Buffer Strip-Friendly Edge-of-Field Nutrient Program Market

Buffer Strip-Friendly Edge-of-Field Nutrient Program Market Size and Share Forecast Outlook 2026 to 2036

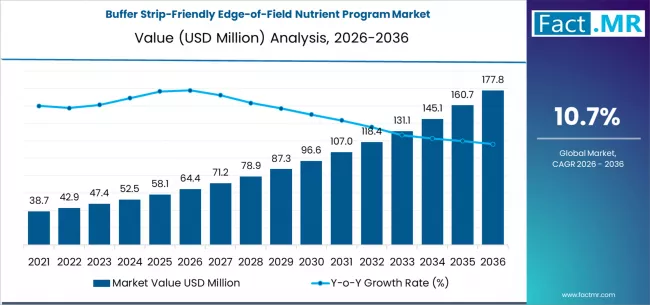

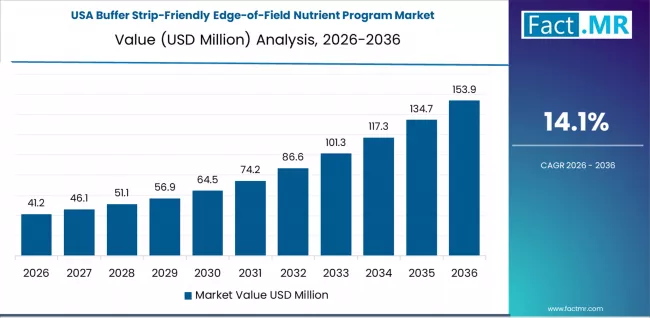

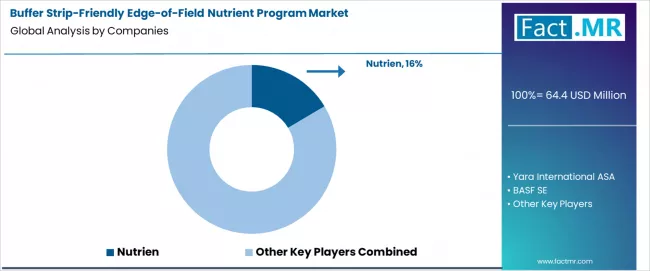

Buffer strip-friendly edge-of-field nutrient program market is projected to grow from USD 64.4 million in 2026 to USD 177.8 million by 2036, at a CAGR of 10.7%. Cereals will dominate with a 48.8% market share, while granular will lead the form segment with a 46.0% share.

Buffer Strip-Friendly Edge-of-Field Nutrient Program Market Forecast and Outlook 2026 to 2036

The global market for buffer strip-friendly edge-of-field nutrient programs is projected to grow from USD 64.35 million in 2026 to USD 177.84 million by 2036, advancing at a CAGR of 10.7%. This market represents a targeted and ecologically integrated approach to nutrient management, specifically designed to work in harmony with vegetative buffer strips and other edge-of-field conservation practices.

Key Takeaways from the Buffer Strip-Friendly Edge-of-Field Nutrient Program Market

- Market Value for 2026: USD 64.35 Million

- Market Value for 2036: USD 177.84 Million

- Forecast CAGR (2026-2036): 10.7%

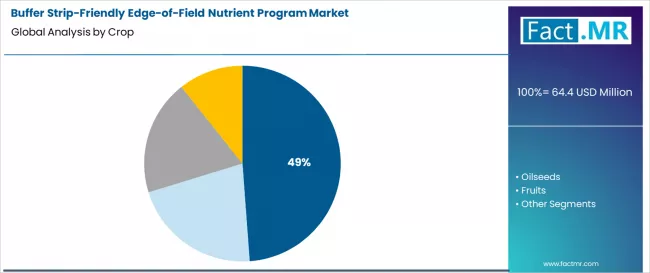

- Leading Crop Type Segment (2026): Cereals (49%)

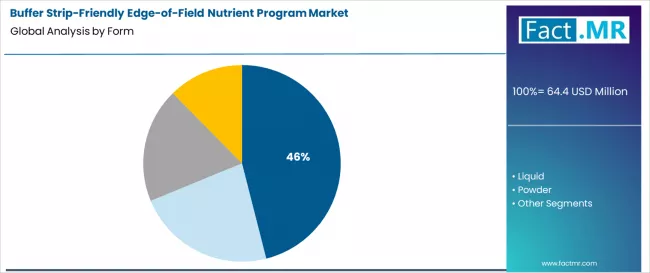

- Leading Form Segment (2026): Granular (46%)

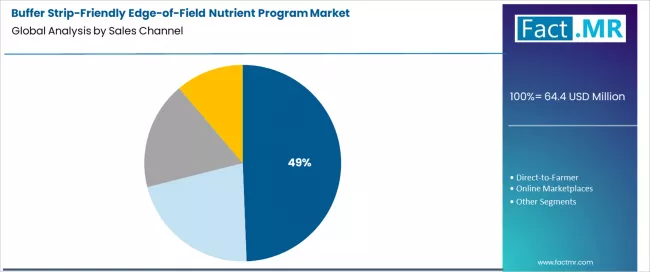

- Leading Sales Channel Segment (2026): Ag-Retailers (49%)

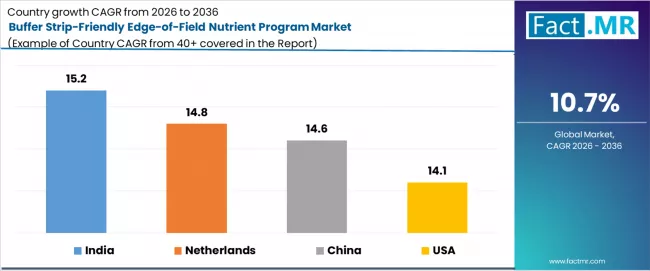

- Key Growth Countries: India (15.2% CAGR), Netherlands (14.8% CAGR), USA (14.1% CAGR), China (14.6% CAGR)

- Key Players in the Market: Nutrien, Yara International ASA, BASF SE, Corteva Inc., Syngenta AG, UPL Limited

These programs focus on optimizing fertilizer use in the zones immediately adjacent to waterways or field boundaries, where the risk of nutrient runoff and leaching is highest, ensuring that crop nutrition goals are met without compromising the protective function of riparian buffers.

Growth is driven by the intensification of regulations aimed at non-point source water pollution, particularly for nitrogen and phosphorus. Environmental protection agencies and watershed management bodies are increasingly mandating or incentivizing the use of integrated practices that combine in-field management with edge-of-field mitigation.

These specialized programs offer farmers a compliant pathway to maintain productivity while actively protecting water quality, turning field edges from potential liability zones into managed components of the farm ecosystem.

The market’s expansion is centered on the development of tailored fertilizer formulations and application protocols that account for soil hydrology and buffer strip interactions. Success depends on providing agronomic solutions that deliver nutrients effectively to crops while minimizing mobility toward sensitive areas, thereby supporting both agricultural output and regulatory compliance in an increasingly scrutinized landscape.

Metric

| Metric | Value |

|---|---|

| Market Value (2026) | USD 64.35 Million |

| Market Forecast Value (2036) | USD 177.84 Million |

| Forecast CAGR (2026-2036) | 10.7% |

Category

| Category | Segments |

|---|---|

| Crop Type | Cereals, Oilseeds, Fruits, Vegetables |

| Form | Granular, Liquid, Powder, Suspension |

| Sales Channel | Ag-Retailers, Direct-to-Farmer, Online Marketplaces, Cooperatives |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, MEA |

Segmental Analysis

By Crop Type, Which Systems are Most Adjacent to Waterways?

The cereals segment leads with a 49% share. Large-scale cereal production, especially corn and wheat, often occurs on landscapes with defined hydrological flow paths. These fields frequently border ditches, streams, or drainage channels, making edge-of-field management critical.

Programs for cereals focus on precise nitrogen and phosphorus placement and the use of stabilizers to keep nutrients within the root zone, reducing the pollutant load that adjacent buffer strips must mitigate.

By Form, Which Allows for Precise Placement Near Boundaries?

Granular form holds a 46% share, primarily due to the control it offers in variable-rate applications. Granular fertilizers, particularly slow-release or polymer-coated types, can be strategically placed away from field edges or banded at specific depths to minimize surface runoff. This physical characteristic allows for the precise management required in transition zones near buffer strips, where broadcast applications are often too risky.

By Sales Channel, Who Provides the Necessary Localized Knowledge?

Ag-retailers are the leading channel, accounting for 49% of sales. Effective edge-of-field programs require intimate knowledge of local topography, soil types, and watershed regulations.

Local retailers are best positioned to provide this hyper-local agronomic advice, helping farmers design and implement nutrient plans that respect buffer zones while meeting crop needs. They act as a critical bridge between regulatory requirements and practical farm management.

What are the Drivers, Restraints, and Key Trends of the Buffer Strip-Friendly Edge-of-Field Nutrient Program Market?

The central market driver is the strengthening of water quality regulations under frameworks like the US Clean Water Act and the EU Water Framework Directive, which mandate reductions in agricultural nutrient runoff. Cost-share programs from government agencies that subsidize buffer strip establishment often require compatible nutrient management plans, creating a direct linkage. Growing consumer demand for sustainably produced food also pressures growers to adopt verifiable edge-of-field stewardship practices.

A primary restraint is the perceived complexity and management intensity of these programs compared to whole-field uniform application. Farmers may be hesitant to manage field edges separately due to time and equipment constraints. There can also be a short-term yield concern if nutrient rates are adjusted downward in zones near buffers, even if the overall economic and environmental benefit is positive. Demonstrating a clear return on investment from reduced regulatory risk and improved ecosystem services is essential for broader adoption.

Key trends include the integration of digital mapping tools that define critical source areas for runoff within fields, allowing for automated variable-rate application that respects buffer zones. There is a growing emphasis on multi-functional buffer strips that include fertilizer-absorbing plant species, which in turn influences the formulation of adjacent nutrient programs. Public-private partnership models are also emerging, where water utilities or conservation groups financially incentivize farmers to adopt these targeted programs to meet regional water quality goals.

Analysis of the Buffer Strip-Friendly Edge-of-Field Nutrient Program Market by Key Countries

| Country | CAGR (2026-2036) |

|---|---|

| India | 15.2% |

| Netherlands | 14.8% |

| China | 14.6% |

| USA | 14.1% |

How is India's National Focus on River Health and Sustainable Agriculture Influencing Growth?

India’s leading CAGR of 15.2% is driven by national missions like "Namami Gange" aimed at restoring major river systems. These projects recognize agricultural runoff as a key pollutant and promote integrated farming practices.

Buffer strip initiatives along canals and rivers are being coupled with demonstrations of compatible nutrient management, creating a policy-driven push for these programs among farmers in key watersheds, supported by subsidies and extension services.

Why are the Netherlands a Leader in Precision Edge-of-Field Management?

The Netherlands' 14.8% growth stems from its extraordinarily dense water network and stringent nitrogen and phosphorus application laws. Dutch farmers are required to maintain precise nutrient balances at the parcel level.

This regulatory environment has spurred innovation in precision application equipment and site-specific nutrient plans that meticulously account for every meter of land, including margins, making buffer strip-friendly programs a standard operational necessity rather than an optional add-on.

What Role does China's Sponge City and Agricultural Green Development Play?

China’s 14.6% CAGR is linked to its Sponge City initiative for urban water management and the parallel push for green agriculture in rural areas. Policies encourage the construction of vegetative buffers around farm ponds and drainage channels.

The government promotes tailored fertilizer techniques for these sensitive perimeters to prevent nutrient loading into the sponge city infrastructure, driving demand for scientifically formulated edge-of-field programs.

How is the USA's Watershed-Specific Regulation and Conservation Funding Shaping the Market?

The USA’s 14.1% growth is largely driven by watershed-specific total maximum daily load requirements and significant federal conservation funding through programs like the Environmental Quality Incentives Program.

These programs provide financial and technical assistance to farmers who implement coordinated practices, including buffer strips and companion nutrient management. This creates a clear economic incentive for adopting integrated edge-of-field nutrient programs, particularly in the Midwest and Chesapeake Bay watersheds.

Competitive Landscape of the Buffer Strip-Friendly Edge-of-Field Nutrient Program Market

The competitive landscape features established agri-input companies competing with specialized environmental service providers and conservation technology firms. Competition is based on the strength of agronomic research linking specific fertilizer products to reduced edge-of-field losses, the ability to integrate with precision agriculture hardware for zone-specific application, and success in forming partnerships with governmental conservation agencies.

Providing a complete service package, including planning software, appropriate products, and verification support for conservation programs, is a key differentiator in this compliance-sensitive market.

Key Players in the Buffer Strip-Friendly Edge-of-Field Nutrient Program Market

- Nutrien

- Yara International ASA

- BASF SE

- Corteva Inc.

- Syngenta AG

- UPL Limited

Scope of Report

| Items | Values |

|---|---|

| Quantitative Units | USD Million |

| Crop Type | Cereals, Oilseeds, Fruits, Vegetables |

| Form | Granular, Liquid, Powder, Suspension |

| Sales Channel | Ag-Retailers, Direct-to-Farmer, Online Marketplaces, Cooperatives |

| Key Countries | USA, Netherlands, India, China |

| Key Companies | Nutrien, Yara International ASA, BASF SE, Corteva Inc., Syngenta AG, UPL Limited |

| Additional Analysis | Efficacy studies of nutrient retention comparing different formulations near buffer strips; hydro-logical modeling of nutrient transport from field edges; economic analysis of yield trade-offs vs. regulatory compliance benefits; review of government cost-share and certification programs; integration techniques with precision application technology. |

Market by Segments

-

Crop Type :

- Cereals

- Oilseeds

- Fruits

- Vegetables

-

Form :

- Granular

- Liquid

- Powder

- Suspension

-

Sales Channel :

- Ag-Retailers

- Direct-to-Farmer

- Online Marketplaces

- Cooperatives

-

Region :

-

North America

- USA

- Canada

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Western Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- BENELUX

- Rest of Western Europe

-

Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

-

East Asia

- China

- Japan

- South Korea

- Rest of East Asia

-

South Asia & Pacific

- India

- ASEAN

- Australia

- Rest of South Asia & Pacific

-

MEA

- Saudi Arabia

- UAE

- Turkiye

- Rest of MEA

-

Table of Content

- Executive Summary

- Global Market Outlook

- Demand to side Trends

- Supply to side Trends

- Technology Roadmap Analysis

- Analysis and Recommendations

- Market Overview

- Market Coverage / Taxonomy

- Market Definition / Scope / Limitations

- Market Background

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Trends

- Scenario Forecast

- Demand in Optimistic Scenario

- Demand in Likely Scenario

- Demand in Conservative Scenario

- Opportunity Map Analysis

- Product Life Cycle Analysis

- Supply Chain Analysis

- Investment Feasibility Matrix

- Value Chain Analysis

- PESTLE and Porter’s Analysis

- Regulatory Landscape

- Regional Parent Market Outlook

- Production and Consumption Statistics

- Import and Export Statistics

- Market Dynamics

- Global Market Analysis 2021 to 2025 and Forecast, 2026 to 2036

- Historical Market Size Value (USD Million) Analysis, 2021 to 2025

- Current and Future Market Size Value (USD Million) Projections, 2026 to 2036

- Y to o to Y Growth Trend Analysis

- Absolute $ Opportunity Analysis

- Global Market Pricing Analysis 2021 to 2025 and Forecast 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Crop

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Crop, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Crop, 2026 to 2036

- Cereals

- Oilseeds

- Fruits

- Vegetables

- Cereals

- Y to o to Y Growth Trend Analysis By Crop, 2021 to 2025

- Absolute $ Opportunity Analysis By Crop, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Form

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Form, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Form, 2026 to 2036

- Granular

- Liquid

- Powder

- Suspension

- Granular

- Y to o to Y Growth Trend Analysis By Form, 2021 to 2025

- Absolute $ Opportunity Analysis By Form, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Sales Channel

- Introduction / Key Findings

- Historical Market Size Value (USD Million) Analysis By Sales Channel, 2021 to 2025

- Current and Future Market Size Value (USD Million) Analysis and Forecast By Sales Channel, 2026 to 2036

- Ag-Retailers

- Direct-to-Farmer

- Online Marketplaces

- Cooperatives

- Ag-Retailers

- Y to o to Y Growth Trend Analysis By Sales Channel, 2021 to 2025

- Absolute $ Opportunity Analysis By Sales Channel, 2026 to 2036

- Global Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Region

- Introduction

- Historical Market Size Value (USD Million) Analysis By Region, 2021 to 2025

- Current Market Size Value (USD Million) Analysis and Forecast By Region, 2026 to 2036

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia and Pacific

- Middle East & Africa

- Market Attractiveness Analysis By Region

- North America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- USA

- Canada

- Mexico

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Latin America Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Brazil

- Chile

- Rest of Latin America

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Western Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Germany

- UK

- Italy

- Spain

- France

- Nordic

- BENELUX

- Rest of Western Europe

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Eastern Europe Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Russia

- Poland

- Hungary

- Balkan & Baltic

- Rest of Eastern Europe

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- East Asia Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- China

- Japan

- South Korea

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- South Asia and Pacific Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- India

- ASEAN

- Australia & New Zealand

- Rest of South Asia and Pacific

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Middle East & Africa Market Analysis 2021 to 2025 and Forecast 2026 to 2036, By Country

- Historical Market Size Value (USD Million) Trend Analysis By Market Taxonomy, 2021 to 2025

- Market Size Value (USD Million) Forecast By Market Taxonomy, 2026 to 2036

- By Country

- Kingdom of Saudi Arabia

- Other GCC Countries

- Turkiye

- South Africa

- Other African Union

- Rest of Middle East & Africa

- By Crop

- By Form

- By Sales Channel

- By Country

- Market Attractiveness Analysis

- By Country

- By Crop

- By Form

- By Sales Channel

- Key Takeaways

- Key Countries Market Analysis

- USA

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Canada

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Mexico

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Brazil

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Chile

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Germany

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- UK

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Italy

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Spain

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- France

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- India

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- ASEAN

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Australia & New Zealand

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- China

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Japan

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- South Korea

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Russia

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Poland

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Hungary

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Kingdom of Saudi Arabia

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- Turkiye

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- South Africa

- Pricing Analysis

- Market Share Analysis, 2025

- By Crop

- By Form

- By Sales Channel

- USA

- Market Structure Analysis

- Competition Dashboard

- Competition Benchmarking

- Market Share Analysis of Top Players

- By Regional

- By Crop

- By Form

- By Sales Channel

- Competition Analysis

- Competition Deep Dive

- Nutrien

- Overview

- Product Portfolio

- Profitability by Market Segments (Product/Age /Sales Channel/Region)

- Sales Footprint

- Strategy Overview

- Marketing Strategy

- Product Strategy

- Channel Strategy

- Yara International ASA

- BASF SE

- Corteva Inc.

- Syngenta AG

- UPL Limited

- Nutrien

- Competition Deep Dive

- Assumptions & Acronyms Used

- Research Methodology

List Of Table

- Table 1: Global Market Value (USD Million) Forecast by Region, 2021 to 2036

- Table 2: Global Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 3: Global Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 4: Global Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 5: North America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 6: North America Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 7: North America Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 8: North America Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 9: Latin America Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 10: Latin America Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 11: Latin America Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 12: Latin America Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 13: Western Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 14: Western Europe Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 15: Western Europe Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 16: Western Europe Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 17: Eastern Europe Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 18: Eastern Europe Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 19: Eastern Europe Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 20: Eastern Europe Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 21: East Asia Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 22: East Asia Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 23: East Asia Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 24: East Asia Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 25: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 26: South Asia and Pacific Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 27: South Asia and Pacific Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 28: South Asia and Pacific Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

- Table 29: Middle East & Africa Market Value (USD Million) Forecast by Country, 2021 to 2036

- Table 30: Middle East & Africa Market Value (USD Million) Forecast by Crop, 2021 to 2036

- Table 31: Middle East & Africa Market Value (USD Million) Forecast by Form, 2021 to 2036

- Table 32: Middle East & Africa Market Value (USD Million) Forecast by Sales Channel, 2021 to 2036

List Of Figures

- Figure 1: Global Market Pricing Analysis

- Figure 2: Global Market Value (USD Million) Forecast 2021 to 2036

- Figure 3: Global Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 4: Global Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 5: Global Market Attractiveness Analysis by Crop

- Figure 6: Global Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 7: Global Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 8: Global Market Attractiveness Analysis by Form

- Figure 9: Global Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 10: Global Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 11: Global Market Attractiveness Analysis by Sales Channel

- Figure 12: Global Market Value (USD Million) Share and BPS Analysis by Region, 2026 and 2036

- Figure 13: Global Market Y to o to Y Growth Comparison by Region, 2026 to 2036

- Figure 14: Global Market Attractiveness Analysis by Region

- Figure 15: North America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 16: Latin America Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 17: Western Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 18: Eastern Europe Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 19: East Asia Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 20: South Asia and Pacific Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 21: Middle East & Africa Market Incremental Dollar Opportunity, 2026 to 2036

- Figure 22: North America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 23: North America Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 24: North America Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 25: North America Market Attractiveness Analysis by Crop

- Figure 26: North America Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 27: North America Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 28: North America Market Attractiveness Analysis by Form

- Figure 29: North America Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 30: North America Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 31: North America Market Attractiveness Analysis by Sales Channel

- Figure 32: Latin America Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 33: Latin America Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 34: Latin America Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 35: Latin America Market Attractiveness Analysis by Crop

- Figure 36: Latin America Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 37: Latin America Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 38: Latin America Market Attractiveness Analysis by Form

- Figure 39: Latin America Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 40: Latin America Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 41: Latin America Market Attractiveness Analysis by Sales Channel

- Figure 42: Western Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 43: Western Europe Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 44: Western Europe Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 45: Western Europe Market Attractiveness Analysis by Crop

- Figure 46: Western Europe Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 47: Western Europe Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 48: Western Europe Market Attractiveness Analysis by Form

- Figure 49: Western Europe Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 50: Western Europe Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 51: Western Europe Market Attractiveness Analysis by Sales Channel

- Figure 52: Eastern Europe Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 53: Eastern Europe Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 54: Eastern Europe Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 55: Eastern Europe Market Attractiveness Analysis by Crop

- Figure 56: Eastern Europe Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 57: Eastern Europe Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 58: Eastern Europe Market Attractiveness Analysis by Form

- Figure 59: Eastern Europe Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 60: Eastern Europe Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 61: Eastern Europe Market Attractiveness Analysis by Sales Channel

- Figure 62: East Asia Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 63: East Asia Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 64: East Asia Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 65: East Asia Market Attractiveness Analysis by Crop

- Figure 66: East Asia Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 67: East Asia Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 68: East Asia Market Attractiveness Analysis by Form

- Figure 69: East Asia Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 70: East Asia Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 71: East Asia Market Attractiveness Analysis by Sales Channel

- Figure 72: South Asia and Pacific Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 73: South Asia and Pacific Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 74: South Asia and Pacific Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 75: South Asia and Pacific Market Attractiveness Analysis by Crop

- Figure 76: South Asia and Pacific Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 77: South Asia and Pacific Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 78: South Asia and Pacific Market Attractiveness Analysis by Form

- Figure 79: South Asia and Pacific Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 80: South Asia and Pacific Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 81: South Asia and Pacific Market Attractiveness Analysis by Sales Channel

- Figure 82: Middle East & Africa Market Value Share and BPS Analysis by Country, 2026 and 2036

- Figure 83: Middle East & Africa Market Value Share and BPS Analysis by Crop, 2026 and 2036

- Figure 84: Middle East & Africa Market Y to o to Y Growth Comparison by Crop, 2026 to 2036

- Figure 85: Middle East & Africa Market Attractiveness Analysis by Crop

- Figure 86: Middle East & Africa Market Value Share and BPS Analysis by Form, 2026 and 2036

- Figure 87: Middle East & Africa Market Y to o to Y Growth Comparison by Form, 2026 to 2036

- Figure 88: Middle East & Africa Market Attractiveness Analysis by Form

- Figure 89: Middle East & Africa Market Value Share and BPS Analysis by Sales Channel, 2026 and 2036

- Figure 90: Middle East & Africa Market Y to o to Y Growth Comparison by Sales Channel, 2026 to 2036

- Figure 91: Middle East & Africa Market Attractiveness Analysis by Sales Channel

- Figure 92: Global Market - Tier Structure Analysis

- Figure 93: Global Market - Company Share Analysis

- FAQs -

How big is the buffer strip-friendly edge-of-field nutrient program market in 2026?

The global buffer strip-friendly edge-of-field nutrient program market is estimated to be valued at USD 64.4 million in 2026.

What will be the size of buffer strip-friendly edge-of-field nutrient program market in 2036?

The market size for the buffer strip-friendly edge-of-field nutrient program market is projected to reach USD 177.8 million by 2036.

How much will be the buffer strip-friendly edge-of-field nutrient program market growth between 2026 and 2036?

The buffer strip-friendly edge-of-field nutrient program market is expected to grow at a 10.7% CAGR between 2026 and 2036.

What are the key product types in the buffer strip-friendly edge-of-field nutrient program market?

The key product types in buffer strip-friendly edge-of-field nutrient program market are cereals, oilseeds, fruits and vegetables.

Which form segment to contribute significant share in the buffer strip-friendly edge-of-field nutrient program market in 2026?

In terms of form, granular segment to command 46.0% share in the buffer strip-friendly edge-of-field nutrient program market in 2026.