Diquat Market

Diquat Market Analysis, By Product Type, By Form, By End-Use Verticals, and By Region - Market Insights 2025 to 2035

Analysis of the Diquat Market Covering 30+ Countries Including Analysis of the US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea, and many more

Diquat Market Outlook (2025 to 2035)

The global diquat market will be valued at USD 2.4 billion by 2025, as per Fact.MR analysis, diquat will grow at a CAGR of 4.8% and reach USD 3.8 billion by 2035.

In 2024, the global industry achieved a valuation of USD 2.3 billion, marking a moderate growth year driven by a combination of conventional agricultural applications and specialty industrial uses. The leading 67.9% of the industry was controlled by product dibromide, worth 1.5 billion, underscoring its sustained leadership as the formulation of choice.

The agriculture sector remained the largest industry, with diquat widely used as a non-selective herbicide and pre-harvest desiccant in regions with lax regulations. Intensively cropping nations, particularly those specializing in oilseeds, legumes, and cereals, continued to boost growth with their rapid desiccation value, which allowed for faster rotation cycles.

Moreover, the use has increased in water treatment, driven by the need to control aquatic weeds in reservoirs, irrigation channels, and recreational water bodies, resulting in an estimated USD 3.6 billion in absolute dollar opportunity by 2034. Furthermore, regulatory attention has started increasing in areas such as the EU and certain regions of North America due to growing concerns regarding the environmental and health effects of diquat.

Looking ahead to 2025 and beyond, the industry is expected to continue its growth trend, driven by a 4.8% compound annual growth rate (CAGR), supported by ongoing demand in emerging economies. Additionally, industry participants will need to face growing pressure to provide safer, more environmentally friendly formulations in order to remain competitive in the long term.

Key Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 2.4 billion |

| Industry Value (2035F) | USD 3.8 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

Fact.MR Survey on Diquat Industry

Fact.MR Survey Findings: Trends According to Stakeholder Opinion

(Survey carried out during Q1 2025, n=520 stakeholder respondents evenly split among agrochemical producers, distributors, agronomists, and commercial growers in the USA, EU-5, China, India, and Brazil)

Priorities of Stakeholders

Regulatory Compliance:

- 84% of global stakeholders rated adhering to herbicide safety and residue levels as a "business-critical" priority, especially under changing MRL (maximum residue limit) regulation.

Efficacy in Desiccation and Weed Control:

- 79% gave high importance to performance during inclement weather, particularly pre-harvest desiccation.

Regional Variance:

- USA: 72% were concerned with product compatibility with glyphosate alternatives to address EPA scrutiny.

- EU-5 (France, Germany, Italy, Spain, UK): 87% were concerned with alignment with REACH and Farm-to-Fork guidelines.

- China/India: 64% required fast-action formulations to minimize crop cycles in water-deficient regions.

- Brazil: 69% gave high priority to rainfastness and broader efficacy due to year-round farming.

Adoption of Advanced Formulations

High Variance in Uptake:

- USA: 61% reported switching to drift-reduction and encapsulated formulations.

- EU-5: 49% were transitioning toward low-residue t products, especially in vineyards and orchards.

- India/China: Only 24% used newer formulations, citing price sensitivity and lower regulatory pressure.

Brazil: 56% adopted tank-mix compatibility for the convenience of multi-stage applications.

Return on Investment (ROI):

- 68% of respondents from the USA and EU saw a positive ROI within one season after switching to newer formulations.

- Contrastingly, 73% of Indian and Chinese growers still employed legacy products due to lower initial cost.

Material and Form Preference (Formulation Type)

Consensus:

- Diquat Dibromide: Selected by 71% worldwide, regarded as the benchmark for broadleaf weed desiccation.

Regional Divergence:

- EU-5: 54% used liquid suspension concentrates (SC) with anti-drift agents.

- India/China: 61% used water-soluble granules (SG) because they are easy to transport and store.

- USA: 66% maintained EC (emulsifiable concentrate) forms, but 35% of Western states tilted towards biodegradable adjuvant mixtures.

- Brazil: 48% preferred multi-mix ready-to-use packs due to their operating ease.

Price Sensitivity

Shared Concerns:

- 85% referenced raw material price inflation (bromine, surfactants) as influencing cost structures.

Willingness to Pay Premiums:

- USA/EU-5: 59% willing to pay 12-18% extra for safer, greener blends.

- China/India: 82% opted for budget SKUS

- Brazil: 45% were interested in subscription-based input supply modes to distribute costs, as opposed to 17% in the USA.

Supply Chain & Operational Bottlenecks

Manufacturers:

- India: 57% mentioned inconsistency in bromine supply chains.

- EU-5: 49% indicated late REACH certification approvals for novel formulations.

- Brazil: 63% stated shortages of packaging materials for bulk orders.

Distributors:

- USA: 68% indicated delayed port clearances due to new EPA evaluation protocols.

- China: 52% mentioned inconsistencies in regional herbicide registrations province-wise.

- EU-5: 45% mentioned pressure from generic competition from Eastern Europe.

Growers (End-users):

- Brazil/India: 58% grumbled about application mistakes because of inadequate training or label confusion.

- EU-5: 47% mentioned insufficient availability of precision spraying services in rural areas.

- USA: 42% mentioned short shelf-life in warmer climates as a key challenge.

Future Investment Priorities

Global Alignment:

- 77% of manufacturers surveyed intend to invest in safer versions with improved rain fastness and low soil leaching.

Divergence in Direction:

- USA: 63% investing in glyphosate-free weed control portfolios with a bridge product.

- EU-5: 58% focusing on biodegradable carrier R&D.

- China/India: 49% concentrating on cost-effective manufacturing processes.

- Brazil: 53% investing in weather-resistant surfactants and mixing agents.

Regulatory Influence on Purchasing Decisions

- USA: 66% reported that EPA reviews and state prohibitions (e.g., California's groundwater risk classification) resulted in major formulation changes.

- EU-5: 82% of respondents thought that EU Green Deal legislation pushed them toward higher-grade, compliant products, particularly in food export-driven industries.

- China, India, and Brazil: Just 34% thought that national regulatory requirements had any real impact on product selection, with less variable enforcement.

Conclusion: Consensus vs. Regional Disparity

High Consensus:

- Pressure to comply, crop cycle optimization demands, and raw material price issues are global across regions.

- Diquat dibromide continues to be the world's workhorse formulation, although regional adaptation is increasing.

Key Disparities:

- USA/EU-5: Pioneering adoption of safer, automated-compatible formulations.

- India/China: Cost-driven industries where fundamental efficacy is a priority concern.

- Brazil: A compromise, balancing efficacy, price, and convenience, particularly in big commercial farms.

Strategic Insight:

- Manufacturers need to segment their industries according to regulatory environments, farm sizes, and climatic conditions in order to remain competitive.

Government Regulations on Diquat Industry

| Country/Region | Regulatory Impact |

|---|---|

| USA | It is regulated under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) and the Food Quality Protection Act (FQPA). The Environmental Protection Agency (EPA) oversees its registration and usage. Labels on products are legally binding, and misuse constitutes a federal offense. State-level regulations, such as California's Proposition 65, add additional compliance layers. (Source: CPA) |

| European Union | It has been banned since October 12, 2018, following the EU's directive to remove its approval for any use. This ban affects all member states, eliminating from the EU industry. |

| India | It is regulated under the Insecticides Act, 1968, requiring registration with the Central Insecticides Board & Registration Committee (CIB & RC). While not currently banned, India is strengthening chemical management by adding more products to the mandatory Bureau of Indian Standards (BIS) certification list, which could affect in the future. |

| Brazil | It is still in use, with significant imports from countries like the UK. However, there are rising public health concerns due to incidents of pesticide poisoning linked to exposure. Despite its ban in the UK and EU, diquat-containing products are exported to Brazil, leading to calls for stricter regulations |

| China | It is permitted and widely used in agriculture. The Ministry of Agriculture and Rural Affairs oversees pesticide regulation, focusing on safety and efficacy. There is an ongoing effort to strengthen the regulation of new pollutants, which may impact diquat's future usage. |

| Japan | It is approved for use, with regulations enforced by the Ministry of Agriculture, Forestry and Fisheries (MAFF). The Pesticide Registration System ensures that product meets safety standards before approval. |

| South Korea | The usage is permitted, regulated under the Agrochemicals Control Act. The Rural Development Administration (RDA) manages pesticide registration and monitoring to ensure compliance with safety standards. |

| UK | It has been banned for domestic use since 2019. However, production for export continues, leading to ethical concerns over exporting banned substances to countries with less stringent regulations. |

Market Analysis

The diquat industry is witnessing contradictory regional trends, with weakening demand in Europe and the UK due to regulatory prohibitions. At the same time, growing areas such as Brazil, India, and select regions of Asia are still reliant on products for effective weed management. An increased focus on environmental and human health effects is driving more stringent regulatory scrutiny, bringing both risk and opportunity to agrochemical businesses. Producers of safer alternatives or those with regulatory flexibility must benefit, whereas producers relying on existing formulations risk losing market share over the long term.

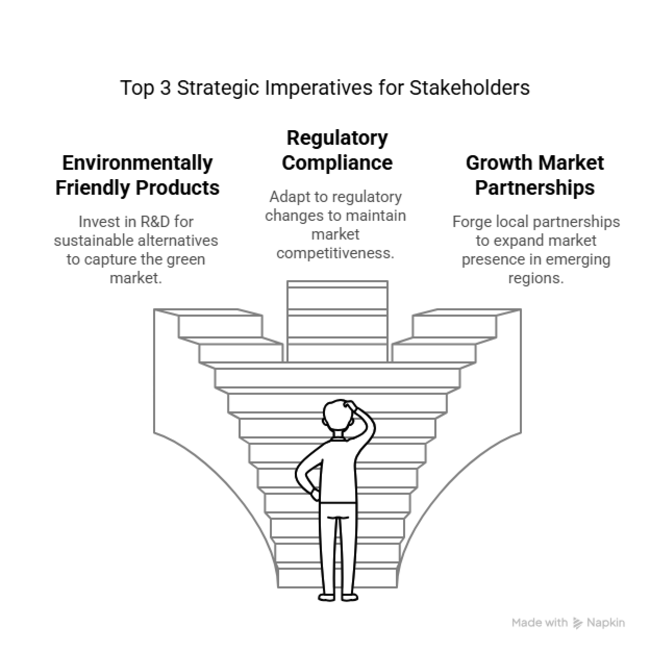

Top 3 Strategic Imperatives for Stakeholders

Broaden Product Mix with Environmentally Friendly Alternatives

Spend on R&D to create or acquire herbicide substitutes with a reduced environmental footprint, like bio-based or selective herbicides, to preempt regulatory limitations and capture the expanding sustainable agriculture industry.

Buy into Regulatory and Regional Trends

Track changing regulations in major industries, particularly the EU, UK, and North America-and adjust formulations or practice of use to continue in compliance and defensibility in high-margin industries. Adopt stewardship programs to avoid health and environmental hazards.

Enhance Presence in Growth through Localized Partnerships

Increase share in Latin America, South Asia, and Africa through strategic alliances with local distributors and agro-cooperatives. Invest in regional manufacturing or formulation plants to enhance cost competitiveness and local responsiveness.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability/Impact |

|---|---|

|

High |

|

Medium |

|

Medium |

Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Evaluate Portfolio Diversification | Conduct feasibility on pivoting toward bio-based or low-toxicity herbicide options. |

| Engage with Regulatory Bodies Early | Initiate proactive dialogues with EU, EPA, and APAC regulators to anticipate bans. |

| Strengthen Emerging Footholds | Launch OEM partner onboarding in LATAM and Southeast Asia with regulatory liaiso |

For the Boardroom

To stay ahead in the evolving industry, the client must pivot from a volume-led strategy to a resilience- and compliance-driven roadmap. With rising regulatory scrutiny across the EU and parts of APAC and increasing momentum for environmentally benign herbicides, the next 12 months should focus on regulatory foresight, R&D for dual-purpose molecules (desiccant + aquatic-safe), and expansion in less-restrictive yet high-demand regions such as Latin America and Southeast Asia.

This intelligence signals a shift in the growth thesis from traditional agri-dominant usage to a diversified application base supported by reformulation innovation, proactive policy alignment, and agile entry frameworks

Segment-wise Analysis

By Product Type

The dibromide segment is expected to register a 67.9% share in 2025. Diquat dibromide is the leading and fastest-growing product segment in the industry because it is cost-effective and has broad-spectrum weed and algae killing capability. The substance is very quick in its action and also highly versatile with regard to different climatic and field conditions, thus becoming the choice herbicide for agriculture as well as water treatment.

Its rapid desiccating action, low persistence, and established effectiveness in lowering the operational costs involved in large-scale vegetation management promote adoption. In the United States, its common application in irrigation canals and reservoirs saves millions in maintenance. Such efficiencies enable sustained adoption, particularly in areas looking for cost-effective and scalable weed control options.

By Form

The liquid segment is expected to register a 62.0% share in 2025. Liquid is the most commonly used diquat form because of its better ease of application, quicker activation, and compatibility with contemporary spraying and irrigation systems.

This form permits uniform distribution on vast surface areas, making it extremely effective in both agricultural land and aquatic environments. Liquid form is easy to mix with water and does not need a lot of preparation time, a fact that is particularly beneficial in mass operations like municipal water treatment or commercial agriculture.

Its bioavailability is greater than that of the crystalline form, resulting in faster desiccation of desired vegetation. Also, liquid formulation tends to be in ready-to-use or concentrate format, permitting adaptability depending on end-user requirements. Consequently, liquid form remains the users' first choice to achieve operational effectiveness, quicker performance, and lower labor requirements.

By End-Use Verticals

The water treatment segment is expected to register a 54.8% share in 2025. Water treatment is the leading and fastest-growing end-use segment for diquat. Sustainability imperatives and rising demand for safe, high-quality water are prompting utilities to invest in reliable aquatic weed control.

Diquat’s effectiveness in algae control, combined with its low-residual impact and rapid disinfection capability, makes it indispensable for water authorities worldwide. As seen in cases like Los Angeles, its use leads to measurable improvements in water quality, reducing both operational costs and risks of contamination. Growing global awareness of waterborne pollutants further drives expansion in this segment.

Country-wise Analysis

| Countries | CAGR |

|---|---|

| USA | 5.5% |

| UK | 4.0% |

| France | 3.8% |

| Germany | 3.9% |

| Italy | 3.7% |

| South Korea | 5.0% |

| Japan | 4.9% |

| China | 5.1% |

USA

The industry in the USA is expected to expand at a CAGR of 5.5% between 2025 and 2035 due to large-scale agricultural operations and the necessity for effective weed control solutions. Farmers are increasingly using herbicides to increase crop yields, especially in growing corn, soybeans, and cotton. They are controlled through the Environmental Protection Agency (EPA) under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), with stringent controls to allow for safe use.

These regulations specify that the content in water should not exceed 1.9% and that application rates should not exceed 2.4 pounds per acre. Adherence to such laws is essential for industry players to ensure product approvals and keep pace with the increasing demand for herbicides in the USA agricultural industry.

China

The industry in China is expected to grow at a CAGR 5.1% from 2025 to 2035, driven by China's position as the world's largest producer and consumer of rice and wheat. This growth calls for efficient weed control measures, making a go-to herbicide. Government efforts to increase domestic food production and decrease import dependence further enhance this upward trajectory. Companies with a focus on sustainable and efficient herbicide products are likely to find profitable opportunities in this growing industry.

Japan

The industry in Japan is expected to register CAGR 4.9% during the forecast period, largely based on the requirements for efficient weed control in small arable land areas. Japan's sophisticated agricultural practices and precision farming focus support the use of herbicides such as diquat. Furthermore, Japan's tight environmental regulations require effective yet environmentally safe herbicides. Manufacturers who can keep pace with these regulatory requirements and provide innovative solutions stand a good chance of success in the Japanese industry.

South Korea

South Korea's sales are expected to grow at CAGR 5.0% from 2025 to 2035, fueled by the nation's emphasis on maximizing agricultural productivity and optimizing limited arable land. The use of advanced farming methods and the requirement for efficient weed control products are factors driving the demand for diquat. The regulatory framework in South Korea is also favorable for the use of herbicides that are safe and environmentally friendly, leading manufacturers to produce compliant and effective products.

UK

The industry in the UK is projected to grow at a CAGR of 4.0% during the forecast period. In 2018, the European Union, to which the UK belonged at that point, prohibited on account of its environmental and health concerns. After Brexit, the UK has upheld strict regulations regarding herbicide use, restricting the growth potential. Yet, there is still niche demand for non-traditional weed control options, and firms that invest in research and development of less hazardous formulations might find something to exploit within the UK regulatory environment.

France

France's sales are expected to grow at a CAGR of 3.8% during the forecast period, which was implemented in 2018 on account of environmental and health issues. French farming, which has a strong focus on sustainability and organic farming, has been transitioning to other weed control methods. Demand for product has, therefore, gone down, and growth in the industry is restricted. Firms engaged in the creation of environmentally friendly and compliant herbicides can have more opportunities in this industry.

Germany

In Germany, the industry is expected to grow at a CAGR of 3.9% during the forecast. Germany is also impacted by the EU ban of the herbicide in 2018. Its strong focus on environmental sustainability and sustainable farming has resulted in the reduced use of chemical herbicides such as diquat. The farmers of Germany are switching more towards integrated weed management methods and alternative measures, leading to the limited prospects for growth for product in the industry here.

Italy

Italy's sales are expected to grow at a CAGR of 3.7% from 2025 to 2035, and its application has gone down. Italian farming, a combination of conservative and advanced methods, is gradually adopting sustainable and organic agricultural practices. This trend has cut down the usage of chemical herbicides such as diquat, and expansion is likely to be modest.

Market Share Analysis

Sinon Corporation (Taiwan): 3.7%

Sinon Corporation is a mid-sized agrochemical producer with a high export focus, especially toward Southeast Asia, Africa, and Latin America. The firm has capitalized on its regulatory approvals and competitive prices to deliver bulk volumes of product formulations for agricultural and aquatic uses.

Its formulation strengths are expanding incrementally, and it is increasingly shifting toward branded generic products in rapidly expanding but underpenetrated areas such as Vietnam, Nigeria, and Colombia. Although not an international giant, Sinon is an important player in price-conscious ecosystems and is slowly building share through enhanced distribution and technical assistance.

Rainbow Agro (China): 4.1%

Rainbow Agro is becoming a new age player in the global crop protection industry through an aggressive agenda with a focus on emerging industries. Its product business is being increasingly visible across East Africa, Southeast Asia, and the Middle East based on solid field level back-up support and availability across integrated value chains. It sells through a comprehensive registration portfolio across more than 80 countries. Rainbow Agro's value proposition is one of consistent quality and quick supply, making it a serious contender among second-tier players.

UPL Ltd. (India):3.1%

UPL is one of India's largest agrochemical firms and an emerging global player. While not its lead molecule, UPL's large global reach and generic portfolio allow it to have a significant presence in developing economies like Brazil, India, and portions of Africa. UPL's cost leadership, compliance infrastructure, and ability to formulate and export in bulk allow it to maintain a presence in this industry, especially in post-patent supply chains. Growth is anticipated to continue as the firm ventures further into the Latin American agriculture business via partnerships and acquisitions.

Excel Crop Care / Sumitomo Chemical India: 1.8%

Now a part of Sumitomo’s agrochemical operations in India, Excel Crop Care has a niche but relevant presence in the domestic Indian landscape and some East African regions. Its offerings are typically generic and targeted at local cooperatives, small-scale agriculture, and water management boards. While it lacks a major international footprint, its domestic strength ensures consistent revenue from diquat, and long-term prospects look promising due to India’s large agricultural base and rising herbicide adoption.

Crystal Crop Protection (India): 1.6%

Crystal Crop Protection sells generic products mainly to the Indian and some South Asian industries. Its low price point and dealer-focused strategy provide strong rural reach. Though it has not moved much beyond India, Crystal's increasing distribution power and vision in African industries presage potential future expansion. Its share is modest but stable as a result of strong grass-roots demand and low-cost scalability.

Shandong Qiaochang Chemical Co., Ltd. (China): 2.8%

This technical-grade manufacturer in China provides bulk active ingredients to formulators globally, particularly in Eastern Europe, Central Asia, the Middle East, and others. Its backward integration and bulk volume enable it to provide both branded and unbranded industries. Although not well known among end-users, Shandong Qiaochang is a key B2B player in making price-sensitive industries remain affordable and within reach.

Other Key Players

- Aceto

- Alligare

- Syngenta

- YongNong BioSciences CO., LTD.

- Syngenta

- Sinon Corporation

- India-based generics

- Zhejiang Jinfanda Biochemical Co., Ltd.

- Other Major Players

Segmentation

By Product Type:

- Dibromide

- Dichloride

- PCB Laminates

By Form:

- Crystalline

- Liquid

By End-Use Verticals:

- Water Treatment

- Agriculture

- Others

By Region:

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa (MEA)

Table of Content

- Executive Summary

- Industry Introduction, including Taxonomy and Market Definition

- Market Trends and Success Factors, including Macro-economic Factors, Market Dynamics, and Recent Industry Developments

- Global Market Demand Analysis: 2020 to 2024 and Forecast 2025 to 2035, including Historical Analysis and Future Projections

- Pricing Analysis

- Global Market Analysis: 2020 to 2024 and Forecast 2025 to 2035

- By Product Type

- By Form

- By End-Use Verticals

- Global Market Analysis: 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Dibromide

- Dichloride

- PCB Laminates

- Global Market Analysis: 2020 to 2024 and Forecast 2025 to 2035, By Form

- Crystalline

- Liquid

- Global Market Analysis: 2020 to 2024 and Forecast 2025 to 2035, By End-Use Verticals

- Water Treatment

- Agriculture

- Others

- Global Market Analysis: 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- South Asia

- East Asia

- Eastern Europe

- Middle East & Africa

- North America Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Latin America Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Western Europe Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- South Asia Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- East Asia Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Eastern Europe Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Middle East & Africa Sales Analysis: 2020 to 2024 and Forecast 2025 to 2035, by Key Segments and Countries

- Sales Forecast: 2025 to 2035 by Product Type, Form, and End-Use Verticals for 30 Countries

- Competition Outlook, including Market Structure Analysis, Company Share Analysis by Key Players, and Competition Dashboard

- Company Profile

- Aceto

- Alligare

- Syngenta

- YongNong BioSciences CO., LTD.

- Syngenta

- Sinon Corporation

- India-based generics

- Zhejiang Jinfanda Biochemical Co., Ltd.

- Other Major Players

- Assumptions and Acronyms Used

- Research Methodology

- FAQs -

How big is the diquat market

The industry is anticipated to reach USD 2.4 billion in 2025.

What is the outlook on diquat sales?

The industry is predicted to reach a size of USD 3.8 billion by 2035.

Who are the key diquat companies?

Prominent players include Aceto, Alligare, Syngenta, YongNong BioSciences Co., Ltd., Sinon Corporation, India-based generics, Zhejiang Jinfanda Biochemical Co., Ltd., and other major players.

Which is the widely used diquat?

Dibromide is widely used.

Which country is likely to witness the fastest growth in the diquat market?

USA, set to grow at 5.5% CAGR during the forecast period, is poised for the fastest growth.