis by Vertical

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Service

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Delivery Model

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Vertical

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2025 and 2035

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Service , 2025 and 2035

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Service , 2025-2035

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Service

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Delivery Model, 2025 and 2035

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Delivery Model, 2025-2035

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Delivery Model

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Vertical, 2025 and 2035

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Vertical, 2025-2035

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Vertical

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the professional drone services market in 2025?

The global professional drone services market is estimated to be valued at USD 2.1 billion in 2025.

What will be the size of professional drone services market in 2035?

The market size for the professional drone services market is projected to reach USD 7.0 billion by 2035.

How much will be the professional drone services market growth between 2025 and 2035?

The professional drone services market is expected to grow at a 12.8% CAGR between 2025 and 2035.

What are the key product types in the professional drone services market?

The key product types in professional drone services market are inspections & compliance, aerial surveying/mapping and media & events.

Which delivery model segment to contribute significant share in the professional drone services market in 2025?

In terms of delivery model, managed service contracts segment to command 57.0% share in the professional drone services market in 2025.